Wind Turbine Installation Vessel Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 440376 | Date : Jan, 2026 | Pages : 258 | Region : Global | Publisher : MRU

Wind Turbine Installation Vessel Market Size

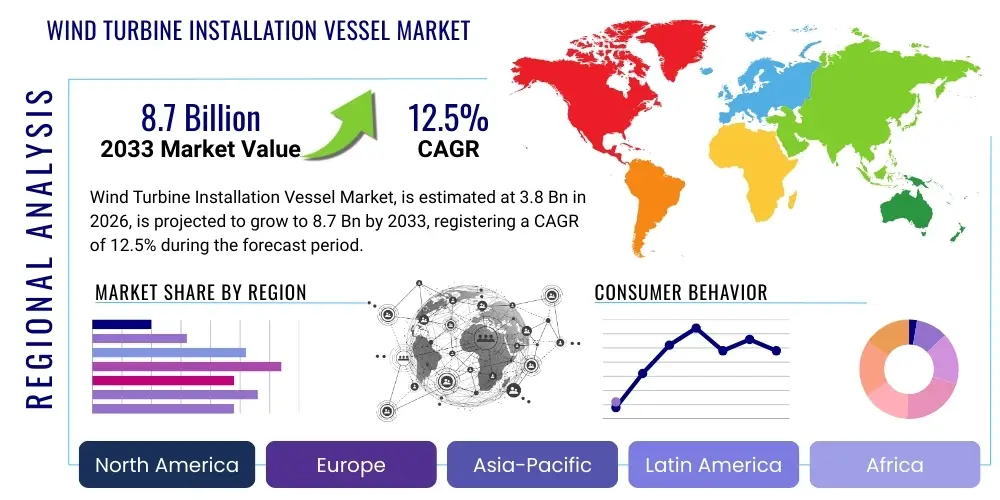

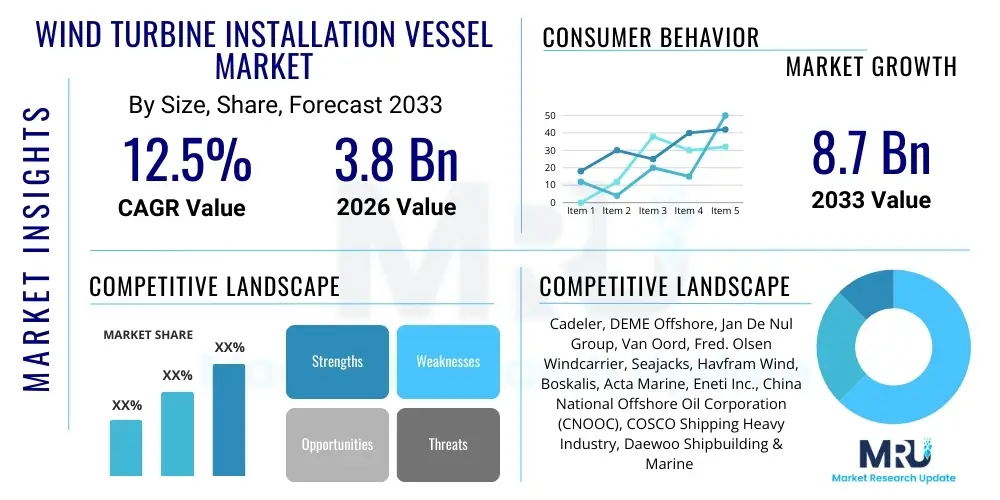

The Wind Turbine Installation Vessel Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.5% between 2026 and 2033. The market is estimated at USD 3.8 Billion in 2026 and is projected to reach USD 8.7 Billion by the end of the forecast period in 2033.

Wind Turbine Installation Vessel Market introduction

The Wind Turbine Installation Vessel (WTIV) market encompasses the specialized maritime industry dedicated to the transportation, lifting, and installation of offshore wind turbines and their foundations. These highly sophisticated vessels are critical enablers of the global transition to renewable energy, serving as the backbone for the construction of increasingly complex and large-scale offshore wind farms. The product, a WTIV, is a purpose-built marine asset, often featuring dynamic positioning systems, advanced crane capabilities, and robust jacking systems to stabilize the vessel in challenging offshore conditions. These vessels are designed to handle the massive components of modern wind turbines, including foundations, towers, nacelles, and blades, which can weigh thousands of tons and stand hundreds of meters tall. Their design varies from jack-up vessels that lift themselves out of the water on legs to provide a stable platform, to semi-submersibles and floating heavy-lift crane vessels used in deeper waters.

Major applications of WTIVs include the initial construction of offshore wind farms, involving the meticulous placement of foundations (monopiles, jackets, gravity-based, or floating structures), followed by the sequential installation of tower sections, nacelles, and rotor blades. Beyond initial construction, these vessels are also increasingly utilized for significant maintenance and repair operations, such as replacing major components like gearboxes or generators, which cannot be handled by standard service operation vessels (SOVs). The primary benefits derived from the use of WTIVs include their unparalleled capacity to install multi-megawatt turbines in challenging marine environments, ensuring efficiency and safety during complex lifting operations, and enabling the rapid deployment of vast amounts of renewable energy capacity. They mitigate many risks associated with conventional construction methods at sea, providing a stable work platform and precise control over heavy loads. Key driving factors for this market are the accelerating global push for decarbonization and energy independence, leading to ambitious offshore wind energy targets set by governments worldwide. Furthermore, technological advancements in turbine size and foundation types, coupled with decreasing costs of offshore wind power generation, are significantly fueling the demand for these specialized installation assets. The imperative for specialized vessels arises directly from the escalating scale and weight of next-generation wind turbines, making conventional heavy-lift vessels inadequate for the tasks at hand.

Wind Turbine Installation Vessel Market Executive Summary

The Wind Turbine Installation Vessel (WTIV) market is experiencing a period of robust expansion, driven by an unprecedented global commitment to offshore wind energy as a cornerstone of future energy mixes. Business trends indicate a significant surge in new vessel orders and upgrades of existing fleets to accommodate the escalating size and weight of next-generation offshore wind turbines. Developers are increasingly favoring larger, more capable vessels that can handle 15MW+ turbines, leading to substantial capital investments in shipbuilding and specialized equipment. There is a growing focus on optimizing operational efficiency through advanced digitalization, automation, and real-time data analytics, aiming to reduce installation times and costs. Furthermore, strategic collaborations and joint ventures between vessel operators, original equipment manufacturers (OEMs), and energy companies are becoming common to pool resources, mitigate risks, and secure long-term contracts. The market is also witnessing consolidation among smaller players and the entry of new participants, particularly from Asian shipbuilding nations, intensifying competition and fostering innovation.

Regional trends highlight Europe and Asia Pacific as the dominant growth engines. Europe, with its mature offshore wind industry, continues to invest heavily in new projects and repowering existing sites, particularly in the North Sea and Baltic Sea, driving demand for advanced WTIVs capable of operating in diverse conditions. The UK, Germany, and the Netherlands remain key markets. Asia Pacific, led by China, Taiwan, and Japan, is emerging as the fastest-growing region, characterized by ambitious targets, significant new farm developments, and a rapidly expanding domestic WTIV fleet. North America, specifically the East Coast of the United States, is poised for substantial growth with several large-scale projects slated for development, though regulatory complexities and port infrastructure limitations present unique challenges and opportunities for specialized vessels. Latin America, the Middle East, and Africa are nascent markets with significant long-term potential as offshore wind technology matures and becomes more economically viable in these regions, signaling future demand for WTIV services as these markets develop their first large-scale projects.

Segment trends reveal a pronounced shift towards jack-up vessels due to their unparalleled stability and lifting capacity, making them ideal for the fixed-bottom installation of increasingly heavy turbine components. However, with the push into deeper waters, the demand for floating foundation installation capabilities is growing, driving innovation in semi-submersible and specialized crane vessels adapted for floating offshore wind projects. The market is also seeing differentiation by water depth, with specialized vessels tailored for shallow water operations versus those designed for deep and ultra-deep water environments, reflecting the diverse geographical characteristics of new project sites. Furthermore, while initial construction remains the primary application, the segment for maintenance and major component replacement is anticipated to grow significantly as the global offshore wind fleet ages and requires more extensive upkeep, ensuring a sustained demand for WTIVs beyond initial build-out phases. The development of next-generation vessels with higher lifting heights, greater crane capacity, and improved fuel efficiency, often incorporating hybrid propulsion systems, signifies a move towards more sustainable and high-performance operations across all segments. These trends collectively underscore a dynamic market responding actively to technological advancements and evolving global energy demands.

AI Impact Analysis on Wind Turbine Installation Vessel Market

User inquiries concerning AI's influence on the Wind Turbine Installation Vessel (WTIV) market often revolve around efficiency gains, predictive maintenance capabilities, and enhanced operational safety. Users are keen to understand how AI can optimize complex installation logistics, reduce costly downtime, and improve decision-making in challenging marine environments. There's significant interest in AI's role in autonomous or semi-autonomous vessel operations, crew training, and intelligent routing for weather optimization. Concerns frequently arise regarding data security, the initial investment required for AI integration, and the potential impact on workforce skills and employment. However, the overarching expectation is that AI will be a transformative force, enabling greater precision, cost reductions, and safer operations across the entire WTIV lifecycle, from pre-installation planning to ongoing maintenance, ultimately accelerating offshore wind farm deployment.

- AI-driven predictive maintenance for vessel components and crane systems, reducing unexpected breakdowns and extending asset lifespan.

- Optimized route planning and weather forecasting using AI algorithms to minimize transit times and maximize operational windows, enhancing project timelines.

- Automated vessel positioning and dynamic compensation systems for improved stability during heavy lifting operations, increasing safety and precision.

- Enhanced data analytics for project management, allowing for real-time monitoring of installation progress, resource allocation, and risk assessment.

- AI-powered simulation and training platforms for crew members, enabling realistic scenario planning and skill development for complex offshore operations.

- Integration of machine learning for advanced sensor data analysis to detect potential issues with turbine components before installation, preventing future failures.

- Development of semi-autonomous or eventually autonomous WTIVs, reducing crew size requirements and enhancing operational safety in hazardous conditions.

- Intelligent supply chain management and inventory optimization for turbine components and vessel spares, minimizing logistical delays and costs.

DRO & Impact Forces Of Wind Turbine Installation Vessel Market

The Wind Turbine Installation Vessel (WTIV) market is shaped by a complex interplay of drivers, restraints, opportunities, and various impact forces that collectively dictate its growth trajectory and operational landscape. Major drivers include the aggressive global decarbonization goals and national energy security strategies, which are funneling massive investments into offshore wind energy. The escalating scale of offshore wind turbines, with increasing rotor diameters and hub heights, necessitates ever-larger and more capable installation vessels, creating a continuous demand for advanced WTIVs. Furthermore, the decreasing Levelized Cost of Energy (LCOE) for offshore wind projects is making them more economically attractive, stimulating further development and, consequently, demand for installation services. Government incentives, subsidies, and supportive regulatory frameworks across key regions also act as significant accelerators, pushing the expansion of offshore wind capacity and requiring a corresponding expansion of the WTIV fleet to meet these ambitious targets. The maturity of offshore wind technology and its proven reliability contribute to its wider adoption, reinforcing the need for specialized installation capabilities.

Conversely, several significant restraints challenge the market's growth. The extremely high capital expenditure required for designing, building, and maintaining next-generation WTIVs is a major barrier to entry and expansion, limiting the number of new market participants and potentially slowing fleet modernization. Regulatory complexities and cumbersome permitting processes, particularly in emerging offshore wind markets, can cause project delays and cost overruns, impacting the demand for WTIV services. Supply chain bottlenecks, especially for critical components of WTIVs like large cranes and specialized jacking systems, can create construction delays for new vessels. Additionally, a persistent shortage of skilled personnel, including experienced maritime engineers, heavy-lift operators, and technicians, poses a significant operational challenge. The volatility of raw material prices, such as steel, and fluctuating fuel costs also contribute to operational uncertainties and cost pressures for vessel operators, impacting their profitability and investment decisions. The extended lead times for new WTIV construction also mean that fleet expansion can lag behind demand, creating potential bottlenecks for future project deployments.

Amidst these dynamics, substantial opportunities exist for market participants. The emergence of new offshore wind markets in regions like North America (especially the U.S. East Coast), Latin America, and select parts of Asia and Africa presents vast untapped potential for WTIV deployment. Technological advancements in vessel design, including the development of hybrid propulsion systems, larger crane capacities, and enhanced dynamic positioning, offer avenues for improved efficiency, reduced environmental impact, and expanded operational envelopes. The anticipated growth in floating offshore wind technology, which requires different installation methodologies and potentially new types of vessels, represents a significant long-term opportunity, driving innovation and diversification within the WTIV fleet. Furthermore, the future market for repowering aging offshore wind farms, involving the replacement of older, smaller turbines with newer, more powerful ones, will create a sustained demand for WTIV services. The increasing focus on port infrastructure development to support offshore wind logistics also opens opportunities for collaboration and specialized service offerings. The key impact forces influencing the market include the global regulatory landscape regarding renewable energy mandates and emissions reductions, which directly shape investment decisions. Technological innovation continually redefines what is possible in terms of turbine size and installation methods. Economic conditions, including interest rates and investor confidence, play a crucial role in funding new vessel builds and wind farm projects. Environmental policies and public perception of offshore wind projects also influence political support and project viability. Geopolitical stability and international trade relations can impact supply chains and market access for vessels and components. These forces create a dynamic environment requiring continuous adaptation and strategic planning from all market players.

Segmentation Analysis

The Wind Turbine Installation Vessel (WTIV) market is comprehensively segmented to provide granular insights into its diverse operational facets and evolving technological landscape. This segmentation allows for a detailed understanding of market dynamics, specific demand drivers, and technological preferences across various applications and operational environments. The primary segmentation categories include vessel type, installation type, water depth, and application. Each of these segments reflects distinct technical requirements, operational challenges, and market opportunities, influencing investment decisions and strategic planning within the industry. Understanding these segments is crucial for stakeholders to identify niches, optimize fleet deployment, and develop vessels tailored to specific market demands. The interplay between these segments often dictates the design specifications and capabilities of new WTIV builds, ensuring they can effectively address the varied needs of a rapidly expanding global offshore wind sector.

- By Vessel Type:

- Jack-up Vessels: Self-elevating platforms offering high stability for fixed-bottom installations.

- Semi-submersible Vessels: Providing greater stability than conventional floating vessels, suitable for certain floating foundation tasks.

- Floating Cranes: Heavy-lift vessels used for component installation or specialized tasks, often operating in deeper waters.

- Self-propelled Barges: Versatile vessels capable of transporting components, sometimes equipped with cranes for lighter lifts.

- Dynamic Positioning Vessels (DP Vessels): Vessels capable of maintaining position precisely without mooring, crucial for deepwater and complex operations.

- By Installation Type:

- Fixed-bottom Foundations: Including monopiles, jackets, tripods, and gravity-based structures.

- Floating Foundations: Spar, Semi-submersible, Tension-Leg Platform (TLP) foundations for deepwater turbines.

- Turbines (Nacelle, Blades, Tower): Installation of the core components of the wind turbine itself.

- Substation Installation: Installation of offshore converter or transformer substations.

- By Water Depth:

- Shallow Water (up to 30m): Predominantly for traditional fixed-bottom installations closer to shore.

- Deep Water (30m - 60m): Increasingly common for fixed-bottom, and early floating projects.

- Ultra-deep Water (above 60m): Primarily for future floating offshore wind farms.

- By Application:

- Offshore Wind Farm Construction: Initial build-out of new wind farms.

- Maintenance & Repair: Major component exchange, structural repairs, and overhauls.

- Decommissioning: Removal of old turbines and foundations at the end of their operational life.

- Research & Development Projects: Installation for pilot and demonstration wind farms.

- By Region:

- North America (U.S., Canada, Mexico)

- Europe (UK, Germany, Netherlands, Denmark, France, Spain, Norway, Rest of Europe)

- Asia Pacific (China, Japan, South Korea, Taiwan, India, Vietnam, Australia, Rest of APAC)

- Latin America (Brazil, Argentina, Rest of Latin America)

- Middle East & Africa (UAE, Saudi Arabia, South Africa, Rest of MEA)

Value Chain Analysis For Wind Turbine Installation Vessel Market

The value chain of the Wind Turbine Installation Vessel (WTIV) market is a complex ecosystem involving multiple specialized players, from the conceptualization and construction of these sophisticated vessels to their ultimate deployment in offshore wind farm projects. Upstream analysis begins with the raw material suppliers providing steel, specialized alloys, and advanced marine equipment like propulsion systems, jacking gears, and heavy-lift cranes. Shipyards represent a critical upstream segment, responsible for the design, engineering, and construction of WTIVs, often collaborating with naval architects and marine technology firms. Financing institutions play a crucial role at this stage, providing the substantial capital required for these multi-million dollar assets. Component manufacturers, including those producing dynamic positioning systems, safety equipment, and advanced navigation tools, also form an essential part of the upstream segment, ensuring vessels are equipped with cutting-edge technology. The efficiency and reliability of these upstream suppliers directly impact the quality, cost, and delivery timelines of new WTIVs, establishing the foundational capabilities of the market.

Midstream activities primarily involve the ownership, operation, and maintenance of WTIVs. Vessel operators and owners are at the core of this segment, managing the deployment, crewing, and technical upkeep of their fleets. This includes comprehensive logistics planning, project management, and specialized engineering services required for offshore wind turbine installation. These operators often engage in long-term charter agreements or project-specific contracts with offshore wind farm developers. The expertise in offshore heavy-lift operations, marine logistics, and project execution defines the value added in this stage. Downstream analysis focuses on the end-users and beneficiaries of WTIV services, primarily offshore wind farm developers and utility companies. These entities contract WTIV operators for the installation of their wind farms, aiming to efficiently and safely bring renewable energy projects online. The direct distribution channel in this market largely involves direct contractual agreements between WTIV owners/operators and offshore wind farm developers. These are typically high-value, long-term contracts negotiated based on vessel specifications, availability, project scope, and timelines. The direct relationship ensures clear communication, specialized service delivery, and often involves bespoke solutions tailored to the unique requirements of each wind farm project. Indirect channels are less prevalent but can include third-party brokers or consulting firms that facilitate connections between developers and vessel operators, or where WTIV services are part of a broader engineering, procurement, construction, and installation (EPCI) contract managed by a general contractor. Both direct and indirect channels emphasize the highly specialized nature of the WTIV market, where expertise, asset availability, and strong client relationships are paramount for success and efficient project delivery within the burgeoning global offshore wind sector.

Wind Turbine Installation Vessel Market Potential Customers

The primary potential customers and end-users of Wind Turbine Installation Vessels (WTIVs) are large-scale developers and operators of offshore wind farms across the globe. These entities, often major energy companies, utility providers, or specialized renewable energy developers, are directly responsible for the conceptualization, financing, construction, and operational management of offshore wind projects. They contract WTIV operators to execute the critical phase of transporting and installing the massive components of wind turbines and their foundations in the marine environment. Their demand is driven by ambitious renewable energy targets, government auctions for offshore wind leases, and the strategic expansion of their green energy portfolios. These customers seek highly reliable, technically capable, and efficient WTIV services to ensure their multi-billion dollar projects are delivered on time, within budget, and to the highest safety and quality standards, making the choice of a WTIV partner a critical strategic decision in their project execution. They evaluate WTIV operators based on fleet capacity, vessel specifications (crane capacity, jacking capabilities, deck space), track record, safety performance, and increasingly, their commitment to sustainable operations and innovative solutions.

Beyond the core offshore wind farm developers, other key potential customers include general contractors and consortia engaged in large-scale energy infrastructure projects that encompass offshore wind farm development. These EPCI (Engineering, Procurement, Construction, and Installation) contractors often subcontract specialized services, including WTIV operations, as part of their broader project delivery scope. Additionally, national governments and state-owned enterprises that directly fund or operate offshore wind projects, particularly in emerging markets, represent significant potential customers. As the offshore wind industry matures, existing wind farm owners and operators will also become important clients for WTIV services related to major maintenance campaigns, such as gearbox or generator replacements, and ultimately for decommissioning projects at the end of a wind farm's operational life. Furthermore, research and development institutions or pilot project developers may also utilize WTIVs for installing new prototype turbines or innovative foundation designs. The demand from these various customer segments is projected to intensify as the global offshore wind pipeline expands dramatically over the next decade, making the WTIV market a critical enabler for the energy transition and a high-demand service industry.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.8 Billion |

| Market Forecast in 2033 | USD 8.7 Billion |

| Growth Rate | 12.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Cadeler, DEME Offshore, Jan De Nul Group, Van Oord, Fred. Olsen Windcarrier, Seajacks, Havfram Wind, Boskalis, Acta Marine, Eneti Inc., China National Offshore Oil Corporation (CNOOC), COSCO Shipping Heavy Industry, Daewoo Shipbuilding & Marine Engineering (DSME), Hyundai Heavy Industries (HHI), Samsung Heavy Industries (SHI), Keppel Offshore & Marine, PaxOcean Engineering, Northern Ocean, Swire Blue Ocean, Shimizu Corporation |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Wind Turbine Installation Vessel Market Key Technology Landscape

The Wind Turbine Installation Vessel (WTIV) market is characterized by a rapidly evolving technological landscape driven by the increasing size and complexity of offshore wind turbines and the imperative for more efficient, safer, and sustainable installation processes. A cornerstone technology is the advanced jacking system, particularly prevalent in jack-up vessels, which allows these vessels to elevate themselves out of the water, providing a stable platform for precision heavy-lift operations even in challenging sea states. These systems are continuously being refined for faster jacking times, greater lifting capacities, and improved reliability. Another critical technology is the heavy-lift crane, which forms the heart of any WTIV. Modern WTIVs feature cranes with capacities exceeding 3,000 to 5,000 tons, and hook heights reaching over 170 meters above deck, specifically designed to handle the massive nacelles, blades, and tower sections of 15MW+ and future 20MW+ turbines. These cranes integrate sophisticated motion compensation systems and precision controls to manage enormous loads in dynamic offshore conditions, ensuring minimal sway and accurate placement, which is paramount for safety and efficiency. The ongoing innovation in crane design focuses on increasing outreach, lifting height, and operational envelope without compromising stability or safety.

Dynamic Positioning (DP) systems are also fundamental, especially for floating WTIVs or for jack-up vessels during transit and pre-jacking positioning. DP systems use computer-controlled thrusters and propellers to automatically maintain a vessel's position and heading, crucial for precision maneuvering in crowded wind farm areas and for station-keeping in deep water where mooring is impractical. The integration of hybrid propulsion systems, combining traditional diesel-electric engines with batteries, is a growing trend, aimed at reducing fuel consumption, lowering emissions, and improving operational flexibility. These hybrid systems allow for peak shaving, silent operations, and backup power, contributing significantly to the sustainability goals of the offshore wind industry. Digitalization and automation are also transforming WTIV operations, with advanced software for project planning, weather forecasting, real-time vessel performance monitoring, and predictive maintenance. Digital twins of vessels and wind farm components enable precise simulations and optimize installation sequences, leading to reduced downtime and enhanced safety. Remote monitoring and autonomous features for certain vessel functions are also being explored. Furthermore, the development of specialized tools and grippers for handling increasingly large and delicate turbine blades and foundations, along with innovative pile driving equipment for various foundation types, signifies the continuous technological advancements critical for adapting to the evolving demands of offshore wind farm construction, collectively defining a market that is at the forefront of marine engineering innovation and sustainable energy deployment.

Regional Highlights

- Europe: As the pioneer and most mature offshore wind market, Europe continues to be a dominant force in WTIV demand. Countries like the UK, Germany, Netherlands, and Denmark boast extensive offshore wind portfolios and ambitious future targets, driving continuous need for new installations and repowering projects. The region has a well-established supply chain and significant investment in next-generation vessels.

- Asia Pacific (APAC): Emerging as the fastest-growing region, APAC is characterized by a surge in offshore wind development, particularly in China, Taiwan, Japan, and South Korea. China leads the world in installed offshore wind capacity and domestic WTIV fleet expansion, while Taiwan is rapidly developing its pipeline. This region represents immense growth potential for both local and international WTIV operators, often necessitating vessels tailored to specific regional conditions.

- North America: The U.S. East Coast is poised for substantial growth in offshore wind, with several large-scale projects moving from planning to construction phases. This nascent market presents significant opportunities but also challenges related to port infrastructure, regulatory frameworks (e.g., Jones Act in the U.S. for domestic maritime transport), and the need for specialized WTIVs capable of operating within these constraints. Canada is also exploring offshore wind potential.

- Latin America: While still in nascent stages, countries like Brazil and Colombia are exploring their vast offshore wind resources. Future development in this region will gradually increase the demand for WTIVs, especially as regulatory frameworks mature and investment becomes more robust, opening new frontiers for global operators.

- Middle East & Africa (MEA): This region holds long-term potential for offshore wind, particularly with countries like Saudi Arabia and South Africa exploring renewable energy diversification. The initial demand for WTIVs will likely be for pilot projects and early commercial farms, growing in significance as the industry matures in these regions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Wind Turbine Installation Vessel Market.- Cadeler

- DEME Offshore

- Jan De Nul Group

- Van Oord

- Fred. Olsen Windcarrier

- Seajacks

- Havfram Wind

- Boskalis

- Acta Marine

- Eneti Inc.

- China National Offshore Oil Corporation (CNOOC)

- COSCO Shipping Heavy Industry

- Daewoo Shipbuilding & Marine Engineering (DSME)

- Hyundai Heavy Industries (HHI)

- Samsung Heavy Industries (SHI)

- Keppel Offshore & Marine

- PaxOcean Engineering

- Northern Ocean

- Swire Blue Ocean

- Shimizu Corporation

Frequently Asked Questions

What is a Wind Turbine Installation Vessel (WTIV)?

A Wind Turbine Installation Vessel (WTIV) is a specialized marine vessel designed to transport, lift, and install the large components of offshore wind turbines and their foundations. These vessels feature powerful cranes and often jacking systems to provide a stable platform for precise heavy-lift operations at sea, crucial for building offshore wind farms efficiently and safely.

What are the primary types of WTIVs?

The primary types of WTIVs include jack-up vessels, which lift themselves out of the water on legs for stability; semi-submersible vessels, offering enhanced stability for certain floating tasks; and floating heavy-lift crane vessels, used for various installation projects, particularly in deeper waters. Each type is optimized for different operational environments and foundation types.

What is driving the growth of the WTIV market?

The growth of the WTIV market is primarily driven by aggressive global targets for renewable energy and decarbonization, the increasing scale and weight of next-generation offshore wind turbines requiring specialized lifting capabilities, and decreasing costs of offshore wind power generation making projects more economically viable. Government incentives and supportive policies also play a significant role.

What are the main challenges facing the WTIV market?

Key challenges include the extremely high capital expenditure required for new vessel construction and upgrades, regulatory complexities and lengthy permitting processes that can delay projects, persistent supply chain bottlenecks for critical components, and a shortage of skilled maritime personnel. Fluctuating fuel and raw material costs also pose significant operational and financial challenges for operators.

How is AI impacting Wind Turbine Installation Vessels?

AI is impacting WTIVs by enabling predictive maintenance for vessel components, optimizing route planning and weather forecasting for operational efficiency, enhancing precision through automated vessel positioning, and improving safety with advanced sensor data analysis. AI also supports project management, crew training, and is paving the way for semi-autonomous operations, leading to reduced downtime and increased project success rates.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager