Window Blinds Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433636 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Window Blinds Market Size

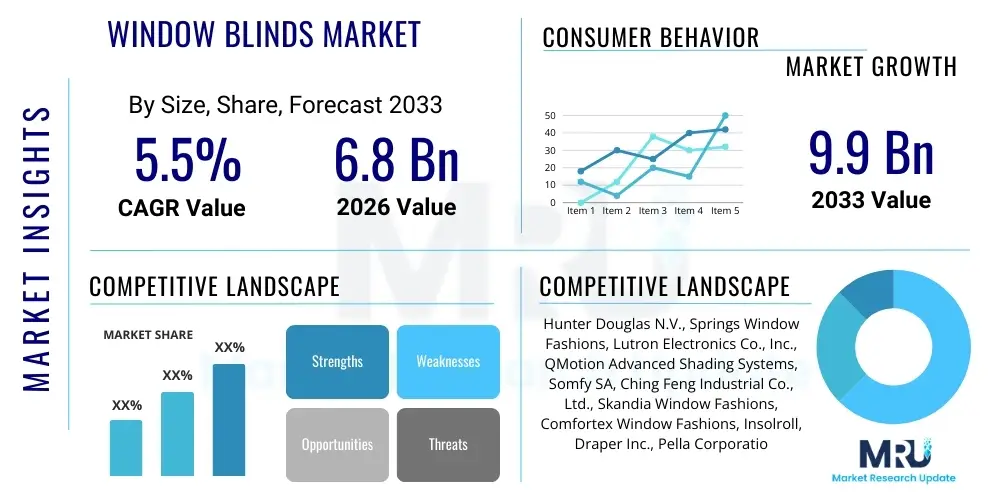

The Window Blinds Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.5% between 2026 and 2033. The market is estimated at USD 6.8 Billion in 2026 and is projected to reach USD 9.9 Billion by the end of the forecast period in 2033. This robust growth trajectory is primarily fueled by increasing global construction activities, particularly in the residential sector, coupled with heightened consumer awareness regarding interior aesthetics, privacy, and thermal efficiency. The transition towards energy-efficient building standards globally mandates advanced window coverings, cementing the market's expansion.

Window Blinds Market introduction

The Window Blinds Market encompasses the manufacturing, distribution, and sale of various types of coverings designed to be installed on windows to control light, privacy, and thermal transfer. These products range from traditional manual systems like Venetian, vertical, and roller blinds, to sophisticated motorized and smart blinds integrated into home automation ecosystems. Product design innovations, focusing on sustainability, enhanced durability, and aesthetic appeal, are critical differentiators in this competitive landscape. The core utility of window blinds extends beyond mere decoration; they are crucial components in building performance, directly influencing heating, cooling, and overall energy consumption, which drives demand in both new construction and retrofit projects.

Major applications of window blinds span across residential, commercial, and industrial sectors. In the residential segment, blinds are essential for maximizing comfort and style, with customization and smart features being highly valued. Commercial applications, including corporate offices, hotels, and healthcare facilities, prioritize durability, fire safety ratings, and advanced light management systems to optimize working environments and comply with building codes. The growing demand for 'net-zero' and 'green' buildings is accelerating the adoption of high-performance blackout and thermal blinds. These applications demonstrate the product's multifunctionality, acting as an intersection of interior design, energy management, and technology.

Key benefits driving the market include superior light control, enhanced security and privacy, and significant thermal insulation properties, which directly translate into reduced utility costs. Driving factors contributing to market acceleration are the rapid urbanization in emerging economies, the rising disposable incomes globally allowing investment in premium and automated solutions, and stringent governmental regulations promoting energy efficiency in building construction. Furthermore, advancements in materials science, leading to lighter yet more robust and sustainable blind materials, consistently expand the product's functional scope and market reach.

- Product Description: Window blinds are interior coverings fixed to windows, offering adjustable slats or fabrics to manage daylight, maintain privacy, and improve thermal performance.

- Major Applications: Residential homes, commercial offices, hospitality sectors, educational institutions, and healthcare facilities.

- Key Benefits: Energy savings through insulation, customizable aesthetics, UV protection, superior light filtration, and enhanced indoor comfort.

- Driving Factors: Growth in smart home integration, stringent energy conservation policies, increased construction volume, and consumer preference for personalized interior décor.

Window Blinds Market Executive Summary

The Window Blinds Market is currently defined by a strong emphasis on automation and sustainable product development, marking significant shifts in business trends. The integration of IoT capabilities into window coverings, leading to smart blinds controlled via voice commands or smartphone applications, is no longer a niche but a central feature driving premium pricing and consumer adoption, especially in developed markets. Manufacturers are investing heavily in R&D to introduce recyclable materials, low Volatile Organic Compound (VOC) components, and durable mechanisms, aligning with global eco-conscious consumption patterns. Strategic mergers, acquisitions, and collaborations between traditional blind manufacturers and technology providers are reshaping the competitive structure, focusing on vertically integrated smart home solutions.

Regional trends highlight divergence in market maturity and growth drivers. North America and Europe dominate in terms of value, driven by high adoption rates of motorized and smart blinds, spurred by high energy costs and strong consumer spending on home renovations. Asia Pacific (APAC), however, exhibits the highest growth rate, fueled by massive infrastructure development, increasing urbanization, and the expanding middle class in countries like China, India, and Southeast Asian nations. While volume sales in APAC are currently concentrated in basic and mid-range manual blinds, there is a rapidly accelerating demand for advanced, energy-efficient solutions in new luxury residential and commercial projects. This regional dynamism underscores the global nature of the market expansion.

Segment trends reveal that roller blinds and Venetian blinds remain market share leaders due to their cost-effectiveness and versatility across various applications. However, the fastest growth is observed in the 'Automated Blinds' segment, categorized both by product type (Motorized) and technology (Smart Home Integration). By material, composite and recycled fabrics are gaining significant traction over traditional wood and aluminum, driven by performance requirements (e.g., thermal resistance) and sustainability mandates. The commercial segment is showing robust performance, specifically demanding specialized solutions like anti-microbial treatments for healthcare environments and highly durable, low-maintenance materials for corporate facilities, illustrating the market's move toward functional specialization.

AI Impact Analysis on Window Blinds Market

Common user questions regarding AI's impact on window blinds often center on functionality, energy savings, privacy implications, and integration complexity. Users frequently ask: "How much energy can AI-controlled blinds really save?", "Are smart blinds secure from hacking?", and "How does AI learn my light preferences throughout the day?" The core themes emerging from these inquiries are expectations for sophisticated, proactive automation that genuinely delivers measurable benefits (primarily energy and comfort), coupled with concerns about data privacy, system reliability, and ease of integration with existing smart home platforms. Consumers anticipate a shift from reactive automation (based on simple timers or light sensors) to predictive management powered by machine learning, optimizing indoor environments based on weather forecasts, occupancy patterns, and historical data, thereby justifying the premium cost.

AI's primary influence is transforming window blinds from static light control mechanisms into dynamic, intelligent climate control devices. Machine learning algorithms analyze various input streams—including internal temperature sensors, external weather feeds, solar intensity data, and user interaction history—to predict optimal blind positioning minute-by-minute. This predictive capability allows the blind systems to pre-emptively manage solar heat gain during peak hours in summer and maximize passive solar heating in winter, optimizing HVAC system performance significantly. This capability is particularly critical in large commercial buildings where managing solar loads is a primary determinant of operational energy expenditure.

Furthermore, AI facilitates superior personalization and customization. Instead of relying on manual adjustments or rigid programming, AI-powered systems learn the unique preferences of occupants regarding lighting levels and privacy at different times of the day and year. This learning process continually refines the automation profile, offering a truly tailored environment that maximizes occupant comfort and well-being. This level of personalized, adaptive control represents a major competitive edge for manufacturers specializing in high-end, integrated smart home solutions, ensuring high user satisfaction and reinforcing the value proposition of premium smart blinds.

- Predictive Energy Management: AI analyzes solar radiation and internal temperatures to automatically adjust blinds, minimizing HVAC dependency and optimizing thermal performance.

- Adaptive Light Harvesting: Machine learning models optimize slat angles to maximize natural light penetration while mitigating glare, enhancing visual comfort and reducing the need for artificial lighting.

- Enhanced Security and Privacy: AI systems can simulate occupancy patterns by randomly adjusting blinds when the house is vacant, acting as a deterrent to intruders.

- Diagnostic and Predictive Maintenance: AI monitors motor performance and battery life, flagging potential failures before they occur, improving system longevity and reliability.

- Seamless Integration: AI facilitates deeper integration with broader IoT platforms (e.g., Apple HomeKit, Amazon Alexa, Google Home), ensuring coordinated operation with lighting, security, and climate control systems.

- Personalized Comfort Profiles: Systems learn specific user preferences for privacy and light exposure across different rooms and times, automating adjustments based on learned historical behavior.

DRO & Impact Forces Of Window Blinds Market

The Window Blinds Market operates under a complex interplay of Drivers, Restraints, and Opportunities (DRO), significantly influencing its growth trajectory and competitive dynamics. The primary drivers revolve around the global emphasis on energy conservation and sustainable building practices, forcing builders and homeowners to adopt advanced window covering solutions that contribute positively to LEED or similar certification standards. Coupled with this is the accelerating demand for smart home technologies, positioning motorized blinds as essential components rather than luxury additions. Opportunities are abundant in customization, particularly Mass Customization enabled by advanced manufacturing technologies, allowing suppliers to meet highly specific aesthetic and functional requirements of architects and interior designers. Furthermore, emerging markets present untapped potential for both basic and mid-range high-volume sales as construction booms.

However, the market faces notable restraints. The initial high cost associated with smart and motorized blinds remains a significant deterrent for price-sensitive consumer segments, especially in developing economies. Technical complexities related to installation, battery management, and integration with diverse smart home ecosystems can also lead to consumer frustration and slow down mass adoption. Furthermore, the market is subject to volatility in raw material prices, particularly aluminum, plastics, and specialized fabrics, which affects manufacturing costs and final product pricing. Navigating these restraints requires strategic sourcing, technological simplification, and effective consumer education regarding the long-term Return on Investment (ROI) derived from energy savings.

The impact forces currently reshaping the market include rapid technological substitution, where traditional manual systems are being swiftly replaced by automated versions, and intensified competition from Asian manufacturers offering cost-effective alternatives. Regulatory impact is also a significant force, particularly the stricter child safety standards related to corded blinds, pushing the entire industry toward cord-free or motorized designs. The overall market momentum is strongly positive, driven by the global imperative to create aesthetically pleasing, comfortable, and highly energy-efficient living and working spaces, ensuring continued investment in innovation across all product segments.

- Drivers (D): Rising consumer demand for automated home systems, stringent energy efficiency regulations in North America and Europe, increasing disposable income favoring premium interior décor, and growing focus on child safety (cordless systems).

- Restraints (R): High upfront investment costs for motorized and smart systems, perceived complexity in integrating IoT devices, and fluctuations in raw material prices (e.g., polymers, specialty textiles).

- Opportunities (O): Expansion into fast-growing infrastructure markets (APAC, MEA), development of sustainable and recyclable material options, strategic partnerships with home automation platform providers, and the retrofit market for upgrading existing residential structures.

- Impact Forces: Technological innovation (Smart control), regulatory push (Child safety mandates), competitive pricing pressure (Emerging market entrants), and energy conservation trends (Adoption of thermal blinds).

Segmentation Analysis

Segmentation analysis provides a crucial framework for understanding the diverse dynamics and growth pockets within the Window Blinds Market. The market is broadly segmented based on Product Type, Material, Operating Mechanism, Application (End-User), and Distribution Channel. This multidimensional approach helps manufacturers tailor their product offerings and market strategies to specific consumer needs, such as focusing on high-volume, low-cost roller blinds for the hospitality sector versus highly customized, automated Venetian blinds for high-end residential projects. The increasing fragmentation of consumer preferences, driven by digital commerce and accessibility to global trends, necessitates precise segmentation targeting.

The operating mechanism segment, differentiating between manual and motorized/smart blinds, is perhaps the most critical determinant of future growth, with the motorized segment consistently outpacing manual sales growth year-over-year. Similarly, the Application segmentation reveals different purchasing criteria; commercial clients prioritize durability, fire rating, and large-scale operational ease, whereas residential consumers place greater emphasis on design aesthetics, personalized automation, and ease of installation. Understanding these core segment characteristics allows companies to optimize their supply chain and channel strategy, such as prioritizing direct sales channels for complex commercial installations and retail/e-commerce platforms for residential products.

Within the materials segment, the transition towards sustainable, high-performance fabrics is a notable trend. While classic materials like wood and aluminum maintain relevance, advanced materials offering superior UV protection, thermal resistance, and easy cleaning are gaining market share. Geographically, segmentation highlights the dominance of established markets in innovation adoption (Smart Blinds) and the high volume potential of developing regions. Effective market penetration requires acknowledging these regional nuances, such as offering hurricane-resistant or highly durable external shading solutions in specific climate zones, demonstrating the necessity of granular analysis across all defined segments.

- By Product Type:

- Roller Blinds

- Vertical Blinds

- Venetian Blinds (Horizontal)

- Roman Blinds

- Panel Blinds

- Pleated and Cellular Shades

- By Material:

- Wood and Faux Wood

- Aluminum

- Vinyl/PVC

- Fabric/Textile (Polyester, Cotton, Specialty Fabrics)

- Composite Materials

- By Operating Mechanism:

- Manual (Corded and Cordless)

- Motorized (Remote Controlled)

- Smart (App/Voice Controlled, Integrated IoT)

- By Application (End-User):

- Residential (Single Family, Multi-Family Housing)

- Commercial (Offices, Retail, Hospitality, Healthcare, Education)

- By Distribution Channel:

- Online Retail

- Offline Retail (Specialty Stores, Departmental Stores)

- Direct Sales and Contract Channels

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For Window Blinds Market

The Value Chain for the Window Blinds Market begins with upstream activities involving raw material procurement and processing. This stage is critical as it dictates the cost, quality, and sustainability profile of the final product. Key upstream elements include sourcing specialized fabrics (thermal, blackout, UV-resistant), extruding aluminum and vinyl components, and acquiring motorization technology (motors, sensors, and microcontrollers). Dependencies on global commodity markets and proprietary technology suppliers (especially for smart components) define this stage. Effective upstream management focuses on establishing long-term supplier relationships, rigorous quality control for consistency, and securing resilient supply chains, minimizing exposure to geopolitical risks and price volatility.

The midstream phase focuses on manufacturing, assembly, and quality assurance. Due to the high degree of product customization demanded by consumers and architects, efficient manufacturing often relies on lean principles and rapid prototyping capabilities. The complexity arises in assembling motorized units and ensuring seamless integration of software and hardware. Direct manufacturing operations, particularly for established brands, often involve significant capital investment in automation to achieve scale and precision. Value addition here is maximized through advanced cutting technologies, material waste minimization, and adherence to international quality standards (e.g., ISO certifications and fire safety compliance).

Downstream activities encompass distribution, installation, and after-sales service, representing the final interaction with the end-user. The distribution channel is bifurcated into direct channels (serving large commercial projects and specialized custom orders) and indirect channels (retailers, e-commerce, and distributors serving the mass residential market). The effectiveness of downstream operations heavily relies on installer training, especially for complex smart systems, and robust logistics to handle varying product sizes and specifications. E-commerce platforms are increasingly serving as high-volume indirect channels, necessitating strong digital marketing and efficient reverse logistics for returns and warranty management.

- Upstream Analysis: Raw material sourcing (Aluminum, PVC, Polyester textiles, specialized motor/battery components), research and development focused on sustainable materials and integration technology, securing intellectual property rights for proprietary mechanisms.

- Downstream Analysis: Logistics and warehousing, final product customization based on window dimensions, professional installation services (crucial for motorized systems), and integration support with home automation hubs.

- Distribution Channel:

- Direct: Contract sales to large real estate developers, commercial builders, and institutional clients (hotels, hospitals).

- Indirect: E-commerce marketplaces, specialized window covering retail stores, major home improvement chains (e.g., Home Depot, IKEA), and independent interior design studios.

Window Blinds Market Potential Customers

Potential customers in the Window Blinds Market are diverse, ranging from individual homeowners seeking basic light control to multinational corporations requiring integrated, high-specification shading systems for their headquarters. The primary end-users can be broadly categorized into residential buyers and commercial/institutional buyers. Residential customers, particularly those in the high-income bracket, are increasingly driven by aesthetic congruence, customization potential, and the desire for high-tech, integrated smart home ecosystems. These buyers prioritize features such as silent motor operation, premium material finishes (e.g., motorized wooden shutters), and seamless voice or app control, viewing window blinds as both a décor element and an essential energy management tool.

Commercial end-users constitute a high-volume, high-value segment with distinct purchasing criteria focused primarily on performance, compliance, and total cost of ownership (TCO). This includes developers of commercial offices, hospitality groups managing luxury hotels, and administrators of healthcare and educational facilities. Their requirements typically mandate fire-retardant materials, robust durability to handle frequent use, and centralized control systems capable of managing hundreds of units simultaneously for optimal building energy performance. Furthermore, specialized commercial customers, such as high-tech manufacturing facilities or data centers, require specific blackout or thermal barriers to protect sensitive equipment, creating niches for technical sales.

A rapidly expanding segment consists of retrofit buyers—existing property owners looking to upgrade outdated window coverings to modern, energy-efficient, or automated systems. This segment is driven by the desire for improved home value, reduced utility bills, and enhanced safety (transitioning from corded to cordless systems). Targeting these potential customers requires focused marketing emphasizing long-term ROI and ease of installation in existing structures, often through collaboration with home renovation contractors and energy auditors. The continuous lifecycle of property maintenance ensures that this retrofit market remains a perennial source of demand for the foreseeable future.

- Residential End-Users: Homeowners (new construction and renovation), renters seeking temporary solutions, and real estate investors managing rental properties.

- Commercial End-Users: Corporate Real Estate Managers, Hotel & Hospitality Developers, Healthcare facility procurement teams, Educational campus administrators, and Retail store planners.

- Niche Segments: Architects and Interior Designers (influencers and specifiers), Government agencies (public housing, administrative buildings), and Home Automation System Integrators (partnering for installation).

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 6.8 Billion |

| Market Forecast in 2033 | USD 9.9 Billion |

| Growth Rate | 5.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Hunter Douglas N.V., Springs Window Fashions, Lutron Electronics Co., Inc., QMotion Advanced Shading Systems, Somfy SA, Ching Feng Industrial Co., Ltd., Skandia Window Fashions, Comfortex Window Fashions, Insolroll, Draper Inc., Pella Corporation, SWFcontract, Bali Blinds, MechoSystems, Louvolite, Tachikawa Corporation, Hillarys Blinds, Nichibei Co., Ltd., Varia blinds, and Blinds 2go. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Window Blinds Market Key Technology Landscape

The technological landscape of the Window Blinds Market is rapidly evolving, driven primarily by the confluence of IoT, material science, and motorization advancements. Core innovation centers around developing smaller, quieter, and more energy-efficient motors capable of handling heavier blinds while minimizing power consumption, crucial for battery-operated smart systems. Lithium-ion battery technology, specifically, has enabled cordless, rechargeable solutions that offer aesthetic benefits and enhanced safety compliance. Furthermore, the reliance on proprietary wireless communication protocols is diminishing in favor of standardized, interoperable standards like Z-Wave, Zigbee, and increasingly, Thread/Matter, which facilitate seamless integration into diverse smart home ecosystems and simplify the installation process for end-users.

Beyond motorization, material technology plays a significant role. Advances in technical textiles are yielding fabrics with superior performance characteristics, such as enhanced solar reflectance (minimizing heat gain), high UV filtering capabilities, and inherent fire-retardant properties, essential for commercial applications. Cellular shade technologies, which trap air within pockets, continue to evolve to offer better thermal insulation values (R-values), directly addressing the energy efficiency imperative. Manufacturers are also pioneering the use of recycled and bio-based polymers for slats and headrails, responding to stringent environmental standards and consumer preference for sustainable building products, thereby future-proofing their offerings against evolving regulations.

Digital technology deployment is crucial for both consumer experience and operational efficiency. This includes developing sophisticated mobile applications for precise scheduling and remote control, often incorporating machine learning for adaptive light management (as detailed in the AI analysis). On the manufacturing side, technologies like 3D printing and advanced CAD/CAM systems are being implemented to accelerate the prototyping of custom components and enable mass customization at scale, reducing lead times for complex, made-to-order blinds. The overall technological direction is moving toward systems that are fully autonomous, highly connected, and optimized for minimal energy usage, making them essential elements of modern building management systems.

- Motorization Advancements: Development of quiet, low-voltage DC motors; integration of long-lasting, rechargeable lithium-ion battery packs; standardized motor controllers for easy replacement and maintenance.

- Connectivity Standards: Adoption of standardized IoT communication protocols (Z-Wave, Zigbee, Thread, Matter) to ensure cross-compatibility with major smart home hubs (Google Home, Amazon Alexa, Apple HomeKit).

- Material Innovation: High-performance thermal fabrics (e.g., metallized backing, specialized blackout coatings), fire-retardant textiles (NFPA and building code compliant), and incorporation of recycled plastics and sustainable woods.

- Sensor Technology: Utilization of sophisticated light sensors, temperature sensors, and occupancy sensors to enable automatic and predictive adjustment of blind positions for optimal light and thermal conditions.

- Customization Platforms: Implementation of online configuration tools and Augmented Reality (AR) visualization apps allowing customers to preview products and specify dimensions precisely before ordering, reducing manufacturing errors.

Regional Highlights

North America holds a substantial market share, driven by high consumer adoption of smart home technologies and significant spending on home renovation projects, particularly in the United States and Canada. The market here is characterized by a strong preference for high-end motorized and automated solutions due to high energy costs, prompting homeowners to invest in superior thermal management provided by cellular and specialized blackout shades. Furthermore, stringent child safety regulations have nearly eliminated corded products, accelerating the transition to motorization. The commercial sector is highly mature, demanding sophisticated Building Management System (BMS) integration for automated solar shading in large corporate and institutional buildings.

Europe represents another mature, high-value market where sustainability and aesthetics are critical drivers. Germany, the UK, and France are key contributors, emphasizing energy efficiency and high-quality construction standards. European consumers show a high affinity for products made from natural or certified sustainable materials. The market also sees a strong presence of external shading systems (shutters and exterior blinds) designed to withstand regional weather variations and provide optimal passive cooling. Regulatory frameworks, such as the European Union’s Energy Performance of Buildings Directive, actively encourage the use of dynamic solar shading solutions, supporting consistent market growth.

Asia Pacific (APAC) is projected to be the fastest-growing region during the forecast period. This growth is underpinned by explosive urbanization, massive government investment in infrastructure, and a rapidly expanding middle class in countries like China, India, and Southeast Asia. While the high-volume segment currently favors cost-effective roller and vertical blinds, the demand for premium, imported, or domestically produced smart blinds is rapidly accelerating in major metropolitan areas. The growing construction of smart cities and luxury residential complexes serves as a powerful catalyst for adopting automated, technology-driven window covering solutions, making APAC a strategic focus area for global manufacturers seeking high volume expansion.

- North America: Market leadership in technology adoption (smart blinds), high emphasis on child safety regulations, and strong retrofit market activity driven by energy efficiency incentives.

- Europe: Driven by sustainable material mandates, high penetration of external shading solutions, and regulatory pressure supporting dynamic solar management in buildings.

- Asia Pacific (APAC): Highest projected CAGR due to rapid infrastructure development, increasing urbanization, booming residential construction, and growing regional manufacturing capabilities.

- Latin America (LATAM): Emerging market with growing demand in major economies like Brazil and Mexico, focusing initially on functional and durable solutions in both residential and commercial construction.

- Middle East and Africa (MEA): High demand for specialized thermal and blackout solutions to combat intense heat and high solar radiation, particularly in the UAE and Saudi Arabia, with smart system adoption growing in luxury residential projects.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Window Blinds Market.- Hunter Douglas N.V.

- Springs Window Fashions

- Lutron Electronics Co., Inc.

- QMotion Advanced Shading Systems

- Somfy SA

- Ching Feng Industrial Co., Ltd.

- Skandia Window Fashions

- Comfortex Window Fashions

- Insolroll

- Draper Inc.

- Pella Corporation

- SWFcontract

- Bali Blinds

- MechoSystems

- Louvolite

- Tachikawa Corporation

- Hillarys Blinds

- Nichibei Co., Ltd.

- Varia blinds

- Blinds 2go

Frequently Asked Questions

Analyze common user questions about the Window Blinds market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary factors driving the growth of the smart window blinds segment?

The growth of the smart window blinds segment is primarily driven by three factors: the global push for residential and commercial energy efficiency, the increasing integration of IoT devices within smart homes (facilitating automated control), and new child safety regulations mandating cordless or motorized solutions. Smart blinds offer superior thermal regulation and convenience, justifying the higher investment.

How significant is the role of energy efficiency in consumer purchasing decisions for window blinds?

Energy efficiency is highly significant, particularly in mature markets (North America and Europe) with high utility costs. Consumers actively seek blinds (such as cellular or specialized thermal fabrics) that provide measurable insulation, contributing to reduced heating and cooling expenses. This factor is crucial for both residential ROI and commercial building certifications like LEED.

Which product type, roller or Venetian blinds, currently holds the largest market share?

Roller blinds generally hold a dominant market share due to their versatility, clean aesthetic, ease of manufacturing, and cost-effectiveness across both residential and commercial applications. However, Venetian blinds remain strong in segments where precise light angle adjustment and traditional aesthetics are prioritized, particularly in office environments.

What are the major challenges facing manufacturers in the window blinds supply chain?

Major challenges include managing the high variability and complexity associated with mass customization (requiring precise, made-to-order manufacturing), mitigating volatility in global raw material prices (especially specialized polymers and motor components), and ensuring seamless integration compatibility with the rapidly evolving array of smart home platforms and communication protocols.

How is the window blinds market addressing the global trend toward sustainable building materials?

The market is responding to sustainability trends by increasing R&D investment in materials such as recycled content polymers, bio-based fabrics, and sustainably harvested wood alternatives (e.g., FSC certified). Manufacturers are also focusing on optimizing production processes to reduce waste and utilizing low-VOC finishes to ensure indoor air quality compliance in green building projects.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Window Blinds Market Size Report By Type (Manual Window Blinds, Electric Window Blinds), By Application (Residential, Commercial Building, Others), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Window Blinds Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Roller Shades, Horizontal Blinds, Verticals Blinds, Roman Blinds), By Application (Commercial, Residential), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager