Windmills Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433102 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Windmills Market Size

The Windmills Market, intrinsically linked to the global transition toward sustainable energy infrastructure and the aggressive decarbonization targets set by international bodies, is projected for substantial expansion. This growth is primarily fueled by continuous technological advancements in turbine efficiency and capacity, along with supportive governmental policies incentivizing renewable energy projects worldwide. The integration of advanced aerodynamics and structural materials is extending the operational lifespan and performance metrics of modern wind power generation systems, further solidifying their economic viability against conventional power sources. This sustained momentum underscores the increasing investment flow into both onshore and challenging offshore wind farm developments.

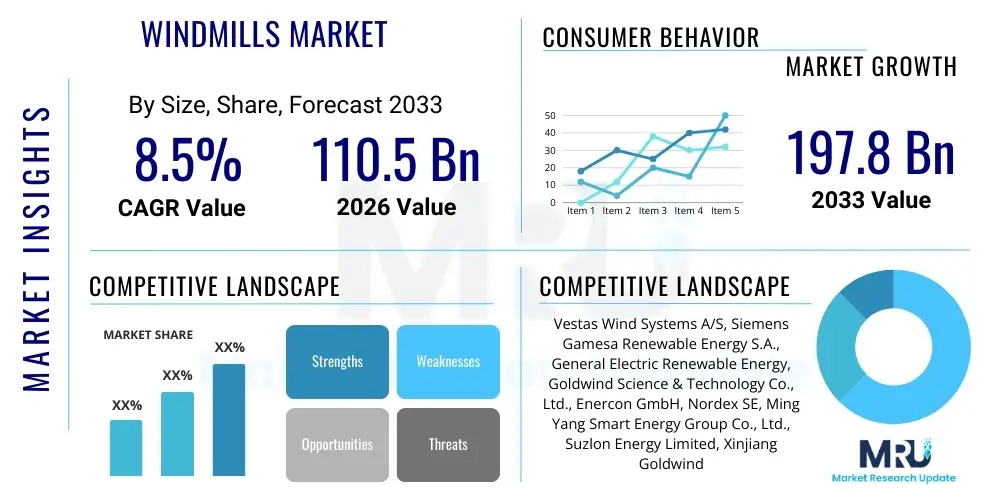

The global windmills market, encompassing systems ranging from traditional water pumping structures to cutting-edge utility-scale wind turbines, is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 110.5 Billion in 2026 and is projected to reach USD 197.8 Billion by the end of the forecast period in 2033. This forecast reflects a robust pipeline of large-scale renewable energy projects and the decreasing Levelized Cost of Electricity (LCOE) associated with wind power generation, making it highly competitive in emerging and mature energy markets globally.

Windmills Market introduction

The Windmills Market, fundamentally redefined in the 21st century by modern wind turbines, focuses on harnessing kinetic energy from wind and converting it into electrical power. This market encompasses the entire value chain, including research and development, manufacturing of sophisticated components such as rotor blades, nacelles, and towers, as well as the installation, operation, and maintenance of expansive wind farms. Modern wind power generation systems are characterized by high capacity factors and optimized performance designed to function reliably across diverse climatic and geographical conditions, driving the global renewable energy transition. Product differentiation often centers on technological innovation, specifically in areas like direct-drive mechanisms, smart grid integration capabilities, and enhanced structural integrity for challenging environments, particularly deep-water offshore installations.

Major applications of wind energy span utility-scale power generation, which feeds electricity directly into national grids, and non-utility applications, including decentralized power systems for remote communities, agricultural pumping, and industrial heating. The primary benefits of utilizing wind power include zero greenhouse gas emissions during operation, substantial reduction in reliance on volatile fossil fuel sources, and the creation of decentralized, resilient energy systems. These factors contribute significantly to energy security and climate change mitigation efforts globally. Furthermore, the land footprint of wind farms is relatively low compared to the energy output, especially in the case of offshore developments, allowing for dual use of land or minimal environmental disturbance.

The market is primarily driven by three critical factors: escalating global concerns regarding climate change necessitating sustainable energy alternatives; substantial governmental support mechanisms such as Production Tax Credits (PTCs), Feed-in Tariffs (FiTs), and Renewable Portfolio Standards (RPSs); and continuous advancements in materials science and aerodynamic engineering that boost turbine efficiency and reduce manufacturing costs. The economies of scale achieved through mass production, coupled with competitive financing rates for green energy projects, further amplify the market's growth trajectory. These converging dynamics position the windmills market as a cornerstone of the future global energy matrix.

Windmills Market Executive Summary

The Windmills Market is experiencing transformative business trends characterized by intense competition among multinational original equipment manufacturers (OEMs) focusing on increasing turbine rating capacity, particularly in the 10 MW and above class, to maximize energy yield per installed unit. A critical trend involves the vertical integration of services, where major players are extending their capabilities beyond manufacturing into long-term operations and maintenance (O&M) contracts, ensuring sustainable revenue streams and optimizing asset performance for project owners. Furthermore, there is a pronounced shift towards digitalization, utilizing predictive maintenance tools, real-time data analytics, and sensor technologies embedded within turbines to minimize downtime and forecast component failures, thereby enhancing the overall reliability and efficiency of wind farms across diverse geographies.

Regional trends highlight Asia Pacific, specifically driven by China and India, as the fastest-growing market due to massive national targets for renewable capacity expansion and readily available land for onshore projects. Europe remains a global leader in offshore wind development, pioneering floating offshore technology and large-scale cross-border grid interconnections. North America, particularly the United States, demonstrates robust growth supported by favorable federal policies and significant private investment, especially in the central wind belt and emerging offshore regions along the coasts. These regional variations in maturity, policy frameworks, and resource availability dictate specific investment strategies and technology deployment preferences, creating unique competitive dynamics in each geographical zone.

Segment trends indicate that the Offshore segment, although currently smaller in capacity than Onshore, is projected to witness the highest Compound Annual Growth Rate (CAGR), driven by superior wind resources, larger turbine sizes, and lower visual impact, overcoming initial high capital expenditure challenges. The Component segmentation emphasizes advanced materials for Rotor Blades, focusing on lightweight, high-strength composites that enable longer blade lengths and improved Annual Energy Production (AEP). Moreover, the Utility application segment continues to dominate the market share, reflecting the imperative for governments and utilities to transition away from centralized fossil fuel generation towards large-scale sustainable sources integrated into the mainstream power supply architecture.

AI Impact Analysis on Windmills Market

Common user questions regarding AI's impact on the Windmills Market frequently revolve around how artificial intelligence and machine learning (ML) algorithms can enhance operational efficiency, reduce maintenance costs, and optimize energy production forecasting. Users are keenly interested in the integration of AI for predictive maintenance—specifically, whether AI can accurately detect subtle component failures before they become catastrophic, minimizing expensive downtime. Concerns also focus on optimizing wind farm layouts, particularly in complex terrain or dense offshore environments, and how AI can dynamically adjust turbine pitch and yaw in real-time based on immediate meteorological data to maximize power capture. The underlying expectation is that AI will be the primary catalyst for achieving the next level of cost reduction and reliability in wind power generation, transforming the current reactive O&M models into proactive, self-optimizing systems.

- Predictive Maintenance and Anomaly Detection: AI algorithms analyze vibration data, temperature readings, and SCADA information to predict component failure (e.g., gearboxes, bearings) with high accuracy, drastically reducing unplanned maintenance costs and downtime.

- Real-Time Performance Optimization: Machine Learning models dynamically adjust turbine operating parameters (pitch, yaw, torque) based on fluctuating wind speeds, direction, and turbulence to maximize Annual Energy Production (AEP).

- Advanced Wind Resource Assessment: AI processes complex topographical and meteorological datasets to provide highly precise wind farm site selection and layout optimization, minimizing wake effects between turbines.

- Grid Integration and Forecasting: AI enhances short-term and long-term wind power generation forecasts, enabling grid operators to manage intermittent wind supply more effectively and maintain system stability.

- Automated Inspections: AI-powered drone inspections use computer vision to analyze visual data of turbine blades for damage (cracks, erosion), accelerating inspection processes and improving detection consistency.

- Supply Chain and Logistics Optimization: ML models improve inventory management for spare parts and optimize the complex logistics associated with transporting and installing large turbine components, especially for offshore projects.

- Design and Simulation: Generative AI tools assist engineers in designing more efficient rotor blade profiles and structural components, simulating performance under extreme stress conditions, accelerating the R&D cycle.

DRO & Impact Forces Of Windmills Market

The Windmills Market is fundamentally shaped by a complex interplay of Drivers, Restraints, and Opportunities (DRO), which collectively form the Impact Forces determining its growth trajectory and competitive landscape. Primary Drivers include the urgent global necessity for climate change mitigation, resulting in robust governmental mandates and incentives, coupled with the rapid decline in the Levelized Cost of Energy (LCOE) for wind power, making it economically superior to many fossil fuel alternatives. These drivers create a compelling environment for sustained capital investment. Conversely, the market faces significant Restraints, such as the inherent intermittency of wind resources, requiring substantial grid infrastructure upgrades and energy storage solutions, alongside persistent challenges related to permitting and public opposition (Not In My Backyard, or NIMBYism) concerning aesthetic and noise impacts, particularly for large onshore projects. The substantial initial capital expenditure required for large-scale wind farms also acts as a financial restraint, although project financing models are continually improving.

Opportunities within the sector are extensive, particularly in the rapid development and commercialization of floating offshore wind technology, which unlocks access to deeper waters with superior and more consistent wind resources, dramatically expanding the potential geographical scope of installations beyond current continental shelf limits. Furthermore, the integration of smart grid technologies, coupled with the deployment of advanced energy storage solutions (like large-scale batteries), represents a significant opportunity to mitigate the intermittency issue, making wind power a more dispatchable and reliable source of electricity. The modernization and repowering of older wind farms also presents a robust opportunity for market players to increase capacity utilization and extend asset lifespan using newer, more efficient turbine technology, bypassing lengthy new site development processes.

These DRO elements exert powerful Impact Forces across the entire value chain. The economic driver of decreasing LCOE forces continuous innovation and cost reduction in manufacturing (Impact Force: Competitive Pricing Pressure), while environmental mandates necessitate adherence to rigorous sustainability standards (Impact Force: Regulatory Compliance). Intermittency acts as a technological pressure point (Impact Force: Innovation Demand), compelling investment in storage and smart grid solutions. Ultimately, the confluence of favorable policy environments and technological maturation creates a strong, sustained demand pull for advanced, high-capacity wind power systems globally, cementing its role as a core component of the future renewable energy mix.

Segmentation Analysis

The Windmills Market is systematically segmented based on Type, Installation Site, Component, and Application, providing a structured view of the diverse technologies and end-user requirements driving demand. This segmentation is crucial for understanding specific market dynamics, technological trends, and investment flows across the sector. The Type segmentation distinguishes between designs based on the orientation of the rotor axis, fundamentally influencing their application suitability and operational footprint. The Installation Site categorization is critical as it dictates the complexity of engineering, logistics, and maintenance, with offshore sites presenting unique challenges and higher energy yields. Component segmentation focuses on the specialized subsystems essential for power conversion and structural integrity, while Application highlights the primary use of the generated electricity, either for centralized grid supply or localized consumption.

Understanding the relative growth rates across these segments allows stakeholders to strategically position themselves within the high-growth areas. For instance, the ongoing shift towards offshore installation, particularly in Europe and emerging Asian markets, signifies a preference for larger, higher-capacity turbines that require specialized infrastructure and advanced corrosion-resistant materials. Similarly, within the component segment, advancements in blade materials and manufacturing processes (such as longer, lighter carbon fiber blades) are key differentiators driving market share. The Utility segment consistently dominates due to the global trend of governmental commitment to large-scale decarbonization projects, requiring massive inputs of renewable energy directly into the national transmission systems to meet mandatory clean energy targets.

Segmentation analysis also reveals regional specialization; for example, North America has historically concentrated on onshore utility-scale projects, whereas the European market has pioneered complex, capital-intensive offshore projects. This strategic differentiation in regional focus impacts technological development and deployment strategies. As technology matures, there is an increasing convergence, with developing economies like India and Brazil showing interest in both onshore and near-shore wind developments, reflecting a pragmatic approach to leveraging diverse resources to ensure energy independence and sustainability goals are met efficiently.

- By Type:

- Horizontal Axis Wind Turbines (HAWT)

- Vertical Axis Wind Turbines (VAWT)

- By Installation Site:

- Onshore

- Offshore

- Fixed-Bottom

- Floating

- By Component:

- Rotor Blades

- Nacelle (Gearbox, Generator, Drive Train, Yaw System)

- Tower

- Control Systems

- Others (Hub, Foundation)

- By Application:

- Utility (Grid-Connected)

- Non-Utility (Off-Grid, Distributed Generation)

Value Chain Analysis For Windmills Market

The Windmills Market value chain is inherently complex, starting with extensive research and development (R&D) and raw material procurement (Upstream Analysis) and extending through manufacturing, installation, and long-term operation (Downstream Analysis). Upstream activities involve sourcing high-strength, lightweight materials such as specialized steel alloys, composite materials (fiberglass, carbon fiber) for blades, and rare earth magnets for generators, often involving global supply chains susceptible to geopolitical and commodity price fluctuations. Key activities at this stage include technological innovation in aerodynamics and power electronics, which are critical for enhancing turbine efficiency and reducing LCOE. Strong relationships with material suppliers and specialized component manufacturers are vital for managing costs and ensuring component quality, particularly for critical items like gearboxes and generators designed to withstand harsh operational conditions over decades.

The core manufacturing stage involves the production of massive components (blades, towers, nacelles) which requires substantial capital investment in specialized factories, often strategically located near ports or major transportation arteries to facilitate logistics. Downstream analysis focuses on project development, which encompasses site selection, permitting, financing, construction, installation, and crucially, long-term Operations and Maintenance (O&M). The successful execution of large-scale wind farm projects requires specialized heavy-lift vessels for offshore installations and complex civil engineering for foundations. The O&M phase, which can last 20–25 years, is increasingly important, representing a significant portion of the total cost of ownership and offering stable, recurring revenue streams to service providers.

Distribution channels are categorized as direct and indirect. Direct distribution is common for large utility-scale projects where Original Equipment Manufacturers (OEMs) sell directly to independent power producers (IPPs), utility companies, or government entities, often bundled with long-term service agreements (LSAs). Indirect channels might involve specialized project developers or engineering, procurement, and construction (EPC) contractors who facilitate the project delivery, procurement, and integration of the wind turbines into the broader energy system. The trend toward digitalization and remote monitoring has also led to the growth of specialized service providers focused purely on data analytics and predictive maintenance, acting as crucial technical intermediaries in the post-installation phase.

Windmills Market Potential Customers

The primary end-users and buyers in the Windmills Market are diversified, reflecting the broad utility of wind power across energy sectors. The most significant customer segment comprises Utility Companies and Independent Power Producers (IPPs), who commission large-scale onshore and offshore wind farms to meet growing energy demand, comply with renewable energy mandates, and diversify their generation mix away from fossil fuels. These entities require high-capacity, reliable, grid-connected systems and are typically focused on securing competitive long-term Power Purchase Agreements (PPAs) that ensure stable returns on their massive capital investments. Their purchasing decisions are heavily influenced by the Levelized Cost of Electricity (LCOE), turbine performance metrics (capacity factor), and the reliability of O&M support offered by the turbine manufacturer.

A secondary, yet rapidly growing, customer base includes large corporations seeking to achieve corporate sustainability goals and reduce their carbon footprint through direct investment in wind power or through corporate Power Purchase Agreements (CPPAs). Tech giants, manufacturing firms, and data center operators are increasingly bypassing traditional utilities to directly source or own renewable assets, driving demand for both utility-scale wind farms and smaller, distributed wind solutions. This segment values transparency in carbon accounting, energy price stability, and the ability to demonstrate quantifiable sustainability impact to stakeholders, thus favoring suppliers that offer tailored financing and integration solutions.

Other vital customers include governmental and municipal bodies, particularly those in remote regions or island nations, requiring off-grid or decentralized energy solutions to improve energy access and resilience. For these customers, reliability in harsh environments and low maintenance requirements are paramount. Furthermore, the agricultural sector remains a niche but steady customer base for traditional or small-scale wind turbines used for water pumping and distributed electricity generation. The overall market demand is characterized by sophisticated procurement processes, deep technical vetting, and a strategic focus on maximizing the return on investment over the long operational life of the wind assets.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 110.5 Billion |

| Market Forecast in 2033 | USD 197.8 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Vestas Wind Systems A/S, Siemens Gamesa Renewable Energy S.A., General Electric Renewable Energy, Goldwind Science & Technology Co., Ltd., Enercon GmbH, Nordex SE, Ming Yang Smart Energy Group Co., Ltd., Suzlon Energy Limited, Xinjiang Goldwind Science & Technology Co. Ltd., Shanghai Electric Wind Power Group Co., Ltd., China General Nuclear Power Corporation (CGN), Senvion GmbH, Repower Systems SE, Acciona Energia S.A., Mitsubishi Heavy Industries Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Windmills Market Key Technology Landscape

The Windmills Market is defined by a dynamic technological landscape centered on maximizing energy capture and enhancing operational resilience while simultaneously driving down system costs. A pivotal technology involves the increasing use of Direct-Drive Generators (DDG), which eliminate the need for a gearbox. This simplification reduces the number of moving parts, leading to significantly lower maintenance requirements, especially beneficial for remote or challenging offshore locations. DDG turbines, while potentially heavier, offer higher reliability and greater control over speed and torque, optimizing energy conversion across a wider range of wind speeds. Furthermore, advancements in power electronics are crucial for seamless integration into modern smart grids, managing voltage stability and frequency regulation even with the intermittent nature of wind generation.

Another major technological frontier is the engineering of ultra-long rotor blades, leveraging advanced composite materials like carbon fiber and resin systems. These materials allow for lightweight yet robust structures that significantly increase the swept area, thus boosting the Annual Energy Production (AEP) of the turbine. Manufacturers are continuously pushing the boundaries of blade length—often exceeding 100 meters—to access higher wind velocities found at greater heights. Complementing this is the development of segmented or modular blades for easier transportation and installation, mitigating one of the primary logistical bottlenecks associated with increasingly large turbine components.

Perhaps the most strategically important innovation, particularly for the long-term expansion of the market, is the progress in Floating Offshore Wind (FOW) platforms. These technologies—including semi-submersibles, tension leg platforms (TLP), and spar buoys—enable the deployment of wind farms in deep-water areas (typically exceeding 60 meters), which were previously inaccessible. FOW opens up vast new resource areas, particularly off the coasts of Japan, the US West Coast, and the Mediterranean. Alongside FOW, sophisticated digital technologies, including IoT sensors, Supervisory Control and Data Acquisition (SCADA) systems, and AI-driven predictive maintenance analytics, are transforming O&M practices, ensuring high availability and maximizing the economic return on these technologically complex assets.

Regional Highlights

Regional variations in policy, resource availability, and grid maturity significantly influence the global Windmills Market landscape, with three major regions—Asia Pacific, Europe, and North America—dominating capacity installation and technological innovation.

- Asia Pacific (APAC): APAC is the epicenter of global wind capacity growth, largely driven by China's aggressive national renewable energy targets. China holds the largest installed wind capacity globally, focusing heavily on both large-scale onshore projects in inland regions and rapid expansion of fixed-bottom offshore wind in coastal areas. India, Vietnam, and Australia are also emerging as key contributors, supported by feed-in tariffs and competitive bidding mechanisms. The region’s growth is characterized by high volume manufacturing and robust domestic supply chains, though challenges exist regarding grid stability and transmission infrastructure needed to connect distant wind farms to demand centers.

- Europe: Europe is recognized as the global technological leader, particularly in offshore wind technology and the implementation of sophisticated energy transition policies. Countries like the United Kingdom, Germany, and Denmark are pioneering deep-water floating offshore wind (FOW) projects, pushing turbine ratings to unprecedented levels (15 MW and above). The focus here is on integration, cross-border infrastructure (such as the North Sea grid), and optimizing system efficiency through digitalization and advanced storage solutions to manage high penetration rates of intermittent renewable power.

- North America: North America, led by the United States, represents a mature and highly policy-sensitive market. The U.S. onshore wind market remains strong, driven by federal tax credits (e.g., PTC) and state-level Renewable Portfolio Standards (RPS). There is a growing focus on repowering existing wind farms with modern, higher-capacity turbines. The U.S. offshore sector, though nascent compared to Europe, is poised for explosive growth, with major commitments along the East Coast and emerging activity on the West Coast, targeting substantial capacity additions over the next decade.

- Latin America: Latin American countries, especially Brazil, Mexico, and Chile, offer exceptional wind resources and are emerging as significant growth markets. Brazil benefits from some of the world's most favorable wind conditions in its Northeast region, attracting substantial international investment into large-scale onshore utility projects. Market development here often hinges on successful energy auctions and stable regulatory frameworks that reduce investment risk.

- Middle East and Africa (MEA): This region is characterized by nascent but fast-accelerating development, particularly in nations like Saudi Arabia, the UAE, Morocco, and South Africa, driven by national diversification agendas away from hydrocarbons and significant solar and wind resource potential. Projects often focus on highly customized solutions tailored to extreme desert heat, dust, and coastal environments, requiring specialized turbine protection and maintenance strategies.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Windmills Market, covering their strategic initiatives, product portfolios, regional presence, and recent developments that influence the competitive dynamics of the global wind energy sector. These companies are instrumental in driving technological advancements, achieving economies of scale, and shaping the future direction of wind power generation and grid integration.- Vestas Wind Systems A/S

- Siemens Gamesa Renewable Energy S.A.

- General Electric Renewable Energy

- Goldwind Science & Technology Co., Ltd.

- Enercon GmbH

- Nordex SE

- Ming Yang Smart Energy Group Co., Ltd.

- Suzlon Energy Limited

- Xinjiang Goldwind Science & Technology Co. Ltd.

- Shanghai Electric Wind Power Group Co., Ltd.

- China General Nuclear Power Corporation (CGN)

- Senvion GmbH (Acquired by Siemens Gamesa/Others)

- Repower Systems SE (Now part of Suzlon)

- Acciona Energia S.A.

- Mitsubishi Heavy Industries Ltd.

- GE Renewable Energy Hydro

- Dongfang Electric Corporation

- Hitachi Ltd.

- Envision Group

- MHI Vestas Offshore Wind (Joint Venture)

Frequently Asked Questions

Analyze common user questions about the Windmills market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the current primary driver of growth in the Windmills Market?

The primary driver is the significant and continuous reduction in the Levelized Cost of Electricity (LCOE) generated by wind power, making it competitive with, and often cheaper than, conventional fossil fuel sources. This economic viability, coupled with stringent global decarbonization policies, accelerates widespread adoption and investment in large-scale wind farms.

How does the development of Floating Offshore Wind (FOW) technology impact market expansion?

FOW technology is critical for unlocking vast, deep-water oceanic areas that possess superior, consistent wind resources but were previously inaccessible using fixed-bottom foundations. This innovation dramatically expands the potential geographical scope for deployment, particularly in countries with deep coastlines, thereby sustaining long-term market growth and enhancing energy yields.

What role does Artificial Intelligence play in the operation and maintenance (O&M) of modern wind farms?

AI plays a transformative role by enabling highly accurate predictive maintenance. AI algorithms analyze operational data (vibration, temperature) to forecast potential component failures, allowing for proactive repairs, minimizing unplanned downtime, reducing maintenance costs, and ultimately maximizing the overall asset availability and energy production efficiency.

What are the key differences between Horizontal Axis Wind Turbines (HAWT) and Vertical Axis Wind Turbines (VAWT)?

HAWTs, the dominant design, feature a rotor axis parallel to the ground, requiring yaw mechanisms to face the wind, and are primarily used for utility-scale power generation due to high efficiency. VAWTs have a vertical axis, capture wind from any direction without yawing, and are generally preferred for small-scale, niche applications in constrained or turbulent urban environments, despite typically having lower efficiency than HAWTs.

Which geographic region is leading the world in terms of current installed wind capacity?

The Asia Pacific region, specifically led by China, currently holds the largest installed wind capacity globally. This dominance is the result of massive government investments in both onshore and offshore projects aimed at meeting ambitious national renewable energy targets and securing domestic energy supply.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager