Wheat Straw Pulp Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434411 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Wheat Straw Pulp Market Size

The Wheat Straw Pulp Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 11.8% between 2026 and 2033. The market is estimated at USD 350.5 Million in 2026 and is projected to reach USD 760.8 Million by the end of the forecast period in 2033.

Wheat Straw Pulp Market introduction

The Wheat Straw Pulp Market encompasses the industry dedicated to processing agricultural residue, specifically wheat straw, into viable cellulose pulp used primarily for paper, packaging, and molded fiber products. This segment of the global pulp and paper industry is rapidly expanding, driven by increasing consumer and regulatory demand for sustainable, non-wood fiber sources. Wheat straw, traditionally considered agricultural waste, offers a compelling alternative to virgin wood fiber, aiding in deforestation mitigation and reducing the carbon footprint associated with conventional papermaking.

Wheat straw pulp is characterized by short fibers but high flexibility, making it highly suitable for applications requiring smoothness and printability, though it often needs blending with longer fibers for structural integrity in certain high-strength applications. Major applications include fine writing and printing paper, tissue products, molded foodservice products (plates, bowls, clamshells), and various types of specialty packaging. The transformation of agricultural waste into valuable industrial input not only solves disposal issues for farmers but also establishes a circular economy model within the bioproducts sector.

Key benefits driving market adoption include its abundance as a readily available, annually renewable resource, and the lower environmental impact compared to wood harvesting and processing. Furthermore, technological advancements in pulping and bleaching processes, particularly those focused on efficient silica removal and Totally Chlorine-Free (TCF) methodologies, have significantly improved the quality and economic viability of wheat straw pulp, positioning it as a critical material in the global push toward bio-based materials and sustainable manufacturing practices.

Wheat Straw Pulp Market Executive Summary

The Wheat Straw Pulp Market is experiencing robust growth fueled by stringent environmental regulations limiting wood harvesting and a strong societal push toward biodegradable packaging solutions. Business trends indicate significant investment in specialized pulping technologies designed to handle the high silica content characteristic of wheat straw, primarily focusing on chemical recovery systems to ensure operational efficiency and cost competitiveness against traditional wood pulp. Strategic collaborations between large packaging manufacturers and agricultural producers are becoming common, securing stable raw material supply chains and optimizing logistics for dense, low-value agricultural residues.

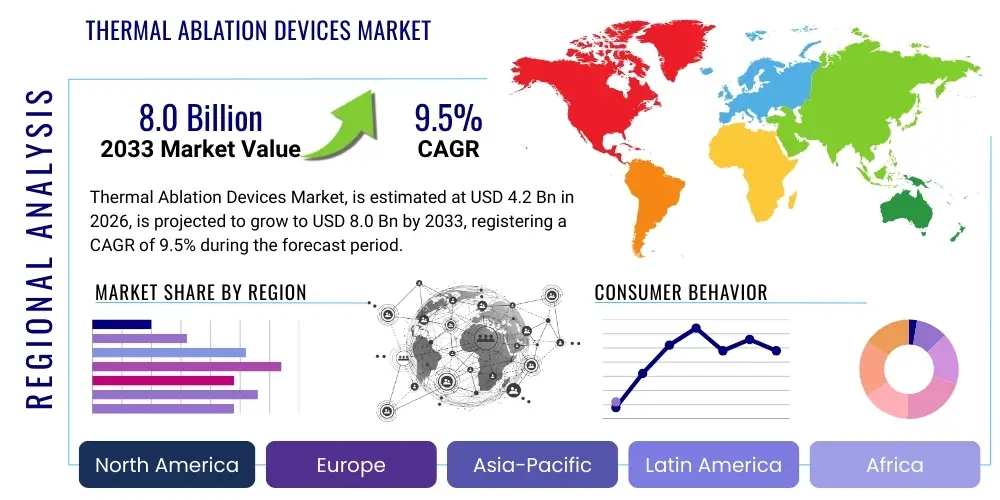

Regionally, Asia Pacific (APAC), particularly China and India, dominates the market both in terms of production capacity and consumption, leveraging vast wheat farming landscapes and facing acute pressures to manage agricultural waste and air pollution (stubble burning). North America and Europe, while having smaller production bases, are high-growth consumption markets, driven by mandates for sustainable foodservice packaging and corporate sustainability targets. Regulatory frameworks in these Western regions often mandate the use of compostable and bio-based materials, accelerating the adoption of wheat straw pulp alternatives.

Segment trends reveal that the unbleached pulp segment, used extensively for molded fiber packaging and industrial cardboard, holds a significant share due to its cost-effectiveness and inherent suitability for brown products. However, the bleached pulp segment, critical for fine writing paper and high-quality tissue, is projected to exhibit the highest growth rate, benefiting from continuous improvements in environmentally friendly bleaching techniques such as oxygen delignification and TCF processes. The foodservice and packaging application category remains the primary end-use driver, strongly outpacing demand from traditional printing and writing paper sectors.

AI Impact Analysis on Wheat Straw Pulp Market

Common user questions regarding AI's impact on the Wheat Straw Pulp Market primarily revolve around operational efficiency, raw material variability management, and quality control. Users are keen to understand how AI can optimize the complex supply chain of agricultural waste collection and predict yield and quality based on weather patterns and crop management practices. A significant concern is whether AI can effectively manage and mitigate the challenges associated with high silica and ash content during the pulping process, which traditionally leads to increased equipment wear and decreased chemical recovery efficiency. Furthermore, users seek clarity on AI's role in predictive maintenance for specialized pulping machinery and optimizing bleaching sequences to achieve desired brightness levels while minimizing chemical usage and environmental discharge.

AI and machine learning (ML) are set to revolutionize the efficiency and sustainability of wheat straw pulping operations. By applying ML algorithms to analyze vast datasets related to raw material composition (fiber length, moisture, silica concentration), processing parameters (cooking temperature, chemical charge), and output quality, facilities can achieve unprecedented control over their processes. This predictive capability allows plant operators to dynamically adjust chemical dosing and retention times, leading to optimized resource use, reduced energy consumption, and higher pulp yield, fundamentally addressing the historical variability inherent in agricultural residues.

Furthermore, the integration of AI-powered computer vision and sensor networks is transforming quality assurance and predictive maintenance. In real-time, AI models can inspect the pulp slurry for contaminants or inconsistencies, ensuring superior final product quality, especially vital for bleached grades used in premium paper. For machinery, AI algorithms analyze vibration, temperature, and pressure data from digesters, washers, and refiners to predict equipment failure long before it occurs, drastically reducing unplanned downtime and maintenance costs, thereby making wheat straw pulp production more economically competitive against established wood pulp mills.

- AI-driven optimization of raw material logistics and collection scheduling, reducing transport costs.

- Machine Learning models predicting optimal chemical loading and cooking cycles for varying wheat straw quality.

- Predictive maintenance schedules for pulping and recovery boilers, minimizing operational downtime caused by silica buildup.

- Computer vision systems ensuring real-time quality control and contaminant removal during cleaning and bleaching.

- Optimization of energy consumption in refining and drying stages using reinforcement learning techniques.

DRO & Impact Forces Of Wheat Straw Pulp Market

The dynamics of the Wheat Straw Pulp Market are shaped by a powerful interplay of supportive drivers, inherent operational restraints, and substantial market opportunities, collectively exerting significant impact forces. The primary drivers are centered on global mandates for environmental sustainability, the urgent need for viable alternatives to wood fiber, and the economic incentive provided by utilizing agricultural waste, which simultaneously addresses waste management issues and provides farmers with a supplementary income stream. Conversely, the market faces significant restraints, chiefly concerning the high technical difficulty and capital cost associated with processing wheat straw, specifically the challenge of managing high silica content that complicates chemical recovery systems and increases equipment wear. Opportunities lie prominently in the rapidly expanding molded fiber packaging sector and the development of high-value specialty products like cellulosic nanofibers derived from wheat straw.

Drivers: Environmental regulations are forcing major consumer packaged goods (CPG) companies and foodservice providers to transition to sustainable, compostable packaging. This regulatory push, particularly bans on single-use plastics and non-recyclable materials in developed economies, dramatically increases the demand for wheat straw pulp, which is naturally biodegradable and compostable. Furthermore, increasing public awareness regarding deforestation and climate change compels manufacturers to secure non-wood fiber sources, ensuring brand compliance with sustainability goals. The abundant, annual availability of wheat straw, especially in major agricultural regions, guarantees a scalable and dependable raw material supply, unlike the lengthy growth cycles required for wood fiber.

Restraints: The single most critical restraint is the technical difficulty posed by the high percentage of silica (up to 8-10%) in wheat straw compared to wood. This silica leads to scaling and fouling in the black liquor recovery boilers, which are essential for chemical and energy recovery in standard pulping processes. Specialized desilication processes, while effective, add complexity and substantial capital expenditure to mill construction and operation, hindering mass adoption, especially by smaller producers. Additionally, the low bulk density of straw necessitates large storage and transportation volumes, driving up logistics costs compared to wood chips.

Opportunity: The market opportunity is immense within the foodservice and quick-service restaurant (QSR) industries, where the shift away from styrofoam and plastic is nearly complete, creating a vast demand void for molded fiber products. Moreover, advances in pre-treatment and extraction technologies are opening pathways for wheat straw pulp to enter high-value sectors such as textiles (rayon, viscose), biochemicals, and even biocomposites, moving beyond traditional paper products. The development of integrated biorefineries that produce pulp alongside biofuels or biochemicals from the remaining hemicellulose and lignin offers a route to significantly improve the overall economic feasibility of wheat straw processing.

Impact Forces: The most influential impact force is the converging pressure from consumer demand and government policy, accelerating the substitution of plastic and wood-based products. This substitution force dictates market volume and price points. Technological innovation, particularly advancements in desilication and TCF bleaching, acts as a mitigating force against high processing costs, improving competitiveness. However, raw material price volatility, linked to agricultural yields and competing uses (e.g., animal feed), remains a persistent external impact force affecting profitability margins across the value chain.

Segmentation Analysis

The Wheat Straw Pulp Market is segmented primarily based on the type of pulp processing, the degree of bleaching applied, and the various end-use application sectors. This segmentation provides crucial insights into the differing cost structures, technical requirements, and demand dynamics across the industry. Processing methods determine the fiber quality and yield, while the level of bleaching dictates the suitability for specific end products, ranging from brown packaging to white printing paper. Understanding these segments is vital for stakeholders to align production capabilities with fast-evolving consumer and regulatory demands, especially concerning sustainability claims and product performance.

Segmentation by grade reveals a division between bleached and unbleached pulp. Bleached pulp commands a higher price and is crucial for premium applications such as high-quality writing paper, tissue products, and specialized medical packaging, requiring advanced and environmentally compliant bleaching techniques. Conversely, unbleached pulp, often produced using simpler, cost-effective methods, dominates the volume segments, serving the molded fiber packaging, egg cartons, and industrial board markets, driven purely by functionality and composting capabilities.

Segmentation by application clearly illustrates the market shift from legacy paper applications towards packaging solutions. While printing and writing paper provided the initial market traction, the foodservice and disposable packaging segment now demonstrates the most aggressive growth. This rapid expansion is underpinned by the superior molding characteristics of wheat straw fiber and its inherent compostability, meeting the urgent global need for disposable, yet sustainable, alternatives in high-volume consumer goods.

- By Grade:

- Bleached Pulp (TCF, ECF)

- Unbleached Pulp

- By Process Type:

- Chemical Pulping (Soda-AQ, ASAM)

- Mechanical Pulping

- Chemi-Mechanical Pulping (CMP)

- By Application:

- Food Service and Disposable Packaging (Plates, Bowls, Clamshells)

- Printing and Writing Paper

- Tissue Paper Products (Facial Tissue, Toilet Paper)

- Molded Fiber Products (Egg Cartons, Cup Holders)

- Specialty Paper and Board

Value Chain Analysis For Wheat Straw Pulp Market

The value chain of the Wheat Straw Pulp Market begins with the highly fragmented upstream segment, involving the collection and consolidation of agricultural residues. This segment is characterized by logistical complexities due to the seasonality and low density of wheat straw. Efficiency in baling, storage, and transport—often requiring specialized logistics providers—is crucial to maintain raw material quality and manage costs before delivery to the pulping mill. Mills must then undertake complex processing steps, including washing, desilication, pulping (chemical or mechanical), washing, screening, and finally, bleaching (if required) to produce market-grade pulp. This upstream analysis highlights the critical need for integration or long-term partnerships between mills and the agricultural sector to ensure a consistent and high-quality feedstock supply.

Midstream activities involve the actual conversion process where high capital investment and technical expertise are concentrated, particularly in managing chemical recovery and mitigating silica-related corrosion. Distribution channels for wheat straw pulp are two-fold: direct and indirect. Direct distribution often involves long-term supply contracts with major downstream paper or packaging converters, particularly large integrated manufacturers seeking specific fiber profiles. Indirect distribution involves selling standardized pulp bales through global commodity traders and specialized pulp distributors, serving a wider array of smaller converters and non-integrated mills.

The downstream analysis focuses on the final converters and end-users. Converters purchase the pulp and transform it into finished goods such as paper sheets, molded trays, or tissue rolls. The final buyers are diverse, including major quick-service restaurants (QSRs), large retailers, commercial printers, and institutional buyers focused on sustainable procurement. The demand pull from these end-users, driven by corporate sustainability commitments and regulatory adherence, exerts significant influence over the quality specifications and pricing power throughout the entire value chain, emphasizing the necessity for product traceability and certified sustainable sourcing claims.

Wheat Straw Pulp Market Potential Customers

The primary potential customers and end-users of wheat straw pulp are concentrated in industries undergoing major sustainable material transformation, led by the disposable packaging and tissue manufacturing sectors. Quick-service restaurants, institutional cafeterias, and large-scale catering operations represent a massive demand base for molded fiber plates, bowls, and cutlery, driven by strict municipal and governmental bans on polystyrene and non-compostable plastics. These buyers require materials that offer robust performance while achieving certification for home and industrial composting, a requirement easily met by wheat straw-based products. Major food service packaging distributors and converters are therefore key customers.

Another crucial customer segment includes manufacturers of consumer packaged goods (CPG) seeking sustainable primary and secondary packaging materials. This includes producers of electronics, cosmetics, and dry goods that are transitioning from virgin cardboard or plastic inserts to custom-molded pulp trays. These customers prioritize materials that enhance their brand image as environmentally responsible, requiring high-quality, often bleached, pulp that ensures product safety and aesthetic appeal. The demand from the CPG sector often focuses on bespoke design and consistency of the molded material.

Finally, the traditional paper industry remains a substantial customer, encompassing manufacturers of fine writing and printing paper, as well as specialty tissue products. While facing structural decline in traditional office paper, the demand for sustainable tissue—like facial tissues and toilet paper marketed as "bamboo-free" or "tree-free"—is increasing significantly. These manufacturers seek wheat straw pulp to blend with longer fibers to achieve desired softness, strength, and brightness while maximizing the use of renewable, non-wood resources, thus appealing directly to environmentally conscious consumers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 350.5 Million |

| Market Forecast in 2033 | USD 760.8 Million |

| Growth Rate | 11.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Columbia Pulp, China Paper Corporation, Shandong Tranlin Group, Yantai Xinhui Paper, Shanxi Shanshui Environment Technology, Hunan Juncheng Group, Green Bay Packaging, The Nonwovens Institute, Chemipulp-Jenbach, North Pacific Paper Company (NORPAC), Nine Dragons Paper (Holdings) Limited, Smurfit Kappa, BillerudKorsnäs, Stora Enso, Resolute Forest Products, Huhtamaki, Pactiv Evergreen, WestRock, Cascades Inc., International Paper. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Wheat Straw Pulp Market Key Technology Landscape

The technological landscape of the Wheat Straw Pulp Market is defined by innovative processes aimed at overcoming the intrinsic challenges of non-wood fiber, primarily the high silica content and the need for efficient, environmentally friendly bleaching. Chemical pulping methods are predominantly utilized, with modifications like the Soda-Anthraquinone (Soda-AQ) process and the Alkaline Sulfite with Anthraquinone and Methanol (ASAM) process gaining traction. These chemical techniques are optimized for delignification and achieving acceptable strength properties. Crucially, contemporary focus is on developing robust desilication stages—either prior to or during cooking—to minimize scaling and ensure the economic viability of the chemical recovery boiler, which is essential for closed-loop operation and cost containment.

Beyond the core pulping chemistry, advancements in bleaching technology are critical for expanding market applications into high-quality white paper and tissue. While traditional elemental chlorine methods are largely being phased out due to environmental concerns, the market is heavily investing in Totally Chlorine-Free (TCF) and Elemental Chlorine-Free (ECF) bleaching sequences. TCF methods, utilizing oxygen, ozone, hydrogen peroxide, and peracetic acid, are preferred for their low environmental impact, aligning with stringent European and North American regulatory standards. These advanced sequences ensure high brightness levels (ISO 85+), making the pulp comparable to high-grade wood pulp without generating hazardous chlorinated organic compounds.

Furthermore, technology is rapidly evolving in the area of fiber fractionation and utilization. New machinery and refining techniques are being deployed to separate the short fibers of wheat straw from its abundant fine material (parenchyma cells), allowing for targeted applications. The development of integrated biorefinery concepts represents the forefront of innovation, where the hemicellulose and lignin byproducts, typically waste streams, are converted into biochemicals, biofuels, or specialty materials. This full-utilization approach significantly improves the overall economic return of wheat straw processing, moving the industry towards a truly sustainable and circular model by maximizing value extraction from every component of the agricultural residue.

Regional Highlights

- Asia Pacific (APAC): APAC is the dominant region in the Wheat Straw Pulp Market, driven by two key factors: the immense annual output of wheat straw feedstock, particularly in China and India, and the pressing environmental mandates to stop open field burning of agricultural residues. China remains the largest producer and consumer, where non-wood fiber accounts for a substantial percentage of the country's overall pulp production. Government policies favoring straw utilization for pulping, coupled with significant investments in modern, large-scale mills equipped with desilication technology, cement APAC's leadership position. India is rapidly emerging as a high-growth market, focusing on developing domestic capacity to meet surging demand for sustainable packaging and reduce reliance on expensive imported wood pulp.

- North America: North America represents a crucial growth market, predominantly characterized by high-value consumption rather than primary production. While wheat straw feedstock is available (especially in the US Midwest and Canadian prairies), the cost of collection and transportation, coupled with higher labor costs, makes large-scale pulp production challenging compared to Asia. However, demand is exceptionally strong, specifically for molded fiber foodservice products, propelled by state and municipal plastic bans (e.g., California, Washington). US-based companies prioritize certified, sustainably sourced wheat straw pulp for their biodegradable packaging initiatives, often importing pulp or integrating smaller, localized straw processing facilities near end-use markets.

- Europe: Europe is characterized by strict environmental policies, making it a high-potential market for sustainable wheat straw pulp adoption. The EU's directives on single-use plastics and waste reduction are major demand catalysts. While European wheat production is substantial, utilization for pulping is moderate, focusing mainly on specialty paper and high-quality packaging niches. European consumers and industries highly favor TCF-bleached pulps and certified organic materials, positioning the region as a premium market where environmental performance often outweighs cost sensitivity. Innovation in biorefinery technology, aiming to convert straw into multiple valuable outputs, is also a regional focus, supported by EU research grants.

- Latin America, Middle East, and Africa (LAMEA): These regions show nascent but growing demand. Latin America, with significant agricultural resources, has potential for localized straw pulp production to serve domestic packaging markets. The Middle East and Africa are primarily import-reliant, with growth driven by infrastructure investment and an increasing focus on sustainable solutions in the tourism and institutional sectors. Adoption in these regions is highly dependent on achieving cost-competitive production relative to imported wood pulp.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Wheat Straw Pulp Market.- Columbia Pulp

- China Paper Corporation

- Shandong Tranlin Group

- Yantai Xinhui Paper

- Shanxi Shanshui Environment Technology

- Hunan Juncheng Group

- Green Bay Packaging

- The Nonwovens Institute

- Chemipulp-Jenbach

- North Pacific Paper Company (NORPAC)

- Nine Dragons Paper (Holdings) Limited

- Smurfit Kappa

- BillerudKorsnäs

- Stora Enso

- Resolute Forest Products

- Huhtamaki

- Pactiv Evergreen

- WestRock

- Cascades Inc.

- International Paper

Frequently Asked Questions

Analyze common user questions about the Wheat Straw Pulp market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary environmental advantages of using wheat straw pulp over traditional wood pulp?

Wheat straw pulp utilization offers significant environmental benefits, including preventing deforestation by using agricultural waste, reducing air pollution associated with straw burning, and providing materials that are easily compostable and biodegradable. It is derived from an annually renewable, rapidly cycling resource, lowering the overall carbon footprint compared to long-cycle forestry.

What is the main technical challenge in producing high-quality pulp from wheat straw?

The principal technical challenge is managing the high percentage of silica content naturally present in wheat straw. Silica causes severe scaling and fouling in the chemical recovery boilers and associated equipment within the pulping mill, necessitating high capital investment in specialized desilication processes to ensure operational efficiency and chemical recovery success.

In which application segment is wheat straw pulp seeing the fastest market growth?

The Food Service and Disposable Packaging segment is experiencing the fastest market growth. This rapid expansion is driven by global regulatory shifts banning single-use plastics and styrofoam, creating immense demand for sustainable, compostable molded fiber products like plates, bowls, and clamshells, for which wheat straw pulp is ideally suited.

How do TCF (Totally Chlorine-Free) methods affect the sustainability and quality of bleached wheat straw pulp?

TCF bleaching methods utilize environmentally benign chemicals like oxygen and hydrogen peroxide, eliminating the generation of harmful chlorinated organic compounds (AOX). This significantly enhances the sustainability profile of the pulp, while continuous technological refinement ensures the final product meets high brightness and strength standards suitable for premium white paper and tissue applications.

Which region currently dominates the global production capacity of wheat straw pulp?

Asia Pacific (APAC), specifically China and India, dominates the global production capacity. This leadership is primarily due to the vast availability of wheat straw feedstock from large agricultural sectors and strong governmental incentives and mandates aimed at promoting the use of non-wood fibers to manage agricultural waste and mitigate pollution.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager