Wheelchair Stair Climber Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431885 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Wheelchair Stair Climber Market Size

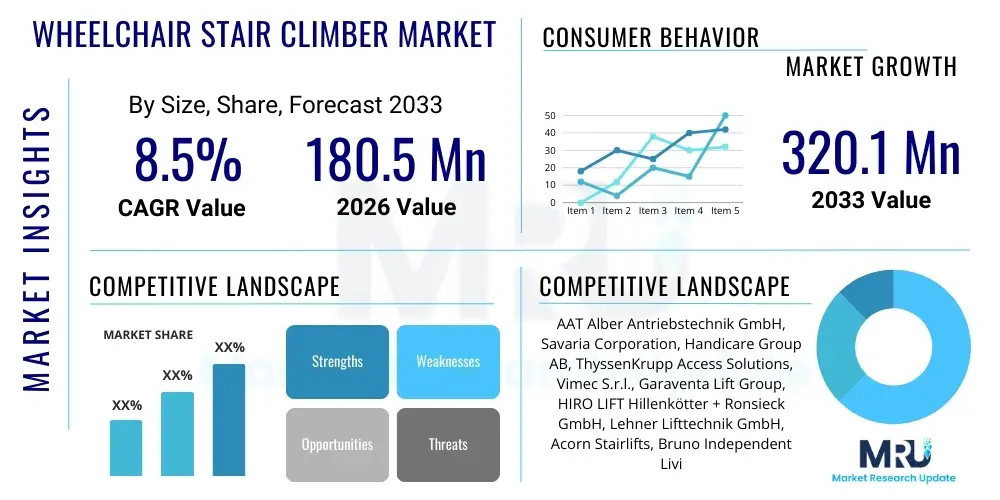

The Wheelchair Stair Climber Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 180.5 Million in 2026 and is projected to reach USD 320.1 Million by the end of the forecast period in 2033.

Wheelchair Stair Climber Market introduction

The Wheelchair Stair Climber Market encompasses specialized mobility devices designed to safely transport individuals using wheelchairs up and down staircases, overcoming architectural barriers in both residential and commercial settings. These devices are critical components of inclusive design and accessibility infrastructure, ensuring that mobility-impaired individuals can navigate multi-story buildings without relying solely on lifts or elevators, which may be costly or structurally impossible to install in older buildings. The core technology involves robust mechanical systems, often featuring tracks or specialized lifting mechanisms, which securely grip the stairs and provide a stable, controlled ascent or descent, dramatically improving the independence and quality of life for users and their caregivers.

Product categories within this market typically include portable (track-based or wheel-based) and fixed (platform-style) solutions. Portable wheelchair stair climbers are highly valued for their versatility, requiring no permanent installation and allowing usage across multiple locations, such as private homes, schools, or public buildings during emergencies. Fixed models, while requiring installation, offer higher weight capacities and are suitable for frequent, heavy-duty use in institutional environments like hospitals and nursing homes. The continuous development of battery technology and ergonomic designs is making these climbers lighter, safer, and easier for attendants to operate, thereby broadening their application scope from primarily medical use to general public accessibility solutions.

Key applications driving market growth include geriatric care facilities, rehabilitation centers, and increasing demand from private residences adapting to the needs of aging populations or individuals with permanent disabilities. The primary benefits of these devices are enhanced accessibility, reduced risk of injury for both users and caregivers during transfers, and cost-effectiveness compared to extensive renovation projects required for elevator installation. Major driving factors include stringent government mandates promoting universal accessibility (such as the ADA in the US or similar European directives), the global increase in the elderly demographic susceptible to mobility issues, and advancements in electromechanical engineering leading to more reliable and affordable climbing technology.

Wheelchair Stair Climber Market Executive Summary

The Wheelchair Stair Climber Market is exhibiting robust growth, propelled by demographic shifts, particularly the rising global aging population, and heightened governmental focus on inclusive design and accessibility standards. Business trends are dominated by technological innovation aimed at enhancing safety, reducing device weight, and improving ease of operation through features like advanced sensors, intuitive control panels, and long-lasting battery systems. A major strategic shift among key players involves expanding rental and subscription models, making expensive equipment more financially accessible to end-users and providing predictable recurring revenue streams for manufacturers. Furthermore, market participants are increasingly investing in localized manufacturing and service networks to comply with regional safety certifications and offer prompt maintenance support, which is crucial for medical devices.

Regional trends indicate that North America and Europe currently hold the largest market shares due to well-established healthcare infrastructure, high disability awareness, and comprehensive regulatory frameworks mandating accessibility in public and private buildings. However, the Asia Pacific (APAC) region is projected to register the fastest growth rate, fueled by rapid urbanization, improving healthcare spending, and substantial infrastructure development focusing on inclusive mobility in countries like China, India, and Japan. Latin America and the Middle East and Africa (MEA) are emerging markets, primarily driven by governmental initiatives in public health and infrastructure projects targeting tourism and medical tourism, gradually adopting these solutions to meet international standards.

Segment trends highlight the dominance of the track-based segment due to its superior stability and suitability for various stair types, although the chair-integrated segment is gaining traction due to its ability to serve users who may not require their personal wheelchair to be climbed. In terms of end-use, the residential sector is experiencing the highest incremental growth, spurred by consumer desire for 'aging in place' solutions. Conversely, the institutional segment (hospitals and nursing homes) remains the largest revenue generator, demanding robust, high-capacity climbers. Manufacturers are concentrating on developing modular components to allow for greater customization across these diverse segments, optimizing device performance for specific user needs and environmental constraints.

AI Impact Analysis on Wheelchair Stair Climber Market

Common user questions regarding AI's impact on the Wheelchair Stair Climber Market frequently revolve around automation capabilities, predictive maintenance, and enhanced safety features. Users often inquire if AI can enable completely autonomous operation, eliminating the need for a human attendant, or if AI algorithms can predict mechanical failures before they occur, ensuring device reliability. There is also significant interest in how machine learning can personalize climbing profiles based on the specific staircase geometry, user weight distribution, and environmental conditions to optimize ascent speed and stability. The key themes summarized across user inquiries focus on maximizing safety through real-time risk assessment, improving efficiency through smart resource management (like battery life optimization), and potentially lowering operational costs through automated diagnostics and remote monitoring capabilities.

- Predictive Maintenance: AI algorithms analyze sensor data (vibration, temperature, current draw) to predict component failure, scheduling maintenance proactively and reducing unexpected downtime.

- Enhanced Safety Protocols: Real-time machine vision systems using AI can detect obstacles, improper loading, or unstable stair conditions, automatically adjusting speed or halting operation to prevent accidents.

- Autonomous Navigation (Assisted Operation): Future models may use AI for semi-autonomous alignment and tracking adjustments on complex or non-standard staircases, reducing operator strain and improving accuracy.

- Ergonomic Optimization: Machine learning optimizes the pitch and speed control based on the specific load characteristics and staircase angle, ensuring the smoothest ride possible.

- Remote Diagnostics and Support: AI-powered remote monitoring enables manufacturers to diagnose issues instantly, reducing service call times and improving customer satisfaction metrics.

- Battery Management: AI optimizes charging cycles and power usage during ascent/descent, extending battery life and operational efficiency between charges.

DRO & Impact Forces Of Wheelchair Stair Climber Market

The market dynamics are shaped by strong socioeconomic drivers, regulatory constraints, and technological opportunities, resulting in significant impact forces. The primary drivers—the accelerating aging population globally and increasing government mandates for public accessibility—provide a foundational demand base that is largely non-cyclical. Restraints mainly center around the high initial cost of these specialized devices, which often requires significant insurance coverage or direct government subsidies, limiting adoption in lower-income demographics or regions with nascent healthcare financing structures. Furthermore, the operational complexity and required training for attendants, especially for portable models, can act as a barrier to entry, necessitating substantial post-sale support from manufacturers.

Opportunities in the sector are vast, particularly in leveraging advancements in lightweight composite materials and high-density battery technology to improve portability and range. The development of 'smart' climbers integrated with IoT capabilities for remote monitoring and diagnostics represents a significant growth vector. Expansion into emerging economies, where new infrastructure is being built with accessibility in mind, also presents untapped market potential. The increasing prevalence of musculoskeletal disorders and chronic conditions necessitating permanent wheelchair use further solidifies the long-term growth trajectory, compelling manufacturers to continually refine safety standards and user experience.

The impact forces are predominantly high due to the necessity of the product. The bargaining power of suppliers is moderate, driven by specialized components (motors, tracks, and controllers), while the bargaining power of buyers (primarily institutions and governments) is significant due to large volume procurement and strict adherence to specifications. The threat of new entrants is low due to high capital requirements for R&D and stringent safety regulations requiring complex certifications. Substitutes, such as elevators or platform lifts, pose a moderate threat, particularly in new construction, but the portable nature and lower installation costs of stair climbers maintain their competitive edge in retrofitting older buildings and residential settings.

Segmentation Analysis

The Wheelchair Stair Climber Market is comprehensively segmented based on product type, operation mechanism, technology, and end-user application. Segmentation is crucial for understanding specific market needs, as the requirements for a high-traffic institutional setting differ vastly from those of a private residential user. Product type differentiation, particularly between portable and fixed models, defines the target application area and investment required. Technological segmentation focuses on track versus wheel-based systems, reflecting varying suitability for different stair materials and angles. The analysis allows manufacturers to tailor marketing strategies and product development to address the precise demands of rehabilitation centers, hospitals, private residences, and public spaces, ensuring optimal resource allocation and maximizing market penetration across diverse geographical landscapes and socio-economic strata.

- By Product Type:

- Portable Wheelchair Stair Climbers (Track-based, Wheel-based)

- Fixed Wheelchair Stair Climbers (Platform Lifts, Inclined Lifts)

- By Operation Mechanism:

- Attendant-Operated

- Self-Operated (Minimal segment, mostly in fixed lifts)

- By Technology:

- Track-Based Climbers

- Wheel-Based Climbers (Powered Wheels)

- Chair-Integrated Climbers (For transfer from standard wheelchairs)

- By End User:

- Residential

- Institutional (Hospitals, Nursing Homes, Rehabilitation Centers)

- Public/Commercial (Schools, Airports, Public Buildings, Transportation)

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East & Africa (MEA)

Value Chain Analysis For Wheelchair Stair Climber Market

The value chain for the Wheelchair Stair Climber Market begins with upstream activities focused on securing high-quality, specialized raw materials and core components. These include robust structural alloys (aluminum or steel), high-performance electric motors, sophisticated gearing and track systems, advanced microcontroller units, and reliable, high-density lithium-ion battery packs. Sourcing these components requires stringent quality checks and often involves long-term contracts with specialized automotive or aerospace component suppliers to ensure durability and adherence to strict safety standards (e.g., ISO, TUV). Research and development (R&D) and intellectual property (IP) protection play a critical role in the upstream phase, as design breakthroughs in stability and portability are key differentiators.

The midstream phase involves manufacturing, assembly, and rigorous quality assurance. Manufacturing processes are highly specialized, focusing on precision engineering, welding, and electronic integration. Due to the life-critical nature of the equipment, regulatory compliance, including mandatory certifications (FDA, CE marking), dictates much of the production workflow. The distribution channel is crucial; direct distribution often involves sales teams focusing on institutional buyers (hospitals, government tenders) that require installation and extensive training. Indirect distribution relies on a network of certified medical device distributors and specialized mobility retailers who handle local sales, inventory, and crucial after-sales support and maintenance services.

Downstream activities center on deployment, training, and maintenance. Given the nature of the product, direct engagement with the end-user (individual or caregiver) is essential for successful adoption. Service contracts for maintenance are a significant revenue stream, extending the lifecycle of the product and ensuring long-term safety compliance. Furthermore, financing and leasing services offered either directly by the manufacturer or through partners are vital for overcoming the high initial capital expenditure barrier. The entire chain emphasizes reliability, certification, and responsive post-sales support, reflecting the medical and safety criticality of wheelchair stair climbing devices.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 180.5 Million |

| Market Forecast in 2033 | USD 320.1 Million |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | AAT Alber Antriebstechnik GmbH, Savaria Corporation, Handicare Group AB, ThyssenKrupp Access Solutions, Vimec S.r.l., Garaventa Lift Group, HIRO LIFT Hillenkötter + Ronsieck GmbH, Lehner Lifttechnik GmbH, Acorn Stairlifts, Bruno Independent Living Aids, Stannah Stairlifts Ltd, Meditek Inc., TK Home Solutions, Summit Lifts, Harmar Mobility |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Wheelchair Stair Climber Market Potential Customers

The primary potential customers for Wheelchair Stair Climbers span across diverse demographics and organizational categories, driven by the core need for overcoming vertical mobility barriers. The most significant segment comprises individual end-users and their families residing in multi-story residential properties who seek solutions for 'aging in place' or managing permanent disabilities without relocating. These customers prioritize ease of use, aesthetic integration, and safety certifications, often relying on state or national disability funding programs and long-term care insurance to cover the substantial purchase cost. The purchasing decision is typically complex, involving input from healthcare professionals, mobility specialists, and caregivers, emphasizing the need for comprehensive product demonstrations and personalized consultation services from manufacturers.

Another major segment consists of institutional buyers, including public and private hospitals, geriatric care centers, assisted living facilities, and specialized rehabilitation clinics. These customers purchase in bulk and demand devices with high duty cycles, exceptional durability, and stringent infection control features. For institutions, the decision criterion is often centered on regulatory compliance (e.g., fire safety evacuation protocols), reliability under heavy use, and comprehensive service agreements provided by the vendor. Public and commercial entities, such as schools, universities, governmental buildings, and transportation hubs, form a distinct customer base mandated by accessibility laws to provide solutions for vertical travel when elevators are impractical or unavailable, often prioritizing portable, easily deployable solutions for emergency preparedness.

Emerging customer groups include specialized rental companies that service short-term needs, such as post-operative recovery or temporary event accessibility, and government bodies procuring equipment for public infrastructure or emergency services (e.g., fire departments, civil defense). Targeting these diverse customer needs requires tailored marketing efforts: direct-to-consumer outreach emphasizing independence and safety, specialized institutional sales focusing on compliance and durability, and strategic partnerships with architectural firms and construction companies promoting integration into new building designs. Understanding these potential buyers’ pain points—cost, training, and reliability—is paramount for successful market penetration.

Wheelchair Stair Climber Market Key Technology Landscape

The Wheelchair Stair Climber market’s technological advancement is primarily centered on improving safety, enhancing portability, and maximizing efficiency. A key technology is the development of advanced electromechanical drive systems, utilizing brushless DC motors coupled with sophisticated gearing mechanisms to provide smooth, controlled movement regardless of load or stair incline. Modern track-based systems feature highly durable, non-marking rubber tracks that automatically adjust tension and contact patch to maintain maximum grip on various stair surfaces, including wood, stone, and carpet. Furthermore, critical safety technologies include multi-sensor systems—such as pressure sensors, tilt sensors, and inertia measurement units (IMUs)—which continuously monitor the device’s stability and prevent operation if dangerous angles or unbalanced loads are detected, significantly mitigating the risk of tipping or slippage.

The second pillar of the technology landscape involves power management and control systems. The transition to high-capacity, lightweight lithium-ion battery technology has dramatically increased the operational range and reduced the overall weight of portable climbers, addressing a major historical constraint. These batteries are often paired with intelligent charging systems that optimize life cycles and provide accurate real-time charge indicators. Control systems now incorporate microprocessors that offer customizable speed settings, soft start/stop functionality, and diagnostic feedback displayed via integrated LCD screens or intuitive control pads. This level of digital control not only enhances safety but also simplifies the training process for attendants, making the devices accessible to a wider pool of caregivers.

Furthermore, technology focusing on user interface and integration is gaining traction. This includes ergonomic improvements in handle design, quick-release wheelchair attachment systems that accommodate diverse wheelchair models, and IoT connectivity for remote fleet management and preventative maintenance monitoring. Some high-end fixed stair climbers now feature integration with smart home automation systems, allowing for voice control or smartphone operation. The continuous drive toward modular design also allows for easier repair and upgrades, ensuring the long-term viability and sustainability of the devices in both institutional and residential environments.

Regional Highlights

Regional dynamics play a crucial role in shaping the Wheelchair Stair Climber Market, influenced heavily by healthcare expenditure, demographic structure, and regulatory accessibility mandates. North America, specifically the United States and Canada, represents a mature and dominant market segment. This dominance is attributed to high levels of consumer awareness, sophisticated reimbursement structures (including Medicare/Medicaid and private insurance), and strict enforcement of accessibility laws like the Americans with Disabilities Act (ADA), which drives demand in public and commercial infrastructure retrofitting projects. Innovation adoption is rapid, and consumers often demand advanced features and customized solutions.

Europe holds the second-largest share, characterized by high adoption rates in countries like Germany, the UK, and France. European market growth is strongly supported by well-funded social security systems that often subsidize mobility aids and a pervasive culture of geriatric care focusing on independent living. Regulatory bodies, such as the European Union’s standardization efforts, ensure high safety and quality benchmarks (CE marking) for all devices, leading to market preference for established, certified manufacturers. Demand is evenly split between residential installations for aging individuals and institutional use in expansive public healthcare systems.

Asia Pacific (APAC) is projected to be the fastest-growing region. This explosive growth is driven by massive infrastructure investment, rapidly increasing elderly populations (especially in Japan, South Korea, and China), and rising disposable incomes allowing for investment in specialized mobility aids. While regulatory environments are still evolving in some developing APAC countries, the sheer scale of urban development and the growing need to provide accessible solutions in overcrowded cities necessitate the adoption of compact and efficient stair climbers. Key growth catalysts include government initiatives promoting barrier-free access in new construction projects and the expansion of private healthcare facilities catering to a wealthier clientele.

- North America (US & Canada): Mature market driven by strict ADA compliance, robust reimbursement frameworks, and high demand for advanced, portable solutions in residential settings.

- Europe (Germany, UK, France): High market penetration supported by comprehensive social security funding, strong institutional demand, and adherence to stringent EU safety and quality standards.

- Asia Pacific (China, Japan, India): Fastest-growing market fueled by demographic aging, rapid urbanization, and increasing government investment in public accessibility infrastructure and healthcare modernization.

- Latin America (Brazil, Mexico): Emerging market focused on public health infrastructure development; growth is highly sensitive to economic stability and the establishment of supportive governmental disability programs.

- Middle East & Africa (UAE, South Africa): Niche market driven primarily by luxury residential applications, high-end medical tourism facilities, and significant government spending on large-scale accessible public projects.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Wheelchair Stair Climber Market.- AAT Alber Antriebstechnik GmbH

- Savaria Corporation

- Handicare Group AB

- ThyssenKrupp Access Solutions

- Vimec S.r.l.

- Garaventa Lift Group

- HIRO LIFT Hillenkötter + Ronsieck GmbH

- Lehner Lifttechnik GmbH

- Acorn Stairlifts

- Bruno Independent Living Aids

- Stannah Stairlifts Ltd

- Meditek Inc.

- TK Home Solutions

- Summit Lifts

- Harmar Mobility

- Apex Medical Equipment

- Sano Transportgeräte GmbH

- Ascension Elevating Devices

- Terry Lifts

- Winncare Group

Frequently Asked Questions

Analyze common user questions about the Wheelchair Stair Climber market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between track-based and wheel-based wheelchair stair climbers?

Track-based climbers use continuous rubber tracks to grip the stairs, offering superior stability and load distribution across varying step materials and angles, making them ideal for institutional use and emergency evacuation. Wheel-based climbers rely on powered wheels and often require an attendant to balance the load, making them generally lighter and more compact but less versatile across highly challenging staircase designs.

Are wheelchair stair climbers suitable for all types of staircases, including spirals or those without landings?

Portable wheelchair stair climbers are highly versatile but are generally optimized for straight staircases with adequate landing space for maneuvering. While some advanced track models can handle gentle turns and intermediate landings, dedicated fixed platform lifts are typically required for tight spiral staircases or continuous curved designs to ensure compliance with stringent safety and structural requirements.

What are the typical operating and maintenance costs associated with a portable stair climber?

The operating costs are relatively low, primarily involving electricity for recharging the lithium-ion batteries, which typically offer several hundred steps per charge. Maintenance costs primarily include annual or bi-annual professional inspections to check motor function, track integrity, and safety sensor calibration. Regular preventative maintenance is critical to ensure the device maintains safety certifications and optimal operational reliability.

How do global accessibility regulations, such as the ADA, influence the demand for stair climbers?

Global regulations, including the ADA (US) and similar EU directives, mandate that public and commercial buildings must provide equitable access. Where installing full elevators or ramps is structurally or financially prohibitive, these regulations directly drive the demand for both fixed and portable stair climbers as legally compliant, cost-effective alternatives for ensuring mobility access and emergency egress for wheelchair users.

Is financing or insurance coverage typically available for the high cost of wheelchair stair climbers?

Yes, due to the classification as durable medical equipment (DME), financing and insurance coverage are common. In North America and Europe, many governmental programs (like Medicare, Medicaid, or national health services) and private insurance plans offer partial or full reimbursement if the device is deemed medically necessary. Manufacturers and specialized dealers also often provide leasing arrangements or subsidized financing options to improve consumer affordability and market accessibility.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager