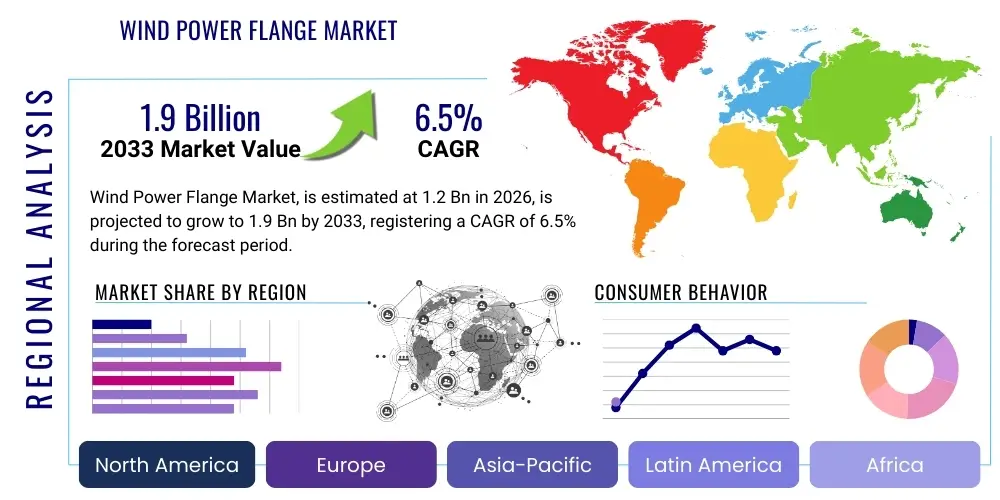

Wind Power Flange Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439422 | Date : Jan, 2026 | Pages : 258 | Region : Global | Publisher : MRU

Wind Power Flange Market Size

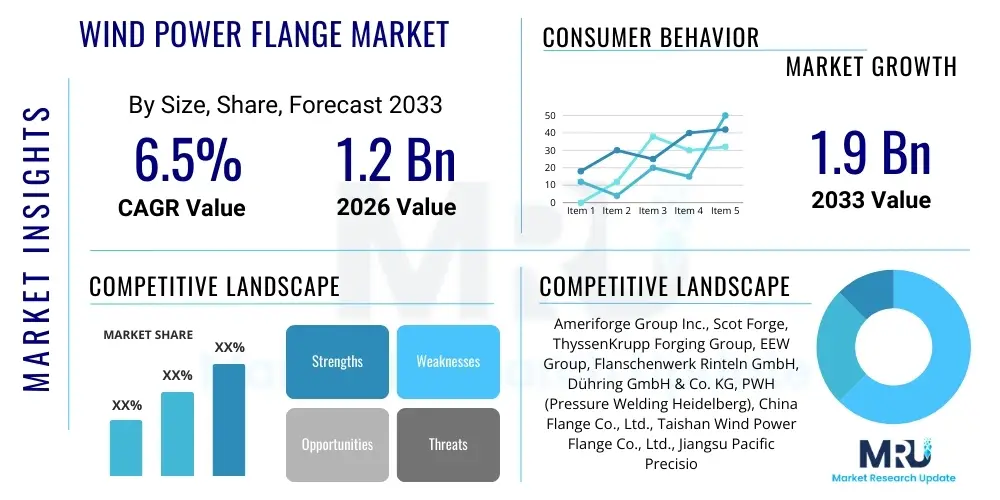

The Wind Power Flange Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 1.2 Billion in 2026 and is projected to reach USD 1.9 Billion by the end of the forecast period in 2033. This growth is underpinned by the accelerating global transition towards renewable energy sources and the increasing deployment of both onshore and offshore wind power installations worldwide. The demand for robust, high-performance flanges, critical components for the structural integrity and operational efficiency of wind turbines, is expanding significantly, driven by larger turbine designs and the challenging environmental conditions of offshore projects.

Wind Power Flange Market introduction

The Wind Power Flange Market encompasses the design, manufacturing, and distribution of specialized flange components integral to the construction of wind turbines. These critical components are fabricated from high-strength steels and alloys, engineered to withstand immense structural loads, fatigue, and environmental stressors, particularly in demanding offshore environments. Flanges serve as essential connecting elements, securely joining various sections of the wind turbine tower, nacelle, rotor hub, and foundation structures like monopiles or jacket foundations. Their primary function is to ensure structural stability, rigidity, and the long-term operational safety of the entire wind turbine system, transmitting mechanical forces effectively and resisting external forces such as wind and waves.

Major applications for wind power flanges span both onshore and offshore wind farms. In onshore installations, flanges connect tower sections and attach the tower to its foundation, facilitating efficient power generation across diverse landscapes. Offshore applications represent a significant growth area, where flanges are engineered for extreme durability to connect turbine towers to complex subsea foundations, including monopiles, jackets, and floating platforms, enduring harsh marine conditions. The benefits derived from high-quality wind power flanges are profound, including enhanced structural integrity, extended operational lifespan of turbines, reduced maintenance costs, and superior safety for personnel and equipment. They are fundamental in enabling the construction of taller, more powerful wind turbines, which are increasingly critical for achieving higher energy yields.

Driving factors for the wind power flange market are multifaceted and interconnected. Globally, stringent governmental policies and ambitious targets aimed at reducing carbon emissions and accelerating renewable energy adoption are paramount. Financial incentives, subsidies, and regulatory frameworks supporting wind energy projects directly stimulate demand for turbine components. Furthermore, the decreasing Levelized Cost of Electricity (LCOE) for wind power makes it increasingly competitive with traditional energy sources, encouraging wider investment. Technological advancements in turbine design, leading to larger capacities and taller towers, necessitate more robust and precisely engineered flanges. The increasing trend towards offshore wind development, characterized by larger turbines and more complex foundation structures, further amplifies the demand for specialized, high-performance flange solutions capable of enduring extreme loads and corrosive marine environments, acting as a crucial catalyst for market expansion.

Wind Power Flange Market Executive Summary

The Wind Power Flange Market is characterized by robust growth, propelled by the relentless global pursuit of renewable energy targets and the rapid expansion of wind energy infrastructure. Key business trends include a drive towards greater material innovation, with manufacturers focusing on developing higher-strength steels and advanced forging techniques to meet the demands of increasingly larger and more powerful turbines. Consolidation within the supply chain, through mergers and acquisitions, is also emerging as companies seek to optimize production efficiencies and expand their geographic reach. Furthermore, there is a growing emphasis on precision manufacturing, quality assurance, and traceability to ensure the reliability and longevity of critical flange components, particularly for high-stress offshore applications. This focus on advanced manufacturing processes and stringent quality control is essential for maintaining turbine uptime and reducing operational expenditures.

Regionally, the market exhibits diverse growth dynamics. Asia Pacific, led by China and India, represents the largest and fastest-growing segment, driven by massive investments in new wind farm installations, favorable government policies, and an escalating energy demand. Europe continues to be a mature but rapidly expanding market, particularly in offshore wind development, with countries like the UK, Germany, and Denmark pioneering large-scale projects that require advanced flange solutions. North America is experiencing significant growth, fueled by renewable energy mandates, tax incentives, and substantial project pipelines in both onshore and emerging offshore wind sectors. Latin America, the Middle East, and Africa are also showing promising potential, albeit at earlier stages of development, as these regions increasingly integrate wind power into their energy mixes, presenting long-term opportunities for market participants as infrastructure develops.

Segment-wise, the trend is unequivocally towards larger, more robust flanges capable of supporting multi-megawatt turbines. The offshore wind segment is a primary driver, demanding flanges with superior corrosion resistance, fatigue strength, and dimensional accuracy to withstand harsh marine environments and immense structural loads. Within materials, high-strength carbon steel and alloy steel continue to dominate, but research into new composite materials and advanced treatments for enhanced durability is ongoing. The application of flanges in tower sections, connecting increasingly taller structures, remains critical, while specialized flanges for nacelles, rotor hubs, and various foundation types (e.g., monopile, jacket, floating) are experiencing tailored innovation. This segmentation highlights the market’s responsiveness to the evolving technical requirements of the wind energy sector, emphasizing resilience, efficiency, and cost-effectiveness across the entire value chain.

AI Impact Analysis on Wind Power Flange Market

The integration of Artificial Intelligence (AI) is set to significantly reshape various facets of the Wind Power Flange Market, addressing common user concerns regarding efficiency, cost, and reliability. Users are keen to understand how AI can mitigate production bottlenecks, reduce material waste, and enhance the structural integrity of flanges, especially for the increasingly complex demands of offshore wind projects. The overarching themes include the potential for AI to optimize manufacturing processes, enable predictive maintenance for installed flanges, improve supply chain resilience, and facilitate more accurate and innovative design, ultimately leading to higher quality, more durable, and cost-effective components. There is a strong expectation that AI will drive a paradigm shift from reactive maintenance and traditional manufacturing to proactive, data-driven strategies across the flange lifecycle.

- Optimized Manufacturing Processes: AI can be used for real-time monitoring and control of forging, welding, and machining processes, leading to reduced material waste, improved product consistency, and higher throughput. Predictive analytics can identify potential defects early, minimizing scrap rates.

- Predictive Maintenance: AI algorithms analyze sensor data from operational wind turbines to predict flange fatigue, wear, and potential failures before they occur. This enables proactive maintenance, reducing downtime and extending the lifespan of critical components.

- Enhanced Design and Simulation: AI-powered generative design tools can explore thousands of design permutations for flanges, optimizing for weight, strength, and material usage based on specific load conditions and environmental factors, leading to more innovative and efficient designs.

- Supply Chain Optimization: AI can forecast demand fluctuations, optimize inventory levels, and manage logistics more efficiently, ensuring timely delivery of raw materials and finished flanges, thereby mitigating supply chain disruptions and costs.

- Quality Control and Inspection: AI-driven vision systems can perform highly accurate and consistent automated inspections of flanges for surface defects, dimensional accuracy, and material integrity, surpassing human capabilities and improving overall product quality.

- Material Innovation and Selection: AI can accelerate the discovery and selection of new high-performance alloys and composite materials by simulating their properties under various stress conditions, facilitating the development of next-generation flanges.

- Workforce Training and Augmentation: AI tools can assist in training new technicians by simulating complex manufacturing scenarios and augmenting existing staff with data-driven insights and decision support systems.

DRO & Impact Forces Of Wind Power Flange Market

The Wind Power Flange Market is shaped by a dynamic interplay of drivers, restraints, opportunities, and competitive forces that dictate its growth trajectory and strategic landscape. A primary driver is the global imperative to achieve decarbonization targets, which has translated into significant governmental support, renewable energy policies, and financial incentives for wind power projects worldwide. The decreasing Levelized Cost of Electricity (LCOE) from wind energy further strengthens its competitive position against fossil fuels, accelerating project development and consequently boosting demand for essential components like flanges. Additionally, continuous technological advancements in turbine design, resulting in larger, more efficient, and often taller turbines, necessitate the development of more robust, precisely engineered, and higher-strength flanges capable of handling increased loads and operational stresses. The relentless expansion of the global offshore wind sector, characterized by its challenging environmental conditions and demand for exceptionally durable components, also serves as a potent growth driver, requiring specialized and high-performance flange solutions.

However, the market also faces notable restraints. High initial capital investment required for establishing and expanding flange manufacturing facilities, particularly for large-scale, precision-forged components, can be a significant barrier to entry and expansion. The volatility in raw material prices, particularly for steel and specialized alloys, directly impacts production costs and profitability, creating unpredictability for manufacturers. Supply chain disruptions, often exacerbated by geopolitical events, trade tensions, or global crises, can lead to material shortages, increased lead times, and elevated costs, hindering market growth. Furthermore, environmental permitting complexities, community opposition (NIMBYism – Not In My Backyard), and grid integration challenges for large-scale wind projects can slow down deployments, thereby affecting the demand for flanges. These restraints necessitate strategic planning for risk mitigation and cost management within the industry.

Despite these challenges, significant opportunities abound for the Wind Power Flange Market. The burgeoning global offshore wind market, with its exponential growth projections, offers an unparalleled opportunity for specialized, high-durability flange manufacturers. Emerging markets in Asia, Latin America, and Africa are increasingly investing in wind energy, creating new demand centers and avenues for market expansion. Innovation in materials science, including the development of advanced high-strength steels, lighter alloys, and corrosion-resistant coatings, presents opportunities for product differentiation and performance enhancement. The adoption of smart manufacturing techniques, such as automation, IoT, and AI-driven process optimization, can lead to increased efficiency, reduced costs, and superior product quality, offering a competitive edge. The market is also influenced by various impact forces, including the bargaining power of buyers (large turbine OEMs and wind farm developers), who demand competitive pricing and high quality, and the bargaining power of suppliers (raw material producers), which can affect material costs and availability. The threat of new entrants is moderate due to high capital requirements and technical expertise, while the threat of substitutes is low, as flanges are indispensable structural components with no direct alternative for their core function. Competitive rivalry among existing players is intense, driven by product differentiation, technological leadership, and cost efficiency, fostering continuous innovation and market evolution.

Segmentation Analysis

The Wind Power Flange Market is comprehensively segmented to provide a detailed understanding of its diverse components, applications, and regional dynamics. This segmentation helps in analyzing market trends, identifying growth opportunities, and understanding the competitive landscape across different dimensions of the industry. The market is primarily divided by material type, product type, and application, reflecting the varying technical requirements and end-use scenarios within the wind energy sector. Each segment caters to specific needs of wind turbine manufacturers and project developers, driving specialized innovation and production processes.

- By Material

- Carbon Steel

- Alloy Steel

- Stainless Steel

- Others (e.g., Duplex Steel, High-Strength Low-Alloy Steel)

- By Type

- Monopile Flanges

- Jacket Flanges

- Tower Flanges (Split Flanges, Integral Flanges)

- Nacelle Flanges

- Rotor Flanges

- Blade Root Flanges

- Others (e.g., Transition Piece Flanges)

- By Application

- Onshore Wind

- Offshore Wind

- By Region

- North America (U.S., Canada, Mexico)

- Europe (Germany, UK, France, Spain, Italy, Nordics, Rest of Europe)

- Asia Pacific (China, India, Japan, South Korea, Australia, Rest of Asia Pacific)

- Latin America (Brazil, Argentina, Rest of Latin America)

- Middle East & Africa (UAE, Saudi Arabia, South Africa, Rest of MEA)

Value Chain Analysis For Wind Power Flange Market

The value chain for the Wind Power Flange Market is a complex and interconnected network involving multiple stages, from raw material sourcing to the final installation and maintenance of wind turbines. It begins with upstream activities, primarily encompassing the extraction and processing of raw materials such as iron ore, coking coal, and alloying elements, which are then used by steel manufacturers to produce high-grade steel plates and billets. These steel producers often specialize in specific alloys tailored for high-strength applications required in wind turbine components. Following material production, the manufacturing process continues with forging companies that transform these raw materials into semi-finished or finished flanges through advanced forging, heat treatment, and machining processes. Precision engineering and quality control are paramount at this stage to meet stringent industry standards for fatigue strength, dimensional accuracy, and material integrity, crucial for the reliable operation of wind turbines.

Further along the value chain are the downstream activities, primarily involving the wind turbine manufacturers (Original Equipment Manufacturers - OEMs) who integrate these flanges into their tower sections, nacelles, and rotor hubs. These OEMs often have their own internal quality assurance and assembly processes. Following manufacturing and assembly, wind farm developers and EPC (Engineering, Procurement, and Construction) contractors are responsible for the installation of the wind turbines, including the foundation structures where many of the large-diameter flanges are utilized. Post-installation, the value chain extends to operations and maintenance (O&M) companies that ensure the long-term performance and reliability of the wind farms, including potential flange inspections and replacements. Each stage adds value through specialized expertise, processing, and integration, ensuring the final product meets the demanding specifications of the wind energy sector.

The distribution channels for wind power flanges can be both direct and indirect. Direct sales often occur between specialized flange manufacturers and major wind turbine OEMs or large wind farm developers, particularly for customized or high-volume orders. This direct approach allows for close collaboration on design, specifications, and supply chain management. Indirect channels involve distributors or agents who procure flanges from manufacturers and supply them to smaller-scale developers, maintenance companies, or provide regional warehousing and logistics support. These channels help to broaden market reach and provide more flexible supply options. The selection of distribution channels often depends on the scale of the project, geographic location, and the specific requirements of the buyer, with a clear trend towards more integrated and secure supply chains to ensure reliability and minimize risks in this mission-critical industry.

Wind Power Flange Market Potential Customers

The primary potential customers and end-users of wind power flanges are entities deeply embedded within the wind energy industry, ranging from the core manufacturers to the operators of wind farms. Foremost among these are the global wind turbine manufacturers, often referred to as Original Equipment Manufacturers (OEMs). Companies like Vestas, Siemens Gamesa, GE Renewable Energy, and Goldwind, among others, procure flanges in large quantities for the assembly of their turbine towers, nacelles, and rotor hubs. These OEMs demand flanges that meet stringent specifications for material strength, dimensional accuracy, fatigue resistance, and durability, as the quality of these components directly impacts the performance, safety, and longevity of their entire turbine systems. Their purchasing decisions are heavily influenced by supplier reliability, quality certifications, and cost-effectiveness, making long-term partnerships with flange manufacturers crucial.

Another significant segment of potential customers includes wind farm developers and Engineering, Procurement, and Construction (EPC) contractors. These entities are responsible for the planning, financing, construction, and sometimes the operation of wind power projects. They procure large-diameter flanges for foundational structures, such as monopiles, jacket foundations, and transition pieces, especially for offshore wind farms. Their purchasing criteria are often driven by project timelines, budget constraints, the ability of flanges to withstand specific environmental conditions (e.g., marine corrosion), and the overall structural integrity requirements of the entire wind farm. Collaboration with flange manufacturers is essential to ensure that components are delivered on schedule and meet the precise structural demands of each unique project site. They seek suppliers capable of providing customized solutions and reliable logistics for large-scale components.

Additionally, independent power producers (IPPs) who own and operate wind farms, as well as maintenance and service providers for existing wind turbines, also represent potential customers, albeit for replacement or upgrade components. While their purchasing volumes may be lower than OEMs or developers, their demand is critical for the ongoing operational efficiency and lifespan extension of aging wind farms. These customers prioritize quick availability, compatibility with existing turbine models, and certified quality to minimize downtime and ensure continued energy generation. Ultimately, the entire ecosystem of the wind energy sector, from those building new capacity to those maintaining existing infrastructure, relies heavily on a robust and reliable supply of high-quality wind power flanges, making these stakeholders the core target market for flange manufacturers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.2 Billion |

| Market Forecast in 2033 | USD 1.9 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Ameriforge Group Inc., Scot Forge, ThyssenKrupp Forging Group, EEW Group, Flanschenwerk Rinteln GmbH, Dühring GmbH & Co. KG, PWH (Pressure Welding Heidelberg), China Flange Co., Ltd., Taishan Wind Power Flange Co., Ltd., Jiangsu Pacific Precision Forging Co., Ltd., Shanghai Huitong Energy & Power Equipment Co., Ltd., Ganzhou Xinjian Heavy Industry Co., Ltd., Forges de Bologne, Broder Metals Group, Dongyi Forging Co., Ltd., Guangxi Hualu Heavy Industry Co., Ltd., Qingdao Haoyunxiang Steel Flange Co., Ltd., Hangzhou Forge Group Co., Ltd., Metra Forgings SpA, Vigor Technology Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Wind Power Flange Market Key Technology Landscape

The technology landscape for the Wind Power Flange Market is continuously evolving, driven by the increasing demands for larger, more powerful, and resilient wind turbines, especially in challenging offshore environments. A cornerstone of this landscape involves advanced forging techniques, which are critical for producing large-diameter, high-strength flanges with optimal grain structure and mechanical properties. Open-die forging, ring rolling, and closed-die forging are routinely employed, often coupled with sophisticated process controls to ensure material integrity and defect-free components. These methods are essential for forming flanges from specialized steel alloys, capable of withstanding extreme fatigue loads and corrosive conditions inherent in wind turbine operation. The precision achieved through these forging processes directly contributes to the structural reliability and lifespan of the entire wind turbine system, making them fundamental to market progress.

Beyond forging, sophisticated machining and fabrication technologies play a pivotal role. Computer Numerical Control (CNC) machining centers are extensively used to achieve tight dimensional tolerances and surface finishes, which are crucial for the secure and precise mating of flange components. Advanced welding techniques, such as submerged arc welding (SAW) and flux-cored arc welding (FCAW), are employed for joining multiple sections or integrating flanges into larger structural components, ensuring high-integrity welds that can withstand dynamic stresses. Furthermore, the selection and processing of materials are continuously advancing. Research focuses on developing new generations of high-strength low-alloy (HSLA) steels, ultra-high-strength steels, and specialized corrosion-resistant alloys that offer superior mechanical properties while minimizing weight. Surface treatments, including specialized coatings and painting systems, are also critical for enhancing corrosion resistance, particularly for flanges exposed to harsh marine environments, thereby extending their operational lifespan and reducing maintenance requirements.

The integration of digital technologies is also significantly impacting the wind power flange market. Digital twins and advanced simulation software are increasingly used during the design and manufacturing phases to model the behavior of flanges under various load conditions, optimizing designs for performance and cost. Non-destructive testing (NDT) methods, such as ultrasonic testing, magnetic particle inspection, and radiographic testing, are indispensable for ensuring the internal integrity and freedom from defects of critical flange components, often automated for higher throughput and accuracy. Furthermore, the adoption of Industry 4.0 principles, including the Internet of Things (IoT) for real-time monitoring of manufacturing parameters and supply chain logistics, is enhancing operational efficiency and traceability. This technological convergence is not only improving the quality and reliability of flanges but also streamlining production processes, contributing to the overall cost-effectiveness and sustainability of wind energy projects globally.

Regional Highlights

- Asia Pacific: This region stands as the dominant force in the Wind Power Flange Market, primarily driven by massive investments in wind energy, particularly in China and India. China leads global wind power installations, with aggressive targets for both onshore and offshore expansion, necessitating a robust domestic manufacturing base for flanges. India is also rapidly expanding its wind energy capacity, fueled by government initiatives and the need for clean energy, creating substantial demand. Other countries like South Korea, Japan, and Australia are making significant strides, especially in offshore wind, driving demand for specialized, large-diameter flanges. The region benefits from lower manufacturing costs and a large skilled labor pool, making it a key production hub and consumer market.

- Europe: A mature yet rapidly growing market, Europe is at the forefront of offshore wind technology and deployment, which heavily influences the demand for high-strength, corrosion-resistant flanges. Countries like the UK, Germany, and Denmark are pioneers in large-scale offshore wind projects, requiring sophisticated and highly durable components. Eastern European countries are also increasing their onshore wind capacity. Strict environmental regulations and ambitious renewable energy targets continue to drive sustained investment in wind infrastructure, ensuring a consistent demand for advanced flange solutions capable of enduring harsh marine conditions and heavy loads.

- North America: The market in North America, particularly the United States, is experiencing substantial growth due to renewed federal and state-level support for renewable energy, including tax incentives and favorable policies. Both onshore and nascent offshore wind sectors are expanding rapidly. The U.S. has significant untapped wind resources, leading to large-scale project developments in states like Texas, Iowa, and Oklahoma for onshore, and along the East Coast for offshore. This expansion fuels demand for a wide range of flanges, from standard tower flanges to those required for larger, next-generation turbines and offshore foundations. Canada and Mexico also contribute to regional growth through their own wind energy initiatives.

- Latin America: This region represents an emerging market with significant growth potential, particularly in countries like Brazil, Argentina, and Chile. Abundant wind resources, coupled with growing energy demand and governmental support for renewable energy projects, are attracting investments. While the market is less mature than in developed regions, the increasing deployment of onshore wind farms is steadily driving demand for wind power flanges. Future growth will be contingent on stable political environments and continued infrastructure development to support larger-scale projects.

- Middle East & Africa (MEA): The MEA region is at an early stage of wind energy development but offers substantial long-term growth opportunities. Countries like Saudi Arabia, UAE, and South Africa are investing in diversified energy portfolios, including wind power, to meet rising energy needs and reduce carbon footprints. While current demand for wind power flanges may be lower compared to other regions, ongoing and planned large-scale renewable energy projects are expected to significantly boost market growth in the coming years, particularly as infrastructure and local manufacturing capabilities develop.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Wind Power Flange Market.- Ameriforge Group Inc.

- Scot Forge

- ThyssenKrupp Forging Group

- EEW Group

- Flanschenwerk Rinteln GmbH

- Dühring GmbH & Co. KG

- PWH (Pressure Welding Heidelberg)

- China Flange Co., Ltd.

- Taishan Wind Power Flange Co., Ltd.

- Jiangsu Pacific Precision Forging Co., Ltd.

- Shanghai Huitong Energy & Power Equipment Co., Ltd.

- Ganzhou Xinjian Heavy Industry Co., Ltd.

- Forges de Bologne

- Broder Metals Group

- Dongyi Forging Co., Ltd.

- Guangxi Hualu Heavy Industry Co., Ltd.

- Qingdao Haoyunxiang Steel Flange Co., Ltd.

- Hangzhou Forge Group Co., Ltd.

- Metra Forgings SpA

- Vigor Technology Co., Ltd.

Frequently Asked Questions

What is the projected growth rate for the Wind Power Flange Market?

The Wind Power Flange Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033, driven by the global expansion of wind energy infrastructure and technological advancements in turbine design. This growth reflects the increasing demand for robust and reliable components for both onshore and offshore wind installations, emphasizing the critical role of flanges in the structural integrity of these large-scale energy projects.

What are the primary factors driving the growth of the Wind Power Flange Market?

Key drivers include stringent global renewable energy targets, declining Levelized Cost of Electricity (LCOE) for wind power, significant government support and incentives for wind energy projects, and continuous technological advancements leading to larger and more efficient wind turbines. The substantial growth in the offshore wind sector, with its demand for high-strength, corrosion-resistant flanges, is also a major accelerator for market expansion, pushing innovation in materials and manufacturing processes across the industry.

How does AI impact the Wind Power Flange Market?

AI significantly impacts the Wind Power Flange Market by optimizing manufacturing processes through real-time monitoring, enabling predictive maintenance to extend component lifespan, and enhancing design efficiency through generative design. It also strengthens supply chain resilience and improves quality control via automated inspection systems. These AI applications lead to reduced costs, higher product quality, and increased operational reliability across the entire flange lifecycle, meeting the increasing demands for efficiency and durability in the wind energy sector.

What are the key materials used in manufacturing wind power flanges?

The primary materials used in manufacturing wind power flanges include high-strength carbon steel, alloy steel, and stainless steel. These materials are selected for their superior mechanical properties, fatigue resistance, and durability under various environmental conditions. Ongoing research also explores advanced high-strength low-alloy (HSLA) steels and specialized corrosion-resistant alloys to meet the increasingly stringent demands of larger turbines and harsher operating environments, particularly in offshore applications, ensuring structural integrity and extending operational life.

Which regions are leading in the demand for wind power flanges?

Asia Pacific, particularly China and India, currently leads in the demand for wind power flanges due to extensive investments in new wind farm installations and ambitious renewable energy targets. Europe also remains a major market, especially for offshore wind, with countries like the UK and Germany driving significant demand for advanced flange solutions. North America, led by the U.S., is experiencing strong growth propelled by favorable policies and substantial project pipelines, ensuring robust demand across these key geographical regions.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager