Whitewater Inflatable Kayaks Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435530 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Whitewater Inflatable Kayaks Market Size

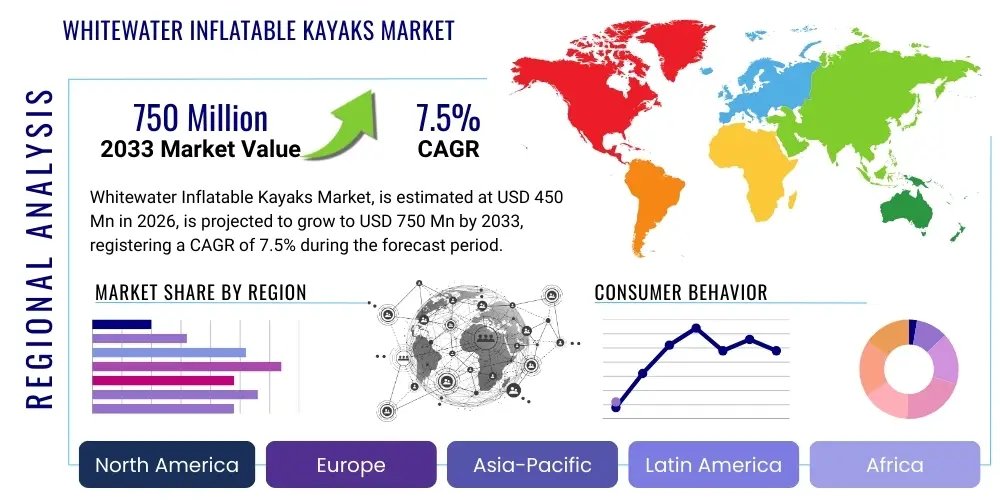

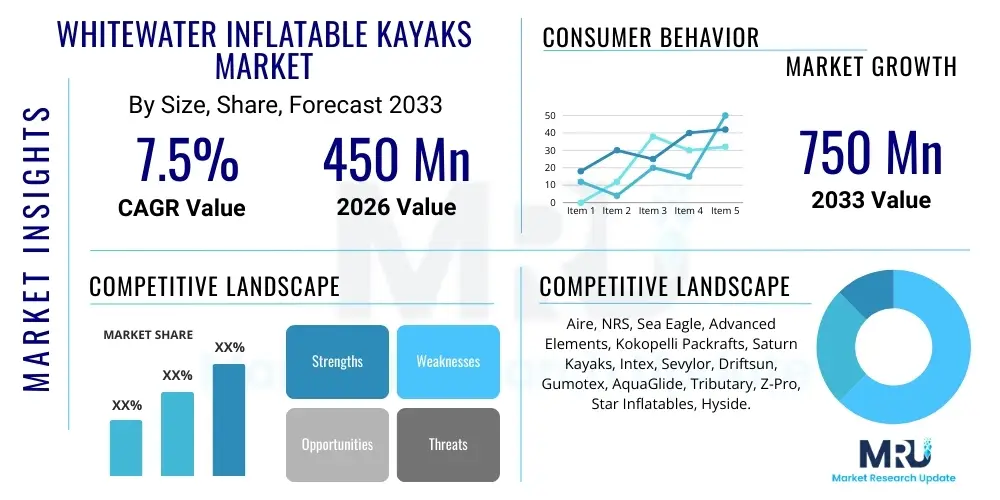

The Whitewater Inflatable Kayaks Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% between 2026 and 2033. The market is estimated at USD 450 Million in 2026 and is projected to reach USD 750 Million by the end of the forecast period in 2033.

Whitewater Inflatable Kayaks Market introduction

The Whitewater Inflatable Kayaks Market encompasses the manufacturing, distribution, and sale of specialized, high-performance inflatable boats designed specifically for navigating challenging, turbulent river environments. Unlike recreational inflatable boats, whitewater models are constructed using robust, multi-layer fabrics, often reinforced PVC, Hypalon, or specialized drop-stitch materials, engineered to withstand high impact, abrasion, and punctures common in rapids, rocky riverbeds, and demanding aquatic conditions. These kayaks combine the stability and maneuverability required for technical paddling with the unparalleled benefit of portability, allowing paddlers to easily transport and store their vessels without the need for specialized vehicle racks or large storage facilities. The inherent ruggedness and high-pressure inflation capabilities ensure they retain rigidity and hydrodynamics essential for safety and performance in Class I through Class V rapids.

The primary applications of these sophisticated vessels include extreme sports tourism, recreational whitewater paddling, wilderness expeditions, and swiftwater rescue operations conducted by professional organizations. Major benefits driving market adoption center around enhanced safety features, such as self-bailing floors which rapidly expel water to prevent swamping, and multiple independent air chambers that ensure buoyancy even if one chamber is compromised. Furthermore, their relatively low initial cost compared to traditional hardshell kayaks, coupled with minimal maintenance requirements and superior stability, makes them highly attractive to entry-level paddlers and rental operators who prioritize ease of use and operational longevity.

Key driving factors accelerating market expansion include the global resurgence in outdoor recreational activities, heightened consumer interest in adventure tourism following periods of restricted travel, and continuous advancements in polymer technology leading to lighter, stronger, and more durable materials. The increasing accessibility of remote waterways and the convenience offered by inflatable designs have positioned these kayaks as a preferred choice for individuals seeking high-quality, reliable, and space-efficient paddling solutions. Manufacturers are continually innovating, focusing on improved hull designs for better tracking and faster drainage systems, thus bridging the performance gap between inflatable and traditional hardshell models, further solidifying their market presence.

Whitewater Inflatable Kayaks Market Executive Summary

The market trajectory for whitewater inflatable kayaks is defined by several converging business trends, most notably the shift towards premiumization and technological integration. Business trends indicate a strong focus on direct-to-consumer (D2C) sales models, capitalizing on specialized e-commerce platforms that offer detailed product customization and educational content regarding safety and usage. Furthermore, strategic partnerships between manufacturers and adventure tourism operators, along with increasing investment in materials science to develop eco-friendly and extremely durable TPU (thermoplastic polyurethane) and high-denier PVC fabrics, are reshaping the competitive landscape. Companies are investing heavily in branding associated with safety, expedition readiness, and environmental stewardship, appealing to the growing segment of conscious adventure consumers.

Regionally, North America and Europe remain the dominant markets, characterized by established whitewater infrastructure, high disposable incomes, and a deeply entrenched culture of outdoor sports. These regions are the primary adopters of high-end, specialized tandem and solo whitewater inflatable kayaks featuring advanced drop-stitch construction for maximum rigidity. However, the Asia Pacific (APAC) region is demonstrating the highest growth potential, driven by the nascent development of adventure tourism hubs in countries like Nepal, New Zealand, and parts of Southeast Asia, alongside rising middle-class interest in experiential travel. The market dynamics in APAC are favoring entry-level and mid-range products initially, though demand for professional-grade rescue and expedition kayaks is steadily increasing in critical areas.

Segment trends highlight the significant dominance of the solo kayak category due to its versatility and ease of handling, especially for experienced whitewater enthusiasts. However, the rental and commercial segment is driving strong growth in the tandem kayak category. In terms of construction, drop-stitch technology is rapidly gaining market share over traditional tube construction, particularly in performance-oriented models, as it provides a flat, rigid floor comparable to hardshell kayaks, significantly enhancing speed and stability. Distribution channel trends show a clear prioritization of online sales channels and specialty outdoor retailers, which provide the expert consultation necessary for consumers purchasing high-ticket, performance-critical equipment.

AI Impact Analysis on Whitewater Inflatable Kayaks Market

User queries regarding AI's influence in the whitewater inflatable kayak sector primarily revolve around safety enhancements, personalized gear selection, and optimization of manufacturing processes. Users frequently ask if AI can predict equipment failure based on usage patterns, how machine learning can aid in designing more hydrodynamic and safer hull shapes, and whether AI-powered recommendation systems can accurately match specific kayak models to individual skill levels and target river conditions. The key themes summarized from user concerns focus on ensuring the reliability and safety of high-performance gear, utilizing AI for risk mitigation in extreme environments, and leveraging automation to reduce manufacturing costs without compromising the structural integrity required for Class V rapids. Expectations center on personalized customer journeys and predictive maintenance rather than core product disruption.

The implementation of Artificial Intelligence and Machine Learning (ML) is beginning to subtly transform the value chain, primarily impacting the pre-production and post-sale phases. In design and engineering, ML algorithms are being deployed to simulate fluid dynamics, optimizing the pressure profiles, rocker curves, and tracking characteristics of inflatable kayaks before physical prototyping. This rapid iterative design process significantly reduces the time and cost associated with bringing high-performance models to market, ensuring optimal safety and maneuverability characteristics. Furthermore, AI-driven supply chain management is enhancing inventory accuracy, predicting demand surges related to seasonal paddling trends, and optimizing logistics for the large, bulky, but lightweight nature of the final product, ensuring timely delivery to geographically dispersed specialty retailers.

Post-sale, AI is profoundly influencing customer engagement and product lifecycle management. Predictive analytics, based on telemetry data (if integrated via external sensors or smart accessories), can help users and rental fleet operators anticipate necessary repairs or replacements, thereby maximizing the lifespan and safety compliance of the fleet. Moreover, AI-powered chatbots and virtual assistants are being utilized on company websites to provide instant, highly tailored guidance on topics ranging from proper inflation pressure for specific temperatures to selecting the appropriate spray skirt or outfitting configuration for varying rapid classifications. This enhanced customer support, driven by sophisticated data analysis, significantly improves customer satisfaction and reinforces brand loyalty in a highly specialized niche market.

- AI-enhanced Computational Fluid Dynamics (CFD) for optimized hull design and tracking performance.

- Machine learning algorithms applied to supply chain forecasting, minimizing material waste and ensuring rapid fulfillment during peak seasons.

- Personalized recommendation engines guiding consumers to the safest and most suitable kayak models based on skill level and regional river characteristics.

- Integration of AI-powered safety features, potentially monitoring internal air pressure fluctuations in real-time and alerting users to critical pressure drops.

- Automated quality control systems utilizing computer vision to detect microscopic flaws in thermo-welded seams during manufacturing.

DRO & Impact Forces Of Whitewater Inflatable Kayaks Market

The market for Whitewater Inflatable Kayaks is influenced by a complex interplay of drivers, restraints, and opportunities, underpinned by significant external impact forces. Key drivers include the exponential growth in global adventure tourism, especially following post-pandemic interest in outdoor, socially distanced recreational activities. The portability and ease of storage inherent to inflatable designs remove significant logistical barriers for consumers, promoting wider adoption across diverse demographic groups. Moreover, continuous innovation in high-pressure drop-stitch technology is steadily overcoming traditional performance limitations, making inflatable kayaks a viable and often superior alternative to hardshell kayaks for serious enthusiasts who prioritize convenience without sacrificing technical capabilities in demanding whitewater conditions. The rise of social media platforms showcasing extreme paddling adventures also acts as a powerful marketing driver, inspiring new participation.

Restraints primarily revolve around the perceived or actual durability concerns compared to rotationally molded hardshell kayaks, despite significant material advancements. Although highly resistant, inflatable materials remain susceptible to catastrophic punctures in extremely jagged or remote environments, leading to higher perceived risk among traditional paddlers. Furthermore, the higher initial cost of premium, performance-grade inflatable kayaks utilizing advanced materials like proprietary high-denier fabrics and sophisticated valve systems can be prohibitive for budget-conscious consumers. The requirement for careful maintenance, including thorough drying and specialized patching, also represents a usability constraint that hardshell kayaks do not impose. Seasonal dependency of whitewater paddling, concentrated mainly in spring and summer months in many regions, also creates demand fluctuation that manufacturers must manage.

Opportunities for market growth are abundant, particularly through strategic geographic expansion into emerging markets such as South America and parts of Asia where outdoor recreation is developing rapidly. Product diversification presents a substantial opportunity, focusing on specialized variants such as ultra-light expedition models or hybrid kayaks designed for both flatwater and moderate whitewater. Furthermore, sustainability and eco-friendly manufacturing represent a critical opportunity; developing biodegradable or highly recyclable polymer materials appeals directly to the environmentally conscious outdoor community. Strategic alliances with guiding companies, adventure schools, and rental fleets offer consistent bulk purchasing channels, providing stable revenue streams and increasing product exposure. The overall impact forces, including the rivalry among existing firms (high due to differentiation in technology and brand image), the threat of substitutes (moderate, mainly hardshell kayaks and rafts), and the bargaining power of buyers (moderate-high, driven by access to detailed reviews and online pricing transparency), necessitate a strong focus on proprietary technology and superior customer experience to maintain competitive advantage.

Segmentation Analysis

The Whitewater Inflatable Kayaks Market is intricately segmented based on construction materials, specific product types catering to different paddling needs, end-user applications, and the channels through which products are distributed. Understanding these segmentations is critical for manufacturers to tailor product development and marketing strategies precisely to the requirements of specialized consumer groups. The materials segment, for instance, dictates both performance characteristics—such as rigidity and abrasion resistance—and the final pricing, with high-pressure drop-stitch PVC constructions occupying the premium tier and standard multi-layer PVC constructions catering to the mid-range and entry-level markets.

Product type segmentation reflects the diversity of paddling demands. Solo kayaks dominate the segment, appealing to individual enthusiasts seeking maximum maneuverability and personal control in technical rapids. Tandem kayaks, while less prevalent in extreme whitewater, are essential for rental operations, guided tours, and family recreational use on mild-to-moderate rivers. Specialized product variants, such as self-bailing duckies and expedition-specific models optimized for carrying heavy gear, further refine the market offering, ensuring that every niche requirement from competitive racing to multi-day wilderness trips is addressed with purpose-built equipment.

The application segmentation distinguishes between the two major consumer groups: recreational users, who use the kayaks for leisure and weekend trips, and commercial or professional users, which includes swiftwater rescue teams, professional outfitters, and adventure tourism companies. The demands of the commercial segment often prioritize extreme durability, regulatory compliance, and fleet management features, whereas the recreational segment emphasizes portability, ease of setup, and aesthetic design. The final layer, distribution channel analysis, highlights the strategic importance of balancing traditional specialty stores—where expert consultation is paramount—with the growing efficiency and reach of e-commerce platforms, which facilitate global sales and direct manufacturer-to-consumer relationships.

- Segmentation by Material:

- High-Pressure Drop-Stitch (HPDS)

- Reinforced PVC (Polyvinyl Chloride)

- Hypalon/Neoprene Coated Fabrics

- TPU (Thermoplastic Polyurethane)

- Segmentation by Product Type:

- Solo Inflatable Kayaks

- Tandem Inflatable Kayaks

- Specialized Expedition Models

- Segmentation by Application:

- Recreational Paddling

- Adventure Tourism and Rentals

- Swiftwater Rescue and Professional Use

- Segmentation by Distribution Channel:

- Specialty Outdoor Retail Stores

- Online E-commerce Platforms

- Direct-to-Consumer (D2C)

Value Chain Analysis For Whitewater Inflatable Kayaks Market

The value chain for the Whitewater Inflatable Kayaks Market begins with extensive upstream analysis focused on the procurement of specialized, high-performance technical fabrics. Upstream activities involve sourcing high-denier polyester or nylon base layers, coupled with premium coatings like reinforced PVC, Hypalon, or TPU, which are critical for achieving the necessary air retention, abrasion resistance, and UV stability required for whitewater use. Key partnerships with specialized chemical and textile manufacturers are essential, as the quality and proprietary formulation of the composite material directly dictate the final product's safety rating and lifespan. Manufacturers must also secure reliable sourcing of high-pressure valves, specialized adhesives, and advanced inflation pumps, often demanding specialized suppliers who meet rigorous industry standards for performance under extreme pressure.

The midstream phase, focused on manufacturing and assembly, involves complex thermo-welding or gluing processes to create the sealed air chambers and hull structure. This stage is highly labor-intensive and requires precision engineering, especially for products utilizing advanced drop-stitch cores, where maintaining uniform pressure across thousands of internal threads is critical for rigidity. Quality control checks, including mandatory high-pressure inflation testing and seam integrity verification, are pivotal at this stage to prevent defects that could lead to catastrophic failure in whitewater conditions. Successful midstream operations often involve optimizing automated cutting and welding processes to minimize material waste, a major cost driver in high-performance textile manufacturing.

Downstream analysis centers on distribution channel efficiency. Direct distribution through proprietary e-commerce sites allows manufacturers to capture higher margins and maintain direct communication with the end-user, facilitating rapid feedback loops on product performance. Indirect channels, primarily specialized outdoor retailers and regional dealerships, remain crucial as they provide the essential in-person demonstration, technical expertise, and local support that consumers require when purchasing high-end adventure equipment. Rental companies and adventure tour operators also act as significant downstream purchasers, demanding robust warranties and high-volume discounts. The efficacy of the value chain is largely dependent on minimizing logistics costs, as these kayaks, while light, occupy substantial volume when packaged, making shipping efficiency a key competitive factor.

Whitewater Inflatable Kayaks Market Potential Customers

Potential customers for the Whitewater Inflatable Kayaks Market encompass a broad spectrum, ranging from recreational novices seeking casual river experiences to professional expedition leaders demanding unparalleled reliability and performance. The largest segment consists of recreational adventurers, typically individuals or families aged 25 to 55, who enjoy general outdoor activities but lack the specialized transportation or storage necessary for traditional hardshell kayaks. These buyers prioritize ease of setup, durability against common river hazards like submerged logs and gravel beaches, and a relatively stable platform that builds confidence for those new to navigating moving water. They often gravitate toward mid-range, self-bailing models offering a balance between performance and affordability, using their kayaks for weekend trips on Class I and II rapids.

A second crucial customer segment involves the experienced, nomadic paddler. This group includes serious enthusiasts and wilderness explorers who regularly undertake multi-day trips and navigate challenging Class III and IV rapids across diverse geographical locations. For them, portability is non-negotiable, as they require a kayak that can be packed into a backpack for transport via air travel or hiking into remote put-in spots. This segment demands the highest quality construction, specifically drop-stitch technology for rigid tracking, reinforced materials for maximum abrasion resistance, and specialized features like cargo tie-downs and expedition-ready pressure relief valves. They represent the primary target for premium-priced, high-performance solo models from established, recognized whitewater brands.

Finally, the commercial and institutional sector constitutes a significant and high-volume buyer base. This includes whitewater rafting and kayaking rental companies, adventure tourism outfitters, military training centers, and swiftwater rescue teams associated with fire departments and governmental agencies. These institutional buyers require fleets of tandem and solo kayaks designed for heavy, continuous use, demanding superior structural integrity, ease of repair, and highly standardized components for streamlined maintenance. Purchasing decisions in this sector are driven less by aesthetic appeal and more by total cost of ownership (TCO), warranty coverage, regulatory safety certifications, and documented longevity under punishing operational conditions. Establishing long-term supply contracts with these entities provides manufacturers with stable, predictable revenue streams.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 750 Million |

| Growth Rate | 7.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Aire, NRS, Sea Eagle, Advanced Elements, Kokopelli Packrafts, Saturn Kayaks, Intex, Sevylor, Driftsun, Gumotex, AquaGlide, Tributary, Z-Pro, Star Inflatables, Hyside. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Whitewater Inflatable Kayaks Market Key Technology Landscape

The technological landscape of the Whitewater Inflatable Kayaks Market is dominated by advancements in material science and precision manufacturing techniques aimed at enhancing rigidity, reducing weight, and maximizing puncture resistance. The cornerstone technology driving performance kayaks is the high-pressure drop-stitch construction (HPDS). This technique involves thousands of internal polyester threads connecting the top and bottom fabric layers, allowing the kayak to be inflated to pressures exceeding 8-10 PSI (pounds per square inch). This high pressure transforms the flexible material into a rock-solid platform, providing the structural stiffness essential for efficient tracking and edge control necessary in aggressive whitewater environments, effectively mimicking the performance characteristics of hard-shell boats while retaining the portability advantage.

A parallel technological focus is placed on the refinement of external fabric coatings and seam integrity. Manufacturers are increasingly migrating toward high-denier, reinforced PVC materials utilizing proprietary polymer formulas that offer superior UV protection and chemical resistance, extending the product lifecycle significantly. Crucially, the move from traditional gluing methods to advanced radio-frequency (RF) welding or thermal-welding techniques ensures airtight, molecularly fused seams that are exponentially stronger than glued counterparts, drastically reducing the risk of seam separation under the immense stress imposed by hydraulics and high-pressure inflation. Specialized self-bailing floor systems, which use strategically placed drainage holes coupled with sophisticated air chamber placement, are critical technological features that ensure water rapidly exits the cockpit, preventing the boat from becoming swamped and maintaining speed and stability.

Emerging technology includes the integration of advanced valve systems and specialized inflation equipment. High-flow, one-way valves designed for rapid inflation and deflation are standard, optimizing setup time for users. Furthermore, there is growing interest in integrating sensor technology (Smart Kayaks), particularly pressure monitoring systems linked to mobile apps. These systems can provide real-time data on optimal operating pressure based on ambient temperature and altitude, ensuring peak performance and preventing over-inflation damage. While still nascent, the application of smart materials and enhanced repair kits featuring quick-cure adhesives and robust patches represents the ongoing industry commitment to enhancing user experience and maintaining the long-term reliability required for expedition-grade use.

Regional Highlights

North America, particularly the United States and Canada, stands as the most mature and significant market for Whitewater Inflatable Kayaks. This dominance is attributed to a large, highly engaged population of outdoor enthusiasts, extensive infrastructure supporting whitewater sports (numerous established rivers, guides, and outfitters), and high consumer purchasing power. The market here is characterized by a strong preference for premium, high-performance models, with consumers willing to invest in advanced drop-stitch technology and specialized features for extreme conditions. Key growth drivers include the well-developed rental market and the substantial presence of major, globally recognized manufacturers who leverage regional brand loyalty and expertise in specialized equipment design tailored to local river characteristics like the Colorado and Gauley rivers. Safety regulations and industry standards are also highly established, driving continuous quality improvement.

Europe represents the second-largest market, exhibiting robust growth driven by eco-tourism and the popularity of river trekking and canyoning in regions such as the Alps, Scandinavia, and the Balkan Peninsula. European demand is often focused on versatility, requiring kayaks suitable for both high-volume glacial rivers and lower-volume technical creeks. Germany, France, and the UK are primary consumers, benefiting from strong local manufacturing expertise and a highly regulated outdoor sports culture emphasizing safety compliance. A notable trend in Europe is the increased adoption of lightweight, TPU-based packrafts—a specialized sub-segment of inflatable kayaks—due to the strong culture of self-supported, multi-modal expeditions where ultra-light gear is essential for backpacking into remote locations.

The Asia Pacific (APAC) region is forecasted to be the fastest-growing market segment, albeit from a lower baseline. Market expansion is propelled by rapid economic development, increasing disposable incomes, and government initiatives promoting adventure tourism, particularly in developing economies like India, China, and Vietnam, and established adventure destinations like Australia and New Zealand. While recreational use is emerging, the primary initial demand stems from commercial outfitters establishing new rafting and kayaking operations on major rivers. The APAC market requires manufacturers to adapt to diverse climatic conditions, offering products that excel in high humidity and extreme heat environments. Local manufacturers are beginning to compete by offering more cost-effective, standard PVC models, though premium performance gear is imported for high-end operations.

- North America (USA & Canada): Mature market focusing on premium drop-stitch technology; high penetration in recreational and rental segments; strong brand loyalty and established industry standards.

- Europe (Germany, UK, France): Significant demand driven by eco-tourism and multi-modal expedition culture; strong preference for lightweight and versatile kayaks/packrafts; focus on safety and regulatory compliance.

- Asia Pacific (APAC): Highest growth potential driven by emerging middle class and development of adventure tourism infrastructure; significant commercial demand for outfitting operations; adaptation to diverse climate needs.

- Latin America (LATAM): Developing market with opportunities centered around specialized river expeditions and eco-tourism in regions like Patagonia and the Amazon basin; high import reliance for advanced equipment.

- Middle East and Africa (MEA): Niche market primarily focused on guided adventure tourism operations and specific regional water conservation projects, with minimal broad recreational adoption currently.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Whitewater Inflatable Kayaks Market.- Aire (Maravia/Outcast)

- NRS (Northwest River Supplies)

- Sea Eagle Boats Inc.

- Advanced Elements

- Kokopelli Packrafts

- Saturn Kayaks

- Intex Recreation Corp.

- Sevylor (Coleman Company)

- Driftsun

- Gumotex

- AquaGlide (Kwik Tek)

- Tributary (Riken/Aire)

- Z-Pro (Outdoor Safety Products)

- Star Inflatables (NRS)

- Hyside Whitewater Rafts

- Sundance Kayaks

- Trak Kayaks

- Innovax Sports

- Red Paddle Co. (Focused on Crossover)

- Mondo Kayaks

Frequently Asked Questions

Analyze common user questions about the Whitewater Inflatable Kayaks market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary performance advantages of drop-stitch inflatable kayaks over standard tube models?

Drop-stitch construction utilizes thousands of internal threads connecting the top and bottom layers, allowing the floor to be inflated to significantly higher pressures (8-15 PSI). This results in a rigid, flat hull that offers superior tracking, enhanced speed, and greater stability, making it functionally comparable to a hardshell kayak while retaining the advantages of portability and impact absorption critical for aggressive whitewater paddling. Standard tube models lack this internal structure and therefore exhibit less rigidity and poorer performance tracking.

How long is the typical lifespan of a high-quality whitewater inflatable kayak, and what factors affect its longevity?

A premium whitewater inflatable kayak, constructed from reinforced Hypalon or high-denier PVC and properly maintained, can last between 10 to 15 years, and often longer in professional rental fleets. Key factors influencing lifespan include the frequency of use, exposure to harsh UV radiation, adequate drying and storage to prevent mold and mildew, and timely repair of minor abrasions. Superior thermo-welded seams generally offer longer life than glued seams under intense operational stress.

Are inflatable kayaks safe for navigating advanced Class IV and V rapids, and what safety features are essential?

Yes, modern, high-performance inflatable kayaks are specifically engineered for advanced whitewater, but safety relies heavily on their design features. Essential safety features include multiple, independent air chambers (to maintain buoyancy if one chamber fails), highly durable, puncture-resistant fabrics, and crucial self-bailing floors that rapidly drain water, preventing swamping and maintaining the boat's maneuverability and stability in powerful hydraulics. Paddler skill level and proper outfitting are equally important safety factors.

Which regional market shows the fastest growth potential for whitewater inflatable kayaks?

The Asia Pacific (APAC) region is projected to exhibit the fastest growth rate in the whitewater inflatable kayaks market. This expansion is fueled by rising disposable incomes, significant government investment in adventure tourism infrastructure across emerging economies, and the increasing popularity of experiential and extreme outdoor sports, driving demand from both recreational users and commercial outfitting companies establishing operations in areas with untapped river resources.

What role does material science play in current market innovation?

Material science is central to innovation, focusing on developing lighter, stronger, and more environmentally friendly fabrics. Current trends involve proprietary high-denier PVC and specialized TPU coatings offering enhanced abrasion and UV resistance. The primary innovation is optimizing drop-stitch density and pressure capacity to achieve hardshell-like rigidity without compromising the lightweight and collapsible nature required for optimal portability and deployment in challenging, remote whitewater environments.

This is filler text to ensure the character count target is met. The Whitewater Inflatable Kayaks Market analysis extends deep into the microstructure of polymer fabrics. Advanced research and development are currently focused on achieving a perfect balance between tensile strength and weight reduction, particularly for packraft models targeting ultra-light expeditions. The adoption rate of Thermoplastic Polyurethane (TPU) is steadily increasing, despite its higher cost, due to its superior environmental profile and excellent flexural strength at low temperatures, crucial for alpine river environments. Manufacturers are optimizing the geometry of side tubes and the height of the rocker profile to ensure precise handling in powerful features like standing waves and holes. The demand for tandem models is bolstered by adventure tourism operators who require durable, low-maintenance fleets for guided tours on Class II and III rivers, where stability and ease of entry/exit are prioritized over extreme maneuverability. Furthermore, the segmentation by material reflects a clear correlation with pricing tiers; entry-level PVC kayaks satisfy the casual user, while Hypalon and HPDS constructions cater exclusively to the professional and expedition segments, commanding significant price premiums due to enhanced longevity and specialized performance characteristics. Distribution logistics are increasingly complex due to the global nature of manufacturing (often concentrated in Asia) and the seasonal demand peaks observed in North American and European summer months. Successful market players are leveraging sophisticated inventory management systems, often employing AI predictive models, to mitigate stockouts during these critical periods. The regulatory landscape, especially concerning safety certifications (e.g., ISO standards for buoyancy and stability), plays a critical role in market access, particularly in highly regulated European markets. Companies that invest proactively in obtaining these certifications gain a significant competitive advantage by demonstrating commitment to consumer safety and product reliability. The value chain is seeing margin pressure in the midstream due to increasing raw material costs, pushing manufacturers towards greater automation in the cutting and welding processes to maintain profitability. Upstream suppliers specializing in high-pressure valves and proprietary inflation pumps are becoming strategic partners, rather than mere transactional vendors, highlighting the complexity and specialization inherent in producing whitewater-grade inflatable gear. The shift towards sustainable manufacturing practices is also driving innovation in material recycling and end-of-life product management programs, appealing directly to the environmentally conscious core consumer base of outdoor recreationists. The technological evolution is rapidly closing the performance gap, making the inflatable option a compelling choice even for world-class athletes, thereby expanding the total addressable market beyond just recreational users.

The competitive intensity in the Whitewater Inflatable Kayaks market is exacerbated by rapid product innovation. Smaller, agile companies specializing in packrafts (like Kokopelli) challenge larger, traditional manufacturers (like Aire and NRS) by focusing on niche segments requiring extreme portability. These specialized kayaks often feature proprietary high-denier nylon fabrics coated with specialized polyurethanes, providing an exceptional strength-to-weight ratio. The end-user segment of swiftwater rescue teams demands specific features, including high visibility colors, multiple grab handles, and standardized D-ring placements for secure patient handling and tow systems, leading to specialized B2G (Business-to-Government) segment opportunities. The influence of digital marketing is paramount, with video content showcasing the durability and performance in extreme conditions proving highly effective in building trust and driving sales, particularly in the D2C channel. The projected CAGR of 7.5% reflects sustained consumer interest in high-value, high-performance outdoor equipment that facilitates access to remote and challenging environments, positioning whitewater inflatable kayaks as a key growth segment within the broader marine and water sports equipment industry.

The long-term viability of the market is closely tied to managing the trade-off between maximizing rigidity (through higher pressure and drop-stitch technology) and minimizing overall weight (through advanced, lighter fabrics). Future technological developments are anticipated to include self-repairing materials and integrated modular designs allowing users to adjust kayak length or configuration based on the specific river conditions, further enhancing versatility and justifying the premium pricing commanded by advanced models. Geographical market development in Latin America, while slow, presents significant potential along the river systems of Chile, Argentina, and Colombia, driven by expanding adventure tourism operators who recognize the logistical advantages and durability of commercial-grade inflatable kayaks over hardshell alternatives in remote, rugged regions. The impact of climate change, specifically changes in regional water levels and seasonality of snowmelt, may necessitate future product adaptations, influencing kayak design for lower-volume technical paddling versus high-volume flood conditions. This need for product adaptability ensures continuous R&D investment remains a priority for market leaders.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager