Wet Tissues and Wipes Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435259 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Wet Tissues and Wipes Market Size

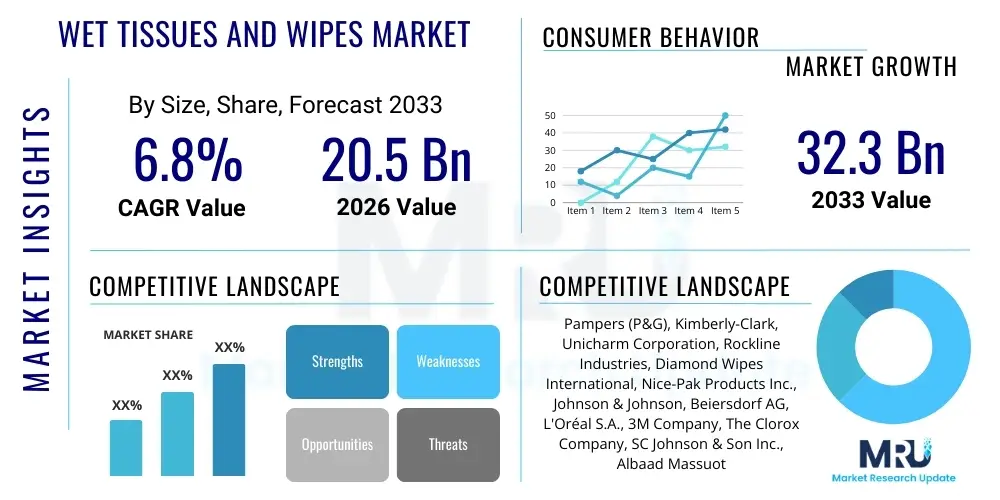

The Wet Tissues and Wipes Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 20.5 Billion in 2026 and is projected to reach USD 32.3 Billion by the end of the forecast period in 2033.

Wet Tissues and Wipes Market introduction

The Wet Tissues and Wipes Market encompasses a wide range of disposable nonwoven cloth products saturated with various chemical or natural solutions designed for cleaning, sanitizing, or moisturizing purposes across multiple applications. These products are crucial elements in modern hygiene and convenience routines, ranging from personal care items like baby wipes and facial wipes to specialized industrial and healthcare sanitizing solutions. The primary market drivers include increasing consumer awareness regarding health and hygiene, particularly post-pandemic, coupled with the rising demand for convenient, ready-to-use cleaning products in fast-paced urban lifestyles. Furthermore, technological advancements in material science, focusing on biodegradable and flushable substrates, are accelerating market adoption and addressing environmental concerns, positioning wet wipes as an essential component of household and personal sanitation standards globally. Major applications span baby care, general household cleaning, specialized cosmetic removal, and medical disinfection, confirming the product's versatility and necessity in contemporary consumer packaged goods sectors.

Wet Tissues and Wipes Market Executive Summary

The Wet Tissues and Wipes Market is characterized by robust growth, driven primarily by expanding hygiene consciousness and significant product innovation focused on sustainability and functional efficacy. Business trends indicate a strong shift towards e-commerce channels, necessitating optimized logistics and digital marketing strategies for major manufacturers. The competitive landscape is consolidating, with key players investing heavily in biodegradable nonwoven materials, such as bamboo and Tencel, to meet stringent regulatory demands and growing consumer preferences for eco-friendly alternatives. Regionally, Asia Pacific is slated for the highest growth due to massive consumer bases, increasing disposable incomes, and improving standards of living, particularly in developing economies like China and India. Segment-wise, the Personal Care category, especially adult hygiene and facial cleansing wipes, dominates market share, while the Household Cleaning segment is experiencing accelerated growth driven by demand for specialized disinfection and surface cleaning products. The market's future trajectory hinges on continuous material innovation and successful navigation of product disposal and environmental impact issues, ensuring long-term viable expansion across all geographical areas.

AI Impact Analysis on Wet Tissues and Wipes Market

Users frequently inquire about how Artificial Intelligence (AI) can revolutionize the manufacturing efficiency, supply chain responsiveness, and new product development within the Wet Tissues and Wipes Market. Key themes revolve around leveraging AI for predictive maintenance in high-speed nonwoven converting lines, optimizing inventory management to handle fluctuating demand (especially during health crises), and utilizing machine learning for personalized product formulation based on localized skin types or cleaning needs. Consumer concerns often focus on the environmental footprint; thus, AI is expected to play a critical role in minimizing material waste during production and optimizing logistics routes to reduce carbon emissions. The primary expectation is that AI will enhance operational precision, ensuring high-quality control in saturation and packaging, thereby reducing defects and improving overall throughput to meet the intensely competitive pricing pressure inherent in the FMCG segment.

- AI-driven predictive maintenance optimizes the uptime of complex nonwoven fabrication and folding machinery, minimizing costly unplanned outages.

- Machine learning algorithms enhance supply chain resilience by accurately forecasting demand spikes and optimizing raw material procurement (fibers, liquids, packaging).

- AI facilitates rapid R&D by simulating the chemical stability and physical properties of novel, sustainable wipe formulations, accelerating time-to-market.

- Quality control utilizes AI vision systems to detect defects in nonwoven substrates and improper saturation levels with unprecedented speed and accuracy.

- Personalization engines informed by AI analytics drive targeted product offerings, customizing scents, ingredients, and packaging designs for specific demographic micro-segments.

DRO & Impact Forces Of Wet Tissues and Wipes Market

The market dynamics are significantly influenced by a favorable confluence of rising global hygiene standards (Drivers) and stringent environmental waste legislation (Restraints), creating a continuous need for material innovation (Opportunity). The primary driver is the pervasive consumer demand for convenience and sanitation, particularly evident in the baby care and medical sectors. However, the market faces substantial restraint from growing public and governmental pressure regarding the non-biodegradable nature of conventional plastic-based wipes and their contribution to sewer blockages and landfill accumulation. This restraint simultaneously acts as a key opportunity, compelling manufacturers to invest heavily in sustainable nonwoven materials (e.g., cellulose, bamboo fiber) and 'flushable' technological certifications. The overall impact force is high, characterized by moderate entry barriers related to large capital investment in sophisticated manufacturing lines, but balanced by the low substitution threat due to the unparalleled convenience offered by pre-moistened disposable products compared to traditional cleaning cloths and solutions.

Segmentation Analysis

The Wet Tissues and Wipes Market is fundamentally segmented based on end-use application, material type, technology, distribution channel, and geography, each influencing market penetration and pricing strategies. Application segmentation defines the product's function, differentiating high-volume categories like baby wipes from niche, high-value segments such as medical or specialty cleaning wipes. Material segmentation is increasingly critical, distinguishing between synthetic (polyester, polypropylene) and natural/sustainable fibers (rayon, cotton, wood pulp), reflecting the industry's pivot toward ecological compliance. Distribution channels determine consumer access and purchasing behavior, with e-commerce registering faster growth than traditional retail. Analyzing these segments is crucial for manufacturers to tailor product portfolios, optimize supply chains, and align with regional regulatory frameworks and consumer ethical priorities.

- By Product Type:

- Baby Wipes

- Personal Care Wipes (Facial, Cosmetic Removal, Intimate Hygiene, Hand & Body)

- Household Wipes (Surface Cleaning, Kitchen, Bathroom)

- Industrial Wipes

- Medical Wipes (Disinfectant, Patient Care)

- By Material Type:

- Synthetic Nonwovens (Polyester, Polypropylene)

- Natural Nonwovens (Cotton, Rayon, Wood Pulp)

- Blended Materials (Viscose/Polyester Mix)

- Sustainable/Biodegradable (Bamboo, Lyocell, Tencel)

- By Technology:

- Spunlace

- Airlaid

- Needle Punch

- By Distribution Channel:

- Supermarkets and Hypermarkets

- Pharmacies and Drug Stores

- Online Retail (E-commerce)

- Specialty Stores

Value Chain Analysis For Wet Tissues and Wipes Market

The value chain for the Wet Tissues and Wipes Market begins with complex upstream activities involving the sourcing and processing of raw materials. This includes procuring nonwoven fibers—both conventional petrochemical-derived synthetics and increasingly bio-based materials like viscose and bamboo—and securing the specialized chemical components (surfactants, preservatives, moisturizing agents, and purified water) for the saturation solution. Key manufacturing steps involve nonwoven fabric production (via hydroentanglement/spunlace technology), slitting, intricate folding, saturation with the active formulation under sterile conditions, and precise packaging into airtight containers. Efficiency and quality control at this stage are paramount, as minor deviations in saturation levels or folding techniques can lead to product spoilage or consumer dissatisfaction, highlighting the necessity of high-precision, automated converting machinery.

The downstream analysis focuses heavily on efficient logistics and distribution, given the high volume and relatively low value per unit of wet wipe products. Distribution channels are highly diversified, encompassing direct sales to institutional customers (hospitals, hotels) and indirect distribution through large-scale retail chains (hypermarkets, convenience stores) and burgeoning e-commerce platforms. The transition to online retail is reshaping the supply chain, demanding faster inventory turnover and localized warehousing. Marketing and brand positioning play a critical role downstream, as consumers often rely on brand trust, particularly for sensitive applications like baby care and medical use. Manufacturers must also navigate reverse logistics concerning product disposal and sustainability initiatives, which are increasingly factoring into brand value and consumer purchasing decisions.

Direct sales channels are typically employed for private label contracts and high-volume B2B segments, such as supplying healthcare providers with clinical disinfection wipes, ensuring specific quality certifications are met. Indirect channels, dominating the B2C segment, rely on wholesalers and retailers to provide broad market penetration. The selection of the channel significantly impacts margin structure; while direct channels offer higher margins, indirect channels provide necessary scale. The complexity of inventory management is amplified by the short shelf life of some wet wipe formulations, requiring stringent stock rotation and temperature-controlled storage, particularly for products utilizing fewer or milder preservatives to align with clean-label trends.

Wet Tissues and Wipes Market Potential Customers

Potential customers for the Wet Tissues and Wipes Market are highly diversified and can be categorized into four major segments: households (B2C), institutional/commercial entities (B2B), healthcare facilities, and industrial users. The largest segment remains the household consumer, primarily driven by the demand for baby wipes—a necessity item for infant care—and personal care wipes, including facial cleansing, body refreshing, and specialized intimate hygiene products. Purchasing decisions in the B2C sector are heavily influenced by convenience, perceived ingredient safety (paraben-free, alcohol-free), material quality (softness, durability), and price, making brand loyalty a significant factor in repeated purchases. The ongoing urbanization and increasing focus on quick, efficient cleaning solutions are continually expanding the addressable household market.

The institutional and commercial customer segment includes sectors like hospitality (hotels, restaurants), fitness centers, and educational institutions, which require bulk quantities of general-purpose and sanitizing wipes for maintaining hygiene standards in communal spaces. These buyers prioritize cost-effectiveness, performance efficiency (kill rate for bacteria/viruses), and volume purchasing options. Furthermore, the healthcare segment, comprising hospitals, clinics, and elderly care facilities, represents a crucial customer base demanding specialized medical-grade antiseptic, disinfecting, and patient bathing wipes. Procurement in this sector is highly regulated, necessitating compliance with strict governmental standards regarding efficacy and sterility, often requiring specialized product certifications (e.g., FDA or EMA approvals).

Finally, the industrial customer segment, although smaller in volume, demands highly specialized, robust wipes for tasks such as heavy-duty machinery degreasing, solvent cleaning, and electronics maintenance. These wipes are typically saturated with potent industrial solvents and require high tensile strength nonwoven materials that can withstand rigorous scrubbing without tearing. Identifying and servicing these diverse end-user needs requires manufacturers to maintain distinct product lines, each tailored with specific saturation solutions, material types, and packaging formats that align with the functional and regulatory requirements of the targeted buying group, ensuring broad market capture across all potential customer verticals.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 20.5 Billion |

| Market Forecast in 2033 | USD 32.3 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Pampers (P&G), Kimberly-Clark, Unicharm Corporation, Rockline Industries, Diamond Wipes International, Nice-Pak Products Inc., Johnson & Johnson, Beiersdorf AG, L'Oréal S.A., 3M Company, The Clorox Company, SC Johnson & Son Inc., Albaad Massuot Yitzhak Ltd., La Petite Abeille (LPA), Premier Inc., Sancella AB, Svenska Cellulosa Aktiebolaget (SCA), Lenzing AG, Parex Group, Meridian Industries. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Wet Tissues and Wipes Market Key Technology Landscape

The Wet Tissues and Wipes Market is undergoing a rapid technological evolution driven by sustainability mandates and the pursuit of enhanced functional performance. A pivotal technological shift involves the transition from traditional, petroleum-based nonwoven substrates, predominantly polyester and polypropylene, to advanced bio-based materials. Spunlace technology, which uses high-pressure water jets to entangle fibers, remains the dominant manufacturing method for creating strong, soft substrates. However, ongoing research focuses on optimizing spunlacing to handle 100% natural and compostable fibers like bamboo, cotton, and Tencel (lyocell), ensuring the resulting wipe retains necessary tensile strength and saturation capacity while meeting stringent disintegration standards for flushable claims. This material innovation is critical for regulatory compliance in regions like the European Union.

Beyond the substrate, significant technological advancements are occurring in the formulation chemistry and packaging automation sectors. Formulations are increasingly moving towards "clean label" ingredients, focusing on mild, pH-balanced, hypoallergenic solutions free from parabens, alcohol, and aggressive synthetic fragrances, which are particularly important in baby and sensitive skin wipes. Preservative technology is adapting to maintain microbial stability while using fewer controversial chemicals, often incorporating natural alternatives or high-efficiency mild systems. Furthermore, packaging technology is focused on maintaining product moisture integrity over the shelf life, utilizing advanced sealing techniques, and introducing sustainable packaging solutions such as resealable labels made from recycled plastics or monomaterial pouches that improve recyclability, aligning with circular economy principles.

Automation and smart manufacturing represent another critical technological area. High-speed converting lines must integrate sophisticated sensor technology to monitor and precisely control saturation weight, folding consistency, and individual wipe count within the package, which is vital for minimizing product giveaway and ensuring consumer satisfaction. The adoption of robotics in packing and palletizing reduces human contamination risk, especially crucial for medical and pharmaceutical wipes, and improves overall factory throughput. The combination of advanced material science, rigorous formulation chemistry, and precise manufacturing automation enables the production of high-quality, specialized wet wipes that meet both stringent regulatory requirements and evolving environmental expectations from the global consumer base, securing long-term viability for this fast-moving consumer goods sector.

Regional Highlights

- North America: North America represents a mature and high-value market segment, characterized by high per capita spending on personal and household hygiene products. The market is primarily driven by strong consumer awareness of health, safety, and disinfection, particularly amplified following global health events. Manufacturers here focus heavily on premiumization, offering specialized functional wipes such as medical-grade disinfectants and advanced facial care wipes (e.g., micellar water formulations). The region is also leading the trend toward eco-friendly products, with significant demand for materials certified as compostable or flushable, driving R&D investment among key U.S. and Canadian players to comply with proposed state-level legislation regarding labeling and disposal claims.

- Europe: Europe is defined by highly diverse national markets and rigorous environmental regulations, particularly the EU’s Single-Use Plastics Directive (SUPD), which heavily impacts the manufacturing and labeling of wipes containing plastic. This regulatory environment is the most significant driver for innovation in sustainable substrates, pushing the market rapidly toward 100% plastic-free and biodegradable nonwovens. Germany, France, and the UK are key markets, showing high consumption of personal hygiene and baby wipes. The region sees strong growth in private label brands, which often compete fiercely on price while simultaneously needing to meet high sustainability standards.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region during the forecast period due to rapid economic development, urbanization, and a massive, growing middle-class population, especially in China, India, and Southeast Asian nations. Increased disposable income is shifting consumer behavior from traditional methods to convenient, disposable hygiene products. Market growth is heavily concentrated in baby care and basic personal hygiene segments. While price sensitivity remains a factor, the demand for premium, imported, or locally trusted branded products that offer enhanced safety features is increasing, signaling a significant future growth trajectory for both domestic and international manufacturers expanding their footprint.

- Latin America (LATAM): The LATAM market is growing steadily, driven by improving economic stability and penetration of global hygiene standards. Brazil and Mexico are the dominant markets. The use of wet wipes is expanding beyond traditional baby care into adult personal hygiene and household disinfection, reflecting increased health consciousness. However, market expansion is sometimes challenged by volatile currency fluctuations and underdeveloped retail infrastructure in some countries, requiring customized distribution strategies focused on local pharmacies and small retail outlets alongside emerging modern trade.

- Middle East and Africa (MEA): The MEA region is witnessing growth driven by infrastructural development, increased tourism, and high birth rates (boosting baby wipe demand). Gulf Cooperation Council (GCC) countries show high demand for premium, imported personal care and cosmetic wipes due to high disposable income and brand preference. In contrast, parts of Africa focus more on basic, affordable hygiene and sanitizing solutions. Water scarcity in certain areas also positions wet wipes as a crucial waterless cleaning alternative, contributing to steady market expansion across key urban centers.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Wet Tissues and Wipes Market.- Procter & Gamble (P&G)

- Kimberly-Clark Corporation

- Unicharm Corporation

- Nice-Pak Products Inc.

- Rockline Industries

- Diamond Wipes International

- Johnson & Johnson

- Beiersdorf AG

- L'Oréal S.A.

- 3M Company

- The Clorox Company

- SC Johnson & Son Inc.

- Albaad Massuot Yitzhak Ltd.

- Goonel Ltd.

- La Petite Abeille (LPA)

- Svenska Cellulosa Aktiebolaget (SCA)

- Lenzing AG (Raw Material Supplier)

- Parex Group

- Meridian Industries Inc.

- Essity AB

Frequently Asked Questions

Analyze common user questions about the Wet Tissues and Wipes market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the shift towards sustainable wet wipes?

The primary driver is stringent environmental regulation, particularly in Europe, targeting single-use plastics (SUPD). This mandates manufacturers to adopt 100% biodegradable or flushable nonwoven materials, such as bamboo, viscose, and wood pulp fibers, to reduce landfill waste and sewer system damage.

Which application segment holds the largest share in the Wet Tissues and Wipes Market?

The Personal Care Wipes segment, which includes baby wipes, facial/cosmetic wipes, and intimate hygiene wipes, consistently holds the largest market share globally due to universal necessity and high-frequency consumption, particularly within the crucial baby care category.

How does the increasing adoption of e-commerce affect the distribution of wet wipes?

E-commerce penetration demands enhanced logistical efficiency and optimized packaging solutions to handle high-volume, bulk orders. It provides manufacturers direct access to consumers, enabling targeted marketing and faster response to regional demand fluctuations and product availability concerns.

What technological advancements are critical for market growth?

Critical technological advancements include the development of plastic-free, high-strength nonwoven substrates (spunlace optimization), clean-label formulation chemistry (using natural preservatives), and smart manufacturing techniques like AI-driven quality control and saturation precision.

Which geographical region is expected to exhibit the highest growth rate?

Asia Pacific (APAC) is projected to experience the highest Compound Annual Growth Rate (CAGR), fueled by rising urbanization, increasing consumer disposable incomes, and improving hygiene standards across major developing economies like China and India.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager