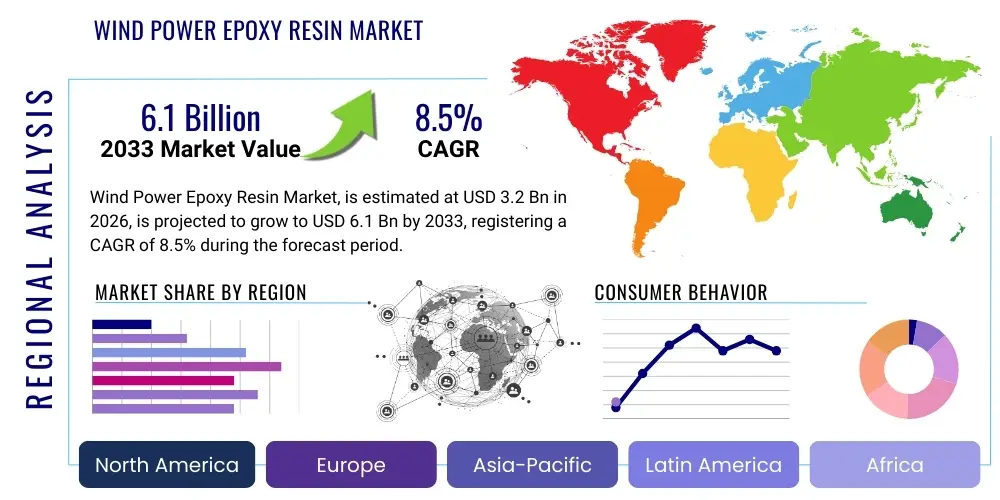

Wind Power Epoxy Resin Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438773 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Wind Power Epoxy Resin Market Size

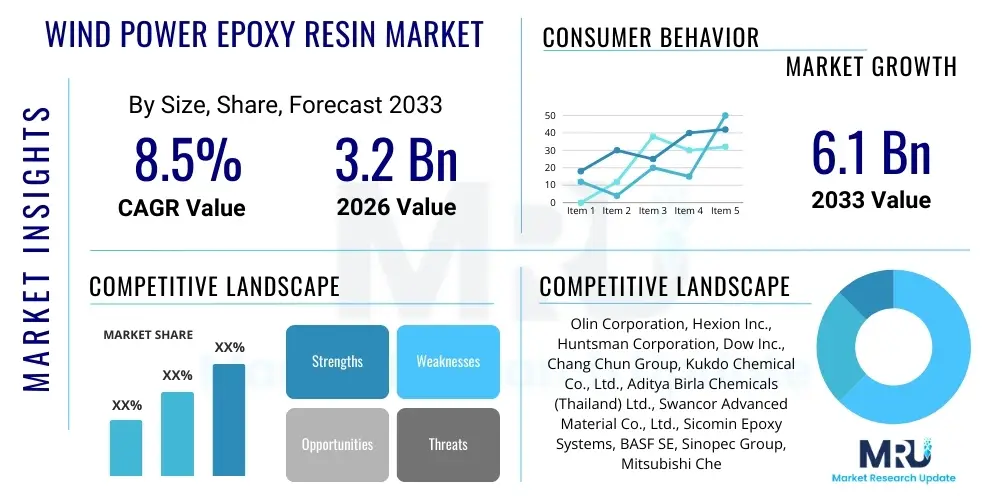

The Wind Power Epoxy Resin Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 3.2 billion in 2026 and is projected to reach USD 6.1 billion by the end of the forecast period in 2033.

Wind Power Epoxy Resin Market introduction

The Wind Power Epoxy Resin Market encompasses the production and supply of specialized thermosetting polymers essential for manufacturing structural components in wind turbine systems, predominantly rotor blades. These advanced resins are crucial due to their superior mechanical properties, including high strength-to-weight ratio, excellent fatigue resistance, and durability against environmental stresses such as moisture and UV radiation. The primary application involves large-scale infusion or vacuum-assisted resin transfer molding (VARTM) processes used to construct the aerodynamic surfaces of wind turbine blades, which are constantly subjected to extreme dynamic loading. The selection of specific epoxy resin systems is paramount, as performance directly impacts the overall efficiency, longevity, and maintenance requirements of the turbine.

Product description highlights the versatility of wind power epoxy resins, which are generally formulated as two-part systems consisting of the resin and a dedicated hardener, allowing for controlled curing speeds necessary for manufacturing exceptionally long blades—often exceeding 80 meters. Key characteristics include low viscosity for optimal fiber wet-out, controlled exothermic reaction for thick laminates, and tailored glass transition temperatures (Tg) to withstand operational temperatures. These resins must adhere to stringent industry standards regarding mechanical reliability and processability, positioning them as non-negotiable materials in high-performance wind energy infrastructure.

Major applications span utility-scale onshore and offshore wind farms, where the resins are used not only in blade fabrication but also, to a lesser extent, in nacelle covers, hubs, and bonding applications within the tower structure. The fundamental benefits driving market growth are directly linked to the global imperative for renewable energy adoption. Epoxy resins enable the manufacture of lighter, stronger, and larger blades, which significantly enhances the annual energy production (AEP) of wind turbines. The driving factors include favorable government policies promoting clean energy, technological advancements leading to increased turbine size, and the competitive cost parity achieved by wind power compared to fossil fuels globally.

Wind Power Epoxy Resin Market Executive Summary

The global Wind Power Epoxy Resin Market is experiencing robust growth fueled by unprecedented capacity additions in both onshore and offshore wind sectors. Business trends indicate a shift towards specialized, high-performance resin systems capable of handling the structural demands of 10 MW+ turbines and extremely long blades. Manufacturers are increasingly focusing on developing bio-based or recyclable epoxy solutions to address sustainability concerns within the wind energy value chain, aligning with the industry’s net-zero objectives. Supply chain stability, particularly regarding the availability and pricing of key precursors like epichlorohydrin and bisphenol A, remains a critical determinant of short-term market dynamics, necessitating strategic long-term procurement agreements.

Regional trends reveal Asia Pacific (APAC) as the dominant and fastest-growing market, primarily led by massive offshore installations in China and the rapid expansion of wind capacity in India and Southeast Asia. Europe maintains a strong foothold, driven by mature offshore markets in the North Sea and progressive regulatory frameworks focused on sustainability and blade recycling initiatives. North America, specifically the United States, demonstrates steady demand, supported by production tax credits (PTC) and ambitious state-level renewable portfolio standards (RPS), focusing heavily on domestic manufacturing capacity expansion and material innovation to reduce lifecycle costs.

Segmentation trends highlight that the infusion process segment accounts for the largest market share due to its efficiency and suitability for large, complex blade geometries, though prepreg systems are gaining traction for niche, high-end applications demanding superior quality control. By application, the blade segment overwhelmingly dominates the market, commanding over 90% of the resin volume. Material formulation trends show increasing investment in toughened epoxy systems designed to improve resistance to environmental degradation, such as leading-edge erosion (LEE), thereby extending the operational lifespan of the turbine components and reducing costly unscheduled maintenance.

AI Impact Analysis on Wind Power Epoxy Resin Market

Common user inquiries regarding AI's influence center on how artificial intelligence can optimize the complex, capital-intensive manufacturing processes associated with large-scale composite blade production and how it can enhance the performance monitoring of these critical components over their operational life. Users are particularly interested in AI's role in predicting material performance under stress, optimizing resin formulation for specific climate conditions, and ensuring quality consistency during the resin infusion process, which is highly sensitive to external variables like temperature and humidity. Concerns often revolve around the initial investment required for digitalization and the necessity of integrating complex AI models with traditional manufacturing execution systems (MES).

The implementation of AI and machine learning (ML) models is expected to revolutionize the materials science aspect of the Wind Power Epoxy Resin Market. AI algorithms can analyze vast datasets from material testing, simulations, and real-world operational environments to predict optimal curing cycles, minimizing defects such as voids or inadequate wet-out in thick laminates. This predictive analytical capability reduces material waste, shortens the time-to-market for new resin formulations, and ensures that the final composite structure achieves its maximum intended mechanical properties. Furthermore, AI-driven process control systems, leveraging real-time sensor data from the manufacturing floor, can autonomously adjust infusion rates and temperatures, ensuring adherence to tight quality specifications across various production batches.

In the post-manufacturing phase, AI significantly impacts the through-life management of resin-based components. By analyzing acoustic emission data, vibration patterns, and SCADA (Supervisory Control and Data Acquisition) system outputs, ML models can detect micro-cracks or structural degradation in the composite blades long before they become visible failures. This allows operators to schedule predictive maintenance, potentially extending the effective life of the blades and thereby influencing future resin demand for replacement parts. The increasing reliance on digital twins, fed by operational performance data, further solidifies AI's role by simulating the structural integrity of blades using the specific characteristics of the epoxy resin used in their construction, driving demand for resins that offer predictable and stable performance profiles.

- AI-driven optimization of resin infusion processes (e.g., flow modeling, cure cycle prediction).

- Machine learning algorithms enhance quality control, minimizing manufacturing defects like voids and porosity.

- Predictive analytics determine optimal composite formulations based on regional climate and operational stress profiles.

- Digital twins utilize AI to simulate structural integrity and remaining useful life of epoxy components.

- Automated non-destructive testing (NDT) and defect detection in large composite structures using computer vision.

- AI optimizes raw material inventory and supply chain forecasting for key chemical precursors.

DRO & Impact Forces Of Wind Power Epoxy Resin Market

The market dynamics of the Wind Power Epoxy Resin sector are governed by a complex interplay of structural drivers, cost-related restraints, and technological opportunities, all subject to intense competitive and regulatory impact forces. Key drivers include aggressive global governmental targets for renewable energy penetration and the continuous trend toward upscaling wind turbines, which necessitates higher volumes of high-performance epoxy resins capable of delivering the structural integrity required for longer and more flexible blades. Concurrently, the increasing focus on offshore wind, which requires resins with enhanced corrosion and fatigue resistance, significantly elevates the demand profile for premium, specialized epoxy systems.

However, the market faces several notable restraints. Fluctuations in the prices of key petrochemical raw materials, particularly crude oil derivatives, directly impact the cost of epoxy resin production, introducing volatility that challenges long-term price contracts with blade manufacturers. Furthermore, the inherent difficulty and high cost associated with recycling thermoset composite materials, including epoxy resins, represent a significant environmental and regulatory constraint. While research into circular economy solutions is accelerating, the current lack of widespread, cost-effective recycling infrastructure limits the sustainability profile of the material compared to alternative structural components.

Opportunities for market growth are primarily concentrated in technological innovation, specifically the development of epoxy systems optimized for out-of-autoclave manufacturing techniques, which lower energy consumption and scale production capacity. The push toward sustainable chemistry offers a substantial opportunity for manufacturers investing in bio-based epoxy resins derived from natural feedstocks, addressing both environmental mandates and consumer preferences. The major impact forces are competitive rivalry among global chemical suppliers, regulatory mandates pushing for blade lifecycle management (including mandatory recycling targets), and the bargaining power of major Tier 1 blade manufacturers who often dictate material specifications and volume pricing.

Segmentation Analysis

The Wind Power Epoxy Resin Market segmentation provides a granular view of demand based on process technology, end-use application, and resin type, revealing critical shifts in manufacturing preferences and material specifications. The market is primarily segmented by the type of curing process utilized during blade manufacturing, which directly influences the volume and flow properties required from the resin system. Furthermore, the differentiation between onshore and offshore applications is crucial, as offshore environments impose harsher operational demands necessitating specialized, high-durability epoxy formulations.

By application, the market is overwhelmingly concentrated in the rotor blade segment, which consumes the vast majority of epoxy resin due to the sheer size and structural requirement of modern blades. Other applications, such as adhesive bonding and repair materials, constitute smaller but rapidly growing niche segments requiring specialized resin characteristics like fast curing and high cohesive strength. Understanding these segments is vital for suppliers to align their product portfolios with the evolving manufacturing landscape, particularly as blade lengths increase and the industry standardizes on efficient, large-scale production methods.

- By Process Technology:

- Resin Infusion (Vacuum Infusion Process - VIP)

- Prepreg

- Resin Transfer Molding (RTM)

- Pultrusion

- By Application:

- Rotor Blade Manufacturing

- Adhesives/Bonding

- Repair & Maintenance

- Nacelle and Structural Components

- By Type of Wind Turbine:

- Onshore

- Offshore

- By Resin Type:

- DGEBA (Bisphenol A diglycidyl ether)

- Toughened Epoxy Systems

- Bio-based Epoxy Resins

Value Chain Analysis For Wind Power Epoxy Resin Market

The value chain for Wind Power Epoxy Resins starts with upstream raw material suppliers, primarily petrochemical companies that provide essential precursors such as epichlorohydrin (ECH), bisphenol A (BPA), and various amine or anhydride hardeners. This segment is characterized by high capital intensity and susceptibility to global crude oil price fluctuations. Chemical manufacturers integrate these precursors to synthesize the specific epoxy resin formulations required by the wind industry. Given the specialized performance demands (e.g., low viscosity, specific cure kinetics), the formulation stage involves significant R&D investment and proprietary technology.

Moving downstream, the distribution channel often involves direct sales or specialized chemical distributors who manage the complex logistics of temperature-sensitive and large-volume resin shipments to blade manufacturers. The direct sales model is prevalent for major chemical suppliers serving Tier 1 blade companies (e.g., Vestas, Siemens Gamesa), allowing for greater quality control and technical support. Indirect channels, involving regional distributors, cater more often to smaller repair shops and maintenance services.

The final stage involves the end-use market, where blade manufacturers utilize the epoxy resins in high-volume, precision manufacturing processes, typically Vacuum Assisted Resin Transfer Molding (VARTM) or vacuum infusion. The efficiency of the downstream manufacturing process is heavily reliant on the consistent quality and processability of the supplied resin. The end-users—wind farm developers and operators—indirectly drive demand by specifying turbine size and performance requirements, which subsequently dictates the type and volume of epoxy resin needed for blade construction. The integration between material suppliers and blade manufacturers is increasingly tight, often involving collaborative R&D to co-develop next-generation composite materials for ever-larger turbines.

Wind Power Epoxy Resin Market Potential Customers

The potential customers and primary buyers in the Wind Power Epoxy Resin Market are concentrated within the composite manufacturing and energy infrastructure sectors. The most significant customers are Tier 1 and Tier 2 wind turbine blade manufacturers who purchase epoxy resins in bulk for continuous high-volume production lines. These manufacturers, who often operate globally, require resins that are precisely formulated for specific large-scale manufacturing techniques, demanding excellent repeatability and stringent quality certification, thereby holding significant bargaining power over resin suppliers.

Beyond the primary blade manufacturers, secondary customer groups include independent composite repair and maintenance service providers. These entities require smaller quantities of specialized, fast-curing epoxy systems and related adhesive products for routine maintenance, leading-edge repair (LEE mitigation), and structural fixes on existing wind turbine fleets. As the global installed base ages, the demand for repair resins is projected to grow substantially, offering a diversified market opportunity away from high-volume, new construction contracts.

Finally, captive consumption by integrated wind energy companies, where the turbine manufacturer owns or partners with the blade manufacturing facility, represents a crucial customer structure. Furthermore, research institutions and material development firms also act as buyers, albeit in smaller volumes, for R&D purposes focused on developing recyclable resins, advanced thermoplastic substitutes, or improved structural bonding agents. The underlying drivers for all these buyers remain material cost optimization, enhanced performance (fatigue life), and improved sustainability metrics.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.2 billion |

| Market Forecast in 2033 | USD 6.1 billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Olin Corporation, Hexion Inc., Huntsman Corporation, Dow Inc., Chang Chun Group, Kukdo Chemical Co., Ltd., Aditya Birla Chemicals (Thailand) Ltd., Swancor Advanced Material Co., Ltd., Sicomin Epoxy Systems, BASF SE, Sinopec Group, Mitsubishi Chemical Corporation, Sika AG, AOC Resins, Reichhold LLC, Epoxies Etc., Gurit Holding AG, 3M Company, Polynt-Reichhold Group, Evonik Industries AG |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Wind Power Epoxy Resin Market Key Technology Landscape

The technology landscape for Wind Power Epoxy Resins is primarily characterized by continuous innovation aimed at reducing manufacturing cycle times, improving structural performance, and enhancing environmental profiles. The Vacuum Assisted Resin Transfer Molding (VARTM) and Vacuum Infusion Process (VIP) remain the core technologies, continually being refined to manage the scale and complexity of modern large blades. Technological advancements focus on developing low-viscosity, fast-curing epoxy systems that maintain a long pot life for large infusions while exhibiting rapid demolding times, thereby maximizing throughput in blade factories. Furthermore, proprietary curing agents are being engineered to allow for lower temperature curing, minimizing internal stress within the composite structure and reducing energy consumption during the manufacturing process.

A significant area of technological focus is the development of prepreg systems tailored specifically for wind applications. While traditionally costly, next-generation wind prepregs offer exceptional fiber volume fractions and superior structural consistency, making them increasingly attractive for critical sections of ultra-long offshore blades where performance consistency is paramount. The associated manufacturing technology often involves automated fiber placement (AFP) and specialized heat curing methods. Beyond blade construction, the technology landscape includes advanced adhesive systems. Manufacturers are developing toughened epoxy-based adhesives capable of withstanding extreme shear and peel forces for bonding shell halves and structural spars, often requiring rapid exothermic curing to facilitate production line speed.

The emerging technological frontier is centered on sustainability and end-of-life solutions. This includes the commercialization of bio-based epoxy resins, which substitute petrochemical precursors with sustainable sources such as vegetable oils, aiming to lower the carbon footprint of the resulting composites. Simultaneously, chemical companies and research consortia are heavily investing in developing 'cleavable' or 'dissolvable' epoxy resins. These innovative resins are designed to break down under specific chemical or thermal treatments, allowing the glass or carbon fibers to be efficiently recovered and recycled, addressing the critical waste management challenge facing the wind industry and fundamentally altering the lifecycle economics of epoxy composites.

Regional Highlights

- Asia Pacific (APAC): APAC is the largest and fastest-growing regional market, driven overwhelmingly by China's dominant position in both onshore and offshore capacity additions. The region benefits from robust government subsidies, high domestic manufacturing capacity, and the increasing trend of manufacturing larger turbines, necessitating significant consumption of specialized epoxy resins. India, Vietnam, and South Korea are also emerging as key markets, fueling localized production and supply chain optimization.

- Europe: Europe represents a mature market focusing heavily on premium and specialized epoxy systems, particularly those designed for the harsh, saline conditions of the North Sea offshore environment. The European market emphasizes material innovation related to sustainability, demanding high performance, long-life resins, and leading the transition toward implementing recycling technologies and bio-based resin alternatives due to stringent regulatory pressures (e.g., EU Green Deal).

- North America: The North American market is characterized by consistent onshore growth, supported by federal tax incentives and state-level clean energy mandates. The demand profile focuses on cost-competitive, high-volume resins for standard utility-scale turbines. The region is witnessing growing investment in offshore wind, particularly along the East Coast, which will drive demand for specialized, corrosion-resistant epoxy formulations in the medium term.

- Latin America (LATAM): LATAM, spearheaded by countries like Brazil and Mexico, offers substantial potential due to excellent wind resources and expanding electricity grids. While infrastructure development faces challenges, the demand for epoxy resins is steady, primarily focused on onshore projects and utilizing proven, cost-effective resin systems supplied both locally and through imports.

- Middle East and Africa (MEA): The MEA region is an emerging market with ambitious renewable energy targets in countries such as Saudi Arabia and South Africa. Demand is currently nascent but poised for rapid acceleration, particularly as infrastructure projects mature, focusing on large-scale solar and wind hybridization projects that require robust, high-temperature tolerant epoxy materials.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Wind Power Epoxy Resin Market.- Olin Corporation

- Hexion Inc.

- Huntsman Corporation

- Dow Inc.

- Chang Chun Group

- Kukdo Chemical Co., Ltd.

- Aditya Birla Chemicals (Thailand) Ltd.

- Swancor Advanced Material Co., Ltd.

- Sicomin Epoxy Systems

- BASF SE

- Sinopec Group

- Mitsubishi Chemical Corporation

- Sika AG

- AOC Resins

- Reichhold LLC

- Epoxies Etc.

- Gurit Holding AG

- 3M Company

- Polynt-Reichhold Group

- Evonik Industries AG

- Cytec Solvay Group (part of Solvay)

- Ashland Global Holdings Inc.

- Jiangsu Sanmu Group Co., Ltd.

- Wanhua Chemical Group Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Wind Power Epoxy Resin market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary drivers of growth in the Wind Power Epoxy Resin Market?

The main growth drivers are the increasing global demand for renewable energy, stringent governmental targets for wind capacity deployment (especially offshore), and the trend toward manufacturing significantly larger wind turbine blades which require greater volumes of specialized, high-performance epoxy composites for structural integrity.

How does the complexity of offshore wind farms affect resin requirements?

Offshore wind necessitates highly durable epoxy resins with enhanced resistance to moisture ingress, corrosion, and continuous fatigue loading. These systems often require specialized toughening agents and specific formulations to ensure a lifespan exceeding 25 years in harsh marine environments, driving demand for premium products.

What is the current challenge regarding the recycling of epoxy-based wind turbine blades?

The primary challenge is the thermoset nature of epoxy resins, which prevents them from being easily melted or reshaped. Current recycling methods, such as mechanical grinding or pyrolysis, are energy-intensive and often result in degraded fiber quality. The industry is actively seeking chemical recycling solutions, including cleavable resins, for sustainable fiber recovery.

Which process technology segment dominates the consumption of wind power epoxy resins?

The Resin Infusion process, specifically Vacuum Infusion (VIP) or VARTM, accounts for the largest share of consumption. This technology is highly scalable, cost-effective, and optimally suited for the manufacture of the current generation of long, complex wind turbine blades, providing superior fiber wet-out and reduced weight compared to traditional methods.

What role do bio-based epoxy resins play in the market's future?

Bio-based epoxy resins are crucial for meeting industry sustainability goals and regulatory mandates, offering a lower carbon footprint by replacing petrochemical raw materials with renewable feedstocks. While currently a niche segment, ongoing R&D aims to achieve performance parity and cost competitiveness with conventional epoxy, positioning them as a major long-term market opportunity.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager