Wetland Management Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431450 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Wetland Management Market Size

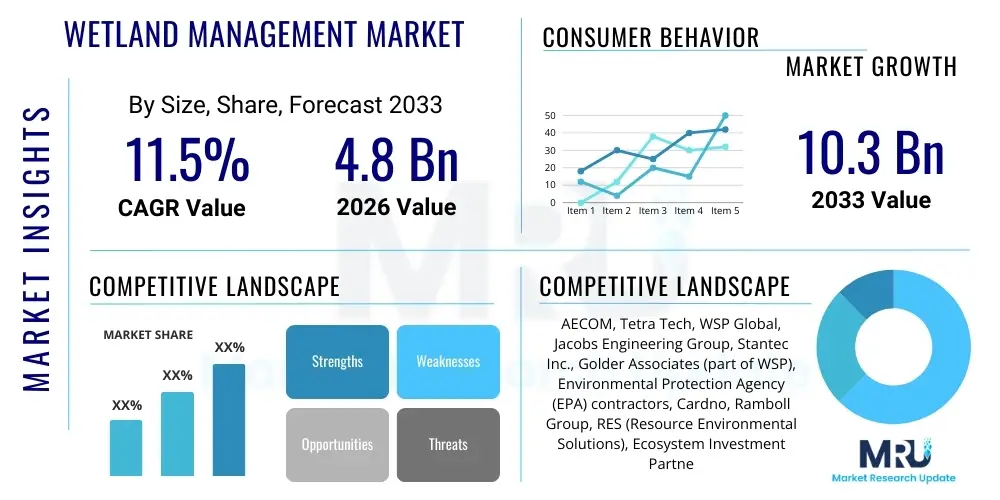

The Wetland Management Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 11.5% between 2026 and 2033. The market is estimated at USD 4.8 Billion in 2026 and is projected to reach USD 10.3 Billion by the end of the forecast period in 2033. This growth trajectory is fundamentally driven by escalating global concerns regarding climate change resilience, the increasing necessity for sustainable water resource management, and stringent international and national regulatory frameworks aimed at preserving critical ecosystem services provided by wetlands, such as carbon sequestration and biodiversity maintenance. The economic valuation of these services has significantly increased, prompting greater investment from both governmental bodies and private sector entities involved in infrastructure development, resource extraction, and environmental mitigation, thus solidifying the long-term upward trend of the market valuation across all major geographic regions and functional segments.

Wetland Management Market introduction

The Wetland Management Market encompasses a diverse range of services, technologies, and infrastructure solutions dedicated to the conservation, restoration, sustainable use, and regulatory compliance of natural and constructed wetland ecosystems. These vital environments, including marshes, swamps, bogs, and coastal areas, provide essential services such as water purification, flood control, shoreline stabilization, and critical habitats for diverse flora and fauna. The market primarily revolves around hydrological modeling, remote sensing, monitoring programs, invasive species control, and the implementation of restoration projects, often driven by international conventions like the Ramsar Convention and domestic environmental legislation. The core product is the delivery of successful ecological outcomes that balance conservation needs with human development and economic pressures, requiring specialized ecological engineering and sophisticated data analytics to ensure efficacy and long-term sustainability of management interventions across varied geographic and climatic zones.

Major applications of wetland management solutions span across various sectors, including municipal water management, coastal resilience and disaster risk reduction, infrastructure development (where mitigation banking is frequently utilized), agriculture (for constructed wetlands handling nutrient runoff), and the rapidly expanding ecological tourism sector. Key benefits realized by effective wetland management include enhanced climate change adaptation through increased natural flood barriers, improved water quality through biological filtration of pollutants and excess nutrients, substantial contributions to climate change mitigation via peatland restoration and carbon storage optimization, and the preservation of irreplaceable biological diversity. Furthermore, managed wetlands often serve as critical components in sustainable urban planning and green infrastructure initiatives, offering co-benefits for human well-being and local economic development through nature-based solutions that are often more cost-effective and resilient than purely engineered alternatives.

The market is significantly driven by a confluence of accelerating factors, prominently including the severe global impacts of climate change, which necessitate robust natural defenses against sea-level rise and extreme weather events. Regulatory mandates, particularly those demanding compensatory mitigation for wetland losses resulting from large-scale infrastructure projects, create a reliable demand stream. Moreover, advancements in digital technologies, such as high-resolution satellite imagery, sophisticated Geographic Information Systems (GIS), and predictive modeling tools, are making monitoring and intervention more precise and scalable than ever before, attracting innovative technology providers. The rising public and corporate awareness of Environmental, Social, and Governance (ESG) criteria further propels private sector investment in conservation and sustainable land use practices, establishing wetland health as a measurable and critical metric for corporate responsibility and long-term operational resilience, particularly in water-stressed regions or areas susceptible to coastal erosion and flooding. The continuous integration of policy compliance needs with technological capacity forms the bedrock of market expansion.

Wetland Management Market Executive Summary

The Wetland Management Market is exhibiting strong growth, characterized by significant business trends centered on the integration of Nature-based Solutions (NbS) and the widespread adoption of digital monitoring technologies, moving the industry towards predictive and proactive management rather than purely reactive restoration. Key business trends include the consolidation of specialized ecological consulting firms, the proliferation of large-scale mitigation banks attracting significant private capital, and the development of standardized metrics for quantifying ecosystem service value, which facilitates carbon credit generation and performance-based contracts. Regional trends show robust regulatory-driven expansion in North America and Europe, coupled with rapidly increasing demand in Asia Pacific, driven by intensive coastal development, megacity flood protection requirements, and government-led ecological restoration programs, particularly in major economies facing severe water security issues. Latin America and the Middle East and Africa are emerging growth hubs, focusing on sustainable water infrastructure and peatland preservation initiatives, respectively, often supported by international development funding mechanisms and partnerships aimed at achieving sustainable development goals and enhancing regional climate resilience strategies.

Segment trends highlight the dominance of the Restoration and Remediation Service segment due to extensive historical losses and ongoing climate impacts requiring active intervention, coupled with significant technological advancements in Remote Sensing and GIS applications, which are becoming standard operational tools. The Coastal and Estuarine Wetlands segment is experiencing the fastest growth, primarily fueled by the imperative to protect vulnerable coastal populations and infrastructure against rising sea levels and storm surges, driving substantial investment in 'living shorelines' and engineered ecological solutions. Furthermore, the increasing complexity of regulatory compliance and permitting processes is bolstering the Consulting and Advisory Services subsegment. The overarching theme across all segments is the shift towards holistic, watershed-scale planning, integrating upland management practices with downstream wetland health, which demands multidisciplinary expertise and continuous technological upgrades to handle vast datasets and complex ecological interactions accurately and efficiently across jurisdictional boundaries and diverse environmental challenges.

Investment patterns are increasingly favoring large-scale, multi-year projects that demonstrate clear measurable outcomes tied to climate adaptation and biodiversity goals, often utilizing sophisticated financial instruments like green bonds and public-private partnerships. The integration of high-fidelity data from drones, low-cost sensors, and satellite constellations is democratizing access to monitoring capabilities, enabling smaller organizations and local governments to participate effectively in wetland preservation. The market structure remains fragmented but is trending towards greater specialization, with companies focusing on niche areas such as specific invasive species management techniques, advanced hydrological modeling software platforms, or specialized regulatory compliance services, catering to the growing demand for scientifically rigorous, evidence-based management decisions that maximize ecological uplift and ensure long-term regulatory approval and environmental sustainability across global operations.

AI Impact Analysis on Wetland Management Market

Common user questions regarding AI's impact on the Wetland Management Market frequently center on its ability to enhance monitoring efficiency, predict ecological shifts, and automate data analysis tasks, leading to better resource allocation. Users are concerned about how AI can accurately classify complex habitats using remote sensing data, whether Machine Learning (ML) models can reliably forecast the spread of invasive species or the impact of extreme weather events on wetland hydrology, and the practical challenges of integrating these high-tech tools into existing, often low-tech, management workflows. There is strong expectation that AI will significantly reduce the cost and time associated with manual fieldwork and traditional surveying methods, particularly in vast, inaccessible areas like remote peatlands or large coastal marshes. Overall, users seek clarity on AI's capability to deliver actionable, real-time insights for dynamic decision-making, moving beyond simple data collection to sophisticated ecological prognostics and prescriptive conservation recommendations tailored to specific regulatory and environmental contexts.

- AI-driven image recognition models drastically accelerate the identification and mapping of wetland vegetation, land cover changes, and unauthorized encroachments using high-resolution drone or satellite imagery, improving monitoring efficiency.

- Machine Learning (ML) algorithms predict hydrological changes, water quality fluctuations, and potential wetland degradation based on climate models, sensor data inputs, and historical ecological patterns, facilitating proactive intervention strategies.

- Predictive modeling powered by AI optimizes resource allocation for restoration projects by identifying high-priority intervention zones where conservation efforts yield the maximum ecological return, thereby increasing cost-effectiveness.

- Natural Language Processing (NLP) tools automate the review and synthesis of extensive regulatory documents, scientific literature, and environmental impact assessments (EIAs), significantly streamlining the complex permitting and compliance processes.

- AI integration supports the development of sophisticated early warning systems for events like toxic algal blooms, pathogen detection, or invasive species incursions, allowing managers to implement rapid, targeted response measures crucial for maintaining wetland integrity.

- Deep Learning techniques are utilized for analyzing acoustic monitoring data to assess biodiversity health (e.g., classifying bird calls or amphibian choruses), providing non-invasive, continuous ecological health assessments over large geographical areas with minimal field presence requirements.

- Automated classification tools enhance the accuracy of carbon stock assessments in blue carbon ecosystems and peatlands by precisely delineating boundaries and calculating biomass density from multi-spectral remote sensing data, supporting verifiable carbon credit schemes.

DRO & Impact Forces Of Wetland Management Market

The Wetland Management Market is shaped by powerful Drivers, persistent Restraints, and significant Opportunities, which collectively define the Impact Forces steering its evolution. Key drivers include the global mandate for climate change adaptation and mitigation, specifically leveraging wetlands for carbon sequestration (blue carbon) and natural flood defense, coupled with increasingly stringent environmental regulations that necessitate compensatory mitigation for development impacts. Restraints largely center on the high initial capital investment required for extensive restoration projects, the prolonged timescales necessary for ecological recovery and successful regulatory sign-off, and the technical complexity involved in integrating diverse data sources for effective hydrological and biological modeling across different ecosystems. Opportunities are primarily found in the rapid expansion of digital monitoring technologies (IoT, remote sensing), the development of innovative financing mechanisms like mitigation banking and biodiversity offsets, and the growing corporate demand for credible Environmental, Social, and and Governance (ESG) compliance, which favors verifiable ecological restoration outcomes. These forces push the market toward higher technological adoption and greater financial sophistication, transforming wetland management from a niche environmental service into a core component of sustainable economic development and climate resilience planning globally.

Drivers: Global Climate Resilience Needs and Regulatory Push. The fundamental market acceleration stems from the urgent need to manage freshwater resources and protect human settlements from climate extremes. Wetlands serve as critical buffers, absorbing floodwaters and protecting coasts from storm surges. International agreements, notably the Ramsar Convention on Wetlands, along with national ‘No Net Loss’ policies prevalent in North America and parts of Europe, create non-discretionary demand for assessment, permitting, and large-scale restoration services. This regulatory landscape ensures consistent demand regardless of short-term economic fluctuations. Furthermore, the recognition of wetlands, especially coastal and peatland types, as significant carbon sinks has opened up major funding avenues related to carbon markets and climate finance, turning ecological restoration into a high-value climate solution. The continuous pressure from infrastructure development and urbanization mandates ongoing investment in compensatory wetland creation and management, solidifying the market's foundational stability and growth prospects for the foreseeable future, driving innovation in project delivery and monitoring.

Restraints: Financial Barriers and Technical Complexity. Despite the clear benefits, wetland management projects often face significant headwinds due to the substantial upfront costs associated with land acquisition, hydrological engineering, and long-term monitoring requirements, which can deter private investment without robust regulatory assurances. Technical restraints arise from the sheer complexity of ecological systems; successful restoration requires deep understanding of site-specific hydrology, soil chemistry, and native plant succession, making standardized solutions often ineffective. Furthermore, a shortage of highly specialized ecological engineers and technicians capable of effectively implementing and managing advanced technologies (like AI in hydrology) in remote or complex field settings poses a critical bottleneck. The long-term nature of monitoring—often spanning 10 to 50 years to prove ecological success—ties up capital and increases project risk, necessitating innovative contractual structures and performance guarantees to overcome these intrinsic financial and technical obstacles inherent in natural systems restoration and management practices globally.

Opportunities: Technological Advancements and Mitigation Banking Expansion. The market is poised for significant disruptive growth through technological integration. The decreasing cost and increasing capability of satellite imagery, UAVs (drones), and IoT sensor networks offer unparalleled opportunities for continuous, high-fidelity monitoring and performance evaluation, drastically reducing the cost of verifying ecological success and improving the transparency required by regulators and investors. Crucially, the expansion of Wetland Mitigation Banking is providing a scalable, market-based solution that aggregates capital and expertise, allowing developers to offset impacts efficiently and channeling private investment directly into large-scale, ecologically significant restoration sites. This mechanism, coupled with the rising demand for standardized biodiversity metrics and verifiable carbon offsets generated by blue carbon projects, creates vast financial incentives for innovative project development and management practices, positioning the market to capitalize on both climate finance and corporate sustainability commitments worldwide.

Segmentation Analysis

The Wetland Management Market is strategically segmented across several critical dimensions, including Service Type, Wetland Type, and Application, to accurately reflect the diverse needs and technical specializations within the ecosystem conservation sector. Segmentation by Service Type captures the full project lifecycle, from initial assessment and planning to active intervention and long-term monitoring, highlighting the robust demand for both data-driven consultative services and direct on-the-ground ecological engineering. Wetland Type differentiation acknowledges the distinct management challenges and regulatory requirements associated with different ecological settings—such as freshwater marshes requiring specialized hydrological interventions versus coastal estuaries demanding complex strategies for salinity control and protection against sea-level rise. Analyzing the market by Application reveals the primary end-user sectors driving demand, spanning from government-led conservation initiatives to private-sector compliance and infrastructure development, showcasing the versatility and necessity of wetland management across the global economy and environmental protection efforts.

This structured segmentation is crucial for understanding market dynamics, allowing stakeholders to identify high-growth niches, particularly in specialized areas like remote sensing monitoring for inaccessible peatlands or advanced hydrological modeling for complex flood mitigation zones. The overlap between segments often dictates project complexity; for example, a coastal infrastructure project (Application) requiring mitigation banking (Service Type) in an estuarine environment (Wetland Type) demands a highly integrated set of technical and regulatory expertise. The detailed analysis of these segments confirms that while regulatory compliance remains the backbone of the market, the fastest expansion is occurring in technologically intensive areas focused on enhancing climate resilience and maximizing the value of ecosystem services, pushing the market towards sophisticated, outcome-based contracting models and multi-sectoral partnerships for large-scale ecological benefit and sustainable development outcomes.

- By Service Type:

- Restoration, Remediation, and Ecological Engineering

- Monitoring, Mapping, and Remote Sensing

- Consulting, Planning, and Regulatory Compliance

- Data Management and Modeling Services (GIS and Hydrological)

- Mitigation Banking Services

- Invasive Species Management and Control

- Water Quality Testing and Analysis

- By Wetland Type:

- Coastal and Estuarine Wetlands (Mangroves, Salt Marshes)

- Inland Wetlands (Marshes, Swamps, Floodplains)

- Peatlands and Bogs

- Constructed Wetlands

- Riparian Zones and Riverine Ecosystems

- By Application/End-User:

- Government and Regulatory Agencies (Federal, State, Local)

- Infrastructure Development (Transportation, Energy, Construction)

- Water and Wastewater Management Authorities

- Agriculture and Forestry

- Non-Governmental Organizations (NGOs) and Research Institutions

- Real Estate and Land Development

- Mining and Resource Extraction

- By Technology:

- Geographic Information Systems (GIS) and Mapping

- Remote Sensing (Satellite, Drone, Aerial)

- IoT Sensors and Monitoring Devices

- Hydrological and Ecological Modeling Software

- Advanced Data Analytics and AI Platforms

Value Chain Analysis For Wetland Management Market

The Value Chain of the Wetland Management Market begins with upstream suppliers providing foundational data, technology, and materials crucial for planning and implementation. This upstream segment is dominated by providers of high-resolution remote sensing data (satellite operators, drone services), specialized ecological software (GIS platforms, hydrological modeling tools), and native plant nurseries and soil amendment suppliers essential for restoration projects. The efficient and timely delivery of high-quality data and materials directly impacts the planning precision and overall success of subsequent restoration and management phases. Partnerships with reliable technology vendors offering advanced analytics and real-time monitoring capabilities are becoming increasingly critical at this initial stage to ensure data integrity and maximize the effectiveness of site assessments, particularly in complex or large-scale wetland ecosystems where site accessibility is limited or continuous data acquisition is mandated by regulatory bodies to track baseline conditions accurately.

The core midstream segment involves the specialized service providers—ecological consultants, engineering firms, and mitigation banking developers—who translate raw data and regulatory requirements into actionable management plans and physical interventions. These firms execute complex tasks such as hydrological restoration, invasive species eradication, site grading, and planting programs. Distribution channels are varied but can be categorized into direct and indirect routes. Direct distribution involves large governmental agencies or major private developers contracting directly with established engineering and consulting firms for specific, large-scale projects (e.g., coastal resilience projects or major pipeline mitigation). Indirect channels often involve the use of mitigation banks or specialized brokers who manage the regulatory compliance and credit transfer process, acting as intermediaries between the developers who need to offset impacts and the restoration firms who manage the banked wetland sites, creating a standardized, scalable market mechanism for compliance. The effectiveness of this midstream phase hinges on deep technical expertise, regulatory acumen, and the ability to manage complex multidisciplinary teams comprising ecologists, engineers, and policy experts.

The downstream analysis focuses on the end-users and the long-term stewardship required to sustain the ecological value created. End-users include governmental entities that manage public lands, infrastructure developers seeking permits, and water utilities aiming to improve water quality through natural filtration systems. Post-implementation, the downstream value includes rigorous, often mandated, monitoring and maintenance services to ensure the restored wetland meets performance standards over the long term (typically 5–10 years or more). This stewardship phase generates continuous demand for specialized monitoring, reporting, and adaptive management services. The success of the entire value chain is ultimately measured by the ecological outcomes delivered and the sustained regulatory compliance achieved for the buyer, creating a closed-loop system where data from downstream monitoring feeds back into upstream planning processes, promoting continuous improvement in restoration techniques and regulatory standards across the entire industry landscape.

Wetland Management Market Potential Customers

Potential customers for wetland management solutions are diverse, spanning both public and private sectors, with demand primarily originating from entities whose operations either impact wetland ecosystems or whose strategic objectives necessitate the services wetlands provide, such as climate resilience and water security. The largest cohort of customers includes governmental and regulatory agencies at federal, state, and local levels worldwide. These entities drive demand through legislative mandates for conservation, implementation of large-scale public works projects (like flood control and coastal defense), and the ongoing management of publicly owned protected areas. Agencies such as the US Army Corps of Engineers, European Environment Agency equivalents, and national parks services are consistent and major consumers of consulting, restoration, and long-term monitoring services to ensure compliance with environmental law and meet specific biodiversity targets stipulated by national policies and international treaties like the Ramsar Convention, emphasizing the non-discretionary nature of this public sector demand for ecological integrity services.

In the private sector, key buyers are predominantly concentrated in industries characterized by extensive land footprint and significant environmental liabilities. Infrastructure developers (e.g., construction, energy transmission, highway development) are crucial clients, driven by the need to secure regulatory permits which almost always require compensatory wetland mitigation for unavoidable losses under "No Net Loss" policies. These developers frequently utilize mitigation banking services to fulfill their obligations efficiently. Similarly, the mining, oil and gas, and real estate development industries invest heavily in management services to address operational impact assessments, secure expansion permits, and demonstrate adherence to increasingly strict Environmental, Social, and Governance (ESG) standards demanded by investors and stakeholders. Furthermore, water utilities and municipal wastewater management authorities utilize constructed and natural wetlands for cost-effective, sustainable tertiary treatment of wastewater and stormwater runoff, generating consistent demand for hydrological engineering and water quality monitoring expertise to maintain the efficacy of these natural infrastructure assets.

A rapidly expanding segment of potential customers includes large corporations seeking to invest in verifiable carbon and biodiversity offsets as part of their climate commitment strategies. Companies aiming for carbon neutrality are increasingly looking towards high-quality blue carbon projects in coastal wetlands or large-scale peatland restoration efforts, driving demand for specialized quantification, verification, and long-term management services that adhere to rigorous international standards (e.g., Verified Carbon Standard). Non-Governmental Organizations (NGOs) and international conservation bodies also act as significant buyers and implementation partners, often utilizing management services for large-scale, ecosystem-focused restoration efforts funded through philanthropic grants or global climate finance initiatives. This diverse customer base ensures a resilient and steady market flow, balancing mandatory regulatory demand with voluntary corporate sustainability commitments, reinforcing the long-term financial viability of the wetland management services sector across various geographical and economic landscapes.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.8 Billion |

| Market Forecast in 2033 | USD 10.3 Billion |

| Growth Rate | 11.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | AECOM, Tetra Tech, WSP Global, Jacobs Engineering Group, Stantec Inc., Golder Associates (part of WSP), Environmental Protection Agency (EPA) contractors, Cardno, Ramboll Group, RES (Resource Environmental Solutions), Ecosystem Investment Partners (EIP), The Nature Conservancy (Consulting Wing), Wetlands & Ecology Ltd., Tierra Resource Consultants, Environmental Consulting & Technology, Inc. (ECT), CH2M Hill (now Jacobs), HDR, Inc., Blue Earth Consultants. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Wetland Management Market Key Technology Landscape

The technological landscape driving the Wetland Management Market is rapidly evolving, moving away from labor-intensive field measurements toward sophisticated, data-driven platforms that integrate remote sensing, ground-based sensors, and advanced analytical software. Geographic Information Systems (GIS) and high-resolution mapping technologies remain foundational, providing the necessary spatial framework for site assessment, planning restoration designs, and tracking compliance boundaries. However, the true transformation is occurring with the widespread adoption of Remote Sensing (RS) technologies, including high-frequency satellite imagery (e.g., Sentinel, Planet Labs data) and Unmanned Aerial Vehicles (UAVs or drones). These tools deliver multi-spectral and LiDAR data with unprecedented spatial and temporal resolution, enabling detailed monitoring of vegetation health, water level changes, and subtle shifts in landscape topography crucial for detecting early signs of degradation or successful ecological recovery, vastly improving the efficiency and accuracy of large-scale assessments and long-term project verification processes mandated by regulators and performance-based contracts across the industry value chain.

Furthermore, the proliferation of Internet of Things (IoT) sensors and low-cost environmental monitoring devices is enabling real-time, continuous data collection on critical hydrological and water quality parameters, such as dissolved oxygen, pH, temperature, and water flow dynamics. These sensor networks provide granular insights into the ecosystem function that traditional, periodic sampling methods cannot achieve, allowing managers to implement adaptive management strategies instantly in response to environmental stressors or changing conditions. The massive datasets generated by RS and IoT are increasingly being processed using advanced analytical techniques, specifically incorporating Machine Learning (ML) and Artificial Intelligence (AI) algorithms. These AI platforms are capable of automating data processing, classifying complex wetland types from imagery, predicting contaminant movement, and modeling the future impacts of climate change (e.g., sea-level rise or drought) on site integrity, transforming raw data into actionable, predictive intelligence necessary for proactive conservation decisions and risk mitigation strategies in high-stakes restoration projects.

Hydrological and ecological modeling software forms another critical pillar of the technological landscape, utilized for designing effective restoration projects and demonstrating ecological success to regulatory bodies. These sophisticated models simulate water movement, sediment transport, and nutrient cycling within the wetland and its surrounding watershed, ensuring that physical interventions (like dike removal or stream re-meandering) achieve the desired ecological outcome, particularly concerning hydroperiod restoration, which is often the most critical factor for wetland success. The integration of Building Information Modeling (BIM) principles, although nascent, is also starting to be applied to complex ecological engineering projects, allowing for better collaboration between engineers and ecologists. This convergence of high-fidelity remote data acquisition, automated processing via AI, and sophisticated predictive modeling tools is defining the modern standard for wetland management, enabling scalable, precise, and economically viable conservation efforts that address the intricate challenges posed by global environmental change and increasing development pressures simultaneously across diverse geographical contexts.

Regional Highlights

- North America: North America, particularly the United States, represents the most mature and dominant market globally for wetland management, largely driven by the stringent regulatory framework established under Section 404 of the Clean Water Act and state-level 'No Net Loss' policies. The demand is heavily focused on compensatory mitigation, leading to a highly sophisticated market for wetland mitigation banking, which attracts substantial private investment and leverages advanced ecological engineering techniques for large-scale restorations necessary for major infrastructure projects like highways, energy pipelines, and commercial developments. Canada also contributes significantly, primarily through government-led conservation initiatives focusing on boreal peatlands (critical carbon sinks) and managing impacts related to resource extraction and oil sands development, demanding expertise in remediation and long-term ecosystem health monitoring using sophisticated remote sensing technologies across vast, often inaccessible areas. The region is characterized by high technological adoption, robust consulting services, and a competitive environment among specialized environmental engineering firms, driving innovation in project delivery and performance metrics.

- Europe: Europe is a highly regulated market emphasizing ecological restoration driven by the EU Water Framework Directive, the Habitats Directive, and various national conservation programs targeting biodiversity goals. The focus is less on compensatory mitigation banking (though it exists) and more on integrated river basin management, large-scale nature restoration projects, and the preservation of coastal systems against sea-level rise, especially in countries like the Netherlands and the UK. Significant market activity is centered around the restoration of degraded peatlands—a major focus due to their immense carbon storage potential—and the creation of natural flood protection schemes, utilizing nature-based solutions (NbS) as alternatives to hard engineering. Scandinavian countries lead in sophisticated monitoring and data analysis, while Eastern Europe presents significant opportunities for funded restoration work aimed at aligning with EU environmental standards, particularly concerning agricultural runoff management and water quality improvement through constructed and managed wetlands.

- Asia Pacific (APAC): The APAC region is the fastest-growing market, primarily fueled by rapid urbanization, massive infrastructure expansion, and severe vulnerability to climate change impacts, particularly coastal flooding and saline intrusion in mega-deltas (e.g., Mekong, Ganges). Governments in major economies like China, India, and Australia are undertaking massive ecological restoration and water management projects. China, in particular, has made substantial state-led investments in creating 'sponge cities' and restoring coastal wetlands (mangroves) for disaster risk reduction and water security, creating immense demand for hydrological engineering and large-scale project execution. Australia focuses heavily on managing river systems (like the Murray-Darling Basin) and coastal assets, requiring advanced data modeling and management services to balance agricultural needs with ecological flows. The challenge in APAC lies in balancing rapid development needs with conservation mandates, leading to a strong demand for innovative solutions in mitigation planning and regulatory compliance that can be executed quickly and at scale.

- Latin America: The market in Latin America is characterized by large, often internationally funded, biodiversity and climate resilience projects focused on conserving critical ecosystems like the Amazon wetlands, the Pantanal, and major coastal areas. Demand is driven by conservation NGOs, international development banks, and government agencies seeking to manage impacts from agriculture, resource extraction (mining), and illegal deforestation. Brazil and Colombia are key markets, requiring specialized expertise in remote sensing for illegal activity monitoring and the implementation of sustainable management practices for large, complex ecosystems. The market structure is often less mature than in North America, relying heavily on international partnerships for technical expertise, financing, and technological deployment, emphasizing capacity building and integrated land-use planning methodologies.

- Middle East and Africa (MEA): The MEA market is highly focused on sustainable water resource management in arid environments, often utilizing constructed wetlands for wastewater treatment and reuse, particularly in the Middle East. Demand is also driven by the protection of unique desert wetlands and coastal mangrove systems for biodiversity and climate resilience. Africa's market potential is immense, driven by the need for sustainable agricultural practices, management of major river basin wetlands (like the Nile and Congo), and addressing degradation caused by population pressure and resource conflicts. International donor agencies and climate finance mechanisms are the primary investment sources, requiring management solutions that are low-cost, locally adaptable, and focused on enhancing community livelihoods and regional food security through integrated water and land management strategies.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Wetland Management Market.- AECOM

- Tetra Tech

- WSP Global

- Jacobs Engineering Group

- Stantec Inc.

- Golder Associates (part of WSP)

- Environmental Protection Agency (EPA) contractors

- Cardno

- Ramboll Group

- RES (Resource Environmental Solutions)

- Ecosystem Investment Partners (EIP)

- The Nature Conservancy (Consulting Wing)

- Wetlands & Ecology Ltd.

- Tierra Resource Consultants

- Environmental Consulting & Technology, Inc. (ECT)

- CH2M Hill (now Jacobs)

- HDR, Inc.

- Blue Earth Consultants

- SNC-Lavalin Group

- Wood Environment & Infrastructure Solutions

- Bayer CropScience (via environmental services divisions)

- Ecology and Environment, Inc. (now part of WSP)

Frequently Asked Questions

Analyze common user questions about the Wetland Management market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is Wetland Mitigation Banking and why is it crucial to the market?

Wetland Mitigation Banking is a market-based approach where wetland areas are restored or created to generate "credits" which can then be sold to developers seeking to offset unavoidable environmental impacts caused by their projects, thereby ensuring regulatory compliance. It is crucial because it aggregates capital for large-scale, ecologically sound restoration efforts, offering a scalable and efficient solution for mandatory compensation requirements under environmental laws like the US Clean Water Act, streamlining the permitting process for infrastructure development while guaranteeing verifiable ecological uplift, minimizing fragmented, site-by-site remediation efforts and concentrating expertise and investment.

How is AI and Remote Sensing transforming the effectiveness of wetland monitoring?

AI and Remote Sensing (e.g., satellite imagery, drones) are dramatically improving monitoring effectiveness by providing continuous, high-resolution spatial data across vast areas that were previously inaccessible or costly to survey manually. AI algorithms analyze this imagery to automatically classify habitat types, detect hydrological changes, monitor invasive species spread, and quantify ecological success metrics (like vegetation cover) in real-time. This automation significantly reduces labor costs, enhances the accuracy of performance assessments, and allows managers to implement adaptive measures instantly based on predictive insights, moving the industry towards more proactive and scalable conservation strategies required for climate change adaptation.

What are the primary challenges restraining the growth of the Wetland Management Market?

The primary constraints include the high initial capital investment required for comprehensive restoration projects, often involving complex hydrological engineering and significant land acquisition costs. Furthermore, the prolonged regulatory monitoring period (often exceeding five to ten years) needed to demonstrate ecological success ties up financial resources and increases project risk. Technical complexity, specifically the need for highly specialized ecological and engineering expertise to manage site-specific variables (soil, water chemistry), also limits standardization and scalability, presenting a critical bottleneck in the widespread adoption and successful execution of nature-based solutions.

Which geographical region exhibits the highest growth potential for wetland management services?

The Asia Pacific (APAC) region is projected to exhibit the highest growth potential due to several macro factors, including rapid urbanization and massive infrastructure development that necessitate large-scale compensatory mitigation. Furthermore, the region's acute vulnerability to climate change impacts, such as coastal erosion and intense flooding in dense delta regions, is driving substantial government investment in major coastal and inland wetland restoration projects (e.g., China's 'sponge city' initiatives and mangrove restoration efforts) for disaster risk reduction, creating immense, sustained demand for technological solutions, ecological engineering, and regulatory compliance expertise that addresses both development and ecological conservation needs simultaneously.

How do wetlands contribute to climate change mitigation and adaptation, driving market demand?

Wetlands are critical for climate change mitigation by serving as highly effective carbon sinks, especially peatlands and coastal "blue carbon" ecosystems (mangroves and salt marshes), which store vast amounts of carbon in their soils and biomass, making their preservation and restoration a high-priority climate finance objective. For adaptation, they provide essential ecosystem services such as natural flood attenuation (reducing downstream flood severity) and coastline stabilization, acting as resilient buffers against storm surges and sea-level rise. This dual role in climate security directly drives market demand from governments and corporations seeking verifiable, nature-based solutions to meet both national climate targets and corporate ESG commitments, establishing wetland management as a core climate service.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager