Wind Automation Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434946 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Wind Automation Market Size

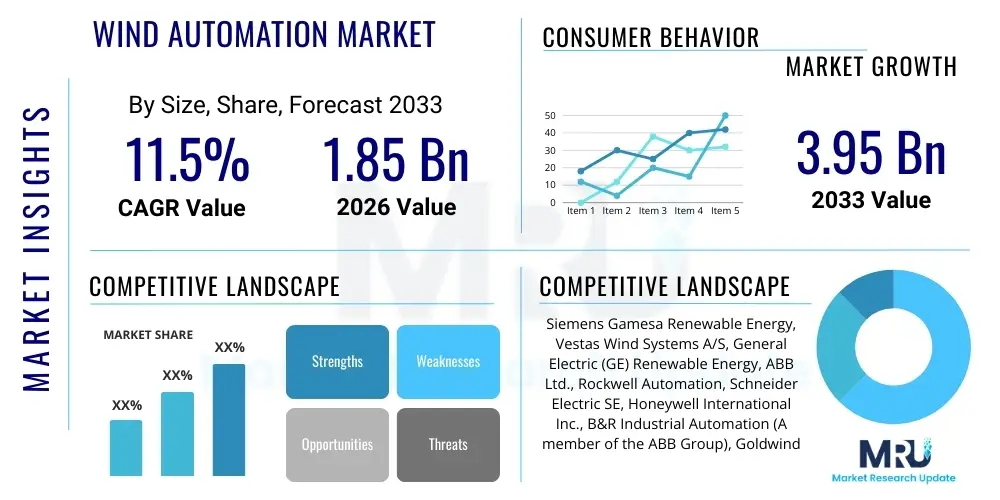

The Wind Automation Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 11.5% between 2026 and 2033. The market is estimated at USD 1.85 Billion in 2026 and is projected to reach USD 3.95 Billion by the end of the forecast period in 2033.

Wind Automation Market introduction

The Wind Automation Market encompasses the integration of sophisticated control systems, supervisory control and data acquisition (SCADA) platforms, advanced sensors, and intelligent software solutions designed to optimize the performance, reliability, and maintenance of wind farms. This market addresses the increasing demand for higher energy yields and reduced operational expenditures (OPEX) across both onshore and offshore wind installations. Wind automation systems utilize data acquisition and processing capabilities to monitor turbine health in real-time, implement precise pitch and yaw control mechanisms, and manage grid connectivity effectively, thereby maximizing the asset lifetime and energy production potential of utility-scale wind projects.

Product descriptions within this domain include hardware components such as advanced controllers, condition monitoring systems (CMS), programmable logic controllers (PLCs), and edge computing devices, complemented by complex software platforms. Major applications span across the full lifecycle of a wind asset, from initial installation and commissioning to continuous operation, fault detection, and eventual decommissioning planning. The primary benefits of adopting comprehensive automation solutions include enhanced turbine reliability, a reduction in unplanned downtime through predictive maintenance, improved compliance with grid codes, and ultimately, a substantial increase in the capacity factor (CF) of the wind farm, making renewable energy generation more economically competitive.

Driving factors propelling this market involve global governmental mandates favoring renewable energy adoption, significant advancements in sensor technology making data collection more accurate and affordable, and the crucial need for sophisticated grid management tools as the penetration of intermittent wind energy sources increases within national power grids. Furthermore, the expansion into complex offshore environments demands robust, reliable, and often remote automation capabilities to manage assets in challenging logistical conditions, solidifying the necessity for high-level automation systems.

Wind Automation Market Executive Summary

The Wind Automation Market is characterized by a rapid integration of digital technologies, driven primarily by the global shift towards maximizing renewable energy asset performance. Key business trends include the consolidation of automation providers offering end-to-end solutions, the increasing adoption of cloud-based SCADA systems replacing traditional on-premise infrastructure, and a strong focus on cybersecurity standards tailored specifically for energy infrastructure. Business models are evolving to include performance-based service contracts, where automation vendors guarantee certain operational improvements, shifting the financial risk profile and accelerating technology adoption among Independent Power Producers (IPPs) and utility companies globally.

Regionally, Asia Pacific (APAC), particularly China and India, represents the fastest-growing market segment, fueled by massive national targets for renewable energy capacity expansion and corresponding investments in large-scale onshore wind farms requiring extensive automation infrastructure. North America and Europe maintain dominance in terms of technology maturity and adoption of advanced solutions such as Digital Twins and Artificial Intelligence (AI) for deep optimization. European markets, especially those involved in the North Sea and Baltic Sea projects, are leading the demand for highly resilient offshore automation and monitoring systems, necessitating specialized solutions capable of deep-sea connectivity and autonomous operation.

Segment trends indicate a pronounced pivot towards the software and services component of the market, surpassing the growth rate of pure hardware components. Within segmentation by type, pitch control systems and turbine control units (TCUs) remain core hardware elements, but the most transformative growth is seen in Asset Performance Management (APM) software platforms utilizing predictive analytics. Furthermore, the market is experiencing strong demand for retrofitting existing wind farms (repowering and life extension projects) with modern automation packages, creating a sustainable service stream alongside new capacity installations.

AI Impact Analysis on Wind Automation Market

User inquiries regarding AI's influence in the Wind Automation Market frequently center on its ability to transcend traditional reactive maintenance models, specifically asking how AI can truly optimize energy production in real-time under variable weather conditions. Key user themes involve concerns about data quality and standardization needed for effective AI algorithms, the ROI of implementing complex machine learning models versus simpler control heuristics, and the impact of AI on workforce requirements, particularly concerning remote monitoring and fault diagnosis. There is a strong expectation that AI will unlock unparalleled levels of efficiency, making highly volatile power sources manageable and predictable, integrating seamlessly into smart grid architectures.

The application of Artificial Intelligence, specifically Machine Learning (ML) algorithms, is fundamentally transforming operational strategies in wind power generation. AI models analyze massive historical and real-time data streams—including meteorological conditions, operational telemetry (vibration, temperature, power output), and component wear rates—to create high-fidelity digital twins of individual turbines and entire farms. This predictive capability allows operators to schedule maintenance precisely when degradation begins, minimizing costly failures and significantly reducing turbine downtime, a factor crucial for maximizing overall return on investment (ROI).

Furthermore, AI facilitates advanced control optimization, moving beyond fixed operational curves. Machine learning models can dynamically adjust turbine parameters (such as pitch angle and yaw alignment) multiple times per second based on instantaneous wind shear and turbulence readings, ensuring the turbine operates at its maximum power coefficient (Cp) across a wider range of environmental states. This level of optimization, known as ‘intelligent control’ or ‘wake steering,’ is impossible using conventional control systems and results in substantial marginal gains in Annual Energy Production (AEP), positioning AI as a critical enabler for maximizing the profitability of modern wind assets.

- Real-time Production Optimization: AI algorithms dynamically adjust turbine settings (pitch, yaw) to maximize power capture under varying environmental conditions.

- Predictive Maintenance (PdM): Machine learning identifies subtle operational anomalies weeks or months before component failure, drastically reducing unplanned downtime.

- Digital Twin Development: AI facilitates the creation and calibration of highly accurate virtual replicas for simulation, testing, and lifecycle management.

- Enhanced Cybersecurity: AI-driven anomaly detection monitors network traffic and operational data patterns to identify and mitigate cyber threats targeting SCADA systems.

- Wake Steering Control: Optimized control strategies minimize aerodynamic interference between turbines within a farm, boosting overall fleet efficiency.

DRO & Impact Forces Of Wind Automation Market

The Wind Automation Market is primarily driven by the imperative to reduce the Levelized Cost of Energy (LCOE) for wind power, making it competitive with fossil fuels. Restraints include the high initial capital expenditure (CAPEX) required for sophisticated digital infrastructure and the acute shortage of skilled personnel capable of managing complex automation and data analytics systems. Opportunities are vast, focused on leveraging the untapped potential of retrofitting existing aging fleets with modern automation and expanding specialized solutions for the rapidly growing offshore market. The major impact force is the regulatory pressure imposed by national governments and international bodies demanding grid stability and higher reliability standards for intermittent renewable energy sources, thereby forcing operators to adopt advanced control and forecasting automation technologies.

Specific drivers include the significant technological improvements in sensor accuracy and data transmission speeds (facilitated by 5G and edge computing), which provide the foundation necessary for complex automation decision-making. The increasing turbine size and capacity, especially in offshore projects, elevate the financial consequences of equipment failure, thus increasing the financial justification for investment in robust monitoring and automation systems. Conversely, a major restraint is data fragmentation; many older wind farms utilize proprietary or siloed data acquisition systems, making the seamless integration required for holistic automation solutions challenging and costly.

Key opportunities revolve around the development of standardized, open-source communication protocols that can bridge the gap between different vendor hardware and software components, promoting interoperability and accelerating innovation. Furthermore, the convergence of operational technology (OT) and information technology (IT) systems offers automation providers a chance to deliver integrated enterprise solutions that link field operations directly to business planning and asset financing. The impact forces are continually reshaping the market landscape, pushing automation from a desirable feature to a fundamental requirement for securing project financing and maintaining operational licenses in competitive energy markets.

Segmentation Analysis

The Wind Automation Market is comprehensively segmented based on the component type, application area, deployment location, and the specific technology utilized for control and monitoring. Component segmentation differentiates between the physical hardware devices necessary for field operations and the sophisticated software platforms required for data processing and supervisory control. Application segmentation highlights the critical functions, such as pitch control, yaw control, and condition monitoring, while deployment segmentation reflects the fundamental differences in automation needs between onshore and challenging offshore environments. This structured segmentation provides clarity on the diverse technological requirements and investment priorities across the wind energy sector.

- By Component:

- Hardware (Sensors, Controllers, PLCs, Data Acquisition Systems (DAS))

- Software & Services (SCADA Systems, Condition Monitoring Software, Predictive Maintenance Platforms, Cybersecurity Services)

- By Application:

- Turbine Control (Pitch Control, Yaw Control, Rotor Speed Control)

- Condition Monitoring and Diagnostics (Vibration Monitoring, Temperature Monitoring, Oil Analysis)

- Power Curve Optimization

- Grid Integration and Forecasting

- By Deployment:

- Onshore Wind Farms

- Offshore Wind Farms

- By Turbine Capacity:

- Below 2 MW

- 2 MW to 5 MW

- Above 5 MW

Value Chain Analysis For Wind Automation Market

The value chain for the Wind Automation Market begins with upstream suppliers providing specialized components such as advanced microcontrollers, industrial sensors (accelerometers, gyroscopes), and communication modules crucial for data acquisition. These raw components are procured by automation hardware manufacturers who develop robust industrial PCs, PLCs, and SCADA servers tailored for harsh wind turbine environments. Simultaneously, specialized software developers create proprietary algorithms and user interface platforms necessary for translating raw data into actionable insights for operational management. The early stage of the value chain is characterized by high R&D investment necessary to maintain technological superiority and comply with increasing industry standards for reliability and functional safety.

The midstream involves system integration, where automation solutions are customized and installed either directly into new turbine models by Original Equipment Manufacturers (OEMs) or retrofitted onto existing assets by specialized third-party integrators. This stage is critical as it involves the complex interface between the control system and the turbine's mechanical and electrical systems. Distribution channels are typically dual: Direct distribution occurs when major turbine OEMs integrate their proprietary automation packages as standard offerings, capturing a significant portion of the market for new installations. Indirect distribution utilizes specialized industrial distributors and system integration partners to reach independent operators and older wind farm assets requiring upgrades.

The downstream segment is dominated by the end-users—Wind Farm Owners and Operators (IPPs, Utilities)—who derive value through enhanced performance and reduced maintenance costs. This segment is heavily reliant on ongoing services, including software updates, remote monitoring, and data analytics consultation provided by the automation vendors or third-party service providers. The feedback loop from the downstream operation back to the upstream R&D is vital for continuous product improvement, especially concerning cybersecurity resilience and compatibility with evolving grid regulations.

Wind Automation Market Potential Customers

The primary customers for wind automation solutions are segmented into three major categories: Utility Companies, Independent Power Producers (IPPs), and Wind Turbine Original Equipment Manufacturers (OEMs). Utility companies, often state-owned or large private enterprises, purchase automation solutions to ensure grid reliability and manage the fluctuating input of large-scale wind power into the conventional grid infrastructure. Their purchasing motivations are centered on regulatory compliance, ensuring system stability, and integrating renewable assets seamlessly with fossil fuel and nuclear generation assets through sophisticated forecasting and control systems.

Independent Power Producers (IPPs) represent a crucial segment, prioritizing maximizing the financial return on their wind asset investments. IPPs seek cutting-edge automation systems that promise the highest Annual Energy Production (AEP) and the lowest operational expenditure (OPEX) over the asset's 20-25 year lifespan. They are often early adopters of advanced predictive maintenance software and digital twin technology, as the financial benefits of avoiding catastrophic failures and maximizing uptime directly impact their profitability and shareholder returns. Their purchasing decisions are heavily influenced by proven LCOE reduction metrics and vendor reputation for system reliability.

Wind Turbine OEMs, such as Vestas, Siemens Gamesa, and GE Renewable Energy, are often internal consumers of automation components, integrating them directly into their turbine control units (TCUs) before sale. They seek highly reliable, scalable, and standardized automation hardware and software that can be deployed globally. Additionally, a growing customer base includes asset managers and specialized operations and maintenance (O&M) service providers who purchase software platforms to manage portfolios of wind farms owned by diverse financial entities, focusing specifically on portfolio-level optimization and aggregated performance reporting.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.85 Billion |

| Market Forecast in 2033 | USD 3.95 Billion |

| Growth Rate | 11.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Siemens Gamesa Renewable Energy, Vestas Wind Systems A/S, General Electric (GE) Renewable Energy, ABB Ltd., Rockwell Automation, Schneider Electric SE, Honeywell International Inc., B&R Industrial Automation (A member of the ABB Group), Goldwind Science & Technology Co., Ltd., Nordex SE, Senvion GmbH (acquired assets), Moxa Inc., Beckhoff Automation, Bachmann electronic GmbH, Emerson Electric Co., Yokogawa Electric Corporation, Inductive Automation, OSIsoft (now Aveva Group plc), Winergy (Flender GmbH). |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Wind Automation Market Key Technology Landscape

The technological landscape of the Wind Automation Market is rapidly evolving, driven by the integration of Information Technology (IT) methods into Operational Technology (OT). Supervisory Control and Data Acquisition (SCADA) systems remain the foundational technology, providing centralized monitoring and remote control capabilities for wind farms. However, modern SCADA deployments are shifting from proprietary, isolated networks to cloud-based, distributed architectures that leverage industrial internet of things (IIoT) connectivity. This shift allows for the processing of significantly larger datasets and enables collaboration across multiple operational sites, transforming maintenance scheduling from a fixed calendar event to a data-driven, predictive activity.

A critical emerging technology is the Digital Twin, which is a virtual representation of a physical wind turbine or farm. Digital Twins use real-time sensor data, historical performance logs, and physics-based models to simulate operational behavior and predict future states. This allows operators to test optimization strategies (e.g., control adjustments, component replacements) in a virtual environment before deployment, significantly reducing risk and maximizing the efficacy of automation interventions. Furthermore, the convergence of edge computing capabilities—placing data processing closer to the turbine controller—is enabling faster decision-making and autonomous response to minor faults without reliance on central SCADA intervention, increasing system robustness.

Condition Monitoring Systems (CMS), primarily relying on advanced sensor fusion technologies (combining vibration, acoustic, and thermal data), are becoming more intelligent. The latest generation of CMS is leveraging machine learning to filter out operational noise and accurately identify incipient component failures, particularly in gearboxes and main bearings, which are critical high-cost components. Other pivotal technologies include advanced control algorithms for wake steering, using lidar and radar systems to measure inflow wind characteristics, and advanced cybersecurity tools specifically designed to protect SCADA networks from sophisticated cyber-physical attacks, recognizing the critical infrastructure status of wind assets.

Regional Highlights

- Asia Pacific (APAC): Expected to exhibit the highest CAGR due to massive build-out programs in China, India, and Australia. China leads in sheer volume of installed automation capacity, driven by national energy goals and local technology providers.

- Europe: A mature market characterized by high technology adoption, particularly in offshore automation (North Sea, Baltic Sea). Europe leads in implementing advanced AI control systems and stringent grid integration standards, driving demand for sophisticated forecasting and control software.

- North America: A significant early adopter of SCADA and condition monitoring solutions, primarily driven by the U.S. Production Tax Credit (PTC) cycle and repowering efforts. The market is defined by strong demand for retrofit automation solutions and cybersecurity enhancement services for aging infrastructure.

- Latin America: Emerging market with strong growth in Brazil and Mexico. The focus here is on foundational automation—reliable SCADA and basic turbine control systems—to manage large, remote onshore wind farms effectively.

- Middle East and Africa (MEA): A high-potential region with Saudi Arabia, the UAE, and South Africa investing heavily in renewable energy diversification. The automation market is focused on robust systems designed to withstand harsh desert and coastal operating environments.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Wind Automation Market.- Siemens Gamesa Renewable Energy

- Vestas Wind Systems A/S

- General Electric (GE) Renewable Energy

- ABB Ltd.

- Rockwell Automation

- Schneider Electric SE

- Honeywell International Inc.

- B&R Industrial Automation (A member of the ABB Group)

- Goldwind Science & Technology Co., Ltd.

- Nordex SE

- Moxa Inc.

- Beckhoff Automation

- Bachmann electronic GmbH

- Emerson Electric Co.

- Yokogawa Electric Corporation

- Inductive Automation

- Aveva Group plc (formerly OSIsoft)

- Flender GmbH (Winergy)

- Trexel, Inc.

- DEIF A/S

Frequently Asked Questions

Analyze common user questions about the Wind Automation market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the adoption of advanced wind automation systems?

The primary driver is the necessity to reduce the Levelized Cost of Energy (LCOE) through increased efficiency and reduced operational expenditures (OPEX). Advanced automation maximizes Annual Energy Production (AEP) by optimizing control systems and minimizes downtime through sophisticated predictive maintenance (PdM) capabilities.

How does the integration of AI specifically benefit wind farm profitability?

AI benefits profitability by enabling real-time, dynamic control optimization (wake steering) to increase energy capture and by powering predictive maintenance platforms. These platforms forecast component failures, allowing repairs to be scheduled proactively, thereby minimizing catastrophic failures and high-cost, unscheduled downtime.

What are the main technological challenges faced by the offshore wind automation segment?

Offshore wind automation faces challenges related to extreme environmental conditions, ensuring reliable deep-sea communications, high cybersecurity demands for remote assets, and the need for systems with enhanced resilience and long Mean Time Between Failures (MTBF) due to difficult logistical access for maintenance.

Which component segment holds the largest market share in wind automation?

The Software and Services segment is projected to hold the largest market share and exhibit the fastest growth. This is due to the increasing demand for advanced SCADA platforms, specialized Asset Performance Management (APM) software, and data analytics tools required to manage complex digital wind farms efficiently.

Is the Wind Automation Market dominated by existing turbine OEMs or specialized third-party providers?

The market is characterized by a dual structure. Turbine OEMs (like Vestas and Siemens Gamesa) dominate new installations by offering integrated proprietary control systems. However, specialized third-party providers (like ABB, Rockwell, and dedicated software firms) are strongly positioned in the lucrative retrofit market and provide vendor-agnostic advanced monitoring software.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager