Wheelchair Cushion Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436013 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Wheelchair Cushion Market Size

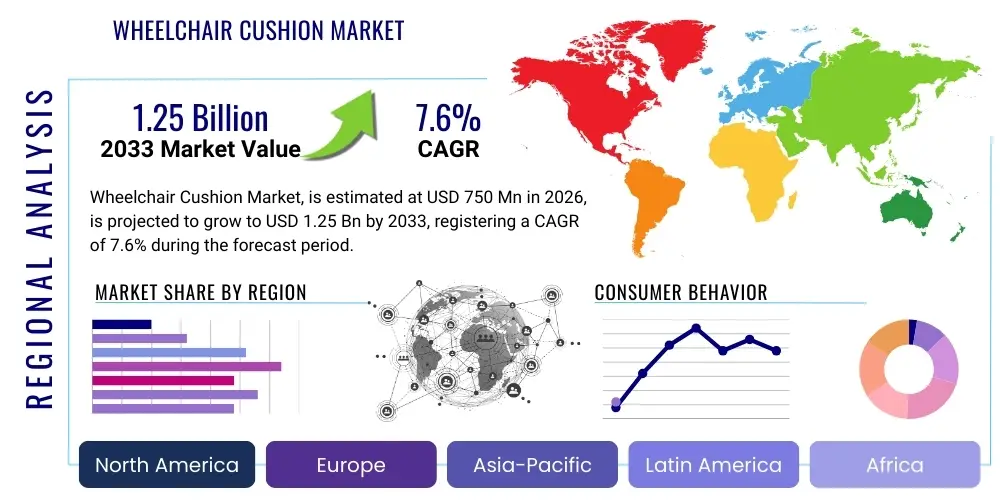

The Wheelchair Cushion Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.6% between 2026 and 2033. The market is estimated at USD 750 Million in 2026 and is projected to reach USD 1.25 Billion by the end of the forecast period in 2033.

Wheelchair Cushion Market introduction

The Wheelchair Cushion Market encompasses the global manufacturing, sales, and distribution of specialized seating systems designed for individuals requiring long-term or short-term mobility assistance via wheelchairs. These devices are fundamentally critical components of preventative healthcare, moving beyond simple comfort to actively manage and reduce the risk of severe pressure injuries, also known as decubitus ulcers or bedsores. Pressure injuries represent a significant burden on global healthcare systems, leading to prolonged hospitalization, complex treatments, and considerable patient morbidity. Consequently, the focus of this market is heavily centered on developing sophisticated materials and ergonomic designs that optimize pressure redistribution, shear reduction, and microclimate control (heat and moisture management) at the seat-to-body interface, ensuring sustained skin integrity and maximizing sitting tolerance for users across all levels of mobility impairment and risk classification.

Product diversity within this market is substantial, ranging from relatively simple, low-cost foam pads suitable for temporary use, to advanced, multi-chambered air flotation systems (like those utilizing proprietary cellular technology) and complex custom-molded cushions tailored for patients with severe postural asymmetries or high clinical risk. Major applications span the entire continuum of care, including acute care hospitals, specialized spinal cord injury rehabilitation centers, long-term residential care facilities, and crucially, the expansive home care sector, which increasingly relies on durable and effective mobility aids. The core benefit derived from these products is the direct correlation between high-quality cushions and a measurable reduction in the incidence and severity of pressure ulcers, thereby improving patient quality of life, reducing pain, and leading to substantial long-term healthcare cost savings related to wound care management and surgical interventions.

Market expansion is principally driven by non-discretionary demand stemming from significant global demographic and health trends. The persistent and accelerating aging of populations worldwide increases the pool of individuals suffering from age-related mobility restrictions and co-morbidities such as obesity and diabetes, which heighten pressure injury risk. Furthermore, improvements in trauma care are leading to higher survival rates for severe injuries (e.g., spinal cord injuries), resulting in a larger cohort of permanent wheelchair users requiring advanced therapeutic support. Concurrently, technological advancements in material science—such as the creation of highly resilient, temperature-regulating foams and smart gels—and growing public and professional awareness campaigns regarding the importance of proactive seating management continually fuel investment and consumer demand for next-generation cushion solutions globally.

Wheelchair Cushion Market Executive Summary

The global Wheelchair Cushion Market is characterized by intense innovation focused on personalized pressure management, moving away from standardized products toward custom, data-driven solutions. Current business trends include a strong emphasis on integrating Internet of Things (IoT) capabilities into cushions, facilitating real-time data collection on posture, pressure points, and movement patterns. This data is critical for preventative clinical intervention and for demonstrating the effectiveness of high-cost devices to third-party payers. Key players are investing heavily in mergers and acquisitions to consolidate market share and acquire specialized material technologies or distribution channels. Furthermore, the push towards environmentally sustainable and bio-based materials is emerging as a critical differentiator, especially in European markets where regulatory and consumer pressure favors green manufacturing processes.

Geographically, market dynamics exhibit a clear dichotomy. North America and Western Europe maintain their leading positions in terms of market value, driven by established reimbursement mechanisms that support the purchase of expensive therapeutic cushions and high standards of long-term care. These regions are the primary early adopters of dynamic and customized seating solutions. Conversely, the Asia Pacific (APAC) region is projected to be the engine of future volume growth, benefiting from rapid infrastructure development, expanding healthcare access, and large-scale urbanization. Investment in APAC is focused on establishing scalable local manufacturing and distribution networks capable of handling large volumes while addressing regional affordability constraints. Regulatory standardization efforts, such as the implementation of the European Union's Medical Device Regulation (MDR), are creating barriers for entry but simultaneously raising product quality benchmarks globally.

Segmentation analysis underscores the enduring strength of the Combination/Hybrid cushion segment, valued for its ability to offer the postural stability of foam combined with the superior pressure distribution of air or gel, making it ideal for a broad range of clinical needs. The shift in end-user preferences sees the Home Care Settings segment growing fastest, reflecting the global trend toward de-institutionalization of long-term care. This shift necessitates products that are lightweight, durable, easy for caregivers to manage, and simple for individual users to understand and adjust. Manufacturers are therefore prioritizing user-centric design and intuitive interfaces to meet the escalating requirements of non-clinical care environments, ensuring that advanced pressure relief technology remains accessible and functional outside the hospital setting.

AI Impact Analysis on Wheelchair Cushion Market

Analysis of common user questions reveals a strong focus on how Artificial Intelligence (AI) can revolutionize the personalization and proactive management aspects of seating technology. Users frequently ask if AI systems can learn individual movement patterns to predict when a weight shift is due, thereby preventing risk before elevated pressure becomes dangerous. There is significant interest in AI’s role in streamlining the complex process of custom molding, using advanced algorithms to process 3D scans and biomechanical data to instantly design the perfect cushion profile. Users and clinicians are seeking assurances that AI-driven devices can integrate seamlessly with Electronic Health Records (EHRs) to track compliance and therapeutic outcomes objectively. Summarily, the core user expectation is that AI will transform the passive wheelchair cushion into an intelligent, adaptive medical device, minimizing human error in pressure management and enabling truly individualized preventative care.

- AI-driven personalized design algorithms utilize 3D body mapping data to create custom cushion contours that precisely match the user’s pressure distribution needs, significantly reducing fitting errors.

- Integration of machine learning models allows ‘smart cushions’ to learn the user's habitual sitting postures and activity rhythms, providing timely, proactive alerts for necessary position changes.

- Predictive risk modeling through AI analyzes sensor data (pressure, heat, humidity) in real-time to forecast the likelihood of pressure injury development hours or even days in advance.

- AI enhances manufacturing efficiency by automating quality inspection processes, ensuring every foam pour or air cell array meets precise clinical specifications.

- Automated reporting generated by AI systems supports reimbursement claims by objectively documenting sitting time, compliance with weight shift schedules, and the therapeutic effectiveness of the cushion.

DRO & Impact Forces Of Wheelchair Cushion Market

The core drivers sustaining market growth include the indisputable clinical necessity of pressure injury prevention, coupled with the rising incidence of chronic diseases such as multiple sclerosis, Parkinson’s disease, and stroke, all of which contribute significantly to the permanent need for advanced seating solutions. Furthermore, government initiatives in developed nations aimed at reducing the economic burden associated with wound care—which can cost tens of thousands of dollars per patient—are compelling institutions and payers to invest in preventative tools, primarily high-quality wheelchair cushions. These preventative measures offer a high return on investment (ROI) compared to the cost of treating severe ulcers, thus reinforcing the market’s fundamental growth trajectory and validating the expenditure on sophisticated products.

Major restraints impede market penetration, particularly concerning the cost-sensitivity in emerging markets and the complexity associated with clinical assessment and fitting. Advanced therapeutic cushions often require specific prescription and fitting by certified seating clinicians (SMS), a specialist resource that is scarce in many regions. Furthermore, while reimbursement is adequate in high-income regions, many developing economies lack robust social security or insurance systems to cover high-cost durable medical equipment, relegating many potential users to substandard, inadequate seating. These financial and infrastructural restraints slow the adoption rate of cutting-edge technologies, creating a significant gap between technological capability and global access.

Opportunities abound in the digitalization of seating technology, allowing manufacturers to move into the service domain by offering subscription-based data monitoring and clinical support alongside the physical product. Strategic expansion into underserved regional markets, particularly in South Asia and Southeast Asia, through localized partnerships and tailored product offerings (addressing specific regional body types and climate conditions) represents a major revenue avenue. Impact forces are dominated by intense competitive pressure, forcing continuous R&D investment in lighter, more durable, and aesthetically appealing designs. Regulatory forces, while restrictive, drive up quality standards, favoring established firms with robust compliance capabilities, creating a market environment where innovation must always be substantiated by rigorous clinical evidence.

The competitive rivalry within the segment is intensely high, particularly among manufacturers of air flotation systems and high-density viscoelastic foams. Firms continuously engage in patent battles and intellectual property protection related to internal cell design, valve mechanisms, and proprietary material compositions. This strong rivalry forces manufacturers to differentiate through specialized clinical testing, demonstrating measurable clinical outcomes in terms of sustained pressure relief performance over extended periods of use. Additionally, the bargaining power of major buyers, especially large institutional purchasing groups and national health services (like the NHS in the UK), exerts downward pressure on pricing for standard volume products, thereby necessitating product stratification into premium clinical lines and economically viable basic lines to maintain profitability.

Segmentation Analysis

Segmentation within the Wheelchair Cushion Market is essential for understanding the diverse needs and clinical risks associated with mobility impairment. Product types are segmented by design complexity, ranging from basic flat surfaces to highly engineered, deep-contoured shapes specifically designed to manage severe orthopedic or neurological challenges. Material type segmentation reflects the fundamental mechanisms used for pressure management—whether through static immersion (foams/gels) or dynamic support (air systems). End-user analysis reveals the shift from institutional purchasing towards decentralized home care, while distribution channels reflect the hybrid nature of sales, requiring both clinical expertise (direct/distributors) and mass-market reach (online retail).

- Product Type:

- Standard Cushions: Basic, flat cushions suitable for low-risk, short-term use.

- Contoured Cushions: Feature pre-formed shapes to enhance pelvic stability and alignment, suitable for medium to high risk.

- Custom-Molded Cushions: Individually fabricated based on patient anatomy for complex postural needs and maximum pressure relief in high-risk patients.

- Material Type:

- Foam Cushions (e.g., Polyurethane, Viscoelastic/Memory Foam): Dominant market share due to cost-effectiveness and stability; viscoelastic foam offers superior immersion.

- Air Cushions (e.g., Cellular Air, Non-Adjustable Air): Essential for high-risk users due to unmatched pressure redistribution capabilities; includes dynamic and static air systems.

- Gel Cushions: Utilized for effective surface cooling and pressure mitigation, often favored for heat management.

- Combination/Hybrid Cushions: Blends foam base with air or gel inserts, providing stability, skin protection, and ease of use, making them highly versatile.

- End-User:

- Hospitals and Clinics: High volume turnover for short-term and specialized acute care seating needs.

- Rehabilitation Centers: Focus on long-term training and therapeutic use, driving demand for technologically advanced and adaptable cushions.

- Long-Term Care Facilities: Constant demand for durable, easy-to-clean cushions for continuous residency.

- Home Care Settings and Individual Users: Fastest-growing segment; prioritizes comfort, ease of maintenance, and compatibility with daily living.

- Distribution Channel:

- Direct Sales: Primary channel for large institutional contracts and custom products requiring manufacturer installation and training.

- Distributors and Dealers: Critical for regional market coverage and providing clinical fitting services (HME providers).

- Online Channels: Growing rapidly for replacement parts and standard, low-risk cushions, optimizing consumer convenience.

Value Chain Analysis For Wheelchair Cushion Market

The upstream segment of the value chain is highly reliant on specialized chemical manufacturers and textile suppliers. Key inputs include high-resilience, medical-grade foams, viscoelastic polymers, synthetic rubber compounds for air cells, and specialized fluid-resistant, breathable cover materials. Securing a reliable supply of these advanced materials is crucial, especially those that meet stringent flammability and biocompatibility standards (e.g., ISO 10993). Research and Development activities at this stage focus not only on improving pressure mapping efficacy but also on reducing the overall weight of the cushion and extending its service life, thus enhancing product value proposition. Manufacturing involves complex processes such as RF welding for air cell assemblies, high-precision injection molding for rigid components, and CNC contour cutting for customized foam bases, demanding significant capital investment in automation and quality control systems.

Midstream activities involve sophisticated assembly, rigorous quality assurance, and regulatory compliance management. Given the classification of wheelchair cushions as Class I or Class II medical devices, adherence to international standards (e.g., FDA 510(k) clearance, EU MDR certification) is non-negotiable and represents a major cost center. Inventory management requires careful forecasting due to the diversity of sizes, shapes, and material combinations demanded by the market. Companies must maintain deep clinical expertise within their product management teams to continuously iterate designs based on feedback from occupational and physical therapists, ensuring that products remain clinically relevant and aligned with contemporary seating practices.

Downstream operations are defined by the requirement for specialized clinical engagement. The distribution channel is heavily mediated by certified assistive technology professionals (ATPs) who assess patient needs, select the appropriate cushion, and ensure proper fitting and setup—a service often required for insurance reimbursement. Direct distribution allows for maximum profit capture and direct customer relationship management with large institutions. However, the use of indirect channels (dealers and HME providers) is necessary to reach the dispersed individual user base and handle localized post-sale services. E-commerce facilitates the sale of replacement covers and standard cushions, bypassing the need for clinical consultation but demanding exceptional clarity in product descriptions and sizing guides. Effective logistical operations, including temperature-controlled storage and rapid fulfillment, are vital to maintain the integrity of polymer and gel materials during transit to the end customer.

Wheelchair Cushion Market Potential Customers

The core customer base for the Wheelchair Cushion Market is categorized by institutional purchasing power and clinical risk profile. Primary institutional customers include governmental healthcare systems procuring equipment in bulk for publicly funded hospitals and long-term care facilities, where purchasing decisions are heavily influenced by cost-efficiency, durability, and compliance with national standards for pressure injury prevention. Private hospital networks and rehabilitation clinics represent another significant institutional segment, often prioritizing advanced technology and customized solutions to enhance patient outcomes and attract high-paying clientele, thus driving demand for premium products.

The largest volume potential lies with individual consumers and their caregivers, encompassing individuals with permanent mobility disabilities, those recovering from orthopedic surgeries, and the rapidly growing elderly population utilizing mobility aids in the home setting. This consumer group relies heavily on recommendations from rehabilitation specialists and often utilizes insurance benefits or out-of-pocket funds for purchasing. Key buying criteria for individual users include comfort, aesthetic appeal, ease of cleaning, weight (for active users), and critical clinical attributes that prevent skin breakdown, highlighting a complex decision-making process balancing clinical need with lifestyle factors.

Furthermore, indirect customers who significantly influence purchasing include insurance providers and national medical reimbursement bodies. Their decisions regarding which cushion types qualify for coverage based on medical necessity criteria directly shape market demand and product development strategies. Manufacturers must rigorously document clinical efficacy and cost-effectiveness to ensure favorable coverage determinations. Non-traditional customers, such as adaptive sports organizations and specialized travel companies focusing on disabled clientele, also represent niche markets requiring ultra-lightweight, high-performance, and extremely durable cushions optimized for dynamic environments, further broadening the scope of potential applications and customer demographics.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 750 Million |

| Market Forecast in 2033 | USD 1.25 Billion |

| Growth Rate | 7.6% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Sunrise Medical, Invacare Corporation, Ottobock SE & Co. KGaA, Permobil AB, ROHO Group (subsidiary of Permobil), The Comfort Company, Vicair B.V., Medical Depot (Drive DeVilbiss Healthcare), Supracor, Varilite (A Steeper Group Company), Nova Medical Products, Action Products, Inc., Miki Kogyo Co. Ltd., Trulife, Quantum Rehab (Q-Logic Systems), Aspen Seating, Span-America Medical Systems, Prism Medical Products, Comfort Medical, Kuschall (Küschall AG). |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Wheelchair Cushion Market Key Technology Landscape

The technological evolution in the Wheelchair Cushion Market is primarily driven by breakthroughs in advanced polymers and embedded electronics. Leading-edge foam technology incorporates open-cell structures designed for maximum breathability and heat dissipation, often treated with specialized antimicrobial agents to maintain hygienic standards, particularly critical in long-term care environments. Manufacturers are optimizing the density and recovery properties of viscoelastic (memory) foams to ensure deep immersion for pressure relief without compromising postural support, often creating multi-layered cushions where different foam densities address specific body regions (e.g., denser foam under the thighs for stability, softer foam under the ischial tuberosities for protection).

The most significant innovation lies in dynamic seating solutions. This involves sophisticated air systems featuring multiple interconnected or individually adjustable air cells managed by microprocessors and small pumps. These systems can autonomously adjust air pressure based on programmed timing cycles or, in advanced models, in response to real-time feedback from integrated pressure sensors. This dynamic adjustment is designed to simulate weight shifts, thereby periodically redistributing pressure and improving circulation without requiring user intervention. The complexity of these dynamic systems necessitates rigorous testing and validation to ensure reliability and battery life, which are critical adoption factors in the home care setting.

Furthermore, technology is rapidly advancing in the field of customization. Sophisticated computer-aided design (CAD) and manufacturing (CAM) processes, combined with 3D scanning technology, allow for the creation of intricate custom-molded cushions. These cushions utilize precise anatomical measurements to optimize contact area and provide unparalleled stability for individuals with complex orthopedic needs or fixed postural deformities. The use of specialized lightweight materials, such as aerospace-grade carbon fiber for rigid bases and novel polymer matrices, is enhancing the functionality of these custom devices, making them lighter, more durable, and increasingly effective for active wheelchair users who demand high performance without compromising clinical protection.

The emerging technological frontier includes the integration of haptic feedback systems and augmented reality (AR) tools for fitting and training. Haptic feedback cushions provide gentle vibrations to the user when high-pressure thresholds are reached, promoting spontaneous weight shifts. AR technology, meanwhile, is being explored to assist clinicians in visually overlaying pressure data onto the patient’s body in real-time during the fitting process, ensuring optimal contact and alignment immediately. This convergence of advanced materials, smart electronics, and digital tools marks a clear shift towards an ecosystem where the wheelchair cushion is not just a device, but an active component of the patient’s overall healthcare management plan, continuously collecting and transmitting actionable therapeutic data to healthcare providers.

Regional Highlights

North America

North America, particularly the United States, holds the largest market share due to its established infrastructure for specialized medical equipment, robust public and private insurance frameworks (Medicare/Medicaid, private commercial plans), and a cultural emphasis on litigation and liability, which drives clinicians to utilize the best available preventative technologies against pressure injuries. The market is highly mature and competitive, characterized by rapid adoption cycles for innovative products, including custom-molded cushions and smart seating systems. High awareness among clinical professionals (Occupational Therapists and Physical Therapists) specializing in seating and mobility further ensures that patients receive appropriate, high-risk cushions tailored to complex needs. The region's market value is further amplified by the high prevalence of obesity, which necessitates specialized, higher-capacity cushions, and a significant veteran population requiring long-term mobility support from governmental sources, necessitating continual procurement of top-tier therapeutic devices.

Europe

The European market demonstrates strong, steady growth, underpinned by universal healthcare access and strict regulatory requirements imposed by the EU Medical Device Regulation (MDR). This regulation has necessitated rigorous clinical evidence and post-market surveillance for all cushion manufacturers, fostering a high-quality, safety-focused environment. Western European countries, particularly Germany, the UK, and Scandinavia, prioritize comprehensive rehabilitation and long-term quality of life, leading to stable demand for durable, clinically proven foam and hybrid systems. Eastern Europe, while having lower per capita spending, represents a growing opportunity as healthcare modernization progresses and access to specialized mobility aids improves. The region also leads in sustainable material science, with increasing consumer and institutional preference for cushions manufactured using environmentally conscious and recycled polymers.

Asia Pacific (APAC)

The APAC market is the most dynamic and fastest-growing segment globally. Its expansion is fueled by demographic factors, specifically the rapid increase in the aging population in China and Japan, coupled with massive investments in medical infrastructure across emerging economies like India, Indonesia, and Southeast Asian nations. Although price sensitivity remains a major factor, the demand for imported, high-quality therapeutic cushions is rising among the burgeoning middle and upper classes who can afford private healthcare. Local manufacturers are entering the market, focusing on developing cost-effective cushions that meet a functional baseline, thereby capturing the vast, underserved low-to-medium risk segments. Challenges persist regarding fragmented distribution networks and varying regulatory standards across countries, requiring nuanced market entry strategies focused on localization and establishing strong relationships with key medical distributors and government health agencies responsible for procurement.

- North America: Leads in market value; driven by favorable reimbursement policies, high clinical awareness, and rapid adoption of sensor-based seating technology for high-risk patients.

- Europe: Stable and quality-focused market; strongly influenced by the high standards of the MDR and public healthcare systems prioritizing preventative care for the vast geriatric population.

- Asia Pacific (APAC): The dominant growth region; propelled by significant healthcare investment, population size, and increasing adoption of therapeutic cushions moving away from rudimentary solutions.

- Latin America (LATAM): Growth is incremental, challenged by economic volatility and reliance on out-of-pocket spending; opportunities exist in large urban centers with specialized private rehabilitation facilities.

- Middle East and Africa (MEA): Concentrated demand in affluent Gulf Cooperation Council (GCC) countries due to high standards in specialized hospitals catering to medical tourism; the broader African market remains constrained by infrastructure limitations.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Wheelchair Cushion Market.- Sunrise Medical

- Invacare Corporation

- Ottobock SE & Co. KGaA

- Permobil AB

- ROHO Group (subsidiary of Permobil)

- The Comfort Company

- Vicair B.V.

- Medical Depot (Drive DeVilbiss Healthcare)

- Supracor

- Varilite (A Steeper Group Company)

- Nova Medical Products

- Action Products, Inc.

- Miki Kogyo Co. Ltd.

- Trulife

- Quantum Rehab (Q-Logic Systems)

- Aspen Seating

- Span-America Medical Systems

- Prism Medical Products

- Comfort Medical

- Kuschall (Küschall AG)

Frequently Asked Questions

Analyze common user questions about the Wheelchair Cushion market and generate a concise list of summarized FAQs reflecting key topics and concerns.What regulatory standards primarily govern the manufacturing of wheelchair cushions globally?

The manufacturing and sale of wheelchair cushions are governed by major regulatory bodies, primarily the U.S. FDA (requiring 510(k) clearance for many therapeutic models) and the European Union’s MDR (Medical Device Regulation). These regulations enforce strict standards for biocompatibility, fire retardancy, durability, and clinical efficacy documentation.

How do hybrid cushions balance stability and pressure relief for high-risk users?

Hybrid cushions balance these requirements by utilizing a stable, contoured foam base to ensure postural support and pelvic alignment. Specialized air or gel inserts are strategically placed under high-pressure bony prominences (ischial tuberosities) to maximize immersion and envelopment, offering superior localized pressure redistribution where it is most needed.

What is the main driver behind the rapid growth of the home care segment in this market?

The shift towards the home care segment is driven by global healthcare policies promoting early discharge and de-institutionalization, coupled with increasing consumer preference for receiving care in a familiar setting. This segment demands cushions that are highly durable, low-maintenance, and easy for non-professional caregivers to handle.

What is the economic impact of pressure ulcers on healthcare systems, driving cushion adoption?

Pressure ulcers impose a massive financial burden on healthcare systems globally, with treatment costs for a single severe ulcer potentially reaching hundreds of thousands of dollars. This high cost incentivizes healthcare payers and institutions to invest proactively in specialized, high-efficacy preventative tools, such as advanced therapeutic cushions, as a cost-saving measure.

What technological advancements are enhancing cushion customization?

Customization is being revolutionized by 3D printing and advanced scanning technology. These tools capture precise anatomical contours and pressure profiles, allowing manufacturers to rapidly produce custom-molded cushions with internal geometries perfectly matched to the user's body, optimizing contact area and maximizing therapeutic effectiveness.

The preceding analysis provides a comprehensive overview of the Wheelchair Cushion Market, synthesizing technological trends, demographic shifts, and regional performance indicators to define the current and future competitive landscape.

End of Report.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager