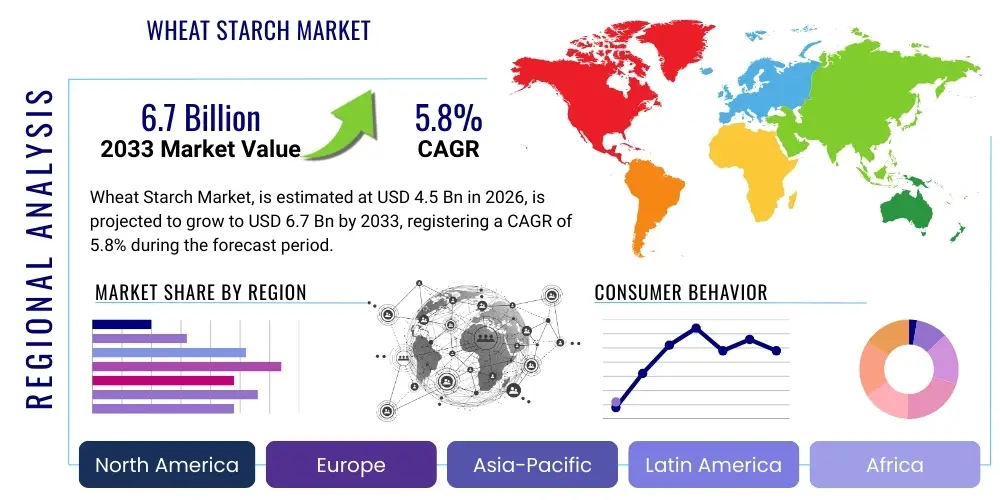

Wheat Starch Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439128 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Wheat Starch Market Size

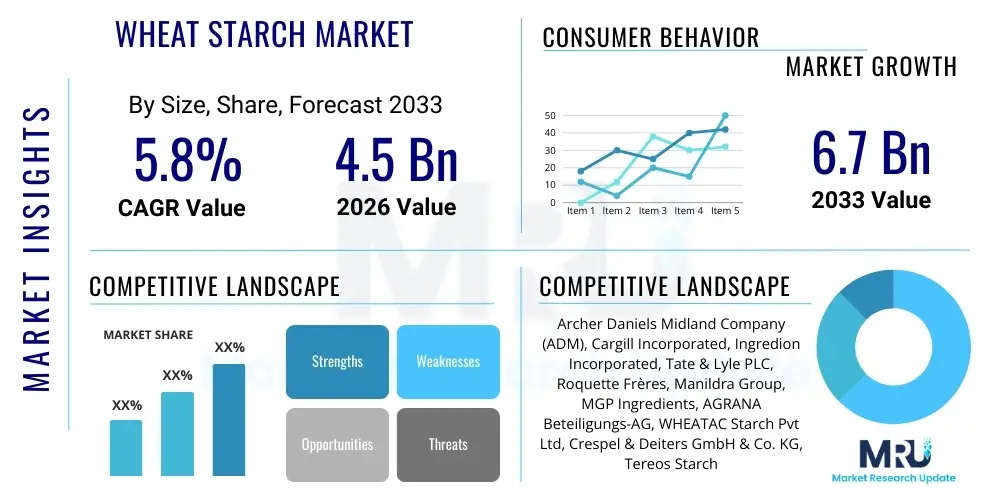

The Wheat Starch Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 4.5 billion in 2026 and is projected to reach USD 6.7 billion by the end of the forecast period in 2033.

Wheat Starch Market introduction

The Wheat Starch Market encompasses the production, distribution, and consumption of starch derived from wheat grain, serving as a vital ingredient across numerous industrial and food applications globally. Wheat starch is primarily valued for its functional properties, including thickening, binding, stabilizing, and gelling capabilities, making it indispensable in modern food processing, particularly in bakery, confectionery, and processed meat sectors. Beyond food, its high purity and versatility drive significant demand in industrial applications, notably in the paper manufacturing industry where it improves strength and printability, and in the textile sector for sizing and finishing. The increasing global preference for natural and clean-label ingredients is a key driver, as wheat starch is perceived as a traditional, non-GMO, and natural additive compared to certain chemically modified starches. Furthermore, the rising demand for derivatives such as vital wheat gluten, which is co-produced during the starch extraction process, enhances the overall economic viability of wheat processing, supporting continuous investment and technological advancements within the market. This symbiotic relationship between starch and gluten production ensures sustained supply stability and competitive pricing, fostering market expansion into novel biochemical and pharmaceutical uses.

Wheat starch is characterized by its bland taste and excellent solubility, enabling its widespread use as an extender and textural agent without altering the primary flavor profile of the final product. Product descriptions typically highlight two main forms: native starch, which is unmodified and used extensively in basic thickening and adhesive roles, and modified starches, which have undergone physical, chemical, or enzymatic treatment to enhance specific properties like shear stability, freeze-thaw stability, or improved solubility under varied pH conditions. Major applications span the food industry (noodles, baked goods, sauces, soups), non-food industrial sectors (paper, textiles, adhesives, bioplastics), and feed industries. The primary benefits driving market demand include its high performance in binding water, its ability to improve the structure and volume of baked goods, and its biodegradable nature, which is increasingly favored in packaging and adhesive formulations over synthetic alternatives. The market is also heavily influenced by the robust global consumption of wheat, ensuring a consistent raw material supply necessary for large-scale production, particularly in regions with established wheat cultivation infrastructure like Europe and North America.

Driving factors for sustained market growth include rapid urbanization in developing economies, leading to increased consumption of processed and convenience foods, which heavily rely on functional ingredients like wheat starch for texture and shelf-life extension. Simultaneously, the expanding application scope into specialty chemical production, such as polyols and glucose syrups, further diversifies revenue streams for producers. Regulatory support for bio-based materials and the push towards sustainable industrial practices globally also contribute positively, positioning wheat starch as an environmentally friendly raw material. However, the market remains sensitive to fluctuations in wheat commodity prices, which directly impact the cost of production, requiring producers to adopt efficient extraction and processing technologies to maintain competitive margins and ensure stable supply chains capable of meeting fluctuating global demand for both native and specialized modified wheat starch products.

Wheat Starch Market Executive Summary

The Wheat Starch Market Executive Summary highlights a period of steady expansion fueled by robust demand from the food processing and industrial sectors, underpinned by significant technological advancements in starch modification and co-product utilization. Key business trends point toward increased consolidation among major global players seeking vertical integration to secure raw material supply and optimize extraction processes, particularly focusing on sustainable manufacturing techniques to meet evolving consumer expectations for eco-friendly ingredients. Regional trends indicate that Asia Pacific (APAC) is emerging as the fastest-growing market due to rapid industrialization, expanding domestic processed food consumption bases, and significant investment in new paper and textile manufacturing facilities, while Europe and North America maintain dominant shares driven by established functional food markets and high utilization rates in non-food applications. Segment trends reveal that the modified wheat starch segment is outpacing native starch growth, primarily due to its superior functional stability and tailorability, catering to complex manufacturing requirements in deep-frozen foods, specialized coatings, and bio-based chemical intermediaries, demonstrating a clear shift toward value-added products over basic commodities.

Analysis of the competitive landscape shows that differentiation is increasingly based on product functionality and compliance with strict regulatory standards related to food safety and ingredient origin. Companies are heavily investing in research and development to create novel starch derivatives that can act as fat replacers or superior binding agents, addressing specific health and nutritional concerns, particularly within the gluten-free and low-fat food sectors. The strategic pivot towards maximizing the value of co-products, such as vital wheat gluten and wheat germ, is central to the profitability of integrated facilities, mitigating the risks associated with volatile wheat prices. Furthermore, supply chain optimization, including better logistics for handling bulk shipments and developing localized processing hubs closer to consumption centers, is critical for maintaining market agility and reducing overall operational costs, thereby ensuring competitive advantages for multinational corporations operating in diverse geographical locations.

In terms of future outlook, the market is structurally resilient, benefiting from the fundamental need for binding and thickening agents across almost every manufacturing sector. However, the market must navigate challenges related to regulatory scrutiny on carbohydrate content and competition from alternative starches (e.g., corn, potato, tapioca). Successful market penetration in the coming years will depend on addressing these challenges through innovation in clean label production, demonstrating clear sustainability credentials, and leveraging digital technologies for predictive modeling of commodity price fluctuations and demand forecasting. The overall market trajectory indicates continued moderate to high growth, sustained by the versatility of wheat starch derivatives and their irreplaceable role in both established and emerging high-growth end-user industries.

AI Impact Analysis on Wheat Starch Market

User queries regarding the impact of Artificial Intelligence (AI) on the Wheat Starch Market center around how machine learning can optimize raw material sourcing, enhance process efficiency in extraction plants, and predict quality parameters based on wheat variety and weather patterns. Users frequently ask about AI's role in improving yield (maximizing starch and gluten recovery), reducing energy consumption in drying processes, and ensuring product consistency for highly regulated end-user industries like pharmaceuticals and specialty foods. A significant theme is the use of predictive analytics to manage complex commodity price volatility, allowing producers to hedge against adverse market movements. Furthermore, there is rising interest in how AI-driven quality control systems can instantly detect and categorize variations in native starch structure, facilitating precise batch management necessary for specialized modified starch production, ultimately leading to reduced waste and improved operational margins across the entire value chain.

- AI-powered predictive maintenance minimizes downtime in high-throughput extraction facilities, ensuring continuous production flow.

- Machine learning algorithms optimize the separation process (wet milling or batter process) to maximize the co-extraction yield of vital wheat gluten and starch.

- Advanced analytics predict the optimal timing for raw wheat purchase and storage based on weather forecasts, commodity market trends, and historical quality data.

- AI-driven quality control systems utilize computer vision and sensor data to continuously monitor starch purity, particle size distribution, and moisture content in real time.

- Generative AI tools assist R&D teams in simulating molecular modifications, accelerating the development of novel functional wheat starch derivatives for specific applications (e.g., specific viscosity for coatings).

- Optimization models reduce the energy intensity associated with drying and wastewater treatment, lowering operational expenses and improving sustainability metrics.

- Automated robotics and vision systems, guided by AI, enhance precision in packaging and logistics, reducing labor costs and minimizing potential contamination.

- Supply chain visibility tools leverage AI to trace raw material origin and predict logistical bottlenecks, ensuring timely delivery to key industrial customers.

DRO & Impact Forces Of Wheat Starch Market

The Wheat Starch Market is influenced by a complex interplay of Drivers, Restraints, and Opportunities, which collectively form the impact forces dictating its growth trajectory and competitive dynamics. Key drivers include the exponential growth of the global processed food industry, necessitating superior binders and texturizers, coupled with the increasing substitution of synthetic materials with bio-based starch derivatives in industrial applications like biodegradable plastics and adhesives. However, the market faces significant restraints, primarily stemming from the inherent volatility of global wheat commodity prices, which directly affects operational costs and pricing strategies, alongside the intense competition from readily available and sometimes lower-cost alternatives suchases corn starch and tapioca starch, particularly in APAC. Opportunities lie in expanding the high-value modified starch segment, specializing in functionalities required for clean-label, gluten-free, and high-performance industrial uses, and capitalizing on the burgeoning demand for high-protein co-products like vital wheat gluten, thereby strengthening the integrated economic model of wheat processing plants and maximizing profit realization across all production streams.

The impact forces operate on multiple levels, with market drivers creating underlying demand stability while restraints impose cost pressure and require constant technological vigilance. For instance, the driver related to the clean-label trend pushes companies toward investing in enzyme modification technologies, which is simultaneously constrained by the high capital expenditure required for such sophisticated processing equipment. The primary opportunity lies in the synergistic value generation of co-products; if the market price for vital wheat gluten is high, producers can absorb higher raw material costs and still maintain profitability on the starch side. Conversely, if wheat prices spike globally due to adverse weather or geopolitical instability, it acts as a severe restraint, potentially slowing down investments in expansion and forcing end-users to consider cheaper alternatives, thereby dampening overall market growth despite strong underlying demand in major application sectors.

Strategic differentiation is essential for companies to navigate these forces successfully. Those focusing on developing proprietary, high-performance modified starches with unique functional benefits (e.g., enhanced stability in low pH environments or improved film-forming capabilities for coatings) are better positioned to command premium pricing and mitigate the impact of commodity price fluctuations. Furthermore, focusing on regional supply chain optimization and securing long-term contracts with large industrial buyers, such as paper manufacturers or major food conglomerates, provides a necessary buffer against market volatility. The continuous drive towards maximizing resource efficiency through advanced extraction techniques, which reduce water and energy consumption, not only addresses environmental sustainability concerns but also provides a crucial cost advantage, transforming operational improvements into a competitive edge against regional competitors relying on older, less efficient processing infrastructure.

Segmentation Analysis

The Wheat Starch Market segmentation provides a crucial framework for understanding the diverse applications, product types, and end-user demands driving market structure and growth globally. The market is primarily segmented based on product type (Native Starch and Modified Starch), application (Food & Beverage, Industrial, and Feed), and functional form (Powder and Liquid). The analysis shows a distinct trend where volume growth is dominated by native starch utilized in bulk industrial sectors like paper manufacturing, whereas value growth is increasingly concentrated within the modified starch segment. Modified starches offer specialized functionalities essential for complex modern food formulations and high-performance industrial coatings, thereby attracting premium pricing and higher margins for producers who invest in advanced modification technologies. This detailed segmentation allows market players to tailor production strategies and marketing efforts toward specific, high-growth pockets of demand, ensuring optimal resource allocation and maximizing overall market penetration.

- By Product Type:

- Native Wheat Starch

- Modified Wheat Starch (e.g., Acid-modified, Cationic, Oxidized, Pregelatinized)

- By Application:

- Food & Beverage (Bakery, Confectionery, Soups & Sauces, Dairy & Convenience Foods)

- Industrial (Paper & Pulp, Textiles, Adhesives, Bioplastics, Pharmaceuticals)

- Animal Feed

- By Form:

- Powder

- Liquid

- By Grade:

- Food Grade

- Industrial Grade

- Feed Grade

Value Chain Analysis For Wheat Starch Market

The Wheat Starch value chain is inherently complex, starting with the upstream sourcing of raw materials, primarily high-quality milling wheat, extending through sophisticated processing and fractionation, and concluding with the downstream distribution to diverse industrial and food end-users. Upstream analysis focuses heavily on agricultural practices, commodity trading, and securing long-term supply agreements with wheat growers and cooperatives to mitigate price volatility and ensure consistent quality inputs necessary for food-grade production. The primary transformation occurs in the midstream, where wet milling or batter processes are employed to separate the wheat grain into three main components: wheat starch, vital wheat gluten (a high-value protein co-product), and wheat germ/feed ingredients. Efficiency in this stage is paramount, utilizing advanced separation technologies, such as decanting centrifuges and hydrocyclones, to maximize the yield and purity of the starch, which significantly influences the cost structure and competitive positioning of the processor.

Downstream analysis highlights the crucial role of specialized modification technologies, converting native starch into value-added derivatives tailored for specific functional requirements, such as improved shear stability for sauces or enhanced film-forming properties for paper coatings. Distribution channels are highly fragmented yet specialized; bulk native starch often moves through large-scale industrial distributors serving the paper and textile industries, while modified, food-grade starches require highly controlled, specialized distribution networks capable of handling sensitive ingredients with strict quality assurance protocols. Direct sales channels are common for large volume industrial customers, particularly for tailored modified starches, where technical support and application expertise are critical components of the sale, fostering strong, collaborative relationships between the producer and the end-user manufacturer.

Indirect distribution plays a vital role for smaller food processors and international markets, utilizing a network of regional ingredient distributors and agents who manage warehousing, packaging, and regulatory compliance across diverse geographies. The profitability across the value chain is highly dependent on effective logistics management and optimized co-product sales; success is often measured not just by the efficiency of starch recovery but equally by the market performance of the vital wheat gluten, which can account for a substantial portion of the overall revenue. Consequently, continuous process improvement aimed at reducing energy consumption in the drying stages and minimizing wastewater output is critical for maintaining robust margins throughout the highly integrated wheat starch supply chain, driving sustainable and competitive operations globally.

Wheat Starch Market Potential Customers

Potential customers for the Wheat Starch Market are highly diversified, spanning multiple high-volume sectors where the product's functional properties—thickening, binding, stabilization, and texturizing—are essential. The largest segment of buyers resides within the Food & Beverage industry, encompassing major bakeries that rely on starch for crumb structure and volume, confectionery manufacturers needing gelling agents, and producers of convenience foods, including ready meals, soups, and sauces, where starch acts as a primary thickener and moisture retainer, extending shelf life and improving mouthfeel. These food manufacturers prioritize highly purified, food-grade starches and increasingly demand modified variants that perform reliably under harsh processing conditions (e.g., high heat or extreme pH levels) and align with clean-label requirements, focusing on enzyme-modified starches as acceptable natural alternatives to chemical modifications.

Equally critical are the industrial buyers, primarily large-scale Paper and Pulp manufacturers. Wheat starch is extensively used as a binder and sizing agent to improve the strength, stiffness, and printability of paper and corrugated board, representing a major bulk consumption area where cost-efficiency and high binding capacity are the key purchasing criteria. Textile manufacturers form another significant customer base, utilizing starch for warp sizing to strengthen yarns during weaving and for subsequent finishing applications, ensuring the fabric achieves the desired texture and finish. These industrial end-users typically purchase native or minimally modified industrial-grade starch in large volumes, necessitating strong logistical capabilities from the suppliers to ensure timely and cost-effective bulk delivery across global manufacturing hubs, particularly in Asia Pacific where textile production is concentrated.

Emerging high-potential customers include manufacturers in the specialty chemicals sector, particularly those developing bio-based plastics, adhesives, and pharmaceutical excipients. These buyers require highly specialized, consistent, and often functionalized wheat starch derivatives (e.g., starch polyols, microcrystalline starch) tailored for innovative product development where high purity and predictable rheological behavior are non-negotiable specifications. Furthermore, the animal feed industry consumes substantial quantities of feed-grade wheat starch as an energy source and binder in pellet manufacturing. Suppliers targeting these diverse customer segments must maintain rigorous quality control standards, offer customized technical support, and align their product portfolio with regional regulatory requirements to successfully penetrate and retain market share across these varied buyer categories, ranging from commodity-driven bulk users to high-specification specialty chemical producers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 6.7 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Archer Daniels Midland Company (ADM), Cargill Incorporated, Ingredion Incorporated, Tate & Lyle PLC, Roquette Frères, Manildra Group, MGP Ingredients, AGRANA Beteiligungs-AG, WHEATAC Starch Pvt Ltd, Crespel & Deiters GmbH & Co. KG, Tereos Starch & Sweeteners, Pioneer Industries, Vimal Group, Sacchetto S.p.A., Amylon S.R.O., KMC A/S, Emsland Group, Grain Processing Corporation (GPC), VandeWalle Starch Company, Jiangsu Huajing Starch Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Wheat Starch Market Key Technology Landscape

The technological landscape of the Wheat Starch Market is continuously evolving, driven by the dual needs for maximizing co-product yield and creating highly specialized functional ingredients. The core processing technology remains the wet milling of wheat, but modern plants utilize sophisticated fractionation techniques, primarily focused on improving the separation efficiency between starch and vital wheat gluten. Advanced equipment, such as high-speed decanter centrifuges, hydrocyclones, and ultrafiltration membranes, are crucial for achieving high purity levels for food and pharmaceutical applications, minimizing the loss of the high-value protein component. Furthermore, process integration, which links the initial separation stages with subsequent drying and modification steps, is vital for energy efficiency; producers are adopting flash drying and ring drying systems designed to remove moisture quickly and efficiently while preserving the native functionality of both starch and gluten, significantly reducing the industry’s overall carbon footprint and operational costs.

In the segment of value addition, starch modification technologies represent the most dynamic area of innovation. Producers are moving beyond traditional chemical modification (such as oxidation or acetylation) toward enzyme-based modifications (enzymatic hydrolysis, transglycosylation) to create clean-label, functionally enhanced starches that satisfy consumer demand for natural ingredients. These technologies produce starches with unique characteristics, such as high resistance to digestion (resistant starch for dietary fiber applications) or enhanced viscosity under specific temperature profiles, allowing them to substitute synthetic stabilizers. Furthermore, the development of physical modification techniques, including annealing, heat-moisture treatment, and extrusion, is gaining traction, as these methods alter the crystalline structure of the starch granule without chemical additives, offering desirable textural attributes for specific food applications without requiring labeling as chemically modified.

Beyond processing, digitalization and automation are transforming plant operations. The integration of advanced sensor technology (spectroscopy, NIR analysis) and Industrial Internet of Things (IIoT) platforms allows for real-time monitoring of critical process parameters, such as pH levels, temperature gradients, and solid content throughout the extraction process. This data is fed into sophisticated process control systems and often augmented by AI algorithms to automatically adjust operational variables, maximizing throughput, ensuring batch consistency, and rapidly detecting quality deviations before costly material losses occur. The continuous innovation in these areas, from highly efficient co-product recovery systems to precision modification techniques and smart factory integration, is defining the competitive advantage for leading global wheat starch producers, enabling them to meet the stringent quality requirements and efficiency demands of the modern industrial and food ingredient markets effectively and sustainably.

Regional Highlights

The global Wheat Starch Market exhibits distinct dynamics across key geographical regions, influenced by localized agricultural capabilities, industrial output, and consumer dietary trends. Europe currently holds a leading market share, primarily due to its established, large-scale wheat processing infrastructure and strong regulatory environment favoring bio-based and sustainable ingredients. European demand is robust across both industrial sectors (high-quality paper manufacturing) and sophisticated food ingredient markets, where strict quality standards necessitate premium, highly functional modified starches. The region benefits from reliable domestic wheat supply, although production costs are relatively high compared to emerging economies, pushing European manufacturers to specialize in high-value derivatives and co-products.

Asia Pacific (APAC) is projected to record the highest growth rate during the forecast period. This accelerated expansion is driven by rapid urbanization, significant growth in the middle-class population, and the corresponding shift towards packaged and processed foods, particularly in highly populous countries like China and India. Furthermore, APAC serves as a massive industrial manufacturing hub; the explosive growth in paper, textile, and packaging industries across Southeast Asia creates immense bulk demand for industrial- grade native wheat starch. Local governments in APAC are increasingly supporting the development of domestic processing capacities to reduce reliance on imported starches, although raw material sourcing efficiency remains a challenge due to varied wheat quality and volatile local agricultural yields.

North America maintains a mature and stable market, characterized by technological leadership and a strong focus on functional food ingredients, particularly starch derivatives used in gluten-free products and specialized diet formulations. North American producers benefit from large-scale, highly mechanized farming operations providing consistent quality wheat. Market growth here is propelled less by volume and more by innovation, focusing on bio-engineered starches and sustainable production methods. Latin America and the Middle East & Africa (MEA) represent emerging markets, where demand growth is steady but highly dependent on local economic development and investment in food processing and manufacturing infrastructure. MEA, in particular, shows promise in leveraging starch as a component in local beverage and snack production, but is often constrained by logistical challenges and lower per capita wheat consumption compared to Western nations.

- Europe: Market leader driven by sophisticated food ingredient demand, advanced modification technology adoption, and large industrial paper sectors. Focus on sustainable and high-purity starches.

- Asia Pacific (APAC): Fastest growing region due to massive demand from processed food consumption and large-scale textile and paper manufacturing expansion across China, India, and ASEAN nations.

- North America: Mature market characterized by high investment in R&D, specialized functional starches (e.g., non-GMO and gluten-free applications), and efficient raw material supply chains.

- Latin America (LATAM): Moderate growth fueled by expanding meat processing and bakery sectors, though market size is smaller and subject to local economic stability and trade policies.

- Middle East & Africa (MEA): Emerging growth market, focused primarily on basic thickening agents for beverages and convenience foods, with growth constrained by infrastructure limitations.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Wheat Starch Market.- Archer Daniels Midland Company (ADM)

- Cargill Incorporated

- Ingredion Incorporated

- Tate & Lyle PLC

- Roquette Frères

- Manildra Group

- MGP Ingredients

- AGRANA Beteiligungs-AG

- Crespel & Deiters GmbH & Co. KG

- Tereos Starch & Sweeteners

- Vimal Group

- Pioneer Industries

- Sacchetto S.p.A.

- Amylon S.R.O.

- KMC A/S

- Emsland Group

- Grain Processing Corporation (GPC)

- WHEATAC Starch Pvt Ltd

- VandeWalle Starch Company

- Jiangsu Huajing Starch Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Wheat Starch market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between native and modified wheat starch, and which segment is driving value growth?

Native wheat starch is the raw, unmodified product used primarily for basic thickening and binding in bulk industrial applications (paper, textiles). Modified wheat starch has undergone physical or chemical treatment to enhance specific functionalities like high stability or improved solubility. The modified starch segment is driving value growth due to its superior performance in complex, high-margin food and specialty industrial applications requiring tailored functional properties.

How does the co-production of vital wheat gluten impact the overall economics of the wheat starch industry?

Vital wheat gluten (a high-protein co-product) significantly bolsters the profitability of wheat starch production. The high market value of gluten, used extensively in bakery and vegetarian protein markets, offsets the volatile cost of raw wheat and the capital investment required for processing, transforming the starch extraction process into a highly integrated and economically favorable protein-starch business model.

Which application segment consumes the largest volume of wheat starch globally?

The Industrial Application segment, specifically the Paper and Pulp manufacturing industry, consumes the largest volume of native wheat starch globally. Starch is essential in paper making as a sizing agent and binder, improving surface properties, strength, and printability of paper and board products, requiring bulk, industrial-grade supply.

What are the key technological advancements shaping the future of wheat starch production?

Key technological advancements include the adoption of enzyme-based modification techniques for creating clean-label starches, advanced centrifugation and filtration systems to maximize co-product (gluten) yield, and the integration of AI-driven sensors and process control systems for real-time monitoring, significantly enhancing efficiency and ensuring product consistency across different manufacturing batches.

What role does Asia Pacific play in the future expansion of the Wheat Starch Market?

Asia Pacific is forecasted to be the fastest-growing region, driven by explosive demand from the expanding processed food sector due to rising middle-class consumption, coupled with robust growth in industrial sectors like textiles and paper manufacturing. Investment in local processing capabilities and increasing urbanization heavily influence this accelerated regional market expansion.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager