Wind Turbine Components Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431706 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Wind Turbine Components Market Size

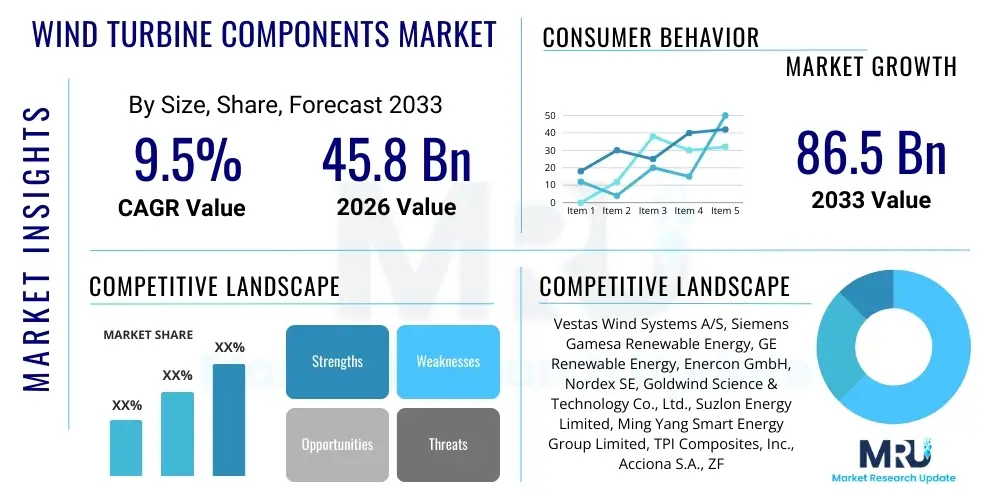

The Wind Turbine Components Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.5% between 2026 and 2033. The market is estimated at USD 45.8 Billion in 2026 and is projected to reach USD 86.5 Billion by the end of the forecast period in 2033.

Wind Turbine Components Market introduction

The Wind Turbine Components Market encompasses the manufacturing, distribution, and servicing of the essential elements that constitute a functional wind energy generation system. These components are critical for converting kinetic energy from the wind into electrical power, ranging from massive rotor blades that capture the energy, to the sophisticated nacelles housing the mechanical and electrical systems, and the robust towers that support the structure. The core product categories include blades, gearboxes, generators, towers, hubs, pitch systems, and yaw drives, all designed to maximize energy capture, ensure operational longevity, and withstand extreme environmental conditions.

Major applications of wind turbine components are bifurcated into onshore and offshore wind farms. Onshore installations traditionally represent the larger share due to lower capital expenditure and easier accessibility, though the trend is shifting towards larger, high-capacity offshore projects, particularly in Europe and Asia Pacific, which necessitate specialized, durable components capable of resisting corrosive marine environments and intense structural loads. The necessity for reliable energy sources and the global pivot towards decarbonization are primary drivers propelling the demand across both application segments. The continuous pursuit of higher capacity factors and reduced levelized cost of energy (LCOE) mandates innovation in component design, particularly focusing on lightweight, high-strength materials like advanced composites and carbon fiber.

The benefits associated with robust wind turbine components include enhanced energy production efficiency, extended operational lifespan, reduced maintenance cycles, and improved grid stability integration. Driving factors include supportive governmental policies such as production tax credits and renewable portfolio standards, significant cost reductions in wind energy technology over the past decade, and the urgent global requirement to mitigate climate change effects. Furthermore, technological advancements, such as the development of direct-drive generators and increasingly long blades (exceeding 100 meters), are continuously expanding the potential geographical scope and economic viability of wind power projects globally, reinforcing the market’s positive trajectory.

Wind Turbine Components Market Executive Summary

The global Wind Turbine Components Market exhibits robust growth, primarily driven by aggressive national renewable energy targets and substantial investment in large-scale offshore projects. Key business trends indicate a shift towards modular component design, facilitating easier transportation and installation, alongside heightened consolidation among major original equipment manufacturers (OEMs) seeking greater supply chain control and technological integration. Furthermore, there is a pronounced focus on digitalization and predictive maintenance solutions (Condition Monitoring Systems - CMS) integrated directly into components to minimize downtime and optimize energy yield, demonstrating a clear movement towards smart wind farm operations and servicing.

Regionally, the market is dominated by the Asia Pacific (APAC), led by China's massive installation capacity and ambitious long-term renewable energy commitments. Europe remains a critical hub, specifically for offshore wind technology innovation, driving demand for specialized, high-durability components such as corrosion-resistant towers and advanced pitch systems. North America is characterized by high demand for repowering older fleets and expanding capacity in land-constrained areas, necessitating highly efficient, next-generation components. These regional dynamics create varied demands for material science and manufacturing scale, influencing global component pricing and supply chain logistics significantly.

Segment trends reveal that the Blades segment, particularly those utilizing carbon fiber and advanced composite structures, is experiencing the fastest growth due to the pursuit of higher swept areas for increased power capture. The Generator segment is witnessing rapid adoption of permanent magnet synchronous generators (PMSGs) over doubly fed induction generators (DFIGs), especially in large offshore turbines, offering improved reliability and reduced need for complex gearboxes. This technological evolution across core components is leading to increased specialization among Tier 1 and Tier 2 suppliers, focusing on enhancing material durability and integration capabilities to support the ever-increasing size and complexity of modern wind turbines.

AI Impact Analysis on Wind Turbine Components Market

User inquiries regarding the impact of Artificial Intelligence (AI) in the Wind Turbine Components Market primarily revolve around operational efficiency, maintenance predictability, and design optimization. Common questions concern how AI can extend component lifespan, reduce catastrophic failures, and streamline complex manufacturing processes. Users are keenly interested in predictive maintenance models trained on vast datasets of vibration, temperature, and performance metrics collected via integrated sensors (IoT), aiming to predict component failure (especially in gearboxes and bearings) long before they occur, thus optimizing scheduled servicing. Furthermore, there is strong interest in using AI algorithms for load and fatigue analysis during the design phase of large components like blades, enabling engineers to create lighter yet stronger structures, ultimately reducing material costs and improving aerodynamic performance. This emphasis on enhancing reliability and efficiency through data-driven insights positions AI as a transformative tool across the entire component lifecycle.

- AI-driven predictive maintenance systems minimize downtime for high-value components (e.g., gearboxes, generators).

- Optimization of aerodynamic profiles for rotor blades using machine learning, leading to increased annual energy production (AEP).

- Enhanced quality control during component manufacturing (e.g., composite layup inspection) via computer vision and deep learning.

- AI algorithms utilized for dynamic load balancing and pitch control, reducing structural stress and extending component fatigue life.

- Optimization of wind farm layout and turbine positioning based on AI analysis of complex wind flow models, maximizing component performance.

DRO & Impact Forces Of Wind Turbine Components Market

The market is primarily driven by global governmental mandates favoring renewable energy adoption and the continuous decline in the LCOE of wind power, making it increasingly competitive against traditional fossil fuels. Restraints include significant supply chain bottlenecks, volatility in raw material prices (especially steel and rare earth minerals for generators), and the substantial upfront capital investment required for large-scale offshore infrastructure. Opportunities lie predominantly in repowering aging fleets in mature markets, the emergence of floating offshore wind technology opening up deeper water areas, and advancements in component recycling technologies addressing end-of-life concerns. These factors collectively determine market buoyancy and strategic investment decisions.

Key drivers include escalating energy demand in developing nations, coupled with stringent environmental regulations implemented globally to meet net-zero emissions goals. The increasing average size and capacity of newly installed wind turbines necessitate corresponding advancements in components, demanding stronger materials, larger bearing systems, and more robust electrical infrastructure. Technological leaps in component reliability, reducing the frequency and cost of maintenance activities, further enhance the economic viability of wind projects, acting as a crucial sustained driver for market expansion across all major geographical regions.

However, the market faces structural constraints related to logistics and infrastructure. Transporting massive components, such as blades exceeding 80 meters or oversized nacelles, presents significant logistical challenges requiring specialized transport vehicles and substantial route planning, particularly for onshore projects. Additionally, the limited number of specialized port infrastructure capable of handling the colossal components required for modern offshore wind installations acts as a bottleneck. These restraints, alongside geopolitical instability affecting key manufacturing hubs, exert continuous pressure on the lead times and overall cost structure of wind turbine components, demanding innovative solutions in modularity and localized production.

Segmentation Analysis

The Wind Turbine Components Market is segmented primarily based on the Type of component, the Application (Onshore or Offshore), and the Material utilized in manufacturing. This segmentation provides a granular understanding of demand drivers and technological focus areas within the industry. The Type segment is critical, as components like blades and gearboxes are high-value elements that dictate overall turbine performance and capital cost. Market dynamics differ significantly between the high-volume, cost-sensitive onshore sector and the high-specification, durability-focused offshore sector, necessitating distinct supply chains and material specifications across applications.

Further analysis of the segmentation reveals that the market for structural materials is evolving rapidly, moving away from conventional steel towards advanced composites and hybrid materials, particularly in high-stress components like towers and blades, to reduce weight while maintaining or increasing strength. This shift is crucial for realizing the economic benefits of larger turbines. Geographically, regional segments reflect varying levels of maturity; mature markets focus on replacements and upgrades, while emerging markets prioritize new installations, affecting the demand mix between standard and customized component specifications.

- By Component Type:

- Blades (Rotor Systems)

- Nacelles (Housing)

- Gearboxes

- Generators (DFIG, PMSG)

- Towers (Steel, Concrete, Hybrid)

- Hubs

- Pitch & Yaw Systems

- Brake Systems

- Controller Systems (Electronics)

- By Application:

- Onshore Wind

- Offshore Wind (Fixed-Bottom, Floating)

- By Material:

- Fiberglass Reinforced Plastic (FRP)

- Carbon Fiber Reinforced Plastic (CFRP)

- Steel Alloys

- Aluminum

- Cast Iron

Value Chain Analysis For Wind Turbine Components Market

The value chain of the Wind Turbine Components Market begins with the upstream segment, which involves the sourcing and processing of critical raw materials, including steel, fiberglass, resins, carbon fiber, copper, and rare earth elements (like Neodymium) essential for permanent magnets in generators. Key upstream activities involve material extraction, advanced composite manufacturing, and precision forging and casting. Suppliers in this segment, such as chemical companies and steel producers, dictate the initial cost and quality profile of the final components. Stability and transparency in the upstream supply chain are paramount, given the increasing geopolitical risks associated with certain critical materials.

The midstream stage focuses on the manufacturing and assembly of the complex components themselves, carried out by specialized component manufacturers (Tier 1 and Tier 2 suppliers) and integrated Original Equipment Manufacturers (OEMs) like Vestas or Siemens Gamesa. This stage involves sophisticated processes such as large-scale blade molding, complex gearbox assembly, and the fabrication of massive steel towers. Distribution channels are highly complex, often involving direct sales contracts between component suppliers and OEMs or project developers. Due to the size and weight of many components, logistics and specialized transport (direct) play a critical role, often requiring localized manufacturing facilities or strategic port proximity to minimize transport costs and risks.

The downstream segment includes project development, installation, operations, and maintenance (O&M), and eventual repowering or decommissioning. End-users (potential customers) are typically utility companies, independent power producers (IPPs), and corporate energy buyers. Indirect distribution channels primarily involve service providers, consultants, and financiers who facilitate the procurement and integration of components into complete wind farms. The efficiency and longevity of the components directly impact the profitability and operational success in the downstream sector, linking component quality directly to long-term project viability and subsequent demand for replacement parts and upgrades over the turbine’s 20-30 year lifespan.

Wind Turbine Components Market Potential Customers

Potential customers and primary buyers in the Wind Turbine Components Market are primarily large-scale energy producers and developers responsible for constructing and operating wind farms globally. These entities include major utility companies that integrate wind power into their generation mix to meet regulatory mandates and customer demand for clean energy. Their procurement strategies are highly focused on component reliability, long-term warranty provisions, and standardized maintenance requirements, as system failure translates directly into significant revenue loss and increased operational expenditure.

Independent Power Producers (IPPs) represent another critical customer segment. IPPs typically develop, own, and operate power generation facilities, often selling electricity under long-term power purchase agreements (PPAs). For IPPs, component purchasing decisions are heavily influenced by the levelized cost of energy (LCOE) projections, leading them to favor cutting-edge components that offer the highest possible energy yield and lowest lifetime operational costs. They often engage directly with OEMs but exert significant influence over the selection of sub-components to ensure project financing milestones are met.

Furthermore, specialized segments such as corporate energy buyers (e.g., large tech companies seeking to source 100% renewable power) are increasingly acting as direct or indirect customers by commissioning bespoke wind projects. Additionally, maintenance and repair organizations (MROs) and repowering specialists constitute a growing customer base for replacement and upgraded components. These buyers require specialized inventory, focusing on components compatible with various turbine models, emphasizing the after-sales market importance for component manufacturers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 45.8 Billion |

| Market Forecast in 2033 | USD 86.5 Billion |

| Growth Rate | 9.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Vestas Wind Systems A/S, Siemens Gamesa Renewable Energy, GE Renewable Energy, Enercon GmbH, Nordex SE, Goldwind Science & Technology Co., Ltd., Suzlon Energy Limited, Ming Yang Smart Energy Group Limited, TPI Composites, Inc., Acciona S.A., ZF Wind Power, Xinjiang Goldwind Science & Technology Co., Ltd., CSIC Haizhuang Windpower Co., Ltd., United Power, ENVISION Group, Hexcel Corporation, Toray Industries, Inc., DNV GL, SGS SA, SKF Group |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Wind Turbine Components Market Key Technology Landscape

The technological landscape of the Wind Turbine Components Market is characterized by a relentless drive towards maximizing efficiency, durability, and scalability, primarily in response to the massive requirements of offshore wind farms. A key area of innovation is in rotor blade technology, specifically the integration of advanced composites like carbon fiber spars and structural elements. These materials allow for the production of extremely long blades (often exceeding 100 meters) without prohibitive increases in weight, thereby enabling higher energy capture and increased turbine ratings. Furthermore, segmented or modular blade designs are emerging to overcome logistical bottlenecks associated with transporting ultra-large components, facilitating deployment in previously inaccessible locations.

In the field of power conversion and transmission, the technology shift is palpable. There is a marked transition from traditional geared drivetrains utilizing Doubly Fed Induction Generators (DFIGs) towards direct-drive systems employing Permanent Magnet Synchronous Generators (PMSGs). Direct-drive systems eliminate the complex, high-maintenance gearbox, significantly boosting reliability, particularly in harsh offshore environments where scheduled maintenance is costly and weather-dependent. While PMSGs require rare earth elements, the operational benefits—including better low-wind performance and simplified O&M—often outweigh the material cost considerations, driving widespread adoption in next-generation high-capacity turbines (8 MW and above).

Another crucial technological focus involves smart components integrating advanced monitoring and control systems. Pitch and yaw systems now employ highly sophisticated sensory arrays and computational fluid dynamics (CFD) modeling capabilities to adjust blade angles and nacelle orientation dynamically and instantaneously, optimizing power output and minimizing damaging structural loads, especially during turbulent weather events. Furthermore, non-destructive testing (NDT) technologies, including ultrasonic and thermal imaging inspection tools, are becoming standard for quality assurance in high-stress components like rotor shafts and main bearings, ensuring structural integrity throughout the component lifespan and proactively preventing costly failures, enhancing the overall resilience of the wind energy infrastructure.

Regional Highlights

- Asia Pacific (APAC): APAC is the largest and fastest-growing regional market, fundamentally driven by China's dominant position in both manufacturing and installation, especially in onshore wind. Rapid expansion in emerging economies like India, coupled with massive offshore build-out plans in nations such as Vietnam, South Korea, and Japan, fuels extraordinary demand for all component types. The region benefits from localized supply chains, although global commodity price fluctuations remain a challenge.

- Europe: Europe is the established leader in offshore wind technology and innovation, setting the global standard for component size and durability, particularly for floating offshore components. Countries like the UK, Germany, and Denmark are driving demand for highly specialized, robust components designed to withstand severe North Sea conditions. The region’s focus is strongly weighted towards R&D, standardization, and sustainability, emphasizing component recycling capabilities.

- North America: The market is characterized by robust regulatory support (e.g., Inflation Reduction Act - IRA in the US) stimulating both new project installations and a significant surge in repowering activity, where older, less efficient components are replaced with modern, higher-capacity technology. This creates sustained demand for medium-sized blades, gearboxes, and control systems optimized for the US land-based fleet, with growing opportunities in emerging offshore wind areas along the East Coast.

- Latin America: This region shows promising potential, with high-growth markets in Brazil and Mexico utilizing their abundant wind resources. Demand is centered on reliable, cost-effective components suitable for remote installation and varied climatic conditions. Financing and political stability remain key determinants affecting the pace of component procurement and project deployment.

- Middle East and Africa (MEA): While currently a smaller contributor, the MEA region is poised for significant growth, especially in countries like Saudi Arabia, UAE, and South Africa, as they diversify their energy portfolios. Component demand here is highly specific, requiring components designed to withstand high temperatures, sand abrasion, and often operate in challenging, remote desert environments.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Wind Turbine Components Market.- Vestas Wind Systems A/S

- Siemens Gamesa Renewable Energy

- GE Renewable Energy

- Enercon GmbH

- Nordex SE

- Goldwind Science & Technology Co., Ltd.

- Suzlon Energy Limited

- Ming Yang Smart Energy Group Limited

- TPI Composites, Inc.

- Acciona S.A.

- ZF Wind Power

- Xinjiang Goldwind Science & Technology Co., Ltd.

- CSIC Haizhuang Windpower Co., Ltd.

- United Power

- ENVISION Group

- Hexcel Corporation

- Toray Industries, Inc.

- DNV GL

- SGS SA

- SKF Group

Frequently Asked Questions

Analyze common user questions about the Wind Turbine Components market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the current growth of the Wind Turbine Components Market?

The primary driver is the declining Levelized Cost of Energy (LCOE) for wind power, which makes it economically competitive with conventional power sources, coupled with aggressive global governmental policies and renewable energy targets stimulating rapid new installation capacity, particularly in offshore wind projects requiring specialized, high-capacity components.

Which component segment is expected to experience the highest growth rate?

The Rotor Blades segment is projected to show the highest growth, driven by the increasing size of new turbines, necessitating advanced materials like carbon fiber for manufacturing ultra-long blades (80+ meters) that maximize the swept area and enhance energy capture efficiency across large-scale projects.

How is the adoption of direct-drive technology influencing the market?

The adoption of Permanent Magnet Synchronous Generators (PMSGs) and direct-drive technology is reducing reliance on traditional gearboxes, thereby decreasing the complexity and maintenance requirements of the drivetrain. This shift is particularly pronounced in the offshore sector due to the high costs associated with remote maintenance activities.

What major logistical challenge is constraining market expansion?

Logistical constraints, specifically the challenge of transporting increasingly massive and oversized components (blades, nacelles, tower sections) from manufacturing facilities to remote project sites, significantly impacts project timelines and costs, requiring localized manufacturing or substantial infrastructure investment.

Which geographical region holds the largest market share for wind turbine components?

The Asia Pacific (APAC) region currently holds the largest market share, predominantly led by China's extensive manufacturing capabilities and massive domestic wind energy installation volume, encompassing both onshore and rapidly expanding offshore projects.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager