WiFi Home Router Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432296 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

WiFi Home Router Market Size

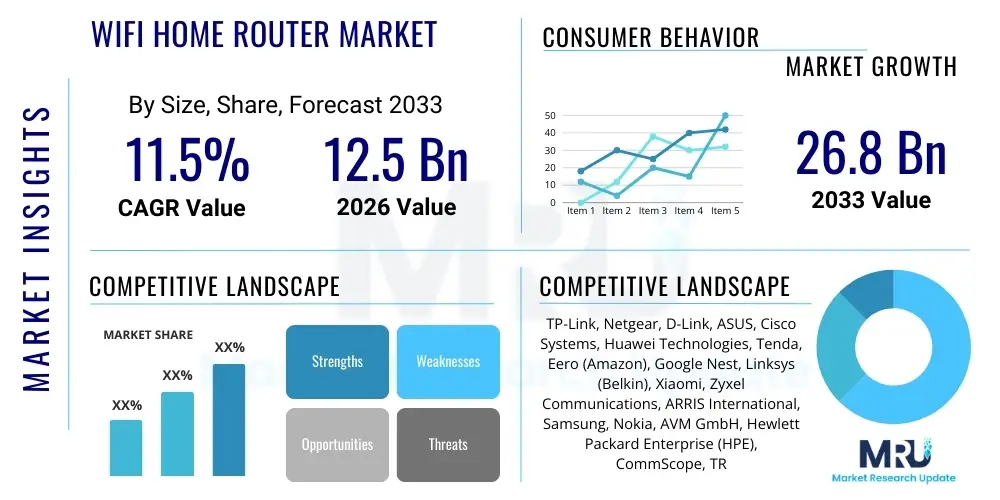

The WiFi Home Router Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 11.5% between 2026 and 2033. The market is estimated at $12.5 Billion in 2026 and is projected to reach $26.8 Billion by the end of the forecast period in 2033.

WiFi Home Router Market introduction

The WiFi Home Router Market encompasses the design, manufacture, distribution, and consumption of devices crucial for establishing local area networks (LANs) and enabling internet access within residential settings. These devices serve as the gateway, connecting diverse client devices such as smartphones, smart televisions, PCs, and numerous Internet of Things (IoT) sensors to the broadband connection. The evolution of this market is intrinsically linked to advancements in wireless standards, moving rapidly from older generations like 802.11n and 802.11ac to cutting-edge standards like Wi-Fi 6 (802.11ax), Wi-Fi 6E, and the emerging Wi-Fi 7 (802.11be), which significantly enhance speed, capacity, and efficiency, addressing the demanding requirements of modern households.

The primary driving force behind the robust growth of the WiFi Home Router Market is the exponential increase in the number of connected devices per household, coupled with the rising demand for high-bandwidth applications. Major applications include 4K/8K video streaming, cloud gaming, sophisticated smart home automation systems, and remote work/e-learning environments which necessitate reliable, low-latency connectivity. Benefits derived from modern routers include superior coverage through mesh technologies, enhanced security features, improved Quality of Service (QoS) management, and better battery life for client devices due to efficient wake-up time scheduling protocols like Target Wake Time (TWT) implemented in Wi-Fi 6 and newer standards.

Key market participants are heavily investing in integrating advanced capabilities such as dedicated Artificial Intelligence (AI) components for network optimization and sophisticated parental controls. The market structure is competitive, characterized by frequent product launches that introduce better coverage, higher throughput, and superior capacity management to handle dense device environments. Furthermore, Internet Service Providers (ISPs) play a critical role, often bundling high-performance routers with high-speed fiber or cable broadband subscriptions, accelerating the penetration of next-generation router technologies into consumer homes across both developed and rapidly developing economies.

WiFi Home Router Market Executive Summary

The WiFi Home Router Market is experiencing transformative growth, driven primarily by the global shift towards high-speed broadband infrastructure, particularly fiber-to-the-home (FTTH), and the increasing penetration of bandwidth-intensive consumer electronics. Business trends highlight a strong transition from traditional single-point routers to advanced mesh networking systems, which solve common household coverage issues and provide seamless connectivity across larger physical spaces. Furthermore, manufacturers are diversifying their product lines to offer specialized gaming routers, robust security-focused devices, and routers specifically designed for professional users operating sophisticated home offices, thereby capturing niche market segments characterized by willingness to pay a premium for guaranteed performance and reliability.

Regional trends indicate that the Asia Pacific (APAC) region is projected to exhibit the highest growth rate, fueled by massive population bases, rapid urbanization, government initiatives supporting digital infrastructure expansion (such as India’s Digital India and China’s broadband strategies), and a burgeoning middle class willing to invest in superior home technology. North America and Europe remain mature markets but are driving the demand for premium, high-end devices adopting the latest standards like Wi-Fi 6E and Wi-Fi 7 swiftly, especially due to high rates of remote working adoption and widespread subscription to gigabit internet services. Conversely, growth in Latin America and MEA is centered on upgrading from older 802.11n devices to 802.11ac and early 802.11ax models, offering substantial volume opportunities.

In terms of segment trends, the Wi-Fi 6 standard (802.11ax) currently dominates the market share due to its excellent balance of cost, performance, and maturity, although Wi-Fi 7 (802.11be) is poised for massive commercialization post-2025, promising disruptive speeds and ultra-low latency critical for metaverse applications and real-time interactive services. The distribution channel segment is seeing ISPs and managed service providers increase their market leverage by supplying customized, often subsidized, hardware that integrates seamlessly with their specific network architecture. The focus remains heavily on robust security features, with consumers increasingly prioritizing built-in defenses against malware and phishing over raw speed alone, prompting innovation in integrated firewall and intrusion detection systems directly within the router hardware.

AI Impact Analysis on WiFi Home Router Market

Common user questions regarding AI's impact on WiFi Home Routers predominantly center around how this technology can ensure consistent, optimal performance and robust security without requiring continuous manual intervention. Users frequently ask: "Can AI truly eliminate dead zones and buffering?" and "How does AI enhance my router’s defense against new cyber threats?" They also express strong interest in features that automatically allocate bandwidth based on the application (e.g., prioritizing a video conference over a background download) and the router’s ability to self-diagnose and fix common connectivity issues. The core user expectation is the transformation of the router from a passive signal emitter into an intelligent, proactive network manager, significantly improving the quality of experience (QoE) through predictive and adaptive functionalities.

Based on these recurring themes, the integration of Artificial Intelligence and Machine Learning (ML) is fundamentally reshaping the value proposition of home routers. AI algorithms are deployed to analyze real-time network traffic patterns, environmental interference, and device usage behavior, allowing the router to dynamically adjust power transmission, channel selection, and antenna configuration (beamforming). This proactive management ensures that resources are optimally allocated, reducing latency spikes, minimizing congestion, and maximizing throughput for critical applications, thereby addressing the common pain points of inconsistent performance and coverage variability often experienced in dense living environments or highly saturated wireless spectrums. Furthermore, ML-driven threat intelligence allows routers to identify and quarantine suspicious traffic patterns or unknown devices more effectively and faster than traditional signature-based security systems.

The future iteration of AI-enabled routers will move towards autonomous networking, creating what is known as cognitive WiFi. These systems will learn the optimal operation parameters specific to a household's geography and usage habits over weeks or months, becoming increasingly efficient and personalized. This extends beyond simple QoS to complex functionalities like intelligent parental controls that adapt content filtering based on time of day or recognized user profiles, and sophisticated fault prediction capabilities that alert users or ISPs to potential hardware failures before they result in a service outage. This strategic integration of AI ensures that high-speed standards like Wi-Fi 7 deliver their full potential by intelligently managing the complex physical layer and application layer demands simultaneously.

- AI-driven Quality of Service (QoS) optimization for dynamic bandwidth allocation based on application priority (e.g., video conferencing vs. streaming).

- Predictive Channel Selection and Interference Mitigation, automatically shifting frequencies to avoid signal degradation.

- Machine Learning (ML) based security systems for real-time threat detection, anomaly identification, and proactive malware quarantine.

- Intelligent Mesh Network Steering to ensure seamless, low-latency roaming between access points within a multi-router system.

- Network Self-Healing capabilities, diagnosing and resolving common connection or configuration faults autonomously.

- Energy Optimization through predictive traffic analysis, maximizing efficiency and minimizing power consumption during low-use periods.

- Adaptive Parental Controls and User Profiling for tailored access management and content filtering based on learned behavioral patterns.

DRO & Impact Forces Of WiFi Home Router Market

The WiFi Home Router Market is highly influenced by a dynamic interplay of Drivers, Restraints, and Opportunities (DRO), collectively forming the impact forces shaping market evolution. Key drivers include the massive global proliferation of IoT and smart home devices, which necessitates high-capacity, stable network infrastructure capable of managing hundreds of simultaneous connections efficiently. The sustained global trend of working from home (WFH) and remote education mandates robust, enterprise-grade connectivity within residential settings, pushing consumers towards premium, high-performance routers, particularly those supporting the Wi-Fi 6/6E standard. This demand is further amplified by the rapid deployment and uptake of ultra-high-speed broadband services (Gigabit and 10-Gigabit fiber connections), which require equally capable terminal equipment to leverage the full subscription speed.

Conversely, the market faces significant restraints. A primary challenge is the high initial cost associated with adopting the newest standards, particularly Wi-Fi 7 (802.11be), which can deter price-sensitive consumers and slow widespread adoption in emerging markets. Technical restraints include persistent issues surrounding interoperability and fragmentation across various vendor-specific mesh systems and smart home protocols, complicating setup and maintenance for the average user. Furthermore, regulatory hurdles, particularly the allocation and standardization of the 6 GHz band for Wi-Fi 6E and future standards, vary significantly by country, creating logistical complexity for manufacturers and delaying uniform global product releases. Consumers also face a high frequency of product replacement cycles due to rapid technological obsolescence, leading to electronic waste concerns.

Despite these restraints, substantial opportunities exist, driven primarily by the rising consumer focus on cybersecurity and privacy, opening up the market for routers integrated with Subscription-based Managed Wi-Fi Services and advanced security features (e.g., VPN integration, dedicated security processors). The expansion of standardized mesh networking protocols, facilitated by organizations like the Wireless Broadband Alliance (WBA), promises to simplify multi-vendor deployments. Furthermore, the development of software-defined networking (SDN) principles applied to residential gateways offers opportunities for ISPs to remotely manage, optimize, and troubleshoot customer networks, reducing support costs and enhancing the user experience. The imminent mass-market availability of Wi-Fi 7 routers capable of MLO (Multi-Link Operation) represents a major revenue opportunity due to its foundational role in facilitating next-generation interactive applications like extended reality (XR) and high-fidelity cloud computing.

Segmentation Analysis

The WiFi Home Router Market is segmented across multiple dimensions, including technology standard, product type, distribution channel, and application. This segmentation provides a granular view of market dynamics, revealing varying growth rates and competitive landscapes across different product categories. The technological segmentation, based on IEEE 802.11 standards, is the most crucial, reflecting the performance capabilities and premium pricing associated with the newest generations. The trend clearly shows a rapid sunsetting of legacy standards like 802.11n and a massive uptake in 802.11ax (Wi-Fi 6) as the baseline for performance, with 802.11be (Wi-Fi 7) representing the highest growth potential segment in the mid-to-long term forecast horizon due to its anticipated features for ultra-high-density and low-latency environments.

Product type segmentation distinguishes between traditional single routers and advanced mesh Wi-Fi systems. Mesh systems are steadily capturing market share, especially in larger homes, driven by their superior coverage, simplified installation processes, and seamless device handoff capabilities. Distribution channels dictate how products reach the end-user, with retail channels providing greater variety and brand choice, while ISP channels ensure broader penetration and guaranteed hardware-network compatibility. The competitive intensity varies significantly across these segments; for instance, the ISP channel is dominated by larger network equipment manufacturers, while the retail channel provides opportunities for consumer electronics brands focused on user experience and aesthetic design.

Understanding these segments allows market participants to tailor their product development and marketing strategies. For instance, manufacturers targeting the North American market often prioritize high-end mesh systems and Wi-Fi 6E/7 technology due to high broadband penetration rates, while those focusing on emerging markets may emphasize cost-effective Wi-Fi 5 or Wi-Fi 6 entry-level devices distributed primarily through ISP channels. The increasing emphasis on advanced features like cybersecurity and AI-driven optimization is creating a new premium sub-segment focused on performance and security, irrespective of the underlying technological standard, targeting consumers with highly sensitive data or demanding home office requirements.

- By Technology Standard:

- 802.11ac (Wi-Fi 5)

- 802.11ax (Wi-Fi 6/6E)

- 802.11be (Wi-Fi 7)

- Others (802.11n)

- By Product Type:

- Traditional Standalone Routers

- Mesh Wi-Fi Systems (Dual-band, Tri-band)

- By Frequency Band:

- Dual-Band

- Tri-Band

- Quad-Band

- By Distribution Channel:

- Retail Stores

- Online Sales Channels

- Internet Service Providers (ISPs)/Managed Service Providers

- By Application:

- Residential Consumer Use

- Small Office/Home Office (SOHO)

- Gaming and High-Performance Applications

Value Chain Analysis For WiFi Home Router Market

The value chain for the WiFi Home Router Market begins with the upstream segment, dominated by highly specialized semiconductor and chipset manufacturers. Companies like Broadcom, Qualcomm, MediaTek, and Intel are critical suppliers, driving innovation in crucial areas such as MIMO technology, frequency band management (2.4 GHz, 5 GHz, 6 GHz), and advanced processing capabilities required for managing complex network traffic and integrated security features. The quality and efficiency of these core chipsets dictate the performance, cost, and time-to-market for the final router products. Intense competition among these few key suppliers necessitates continuous investment in R&D to maintain technological leadership, particularly concerning the implementation of new IEEE standards like Wi-Fi 7.

The midstream involves Original Equipment Manufacturers (OEMs) and Original Design Manufacturers (ODMs) who integrate the chipsets into finished router hardware, manage the physical design, manufacturing, and firmware development. This stage is characterized by high volume production, often outsourced to facilities in East Asia (China, Taiwan, Vietnam) to capitalize on economies of scale. Major brand owners (e.g., Netgear, TP-Link, ASUS) collaborate closely with these manufacturing partners to ensure quality control and adherence to specifications, leveraging their brand equity to command market presence. Differentiation at this stage relies heavily on industrial design, cooling solutions (passive or active), and proprietary software features like user interface design and mobile application connectivity.

The downstream segment, focusing on distribution and sales, is bifurcated into two major channels: direct-to-consumer (retail and online) and business-to-business (ISP procurement). Direct sales channels, including major e-commerce platforms and electronics retailers, offer customers choice and immediate availability, with marketing efforts often emphasizing speed and gaming capabilities. The indirect channel, primarily involving ISPs, is highly strategic, as ISPs often purchase customized routers in bulk to provide to subscribers, ensuring guaranteed compatibility with their network infrastructure. This indirect channel offers stability and volume but necessitates compliance with strict performance and security requirements set by the service providers. Post-sales support and firmware update management represent the final critical step in the value chain, ensuring long-term customer satisfaction and maintaining device security throughout its lifespan.

WiFi Home Router Market Potential Customers

The core customer base for the WiFi Home Router Market is broadly segmented into residential consumers and Small Office/Home Office (SOHO) users, with varying demands based on household size, internet usage intensity, and technological sophistication. Residential consumers form the largest volume segment; their purchasing decisions are increasingly influenced by the proliferation of smart home ecosystems, requiring robust coverage and high device capacity. A key sub-segment within residential customers includes heavy users, such as professional gamers, content creators, and households with multiple remote workers, who prioritize premium features like low-latency performance, advanced QoS controls, and dedicated high-speed ports (2.5G or 10G Ethernet), often leading them to adopt high-end Wi-Fi 6E/7 mesh systems.

The second major group, SOHO users, requires router solutions that bridge the gap between consumer-grade and full enterprise networking. These customers prioritize reliability, advanced security protocols (VPN, strong firewall capabilities), and management features that allow for network segregation (e.g., separate guest networks and professional networks). Their purchasing behavior often leans towards routers offering robust firmware updates and centralized management tools, treating the home network as a critical business infrastructure component. Furthermore, a growing segment of environmentally conscious consumers represents potential buyers for brands focusing on sustainable manufacturing practices, energy-efficient operation (TWT feature adoption), and recyclable product packaging, offering an opportunity for differentiation beyond speed and coverage metrics.

Beyond individual purchases, Internet Service Providers (ISPs) constitute the largest B2B buyer segment, procuring millions of units annually. ISPs seek cost-effective, reliable Customer Premise Equipment (CPE) that is easy to deploy, remotely manageable via standardized protocols (e.g., TR-069), and designed to minimize customer support incidents. Their primary objective is maximizing network efficiency and subscriber satisfaction while minimizing operational expenditure, leading them to favor high-volume agreements with manufacturers capable of providing customized firmware and support. The continued rollout of fiber optic infrastructure worldwide ensures sustained demand from this critical institutional buyer segment, frequently dictating the baseline technological standard for the general market.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $12.5 Billion |

| Market Forecast in 2033 | $26.8 Billion |

| Growth Rate | 11.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | TP-Link, Netgear, D-Link, ASUS, Cisco Systems, Huawei Technologies, Tenda, Eero (Amazon), Google Nest, Linksys (Belkin), Xiaomi, Zyxel Communications, ARRIS International, Samsung, Nokia, AVM GmbH, Hewlett Packard Enterprise (HPE), CommScope, TRENDnet, Ubiquiti Networks. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

WiFi Home Router Market Key Technology Landscape

The technological landscape of the WiFi Home Router Market is rapidly being redefined by the introduction and mainstream adoption of Wi-Fi 6 (802.11ax) and its evolution, Wi-Fi 6E (which utilizes the 6 GHz band). These standards feature fundamental improvements over previous generations, primarily through the utilization of Orthogonal Frequency-Division Multiple Access (OFDMA) and Multi-User Multiple-Input Multiple-Output (MU-MIMO) technologies. OFDMA enables the simultaneous transmission of data to multiple users across sub-channels, dramatically enhancing efficiency in high-density environments, while MU-MIMO allows the router to communicate with several devices at once, boosting overall throughput. Furthermore, Target Wake Time (TWT) protocols are vital, as they allow devices to schedule communication times with the router, conserving battery life for IoT devices—a key feature demanded by smart home ecosystems.

Looking forward, the impending commercialization of Wi-Fi 7 (802.11be) is the most significant technological development. Wi-Fi 7, classified as Extremely High Throughput (EHT), introduces key innovations such as Multi-Link Operation (MLO), which allows a device to simultaneously transmit and receive data across different frequency bands (2.4 GHz, 5 GHz, and 6 GHz). This provides unprecedented reliability, aggregation of bandwidth for higher speeds, and dynamic switching to the best available band, offering truly resilient and low-latency connectivity crucial for applications like augmented reality (AR) and virtual reality (VR) streaming. Additionally, the standard supports 320 MHz channels and 4096-QAM modulation, pushing theoretical speeds significantly higher than those achievable with Wi-Fi 6E, although consumer adoption will depend heavily on regulatory clearance and cost reduction in supporting client devices.

Beyond core wireless standards, advanced networking concepts are being embedded into modern home routers. Mesh networking architectures, which rely on multiple interconnected satellite nodes to create a unified, expansive network, have become standard practice for larger homes, displacing traditional range extenders. Furthermore, the incorporation of hardware-accelerated security processors and integrated AI/ML silicon is becoming commonplace, enabling complex tasks such as deep packet inspection, real-time threat analysis, and automated network optimization without burdening the main CPU. Manufacturers are also exploring Software Defined Networking (SDN) concepts, allowing for centralized, cloud-based management of home networks, providing ISPs and consumers with enhanced control and simplified troubleshooting capabilities, fundamentally changing how home networks are configured and maintained over their operational lifecycle.

Regional Highlights

- Asia Pacific (APAC): APAC is anticipated to be the fastest-growing market globally, primarily due to the rapid rollout of high-speed broadband infrastructure, particularly in populous nations like China, India, and Southeast Asian countries. Government-led digitization initiatives, coupled with soaring adoption rates of 4G/5G mobile connectivity feeding into home networks, are driving substantial volume demand. Furthermore, the sheer scale of manufacturing in this region facilitates competitive pricing and faster technology adoption cycles, with countries like South Korea and Japan often serving as early adopters for cutting-edge standards such as Wi-Fi 6E and Wi-Fi 7 due to high-density living environments and a tech-savvy population.

- North America: North America holds a dominant market share in terms of value, characterized by early adoption of premium technologies (Wi-Fi 6E and tri-band mesh systems) and a high consumer willingness to pay for performance. The widespread prevalence of gigabit and multi-gigabit broadband subscriptions (fiber and cable) directly drives the demand for routers capable of handling high throughputs reliably. The market is also heavily influenced by key players like Amazon (Eero) and Google (Nest), which emphasize integrated ecosystems, smart home functionality, and subscription-based security services bundled with the hardware.

- Europe: The European market demonstrates steady, mature growth, influenced by stringent data privacy regulations (GDPR) which drive demand for robust, secure networking hardware. Western Europe, particularly Germany, the UK, and France, is rapidly transitioning to Wi-Fi 6 standards, often driven by ISPs replacing legacy CPE for better quality of service and reduced operational costs. Mesh networking penetration is increasing steadily, addressing the complex architectural layouts common in older European housing. Eastern Europe is playing catch-up, primarily focusing on upgrading from older 802.11n to 802.11ac/ax through government and ISP modernization programs.

- Latin America (LATAM): The LATAM region presents significant volume opportunities, marked by increasing urbanization and improved broadband access, especially in major economies like Brazil and Mexico. The market is primarily driven by the transition from DSL to fiber connections, necessitating basic to mid-range Wi-Fi 5 and Wi-Fi 6 routers often sourced via ISP contracts. Price sensitivity is high, meaning manufacturers must focus on cost-effective, reliable solutions, although a growing segment of tech-savvy urban youth is beginning to drive demand for performance-focused gaming routers.

- Middle East and Africa (MEA): Growth in MEA is concentrated in the Gulf Cooperation Council (GCC) countries (UAE, Saudi Arabia), where major infrastructure projects and high disposable incomes support the adoption of premium, cutting-edge technology including Wi-Fi 6E. In contrast, the African continent’s market is heavily dependent on infrastructure development and subsidized government programs, with demand centered around fundamental connectivity solutions, often utilizing vendor-specific, customized hardware to manage often-congested wireless environments.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the WiFi Home Router Market.- TP-Link Technologies Co., Ltd.

- Netgear Inc.

- ASUS Global

- D-Link Corporation

- Cisco Systems Inc.

- Huawei Technologies Co., Ltd.

- Linksys (Belkin International, Inc.)

- Google LLC (Nest WiFi)

- Amazon.com, Inc. (Eero LLC)

- Xiaomi Corporation

- Zyxel Communications Corp.

- AVM GmbH

- CommScope Inc. (ARRIS International)

- Ubiquiti Networks, Inc.

- Nokia Corporation

- Samsung Electronics Co., Ltd.

- Tenda Technology Inc.

- TRENDnet, Inc.

- Micro-Star International Co., Ltd. (MSI)

- Intel Corporation (Component Supplier)

Frequently Asked Questions

Analyze common user questions about the WiFi Home Router market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the most important factor driving the current growth of the WiFi Home Router Market?

The most critical factor driving market growth is the widespread proliferation of IoT devices and the substantial increase in demand for high-bandwidth applications, such as 4K/8K streaming and cloud gaming, necessitating high-capacity, stable networks provided by Wi-Fi 6 and mesh systems.

How does the emerging Wi-Fi 7 technology improve upon existing standards like Wi-Fi 6E?

Wi-Fi 7 (802.11be) primarily improves upon Wi-Fi 6E by introducing Multi-Link Operation (MLO), allowing devices to simultaneously use multiple frequency bands (2.4, 5, and 6 GHz) for increased speed, ultra-low latency, and enhanced reliability, alongside the use of wider 320 MHz channels.

Are mesh Wi-Fi systems replacing traditional standalone routers in residential settings?

Yes, mesh Wi-Fi systems are rapidly gaining market share, particularly in mid-to-large residential settings, as they provide superior whole-home coverage, eliminate dead zones, and offer simplified network setup and management compared to traditional single-point routers and range extenders.

What role does Artificial Intelligence (AI) play in modern home routers?

AI is integrated into modern routers to enhance performance through intelligent network management. AI algorithms optimize QoS by prioritizing traffic, proactively select the least congested channels, and bolster security by using Machine Learning (ML) for real-time threat detection and anomaly identification.

Which geographical region is expected to show the highest growth rate in the forecast period?

The Asia Pacific (APAC) region is projected to exhibit the highest Compound Annual Growth Rate (CAGR) due to rapid infrastructure development, urbanization, government initiatives supporting digital connectivity, and a large, expanding consumer base upgrading to newer Wi-Fi standards.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager