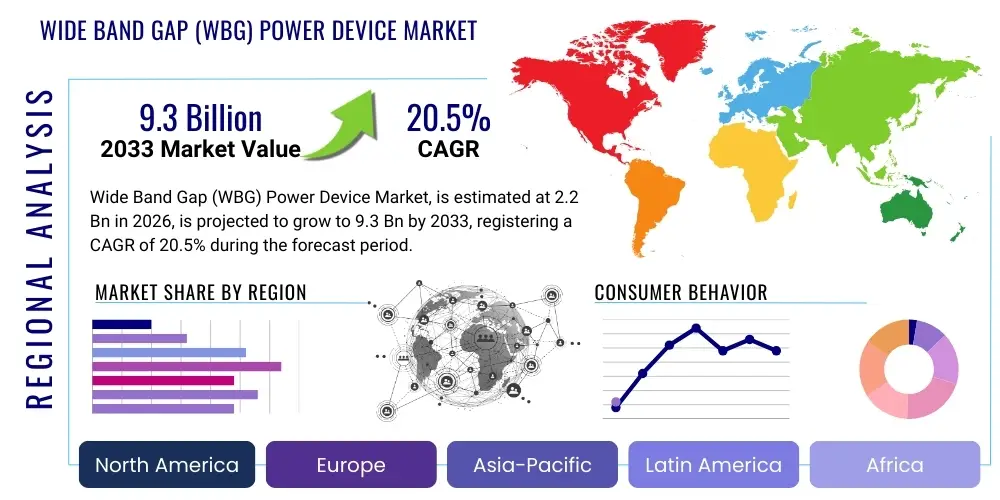

Wide Band Gap (WBG) Power Device Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 440198 | Date : Jan, 2026 | Pages : 257 | Region : Global | Publisher : MRU

Wide Band Gap (WBG) Power Device Market Size

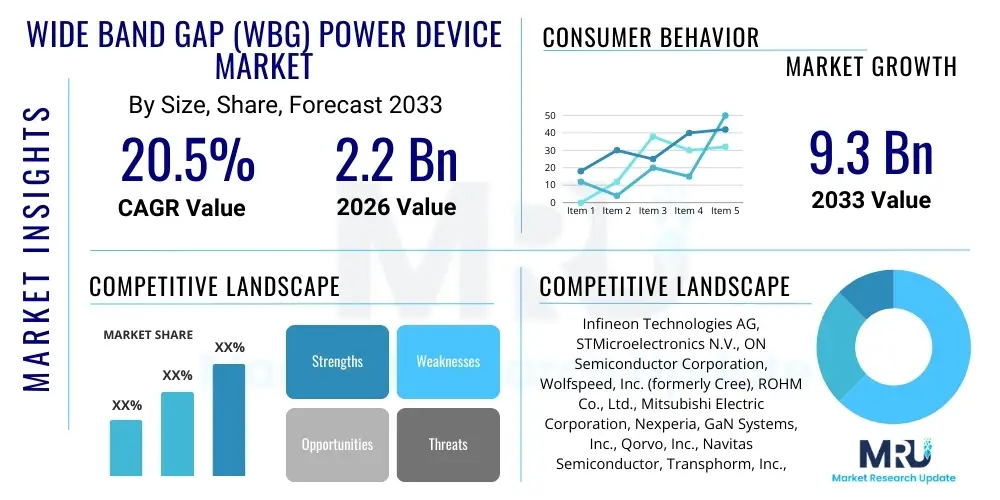

The Wide Band Gap (WBG) Power Device Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 20.5% between 2026 and 2033. The market is estimated at $2.2 Billion in 2026 and is projected to reach $9.3 Billion by the end of the forecast period in 2033. This significant growth trajectory is primarily driven by the increasing demand for energy-efficient power solutions across various industries, including automotive, industrial, and renewable energy. The inherent advantages of WBG materials like Silicon Carbide (SiC) and Gallium Nitride (GaN) in terms of higher efficiency, smaller form factors, and superior performance at elevated temperatures and frequencies are becoming indispensable for next-generation power electronics.

Wide Band Gap (WBG) Power Device Market introduction

The Wide Band Gap (WBG) Power Device Market encompasses a range of semiconductor components fabricated from materials such as Silicon Carbide (SiC) and Gallium Nitride (GaN), which possess a wider energy band gap compared to conventional silicon. This fundamental material property allows WBG devices to operate at significantly higher voltages, temperatures, and switching frequencies with much lower power losses. These attributes are critical for modern power conversion systems, where efficiency and compactness are paramount. Unlike silicon, WBG materials can handle greater electrical stress and dissipate less heat, leading to more robust and reliable power solutions.

The primary products in this market include SiC MOSFETs, SiC diodes, GaN HEMTs (High Electron Mobility Transistors), and various power modules integrating these devices. Major applications span a broad spectrum, notably in electric vehicles (EVs) and hybrid electric vehicles (HEVs) for traction inverters, on-board chargers, and DC-DC converters, where their efficiency directly translates to extended range and faster charging. In the industrial sector, WBG devices are revolutionizing motor drives, uninterruptible power supplies (UPS), and welding equipment by reducing energy consumption and system size. Furthermore, they are crucial for renewable energy systems, enhancing the efficiency of solar inverters and wind turbine converters, and are increasingly adopted in data centers and telecommunications for power supply units that demand high power density and reliability.

The benefits derived from WBG power devices are multifaceted. They offer substantial improvements in power conversion efficiency, leading to reduced energy waste and lower operational costs. Their ability to operate at higher switching frequencies enables the use of smaller passive components (like inductors and capacitors), thereby shrinking the overall system footprint and weight. This compactness is vital for space-constrained applications. Moreover, their superior thermal performance allows for less complex cooling systems, contributing to further cost and size reductions. These inherent advantages are major driving factors for market growth, alongside global trends towards electrification, decarbonization, and the increasing demand for high-performance electronic systems in consumer electronics and advanced computing.

Wide Band Gap (WBG) Power Device Market Executive Summary

The Wide Band Gap (WBG) Power Device Market is experiencing robust expansion, driven by an escalating global imperative for energy efficiency and high-performance power electronics across diverse industries. Business trends highlight a significant shift from traditional silicon-based power solutions to advanced WBG materials like Silicon Carbide (SiC) and Gallium Nitride (GaN), which offer superior performance characteristics, including lower switching losses, higher operating temperatures, and increased power density. Strategic collaborations, mergers, and acquisitions among key players are becoming prevalent as companies strive to expand their product portfolios, enhance manufacturing capabilities, and secure supply chains to meet the burgeoning demand, particularly from the automotive and renewable energy sectors. Investments in research and development are also intensifying to innovate new device architectures and improve manufacturing processes, aiming for cost reduction and performance optimization, which are critical for broader market penetration.

From a regional perspective, Asia Pacific currently dominates the WBG power device market, primarily due to the region's strong manufacturing base for consumer electronics, electric vehicles, and industrial equipment, particularly in China, Japan, and South Korea. Government initiatives promoting electric vehicles and renewable energy further fuel this growth. Europe and North America are also significant markets, propelled by stringent energy efficiency regulations, substantial investments in EV infrastructure, and advanced industrial automation. These regions are witnessing increased adoption in aerospace, defense, and high-performance computing applications, supported by strong research ecosystems and a focus on sustainable energy solutions. Latin America, the Middle East, and Africa are emerging markets, with gradual adoption driven by growing industrialization and increasing investments in sustainable energy projects.

Segmentation trends indicate that the Silicon Carbide (SiC) segment holds a larger market share, especially in high-power applications like electric vehicle traction inverters and industrial motor drives, owing to its maturity and robust performance at high voltages and temperatures. However, the Gallium Nitride (GaN) segment is projected to exhibit a faster growth rate, driven by its suitability for high-frequency applications, such as fast chargers for consumer electronics, telecom base stations, and data center power supplies, where its ultra-fast switching capabilities are highly advantageous. The automotive end-user segment is poised to be the largest and fastest-growing application area, as electrification efforts globally mandate highly efficient and compact power solutions. Industrial applications, including renewable energy inverters and motor control, also represent a substantial and steadily growing segment, underscoring the broad utility of WBG technologies in transforming traditional power systems.

AI Impact Analysis on Wide Band Gap (WBG) Power Device Market

The intersection of Artificial Intelligence (AI) and the Wide Band Gap (WBG) Power Device Market is sparking considerable interest, with users frequently inquiring about how AI can optimize the design, manufacturing, and operational performance of these advanced semiconductors. Key themes include the potential for AI-driven materials discovery to identify novel WBG compounds, the use of machine learning in optimizing fabrication processes for higher yields and reliability, and the application of AI in power management systems to dynamically control WBG devices for peak efficiency. Users are particularly concerned with how AI might accelerate the development cycle, reduce costs, and unlock new performance frontiers for SiC and GaN technologies, thereby overcoming current design complexities and manufacturing challenges. There is also a strong expectation that AI will play a pivotal role in enabling smarter, more adaptive power electronics crucial for future energy grids, autonomous systems, and advanced computing infrastructures.

- AI-driven material science accelerates the discovery and optimization of new WBG compounds and heterostructures.

- Machine learning algorithms enhance manufacturing process control, leading to improved yields and reduced defects in WBG device fabrication.

- AI-powered simulation and modeling tools significantly shorten the design cycle for WBG devices and power modules.

- Predictive maintenance for WBG power systems utilizes AI to monitor device health, anticipate failures, and optimize operational lifespan.

- AI algorithms enable dynamic and adaptive control of WBG power converters, maximizing efficiency under varying load conditions.

- AI facilitates the development of intelligent power management units, optimizing energy flow and reducing losses in complex systems.

- Enhanced thermal management in WBG devices through AI-driven design and real-time operational adjustments to prevent overheating.

- AI-assisted fault detection and diagnosis improve the reliability and safety of WBG-based power electronic systems.

- Optimization of supply chain and logistics for WBG materials and finished devices using AI for demand forecasting and inventory management.

- AI contributes to the creation of more sophisticated power electronic systems, enabling higher integration density and miniaturization.

DRO & Impact Forces Of Wide Band Gap (WBG) Power Device Market

The Wide Band Gap (WBG) Power Device Market is propelled by a confluence of powerful drivers, tempered by specific restraints, while presenting significant opportunities for growth, all underpinned by various impact forces. A primary driver is the accelerating global demand for energy-efficient solutions across all sectors, from consumer electronics to heavy industrial machinery. The superior performance of WBG materials like SiC and GaN, offering lower energy losses, higher operating temperatures, and increased power density compared to traditional silicon, makes them indispensable for achieving sustainability goals and complying with stringent energy regulations. Furthermore, the rapid electrification of the automotive industry, particularly the surging production of electric vehicles (EVs) and hybrid electric vehicles (HEVs), acts as a monumental catalyst, with WBG devices enhancing EV range, charging speed, and overall system efficiency. The expansion of renewable energy infrastructure, including solar and wind power, also significantly boosts demand as WBG devices optimize inverter performance and grid integration.

Despite these strong tailwinds, the market faces several restraints. The high manufacturing cost of WBG wafers and devices, stemming from complex fabrication processes and the relative scarcity of high-quality substrates, represents a significant barrier to widespread adoption, particularly in cost-sensitive applications. The nascent stage of large-scale manufacturing infrastructure for WBG materials, especially GaN, contributes to supply chain bottlenecks and limits volume production. Additionally, the inherent design complexity associated with integrating WBG devices into existing power electronics systems, often requiring specialized circuit designs and thermal management techniques, poses challenges for engineers accustomed to silicon-based solutions. A lack of standardized packaging for high-power WBG modules further complicates integration and increases development timelines, slowing market penetration in some segments.

However, the opportunities within the WBG power device market are vast and continually expanding. Ongoing advancements in material science and manufacturing technologies are expected to drive down production costs and improve device performance, making WBG solutions more competitive. The emergence of new applications in areas like 5G telecommunications infrastructure, advanced robotics, artificial intelligence accelerators, and aerospace and defense systems provides fresh avenues for market expansion. Furthermore, the development of intelligent power modules and integrated solutions that simplify design and enhance reliability will unlock new market segments. The growing awareness among end-users about the long-term cost savings and environmental benefits associated with WBG technology is also a significant opportunity. The impact forces at play include robust government support and incentives for green technologies and EV adoption, increasing private sector investment in WBG research and manufacturing, and intensifying competitive pressures among leading semiconductor companies to innovate and capture market share. The global energy transition and decarbonization efforts will continue to serve as overarching impact forces, ensuring sustained growth for WBG power devices as a foundational technology for a more sustainable future.

Segmentation Analysis

The Wide Band Gap (WBG) Power Device Market is segmented to provide a granular understanding of its diverse components and application landscapes. This comprehensive segmentation considers the fundamental material types, device architectures, key applications, and end-user industries that define the market's structure and growth dynamics. Analyzing these segments helps stakeholders identify specific growth areas, understand competitive landscapes, and tailor strategies to meet precise market demands. The market's complexity necessitates a clear breakdown to assess market size, growth rates, and technological preferences within each niche, reflecting the varied requirements of different power electronic systems.

- By Material:

- Silicon Carbide (SiC)

- Gallium Nitride (GaN)

- By Device Type:

- MOSFET

- Diode

- Transistor (HEMT, JFET)

- Power Module

- Other Devices

- By Voltage Range:

- Low Voltage (0-600V)

- Medium Voltage (600V-1200V)

- High Voltage (>1200V)

- By Application:

- Automotive (EV/HEV, On-board Chargers, DC-DC Converters, Traction Inverters)

- Consumer Electronics (Fast Chargers, Adapters, Power Supplies)

- Industrial (Motor Drives, UPS, Renewable Energy Inverters, Welding Equipment, Robotics)

- Data Centers & Telecom (Server Power Supplies, Telecom Rectifiers)

- Aerospace & Defense

- Medical

- Other Applications

- By End-User Industry:

- Automotive

- Industrial

- Information and Communication Technology (ICT)

- Energy & Utilities

- Consumer Electronics

- Aerospace & Defense

- Other End-Users

Value Chain Analysis For Wide Band Gap (WBG) Power Device Market

The value chain for the Wide Band Gap (WBG) Power Device Market is intricate, beginning with specialized material sourcing and extending through complex manufacturing processes, distribution, and integration into diverse end-user applications. Upstream analysis reveals the critical role of raw material suppliers, particularly for high-purity Silicon Carbide (SiC) and Gallium Nitride (GaN) substrates, epitaxy wafers, and other essential chemicals. The quality and availability of these foundational materials are paramount, significantly influencing device performance and production costs. Key players in this stage focus on developing advanced crystal growth and epitaxial deposition techniques to produce high-quality, large-diameter wafers, which are crucial for scaling manufacturing and achieving cost efficiencies. This segment is characterized by specialized companies that are often vertically integrated or form strategic partnerships with device manufacturers to ensure a stable supply of advanced WBG substrates.

Further along the value chain, the manufacturing stage involves sophisticated processes, including wafer fabrication, device design, chip packaging, and module assembly. This segment is dominated by integrated device manufacturers (IDMs) and specialized foundries that possess the expertise and infrastructure for high-precision semiconductor processing. Given the unique material properties of SiC and GaN, specific processing techniques, such as high-temperature annealing and specialized doping, are required, differentiating it from traditional silicon manufacturing. Packaging is another critical aspect, as WBG devices operate at higher temperatures and frequencies, demanding advanced thermal management solutions and robust interconnect technologies to ensure reliability and performance. The innovation in packaging is essential for maximizing the benefits of WBG chips at the system level.

Downstream analysis focuses on the distribution channels and end-user integration. WBG power devices reach customers through a combination of direct and indirect channels. Direct sales are common for large volume customers, such as major automotive OEMs or industrial equipment manufacturers, allowing for direct technical support and customized solutions. Indirect channels involve distributors and value-added resellers who cater to a broader range of customers, including smaller enterprises and design houses, providing local support, inventory management, and integration services. These distributors often specialize in power electronics, offering comprehensive product portfolios and technical expertise. The final stage involves the integration of WBG devices into various end-user applications, such as electric vehicle drivetrains, renewable energy inverters, data center power supplies, and consumer electronics chargers. The effectiveness of this integration depends heavily on the collaboration between device manufacturers, system designers, and application engineers, highlighting the interconnected nature of the WBG power device value chain in delivering high-performance, energy-efficient solutions to the global market.

Wide Band Gap (WBG) Power Device Market Potential Customers

The Wide Band Gap (WBG) Power Device Market serves a diverse and expanding base of potential customers, primarily comprised of end-user industries that demand high-efficiency, high-power-density, and robust power conversion solutions. At the forefront are original equipment manufacturers (OEMs) in the automotive sector, especially those involved in the production of Electric Vehicles (EVs), Hybrid Electric Vehicles (HEVs), and Plug-in Hybrid Electric Vehicles (PHEVs). These manufacturers are crucial buyers as WBG devices are fundamental to enhancing the performance of traction inverters, on-board chargers, and DC-DC converters, directly impacting vehicle range, charging speed, and overall energy efficiency. The drive towards global vehicle electrification positions automotive OEMs as the largest and most rapidly growing segment of potential customers, continuously seeking advanced WBG solutions to differentiate their products and meet evolving regulatory standards.

Another significant group of potential customers includes industrial equipment manufacturers across various sub-sectors. This encompasses producers of motor drives for factory automation, robotics, and heavy machinery, where WBG devices enable more precise control, higher efficiency, and reduced size for variable frequency drives. Manufacturers of uninterruptible power supplies (UPS) and energy storage systems for data centers, industrial facilities, and critical infrastructure also represent a key customer segment, valuing the reliability and power density that WBG components offer. Furthermore, companies specializing in renewable energy systems, such as solar inverter manufacturers and wind turbine component suppliers, are increasingly adopting WBG technology to optimize power conversion efficiency from intermittent sources to the grid, thereby maximizing energy harvesting and system longevity. The demand from these industrial customers is driven by the need for robust, long-lasting, and highly efficient power electronics capable of operating under demanding conditions.

Beyond automotive and industrial applications, the market caters to manufacturers in the Information and Communication Technology (ICT) sector, including companies producing server power supplies, telecom rectifiers, and networking equipment, where WBG devices facilitate miniaturization and improved energy efficiency vital for high-density data centers and 5G infrastructure. Consumer electronics companies, particularly those focused on developing fast chargers for smartphones, laptops, and other portable devices, constitute another growing customer segment, leveraging GaN technology for compact, high-power adapters. Aerospace and defense contractors are also emerging as niche but high-value customers, requiring WBG devices for power supplies in avionics, radar systems, and electric propulsion due to their superior performance in harsh environments and weight reduction benefits. Ultimately, any industry striving for enhanced power efficiency, reduced system size and weight, and improved operational reliability is a potential customer for Wide Band Gap power devices, reflecting the broad transformative potential of this technology across the global economy.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $2.2 Billion |

| Market Forecast in 2033 | $9.3 Billion |

| Growth Rate | CAGR 20.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Infineon Technologies AG, STMicroelectronics N.V., ON Semiconductor Corporation, Wolfspeed, Inc. (formerly Cree), ROHM Co., Ltd., Mitsubishi Electric Corporation, Nexperia, GaN Systems, Inc., Qorvo, Inc., Navitas Semiconductor, Transphorm, Inc., Littelfuse, Inc., Microchip Technology Inc., Renesas Electronics Corporation, Fuji Electric Co., Ltd., Toshiba Corporation, GeneSiC Semiconductor, Semi-on Semiconductor Co., Ltd., EPC Corporation. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Wide Band Gap (WBG) Power Device Market Key Technology Landscape

The Wide Band Gap (WBG) Power Device Market is characterized by a dynamic and evolving technology landscape, driven by continuous innovation in material science, device design, and manufacturing processes. At the core are the properties of Silicon Carbide (SiC) and Gallium Nitride (GaN), which enable devices to surpass the performance limitations of traditional silicon. For SiC, the critical technologies include advanced crystal growth methods for producing high-quality, large-diameter SiC substrates, essential for reducing wafer costs and scaling production. Epitaxial growth techniques are also vital for depositing precise SiC layers with controlled doping profiles, forming the active regions of devices like SiC MOSFETs and diodes. Furthermore, trench gate technology and superjunction structures are continuously being refined to optimize on-resistance and breakdown voltage for SiC devices, enhancing their suitability for high-power, high-voltage applications such as electric vehicle traction inverters and industrial motor drives. Packaging technology for SiC is also crucial, focusing on low-inductance designs and enhanced thermal dissipation to fully leverage the material's high-temperature operation capabilities.

For GaN, the technology landscape is distinct, primarily centering around Gallium Nitride High Electron Mobility Transistors (GaN HEMTs), which exploit the material's high electron mobility and two-dimensional electron gas (2DEG) phenomenon for extremely fast switching speeds. Key technologies here include growth of GaN epitaxial layers on more readily available and larger diameter substrates like silicon (GaN-on-Si), as well as on SiC or sapphire, to achieve cost-effective manufacturing and improved thermal performance. Techniques like p-GaN gate structures are crucial for achieving normally-off operation, which is a requirement for many power electronics applications. Advances in lateral device architectures and integration with passive components are also critical for GaN, particularly for high-frequency applications like fast chargers, RF power amplifiers, and data center power supplies, where compactness and efficiency are paramount. Research into vertical GaN devices is also ongoing, promising even higher power densities and breakdown voltages, potentially expanding GaN's reach into very high-power applications.

Beyond individual device technologies, the WBG power device market is also shaped by advancements in module packaging, driver ICs, and system-level integration. Integrated power modules that combine multiple WBG devices, gate drivers, and protection circuitry are becoming increasingly sophisticated, offering simplified design and improved performance for system integrators. Advanced packaging materials and designs, including direct-bond copper (DBC) and sintering technologies, are essential for managing the increased heat generated by WBG devices operating at higher power densities. Furthermore, the development of specialized gate drivers optimized for the faster switching speeds and unique gate characteristics of SiC and GaN is critical to extract maximum performance and ensure reliable operation. System-on-chip (SoC) and system-in-package (SiP) solutions integrating WBG power devices with control electronics and other functionalities represent another significant technological trend, aiming to reduce bill-of-materials, footprint, and design complexity, thereby accelerating the adoption of WBG technology across a broader range of applications. These continuous technological advancements are crucial for overcoming existing market barriers and unlocking the full potential of WBG power devices.

Regional Highlights

-

North America: The North American market for Wide Band Gap (WBG) power devices is characterized by strong innovation and significant investment in electric vehicle (EV) infrastructure, renewable energy, and data centers. The region benefits from robust research and development activities, particularly in the United States, fostering advancements in SiC and GaN technologies. Government incentives and increasing regulatory pressure for energy efficiency are driving the adoption of WBG devices in automotive and industrial applications. Key states like California are leading the charge in EV adoption, creating substantial demand for efficient power electronics. The presence of major semiconductor companies and strong demand from the aerospace and defense sectors further contribute to the region's growth.

Companies are focusing on expanding their manufacturing capabilities and forming strategic alliances to strengthen their market position. The region is also a significant adopter of GaN in consumer electronics, especially for fast chargers, and in data center power supplies, where energy savings are a critical factor. Investments in grid modernization and smart energy solutions are also creating new opportunities for WBG technologies, enabling more efficient power delivery and management. -

Europe: Europe is a pivotal market for WBG power devices, driven by stringent environmental regulations, ambitious decarbonization targets, and substantial investments in the automotive industry, particularly in Germany, France, and the UK. The region is a leader in EV manufacturing and renewable energy integration, propelling the demand for high-performance SiC and GaN solutions in traction inverters, charging infrastructure, and solar/wind power converters. European governments are actively supporting research and development initiatives for next-generation power electronics, fostering a vibrant ecosystem for WBG innovation.

Key European players are focusing on developing advanced power modules and integrated solutions to meet the demanding requirements of industrial automation, motor drives, and smart grid applications. The region's commitment to industrial transformation and sustainable energy sources ensures a sustained growth trajectory for WBG technologies, positioning Europe as a crucial hub for advanced power electronics development and deployment. -

Asia Pacific (APAC): The Asia Pacific region holds the largest share in the WBG power device market and is projected to exhibit the highest growth rate during the forecast period. This dominance is attributed to the region's massive manufacturing base for consumer electronics, electric vehicles, and industrial equipment, particularly in China, Japan, South Korea, and Taiwan. China, in particular, is a significant driver due to its aggressive promotion of EVs and massive investments in renewable energy projects and 5G infrastructure. The high volume production of fast chargers for mobile devices is also a major catalyst for GaN adoption.

Governments in the APAC region are actively supporting local WBG semiconductor companies through various policies and funding, aiming to establish self-sufficiency and leadership in advanced power electronics. The intense competition among regional players and the focus on cost-effective, high-volume production are accelerating technological advancements and market penetration. As industrialization continues and energy demands rise, the adoption of WBG devices across various applications, from home appliances to high-power industrial systems, is set to expand rapidly across APAC. -

Latin America: The WBG power device market in Latin America is an emerging segment, experiencing gradual growth driven by increasing industrialization, infrastructure development, and growing awareness of energy efficiency. Countries like Brazil and Mexico are leading the adoption, primarily in industrial applications such as motor drives and power supplies. Investments in renewable energy projects, particularly solar and wind power, are slowly but steadily creating demand for WBG-based inverters and converters.

While the market is smaller compared to other regions, the growing automotive manufacturing sector in Mexico, with increasing integration into global EV supply chains, presents future opportunities for WBG devices. Economic development and a focus on upgrading industrial infrastructure will continue to be key drivers for the adoption of more efficient power solutions in the region. -

Middle East and Africa (MEA): The Middle East and Africa region is witnessing nascent but promising growth in the WBG power device market. This growth is primarily fueled by diversification efforts away from traditional oil and gas economies, with increasing investments in renewable energy projects (solar farms in Saudi Arabia and UAE), smart city initiatives, and developing industrial sectors. The demand for energy-efficient solutions in data centers and telecom infrastructure, driven by digitalization efforts, is also contributing to the market's expansion.

While the adoption rate is slower due to limited manufacturing capabilities and higher initial costs, the long-term strategic visions of many MEA countries towards sustainable development and technological advancement are expected to foster greater integration of WBG power devices in critical infrastructure and emerging EV markets.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Wide Band Gap (WBG) Power Device Market.- Infineon Technologies AG

- STMicroelectronics N.V.

- ON Semiconductor Corporation

- Wolfspeed, Inc. (formerly Cree)

- ROHM Co., Ltd.

- Mitsubishi Electric Corporation

- Nexperia

- GaN Systems, Inc.

- Qorvo, Inc.

- Navitas Semiconductor

- Transphorm, Inc.

- Littelfuse, Inc.

- Microchip Technology Inc.

- Renesas Electronics Corporation

- Fuji Electric Co., Ltd.

- Toshiba Corporation

- GeneSiC Semiconductor

- Semi-on Semiconductor Co., Ltd.

- EPC Corporation

- UnitedSiC (acquired by Qorvo)

Frequently Asked Questions

What are Wide Band Gap (WBG) power devices?

Wide Band Gap (WBG) power devices are advanced semiconductor components made from materials like Silicon Carbide (SiC) and Gallium Nitride (GaN). Unlike traditional silicon, these materials have a larger energy band gap, enabling devices to operate at higher voltages, temperatures, and switching frequencies with significantly lower power losses, leading to superior energy efficiency and compactness in power electronic systems.

What are the main advantages of WBG devices over silicon-based devices?

The primary advantages include higher efficiency due to reduced switching losses, capability to operate at elevated temperatures and frequencies, smaller device size, and lower system weight. These benefits lead to reduced energy consumption, simplified cooling systems, and overall smaller, more reliable power electronic designs across various applications.

Which industries are the biggest adopters of WBG power devices?

The automotive industry, particularly electric vehicles (EVs) for traction inverters and on-board chargers, is the largest and fastest-growing adopter. Industrial applications (motor drives, UPS, renewable energy inverters), data centers, telecom infrastructure, and consumer electronics (fast chargers) are also significant and rapidly expanding markets for WBG power devices.

What are the key materials used in WBG power devices?

The two primary materials are Silicon Carbide (SiC) and Gallium Nitride (GaN). SiC is generally preferred for high-power, high-voltage applications like EVs and industrial motor drives, while GaN excels in high-frequency, lower-power applications such as fast chargers and RF power amplifiers.

What are the future trends in the WBG power device market?

Future trends include continued cost reduction through manufacturing advancements, increased integration of WBG devices into intelligent power modules, expansion into new applications like 5G infrastructure and AI hardware, and further development of GaN-on-Si technologies. The market will also see growing demand driven by global electrification, decarbonization efforts, and the pursuit of higher energy efficiency.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager