WiFi Smart Lock Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432694 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

WiFi Smart Lock Market Size

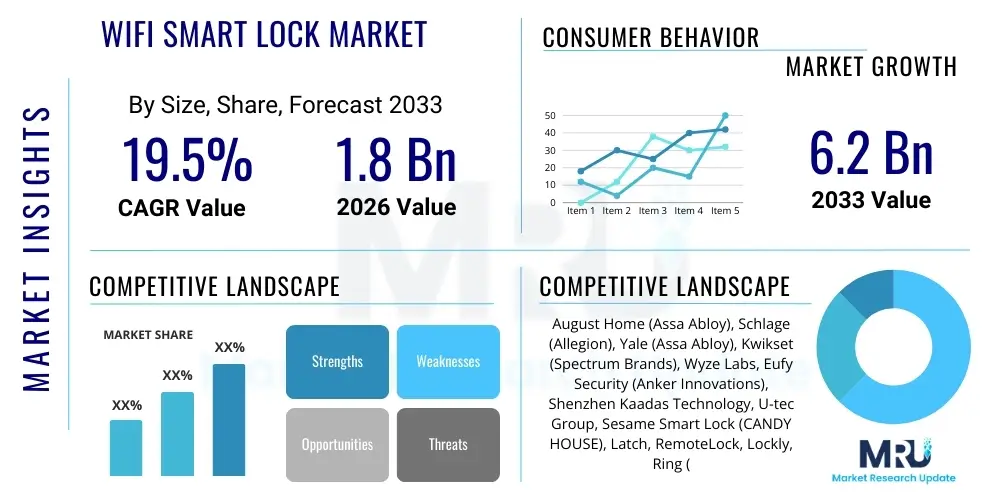

The WiFi Smart Lock Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 19.5% between 2026 and 2033. The market is estimated at USD 1.8 Billion in 2026 and is projected to reach USD 6.2 Billion by the end of the forecast period in 2033.

WiFi Smart Lock Market introduction

The WiFi Smart Lock Market encompasses sophisticated electronic locking mechanisms that integrate standard mechanical locking systems with advanced wireless connectivity, allowing users remote control and monitoring via internet protocols. These devices offer enhanced security, convenience, and seamless integration into larger smart home ecosystems, serving as critical infrastructure for modern automated living and property management. Key product types primarily include robust deadbolts, sleek lever locks, and utility-focused padlocks, all equipped with integrated WiFi modules. This connectivity enables core functionalities such as real-time status notifications, creation of temporary access codes for visitors or service providers, keyless entry via mobile application or code, and comprehensive audit logs detailing all entry and exit events. The primary applications span across residential dwellings, including single-family homes and multi-unit apartments, as well as high-growth commercial sectors such as short-term rentals and boutique hotels, driving demand through increased operational efficiencies and enhanced user experiences.

The core value proposition of WiFi Smart Locks lies in their ability to provide unparalleled access management flexibility, moving security control from a physical key to a globally accessible digital interface. This transition offers robust security features like intrusion alerts, tampering detection, and remote lockdown capabilities, fundamentally transforming the traditional perimeter security paradigm. The market’s upward trajectory is fundamentally propelled by the accelerating global penetration of smart home technologies and the paradigm shift in consumer behavior prioritizing digital convenience and instantaneous control over physical devices. Furthermore, significant driving factors include the rapid standardization of Internet of Things (IoT) protocols and the continued decline in the unit cost of high-performance embedded WiFi modules and microprocessors, making advanced security features increasingly accessible to the mainstream consumer base. The synergy between smart locks and voice assistants, allowing hands-free operation and enhanced user workflows, is another vital element sustaining market momentum and technological evolution.

In addition to residential adoption, the explosive growth of the peer-to-peer sharing economy and short-term accommodation platforms represents a powerful market catalyst. Property managers and hosts require efficient, scalable, and secure methods for granting and revoking access instantly without physical presence, a requirement perfectly addressed by WiFi Smart Lock technology. Continued innovation, particularly in enhancing battery longevity—a major consumer concern for connected locks—and improving system reliability under varying network conditions, is crucial. The integration of advanced features such as geolocation-based auto-locking and seamless interaction with other security components, such as video doorbells and surveillance cameras, is solidifying the smart lock’s position as a foundational element of contemporary smart security infrastructure.

WiFi Smart Lock Market Executive Summary

The WiFi Smart Lock market is currently experiencing dynamic shifts defined by intense competition and a strong focus on ecosystem integration and security service diversification. Key business trends include a notable shift among leading manufacturers toward offering comprehensive, cloud-based access management platforms, often transitioning hardware sales into a platform service model supported by recurring revenue streams from premium monitoring and advanced data analytics subscriptions. This trend necessitates robust cloud architecture capable of handling high volumes of data traffic and ensuring minimal latency for real-time remote operations. Furthermore, sustained efforts are directed toward incorporating advanced, multi-modal authentication methods. While keypads and mobile apps remain standard, the integration of reliable biometric technology, such as improved capacitance fingerprint sensors and facial recognition systems, is becoming a key differentiator, particularly in high-security commercial and luxury residential segments, aiming to enhance security layering and user convenience simultaneously.

From a geographical perspective, the market landscape is clearly segmented. North America and Europe, characterized by highly mature smart infrastructure and high consumer willingness to pay for premium technological integration, maintain market dominance in terms of overall revenue generation. These regions benefit from established retail distribution networks and widespread compatibility with major smart home standards. However, the future growth trajectory is increasingly centered on the Asia Pacific (APAC) region. Rapid economic expansion, coupled with unprecedented levels of urbanization and state-backed investment in smart city infrastructure across major economies like China, India, and Southeast Asia, positions APAC as the fastest-growing market globally. This expansion is often characterized by high volumes of multi-unit residential installations and a greater preference for mobile-centric access solutions that integrate with local digital identity and payment systems.

In terms of segmentation, the residential sector remains the largest revenue contributor, driven by individual household adoption motivated by convenience. Nevertheless, the commercial segment—specifically hospitality, property management (PropTech), and the logistics sector—is forecast to achieve the highest Compound Annual Growth Rate (CAGR). This acceleration is fueled by the critical need for scalable, centralized access management that minimizes human error and reduces operational overhead. Technological trends across all segments emphasize hybrid solutions that mitigate the reliability risks associated solely with WiFi, often incorporating secondary communication protocols like Z-Wave or Zigbee, or maintaining a reliable mechanical key override. This dual-technology approach addresses consumer apprehension regarding connectivity failure and power loss, positioning highly reliable, robust solutions as prerequisites for market success and long-term customer trust.

AI Impact Analysis on WiFi Smart Lock Market

User engagement concerning Artificial Intelligence (AI) in the WiFi Smart Lock sector is driven by a deep desire for security that is not only robust but also predictive and seamlessly invisible. The most common questions fielded by manufacturers relate to how AI can move beyond simple automation to genuine threat detection. Users are keenly interested in features that allow the lock to "learn" the difference between an ordinary family member arriving and a suspicious presence loitering, asking if algorithms can analyze gait, timing, and sequence of events to preemptively flag abnormal activity. This expectation highlights a market demand for sophisticated machine learning models applied to access control data, designed to minimize the plague of false positives often associated with simple motion detection systems while providing proactive alerts based on contextual understanding of household routines. The integration of deep learning models in facial recognition hardware is expected to enhance verification speed and accuracy, even under varying light conditions or partial obstructions, significantly improving the keyless entry experience.

Furthermore, AI plays a pivotal role in optimizing device performance, addressing a critical pain point in WiFi-enabled security devices: power consumption. Consumers frequently ask how AI can extend battery life given the power demands of constant WiFi polling. The answer lies in sophisticated AI-driven power management systems that analyze historical usage patterns—such as locking/unlocking frequency, peak usage times, and user proximity events—to intelligently schedule connection wake-up cycles and transmission bursts. This adaptive power management drastically reduces unnecessary continuous connectivity, thereby maximizing device uptime and minimizing maintenance inconvenience. Manufacturers are leveraging edge AI processing, wherein the intelligent decision-making occurs directly on the lock’s embedded chip rather than relying entirely on cloud processing. This shift improves responsiveness, dramatically cuts down on latency, and critically, addresses user concerns about the privacy of sensitive biometric and behavioral data, ensuring that raw data remains localized and only anonymized metrics are sent to the cloud.

The strategic deployment of AI enables manufacturers to offer truly personalized access experiences. For commercial applications, especially short-term rentals, AI algorithms can dynamically adjust access permissions based on complex factors like booking duration, guest reputation scores, and cross-referencing against local security advisories, thus streamlining property management logistics. In the residential market, AI facilitates adaptive user profiles, where access parameters might change based on time of day (e.g., allowing a child entry only after school hours) or detected environmental conditions (e.g., auto-locking upon detecting a sudden drop in ambient temperature indicating a possible opened window). This comprehensive application of AI transforms the smart lock into an intelligent gatekeeper, continuously refining its security posture and operational efficiency, thereby cementing its central role in the next generation of smart security ecosystems and raising consumer expectations for all IoT security devices.

- AI-Enhanced Behavioral Biometrics: Utilization of deep learning for improved recognition accuracy under varied conditions and enhanced fraud detection based on access sequence analysis.

- Predictive Security Analytics: Algorithms analyzing temporal and behavioral access logs to identify anomalies and potential security risks in real-time, significantly reducing false alarms.

- Adaptive Access Control: AI learning user patterns to dynamically adjust locking/unlocking schedules, personalize access times, and optimize device performance automatically based on context.

- Edge Computing Implementation: Processing biometric and sensitive behavioral data locally on the device to minimize cloud dependency, reduce latency, and substantially enhance user privacy protection.

- Optimized Power Management: Using machine learning to regulate WiFi module usage and scheduling, intelligently extending battery life by predicting usage windows.

DRO & Impact Forces Of WiFi Smart Lock Market

The market dynamics of the WiFi Smart Lock sector are being powerfully propelled by critical technological and societal drivers. A primary driver is the pervasive and rapid expansion of the smart home ecosystem globally, which is creating a symbiotic need for seamlessly interconnected security devices. As consumers increasingly adopt voice assistants and central hubs for managing their homes, the demand for interoperable locks that integrate effortlessly into platforms like Google Home, Amazon Alexa, and Apple HomeKit becomes non-negotiable. Furthermore, the rising awareness and prioritization of personal security, juxtaposed with the convenience offered by keyless entry and remote monitoring, accelerate consumer willingness to upgrade traditional mechanical security. The expansion of the short-term rental industry globally also acts as a potent catalyst, as these operations require centralized, scalable, and instant access control management to handle dynamic guest turnovers efficiently, making WiFi locks an essential business tool.

Despite strong market momentum, several significant restraints challenge widespread adoption. Chief among these is persistent consumer skepticism regarding the cybersecurity resilience of IoT devices. High-profile hacking incidents and data breaches fuel user apprehension regarding the safety of personal data and the risk of unauthorized remote access, requiring manufacturers to continuously invest heavily in demonstrating end-to-end encryption and compliance with global security standards. Operational constraints are also a factor; the inherent power demands of WiFi connectivity mean smart locks often require frequent battery replacements, which presents a convenience hurdle compared to passive mechanical locks. Moreover, performance reliability is tied directly to the quality of the home Wi-Fi network; instability or low signal strength can render the smart lock functionally useless or significantly degrade response time, leading to user frustration and limiting penetration in regions with underdeveloped broadband infrastructure.

Opportunities for market differentiation and expansion are abundant. The transition to advanced telecommunication standards, particularly the rollout of 5G networks, presents an opportunity to overcome current latency issues, enabling instantaneous communication and boosting reliability. This infrastructure improvement will unlock more sophisticated, real-time cloud-based monitoring and analytics services. Furthermore, market expansion into the commercial realm, especially in highly regulated sectors like healthcare facilities and corporate campuses, represents a lucrative opportunity, contingent on developing products that meet strict commercial security standards (e.g., fire rating, heavy-duty durability). Leveraging strategic alliances with insurance providers to offer discounted premiums for homes protected by certified smart locks could also broaden the mass market appeal, positioning smart locks as components of a comprehensive risk mitigation strategy.

The market structure is also shaped by powerful impact forces. Intense price pressure, primarily from highly efficient Asian manufacturing bases, forces established Western brands to differentiate aggressively through superior industrial design, proprietary software features, and premium materials, necessitating continuous R&D investment. Regulatory harmonization, particularly the push for unified global cybersecurity standards for IoT devices, is forcing manufacturers to standardize security protocols, benefiting consumers but increasing compliance costs for smaller players. Finally, the societal impact of convenience versus security remains a force: the perception that a highly convenient product (remote unlock) might inherently be less secure than a traditional mechanism requires ongoing consumer education and marketing efforts focused on trust, reliability, and robust redundancy features (e.g., guaranteed mechanical key override capability).

Segmentation Analysis

A comprehensive segmentation analysis of the WiFi Smart Lock market reveals diverse consumer needs and competitive landscapes across various dimensions. Segmentation by Product Type is foundational, with deadbolts commanding the highest market share due to their widespread use as primary security measures in residential settings, often installed on main entry doors. These products emphasize mechanical durability and robust anti-tamper features, alongside their electronic functionalities. Lever locks, conversely, cater to internal doors, low-security applications, or specific commercial environments where high-traffic flow requires quick engagement. Analyzing these product types allows manufacturers to allocate resources effectively, focusing R&D on materials science for deadbolts and on miniaturization and battery optimization for all form factors, particularly padlocks used in utility or storage environments.

The segmentation by Access Mechanism is critical in defining user experience and security levels. While keypads offer a low-cost, reliable form of access, the segment dominated by Mobile App access (leveraging Bluetooth for proximity and WiFi for remote control) is experiencing the fastest expansion, driven by smartphone ubiquity. The Biometric segment, including advanced fingerprint and facial recognition systems, while currently smaller due to higher initial costs, is highly promising, particularly in high-security commercial and luxury residential sectors where the speed and layered security of biometrics are valued. The ability of a smart lock to offer multiple redundant access methods—combining biometrics, mobile control, and a physical key override—is now a key purchasing criterion, demonstrating system reliability even during power outages or network failures.

End-User segmentation clearly delineates distinct buying cycles and requirements. The Residential segment is motivated by individual convenience, home integration, and ease of DIY installation. Conversely, the Commercial segment, encompassing hospitality, property management (PropTech), and corporate offices, is driven by the need for scalability, centralized cloud management dashboards, regulatory compliance, and robust integration with existing Building Management Systems (BMS). The commercial sector requires enterprise-grade durability and sophisticated user provisioning capabilities far exceeding typical residential needs, thereby demanding specialized product lines. Finally, segmentation by Technology Standard distinguishes between WiFi-Only locks, often favored for their simplicity, and Hybrid Locks (WiFi + Z-Wave/Zigbee), which offer enhanced interoperability with wider smart home networks and act as a reliable fallback connectivity option, addressing critical concerns about network reliability and ensuring uninterrupted service.

- By Product Type:

- Deadbolts

- Lever Locks

- Padlocks

- Others (Rim Locks, Mortise Locks)

- By Access Mechanism:

- Keypad

- Biometrics (Fingerprint, Facial Recognition)

- Mobile App (Bluetooth/WiFi)

- Traditional Key Override

- By End-User:

- Residential (Single-family Homes, Multi-family Units)

- Commercial (Hospitality, Retail, Enterprise, Short-Term Rentals)

- By Technology Standard:

- WiFi-Only Locks

- Hybrid Locks (WiFi + Z-Wave/Zigbee)

- By Region:

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Value Chain Analysis For WiFi Smart Lock Market

The upstream segment of the WiFi Smart Lock value chain is highly dependent on specialized high-technology component sourcing, making strategic supplier relationships paramount. This stage involves the procurement of highly specific raw materials, including aerospace-grade metal alloys for durability, and specialized electronic components such as customized low-power IoT microprocessors (MCU), WiFi modules, and precision sensors for biometric readers. A critical upstream challenge is securing a stable and cost-effective supply of energy-efficient chipsets, as battery performance is a key consumer metric. Manufacturers must also negotiate the complex geopolitical landscape influencing semiconductor supply chains. The success in the upstream segment directly determines the final product's cost structure, energy efficiency, and overall reliability, making supplier diversification and long-term contracts vital for mitigating risk and maintaining competitive pricing in a volatile commodity market.

The midstream stage is defined by advanced manufacturing and intensive software development, where the intellectual property value is significantly generated. Manufacturing involves the precise integration of complex mechanical hardware with delicate electronic printed circuit boards (PCBs) and wiring harnesses. This process demands stringent quality control and highly automated assembly processes to ensure tolerances are met for both the lock mechanism and the electronics housing, especially given the necessary compact designs. Parallelly, the development of proprietary firmware and user-facing mobile applications is crucial. Value is created through secure coding practices, ensuring end-to-end encryption, and developing highly intuitive user interfaces. Regulatory compliance testing, including shock resistance, anti-drilling standards, and connectivity certification (FCC, CE), is integral at this stage, adding substantial value by guaranteeing product safety and market entry readiness across diverse geographies.

Downstream activities focus on effective channel distribution and post-sales support, crucial for consumer satisfaction and market reputation. Distribution utilizes a multi-pronged approach: Direct-to-Consumer (DTC) sales via major e-commerce platforms (Amazon, proprietary websites) allow for higher margins and direct customer data capture. Indirect channels involve partnerships with large brick-and-mortar home improvement retailers (e.g., Home Depot, Lowes), which provide the essential physical presence required for consumers to examine the product before purchase. Furthermore, the specialized channel of professional security integrators and locksmiths remains critically important for commercial installations and complex residential systems, as they provide high-touch service, installation guarantees, and integration into broader security ecosystems. Post-sales support, encompassing mandatory Over-The-Air (OTA) firmware updates to patch security flaws and dedicated technical support, is a non-negotiable value addition that sustains brand loyalty and competitive standing over the product lifecycle.

WiFi Smart Lock Market Potential Customers

The heterogeneous customer base for WiFi Smart Locks is segmented by core motivations: convenience, security, and operational efficiency. The residential market, comprising affluent early adopters and mainstream families, seeks advanced convenience features such as geo-fencing capabilities that automatically unlock doors upon arrival and remote access for unexpected deliveries or family needs. Within multi-family housing units, property managers are key customers, driven by the need to streamline tenant turnover processes, instantly revoke digital keys, and manage access for maintenance staff across hundreds of units using a single centralized dashboard, viewing the technology as a long-term cost-saving solution rather than merely a security upgrade.

The commercial sector features specialized buyers. Hospitality clients, ranging from large hotel chains to boutique lodgings, prioritize seamless guest experience through mobile check-in capabilities and cost savings by eliminating traditional key card expenses and management overhead. Short-Term Rental operators constitute a high-volume buying segment, where the speed and reliability of remote access code generation are paramount to business continuity and customer satisfaction ratings. Furthermore, small to medium enterprises (SMEs) are increasingly adopting these systems for enhanced employee access control, valuing the flexibility of managing permissions based on role and time, making simple installation and low maintenance requirements pivotal purchase criteria.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.8 Billion |

| Market Forecast in 2033 | USD 6.2 Billion |

| Growth Rate | 19.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | August Home (Assa Abloy), Schlage (Allegion), Yale (Assa Abloy), Kwikset (Spectrum Brands), Wyze Labs, Eufy Security (Anker Innovations), Shenzhen Kaadas Technology, U-tec Group, Sesame Smart Lock (CANDY HOUSE), Latch, RemoteLock, Lockly, Ring (Amazon), Google Nest, Xiaomi, Sifely Smart Lock, Salto Systems, Danalock, Ultraloq, Samsung SDS. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

WiFi Smart Lock Market Key Technology Landscape

The technological foundation of the WiFi Smart Lock market is built on robust, energy-efficient connectivity and impenetrable security protocols. Central to the operation is the adoption of highly efficient low-power WiFi standards (such as 802.11 b/g/n, optimized for IoT), integrated with sophisticated power management ICs (Integrated Circuits) that allow the device to "wake up" quickly, transmit data, and revert to a deep sleep state to conserve battery life. This optimization is non-trivial, requiring custom firmware that intelligently prioritizes essential communication while suppressing superfluous network activity. Security is implemented through mandatory end-to-end encryption, often utilizing industry-standard TLS/SSL protocols for cloud communication, coupled with physical security features like secure key storage (SE) and tamper-proof hardware modules that protect encryption keys from physical extraction attempts, addressing the critical concern of data vulnerability.

A major development in the current technological landscape is the increasing adoption of Hybrid Connectivity Solutions. While WiFi provides the necessary reach for remote control via the internet, manufacturers are integrating complementary low-power technologies like Bluetooth Low Energy (BLE) for rapid proximity-based unlocking and Z-Wave or Zigbee to ensure integration into broader mesh networks. This hybrid approach enhances device reliability, provides a critical fail-safe mechanism if the primary WiFi network fails, and improves integration with diverse smart home hubs. Furthermore, the industry is aligning with global standards such as Matter (an application layer standard built on protocols like Thread and WiFi) to ensure future-proof interoperability and minimize fragmentation, which historically has hampered consumer adoption of connected security devices.

The future technology trajectory is heavily focused on enhancing human-device interaction through advanced sensory inputs. This includes the deployment of high-resolution biometric sensors coupled with deep learning algorithms for rapid, accurate, and spoof-resistant authentication across various access modalities. Specifically, advancements in capacitive fingerprint sensors capable of reading subsurface dermal patterns and near-infrared facial recognition are key differentiators. Furthermore, the importance of Over-The-Air (OTA) updates cannot be overstated. A robust OTA infrastructure, protected by secure boot protocols to ensure the firmware installed is legitimate and untampered, is critical for rapid deployment of security patches, making it a foundational technology element for maintaining consumer trust and adhering to emerging regulatory requirements for ongoing IoT device security maintenance throughout the product's lifespan.

Regional Highlights

Regional dynamics play a crucial role in shaping the demand, product specifications, and competitive strategies within the WiFi Smart Lock market. North America, particularly the United States, stands as the commercial epicenter, characterized by a high volume of tech-savvy early adopters and a mature, competitive ecosystem dominated by major players like Assa Abloy and Allegion. Adoption rates are exceptionally high in urban and suburban environments due to widespread infrastructure supporting high-speed internet and the prevalence of DIY consumer electronics installation culture. Key drivers include high disposable income allocated towards home automation and the rapid acceptance of platforms that manage short-term property rentals, which rely heavily on remote access control for efficiency and guest management. Furthermore, the strong presence of influential technology retailers ensures broad market visibility and accessibility for new products, reinforcing the region's market leadership in revenue generation.

The European market exhibits distinct characteristics influenced heavily by regional security standards and regulatory requirements. Countries such as Germany, the UK, and France show high demand, but manufacturers must adhere to stringent physical security certifications, such as CEN (European Committee for Standardization) grades, which often necessitate product modifications compared to North American counterparts. GDPR regulations impose strict constraints on the handling and storage of personal data, pushing manufacturers toward edge processing for biometric data and demanding transparent consent mechanisms. The market is also driven by energy efficiency concerns, favoring locks that utilize robust power management techniques. While generally slower in initial adoption compared to the US, Europe demonstrates a strong preference for premium, high-reliability products that seamlessly integrate into existing historical building architectures without aesthetic compromise.

The Asia Pacific (APAC) region is indisputably the high-growth frontier, poised for explosive expansion over the forecast period. This growth is underpinned by unprecedented rates of urbanization, a massive increase in middle-class purchasing power, and vast governmental investments in future-focused smart city infrastructure (e.g., in Singapore, South Korea, and China). APAC is inherently a mobile-first market, often bypassing traditional computing models, leading to a high reliance on smartphone-based access and seamless integration with local super-apps and digital payment systems. The market is highly price-sensitive and volume-driven, encouraging fierce competition and rapid technological deployment, often resulting in quicker feature adoption (such as sophisticated facial recognition systems) in high-density multi-family residential complexes than seen in Western markets. The potential in India and Southeast Asia for mass adoption, contingent on improving infrastructure reliability and reducing unit costs, marks APAC as the strategic focus for long-term global market dominance.

- North America: Market leader due to high smart home penetration, affluent consumer base, and strong adoption in the short-term rental economy; focus on ecosystem compatibility (e.g., Apple HomeKit, Google Home).

- Europe: Strong emphasis on high-security certifications (e.g., CEN standards) and compliance with stringent data protection laws (GDPR); growing adoption driven by energy efficiency and premium features.

- Asia Pacific (APAC): Highest growth rate driven by smart city initiatives, rapid urbanization, and competitive pricing strategies; strong adoption in high-density multi-family units and integrating with local digital identity solutions.

- Latin America & MEA: Emerging markets driven by premium real estate, commercial security upgrades in major economic hubs, and infrastructure development projects; growth concentrated in major metropolitan areas.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the WiFi Smart Lock Market.- August Home (Assa Abloy)

- Schlage (Allegion)

- Yale (Assa Abloy)

- Kwikset (Spectrum Brands)

- Wyze Labs

- Eufy Security (Anker Innovations)

- Shenzhen Kaadas Technology

- U-tec Group

- Sesame Smart Lock (CANDY HOUSE)

- Latch

- RemoteLock

- Lockly

- Ring (Amazon)

- Google Nest

- Xiaomi

- Sifely Smart Lock

- Salto Systems

- Danalock

- Ultraloq

- Samsung SDS

Frequently Asked Questions

Analyze common user questions about the WiFi Smart Lock market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected Compound Annual Growth Rate (CAGR) for the WiFi Smart Lock Market?

The WiFi Smart Lock Market is anticipated to experience robust growth, projected at a CAGR of 19.5% between the forecast period of 2026 and 2033, driven by increasing IoT adoption and global residential and commercial security modernization efforts.

What are the primary security concerns associated with WiFi Smart Locks?

The main security concerns involve vulnerability to hacking (remote access exploitation), data privacy breaches concerning biometric or usage data, and the risk of unauthorized access due to poor network security protocols or outdated firmware. Manufacturers address these with strong AES 128-bit encryption, hardware hardening, and mandatory Over-The-Air (OTA) security updates.

Which end-user segment is currently dominating the WiFi Smart Lock market?

The Residential segment currently holds the largest market share, fueled by high consumer demand for convenience, keyless entry, remote access capabilities, and seamless integration with established smart home ecosystems like Amazon Alexa and Google Home for unified device control.

How is Artificial Intelligence (AI) influencing the functionality of smart locks?

AI is transforming smart lock functionality through predictive security analytics, identifying unusual access patterns, enhancing the accuracy of biometric recognition through deep learning, and optimizing battery consumption by intelligently managing wireless communication cycles based on learned user schedules (adaptive power management).

Which geographical region exhibits the fastest growth potential in this market?

The Asia Pacific (APAC) region is projected to register the fastest growth rate, attributed to massive governmental investments in smart city infrastructure, rapid urbanization, and a high consumer acceptance rate of mobile-first access technologies, particularly in China and Southeast Asia.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager