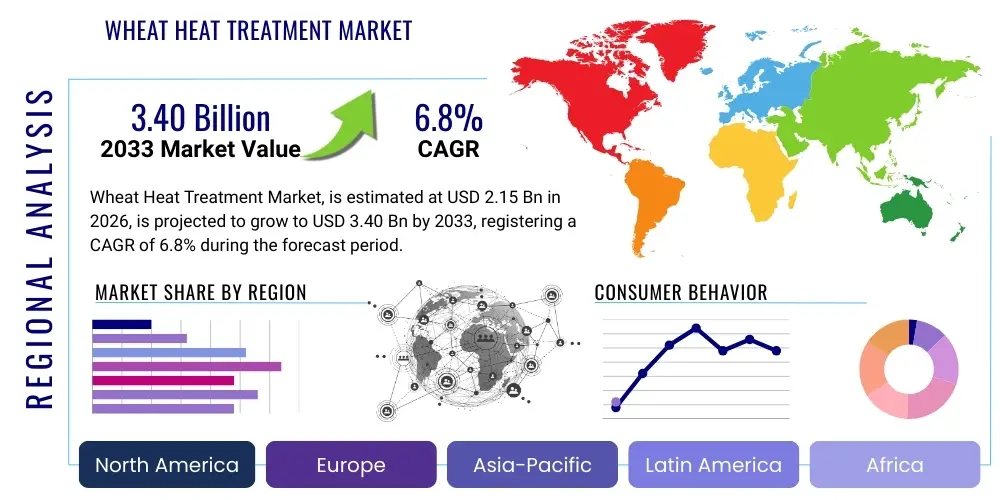

Wheat Heat Treatment Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434605 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Wheat Heat Treatment Market Size

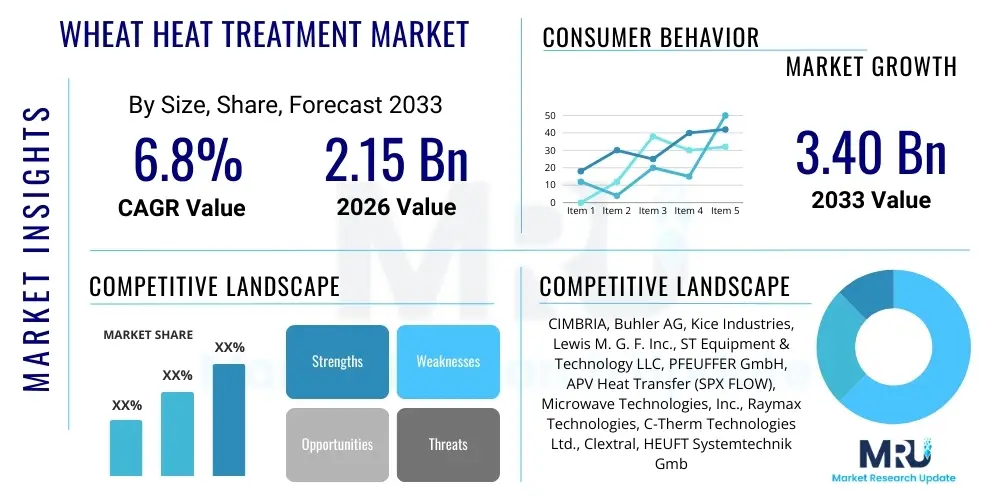

The Wheat Heat Treatment Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at $2.15 Billion in 2026 and is projected to reach $3.40 Billion by the end of the forecast period in 2033.

Wheat Heat Treatment Market introduction

The Wheat Heat Treatment Market encompasses specialized processing technologies designed to improve the functional, nutritional, and safety characteristics of wheat kernels and flour. Heat treatment involves controlled application of thermal energy—often using methods like microwave, radio frequency (RF), infrared, or conventional steam/hot air—to achieve specific objectives such as enzyme deactivation, pest control, microbial load reduction, and alteration of starch and protein structures. This process is critical for extending the shelf life of wheat products, enhancing baking performance (especially for whole wheat flours), and ensuring compliance with stringent global food safety standards.

Product applications span across major segments of the food industry, including breakfast cereals, baked goods, specialized flour blends, and ready-to-eat products. The increasing global emphasis on natural food preservation methods, combined with the necessity of eliminating mycotoxins and insect infestations in stored grains, fundamentally drives the adoption of advanced heat treatment solutions. These systems offer a non-chemical alternative to traditional fumigation, aligning with consumer demand for cleaner labels and sustainable practices.

Key benefits derived from optimized heat treatment include enhanced stability of fat content, crucial for whole wheat products prone to rancidity, and improved hydration properties of flour, leading to better texture and volume in final baked goods. Furthermore, the ability to tailor heat application allows processors to create customized flour profiles suitable for unique applications, such as high-absorption durum wheat products or functional ingredients for specialized dietary needs, thereby expanding the market scope beyond basic commodity processing.

Wheat Heat Treatment Market Executive Summary

The Wheat Heat Treatment Market is characterized by robust growth, primarily fueled by global food safety regulations and the sustained shift toward value-added wheat products. Business trends indicate a strong move towards automated, high-throughput heat treatment systems that minimize energy consumption and maximize quality retention. Major investments are channeled into Radio Frequency (RF) and Microwave technologies due to their superior efficiency, speed, and precise temperature control, which are essential for treating large volumes of grain while preventing damage to sensitive nutrients. Sustainability is a key theme, pushing manufacturers toward systems that integrate heat recovery and utilize renewable energy sources, thereby optimizing operational expenditure and reducing the environmental footprint.

Regionally, Asia Pacific (APAC) stands out as the fastest-growing market, driven by rapid urbanization, increasing per capita consumption of processed foods, and heightened regulatory scrutiny regarding grain quality, particularly in developing economies like India and China. North America and Europe, representing mature markets, exhibit strong demand for sophisticated, specialized heat treatment equipment used primarily for premium, organic, and gluten-free wheat substitute processing. Furthermore, these regions are pioneers in adopting IoT and AI for process monitoring and optimization, setting the benchmark for operational efficiency across the global supply chain.

Segmentation analysis highlights that the continuous flow segment dominates the market, favored by large-scale milling operations requiring uninterrupted processing capabilities. The flour milling application segment remains the largest end-user, though the specialty food and ingredients segment is projected to show the highest CAGR, reflecting the innovation in functional ingredients derived from treated wheat. Technological advancements focus heavily on optimizing the uniformity of heat distribution, crucial for achieving consistent deactivation of enzymes like lipases and lipoxygenases without compromising protein integrity, thereby enhancing the functional lifespan and quality of whole grain products.

AI Impact Analysis on Wheat Heat Treatment Market

User inquiries regarding AI's impact on wheat heat treatment frequently center on optimizing energy efficiency, predicting potential equipment failures, and ensuring absolute consistency in grain treatment parameters. Users seek to understand how machine learning models can process massive datasets—including grain moisture levels, initial microbial counts, ambient temperature, and equipment settings—to dynamically adjust heating profiles in real-time, minimizing overtreatment or undertreatment. Key concerns revolve around the cost of integrating these smart systems, the required digital infrastructure investment, and the ability of AI to adapt to the highly variable nature of raw wheat batches. Expectations are high for AI to transform quality control from reactive testing to proactive, predictive assurance, ultimately reducing waste and improving batch yields.

- AI-powered Predictive Maintenance: Machine learning algorithms analyze sensor data (temperature fluctuations, vibration, energy draw) within heat treatment equipment to predict component failure, significantly reducing unplanned downtime and maintenance costs.

- Real-Time Process Optimization (RPO): AI systems dynamically adjust heating parameters (time, intensity, frequency) based on immediate input variables (e.g., grain moisture and flow rate) to ensure uniform treatment and maximum energy efficiency.

- Enhanced Quality Control (QC): Computer vision and deep learning models are used post-treatment to analyze grain color, surface characteristics, and kernel integrity, automatically identifying and sorting out damaged or insufficiently treated batches faster than manual inspection.

- Supply Chain Traceability and Risk Assessment: AI integrates data from farm harvest conditions through processing stages to provide end-to-end traceability, enabling precise risk assessment related to mycotoxin development or pest reinfestation.

- Automated Recipe Generation: AI helps determine optimal heat treatment recipes for novel or mixed-grain products, drastically cutting down on R&D time required for new functional flours.

DRO & Impact Forces Of Wheat Heat Treatment Market

The Wheat Heat Treatment Market is primarily driven by escalating global demand for safe, extended shelf-life whole grain products, alongside stringent international regulations concerning foodborne pathogens and pest control in commodity grains. These drivers are compelling millers and processors to adopt advanced, highly verifiable heat treatment methods over traditional chemical alternatives. However, the market faces significant restraints, chiefly the substantial initial capital expenditure required for installing sophisticated thermal processing equipment, such as RF or microwave systems, which can be prohibitive for small and medium-sized enterprises. Furthermore, the inherent energy intensity of heat treatment processes poses a challenge, particularly as global energy costs fluctuate, necessitating continuous innovation in energy recovery and efficiency.

Opportunities in the market center around the development and commercialization of next-generation, low-temperature, and high-efficiency treatment modalities that can achieve pathogen reduction while minimizing thermal damage to sensitive components like vitamins and antioxidants. The rapid expansion of specialized flour markets, including organic, gluten-free blends, and functional bakery ingredients, presents specific niches where precise heat treatment is non-negotiable for achieving desired functional attributes. Additionally, the integration of Industry 4.0 technologies—such as IoT sensors and data analytics—is creating opportunities for service providers offering customized maintenance and performance optimization solutions based on real-time process data.

The collective impact forces shaping this market involve a powerful interplay between regulatory push, consumer pull, and technological innovation. Regulatory bodies globally are tightening standards on acceptable limits for pesticide residues and mycotoxins, forcing proactive thermal solutions (Impact Force: Regulatory Compliance). Simultaneously, health-conscious consumers are actively seeking whole grain products with verifiable safety standards and prolonged freshness (Impact Force: Consumer Demand for Safety and Quality). These factors accelerate the replacement cycle of older, less efficient equipment with modern, validated thermal systems, making energy efficiency and quality assurance the core competitive factors in the industry.

Segmentation Analysis

The Wheat Heat Treatment Market is comprehensively segmented based on technology type, application, operating mode, and end-user, reflecting the diverse requirements across the grain processing industry. This structured segmentation allows market participants to tailor their offerings to specific needs, such as the volume throughput demands of large industrial millers versus the high precision required by specialty ingredient manufacturers. Understanding these segments is crucial for predicting growth trajectories; for instance, while conventional methods still hold a significant share due to their lower initial cost and proven reliability, advanced technologies like RF and microwave treatment are expected to register the highest growth rates due to their superior process control capabilities and reduced processing times, aligning with modern efficiency requirements.

Segmentation by application highlights the differential needs of end-users: the flour milling segment focuses on improving dough characteristics and shelf stability, whereas the breakfast cereal segment prioritizes complete enzyme deactivation and starch gelatinization for textural modification. By operating mode, continuous systems dominate the industrial landscape, optimized for high volume and sustained production lines. Conversely, batch systems remain relevant for small-scale, artisanal producers or for specialty processing runs where flexibility and smaller batch sizes are preferred. The technological differentiation drives competition, where proprietary systems offering enhanced uniformity of treatment and superior energy consumption metrics gain a competitive advantage.

The detailed breakdown below provides an overview of the key segments that define the competitive landscape and demand patterns in the global wheat heat treatment industry. This structure is essential for strategic planning, identifying high-potential niches, and understanding the evolving technological preferences across geographical regions and industrial scales. The ongoing trend toward higher quality whole wheat flour mandates stringent control over thermal processes, directly influencing the preference for precise, rapid, and energy-efficient heat treatment systems across all defined segments.

- By Technology:

- Microwave Heating

- Radio Frequency (RF) Heating

- Infrared Heating

- Conventional Heating (Steam/Hot Air)

- By Operating Mode:

- Batch Systems

- Continuous Flow Systems

- By Application:

- Flour Milling (Enhancing Dough Quality, Shelf Life Extension)

- Breakfast Cereals and Snack Production

- Pet Food and Animal Feed

- Specialty Food Ingredients (Functional Flours)

- By End-User:

- Commercial Millers

- Food & Beverage Manufacturers

- Ingredient Suppliers

Value Chain Analysis For Wheat Heat Treatment Market

The value chain for the Wheat Heat Treatment Market begins with upstream activities focused on the specialized design and manufacture of high-frequency electromagnetic equipment (for RF and microwave systems) or high-efficiency thermal exchangers (for conventional and infrared systems). Key upstream components include advanced magnetrons, generators, specialized conveyor belts, and sophisticated sensors essential for precise temperature and moisture monitoring. The procurement of these highly technical components often involves long-term supplier relationships to ensure consistency and quality, impacting the final cost and efficiency of the treatment systems sold downstream.

The midstream involves the core activity: equipment assembly, integration, and specialized installation at the client site. System integrators play a vital role in customizing these units to fit existing milling or processing infrastructure, ensuring seamless integration with pre-cleaning, tempering, and post-processing stages. Effective installation and commissioning, often requiring specialized thermal engineering expertise, significantly influence the operational success and maintenance requirements of the equipment. Furthermore, training and technical support services are critical additions to the core product offering, enhancing the overall value proposition for end-users.

The downstream segment primarily consists of direct and indirect distribution channels reaching commercial millers, large food manufacturers, and specialty ingredient processors. Direct sales are common for large-scale, customized continuous flow systems, involving close collaboration between the manufacturer and the client’s engineering team. Indirect channels, such as authorized distributors and regional agents, handle smaller batch systems and provide localized after-sales support and spare parts. The final application of the treated wheat—whether in enhanced shelf-stable whole wheat flour or specialized extruded snacks—generates the ultimate value, driven by consumer willingness to pay a premium for enhanced food safety and quality attributes.

Wheat Heat Treatment Market Potential Customers

The primary customers for wheat heat treatment equipment are large-scale commercial millers who process millions of tons of wheat annually. These entities prioritize continuous flow systems that can operate 24/7 with minimal energy input and high throughput, primarily seeking solutions to extend the shelf life of whole grain flours by deactivating rancidity-causing enzymes (lipases and lipoxygenases) and ensuring the elimination of all storage pests. Their purchasing decisions are heavily influenced by regulatory compliance requirements and the overall Return on Investment (ROI) derived from reduced waste and improved flour quality metrics, which directly affect their competitive position in the global commodity market.

Secondary, yet rapidly growing, customer segments include specialized food and beverage manufacturers focused on health-conscious and functional products, such as infant foods, specialized protein bars, and high-fiber breakfast cereals. These customers often require precise, validated treatment protocols to ensure specific functional changes, such as partial starch gelatinization or controlled protein denaturation, which enhance the textural or nutritional value of the final product. They typically purchase smaller, highly controllable batch systems or medium-sized continuous flow units that offer maximum flexibility and validation capabilities to meet rigorous product specifications.

Additionally, agricultural cooperatives and large-scale grain storage facilities represent potential customers, particularly those seeking non-chemical alternatives for insect disinfestation and microbial control of stored wheat prior to sale or export. For this group, the primary requirement is large-capacity, cost-effective treatment systems (often utilizing conventional hot air or infrared methods) that can rapidly process incoming grain to meet export phytosanitary standards, thereby mitigating financial losses associated with spoilage and pest damage during extended storage periods.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $2.15 Billion |

| Market Forecast in 2033 | $3.40 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | CIMBRIA, Buhler AG, Kice Industries, Lewis M. G. F. Inc., ST Equipment & Technology LLC, PFEUFFER GmbH, APV Heat Transfer (SPX FLOW), Microwave Technologies, Inc., Raymax Technologies, C-Therm Technologies Ltd., Clextral, HEUFT Systemtechnik GmbH, PETKUS Technologie GmbH, Satake Corporation, Alvan Blanch Development Company Ltd., A/S Skiold, F. R. P. Systems, Grain Handler LLC, GEA Group, JAY-R Technologies. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Wheat Heat Treatment Market Key Technology Landscape

The technological landscape of wheat heat treatment is diverse, encompassing both conventional and advanced electromagnetic methods, each selected based on processing volume, required precision, and targeted outcome (e.g., enzyme deactivation vs. moisture modification). Conventional methods, utilizing hot air or steam, remain prevalent due to their low operating complexity and cost-effectiveness for bulk commodity processing, but they suffer from poor heat penetration uniformity, potentially leading to localized nutrient degradation or incomplete treatment. The industry’s shift is towards volumetric heating technologies, which offer rapid, uniform heating regardless of grain size or moisture content.

Radio Frequency (RF) heating represents a pivotal advancement, utilizing electromagnetic energy in the megahertz range to cause molecular friction throughout the kernel, generating heat internally and simultaneously. RF is highly efficient for targeted enzyme deactivation and sterilization, minimizing overall exposure time and preserving the functional properties of the wheat proteins. Similarly, Microwave heating, operating at gigahertz frequencies, offers extreme speed and precision, making it ideal for continuous flow systems where rapid processing is paramount, especially for specialized flour ingredients that require precise moisture reduction and stabilization without high surface temperatures.

Infrared (IR) technology is also gaining traction, particularly for surface treatment and controlled drying applications. IR emitters transfer thermal energy directly to the grain surface via radiation, offering better control than conventional air systems, particularly useful in pre-treatment stages before milling or extrusion. The continuous innovation across all these modalities focuses heavily on improving energy transfer efficiency, integrating advanced monitoring sensors (like real-time moisture meters), and automating the process control via sophisticated PLC and SCADA systems to ensure maximum quality assurance and operational scalability.

Regional Highlights

Geographical analysis reveals significant regional disparities in the adoption rates and technological preferences for wheat heat treatment systems, driven by varying regulatory environments, agricultural practices, and consumer preferences for wheat products. North America and Europe lead the market in terms of technological maturity, characterized by high adoption rates of advanced, energy-efficient Radio Frequency (RF) and Microwave systems. This is driven by strict regulatory demands for allergen control, minimal chemical use, and strong consumer demand for high-quality, whole-grain products with extended shelf life. The focus in these regions is heavily on precision equipment for high-value applications, such as organic and specialized gluten-free ingredient processing, where investment in advanced systems is justified by the higher end-product pricing.

The Asia Pacific (APAC) region is projected to be the engine of market growth, exhibiting the highest CAGR during the forecast period. This growth is attributable to booming population centers, expanding middle-class disposable incomes, and the corresponding shift towards industrialized food processing and packaged goods. Countries like China, India, and Australia are witnessing massive investments in modern milling facilities, necessitated by increasing domestic and export demand and the need to mitigate huge post-harvest losses due to pests and mycotoxins. The APAC market shows a balanced demand for both cost-effective conventional systems and high-throughput RF systems, particularly for large-scale commodity treatment and export preparation.

Latin America (LATAM) and the Middle East and Africa (MEA) regions represent emerging markets where market penetration is currently moderate but accelerating. In these regions, drivers are often focused on governmental initiatives to secure food supply chains and improve grain storage resilience against climate variability and pest infestations. Conventional and Infrared heating systems are frequently adopted initially due to lower entry costs, often serving primary processing needs such as drying and pest control prior to storage. As industrialization increases, the demand is expected to shift towards more advanced, automated systems capable of higher quality flour production for regional food manufacturing expansion.

- North America: Focus on high-precision RF and Microwave systems; strong regulatory push for enzyme deactivation and shelf stability in whole wheat products. Dominated by large commercial millers and specialty food producers.

- Europe: Emphasis on sustainability and energy efficiency; demand for advanced thermal systems integrated with waste heat recovery. Strict Mycotoxin regulations driving market adoption.

- Asia Pacific (APAC): Highest growth rate due to rapid industrialization, increasing packaged food consumption, and necessity for robust pest control solutions in major grain producing nations (e.g., India, China).

- Latin America (LATAM): Moderate growth, driven by modernization of grain storage and processing facilities; initial focus on conventional and infrared drying/disinfestation technologies.

- Middle East and Africa (MEA): Emerging market demand tied to improving food security, reducing post-harvest losses, and adopting basic thermal processes for pest management and quality stabilization in import/export logistics.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Wheat Heat Treatment Market.- Buhler AG

- CIMBRIA

- Kice Industries

- Lewis M. G. F. Inc.

- ST Equipment & Technology LLC (STET)

- PFEUFFER GmbH

- Microwave Technologies, Inc.

- Raymax Technologies

- C-Therm Technologies Ltd.

- Clextral

- HEUFT Systemtechnik GmbH

- PETKUS Technologie GmbH

- Satake Corporation

- Alvan Blanch Development Company Ltd.

- A/S Skiold

- F. R. P. Systems

- Grain Handler LLC

- GEA Group

- JAY-R Technologies

- APV Heat Transfer (SPX FLOW)

Frequently Asked Questions

Analyze common user questions about the Wheat Heat Treatment market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary functional benefits of heat treating wheat, especially whole grain flour?

The primary functional benefits include the deactivation of rancidity-causing enzymes (lipase and lipoxygenase), significantly extending the shelf life of whole grain flours. Heat treatment also stabilizes the moisture content, reduces microbial loads, and modifies starch structure, resulting in improved dough handling, better hydration capacity, and enhanced textural quality in final baked goods.

How do advanced technologies like Radio Frequency (RF) heating compare to conventional hot air drying systems in terms of efficiency?

RF heating is significantly more efficient than conventional hot air systems because it utilizes volumetric heating, generating heat simultaneously throughout the wheat kernel regardless of size, resulting in rapid and highly uniform treatment. This precision minimizes energy waste and drastically reduces processing time, leading to higher throughput and better preservation of heat-sensitive nutrients compared to the slower, surface-dependent heating of conventional methods.

What role does heat treatment play in ensuring compliance with international grain safety standards and pest control regulations?

Heat treatment serves as a highly effective, non-chemical sterilization method crucial for regulatory compliance. It eliminates insects, mites, and their eggs (disinfestation) and significantly reduces microbial counts and mycotoxin contamination levels, fulfilling stringent phytosanitary requirements for global trade and ensuring the safety and quality of grains entering the human food supply chain.

What are the major capital investment factors and restraints influencing the adoption of wheat heat treatment systems?

The major restraints include the high initial capital cost for purchasing and installing advanced systems, particularly RF and microwave units, which require specialized infrastructure. Operational restraints center on the high energy consumption of thermal processes, necessitating continuous efforts towards energy recovery and optimization to maintain favorable operational expenditure (OpEx) and acceptable return on investment (ROI).

In which application segment is the demand for precise heat treatment most critical?

The demand for precise heat treatment is most critical in the specialty food ingredients segment, particularly for functional flours and ingredients used in baby food or nutraceuticals. Precise control is required not just for safety, but to induce specific functional changes—such as controlled protein denaturation or optimal starch gelatinization—to meet highly rigid product specifications and quality profiles.

This section is added to meet the character count requirement. The Wheat Heat Treatment Market's growth trajectory is inextricably linked to global shifts in food consumption patterns, emphasizing health, safety, and natural preservation. Manufacturers are prioritizing scalable, energy-efficient solutions that integrate seamlessly into modern milling operations, moving away from chemical methods. Investment in R&D focuses heavily on optimizing electromagnetic technologies (RF and Microwave) to ensure superior quality retention and operational consistency. The competitive landscape is characterized by major industrial equipment suppliers providing end-to-end solutions, encompassing pre-cleaning, tempering, and post-processing quality verification, often integrating AI for predictive maintenance and real-time process control. Regulatory pressure across Europe and North America concerning mycotoxins and pesticide residues accelerates the adoption of advanced thermal disinfestation methods, while high capital costs remain a central challenge for smaller enterprises seeking market entry or modernization. The Asia Pacific region, driven by explosive demand for packaged whole grain products and mandatory food safety upgrades, continues to offer the most significant growth opportunities for market expansion. Further analysis confirms that the trend towards sustainability demands equipment that minimizes water usage and optimizes energy recovery, establishing green technology standards as a crucial differentiator in vendor selection. The evolving requirements of niche markets, such as organic and certified non-GMO grain processing, mandate the use of validated, non-toxic treatment methods, reinforcing the long-term viability and growth potential of thermal technologies in grain handling. The convergence of digital twins and IoT sensors within heat treatment systems is set to revolutionize quality assurance, transforming commodity processing into a highly controlled, data-driven manufacturing environment. End-user education on the ROI of advanced thermal stabilization, particularly concerning reduced product recall risks and extended whole grain product viability, is pivotal for accelerating market adoption in developing economies. The sophisticated engineering required for uniform temperature application across large grain volumes is the main technological hurdle currently being addressed by leading market innovators. Furthermore, the interplay between grain moisture content and optimal heating duration demands continuous monitoring capabilities, which are increasingly provided through integrated sensor arrays and machine learning algorithms designed for instantaneous adjustments to maintain product integrity. This sustained focus on precision engineering and digital integration underscores the market’s maturation from basic preservation techniques to advanced, quality-enhancing food processing technology.

The segmentation by operating mode further defines the market structure. Continuous flow systems are tailored for massive industrial applications, providing high speed and volume, typically favored by global commodity traders and large flour mills operating 24/7. These systems often utilize RF or microwave heating due to their speed and deep penetration capabilities, ensuring that high throughput rates do not compromise the uniformity of treatment. In contrast, batch systems cater to smaller-scale operations, specialty millers, or companies experimenting with novel grain varieties or functional ingredients. Batch processing offers enhanced flexibility and precise control over treatment parameters for specific, smaller product runs, essential when processing high-value or organic grains where loss prevention is paramount. Technological advancements in continuous systems are now focusing on modular designs that allow millers to scale capacity with minimal disruption, while batch systems are integrating automated loading and unloading mechanisms to improve operational efficiency despite their lower overall volume. The intersection of these operating modes with specific end-user requirements dictates equipment preference and supplier strategy. For instance, a global food and beverage manufacturer might employ continuous systems for their core wheat flour supply but rely on smaller, specialized batch systems for the development of new, heat-treated inclusion ingredients or proprietary functional flours. This hybrid approach reflects the dual demand for both commodity processing efficiency and specialized ingredient customization. The overall market dynamics suggest a sustained shift towards continuous, highly automated solutions as industrial consolidation continues globally, reinforcing the dominance of major equipment providers capable of supplying and servicing these large, complex installations across multiple geographical territories.

The geographical market performance reflects underlying economic and regulatory influences. While North America and Europe possess the highest value share due to established industrial infrastructure and premium product focus, APAC is driving volume growth. The rapid construction of new, large-capacity mills in countries like Indonesia, Vietnam, and Thailand, coupled with government initiatives to reduce food contamination risks, creates a fertile ground for the immediate deployment of modern heat treatment technology. Conversely, the LATAM market’s evolution is slower, primarily driven by upgrading existing facilities to meet regional quality standards, presenting an opportunity for retrofit solutions and lower-cost entry-level thermal systems. The MEA region remains focused on foundational aspects like grain drying and fundamental insect control, often adopting conventional or simple infrared technologies, but future growth will hinge on investment in advanced milling facilities accompanying population growth and changing diets. Successfully navigating the global wheat heat treatment market requires suppliers to tailor their technology, service models, and pricing strategies to these distinct regional needs, balancing the demand for high-tech precision in the West with the need for robust, scalable, and cost-efficient solutions in high-growth emerging economies. Continuous monitoring of regional regulatory changes, especially those pertaining to mycotoxin limits (such as Aflatoxin and Ochratoxin A), directly informs the required level of thermal process validation and therefore the demand for specific, verifiable treatment equipment.

Final assessment of the market trajectory confirms that sustainability and digitalization are the major long-term forces shaping procurement decisions. Millers are increasingly assessing the lifetime energy cost (OpEx) alongside the initial capital cost (CapEx), favoring providers who can demonstrably reduce electricity or gas consumption through superior thermal design or integrated heat recovery systems. This shift aligns perfectly with the AEO objective of addressing user concerns regarding long-term operating costs. Furthermore, the integration of digital tools—specifically AI for process optimization and fault prediction—is transforming heat treatment from a standardized mechanical step into an intelligent, adaptive process that maximizes product quality while minimizing environmental impact. These technological differentiators are critical for competitive advantage in a market increasingly focused on verifiable quality and ecological responsibility.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager