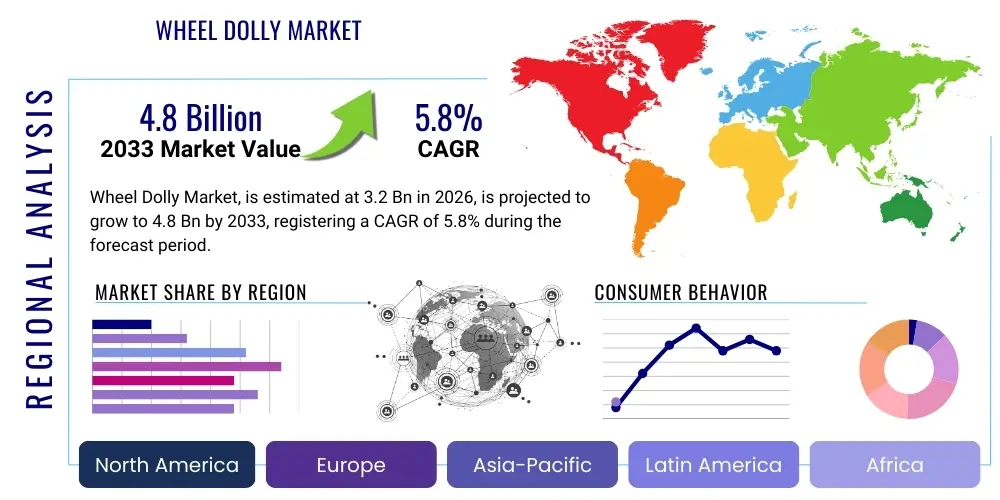

Wheel Dolly Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 440127 | Date : Jan, 2026 | Pages : 249 | Region : Global | Publisher : MRU

Wheel Dolly Market Size

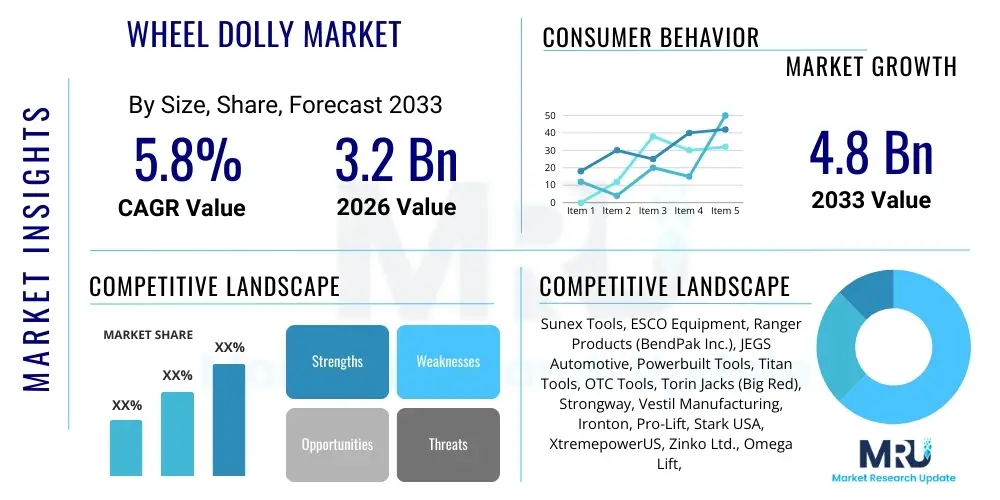

The Wheel Dolly Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 3.2 billion in 2026 and is projected to reach USD 4.8 billion by the end of the forecast period in 2033. This growth trajectory is underpinned by the increasing demand for efficient and ergonomic solutions in vehicle maintenance, material handling, and logistics across various industries globally. The market's expansion is particularly fueled by the automotive aftermarket, burgeoning e-commerce sectors, and the continuous push towards automation in industrial settings, making wheel dollies indispensable tools for a wide array of professional and consumer applications. The evolving design and material science also contribute significantly to enhancing product utility and durability, thus driving market penetration.

Wheel Dolly Market introduction

The Wheel Dolly Market encompasses a wide range of devices designed to facilitate the movement of wheels, tires, and even entire vehicles with ease and safety. These essential tools are utilized across numerous sectors, from automotive repair shops and manufacturing plants to logistics warehouses and individual garages. A wheel dolly typically consists of a sturdy frame, a lifting mechanism (manual, hydraulic, or pneumatic), and a set of swivel casters, allowing for omnidirectional movement. Their primary function is to reduce physical strain on operators, enhance workplace safety, and improve efficiency in tasks involving heavy and bulky wheels or objects, such as changing tires, moving disabled vehicles, or positioning heavy machinery components.

Major applications of wheel dollies span the automotive industry, where they are crucial for tire changes, brake service, and vehicle repositioning in tight spaces. In industrial and manufacturing settings, they assist in moving heavy equipment, machinery parts, and specialized components along production lines or during maintenance. The logistics and warehousing sector relies on them for efficient material handling, especially for goods stored on wheels or those requiring precise placement. Furthermore, the construction industry utilizes heavy-duty dollies for maneuvering large pipes, beams, or machinery. The inherent benefits of these devices include significant improvements in ergonomic conditions, prevention of workplace injuries, reduction in labor time, and enhanced operational flexibility, allowing for complex maneuvers in confined areas that would otherwise be challenging or impossible.

The market's driving factors are multifaceted, largely influenced by the rapid growth of the automotive sector, both in production and aftermarket services, which consistently demands tools for efficient vehicle servicing. The global expansion of e-commerce and subsequent proliferation of logistics and warehousing facilities also contribute significantly, as these operations require constant movement and reorganization of goods. Moreover, the increasing adoption of automation and semi-automation in industrial processes, coupled with stringent safety regulations aimed at protecting workers from manual handling injuries, further propels the demand for specialized wheel handling equipment. Advancements in material technology leading to lighter yet stronger dollies, and the integration of smart features for improved control and precision, are also key accelerators for market growth.

Wheel Dolly Market Executive Summary

The Wheel Dolly Market is experiencing robust growth, driven by key business trends such as the escalating demand in the automotive aftermarket, significant expansion of the global e-commerce logistics infrastructure, and a persistent focus on workplace safety and operational efficiency across various industrial sectors. Technological advancements in design, materials, and automation are leading to more versatile, durable, and user-friendly products, influencing purchasing decisions and market dynamics. Manufacturers are increasingly innovating to meet diverse load capacities and specialized application needs, ranging from compact manual dollies for residential use to heavy-duty hydraulic and electric models for industrial environments. The trend towards modular designs and multi-functional dollies also reflects a broader industry movement towards adaptable and integrated solutions.

Regional trends indicate North America and Europe as mature markets with steady demand, characterized by established automotive industries and advanced logistics networks, along with stringent safety regulations that favor mechanized handling solutions. The Asia Pacific region, particularly countries like China and India, is emerging as a high-growth market, propelled by rapid industrialization, burgeoning automotive manufacturing, and the explosive growth of e-commerce activities. Latin America and the Middle East & Africa are also showing promising growth, albeit from a smaller base, driven by infrastructure development and increasing adoption of modern material handling practices. The market's regional dynamics are further shaped by local economic conditions, labor costs, and the pace of technological adoption, influencing the types of wheel dollies most in demand in specific geographies.

Segmentation trends highlight distinct growth patterns across product types, load capacities, applications, and sales channels. Hydraulic and electric wheel dollies are gaining traction due to their enhanced lifting capabilities and reduced manual effort, particularly in professional and industrial settings. However, manual dollies continue to hold a significant share due to their cost-effectiveness and simplicity for lighter-duty tasks. The automotive aftermarket remains the largest application segment, but industrial and warehousing applications are demonstrating the fastest growth rates. Online sales channels are expanding rapidly, offering greater accessibility and competitive pricing, while traditional offline channels continue to cater to bulk purchases and specialized equipment needs, providing direct customer interaction and after-sales support. The market is also seeing a rise in demand for specialized dollies for electric vehicles (EVs) and larger commercial vehicles, reflecting shifts in the global automotive landscape.

AI Impact Analysis on Wheel Dolly Market

The integration of Artificial Intelligence (AI) into the Wheel Dolly Market primarily addresses key user concerns around operational precision, efficiency, and safety in complex material handling scenarios. Users are increasingly seeking solutions that can autonomously or semi-autonomously navigate challenging environments, optimize load distribution, and provide predictive maintenance insights to minimize downtime. The expectation is that AI can transform traditional, manually operated or purely mechanical dollies into intelligent systems capable of enhanced decision-making, object recognition, and adaptive control. This transition aims to alleviate human error, reduce physical exertion, and accelerate workflow in demanding industrial and logistics operations, thereby unlocking new levels of productivity and safety standards.

- Enhanced autonomous navigation for precision movement in complex layouts, reducing human intervention.

- Predictive maintenance analytics for wheel dolly components, optimizing uptime and reducing repair costs.

- AI-powered load sensing and balancing to prevent instability and ensure safe transport of heavy items.

- Integration with warehouse management systems (WMS) for optimized routing and inventory management.

- Voice command and gesture control interfaces for hands-free operation in industrial environments.

- Real-time environmental awareness through sensors, allowing for obstacle avoidance and dynamic path planning.

- Automated quality control checks for components being transported, ensuring integrity during movement.

- Learning algorithms to adapt to varying floor conditions and load characteristics, improving performance over time.

- Remote monitoring and diagnostics capabilities for centralized management of a fleet of dollies.

- Ergonomic design feedback loops informed by AI, leading to more user-friendly and injury-preventing tools.

DRO & Impact Forces Of Wheel Dolly Market

The Wheel Dolly Market is influenced by a dynamic interplay of Drivers, Restraints, Opportunities, and broader Impact Forces that shape its growth trajectory and competitive landscape. Key drivers include the relentless growth of the automotive aftermarket, fueled by an expanding global vehicle parc and the increasing complexity of vehicle maintenance. The parallel surge in e-commerce and logistics demands for efficient material handling solutions further propels market expansion, as does the global emphasis on workplace safety and ergonomics, driving companies to invest in tools that reduce manual strain and prevent injuries. These factors collectively create a robust demand environment for various types of wheel dollies, from basic manual models to sophisticated hydraulic and electric variants.

However, the market also faces notable restraints. The relatively high initial investment cost associated with advanced hydraulic and electric wheel dollies can deter smaller businesses or individual consumers, especially when more affordable manual alternatives are readily available. The operational and maintenance costs of sophisticated systems, including battery replacement and specialized repairs, can also be a barrier. Furthermore, the presence of various substitute products and alternative material handling equipment, such as forklifts, pallet jacks, or overhead cranes, can limit market penetration for wheel dollies in certain heavy-duty applications. The durability and longevity of existing equipment in some sectors can also reduce the frequency of new purchases, impacting market growth.

Despite these challenges, significant opportunities abound for the Wheel Dolly Market. The burgeoning electric vehicle (EV) market presents a new frontier, as EVs often have different weight distribution and undercarriage access requirements, necessitating specialized dollies. The increasing automation in manufacturing and logistics offers avenues for integrating smart, AI-powered dollies into fully automated systems. Emerging markets, with their rapid industrialization and developing infrastructure, represent untapped potential for market expansion. Moreover, continuous innovation in materials science, leading to lighter, stronger, and more corrosion-resistant dollies, along with advancements in battery technology for electric models, can create significant competitive advantages and open new application areas. The growing focus on environmentally friendly manufacturing practices also encourages the development of energy-efficient and recyclable dolly components. These opportunities, when strategically leveraged, can significantly accelerate market growth and foster product diversification.

Segmentation Analysis

The Wheel Dolly Market is comprehensively segmented to provide granular insights into its diverse components and understand the varied dynamics driving its growth. These segmentations are critical for identifying specific market niches, understanding customer needs, and developing targeted marketing and product development strategies. The primary segmentation criteria typically include product type, load capacity, application, material, and sales channel, each revealing distinct trends and opportunities within the broader market. Analyzing these segments helps stakeholders, from manufacturers to end-users, to grasp the evolving landscape and pinpoint areas of high potential or emerging challenges. Each segment's growth is influenced by unique technological advancements, economic factors, and regulatory environments, making a detailed understanding of these divisions paramount for strategic planning.

Within the various segmentation categories, certain trends are more pronounced. For instance, the demand for hydraulic and electric dollies is steadily increasing due to their ergonomic benefits and capability to handle heavier loads with minimal effort, reflecting a broader industry shift towards mechanization and safety. Concurrently, advancements in material science are leading to the development of dollies made from lighter yet robust composites, challenging the traditional dominance of steel. The application-based segmentation clearly indicates the automotive aftermarket as a foundational segment, while industrial and logistics sectors are experiencing accelerated growth driven by automation and the expansion of global supply chains. Furthermore, the rapid growth of online retail platforms is transforming sales channels, making products more accessible and competitive, alongside the enduring importance of traditional distribution networks for specialized and bulk purchases. This intricate web of segmentation provides a holistic view of the market's structure and future direction.

- By Type

- Manual Wheel Dollies: Characterized by their simplicity, cost-effectiveness, and reliance on human physical effort for lifting and movement. Widely used for lighter loads and basic applications in garages and small workshops.

- Hydraulic Wheel Dollies: Employ hydraulic fluid pressure to lift loads, significantly reducing manual effort. Preferred for medium to heavy-duty applications in professional garages, industrial settings, and by service technicians.

- Electric Wheel Dollies: Utilize electric motors for both lifting and propulsion, offering maximum convenience and efficiency. Ideal for very heavy loads, frequent use, and in environments requiring precise, effortless movement within large facilities.

- Pneumatic Wheel Dollies: Operated by compressed air, often found in industrial settings where pneumatic systems are already in place. Offers smooth lifting and is suitable for certain specialized environments.

- By Load Capacity

- Light-Duty (<1,000 lbs): Designed for passenger car tires, small equipment, and residential or light commercial use.

- Medium-Duty (1,000-5,000 lbs): Suitable for larger passenger vehicles, light trucks, and moderate industrial applications.

- Heavy-Duty (>5,000 lbs): Engineered for commercial trucks, buses, heavy machinery, and industrial logistics.

- By Application

- Automotive Aftermarket: Garages, repair shops, dealerships for tire changes, brake service, and vehicle repositioning.

- Industrial & Manufacturing: Moving heavy components, machinery, and equipment along production lines or during maintenance.

- Logistics & Warehousing: Handling various goods, pallets, and large items in distribution centers and storage facilities.

- Construction: Maneuvering heavy building materials, pipes, and small equipment on job sites.

- DIY & Residential: Home garage use for personal vehicle maintenance, moving heavy furniture, or appliances.

- By Material

- Steel: Traditional choice, known for its strength, durability, and cost-effectiveness, though heavier.

- Aluminum: Lighter weight, corrosion-resistant, and easier to maneuver, often used for portable or specialized dollies.

- Composite Materials: Emerging segment offering a balance of strength, weight reduction, and sometimes enhanced damping properties.

- By Sales Channel

- Online: E-commerce platforms, manufacturer websites, and online retailers offering convenience and competitive pricing.

- Offline: Specialty stores, automotive parts retailers, industrial equipment suppliers, and direct sales through distributors.

Value Chain Analysis For Wheel Dolly Market

The value chain for the Wheel Dolly Market encompasses a series of interconnected activities, starting from raw material sourcing and extending through manufacturing, distribution, and ultimate end-user application. Upstream activities primarily involve the procurement of essential raw materials such as various grades of steel, aluminum alloys, specialized plastics, and rubber for casters and gripping surfaces. Suppliers of hydraulic components, electric motors, and control systems also form a crucial part of this segment, providing specialized parts that define the functionality and performance of advanced dollies. The efficiency of these upstream processes significantly impacts the cost structure and quality of the final product, with manufacturers often negotiating long-term contracts with key suppliers to ensure stable material flow and consistent quality. Innovation in material science and component technology at this stage can offer significant competitive advantages in terms of product durability, weight, and operational efficiency, directly influencing market appeal and pricing strategies.

Midstream activities are centered on the manufacturing and assembly of wheel dollies. This involves processes such as metal fabrication (cutting, welding, bending), precision machining for components, assembly of hydraulic or electric systems, and the integration of casters and ergonomic features. Manufacturers often invest heavily in advanced production technologies, including robotic welding and automated assembly lines, to achieve economies of scale, maintain high-quality standards, and accelerate time-to-market. Quality control and testing are integral at this stage to ensure product reliability and compliance with safety standards, which are particularly stringent in the material handling equipment sector. Customization capabilities, allowing manufacturers to adapt designs for specific load capacities or application environments, represent a key differentiator in this competitive market. The design and engineering phase, prior to manufacturing, is also critical, focusing on user-centric design, material optimization, and compliance with international safety regulations.

Downstream activities involve the comprehensive distribution channel that connects manufacturers with end-users. This typically includes a mix of direct and indirect channels. Direct channels may involve manufacturers selling directly to large industrial clients, government agencies, or through their own online stores, offering customized solutions and direct technical support. Indirect channels are more varied and include a network of wholesalers, distributors, automotive aftermarket retailers, industrial equipment suppliers, and increasingly, major e-commerce platforms. These intermediaries play a vital role in market penetration, inventory management, logistics, and providing local customer support and after-sales services. The choice of distribution channel often depends on the target market segment; for instance, high-volume, standardized manual dollies might be widely available through online retailers and general hardware stores, while specialized heavy-duty hydraulic or electric dollies often require dedicated industrial distributors who can offer technical expertise and installation support. The effectiveness of this downstream network is paramount for market reach and customer satisfaction.

Wheel Dolly Market Potential Customers

The Wheel Dolly Market caters to a broad spectrum of end-users and buyers, each with distinct requirements and purchasing motivations. The largest segment of potential customers resides within the automotive sector, encompassing professional automotive repair shops, dealerships, tire service centers, body shops, and vehicle manufacturers. These entities consistently require wheel dollies for tasks ranging from routine tire changes and brake service to complex engine removal and vehicle repositioning within service bays and production lines. The demand here is driven by the sheer volume of vehicles needing maintenance and repair, the increasing complexity of modern vehicles (e.g., EVs with heavy batteries), and the critical need to enhance technician safety and efficiency. Dealers and large repair chains often invest in advanced hydraulic or electric dollies to handle diverse vehicle types and improve workflow, while smaller independent shops might opt for versatile manual or basic hydraulic models.

Beyond the automotive industry, another significant customer base is found in industrial and manufacturing facilities across various sectors, including heavy machinery, aerospace, marine, and general manufacturing. These users require robust wheel dollies for moving heavy components, jigs, fixtures, and partially assembled products along production lines, during machinery installation, or for maintenance operations within factories and workshops. The emphasis in these environments is often on high load capacity, durability, and sometimes integration with existing material handling systems. Safety regulations and the drive for operational efficiency are key factors influencing purchasing decisions. The logistics and warehousing industry also represents a growing segment, with distribution centers and storage facilities utilizing wheel dollies for efficient movement and organization of goods, especially those that are bulky, difficult to lift, or already on wheeled platforms. As e-commerce continues its rapid expansion, the demand from this sector for flexible and high-capacity material handling solutions, including specialized dollies, is expected to surge.

Furthermore, the Wheel Dolly Market serves a substantial segment of DIY enthusiasts and residential users. Home garage owners, hobby mechanics, and individuals requiring assistance with moving heavy household items such as appliances or large furniture pieces constitute this segment. For these users, affordability, ease of use, and compact storage are often primary considerations, leading to a preference for lighter-duty manual or simple hydraulic dollies. Construction sites also present a niche market for heavy-duty wheel dollies, used for maneuvering large pipes, beams, equipment, and structural components. Specialty applications, such as moving disabled vehicles (e.g., accident recovery, impound lots) or positioning aircraft components, also contribute to the diverse customer landscape. The varied needs across these segments underscore the market's breadth and the necessity for manufacturers to offer a diverse product portfolio to cater to the distinct requirements and budgetary constraints of each customer group.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.2 billion |

| Market Forecast in 2033 | USD 4.8 billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Sunex Tools, ESCO Equipment, Ranger Products (BendPak Inc.), JEGS Automotive, Powerbuilt Tools, Titan Tools, OTC Tools, Torin Jacks (Big Red), Strongway, Vestil Manufacturing, Ironton, Pro-Lift, Stark USA, XtremepowerUS, Zinko Ltd., Omega Lift, Norco Industries, AC Hydraulic A/S, Hein-Werner, Milwaukee Tool |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Wheel Dolly Market Key Technology Landscape

The technology landscape for the Wheel Dolly Market is continuously evolving, driven by the demand for enhanced safety, efficiency, and versatility in material handling. Traditional manual dollies rely on basic mechanical leverage and robust caster systems, but modern advancements are incorporating sophisticated hydraulic and electric power systems to facilitate effortless lifting and movement of heavy loads. Hydraulic technologies, using hand pumps or foot pedals, enable controlled and powerful lifting with minimal physical exertion, while electric systems integrate motors and rechargeable batteries to automate both lifting and locomotion, significantly reducing operator fatigue and increasing productivity in high-volume environments. The development of advanced solenoid valves and microcontrollers in hydraulic and electric systems allows for precise control over lift heights and descent speeds, enhancing operational safety and precision.

Furthermore, material science plays a crucial role in advancing wheel dolly technology. Manufacturers are increasingly utilizing high-strength, lightweight alloys such as aircraft-grade aluminum and specialized composite materials to reduce the overall weight of the dolly without compromising load capacity or durability. This not only makes the dollies easier to maneuver and transport but also improves their resistance to corrosion and wear, extending product lifespan. The design and quality of casters are also paramount, with advancements in wheel materials (e.g., polyurethane, nylon, rubber compounds) and bearing technologies providing smoother rolling, higher load ratings, better floor protection, and enhanced resistance to debris and chemicals. Swivel and locking mechanisms for casters are becoming more robust and intuitive, offering greater stability and control during complex maneuvers, particularly in tight spaces.

The integration of smart technologies represents another significant trend in the wheel dolly market. This includes features such as digital load indicators for accurate weight measurement, overload protection sensors that automatically prevent lifting beyond rated capacity, and integrated braking systems for enhanced safety. For electric and advanced hydraulic dollies, telematics and IoT connectivity are emerging, allowing for remote monitoring of battery status, usage patterns, and predictive maintenance alerts. Some high-end models are exploring semi-autonomous navigation capabilities, leveraging sensors and basic AI algorithms to assist operators with positioning and routing in complex environments. These technological advancements are transforming wheel dollies from simple mechanical aids into intelligent tools that significantly improve workplace safety, operational efficiency, and overall productivity across diverse industrial and automotive applications, meeting the evolving demands of modern material handling.

Regional Highlights

- North America: This region represents a mature and significant market for wheel dollies, characterized by a well-established automotive industry, extensive logistics infrastructure, and a strong emphasis on workplace safety regulations. The presence of major vehicle manufacturers and a robust aftermarket sector drives consistent demand for both manual and advanced hydraulic/electric dollies. The United States and Canada are key contributors, with technological adoption and innovation in material handling equipment being high. The region also sees significant demand from DIY enthusiasts.

- Europe: Europe is another dominant market, driven by its sophisticated automotive manufacturing base, advanced warehousing and logistics operations, and stringent European Union safety standards that necessitate ergonomic and efficient material handling solutions. Countries like Germany, the UK, France, and Italy are pivotal, with a strong preference for high-quality, durable, and technologically advanced wheel dollies. The increasing focus on electric vehicles (EVs) also fuels demand for specialized dolly solutions.

- Asia Pacific (APAC): The APAC region is projected to be the fastest-growing market, primarily due to rapid industrialization, burgeoning automotive production (especially in China, India, Japan, and South Korea), and the explosive growth of e-commerce driving massive expansion in logistics and warehousing infrastructure. Economic development and rising disposable incomes are also boosting the DIY and residential segments. This region offers immense growth opportunities, attracting significant investment from global players.

- Latin America: The market in Latin America is characterized by evolving industrial sectors, growing automotive production, and expanding retail and logistics networks. Countries like Brazil, Mexico, and Argentina are key markets, with demand primarily for cost-effective manual and hydraulic dollies, though there is a gradual shift towards more automated solutions as industrial practices modernize. Infrastructure development projects also contribute to demand for heavy-duty models.

- Middle East and Africa (MEA): The MEA region is an emerging market for wheel dollies, driven by ongoing infrastructure development, diversification of economies beyond oil, and increasing investments in logistics and manufacturing sectors. Countries in the GCC (Gulf Cooperation Council) region are particularly active in adopting advanced material handling technologies due to large-scale construction projects and burgeoning logistics hubs. The African continent presents long-term growth potential as industrialization progresses.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Wheel Dolly Market.- Sunex Tools

- ESCO Equipment

- Ranger Products (BendPak Inc.)

- JEGS Automotive

- Powerbuilt Tools

- Titan Tools

- OTC Tools

- Torin Jacks (Big Red)

- Strongway

- Vestil Manufacturing

- Ironton

- Pro-Lift

- Stark USA

- XtremepowerUS

- Zinko Ltd.

- Omega Lift

- Norco Industries

- AC Hydraulic A/S

- Hein-Werner

- Milwaukee Tool

Frequently Asked Questions

What is a wheel dolly and its primary function?

A wheel dolly is a material handling device designed to lift, move, and position heavy wheels, tires, or even entire vehicles, minimizing manual effort. Its primary function is to enhance efficiency, safety, and ergonomics in tasks involving bulky objects in automotive repair, industrial settings, and logistics.

How do hydraulic wheel dollies differ from electric ones?

Hydraulic wheel dollies use fluid pressure, typically activated by a foot pedal or hand pump, for lifting heavy loads, requiring some manual input for operation. Electric wheel dollies, conversely, utilize an electric motor and battery for both lifting and often for propulsion, offering full automation and minimal physical effort, ideal for very heavy loads and frequent use.

Which industries are the main users of wheel dollies?

The primary industries utilizing wheel dollies are the automotive aftermarket (repair shops, dealerships), industrial and manufacturing sectors (moving heavy machinery parts), and logistics & warehousing (material handling). Additionally, construction sites and residential users also employ them for various heavy lifting and moving tasks.

What are the key factors driving the growth of the Wheel Dolly Market?

Key drivers include the expanding global automotive aftermarket, the rapid growth of e-commerce leading to increased logistics and warehousing activities, heightened focus on workplace safety and ergonomics, and continuous technological advancements in dolly design and functionality. The rise of specialized applications, like EV maintenance, also contributes significantly.

What impact does AI have on modern wheel dollies?

AI impacts modern wheel dollies by enabling features such as autonomous navigation, predictive maintenance, intelligent load balancing, and integration with warehouse management systems. This leads to increased precision, operational efficiency, enhanced safety, and reduced human intervention in complex material handling tasks, transforming traditional tools into smart, adaptive solutions.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager