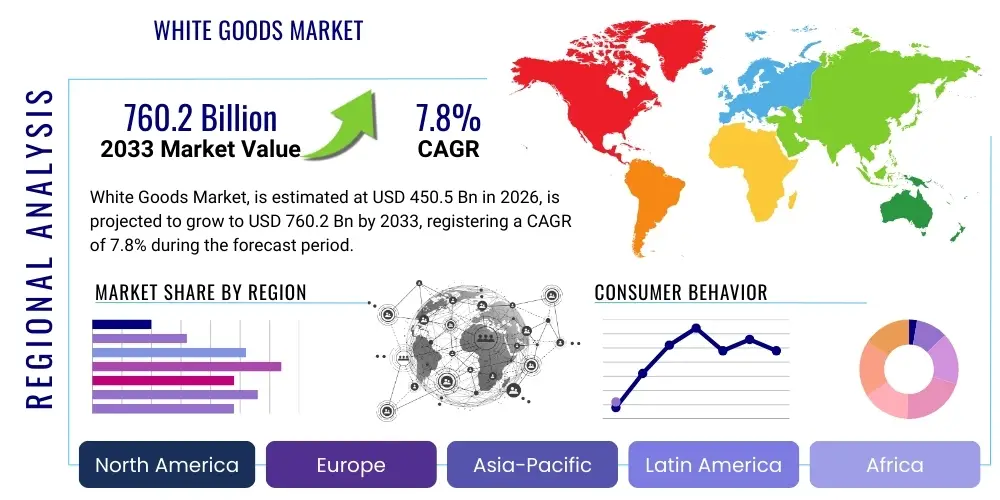

White Goods Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438221 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

White Goods Market Size

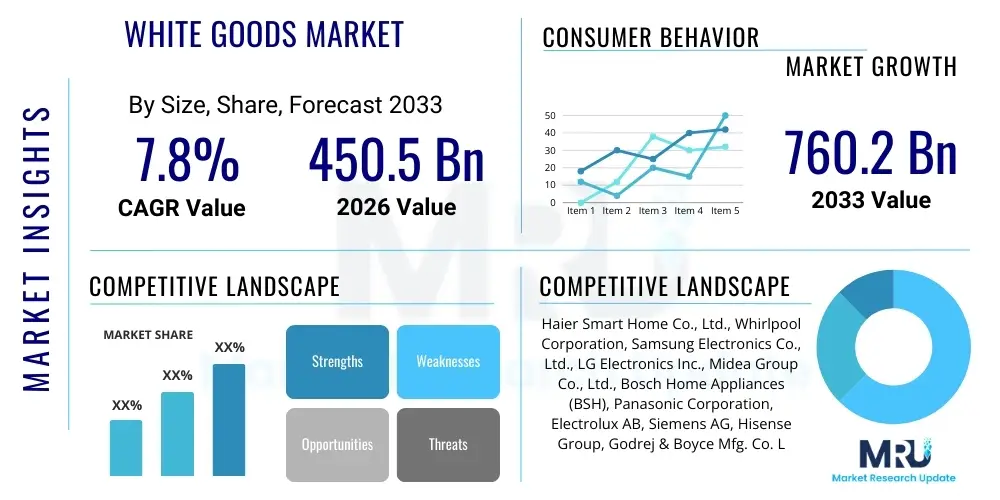

The White Goods Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 450.5 Billion in 2026 and is projected to reach USD 760.2 Billion by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by rapid urbanization across emerging economies, coupled with significant technological advancements that emphasize energy efficiency and smart home integration. The increasing penetration of internet services and the corresponding rise in disposable income among the global middle class are creating a robust demand environment for premium and sophisticated white goods appliances, accelerating market valuation significantly over the next seven years.

White Goods Market introduction

The White Goods Market encompasses large household appliances designed for essential domestic functions, including major appliances such as refrigerators, washing machines, dishwashers, and air conditioners. These products are characterized by their bulkiness and typical white enamel finishing, although modern variants increasingly utilize stainless steel and other designer finishes. Major applications span residential settings, where they form the backbone of modern living, and commercial establishments like hotels, laundromats, and large institutional kitchens. The primary benefit these appliances offer is enhanced convenience, efficiency, and improved quality of life, substantially reducing manual labor and energy consumption through continuous innovation.

The core driving factors for the expansion of this market include the global housing boom, particularly in Asia Pacific, where new residential constructions directly translate into high initial purchase volumes for white goods. Furthermore, the robust replacement cycle observed in mature markets, driven by consumers upgrading to energy-efficient and smart models, contributes significantly to sustained revenue streams. Government initiatives promoting energy conservation and strict regulatory standards regarding appliance efficiency are also compelling manufacturers to invest heavily in research and development, ensuring a constant flow of advanced, feature-rich products into the global marketplace, thereby cementing the market's trajectory.

White Goods Market Executive Summary

Global business trends in the White Goods Market indicate a pronounced shift toward digitalization and connectivity, transforming traditional appliances into integral components of the smart home ecosystem. Manufacturers are increasingly focusing on Artificial Intelligence (AI) integration, enabling predictive maintenance, personalized usage patterns, and seamless operation through voice commands or mobile applications. These innovations are reshaping competitive strategies, placing emphasis on software development and data security alongside hardware performance. Furthermore, sustainability has emerged as a crucial purchasing criterion, compelling companies to adopt circular economy principles, utilize recycled materials, and ensure higher energy star ratings, appealing to environmentally conscious consumers and meeting stringent regulatory frameworks.

Regionally, the Asia Pacific (APAC) continues to dominate the market in terms of volume due to its massive population base, rapid infrastructural development, and increasing economic prosperity in countries like China and India, making it the epicenter for demand. North America and Europe, while growing at a slower pace in volume, lead in value due to the high adoption rate of premium, energy-efficient, and connected appliances, reflecting sophisticated consumer preferences and higher purchasing power. Key segment trends highlight that the Refrigerators and Washing Machines categories remain the largest revenue generators, yet the Air Conditioners segment is witnessing the fastest growth, propelled by rising global temperatures and the necessity for climate control solutions in densely populated urban centers worldwide.

AI Impact Analysis on White Goods Market

Common user inquiries regarding AI in the White Goods Market frequently revolve around perceived value, data privacy implications, and the tangible convenience derived from smart connectivity. Users are keenly interested in understanding how AI-driven features like predictive diagnostics (reducing repair costs), optimized energy usage (lowering utility bills), and automated cycle selection (improving performance) justify the typically higher price point of smart appliances. There is also significant user concern regarding the security of personal data collected by connected devices and how manufacturers ensure robust protection against cyber threats, leading to questions about local processing capabilities versus cloud reliance.

The integration of artificial intelligence is fundamentally redefining the operational capabilities of white goods, shifting them from mere functional tools to personalized, proactive assistants within the home. AI algorithms are now crucial in optimizing washing cycles based on fabric type and load weight, managing refrigerator inventory and shelf life, and adjusting heating/cooling based on ambient temperature and occupancy patterns. This intelligent operational capacity maximizes performance while simultaneously minimizing resource consumption, directly addressing consumer demands for both efficiency and effortless operation. Furthermore, AI facilitates complex interactions, enabling seamless device-to-device communication and integration with broader smart home automation systems.

This technological evolution has a powerful impact on product lifecycle management and customer service. AI-powered diagnostics allow manufacturers to remotely monitor appliance health, identify potential failures before they occur, and automatically schedule necessary maintenance or order replacement parts. This transition from reactive repair models to proactive service delivery significantly enhances customer satisfaction and strengthens brand loyalty. Moreover, AI aids in refining manufacturing processes by analyzing real-time usage data to inform future product design, ensuring that subsequent generations of white goods are even more customized to diverse global consumer needs and usage scenarios.

- AI-enabled Predictive Maintenance: Automated diagnostics and fault identification before physical breakdown occurs, improving lifespan and reducing service costs.

- Optimized Resource Management: Intelligent algorithms regulate water, detergent, and energy use based on real-time factors like load size, minimizing waste.

- Personalized Usage Profiles: Learning consumer habits to pre-set cycles or temperatures, enhancing user convenience and operational efficiency.

- Voice and Gesture Control Integration: Facilitating hands-free operation and seamless interaction with other smart home devices via centralized AI hubs.

- Inventory Management (Refrigerators): Utilizing computer vision and machine learning to track food freshness, suggest recipes, and automatically generate grocery lists.

- Enhanced Security Protocols: Deployment of AI for real-time threat detection and mitigation in connected appliance networks, addressing privacy concerns.

DRO & Impact Forces Of White Goods Market

The White Goods Market dynamic is shaped by a confluence of powerful forces, encapsulated by Drivers, Restraints, and Opportunities (DRO). Key drivers include rapid urbanization, which necessitates the installation of new appliances in constantly growing urban housing units, coupled with increasing global disposable incomes that allow for higher purchasing power, facilitating the adoption of premium and technologically advanced products. Restraints primarily involve the volatile fluctuation in raw material prices, particularly steel and plastic components, which directly impact manufacturing costs and consumer pricing, alongside the challenge of maintaining consumer confidence regarding the cybersecurity of connected appliances. Opportunities, conversely, are vast, focusing on the untapped potential in developing economies and the continuous innovation in green technology and energy efficiency to meet global climate objectives.

The principal impact forces governing market evolution are technological disruption and regulatory pressure. Technological advancements, particularly the pervasive integration of IoT, AI, and edge computing, are forcing manufacturers to rapidly accelerate their innovation cycles, fundamentally redefining what consumers expect from an appliance in terms of connectivity and automation. Simultaneously, global regulatory bodies are imposing increasingly stringent energy efficiency standards (e.g., EU EcoDesign directives and US Energy Star ratings), mandating higher minimum performance thresholds. These external pressures ensure that obsolescence cycles are hastened and drive substantial R&D investment towards sustainable and high-performance engineering, often requiring significant capital expenditure from market participants to remain compliant and competitive.

Furthermore, socioeconomic factors exert a substantial influence on market segmentation and regional penetration. The growing prevalence of smaller households and compact living spaces, especially in densely populated urban centers, drives demand for space-saving and multi-functional appliances, altering product design priorities. The shift towards e-commerce and digital retailing represents another critical impact force, broadening market reach, intensifying pricing competition, and requiring manufacturers to optimize complex logistics for bulky products. Navigating these interconnected drivers (population growth, technological maturity) and restraints (supply chain fragility, security risks) is central to formulating a successful long-term strategy within the dynamic White Goods Market ecosystem.

Segmentation Analysis

The White Goods Market is meticulously segmented based on product type, distribution channel, and end-user, providing a granular view of market dynamics and consumer behavior across various categories. Product segmentation is crucial, as appliances like refrigerators and washing machines represent distinct consumer needs and often have different replacement cycles and price sensitivities. Analyzing these segments helps stakeholders tailor their marketing strategies and optimize production lines for specific consumer demands, whether focusing on high-volume basic models or premium, integrated smart appliances designed for specific lifestyle niches. The overall segmentation analysis underscores the heterogeneity of the market, necessitating tailored strategies for growth.

From a geographic and demographic perspective, the end-user segmentation between residential and commercial applications determines product specifications and volume requirements. The residential segment, driven by household formation and demographic shifts, demands appliances that prioritize aesthetics, energy efficiency, and quiet operation. In contrast, the commercial segment, which includes hotels, hospitals, and large industrial kitchens, focuses heavily on durability, high capacity, heavy-duty performance, and specialized features suitable for continuous operation and stringent health codes. Understanding these varying needs allows manufacturers to allocate resources effectively toward appropriate R&D and specialized sales channels.

The distribution channel analysis further elucidates market accessibility and consumer purchasing habits. While traditional brick-and-mortar retail (hypermarkets, specialized appliance stores) remains vital for product demonstration and immediate fulfillment, the rapidly expanding online channel is capturing significant market share, driven by convenience, competitive pricing, and extensive product reviews. Success in the modern white goods landscape requires an omnichannel strategy, harmonizing the in-store experience with efficient e-commerce logistics and digital customer engagement, leveraging data to predict demand across various channel types.

- Product Type:

- Refrigerators (Single Door, Double Door, Side-by-Side, French Door)

- Washing Machines (Fully Automatic, Semi-Automatic, Top Load, Front Load)

- Air Conditioners (Split ACs, Window ACs, Centralized Systems)

- Dishwashers (Built-in, Countertop)

- Microwaves and Ovens (Convection, Traditional, Built-in)

- Other Large Kitchen Appliances (Cooktops, Range Hoods)

- Small Appliances (Toasters, Blenders, Coffee Makers - often excluded in core definition, but covered by some reports)

- Distribution Channel:

- Offline Retail (Exclusive Stores, Multi-Brand Outlets, Hypermarkets/Supermarkets)

- Online Retail (E-commerce Platforms, Company-Owned Websites)

- End-User:

- Residential (Individual Homes, Apartments)

- Commercial (Hotels and Restaurants, Hospitals, Laundromats, Offices)

Value Chain Analysis For White Goods Market

The value chain of the White Goods Market is complex and extends across multiple continents, starting with the robust upstream analysis focused on the procurement of raw materials, key components, and advanced technologies. Upstream activities are dominated by securing critical commodities such as steel, copper, aluminum, and specialized polymers, which are susceptible to global price volatility and supply chain disruptions. Furthermore, the increasing reliance on complex electronic components, microprocessors, and sensor technologies for smart appliance integration introduces dependencies on global semiconductor and technology suppliers. Efficient inventory management and strategic sourcing agreements are paramount in this phase to mitigate cost risks and ensure a consistent, quality material flow into the manufacturing process.

Midstream operations involve the core manufacturing, assembly, and quality control processes, often characterized by high automation levels and lean production methodologies to achieve economies of scale. Major Original Equipment Manufacturers (OEMs) typically maintain globalized production footprints to optimize labor costs, proximity to key markets, and favorable trade policies. The focus in this stage is on integrating smart manufacturing techniques, utilizing industrial IoT for real-time process monitoring, and maintaining stringent quality standards to ensure product reliability and longevity, a key expectation in the white goods sector. Research and Development (R&D) is a continuous midstream investment, concentrating on improving energy efficiency, reducing noise levels, and enhancing user interface design.

Downstream analysis focuses on distribution channels, marketing, sales, and post-sales service, which critically determine market reach and customer satisfaction. The distribution network is bifurcated into direct channels, where manufacturers sell directly to large commercial clients or via their proprietary online portals, and indirect channels, utilizing extensive networks of third-party distributors, retailers, and e-commerce platforms. Effective downstream management requires sophisticated logistics for handling bulky items, localized warehousing, and highly responsive post-warranty customer support and spare parts availability. The shift towards online sales necessitates investment in digital marketing and virtual reality product showcasing to replicate the in-store experience, ensuring conversion and consumer trust.

White Goods Market Potential Customers

The primary customer base for the White Goods Market is segmented into two major categories: Residential Consumers and Commercial Enterprises. Residential customers represent the largest volume segment, encompassing individuals and households seeking appliances for daily domestic use. This segment is highly diversified, ranging from first-time homeowners requiring complete appliance suites, young professionals purchasing compact, smart devices, to affluent consumers demanding high-end, aesthetically integrated kitchen systems. Buying decisions for residential customers are heavily influenced by factors such as brand reputation, energy efficiency ratings, design aesthetics, available smart features, and competitive pricing, often driven by life events like marriage, moving, or income increases.

The second major category, Commercial Enterprises, includes a variety of institutional buyers whose purchasing criteria prioritize durability, capacity, and specialized functionality. Key buyers within this segment include the hospitality industry (hotels and restaurants demanding commercial-grade refrigeration and high-capacity laundries), healthcare facilities (hospitals requiring specialized sterilization equipment and precise temperature control), and property management companies that purchase large volumes for rental properties and communal facilities. For these customers, total cost of ownership (TCO), robust service contracts, compliance with health and safety regulations, and minimizing operational downtime are the most crucial purchasing considerations, leading to B2B sales cycles characterized by large, infrequent orders.

Furthermore, a rapidly growing segment of potential customers includes renters and residents in multi-family dwellings, who drive the demand for compact and landlord-provided appliances. The rise of developing markets also creates a massive pool of potential first-time buyers transitioning from manual methods to mechanized home functions, particularly in rural and semi-urban areas where electricity grid improvements are accelerating appliance penetration. Targeting these varied customer groups requires highly differentiated product lines, tailored distribution strategies (e.g., microfinance options for developing markets), and specialized marketing content addressing specific needs related to convenience, efficiency, or commercial performance metrics.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450.5 Billion |

| Market Forecast in 2033 | USD 760.2 Billion |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Haier Smart Home Co., Ltd., Whirlpool Corporation, Samsung Electronics Co., Ltd., LG Electronics Inc., Midea Group Co., Ltd., Bosch Home Appliances (BSH), Panasonic Corporation, Electrolux AB, Siemens AG, Hisense Group, Godrej & Boyce Mfg. Co. Ltd., Mitsubishi Electric Corporation, Voltas Limited, Daikin Industries, Ltd., Toshiba Corporation, Hitachi Ltd., Arçelik A.S., Fisher & Paykel Appliances Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

White Goods Market Key Technology Landscape

The White Goods Market is undergoing a rapid technological renaissance centered on connectivity, sustainability, and automated functionality. The core technological advancement involves the integration of the Internet of Things (IoT), which allows appliances to communicate seamlessly with users and with each other through dedicated home networks. This connectivity enables remote monitoring, operational diagnostics, and software updates, fundamentally enhancing user interaction and enabling proactive maintenance solutions. Further complexity is being added through the incorporation of advanced sensor technology, such as sophisticated load and vibration sensors in washing machines and humidity control sensors in refrigerators, enabling real-time environmental adjustments for optimal performance and energy conservation.

Sustainability technology represents another pillar of innovation, driven equally by regulatory mandates and consumer demand for eco-friendly products. This includes the widespread adoption of Variable Refrigerant Flow (VRF) and inverter technology in air conditioning and refrigeration systems, dramatically improving energy efficiency by adjusting compressor speeds rather than constantly cycling on and off. Furthermore, manufacturers are investing in materials science to incorporate recyclable and sustainable components, minimizing the environmental footprint throughout the product lifecycle. These green technologies not only reduce utility costs for the end-user but also position brands favorably in a competitive market increasingly valuing corporate environmental responsibility and circular design principles.

Looking ahead, the technological landscape is increasingly defined by personalized automation powered by Artificial Intelligence (AI) and Machine Learning (ML). ML algorithms are used to analyze long-term user behavior, optimize energy use based on predicted usage times, and provide tailored suggestions, such as laundry settings or food preservation recommendations. Furthermore, advanced diagnostic tools leveraging edge computing allow appliances to process substantial amounts of data locally, improving response times and reducing reliance on continuous cloud connectivity. The convergence of these technologies—IoT, AI, and advanced material science—is creating a new generation of white goods that are safer, significantly smarter, and optimized for minimal environmental impact.

Regional Highlights

The global White Goods Market exhibits significant regional variation in terms of growth rates, consumer preferences, and technological adoption, necessitating region-specific strategic planning. Asia Pacific (APAC) remains the largest and fastest-growing market, primarily fueled by massive population growth, increasing urbanization rates in countries like India and Southeast Asia, and robust residential construction activity. While penetration rates are high in developed nations like Japan and South Korea, the sheer scale of first-time buyers entering the market in China and India, coupled with improved power infrastructure, drives overall market volume. The emphasis in this region is often on affordability, durability, and gradually integrating mid-range smart features into standard models.

North America and Europe represent mature markets characterized by replacement demand rather than first-time purchases. Growth in these regions is driven by high consumer interest in energy-efficient models (mandated by strict standards like Energy Star in the US and EU EcoDesign) and luxury, smart appliances. Consumers here possess higher disposable incomes and place a premium on aesthetics, high connectivity, and advanced AI-driven features. The European market, in particular, shows strong demand for integrated and built-in appliances that conform to smaller kitchen spaces and minimalist design trends, resulting in higher average selling prices (ASPs) compared to volume-driven markets.

Latin America (LATAM) and the Middle East & Africa (MEA) are characterized as emerging markets offering substantial long-term growth potential. LATAM demand is sensitive to economic volatility but sees steady growth driven by demographic expansion and increasing access to credit. In MEA, particularly the Gulf Cooperation Council (GCC) countries, demand for high-end appliances and advanced cooling solutions (Air Conditioners) is extremely high due to climatic necessity and significant purchasing power, alongside large-scale construction projects in hospitality and residential sectors. However, regulatory frameworks and distribution logistics can be more challenging in parts of sub-Saharan Africa, where market penetration is still relatively low but rapidly accelerating with electrification efforts.

- Asia Pacific (APAC): Dominates market share due to population size, rapid urbanization, and rising middle-class income. Key focus on volume, value-for-money, and growing adoption of smart technologies in urban centers (China, India).

- North America: Strong market for replacement and upgrade cycles, high demand for large-capacity, premium, and fully connected smart appliances. Heavily influenced by energy efficiency standards (U.S., Canada).

- Europe: Focus on energy conservation (EcoDesign), compact appliances, and aesthetic integration (built-in units). Market is mature, with high ASPs driven by quality and sustainability features (Germany, UK, France).

- Latin America (LATAM): Growing market driven by demographic expansion and improving access to finance. Demand centers around essential, durable appliances, sensitive to economic stability (Brazil, Mexico).

- Middle East and Africa (MEA): High growth potential, especially for air conditioning systems due to climate. Significant investment in luxury and large-scale commercial appliances driven by infrastructure development (UAE, Saudi Arabia, South Africa).

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the White Goods Market.- Haier Smart Home Co., Ltd.

- Whirlpool Corporation

- Samsung Electronics Co., Ltd.

- LG Electronics Inc.

- Midea Group Co., Ltd.

- Bosch Home Appliances (BSH Hausgeräte GmbH)

- Panasonic Corporation

- Electrolux AB

- Siemens AG

- Hisense Group

- Godrej & Boyce Mfg. Co. Ltd.

- Mitsubishi Electric Corporation

- Daikin Industries, Ltd.

- Toshiba Corporation

- Hitachi Ltd.

- Arçelik A.S.

- Fisher & Paykel Appliances Ltd.

- Sub-Zero Group, Inc.

Frequently Asked Questions

Analyze common user questions about the White Goods market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary factors driving the growth of the White Goods Market globally?

The market is primarily driven by accelerating global urbanization, which generates demand for new housing units requiring appliances. This is coupled with rising disposable incomes in emerging economies, enabling consumers to purchase premium and sophisticated models. Furthermore, continuous technological innovation, particularly in IoT and energy efficiency, fuels regular upgrade cycles in developed markets, contributing to sustained growth.

How is the integration of Artificial Intelligence (AI) affecting the operational performance of white goods?

AI integration significantly enhances operational performance by enabling personalized usage cycles, optimizing energy consumption based on learned behavior, and facilitating predictive maintenance. This proactive diagnostic capability minimizes downtime and repair costs, drastically improving the appliance lifespan and overall user convenience.

Which product segment holds the largest share in the White Goods Market and why?

The Refrigerators segment typically holds the largest market share due to its fundamental necessity in virtually all households worldwide, its long replacement cycle, and continuous innovations in advanced cooling and food preservation technologies. Washing machines also constitute a large segment due to high volume sales across both developed and emerging markets.

What are the major challenges restraining market expansion in the near term?

Key restraints include the intense volatility and high cost of raw materials such as steel, copper, and specialized electronic components, which pressures manufacturer margins and impacts consumer pricing. Additionally, increasing competition from local manufacturers in APAC and consumer concerns regarding data privacy and cybersecurity in connected smart appliances present ongoing challenges.

What role does sustainability and energy efficiency play in consumer purchasing decisions for white goods?

Sustainability and energy efficiency have become crucial purchasing criteria, especially in mature markets like North America and Europe. Consumers actively seek appliances with high Energy Star or similar ratings to reduce long-term utility costs and align with environmental values. This strong consumer preference compels manufacturers to invest heavily in green technology and circular economy design principles.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Vulcanised Rubber Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Nitrile, EPDM, Silicone Rubber, Fluoroelastomers, Neoprene, Fluorosilicone, SBR, Polyurethane rubber), By Application (Electronics, Building and Construction, Automotive, Aerospace, White goods manufacturers, HVAC, Others), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

- Vulcanized Rubber Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Nitrile, EPDM, Silicone rubber fluoro, Elastomer, Neoprene, Fluorosilicone, SBR, Polyurethane rubber), By Application (Electronics, Construction and construction, Automobile, Aerospace, White goods manufacturers, HVAC, Other), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager