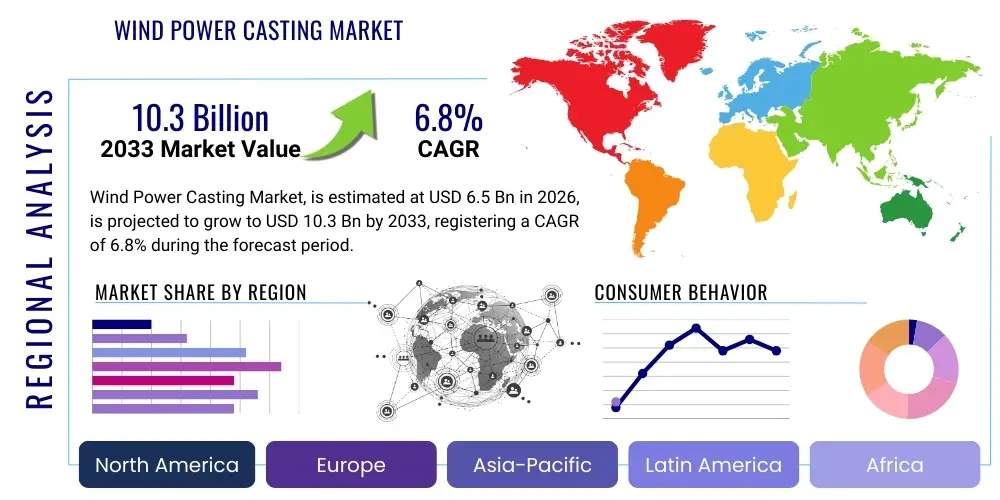

Wind Power Casting Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435844 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Wind Power Casting Market Size

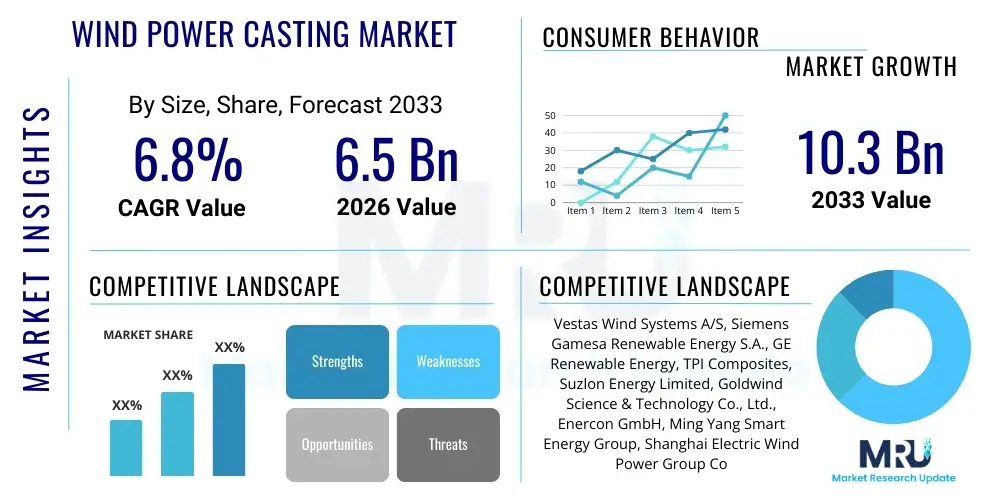

The Wind Power Casting Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 6.5 Billion in 2026 and is projected to reach USD 10.3 Billion by the end of the forecast period in 2033.

Wind Power Casting Market introduction

The Wind Power Casting Market encompasses the manufacturing and supply of critical metallic components used in wind turbine systems, primarily focusing on materials like gray iron, ductile iron, and specialized steel alloys. These large-scale, high-precision castings form the structural backbone of wind turbines, including crucial parts such as hubs, main frames, nacelle beds, bearing housings, and gearbox casings. The fundamental purpose of these components is to ensure the structural integrity, stability, and optimal operational performance of multi-megawatt wind turbines, both onshore and increasingly offshore. Given the immense forces and cyclical loads experienced by modern wind turbines, the demand for castings that offer superior mechanical properties, fatigue resistance, and dimensional accuracy is paramount, driving significant investment in advanced foundry technologies and quality control systems across the globe.

Major applications for wind power castings are concentrated in the rotor and powertrain assemblies. The main frame, often the largest single cast component, supports the entire nacelle structure and transfers operational loads to the tower. Hubs connect the turbine blades to the main shaft, requiring materials capable of handling extreme bending moments and tensile stresses. Product complexity in this market is continuously escalating due to the trend towards larger turbine capacities, pushing manufacturers to innovate in casting methods for components weighing upwards of 100 metric tons. These specialized castings benefit the wind energy sector by providing durable, heavy-duty solutions that maximize turbine uptime and minimize lifecycle maintenance costs, which is critical for achieving competitive Levelized Cost of Energy (LCOE) targets.

The market is predominantly driven by the accelerating global transition to renewable energy sources, bolstered by stringent governmental policies, ambitious decarbonization targets, and widespread public support for climate action. Furthermore, technological advancements in wind turbine design, particularly the development of larger, more powerful turbines (8 MW and above), necessitate corresponding innovations in casting materials and processes to handle increased loads and stresses. The expansion of offshore wind farms, which require significantly larger and more robust cast components capable of withstanding harsh marine environments, represents a major growth catalyst. These factors collectively establish a robust demand landscape for high-quality, reliable, and large-scale wind power castings throughout the forecast period.

Wind Power Casting Market Executive Summary

The Wind Power Casting Market is experiencing dynamic growth, fundamentally underpinned by the global energy transition and significant infrastructure investments in renewable capacity, particularly in the Asia Pacific and European regions. Current business trends indicate a strong move toward supply chain consolidation, where leading foundries are expanding their capacity and technological capabilities to produce ultra-large castings required for next-generation offshore wind turbines. Furthermore, there is a pronounced emphasis on sustainable manufacturing practices, including the use of recycled materials and energy-efficient casting processes, driven by ESG criteria imposed by major turbine OEMs and investors. This strategic shift necessitates foundries to adopt greater levels of automation and digitization to ensure traceability and maintain tight quality tolerances required for certification.

Regionally, Asia Pacific, led by China, remains the dominant hub for manufacturing and consumption, benefiting from robust domestic wind installation targets and a well-developed supply chain infrastructure capable of high-volume production. Europe, while a mature market, is witnessing resurgence driven primarily by large-scale offshore projects in the North Sea and Baltic Sea, demanding specialized, high-grade iron and steel castings for challenging environments. North America is showing accelerated growth momentum, fueled by supportive policy frameworks such as the Inflation Reduction Act (IRA) in the U.S., which encourages domestic manufacturing and incentivizes utility-scale wind farm development, leading to increased demand for locally sourced components and castings.

In terms of segmentation, the market for Ductile Iron Castings is expected to show superior growth compared to Gray Iron or Steel due to its desirable combination of strength, ductility, and cost-effectiveness suitable for highly stressed components like hubs and gearbox casings. The component segment is dominated by demand for Main Frames and Chassis, reflecting the continuous trend towards scaling up turbine size. Meanwhile, the Onshore Wind segment still holds the largest volume share, but the Offshore Wind segment is poised for the highest CAGR expansion, driven by the increasing financial viability and technological maturity of floating and fixed-bottom offshore projects globally. This dual focus on volume (onshore) and value (offshore) defines the strategic priorities of key market participants.

AI Impact Analysis on Wind Power Casting Market

User queries regarding AI's influence in the Wind Power Casting market center predominantly on three areas: enhancing casting quality assurance, optimizing complex foundry operations, and improving supply chain resilience. Users are keenly interested in how Artificial Intelligence and Machine Learning (ML) can move beyond traditional Non-Destructive Testing (NDT) to provide predictive quality analysis, identifying potential defects (such as porosity or inclusions) during the simulation phase or immediately post-casting using computer vision and sensor fusion. Furthermore, there is significant curiosity about using AI algorithms to manage the thermal profiles and cooling rates in large-scale sand molds, crucial steps that directly impact the metallurgical structure and final mechanical properties of critical components. This adoption is expected to drastically reduce scrap rates, optimize energy consumption in melting and heat treatment, and accelerate the validation and certification processes required by international standards organizations.

- AI-driven predictive maintenance modeling for casting machinery reduces unscheduled downtime and optimizes equipment lifespan.

- Machine learning algorithms analyze sensor data from pouring processes to predict and prevent casting defects, enhancing first-pass yield.

- Computer vision systems accelerate Non-Destructive Testing (NDT) by automating the detection and classification of surface and subsurface anomalies in massive components.

- AI optimizes the scheduling and logistics of heat treatment cycles, ensuring precise metallurgical properties are achieved consistently across batches.

- Generative design and topology optimization using AI aids engineers in designing lighter yet stronger casting geometries, reducing material usage.

- Predictive analytics enhance raw material procurement strategies, forecasting price fluctuations and optimizing inventory levels for specialized alloys.

DRO & Impact Forces Of Wind Power Casting Market

The market dynamics are governed by powerful drivers, significant restraints, and emerging opportunities, collectively defining the competitive landscape and strategic direction for stakeholders. The primary driver is the widespread governmental commitment to renewable energy targets, evidenced by supportive policies like feed-in tariffs, production tax credits, and renewable portfolio standards across major economies. These policies provide the long-term certainty necessary for large-scale investment in new wind farm capacity, directly translating to sustained demand for cast components. Simultaneously, the imperative for grid modernization and energy security, especially following recent geopolitical instabilities, further solidifies wind power’s role, thereby stabilizing and increasing the volume requirements for essential castings. The continuous decrease in the Levelized Cost of Energy (LCOE) for wind power, making it cost-competitive with conventional sources, serves as an underlying economic force propelling market expansion.

Restraints primarily revolve around the inherent complexities of manufacturing large, high-precision castings. Strict quality and certification requirements (e.g., DNV, Lloyds Register) necessitate extremely high initial capital expenditure for specialized foundry equipment and quality control instrumentation. Furthermore, fluctuations in raw material prices, particularly for high-grade iron ore and alloying elements (such as nickel and manganese), introduce volatility into manufacturing costs, challenging profit margins. The industry also faces technical constraints related to scaling up production for next-generation, multi-megawatt components, requiring highly skilled labor and facing limitations in current global machining capacity for these massive structures.

Opportunities are strongly concentrated in the rapidly growing offshore wind sector, especially in developing new markets like the US East Coast, Taiwan, and Vietnam. The shift toward floating offshore wind technology opens new design requirements for moorings and substructure castings. Technological opportunities arise from the adoption of advanced manufacturing techniques, such as additive manufacturing for complex tooling and molds, and the incorporation of Digital Twin technology for process simulation and optimization, which promises to enhance efficiency and reduce lead times. Moreover, strengthening localized supply chains to reduce geopolitical risk and improve logistics efficiency presents a significant long-term opportunity for market penetration and establishing regional dominance.

Segmentation Analysis

The Wind Power Casting Market is systematically segmented based on material type, component type, application (onshore versus offshore), and region, providing a granular view of market dynamics and growth potential across various dimensions. Understanding these segments is critical for manufacturers to tailor their production capabilities, investment strategies, and R&D efforts to meet specialized industry needs, particularly the differing demands of onshore and offshore projects. The segmentation highlights where technological innovation, capacity expansion, and high-value contracts are currently concentrated, allowing for focused market entry or expansion strategies.

- By Material Type:

- Gray Iron Castings

- Ductile Iron Castings

- Steel Castings (including nodular cast iron and specialized steel alloys)

- Others (e.g., lightweight composites)

- By Component Type:

- Main Frame and Chassis

- Hubs

- Bearing Housings

- Gearbox Casings

- Rotor Shafts

- Others (e.g., brake discs, pitch and yaw components)

- By Application:

- Onshore Wind Power

- Offshore Wind Power

- By Region:

- North America (U.S., Canada, Mexico)

- Europe (Germany, UK, Spain, France, Italy, Rest of Europe)

- Asia Pacific (China, India, Japan, South Korea, Rest of APAC)

- Latin America (Brazil, Argentina, Rest of LATAM)

- Middle East and Africa (MEA) (South Africa, UAE, Rest of MEA)

Value Chain Analysis For Wind Power Casting Market

The value chain for wind power castings is extensive and highly specialized, beginning with the upstream sourcing of raw materials, predominantly high-quality scrap metal, pig iron, and critical alloying elements required to achieve the desired mechanical properties (e.g., molybdenum, magnesium for ductile iron). Raw material quality control is the first critical checkpoint, as impurities directly impact the final structural integrity of the casting. Upstream suppliers are often globally diversified, meaning logistical efficiency and stable long-term contracts are essential for mitigating supply volatility and price risks, particularly given the large material quantities needed for multi-megawatt components.

The core manufacturing stage involves advanced foundry operations, including mold design (often using complex sand casting techniques), melting and pouring, cooling, and meticulous shakeout processes. This stage also encompasses downstream processing, which is highly cost-intensive: initial rough machining, heat treatments (stress relief and normalization), precision machining to meet tight tolerance specifications, and sophisticated surface coatings or painting for protection against corrosion (especially vital for offshore applications). Foundries typically invest heavily in robotics, specialized CNC machines capable of handling large components, and advanced Non-Destructive Testing (NDT) facilities, such as ultrasonic and magnetic particle inspection, to ensure compliance with stringent industry standards before shipment.

Distribution channels for wind power castings are predominantly direct, characterized by long-term, high-volume contracts between major foundries and large Wind Turbine Original Equipment Manufacturers (OEMs) like Vestas, Siemens Gamesa, and GE Renewable Energy. Indirect channels might involve specialized component suppliers or service companies that procure finished castings for refurbishment or specialized niche applications, but the bulk of the market moves directly from the caster to the OEM assembly plant. This direct sales model necessitates strong collaborative relationships, shared intellectual property regarding component design, and just-in-time delivery capabilities, highlighting the interconnectedness and strategic dependencies within the wind energy supply ecosystem.

Wind Power Casting Market Potential Customers

Potential customers in the Wind Power Casting Market are primarily the global leaders in wind turbine manufacturing, who require immense volumes of standardized, yet technically complex, cast components for their turbine assembly lines. These Original Equipment Manufacturers (OEMs) act as the primary buyers, demanding castings that meet rigorous international standards for fatigue life, durability, and dimensional accuracy, as component failure can lead to catastrophic turbine downtime and significant financial losses. The procurement process for these key customers is highly strategic, often involving multi-year contracts and partnerships with a select few certified Tier 1 foundries capable of meeting both quality and scale requirements globally.

Another significant segment of buyers includes specialized component integrators and Tier 2 suppliers that focus on specific turbine subsystems, such as gearboxes (e.g., manufacturers of planetary and main gears) or pitch systems. These customers purchase intermediate castings, which they further machine, assemble, and supply to the larger OEMs. They require highly specified materials and initial machining tolerances to minimize their own downstream processing costs. The trend towards modular design and localized content requirements in certain markets means these intermediate buyers play an increasingly important role in localized supply chains.

Furthermore, independent service providers (ISPs) and large utility owners operating extensive wind farm fleets represent a growing market segment for replacement and maintenance castings. While not high-volume buyers like OEMs, they require immediate availability of complex spare parts, particularly for aging turbines or components damaged in extreme weather events. This segment emphasizes rapid prototyping capabilities and quality control for smaller, custom batches. In essence, the customer landscape ranges from the massive, centralized demands of global OEMs to the specialized, on-demand needs of the maintenance and service sector.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 6.5 Billion |

| Market Forecast in 2033 | USD 10.3 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Vestas Wind Systems A/S, Siemens Gamesa Renewable Energy S.A., GE Renewable Energy, TPI Composites, Suzlon Energy Limited, Goldwind Science & Technology Co., Ltd., Enercon GmbH, Ming Yang Smart Energy Group, Shanghai Electric Wind Power Group Co., Ltd., Sinovel Wind Group Co., Ltd., CS Wind Corporation, Dajin Heavy Industry Co., Ltd., A.P. Moller – Maersk, Sif Holding N.V., Broadwind Energy Inc., ZF Friedrichshafen AG, NGC Transmission Equipment (Suzhou) Co., Ltd., thyssenkrupp AG, Hitachi Ltd., Doosan Heavy Industries & Construction Co. Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Wind Power Casting Market Key Technology Landscape

The technological landscape of the Wind Power Casting Market is continually evolving, driven by the need to produce ever-larger components with zero-defect quality and reduced lead times. Central to this evolution is the utilization of advanced sand casting techniques, particularly Vacuum Assisted Molding (VAM) and various forms of no-bake molding, which allow foundries to handle the massive volumes of metal required for 10 MW+ turbine components while ensuring high dimensional stability and superior surface finish. Simulation software, specifically Computational Fluid Dynamics (CFD) and solidification modeling, is now indispensable, enabling engineers to predict potential issues like shrinkage porosity and segregation before pouring, drastically optimizing mold and gating system designs, and reducing costly trial-and-error iterations.

Furthermore, automation and robotics are transforming the labor-intensive stages of casting production. Automated handling systems manage the movement of heavy molds and cores, improving safety and efficiency. Robotic fettling and grinding processes are being implemented to automate the removal of risers and gates, a historically difficult and inconsistent task for large castings, ensuring uniformity in component preparation before machining. The integration of specialized machining centers capable of handling components exceeding 150 tons is another crucial technological investment, as even minor inaccuracies in the final machining of critical interfaces (like the yaw bearing connection or main shaft journals) can compromise the entire turbine’s lifespan and operational efficiency.

Quality control technologies are perhaps the most vital area of innovation. The reliance on Non-Destructive Testing (NDT) has shifted from manual inspection to highly automated and integrated systems. Phased Array Ultrasonic Testing (PAUT) and high-resolution industrial Computed Tomography (CT) scanning are increasingly used to detect micro-defects deep within the material structure, ensuring compliance with fatigue specifications. Additionally, metallurgical innovations focus on developing high-strength ductile irons (such as spheroidal graphite cast iron, or SGI) that offer enhanced resistance to brittle fracture and improved fatigue performance required for deep-sea environments and high-stress applications. These technological advancements collectively support the industry’s push towards higher reliability and greater turbine capacity.

Regional Highlights

Regional dynamics play a crucial role in shaping the Wind Power Casting market, reflecting variances in regulatory frameworks, installed capacity, and supply chain maturity.

- Asia Pacific (APAC): This region is the undisputed leader in both production capacity and annual installations, driven primarily by China's aggressive national renewable energy targets. China possesses a massive, integrated supply chain, offering highly competitive pricing and scale for foundational castings. India and South Korea are also emerging as significant markets, driven by domestic utility-scale projects and governmental incentives, increasing demand for localized casting supply.

- Europe: Europe represents a mature market characterized by a strong focus on high-quality, large-scale, offshore-specific castings. Countries like Germany, the UK, and Denmark are major technology hubs, demanding premium components for challenging maritime environments. The region is characterized by high manufacturing standards, stringent environmental regulations, and a clear move toward floating offshore wind infrastructure requiring advanced casting designs.

- North America: The market is experiencing rapid expansion, largely propelled by favorable governmental policies, most notably the U.S. Inflation Reduction Act (IRA). This legislation encourages domestic content utilization, leading to significant investments in establishing or expanding large-scale foundries and machining facilities within the United States, aiming to localize the complex wind component supply chain and reduce reliance on overseas imports.

- Latin America & Middle East and Africa (MEA): These regions represent promising emerging markets. Brazil, with its high wind potential, is a key focus in LATAM, while countries in the MEA region, particularly those pursuing diversification away from fossil fuels (like UAE and South Africa), are initiating large-scale wind projects, driving localized demand for smaller-to-medium-sized castings required for early-stage development.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Wind Power Casting Market.- Vestas Wind Systems A/S

- Siemens Gamesa Renewable Energy S.A.

- GE Renewable Energy

- Suzlon Energy Limited

- Goldwind Science & Technology Co., Ltd.

- Enercon GmbH

- Ming Yang Smart Energy Group

- Shanghai Electric Wind Power Group Co., Ltd.

- Sinovel Wind Group Co., Ltd.

- CS Wind Corporation

- Dajin Heavy Industry Co., Ltd.

- A.P. Moller – Maersk

- Sif Holding N.V.

- Broadwind Energy Inc.

- ZF Friedrichshafen AG

- NGC Transmission Equipment (Suzhou) Co., Ltd.

- thyssenkrupp AG

- Hitachi Ltd.

- Doosan Heavy Industries & Construction Co. Ltd.

- Kawasaki Heavy Industries, Ltd.

Frequently Asked Questions

Analyze common user questions about the Wind Power Casting market and generate a concise list of summarized FAQs reflecting key topics and concerns.What types of materials are predominantly used in high-stress wind power castings?

High-stress wind power castings primarily utilize high-grade Ductile Iron (SGI), particularly for components like hubs and gearbox casings, due to its excellent strength-to-weight ratio and fatigue resistance. Gray Iron and specialized Steel Castings are also critical, used for larger structural parts like main frames and yaw components where sheer bulk and rigidity are prioritized over ductility.

How is the growth of the offshore wind segment impacting casting technology requirements?

The offshore wind segment, characterized by massive multi-megawatt turbines (8 MW and above), drives demand for significantly larger, heavier castings that require superior corrosion resistance and enhanced mechanical integrity against harsh marine environments. This necessitates advanced casting techniques, specialized surface coatings, and stringent non-destructive testing (NDT) protocols.

Which geographical region holds the largest market share for wind power casting production?

The Asia Pacific (APAC) region, dominated by manufacturing capabilities in China, currently holds the largest share of the wind power casting production market. This dominance is due to immense domestic demand, established supply chains, and superior capacity for producing the ultra-large components required by global OEMs.

What are the main technological challenges facing large casting manufacturers today?

Major technological challenges include ensuring zero-defect quality in components exceeding 100 metric tons, managing the complex cooling and solidification profiles of these large parts to prevent internal defects (shrinkage), and reducing the high cost and long lead times associated with specialized machining and finishing processes for high-precision surfaces.

What is the role of AI in improving the efficiency of the wind power casting process?

AI is increasingly used to optimize foundry efficiency by applying machine learning to predict casting defects based on real-time sensor data, thus reducing scrap rates. AI also aids in optimizing energy consumption during melting and heat treatment, streamlining complex supply chain logistics, and automating rigorous quality inspection procedures.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager