Whey Protein Ingredients Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435545 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Whey Protein Ingredients Market Size

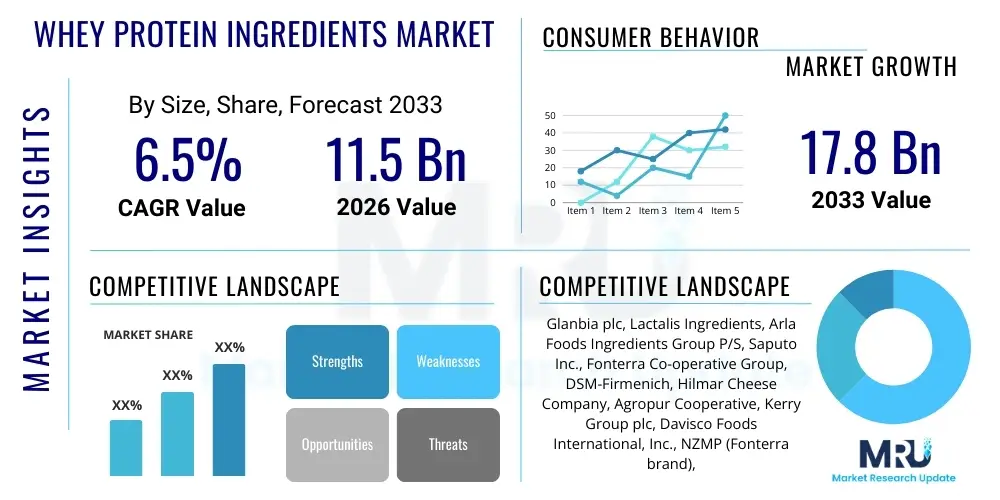

The Whey Protein Ingredients Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 11.5 Billion in 2026 and is projected to reach USD 17.8 Billion by the end of the forecast period in 2033.

Whey Protein Ingredients Market introduction

The Whey Protein Ingredients Market encompasses various dairy-derived protein fractions, primarily sourced as a byproduct of cheese manufacturing. These ingredients are highly valued for their exceptional nutritional profile, high biological value, and superior functional properties, including emulsification, solubility across different pH levels, and foaming capabilities. Key commercial forms include Whey Protein Concentrate (WPC), Whey Protein Isolate (WPI), and Whey Protein Hydrolyzate (WPH), each tailored for specific industrial applications based on protein purity and degree of hydrolysis. WPC, typically containing 34% to 80% protein, serves as a versatile bulk ingredient, while WPI, exceeding 90% purity, targets high-end sports nutrition and clinical dietary requirements due to its minimal fat and lactose content. The continuous innovation in filtration technology, utilizing techniques such as cross-flow microfiltration and ion-exchange, is driving the development of specialized protein fractions that cater to emerging health trends such as weight management, muscle preservation (anti-sarcopenia applications), and immune support through the selective isolation of bioactive components like lactoferrin and immunoglobulins, thereby expanding the market's reach beyond traditional performance nutrition applications into mainstream health and wellness categories. This shift necessitates rigorous quality assurance and traceability across the entire supply chain, from farm to finalized ingredient, to maintain consumer trust and regulatory compliance in diverse global jurisdictions.

Major applications of these ingredients span a vast industrial landscape, predominantly led by the sports nutrition and functional food sectors, where they are integral components of protein powders, ready-to-mix supplements, specialized high-protein bars, and ready-to-drink (RTD) recovery beverages. These applications demand high solubility and thermal stability, properties which are continually refined through technological advances to prevent precipitation or textural degradation during processing and storage, especially in acidic environments typical of sports drinks. Furthermore, the clinical nutrition segment utilizes highly refined and often hydrolyzed whey proteins for specialized medical diets, supporting rapid recovery and nitrogen balance in geriatric, post-operative, and critically ill patients due to easy digestibility, rapid amino acid delivery, and superior biological absorption rates. The use of whey peptides in specialized pediatric formulations addresses nutritional deficiencies and improves tolerance in infants with sensitivities, underscoring the ingredient's versatility across the human lifespan. Ingredient manufacturers must navigate complex global regulatory hurdles regarding nutritional claims, particularly within the sensitive infant formula market, requiring extensive documentation and clinical efficacy data to support product registration and market entry.

Driving factors for market expansion are multi-faceted, anchored by strong scientific validation of whey protein's pivotal role in muscle protein synthesis, satiety enhancement, and overall metabolic health, widely disseminated through digital and social media channels, elevating consumer awareness. Regulatory frameworks, particularly those pertaining to novel food ingredients and permissible health claims in regions like the European Union and the United States, play a crucial role in market access and consumer confidence by standardizing product information and efficacy substantiation. The increasing global focus on sustainable sourcing, ethical farming practices, and the optimization of resource utilization in the dairy industry further positions whey utilization as an economically viable and environmentally responsible practice, transforming a cheese byproduct into a high-value commodity. However, challenges remain concerning the fluctuating costs of raw milk and the energy-intensive nature of ultra-filtration and micro-filtration processes, necessitating continuous operational innovation to maintain competitive pricing. The threat of substitution from highly processed plant proteins also drives a continuous need for investment in research demonstrating the unique superiority of whey protein’s amino acid profile and bioavailability compared to plant-based alternatives.

Whey Protein Ingredients Market Executive Summary

The global Whey Protein Ingredients Market demonstrates robust growth momentum, largely catalyzed by profound shifts in consumer dietary preferences globally favoring high-protein, low-lactose products, aligning with trends toward preventative health maintenance and active lifestyles. Business trends highlight a significant strategic pivot toward ingredient specialization, with leading market players investing heavily in sophisticated fractionation and purification technologies like chromatographic separation and advanced membrane systems to isolate specific, highly functional bioactive peptides, such as alpha-lactalbumin, beta-lactoglobulin, and specialized immunoglobulins. These specialized ingredients command premium pricing and target highly niche health outcomes, including improved gut health, enhanced sleep quality, and immune system modulation, moving whey beyond basic nutritional supplementation. Strategic horizontal and vertical integration activities, including mergers, acquisitions, and joint ventures, aimed at securing consistent, high-quality raw material supply chains and expanding geographical processing footprints, characterize the current competitive landscape, ensuring operational resilience against inherent volatility in global dairy commodity prices. Furthermore, the proliferation of digital commerce and direct-to-consumer (D2C) channels, especially for sports nutrition brands, is democratizing access to tailored whey protein products, intensifying competitive pressure on established manufacturers to maintain product differentiation through superior functional performance, stringent quality control, and rapid innovation in delivery formats and unique flavor systems that cater to global palates.

Regionally, North America and Europe maintain their foundational dominance, primarily driven by high consumer awareness, deep market penetration across all application segments, and well-established, supportive regulatory environments that facilitate the substantiation and marketing of authorized protein health claims. However, the Asia Pacific (APAC) region, spearheaded by the economic powerhouses of China, India, and Southeast Asian nations, represents the unequivocal fastest-growing market segment. This explosive growth is fueled by accelerated urbanization, significant increases in middle-class disposable income, and a rapid, large-scale convergence toward Westernized dietary habits that emphasize convenience foods and nutritional supplementation. This regional demand surge is particularly acute in the highly regulated and volume-intensive segments of infant formula manufacturing and specialized clinical nutritional products. Local and international manufacturers are responding by investing billions in localized, state-of-the-art production facilities in APAC to meet burgeoning demand efficiently, adhere to local regulatory standards, and optimize distribution logistics, mitigating complex import tariffs and transport costs.

Segment trends decisively underscore the rising prominence and premiumization of Whey Protein Isolate (WPI) due to its superior purity profile, minimal caloric density, and perfect alignment with the global clean label movement, increasingly favored by elite athletes, weight-conscious consumers, and individuals managing lactose intolerance. While Whey Protein Concentrate (WPC), due to its cost-effectiveness, remains the volume leader in mass market and general food fortification applications, the most dynamic revenue growth is observed in highly specialized Whey Protein Hydrolyzates (WPH). WPH is crucial for sensitive applications such as clinical recovery and hypo-allergenic infant formula, attributed to its enhanced digestibility, dramatically reduced allergenicity, and ease of incorporation into medical food formats. The application segment continues its significant diversification trajectory, extending robustly beyond traditional sports nutrition into mainstream segments like advanced confectionery systems, specialized bakery products (utilizing whey for texture enhancement and water binding), and the rapidly expanding plant-based/meat alternatives market (where whey provides functional binding and textural stability). This multi-sectoral adoption signifies the successful transition of whey protein from a niche performance supplement to a foundational, indispensable functional food ingredient essential across a broad array of modern food matrices and beverage systems.

AI Impact Analysis on Whey Protein Ingredients Market

User inquiries regarding the profound and accelerating impact of Artificial Intelligence (AI) on the Whey Protein Ingredients Market consistently cluster around three critical operational and strategic areas: leveraging sophisticated machine learning (ML) models to optimize upstream dairy farm productivity and the quality prediction of incoming raw milk; accelerating the complex process of novel ingredient discovery and precise functional characterization of protein fractions; and fundamentally enhancing manufacturing process control, particularly within the energy-intensive membrane filtration and spray drying phases, alongside predictive analytics for global supply chain resilience. Users are keenly interested in understanding how deep learning algorithms can be employed to radically minimize batch-to-batch variability in highly refined whey processing, ensuring absolute consistency in protein structure, denaturation profiles, and yield, a factor paramount for maintaining the efficacy and market price of high-purity products like WPI and WPH. They also seek specific information on AI's ability to accurately model intricate protein-food matrix interactions, helping manufacturers rapidly predict how specific whey ingredient variants will behave regarding stability, rheology (texture), emulsification capabilities, and shelf life when incorporated into complex final product formulations, thereby substantially reducing the need for costly, iterative, and time-consuming physical laboratory testing cycles.

AI's immediate and most tangible impact is currently realized in the upstream stages of the supply chain, moving beyond simple automation into complex, predictive operational intelligence. Deep learning models are rigorously deployed to analyze massive, heterogeneous datasets encompassing variables such as individual herd health markers, detailed feed nutrient composition, localized weather patterns, and real-time milking patterns, establishing previously undetectable correlations. This analysis allows for proactive interventions that optimize the raw milk’s inherent protein content and quality profile before the milk even reaches the primary processing plant, ensuring a superior starting material for high-value protein extraction. In the manufacturing facility itself, sophisticated AI-powered sensor arrays, integrated with advanced control systems, are utilized in critical operations like membrane filtration, continuous chromatography, and controlled atmosphere drying. These systems continuously monitor and analyze data streams—including transmembrane pressure, temperature differentials, protein concentration gradients, and conductivity—adjusting parameters like flow rate, processing duration, and pH levels based on predictive modeling. This high-precision, closed-loop optimization not only minimizes energy consumption and reduces the risk of thermal or shear-induced protein denaturation but also significantly boosts overall operational throughput and recovery yield, ushering manufacturing closer to the goal of a smart, self-optimizing dairy facility capable of producing highly tailored and traceable protein fractions efficiently.

Looking toward the strategic future, AI is set to radically redefine product innovation within the whey market. Computational chemistry, bio-informatics, and high-throughput screening simulations are employed to virtually screen and analyze billions of potential amino acid sequences derived from whey protein hydrolyzates. This allows R&D teams to rapidly and accurately identify novel bioactive peptides with targeted biological functionalities, such as specific anti-inflammatory, antimicrobial, or satiety-inducing effects, at a speed and scale impossible with traditional laboratory methods. This dramatic acceleration significantly shortens the time-to-market for novel, bio-functional whey ingredients, positioning companies at the forefront of the nutritional science field. Furthermore, in commercial and marketing domains, sophisticated AI algorithms are utilized to meticulously analyze real-time social media sentiment, global sales patterns, and aggregated purchase data to rapidly identify emerging consumer needs (e.g., preference for specific protein subtypes in nighttime recovery formulas), guiding R&D investment towards highly personalized protein solutions and optimizing inventory distribution across geographically diverse markets to meet fluctuating regional demand with unprecedented precision, thereby massively enhancing market responsiveness and minimizing product waste across complex supply networks.

- AI optimizes dairy herd management and raw milk quality prediction, ensuring high protein input quality and consistency for extraction.

- Machine learning algorithms significantly enhance the efficiency and precision of ultrafiltration and diafiltration processes, maximizing yield and purity of WPI and WPH while reducing energy expenditure.

- Predictive modeling dramatically shortens R&D cycles for discovering and characterizing novel bioactive whey peptides and specialized functional ingredients.

- AI-driven supply chain analytics improve forecasting accuracy for volatile raw material procurement and optimize complex inventory placement and cold chain logistics.

- Advanced automation and robotics, intelligently controlled by AI systems, drastically reduce human error, minimize contamination risk, and ensure traceability in high-purity ingredient handling.

DRO & Impact Forces Of Whey Protein Ingredients Market

The dynamics of the global Whey Protein Ingredients Market are governed by a complex, constantly shifting matrix of Drivers (D), inherent Restraints (R), strategic Opportunities (O), and potent macro-level Impact Forces that collectively dictate its growth trajectory and competitive structure. The primary, overarching driver is the pervasive and deeply ingrained consumer trend toward protein-centric diets across nearly all global demographics, underpinned by an overwhelming body of scientific evidence robustly supporting whey protein’s unparalleled benefits in crucial areas: efficient muscle protein synthesis, effective weight management through enhanced satiety, and support for overall metabolic health, particularly resonating with the rapidly expanding global population of aging adults and dedicated fitness enthusiasts. Concurrently, continuous and revolutionary technological advancements in processing, particularly in state-of-the-art separation techniques like cross-flow microfiltration, chromatographic isolation, and advanced enzymatic hydrolysis, enable manufacturers to consistently produce highly purified, superior functional ingredients (WPI, specialized hydrolyzates) that meet the extremely stringent quality and safety standards mandated for clinical nutrition, high-performance sports products, and sensitive infant formula applications. This escalating demand is further amplified by massive, sustained marketing investment and continuous product innovation from leading global industry players who aggressively introduce novel flavor systems, unique textural properties, and consumer-friendly delivery formats to widen whey protein's appeal far beyond traditional athletic demographics into general wellness markets.

Restraints primarily coalesce around two major external economic vulnerabilities: the inherent and often acute volatility of global dairy commodity markets and the escalating competition from substitute products. Raw material pricing, which is heavily reliant on unpredictable global milk production cycles, localized subsidies, geopolitical tensions affecting trade, and rapidly fluctuating feed costs, introduces profound uncertainty and significant risk in manufacturing costs and long-term profit forecasting. Furthermore, the market faces increasingly intense, well-funded competition from alternative protein sources, particularly those derived from plants (e.g., pea, rice, soy, potato protein), which successfully appeal to the rapidly growing segments of vegan, vegetarian, and flexitarian consumers, along with those seeking more environmentally sustainable or perceived ethical options. This competitive pressure necessitates that whey ingredient producers must continually invest in advanced R&D and clear scientific communication to differentiate their products by highlighting the unparalleled biological value, superior amino acid completeness, and unique functional advantages of whey protein compared to its substitutes, justifying its often premium price point. Additionally, high capital expenditure requirements for specialized processing technology and significant operational energy costs related to drying and filtration represent considerable barriers, particularly for new market entrants.

Strategic opportunities for significant, future growth are substantial, particularly in leveraging whey’s unique and highly bioavailable nutritional profile for rapid penetration into the clinical, therapeutic, and geriatric nutrition sectors, addressing the accelerating global health crises related to sarcopenia (age-related muscle wasting) and widespread malnutrition in older adults, a demographic experiencing rapid global expansion. The nascent but highly promising market for hyper-personalized nutrition solutions, which utilizes advanced genetic and biometric data analysis to formulate customized whey-based supplements precisely tailored to optimize individual physiological needs and specific health biomarkers, offers a major future revenue pathway and brand differentiation platform. Key macro-level impact forces, such as the increasing global push for stricter food safety regulations, complex, evolving international trade policies (tariffs, quotas), and intense consumer and regulatory scrutiny on clean label sourcing and environmental sustainability, exert continuous and powerful pressure on all supply chain participants. The long-term competitive success of the whey protein industry will be critically defined by its collective ability to strategically navigate these persistent forces—primarily through achieving robust global supply chain transparency, optimizing internal processing efficiency utilizing intelligent automation (AI/ML), and proactively investing in the development of highly profitable, high-margin functional ingredient specializations.

Segmentation Analysis

The global Whey Protein Ingredients Market is comprehensively segmented across three primary dimensions: product type, end-use application, and final form, providing a granular view of market structure and consumption patterns that reflect the diversity of industrial requirements and consumer needs globally. Product segmentation is fundamental, rigorously distinguishing ingredients based on their protein purity, degree of modification, and intrinsic functional characteristics, ranging from high-volume, cost-effective Whey Protein Concentrate (WPC) to highly refined Whey Protein Isolate (WPI) and specialized, highly digestible Whey Protein Hydrolyzate (WPH). This intrinsic differentiation is vital as it dictates the manufacturer's ability to target specific, disparate market verticals; for instance, WPC 34% is typically reserved for large-scale, cost-sensitive uses like animal feed and basic food fortification, whereas WPI (90%+) and WPH are essential for premium, highly regulated health and medical products where maximum protein purity, fast absorption kinetics, and minimal residual lactose are paramount requirements. Continued advancements in iterative membrane separation technology are allowing for the blurring of traditional purity lines, enabling the development of customized, highly functional protein concentrates (like WPC 80%) with enhanced solubility and reduced off-flavors, thereby challenging established boundaries between segments.

Application analysis clearly highlights the persistent, dominant role of the sports nutrition sector, which continues to drive both volume and innovation, followed closely in importance by the highly lucrative clinical nutrition and sensitive infant formula segments. Beyond these core areas, the functional food and beverage sector is rapidly emerging as a transformative growth engine, aggressively incorporating whey proteins into a broad spectrum of everyday consumer goods, including enhanced yogurts, sophisticated dietary breakfast cereals, specialized savory snacks, and sophisticated dietary supplements aimed at broader general wellness, moving the perception of whey protein far beyond specialized athletic performance. This trend demands whey ingredients with superior stability under various processing conditions, minimal impact on flavor profile, and enhanced shelf life. Form segmentation delineates between dry, powdered ingredients—which overwhelmingly dominate the market due to their superior shelf stability, reduced weight for transportation, and ease of dosage for supplement manufacturers—and liquid forms, which represent a niche but strategically important segment for high-demand, ready-to-drink (RTD) beverage formulations where extreme solubility and maintained protein stability in aqueous, often acidic, solutions are critical formulation parameters, demanding specialized thermal processing techniques.

- By Type:

- Whey Protein Concentrate (WPC) (34%, 80%)

- Whey Protein Isolate (WPI)

- Whey Protein Hydrolyzate (WPH)

- Demineralized Whey Powder (DWP)

- Whey Permeate

- Milk Protein Concentrates (MPC)

- Lactoferrin and Specialty Bioactive Peptides

- By Application:

- Sports Nutrition (Powders, Bars, RTDs)

- Infant Formula and Pediatric Nutrition

- Clinical and Medical Nutrition (Enteral Feeding, Recovery Formulas)

- Functional Foods and Dietary Supplements

- Beverages (Enhanced Juices, Protein Shakes, Powder Mixes)

- Bakery, Confectionery, and Dairy Products

- Meat & Seafood Processing (Binding Agents)

- Animal Feed and Pet Food Applications

- By Form:

- Dry/Powder (Dominant Segment)

- Liquid/Ready-to-Drink (RTD) Solutions and Concentrates

Value Chain Analysis For Whey Protein Ingredients Market

The intricate value chain for whey protein ingredients commences rigorously at the upstream level with the highly critical raw material procurement phase: the efficient and hygienic collection, standardization, and initial cooling of raw liquid milk from globally distributed dairy farms. The foundational efficiency and quality parameters established at this stage, particularly focusing on the raw milk’s measured protein concentration, microbial load, and overall hygienic handling, directly dictate the achievable yield, functional integrity, and overall quality of the subsequent high-value whey protein products. The subsequent processing segment is characterized by highly technical, capital-intensive, and energy-demanding operations. This includes the initial primary separation stage—classical cheese manufacturing, which separates the insoluble casein curds from the liquid whey serum—followed immediately by critical secondary processing steps. These encompass flash pasteurization, initial centrifugation to remove residual fat, and subsequently, sophisticated, multi-stage membrane filtration processes such as ultrafiltration (UF), microfiltration (MF), and often nanofiltration or reverse osmosis. These separation technologies are absolutely crucial for concentrating the functional protein fractions while selectively and efficiently removing undesirable components like residual fats, lactose, and minerals, allowing the manufacturer to precisely tailor the ingredient to meet specific purity thresholds (e.g., WPC 80% versus WPI 90%+). Significant and sustained investment in advanced, high-efficiency filtration equipment, specialized membrane maintenance protocols, and rigorously controlled drying facilities (typically large-scale spray drying systems) represents a formidable structural barrier to entry in this complex manufacturing segment.

The midstream segment involves the highly specialized transformation of concentrated liquid whey into refined, functional ingredients ready for industrial compounding. This often necessitates additional modification steps, such as highly controlled enzymatic hydrolysis for the creation of WPH, a process that intentionally cleaves the long protein chains into shorter, highly bioavailable, and less allergenic peptides, essential for sensitive clinical and infant nutrition applications. The precise control over the Degree of Hydrolysis (DH) is a highly technical proprietary factor, as it fundamentally dictates the final product’s taste profile (reducing bitterness), solubility, and inherent biological function. Rigorous quality assurance protocols are applied throughout this phase, including extensive testing for microbial contaminants, analysis of amino acid profiles, and ensuring unwavering compliance with disparate international food safety and labeling standards (e.g., European Food Safety Authority (EFSA), U.S. FDA, and regional APAC regulations). Downstream activities focus on the final compounding, precise blending, secure packaging, and sophisticated distribution logistics. Ingredient producers typically engage in two primary distribution methods: selling their standardized or tailored ingredients directly to massive, high-volume end-use manufacturers (e.g., global sports supplement corporations, multinational infant formula producers) or utilizing indirect channels to penetrate smaller, highly localized markets.

Distribution channels are strategically segregated into direct and indirect routes to maximize market efficiency. Direct sales offer manufacturers complete oversight and tight control over product handling, technical support, and logistical execution, benefiting large industrial clients who require customized specifications and long-term contractual pricing stability, often necessitating dedicated, in-house technical sales teams. Conversely, indirect sales leverage specialized, local ingredient distributors, brokers, and regional wholesalers who manage diversified inventory, handle smaller-batch orders, and provide essential localized technical and regulatory support to mid-sized or emerging manufacturers. This indirect model offers vastly wider geographical reach and penetration into diverse SME (Small and Medium Enterprise) markets without the need for the ingredient producer to maintain an extensive, proprietary international sales infrastructure. The choice of channel is intrinsically linked to the target application and ingredient sensitivity: high-purity WPI or WPH destined for sensitive pharmaceutical or clinical clients typically utilize strictly direct channels to maintain absolute quality control and traceability, whereas standardized WPC for bakery or general food fortification generally relies on broader, more cost-effective distributor networks. Crucially, while powdered forms are largely shelf-stable, optimized global cold chain management and moisture barrier packaging remain essential considerations for maintaining ingredient integrity across complex international trade routes, especially in regions with high temperatures and humidity.

Whey Protein Ingredients Market Potential Customers

The core customer base for whey protein ingredients is highly diversified, strategically segmented by usage needs, encompassing high-volume industrial manufacturers, specialized medical institutions, and direct consumer-facing businesses, all unified by the need for superior protein quality and functionality. The single largest consumer category resides within the performance and sports nutrition industry, encompassing a broad demographic range from elite professional athletes and high-performance teams to dedicated amateur fitness enthusiasts, gym-goers, and general wellness consumers utilizing whey products (including specialized powders, ready-to-eat bars, and complex recovery shakes) for essential muscle repair, accelerated post-exercise recovery, lean mass hypertrophy, and strategic weight management. These demanding customers prioritize ingredients offering maximum biological value (BV), extremely rapid absorption kinetics, optimal solubility, and adherence to stringent clean labeling standards, making them the primary targets for premium WPI and highly refined WPH variants. Purchasing decisions in this dynamic segment are strongly influenced by factors such as established brand credibility, high-profile athletic endorsements, third-party certification of purity (e.g., Informed Sport), and clear, scientifically backed perceived product efficacy, often leading to a high willingness to pay substantial premium prices for patented, specialized protein formulations.

Another critically important and rapidly expanding customer segment is the regulated clinical and medical nutrition sector, comprising vast networks of hospitals, specialized rehabilitation facilities, long-term geriatric care homes, and specialized providers of dietary supplements for managing chronic diseases. This institutional segment extensively utilizes hydrolyzed and highly purified whey protein ingredients in complex enteral feeding formulas, targeted dietary management solutions for addressing sarcopenia (severe age-related muscle loss), and crucial post-surgical or chemotherapy recovery diets. For these sensitive clinical applications, regulatory factors such as exceptionally low allergenicity, pharmaceutical-grade purity (minimal residual heavy metals or contaminants), guaranteed batch-to-batch stability, and scientifically validated physiological efficacy are non-negotiable requirements, rigorously driving consistent demand for specialized functional fractions like concentrated alpha-lactalbumin and therapeutic WPH. Regulatory compliance, rigorous quality documentation (cGMP adherence), and validation through extensive human clinical trials are the fundamental purchasing criteria for these sophisticated institutional buyers and pharmaceutical formulators, necessitating that ingredient suppliers adhere to the highest industry standards for manufacturing and traceability.

Furthermore, the highly scrutinized infant formula manufacturing industry represents a significant, technically demanding, and ethically sensitive customer segment. Whey proteins, particularly specialized fractions such as demineralized whey powder (DWP) and specific protein isolates (used to adjust the casein-to-whey ratio), are absolutely essential components used to closely mimic the complex amino acid profile and functional properties of human breast milk, thereby supporting healthy cognitive development a

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 11.5 Billion |

| Market Forecast in 2033 | USD 17.8 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Glanbia plc, Lactalis Ingredients, Arla Foods Ingredients Group P/S, Saputo Inc., Fonterra Co-operative Group, DSM-Firmenich, Hilmar Cheese Company, Agropur Cooperative, Kerry Group plc, Davisco Foods International, Inc., NZMP (Fonterra brand), Carbery Group, Milk Specialties Global, AMCO Proteins, Hoogwegt Group, FrieslandCampina DOMO, Ingredia SA, Grassland Dairy Products Inc., Axiom Foods, Merck KGaA, Volac International Ltd., Tate & Lyle PLC, ADM (Archer Daniels Midland Company), Nutrabolt (Cellucor). |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Whey Protein Ingredients Market Key Technology Landscape

The contemporary technological landscape of the Whey Protein Ingredients Market is fundamentally defined by continuous refinement and innovation in advanced separation science, specific modification techniques, and state-of-the-art drying methods, all meticulously engineered to achieve maximum protein purity, significantly enhance inherent functional properties, and produce ingredients with optimized biological availability. Membrane separation processes, specifically encompassing sequential ultrafiltration (UF), highly controlled microfiltration (MF), and often supplementary nanofiltration, remain the foundational, large-scale industrial methods. These technologies enable processors to selectively and efficiently remove lower molecular weight non-protein components—primarily lactose, water, and minerals—while simultaneously concentrating the desirable, functional protein fraction. Recent process innovations are heavily focused on dramatically improving system performance metrics such as membrane flux rates, minimizing membrane fouling through novel cleaning regimes and specialized hydrophilic coatings, and utilizing highly durable ceramic or cutting-edge polymeric membrane materials. These improvements collectively aim to significantly increase overall operational efficiency, extend membrane lifespan, and substantially reduce the unit cost and environmental footprint of producing high-purity WPI and WPC 80%. Furthermore, the incorporation of diafiltration—the strategic process of washing the concentrated protein solution with purified water to further strip residual impurities—has become a standardized best practice, driving the industry toward continuous, highly automated processing systems that minimize both specific energy consumption and water utilization, aligning perfectly with evolving global sustainability and efficiency mandates.

Moving beyond basic concentration, highly advanced, specialized technologies are actively deployed for ingredient specialization and the creation of premium products. Ion-exchange chromatography remains a critical, albeit higher capital expenditure, method for producing exceptionally pure Whey Protein Isolate, often exceeding 95% protein content, which is stringently required for pharmaceutical-grade applications and highly sensitive medical food formulations where absolute minimal trace elements are tolerated. For the crucial production of Whey Protein Hydrolyzates (WPH), enzymatic hydrolysis, meticulously controlled through the precise application of specific food-grade proteases, constitutes the core technology. The ability to achieve granular control over the Degree of Hydrolysis (DH) is technically paramount, as this precise manipulation directly determines the resulting peptide chain length distribution, which fundamentally influences final product attributes such as taste profile (minimizing bitterness), rate of digestion, and optimal solubility across various pH values. Manufacturers are increasingly adopting sophisticated bio-reactor designs and utilizing immobilized enzyme technology to dramatically improve process control reproducibility, enhance enzyme reusability, and successfully reduce the overall manufacturing cost burden associated with producing low-bitterness WPH suitable for high-volume infant nutrition and clean-tasting sports recovery products.

Emerging technologies continue to drive market evolution, focusing on preservation and incorporation. These include specialized spray drying and fluidized bed drying techniques meticulously tailored to create encapsulated protein powders, substantially improving their long-term stability, inherent flowability for automated blending, and seamless integration into complex food matrices without incurring significant protein denaturation during final product manufacture. High-Pressure Processing (HPP) and sophisticated, rapid UHT (Ultra-High Temperature) pasteurization techniques are under intensive exploration to guarantee absolute microbial safety while simultaneously striving to preserve the native conformational structure and full functionality of extremely sensitive bioactive components naturally present in whey, such as immunoglobulins, lactoferrin, and specific growth factors. The pervasive integration of advanced sensor technology, frequently coupled with powerful AI-driven data analytics and machine learning algorithms, now provides processors with invaluable, real-time molecular-level monitoring of protein structure, denaturation kinetics, and aggregate formation during key processing stages. This capability enables immediate, precision adjustments to manufacturing parameters, ensuring peak product quality and signaling a decisive global shift toward dynamic, responsive precision manufacturing within the modern whey protein ingredient supply chain.

Regional Highlights

- North America: This region decisively dominates the global market in terms of absolute market valuation and innovation output. Its leadership is primarily driven by an extremely mature, highly competitive sports nutrition sector, significant societal consumer awareness regarding the benefits of high-protein diets, and robust domestic dairy production capabilities (particularly in the U.S. and Canada). The market is characterized by rapid development of highly sophisticated, specialized ingredients (e.g., specialized WPI derivatives for specific health conditions) and significant R&D investment focused on functional food matrix integration and personalized nutrition solutions, supported by a supportive, well-defined regulatory framework.

- Europe: Represents the second-largest and a critically important market segment globally, particularly recognized for its exceptionally high standards in quality and traceability for WPI and specialized derivatives extensively utilized in sensitive clinical and premium infant nutrition products. Leading countries, including Germany, Ireland, France, and the Netherlands, benefit from exceptionally strong domestic dairy processing industries and strict regulatory oversight provided by EFSA. The current focus across the continent is increasingly centralized on environmental sustainability, ethical sourcing, guaranteed animal welfare standards, and the adoption of mandatory clean label certifications, which heavily influence both industrial purchasing decisions and consumer preference throughout the entire continent.

- Asia Pacific (APAC): Exhibits the most dynamic and highest Compound Annual Growth Rate (CAGR) globally. This rapid expansion is underpinned by dramatic increases in middle-class disposable income, accelerated urbanization, and the large-scale cultural convergence toward Western nutritional habits across major economies like China, India, and Southeast Asia. Demand in APAC is heavily concentrated and robust in the highly regulated infant formula manufacturing sector, paralleled by explosive, localized growth in functional beverage and convenience food markets. Both international and local manufacturers are investing aggressively in constructing new, localized production infrastructure to efficiently meet the surging demand, mitigate complex logistical challenges, and adhere precisely to diverse local regulatory standards, optimizing regional supply chains.

- Latin America (LATAM): Showing robust, steady growth trajectory, predominantly centered in large economies such as Brazil and Mexico. This growth is largely driven by increasing public health concerns related to high rates of obesity and associated metabolic conditions, prompting greater societal demand for healthier, protein-rich dietary alternatives and affordable mass-market sports supplements. The market structure predominantly focuses on cost-effective, high-volume ingredients, such as WPC and standard WPI, for local formulation and widespread food fortification programs, often relying on simplified distribution networks.

- Middle East and Africa (MEA): Remains a nascent market characterized by substantial, untapped growth potential. Growth acceleration is concentrated primarily within the affluent GCC (Gulf Cooperation Council) countries, attributed to high per capita expenditure on imported health and wellness products, including premium sports supplements. Key challenges confronting regional expansion include navigating fragmented, inconsistent regulatory environments, managing high logistics costs, and overcoming the significant dependence on reliable international sourcing for highly specialized or sensitive whey fractions, requiring robust cold chain infrastructure.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Whey Protein Ingredients Market.- Glanbia plc

- Lactalis Ingredients

- Arla Foods Ingredients Group P/S

- Saputo Inc.

- Fonterra Co-operative Group

- DSM-Firmenich

- Hilmar Cheese Company

- Agropur Cooperative

- Kerry Group plc

- Davisco Foods International, Inc.

- NZMP (Fonterra brand)

- Carbery Group

- Milk Specialties Global

- AMCO Proteins

- Hoogwegt Group

- FrieslandCampina DOMO

- Ingredia SA

- Grassland Dairy Products Inc.

- Axiom Foods

- Merck KGaA

- Volac International Ltd.

- Tate & Lyle PLC

- ADM (Archer Daniels Midland Company)

- Nutrabolt (Cellucor)

Frequently Asked Questions

Analyze common user questions about the Whey Protein Ingredients market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary differences between Whey Protein Concentrate (WPC) and Isolate (WPI)?

WPC contains a lower protein concentration (typically 34% to 80%) coupled with higher residual levels of fat and lactose, making it highly cost-effective for bulk food fortification. WPI, produced using advanced microfiltration or ion exchange, achieves greater than 90% protein purity, dramatically minimizing lactose and fat content, positioning it as the preferred ingredient for high-end sports nutrition and catering specifically to consumers with lactose intolerance or those adhering to strict low-carb diets.

How does the volatility of raw milk prices affect the profitability of whey protein manufacturers?

The cost of raw milk, influenced by global dairy cycles and geopolitical factors, constitutes the largest variable expense for whey processing. Extreme price volatility directly risks compressing profit margins, especially for standardized WPC production. Leading manufacturers strategically mitigate this risk by focusing intense R&D efforts on high-margin, specialized functional ingredients (WPH, bioactive peptides) and securing robust, long-term procurement contracts to stabilize critical input costs across their operations.

Which geographical regions are projected to drive the fastest growth in the global whey protein ingredients market?

The Asia Pacific (APAC) region, significantly propelled by the massive consumer markets of China and India, is unequivocally forecasted to exhibit the highest Compound Annual Growth Rate (CAGR). This regional acceleration is intrinsically linked to rising middle-class consumer wealth, rapid adoption of Western nutritional supplementation habits, and burgeoning local demand for specialized, fortified infant formula products and advanced sports recovery solutions.

What key role does technology, specifically membrane filtration, play in the production of high-quality whey ingredients?

Membrane technologies like ultrafiltration and microfiltration are essential. They physically separate and concentrate the protein fractions from lactose, minerals, and water based on molecular size. Continuous technological refinement in these membranes is crucial for achieving the high purity levels required for WPI and WPH economically, simultaneously improving energy efficiency and ensuring strict adherence to global food safety standards through precise contaminant removal.

What are the key technical challenges encountered when producing high-quality Whey Protein Hydrolyzates (WPH) for sensitive applications?

The central technical hurdle in WPH production is precisely controlling the enzymatic reaction, known as the degree of hydrolysis (DH), to ensure maximum digestibility and hypoallergenicity while rigorously avoiding the creation of small, bitter-tasting peptides. Successfully minimizing this off-flavor is crucial for market acceptance, particularly when formulating palatable WPH products for sensitive clinical diets and specialized infant nutrition, demanding significant R&D investment in specific enzyme selection and process optimization.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Whey Protein Ingredients Market Statistics 2025 Analysis By Application (Foods & Beverages, Personal Care and Cosmetics, Infant Nutrition, Animal Feed), By Type (Whey Protein Concentrate, Whey Protein Isolate, Hydrolyzed Whey Protein, Demineralized Whey Protein), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Whey Protein Ingredients Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Dairy Proteins, Whey Proteins), By Application (Food, Medical, Cosmetics, Feed, Others), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager