Wind Turbine Condition Monitoring System Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437642 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Wind Turbine Condition Monitoring System Market Size

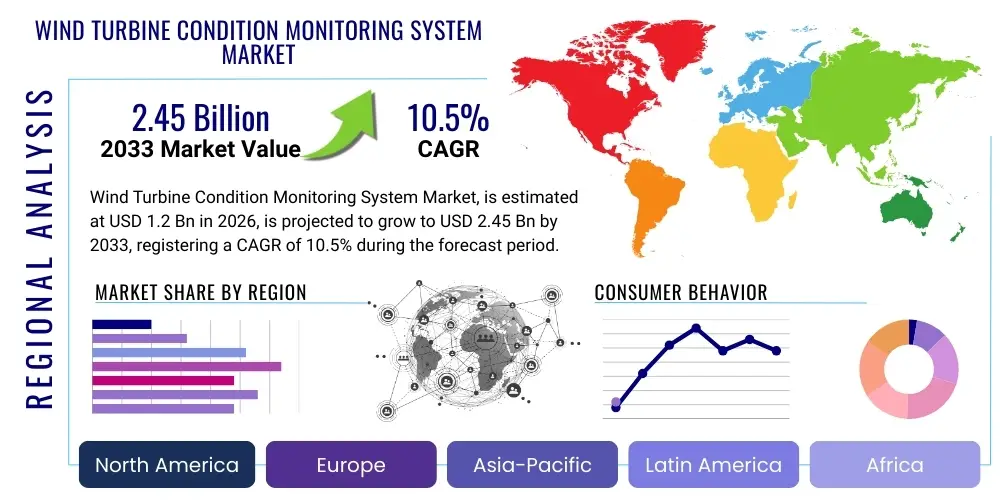

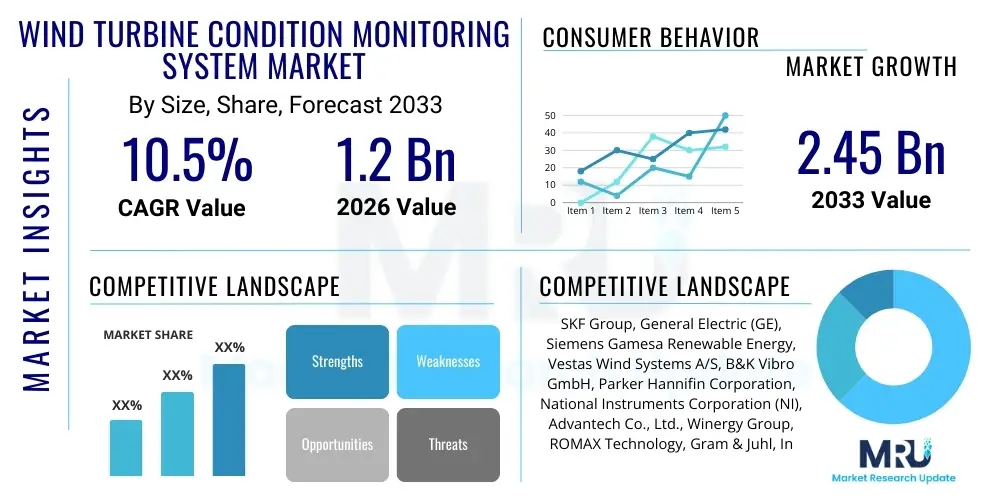

The Wind Turbine Condition Monitoring System Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 10.5% between 2026 and 2033. The market is estimated at USD 1.2 Billion in 2026 and is projected to reach USD 2.45 Billion by the end of the forecast period in 2033.

Wind Turbine Condition Monitoring System Market introduction

The Wind Turbine Condition Monitoring System (CMS) Market encompasses sophisticated solutions designed to monitor the operational health of critical wind turbine components, including gearboxes, generators, blades, bearings, and drivetrains. These systems utilize various sensors—such as accelerometers, proximity probes, temperature sensors, and acoustic emission devices—to collect real-time data on vibration, stress, temperature, and oil particle count. The primary objective is to enable predictive maintenance strategies, shifting the industry focus from reactive fault fixing to proactive intervention, thereby minimizing downtime, extending asset lifespan, and significantly reducing overall maintenance expenditures (OPEX). The increasing global commitment to renewable energy sources, particularly wind power, coupled with the necessity of maintaining operational efficiency in aging turbine fleets, establishes a robust foundation for market expansion across key geographical regions, especially in offshore wind farms where maintenance logistics are complex and costly.

Condition monitoring systems are fundamentally crucial for optimizing energy production reliability. Early detection of component degradation, such as incipient bearing failure or gear tooth cracks, allows operators to schedule repairs during favorable weather conditions or low-demand periods, preventing catastrophic failure and subsequent long-term outages. The integration of advanced analytics, including Machine Learning (ML) algorithms, into CMS platforms is transforming raw sensor data into actionable insights, providing high-fidelity fault diagnostics and prognostics. Furthermore, the standardization of communication protocols and the proliferation of IoT devices enhance the connectivity and scalability of these monitoring solutions, driving adoption across utilities, independent power producers (IPPs), and asset management firms specializing in wind energy generation. The increasing size and complexity of modern, multi-megawatt wind turbines necessitate these advanced monitoring capabilities to ensure sustained economic viability.

Major applications of WT CMS include continuous monitoring of turbine drivetrain integrity, blade structural health monitoring (BSHM), lubrication oil analysis, and tower vibration checks. Key market drivers include stringent regulatory requirements for operational safety, the rising average age of the installed wind energy capacity globally requiring life extension solutions, and the ongoing technological advancements in sensor miniaturization and wireless data transmission. The quantifiable economic benefit derived from avoided major repairs and reduced insurance premiums serves as a compelling financial incentive for widespread implementation of these systems across both onshore and challenging offshore environments, thereby accelerating the market trajectory.

- Product Description: Integrated hardware and software solutions utilizing sensors (vibration, temperature, oil particle) to monitor turbine component health in real-time.

- Major Applications: Gearbox monitoring, bearing analysis, generator health inspection, blade pitch system diagnostics, and structural integrity checks.

- Benefits: Increased asset uptime, optimized maintenance scheduling (predictive maintenance), extended turbine lifespan, reduced operational costs, and enhanced safety compliance.

- Driving Factors: Growth in global wind energy installations, high costs associated with unexpected component failure, and necessity of optimizing performance in remote/offshore locations.

Wind Turbine Condition Monitoring System Market Executive Summary

The Wind Turbine Condition Monitoring System (CMS) market is characterized by rapid technological assimilation, particularly the integration of Artificial Intelligence (AI) and edge computing for real-time anomaly detection and prognosis, moving beyond traditional signature analysis. Business trends highlight a strong focus on service-based models, where vendors offer Monitoring-as-a-Service (MaaS), bundling hardware, software, and expert analysis into subscription packages, which lowers the initial capital expenditure barrier for smaller operators and standardizes fleet management across diverse turbine models. Consolidation is observable among specialized software and sensor providers, aiming to offer holistic, vertically integrated solutions. Furthermore, there is a pronounced shift towards retrofitting existing older turbines with advanced CMS technologies to maximize the Return on Investment (ROI) from aging assets, particularly in mature markets like Europe and North America. Supply chain resilience and the ability to integrate heterogeneous data sources efficiently remain key competitive differentiators within the ecosystem.

Regionally, the market is spearheaded by Europe, primarily due to its vast offshore wind capacity and aggressive renewable energy targets, demanding high reliability from assets situated in harsh environments. Asia Pacific (APAC), however, represents the fastest-growing region, driven largely by massive new onshore and offshore installations in China, India, and emerging economies in Southeast Asia. Government support, coupled with the increasing complexity of new-generation turbines manufactured locally, is fueling demand for sophisticated CMS solutions in APAC. North America maintains significant market presence, focusing heavily on technology refinement, particularly the deployment of advanced wireless sensing networks and cloud-based analytics platforms to manage geographically dispersed wind farms efficiently and cost-effectively.

Segment trends reveal that vibration monitoring remains the dominant technology segment due to its proven efficacy in diagnosing mechanical faults, though acoustic emission and electrical signature analysis (ESA) are gaining momentum for earlier and more nuanced fault detection in gearboxes and generators, respectively. In terms of components, the gearbox segment retains the largest market share, given its complexity and susceptibility to high failure rates and associated costly repairs. The trend is moving towards multi-technology integration, where operators deploy a suite of complementary monitoring techniques to achieve a comprehensive diagnostic view, ensuring high fault detection rates and minimal false positives, thereby solidifying the market structure towards integrated diagnostic platforms rather than isolated monitoring tools.

- Business Trends: Shift towards MaaS (Monitoring-as-a-Service), increased strategic partnerships between hardware and AI firms, and focus on integrated diagnostic platforms.

- Regional Trends: Europe leading due to offshore investments, APAC fastest-growing market driven by China and India, and North America focusing on advanced data analytics and wireless solutions.

- Segments Trends: Vibration monitoring remains dominant, but integrated multi-technology systems combining acoustic emission and oil particle counters are driving growth, particularly targeting critical components like gearboxes and main bearings.

AI Impact Analysis on Wind Turbine Condition Monitoring System Market

User inquiries concerning the impact of Artificial Intelligence (AI) on the Wind Turbine Condition Monitoring System (CMS) market overwhelmingly revolve around themes of predictive accuracy, operational scalability, and data security. Users frequently ask how AI, specifically Machine Learning (ML) models, can transition from merely detecting existing faults to accurately predicting the remaining useful life (RUL) of components, and whether AI-driven systems can handle the massive, continuous data streams generated by multi-megawatt turbines across large fleets without overwhelming existing infrastructure. A key concern is the reliability and explainability of AI diagnoses; operators require transparent models that justify fault predictions to ensure trust and avoid unnecessary or premature maintenance interventions. Furthermore, questions center on the integration complexity of AI platforms with proprietary turbine Supervisory Control and Data Acquisition (SCADA) systems and the necessary cybersecurity measures required to protect sensitive operational data transmitted across cloud or edge environments.

The core promise of AI in this domain is its ability to extract complex, non-linear patterns indicative of early component failure that often remain undetected by traditional, rule-based monitoring thresholds or simple statistical methods. AI algorithms, particularly deep learning networks, excel at processing high-dimensional sensor data—such as vibration spectra combined with operational variables (e.g., wind speed, torque, temperature)—to perform highly accurate pattern recognition. This capability drastically improves fault isolation and reduces false alarms, which historically plague traditional CMS, allowing maintenance teams to focus resources precisely where they are needed. Moreover, AI enables fleet-wide benchmarking, identifying systemic design or operational flaws by analyzing performance deviations across hundreds of identical assets simultaneously, thus transforming individualized component monitoring into enterprise-level asset management strategy.

The long-term expectation is that AI will automate the entire diagnostic workflow. Edge computing hardware embedded within the turbine will use optimized ML models to pre-process data and flag anomalies locally, reducing data transmission latency and bandwidth requirements. Cloud-based AI platforms will then refine these diagnoses, offering prescriptive maintenance recommendations—telling the operator not just that a bearing is failing, but precisely when it must be replaced to minimize costs while maintaining reliability. This shift facilitates genuine predictive maintenance, maximizing energy yield and significantly lowering the Levelized Cost of Energy (LCOE) associated with wind power generation, establishing AI as the critical technological enabler for the next generation of wind farm operations.

- AI impacts in concise points

- Enables highly accurate Remaining Useful Life (RUL) predictions for critical components like gearboxes and bearings.

- Automates anomaly detection using Machine Learning (ML) across massive fleet datasets, identifying nascent failure patterns.

- Facilitates Prescriptive Maintenance by generating optimized repair schedules, minimizing operational downtime.

- Improves diagnostic specificity, significantly reducing false positive alarms compared to traditional threshold-based monitoring.

- Optimizes data processing through integration of Edge Computing, enabling faster, real-time diagnostic feedback loops.

- Enhances fleet benchmarking capabilities by standardizing component health assessment across diverse operational environments.

DRO & Impact Forces Of Wind Turbine Condition Monitoring System Market

The dynamics of the Wind Turbine Condition Monitoring System (CMS) market are shaped significantly by powerful drivers, systemic restraints, and emerging opportunities, all mediated by several impactful forces. A primary driver is the sheer scale and complexity of modern wind infrastructure; as turbines increase in height, rotor diameter, and power rating (reaching 10+ MW), the cost and logistical complexity of maintenance, especially offshore, escalate dramatically, making preventative CMS implementation economically indispensable. The global push for renewable energy targets and the consequent robust investment in new wind farm capacity, coupled with the need to extend the operational life of legacy assets beyond 20 years, further amplify demand. Conversely, the high initial capital investment required for comprehensive, multi-channel CMS installation acts as a restraint, particularly for smaller independent power producers (IPPs). Moreover, the lack of standardized data formats across different turbine original equipment manufacturers (OEMs) and the inherent difficulty in integrating proprietary SCADA systems present technical hurdles that slow widespread adoption and increase deployment costs for third-party monitoring solutions.

Opportunities in this sector are vast, driven primarily by technological innovation. The ongoing development of cost-effective, high-resolution wireless sensor technologies eliminates the need for complex cabling, drastically simplifying retrofit installations and lowering implementation costs. Furthermore, the burgeoning field of specialized predictive maintenance software, leveraging advanced physics-informed AI models, offers substantial growth avenues. Developing integrated CMS solutions that combine vibration, oil, and electrical monitoring into a single, cohesive diagnostic platform presents a major opportunity for market leadership. The increasing focus on blade structural health monitoring (BSHM), using drone inspection data combined with CMS telemetry, is another high-growth area, addressing the crucial issue of rotor degradation which significantly impacts energy production efficiency and structural safety.

The impact forces influencing the market trajectory include rapid technological obsolescence—the constant introduction of more sophisticated sensors and faster processing algorithms compels existing players to continuously innovate. Regulatory policies, such as mandatory safety standards and long-term warranties dictated by financial institutions, exert pressure on operators to adopt certified monitoring solutions. Competitive pressure from major turbine OEMs entering the monitoring service space, offering bundled services directly to clients, forces independent CMS providers to differentiate through advanced analytical capabilities and superior service reliability. The macroeconomic environment, specifically volatile energy prices and fluctuating governmental subsidies for renewables, indirectly impacts investment decisions for both new construction and major retrofitting projects, influencing the pace of CMS uptake globally.

- Drivers:

- Rapid expansion of large-scale offshore wind farms demanding maximum uptime.

- Escalating costs associated with catastrophic failures and unplanned downtime in remote locations.

- Increasing governmental mandates and incentives supporting renewable energy infrastructure.

- Necessity of extending the lifespan and maximizing the ROI of aging turbine fleets.

- Restraints:

- High initial installation costs (CAPEX) for advanced multi-channel monitoring systems.

- Lack of standardization and interoperability across proprietary OEM turbine control systems (SCADA).

- Need for highly specialized expertise for data analysis and accurate fault interpretation.

- Opportunities:

- Development of low-cost, high-fidelity wireless sensing networks suitable for quick retrofitting.

- Integration of advanced AI/ML for precise Remaining Useful Life (RUL) prognostics.

- Expansion into emerging markets, particularly Asia Pacific, with significant planned capacity additions.

- Focus on specialized applications like structural health monitoring (SHM) for turbine blades and towers.

- Impact Forces:

- Competitive dynamics driven by OEM vs. Independent Service Provider (ISP) offerings.

- Technological innovation pace (e.g., migration from wired to wireless systems and cloud analytics).

- Global economic trends impacting capital investment in long-term infrastructure projects.

- Strict environmental and safety regulations mandating preventative maintenance protocols.

Segmentation Analysis

The Wind Turbine Condition Monitoring System (CMS) Market is primarily segmented based on the technology deployed, the specific component being monitored, the application environment (onshore vs. offshore), and the service model adopted. This segmentation allows stakeholders to target specialized requirements, particularly differentiating solutions tailored for highly accessible onshore farms versus the high-reliability, rugged systems required for complex offshore installations. Technology segmentation reflects the maturity and diagnostic focus of various sensors, ranging from vibration analysis—the traditional backbone of CMS—to emerging technologies like acoustic emission and electrical signature analysis which offer complementary benefits, particularly in detecting specific types of fault phenomena such as electrical winding degradation or lubricity issues, thereby providing a multi-layered diagnostic approach to turbine health management.

Component segmentation highlights the proportional investment allocated to monitoring the most failure-prone and costly parts of the turbine. Gearboxes and main bearings consistently represent the largest segment due to their high repair cost and their critical role in the drivetrain, justifying the deployment of highly redundant and specialized monitoring hardware. Similarly, blade monitoring is rapidly gaining prominence as rotor size increases and potential damage from lightning, erosion, or fatigue becomes a greater concern for structural integrity. Analyzing these segments helps firms tailor their offerings, perhaps specializing in advanced bearing diagnostics for offshore fleets or focusing on cost-effective, standardized vibration kits for mass deployment in established onshore markets, optimizing product-market fit.

The categorization by service model—hardware sales versus service contracts—is increasingly important, reflecting the industry shift toward outcome-based relationships. Monitoring-as-a-Service (MaaS) contracts provide operators with expert analysis and actionable reports rather than just raw data, making advanced CMS accessible even to those lacking in-house data science expertise. This trend is central to market growth, facilitating easier procurement and budgeting for wind farm owners and shifting the risk and complexity of data interpretation onto the service provider, which typically leads to higher customer retention rates and predictable recurring revenue streams for the CMS vendors.

- Key Market Segments:

- By Technology:

- Vibration Monitoring

- Oil Particle Counting/Analysis

- Acoustic Emission

- Temperature Monitoring

- Electrical Signature Analysis (ESA)

- By Component:

- Gearbox

- Main Bearing

- Generator

- Rotor Blade

- Hydraulic and Yaw System

- By Application/Location:

- Onshore

- Offshore

- By Service Model:

- Hardware Sales

- Monitoring-as-a-Service (MaaS) / Service Contracts

- Software and Analytics Solutions

Value Chain Analysis For Wind Turbine Condition Monitoring System Market

The value chain for the Wind Turbine CMS market begins with the upstream suppliers responsible for manufacturing critical hardware components. This includes specialized sensor manufacturers (accelerometers, ultrasonic sensors, fiber optics), data acquisition system (DAQ) and logger producers, and signal conditioning equipment vendors. Success in this stage relies heavily on high precision, robustness against harsh environmental conditions (temperature extremes, vibration, humidity), and cost-effective mass production capabilities. Competition here is often based on technological superiority, particularly in developing wireless, low-power sensor networks and embedded processing capabilities for edge computing, ensuring high data integrity before transmission. Key strategic moves involve securing reliable sources for specialized materials and maintaining high quality control standards to ensure sensor longevity.

The middle segment involves system integrators and monitoring solution providers. These entities take the upstream components and integrate them into a cohesive, proprietary CMS platform, which includes both hardware installation expertise and, crucially, the development of sophisticated diagnostic and prognostic software. This is where proprietary algorithms, data processing capabilities, and advanced analytics (including AI/ML models) are developed to transform raw physical measurements into actionable health insights (fault alarms, severity assessments, Remaining Useful Life calculations). Distribution channels for these solutions are bifurcated: direct sales to major Wind Turbine OEMs who bundle the CMS into new turbine packages, and direct sales/service contracts with Independent Service Providers (ISPs) or end-user wind farm operators for retrofitting or fleet management.

The downstream segment primarily consists of the end-users—wind farm operators, asset managers, and utility companies—who utilize the CMS output to inform their maintenance strategies. This stage is dominated by service delivery (Monitoring-as-a-Service, MaaS), where data interpretation, expert reporting, and consultative support are provided. Direct interaction with the end-user ensures the CMS outputs align with real-world maintenance logistics and economic constraints. The indirect path often involves system integrators working through EPC (Engineering, Procurement, and Construction) companies during the wind farm construction phase. Profitability throughout the chain is highest in the software and service layer, driven by recurring revenue, superior margins on specialized analytical services, and the immense value derived from preventing expensive catastrophic failures.

- Upstream Analysis: Raw sensor manufacturing (MEMS, piezoelectric), data acquisition hardware development, and signal processing technology providers.

- Downstream Analysis: Wind farm owners (utilities, IPPs), asset managers, and specialized maintenance service providers who consume diagnostic reports and actionable insights.

- Distribution Channel: Direct sales to OEMs and major utilities; indirect sales via system integrators, EPC contractors, and long-term Monitoring-as-a-Service (MaaS) contracts.

- Direct and Indirect: Direct channels offer better control over service quality and customer relationships; indirect channels provide scalability and rapid market penetration through established OEM relationships.

Wind Turbine Condition Monitoring System Market Potential Customers

The primary potential customers for Wind Turbine Condition Monitoring Systems are categorized into four major groups, each having distinct procurement criteria and operational requirements. The largest segment includes Independent Power Producers (IPPs) and large utility companies that own and operate extensive wind turbine fleets across diverse geographical locations. For these entities, the procurement decision is driven by maximizing overall fleet performance, minimizing insurance costs, and ensuring regulatory compliance. They prioritize scalable, interoperable CMS platforms that can seamlessly integrate data from thousands of turbines of varying ages and models, demanding sophisticated centralized data analytics and prognostic capabilities to support enterprise-level asset management strategies.

The second major group comprises Wind Turbine Original Equipment Manufacturers (OEMs). OEMs often integrate CMS solutions directly into their newly built turbines, offering monitoring as a standard or optional feature. Their objective is twofold: to enhance the reliability reputation of their machines and to generate high-margin, long-term service contract revenue (Monitoring-as-a-Service). OEMs require robust, highly customized CMS hardware optimized for their specific turbine designs, often partnering with sensor specialists for proprietary monitoring technology. This segment typically accounts for a significant volume of initial CMS deployment units globally, particularly in new wind project construction.

The third group encompasses third-party Independent Service Providers (ISPs) and specialized asset management firms. These companies manage and maintain wind farms for smaller owners or financial institutions. They are highly motivated by efficiency and cost-effectiveness, seeking flexible CMS solutions that can be easily retrofitted onto diverse turbine types without extensive modification. ISPs value systems that offer rapid deployment, high diagnostic accuracy, and user-friendly interfaces, enabling their technicians to execute precise, proactive maintenance actions quickly, thereby enhancing the value proposition they offer to their clients.

Finally, governmental and private research institutions constitute a smaller but crucial customer base, utilizing advanced CMS for life extension studies, component reliability testing, and optimizing next-generation turbine designs. Their demand centers around specialized, high-resolution monitoring equipment capable of detailed failure analysis and collecting granular data for modeling purposes, often leveraging the latest R&D in fiber optic or acoustic sensing technologies to push the boundaries of current predictive maintenance capabilities.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.2 Billion |

| Market Forecast in 2033 | USD 2.45 Billion |

| Growth Rate | 10.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | SKF Group, General Electric (GE), Siemens Gamesa Renewable Energy, Vestas Wind Systems A/S, B&K Vibro GmbH, Parker Hannifin Corporation, National Instruments Corporation (NI), Advantech Co., Ltd., Winergy Group, ROMAX Technology, Gram & Juhl, InsiteIG, ZF Friedrichshafen AG, Condition Monitoring Systems LLC, Vaisala Oyj, Envision Energy, Goldwind Science & Technology Co., Ltd., AWS Truepower (now UL Solutions), DNV GL, and ONYX InSight. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Wind Turbine Condition Monitoring System Market Key Technology Landscape

The technological landscape of the Wind Turbine Condition Monitoring System (CMS) market is rapidly evolving, moving from purely reactive, signature-based analysis toward sophisticated prognostic systems powered by real-time data integration. Vibration monitoring remains the foundational technology, utilizing high-frequency accelerometers and complex signal processing techniques (e.g., FFT analysis, envelope demodulation) to diagnose mechanical defects like bearing and gear wear. The advancement here lies in integrating multi-axis sensors and optimizing data collection frequency to capture short-lived fault signatures. However, the market is increasingly adopting complementary technologies to achieve a comprehensive view of turbine health, recognizing that no single sensor modality provides a complete diagnostic picture. This multi-modality approach is becoming the industry standard, ensuring high reliability and specificity in fault detection.

One critical technological development is the proliferation of wireless sensor networks (WSN) and edge computing. WSNs address the significant installation challenge associated with wired systems, especially in retrofit scenarios, offering high-fidelity data transmission via protocols like Wi-Fi 6 or specialized mesh networks (e.g., LoRaWAN). Edge computing processors embedded directly within the turbine housing allow pre-processing and data compression, executing initial AI/ML models locally to filter non-critical data before transmission to the cloud. This architecture dramatically reduces bandwidth dependency, lowers operational latency, and enhances cybersecurity by minimizing the volume of sensitive data transmitted externally, making remote monitoring more feasible and cost-effective across geographically dispersed wind farms and remote offshore assets.

Furthermore, the software and analytics layer represents the highest value-add technology. Advanced prognostics platforms utilize physics-informed deep learning models to predict the Remaining Useful Life (RUL) of components, far surpassing simple empirical models. Electrical Signature Analysis (ESA) is gaining traction, particularly for generator and power converter monitoring, detecting electrical anomalies that vibration sensors might miss, such as rotor bar issues or winding degradation, without requiring physical installation inside the nacelle. Simultaneously, non-contact monitoring techniques, such as acoustic emission sensors for incipient crack detection and thermal imaging for overheating components, are being integrated to provide non-intrusive monitoring alternatives, collectively contributing to a highly robust and technologically advanced predictive maintenance framework.

Regional Highlights

Europe currently commands a significant portion of the Wind Turbine Condition Monitoring System (CMS) market, driven primarily by its mature wind energy sector and extensive offshore deployment. Countries like Germany, the UK, and Denmark have large, aging fleets that require sophisticated CMS solutions for life extension and operational optimization. The region benefits from stringent regulatory frameworks and a highly competitive service market, compelling operators to adopt best practices in predictive maintenance to reduce high insurance costs associated with offshore failures. European investment in innovative technologies, particularly in integrating digital twins and AI-driven platforms with CMS data, establishes the continent as a leader in high-fidelity diagnostics and advanced asset management strategies, focusing heavily on minimizing intervention frequency in deep-water environments.

The Asia Pacific (APAC) region is projected to exhibit the fastest Compound Annual Growth Rate (CAGR) throughout the forecast period. This rapid growth is fueled by massive governmental targets for renewable energy capacity, led predominantly by China and India, which are undertaking the construction of some of the world's largest onshore and coastal offshore wind farms. While the initial focus in APAC was on basic monitoring for new installations, the rapid scaling and the increasing complexity of locally manufactured multi-megawatt turbines are now necessitating the adoption of advanced, integrated CMS technologies. Key market drivers include the need for localized maintenance expertise and the increasing requirement for robust, reliable systems capable of withstanding the challenging environmental conditions prevalent in Southeast Asia, creating immense opportunities for both global and domestic CMS providers.

North America, particularly the United States, represents a highly lucrative market segment characterized by a large installed base across widespread geographical areas, often subjected to extreme weather variability. Demand here is strongly centered on optimizing logistical efficiency and fleet management through centralized, cloud-based analytics. Operators prioritize wireless CMS solutions for ease of retrofit onto existing infrastructure and robust software capable of handling massive data throughput efficiently. Furthermore, Latin America and the Middle East & Africa (MEA) are emerging markets, where new wind energy projects, particularly in Brazil, South Africa, and parts of the UAE, are driving initial deployment of CMS solutions, often bundled with new turbine sales, as part of comprehensive long-term maintenance contracts focusing on asset reliability from the onset of operation.

- North America: Focus on fleet optimization, cloud analytics integration, and widespread adoption of wireless monitoring systems for decentralized asset management.

- Europe: Market leader driven by extensive offshore capacity, aging fleet life extension programs, stringent regulatory standards, and high adoption of digital twin technology.

- Asia Pacific (APAC): Fastest-growing region, powered by massive new installations in China and India, high demand for scalable, cost-effective CMS solutions, and increasing focus on localized manufacturing support.

- Latin America (LATAM): Emerging market, primarily driven by new utility-scale projects in Brazil and Mexico, integrating CMS solutions early in the asset life cycle.

- Middle East and Africa (MEA): Growth linked to long-term government investment in renewable energy diversification strategies, requiring robust monitoring for large-scale, remote installations.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Wind Turbine Condition Monitoring System Market.- SKF Group

- General Electric (GE)

- Siemens Gamesa Renewable Energy

- Vestas Wind Systems A/S

- B&K Vibro GmbH

- Parker Hannifin Corporation

- National Instruments Corporation (NI)

- Advantech Co., Ltd.

- Winergy Group

- ROMAX Technology

- Gram & Juhl

- InsiteIG

- ZF Friedrichshafen AG

- Condition Monitoring Systems LLC

- Vaisala Oyj

- Envision Energy

- Goldwind Science & Technology Co., Ltd.

- AWS Truepower (now UL Solutions)

- DNV GL

- ONYX InSight

Frequently Asked Questions

Analyze common user questions about the Wind Turbine Condition Monitoring System market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary benefit of deploying a Wind Turbine Condition Monitoring System (CMS)?

The primary benefit of deploying a CMS is enabling predictive maintenance (PdM). This allows operators to accurately anticipate component failures, shift from costly reactive repairs to planned interventions, minimize catastrophic downtime, and significantly extend the operational lifespan of the wind turbine asset, ultimately lowering the Levelized Cost of Energy (LCOE).

How does Artificial Intelligence (AI) enhance traditional Wind Turbine CMS capabilities?

AI, specifically Machine Learning (ML), enhances CMS by processing massive, complex sensor data to detect subtle, incipient failure patterns that traditional threshold monitoring misses. AI improves diagnostic accuracy, significantly reduces false alarms, and provides crucial prognostic estimates, such as the Remaining Useful Life (RUL) of critical components like gearboxes and main bearings.

Which component typically requires the most specialized monitoring and why?

The gearbox typically requires the most specialized monitoring. As the most complex mechanical component, it is highly prone to wear, fatigue, and sudden failure. Gearbox repairs are exceptionally costly and require long downtime, necessitating multi-channel monitoring (vibration, oil analysis, temperature) to detect early stage defects across its gears and bearings.

Is the Wind Turbine CMS market growth driven more by onshore or offshore installations?

While onshore installations constitute the largest installed base, the market growth and technological sophistication are increasingly driven by offshore installations. The extremely high operational and logistical costs associated with offshore maintenance necessitate highly robust, predictive CMS solutions to guarantee maximum uptime in remote and harsh marine environments.

What is Monitoring-as-a-Service (MaaS) and why is it gaining traction in the CMS market?

Monitoring-as-a-Service (MaaS) is a subscription-based model where vendors provide the full CMS solution—hardware, software, data analysis, and expert reporting—rather than just selling equipment. It is gaining traction because it lowers the initial capital expenditure for operators and transfers the complexity of data interpretation to the service provider, offering actionable insights necessary for efficient asset management.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager