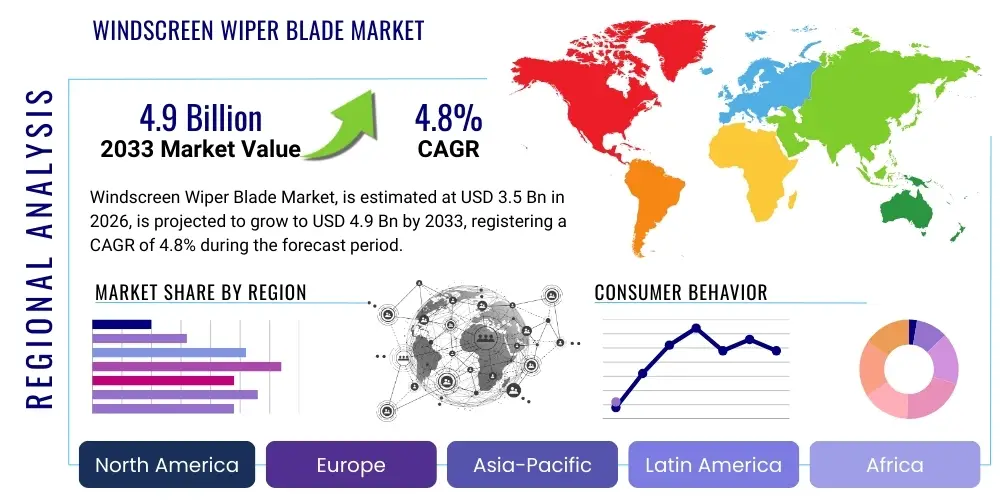

Windscreen Wiper Blade Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436737 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Windscreen Wiper Blade Market Size

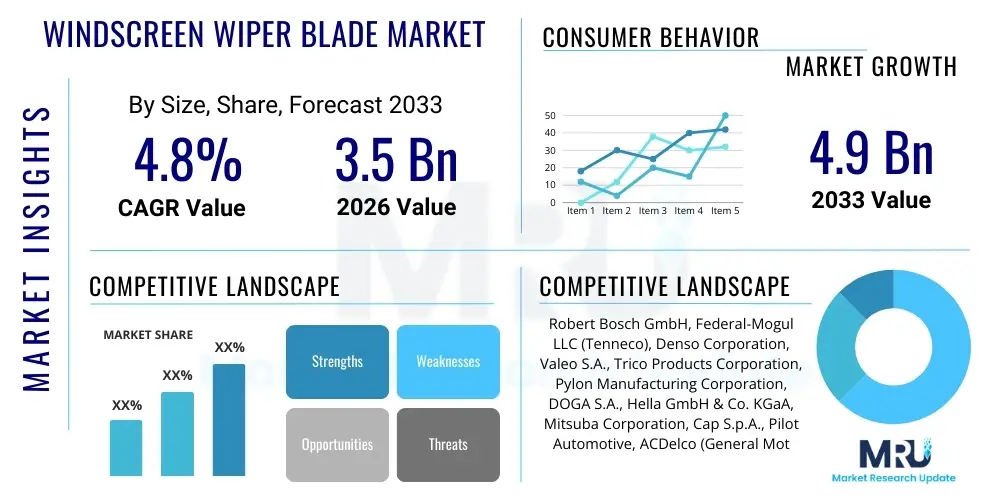

The Windscreen Wiper Blade Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 3.5 Billion in 2026 and is projected to reach USD 4.9 Billion by the end of the forecast period in 2033.

Windscreen Wiper Blade Market introduction

The Windscreen Wiper Blade Market encompasses the manufacturing, distribution, and sale of blades designed for clearing rain, snow, debris, and other obstructions from vehicle windshields and rear windows, ensuring optimal visibility and driver safety. These essential automotive components are categorized primarily into conventional (framed), flat/aero (beam), and hybrid designs, utilizing various materials such as natural rubber, silicone, and synthetic compounds. The core product objective is to provide a reliable, streak-free sweep across the glass surface under diverse weather conditions. Major applications span across passenger vehicles, commercial vehicles (trucks and buses), and specialty vehicles (construction and agricultural machinery). The market is heavily influenced by the global production volume of new vehicles, stringent governmental regulations regarding road safety, and the consistent aftermarket demand driven by the typical replacement cycle of wiper blades, which is generally 6 to 12 months depending on usage and environmental factors.

The primary benefits offered by high-quality windscreen wiper blades include enhanced road safety through superior visibility, improved driving comfort, and reduced driver fatigue, particularly during inclement weather. Driving factors propelling market expansion include the continuous expansion of the global vehicle parc, especially in emerging economies like China and India, which correlates directly with increased replacement demand. Furthermore, technological advancements, such as the integration of advanced polymers and aerodynamic designs (beam blades), are boosting average selling prices and extending product lifespan, although the fundamental need for replacement remains a consistent revenue stream. The evolution towards smart vehicles is also creating opportunities for sensor-integrated and heated wiper systems, catering to premium segment consumers who demand enhanced performance and durability.

The market faces a persistent challenge concerning counterfeiting and the proliferation of low-quality blades, which can damage windshields and compromise safety, impacting established brand manufacturers. However, the regulatory environment, particularly in North America and Europe, which mandates minimum standards for windshield visibility, consistently reinforces the need for certified, high-performance replacement parts. The shift in consumer preference towards premium beam blades, due to their superior aesthetics and better pressure distribution across curved windshields, is reshaping manufacturing strategies and investment in automation for consistent quality control. This sustained demand, coupled with innovation in materials science (e.g., graphene coatings for durability), solidifies the windscreen wiper blade sector as a critical and steadily growing segment within the broader automotive parts industry.

Windscreen Wiper Blade Market Executive Summary

The Windscreen Wiper Blade Market demonstrates robust growth, primarily fueled by consistent aftermarket demand stemming from the necessity of regular product replacement and the expansive growth of the global vehicle fleet, particularly within the Asia Pacific region. Business trends are characterized by a pronounced shift from traditional conventional wiper blades to advanced beam and hybrid designs, which offer superior aerodynamic performance, aesthetic integration, and longevity, thus commanding higher prices and improving profitability margins for key manufacturers. Strategic consolidation among major players is evident, focusing on optimizing global supply chains, integrating advanced automation into manufacturing processes to reduce defects, and securing long-term contracts with Original Equipment Manufacturers (OEMs). Furthermore, there is a burgeoning emphasis on sustainability, prompting research into recyclable materials and reducing the overall environmental footprint of wiper blade production and disposal.

Regional trends indicate that the Asia Pacific (APAC) region remains the dominant growth engine, driven by massive vehicle production volumes in China and the rapid increase in car ownership across Southeast Asia, which generates substantial OEM and replacement demand. North America and Europe, while mature markets, are leading the charge in adopting premium wiper technologies, including heated blades and those integrated with advanced driver assistance systems (ADAS) sensors, focusing on maximizing visibility performance in diverse climatic zones. The adoption of e-commerce platforms for aftermarket sales is rapidly accelerating across all geographies, offering consumers greater convenience and competitive pricing, forcing traditional brick-and-mortar auto parts retailers to adapt their inventory and distribution models.

Segmentation trends highlight the increasing dominance of the beam blade segment over the forecast period, reflecting consumer willingness to pay a premium for enhanced performance and modern vehicle design integration. By sales channel, the aftermarket segment accounts for the largest share due to the predictable replacement cycle, but the OEM segment is vital for establishing brand dominance and securing initial product adoption. Vehicle type analysis confirms that the passenger vehicle category maintains the largest market share; however, the commercial vehicle segment is experiencing stable growth driven by strict regulations governing operational safety and the expanding logistics industry, necessitating durable, heavy-duty wiping solutions designed for continuous, high-mileage use.

AI Impact Analysis on Windscreen Wiper Blade Market

Common user questions regarding AI's impact on the Windscreen Wiper Blade Market frequently revolve around how artificial intelligence can influence traditional mechanical components, specifically asking about predictive maintenance scheduling, the optimization of manufacturing quality control, and the potential for fully autonomous or ‘smart’ wiping systems. Users are concerned about whether AI integration will lead to radically different product designs or if its primary role will be confined to enhancing supply chain efficiency and material usage predictability. The central themes emerging from these inquiries highlight expectations for reduced operational costs in production, the ability to predict blade wear life accurately, and the development of next-generation wiper systems that utilize computer vision and machine learning algorithms to precisely adjust wiping frequency and force based on real-time environmental data rather than simple moisture sensors.

- AI-driven predictive maintenance scheduling based on vehicle usage and localized weather data, optimizing replacement timing for consumers and fleets.

- Integration of machine vision and learning algorithms into quality control systems during manufacturing, significantly reducing defect rates associated with rubber molding and coating application.

- Development of smart wiping systems utilizing AI to analyze camera and radar inputs (common in ADAS) to determine required visibility levels, dynamically adjusting speed and pressure for optimal, energy-efficient cleaning.

- Optimization of supply chain and inventory management using AI to forecast aftermarket demand fluctuations based on seasonal weather patterns and vehicle parc statistics.

- AI-assisted material science research, speeding up the discovery and development of next-generation coatings (e.g., hydrophilic or self-cleaning properties) for extended blade life and enhanced performance.

DRO & Impact Forces Of Windscreen Wiper Blade Market

The market dynamic is a complex interplay of inherent product necessity, regulatory mandates, and technological advancement, summarized by robust drivers, persistent restraints, and significant opportunities, which collectively define the impact forces. Key drivers include the mandatory replacement nature of the product, increasing global vehicle production volumes, and stringent government regulations prioritizing driver visibility and safety across all major economies. These factors ensure a continuous, non-negotiable demand flow in both the OEM and replacement sectors. However, the market faces restraints such as intense price competition, particularly in the aftermarket segment due to the low entry barrier for conventional blade manufacturing, and the increasing durability and extended lifespan of premium silicone and coated blades, which modestly lengthen the replacement cycle. The major opportunities lie in the integration of specialized blades for advanced ADAS-equipped vehicles, the expanding commercial fleet market, and leveraging e-commerce for direct-to-consumer sales channels.

The primary impact force remains the regulatory environment, which continually pushes manufacturers toward higher quality and superior wiping performance, often requiring investments in better materials and aerodynamic designs to meet standardized visibility tests. Another powerful force is consumer preference, which is increasingly favoring premium beam and hybrid blades over lower-cost conventional alternatives, driven by perceived quality differences, superior aesthetics, and easier self-installation. This shift is escalating the average selling price (ASP) across the market. Furthermore, volatility in raw material prices, specifically natural and synthetic rubber, steel, and plastics, exerts a significant influence on manufacturing costs and ultimately affects the final pricing strategy adopted by market leaders, necessitating sophisticated hedging and supply contract management.

The interplay between OEM standardization and aftermarket innovation forms a critical dynamic. OEMs demand highly specific, integrated designs, often with custom connectors, restricting the immediate aftermarket options and benefiting their associated supply partners. Conversely, the aftermarket thrives on universality and cost-effectiveness, leading to the development of multi-adapter systems that fit a wide range of vehicles, capturing consumer loyalty through convenience and aggressive pricing strategies. The sustained proliferation of electric vehicles (EVs) also acts as an emerging force, as EVs often require specialized, low-noise blades and aerodynamic designs to minimize drag and maximize battery range, creating a niche market for high-efficiency products designed specifically for the unique demands of electric mobility.

Segmentation Analysis

The Windscreen Wiper Blade Market is systematically segmented based on Type, Material, Vehicle Type, and Sales Channel, reflecting the diverse applications and end-user requirements across the automotive ecosystem. The analysis of these segments is crucial for manufacturers to tailor product development, optimize pricing strategies, and allocate distribution resources effectively across various geographical markets. Differentiation across these parameters allows stakeholders to identify high-growth niches, such as the premium silicone beam blade market in developed economies, or the high-volume, cost-sensitive conventional blade market prevalent in developing regions. Understanding the dominant segments—for instance, the heavy reliance on the Aftermarket sales channel and the overwhelming market share held by Passenger Vehicles—is foundational for accurate revenue forecasting and strategic planning.

- By Type:

- Conventional (Framed) Blades

- Flat (Beam/Aero) Blades

- Hybrid Blades

- Specialty Blades (e.g., Heated Blades, Rear Wiper Blades)

- By Material:

- Natural Rubber

- Synthetic Rubber

- Silicone Blades

- Coated Blades (e.g., Graphite, Teflon, Graphene)

- By Vehicle Type:

- Passenger Vehicles (Hatchbacks, Sedans, SUVs)

- Commercial Vehicles (Light Commercial Vehicles (LCV), Heavy Commercial Vehicles (HCV), Buses)

- By Sales Channel:

- Original Equipment Manufacturer (OEM)

- Aftermarket (Independent Aftermarket (IAM), Authorized Service Stations, Retail Stores, E-commerce)

Value Chain Analysis For Windscreen Wiper Blade Market

The value chain for the Windscreen Wiper Blade Market initiates with the upstream procurement and processing of key raw materials, primarily steel (for frames and springs), natural and synthetic rubber (for the wiping element), and various polymers and plastics (for connectors and housing). Upstream analysis reveals significant dependence on petrochemical and steel industries, making the initial manufacturing costs vulnerable to global commodity price fluctuations. Key activities at this stage include refining rubber compounds to achieve specific durability and flexibility characteristics, and precision stamping of spring steel to ensure even pressure distribution across the windshield. Efficiency in raw material conversion and the adoption of high-precision molding techniques are critical determinants of a manufacturer's competitive cost structure and final product quality, directly impacting the effective lifespan of the wiper blade.

The midstream stage involves the core manufacturing, assembly, and quality control processes. This stage is dominated by large-scale manufacturers who often possess proprietary technologies for blade coating and connector design. Manufacturing is capital-intensive, requiring advanced automation for the precise attachment of rubber elements to metal frames or beam structures, ensuring tight tolerance adherence for reliable performance. Downstream activities involve distribution channels, which are bifurcated into the OEM channel and the Aftermarket. The OEM channel involves direct supply to automotive assembly lines, requiring high volume capacity and strict just-in-time delivery compliance. The Aftermarket channel is complex, involving wholesalers, large retailers, independent garages, and increasingly, direct-to-consumer e-commerce platforms, all vying for rapid and localized inventory fulfillment.

Distribution channels are strategically vital; direct channels (OEM supply and some large fleet contracts) ensure stable, high-volume revenue, while indirect channels (Aftermarket distribution) offer wider market reach and capitalize on the frequent replacement demand cycle. E-commerce platforms are accelerating the shift towards indirect distribution by reducing dependence on physical retail space, providing consumers with detailed product information and installation guides, and enabling manufacturers to bypass multiple layers of traditional wholesale distribution. Effective logistics management, minimizing inventory holding costs while ensuring quick availability of diverse product lines (conventional, beam, hybrid), especially for the high-turnover aftermarket, is a major differentiating factor for success in the competitive landscape.

Windscreen Wiper Blade Market Potential Customers

The potential customer base for the Windscreen Wiper Blade Market is broadly categorized into two main groups: Original Equipment Manufacturers (OEMs) and end-users served through the Aftermarket channel. OEMs represent major global automotive manufacturers—including firms producing passenger cars, heavy trucks, buses, and specialized vehicles—who require high-volume, custom-designed wiper systems integrated directly into new vehicle production lines. Securing OEM contracts is highly prized as it guarantees stable volume and establishes a benchmark for quality and technological adoption, often leading to subsequent replacement revenue once the vehicles enter the maintenance cycle. These customers prioritize consistency, zero-defect quality, and compliance with specific vehicle design and aerodynamic requirements, often demanding collaborative product development efforts.

The second, and quantitatively larger, customer group comprises vehicle owners and fleet operators who drive the robust Aftermarket demand. This category includes individual car owners (the largest segment of replacement buyers), commercial fleet managers (trucking, logistics, taxi services), and government/municipal entities managing public transport and service vehicles. Individual consumers are typically driven by replacement urgency, ease of installation, brand reputation, and price sensitivity, although there is a growing segment willing to pay a premium for advanced features like silicone blades or superior beam performance. Fleet operators, conversely, prioritize durability, long operational life, bulk purchasing efficiency, and standardized inventory to minimize vehicle downtime and maintenance costs, often opting for heavy-duty or specialized blades designed for sustained, harsh commercial use environments.

Furthermore, specialized segments represent crucial niche opportunities, including customers requiring heavy-duty blades for agricultural or construction equipment operating in excessively dirty or abrasive conditions, and specialty vehicle manufacturers (e.g., marine vessels, trains) needing unique wiping mechanisms. The emergence of autonomous vehicle technology also creates a subset of potential customers (both OEMs and future service providers) who demand ultra-reliable, fully integrated, and sensor-compatible wiping systems, emphasizing flawless performance as visibility becomes critically linked to the operation of high-cost sensor arrays (Lidar, cameras). Manufacturers must employ distinct sales strategies and distribution channels to cater effectively to the specific procurement cycles and quality benchmarks of these disparate customer groups, ranging from long-term OEM partnerships to high-velocity retail sales.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.5 Billion |

| Market Forecast in 2033 | USD 4.9 Billion |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Robert Bosch GmbH, Federal-Mogul LLC (Tenneco), Denso Corporation, Valeo S.A., Trico Products Corporation, Pylon Manufacturing Corporation, DOGA S.A., Hella GmbH & Co. KGaA, Mitsuba Corporation, Cap S.p.A., Pilot Automotive, ACDelco (General Motors), KCW Co., Ltd., B. Hepworth and Company Ltd., ITW Global Brands, Continental AG, SWF (Valeo brand), WEXCO Industries, Ningbo Keli Auto Parts Co., Ltd., Lukasi Auto Parts. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Windscreen Wiper Blade Market Key Technology Landscape

The technology landscape of the Windscreen Wiper Blade Market is undergoing continuous refinement, moving beyond basic rubber-on-glass mechanics toward advanced material science and integration with automotive electronics. The most transformative shift has been the widespread adoption of Flat (Beam) blade technology. Beam blades utilize a robust tension spring within a spoiler-like structure to apply uniform pressure across the entire curvature of the modern windshield, offering superior performance and aerodynamics compared to the articulated frames of conventional blades. This technology also facilitates better integration with sleek vehicle aesthetics and reduces wind lift at high speeds, which is a key performance requirement. Furthermore, the development of sophisticated wiper rubbers and coatings, specifically silicone rubber compounds and PTFE (Teflon) or graphite coatings, represents a major technological leap, significantly enhancing durability, reducing friction noise, and ensuring streak-free wiping even after prolonged exposure to UV and environmental contaminants.

The integration of the wiper system with Advanced Driver Assistance Systems (ADAS) is rapidly becoming a fundamental technological requirement. This involves the use of specialized, often custom-designed, wiper arms and blades that prevent interference with sensitive windshield-mounted sensors, such as cameras and Lidar systems, which are crucial for adaptive cruise control and lane-keeping assistance. Heated wiper blades and fluid nozzles constitute another significant advancement, specifically targeting performance in cold climate regions by rapidly melting ice and snow accumulation, thereby enhancing immediate driver visibility upon vehicle startup. This technology requires specialized wiring and robust thermal elements integrated within the blade structure itself, posing unique manufacturing and power management challenges.

Material science innovation remains central to technological advancement, focusing on achieving longer replacement cycles and optimizing performance. Graphene and similar nanomaterial coatings are being explored to imbue blades with self-lubricating properties, drastically minimizing wear and tear. Furthermore, the development of smart wiper systems, utilizing capacitive or optical moisture sensors integrated into the windshield or wiper arm, allows for automatic, speed-variable wiping action optimized for the intensity of precipitation. The continuous miniaturization and precision engineering of proprietary connecting mechanisms (adapters) also represent crucial intellectual property, allowing manufacturers to create universal or specialized products that ensure compatibility across the extremely fragmented global vehicle parc while guaranteeing secure, reliable operation at high speeds.

Regional Highlights

The regional analysis of the Windscreen Wiper Blade Market reveals differential growth rates and technology adoption patterns heavily influenced by local vehicle manufacturing capacity, average vehicle age, and predominant climate conditions.

- Asia Pacific (APAC): APAC dominates the market both in terms of production volume and demand, primarily driven by massive vehicle manufacturing hubs in China, Japan, and India. This region benefits from a rapidly expanding middle class leading to increased car ownership and a substantial volume of new vehicle sales fueling the OEM segment. While price sensitivity in the aftermarket is high, demanding efficient production of conventional blades, the swift adoption of premium vehicle models is accelerating the demand for sophisticated beam and hybrid blades, making APAC the key growth driver globally.

- North America: This region is characterized by high replacement demand and a strong consumer preference for premium, durable products, largely due to diverse and often severe weather conditions (heavy snow, intense heat). The market is mature, but growth is fueled by the continuous integration of ADAS technology, necessitating specialized blades that integrate seamlessly with windshield sensors. Aftermarket distribution efficiency, coupled with strong brand loyalty, defines the competitive landscape here.

- Europe: Europe is a highly regulated market, with stringent safety standards driving demand for high-performance, aerodynamic wiper systems, often supplied by major European players. The European market shows a higher penetration rate of beam and hybrid blades compared to conventional types. Focus is increasingly placed on sustainability, leading to demand for long-life products and exploring recyclable material compositions.

- Latin America (LATAM): LATAM remains a price-sensitive market where replacement demand dictates sales. Conventional blades hold a stronger share due to cost constraints. Market growth is stable, correlating with increasing vehicle fleet size, although economic volatility in major economies like Brazil and Mexico can occasionally impact consumer replacement timing.

- Middle East and Africa (MEA): This region presents a unique demand profile, driven by harsh environmental factors such as dust, sand, and extreme heat, accelerating blade degradation. While smaller in scale, the market requires robust, heat-resistant, and durable solutions, presenting opportunities for specialized synthetic and silicone blades, particularly in the premium and fleet segments servicing the rapidly growing infrastructure projects.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Windscreen Wiper Blade Market.- Robert Bosch GmbH

- Federal-Mogul LLC (Tenneco)

- Denso Corporation

- Valeo S.A.

- Trico Products Corporation

- Pylon Manufacturing Corporation

- DOGA S.A.

- Hella GmbH & Co. KGaA

- Mitsuba Corporation

- Cap S.p.A.

- Pilot Automotive

- ACDelco (General Motors)

- KCW Co., Ltd.

- B. Hepworth and Company Ltd.

- ITW Global Brands

- Continental AG

- SWF (Valeo brand)

- WEXCO Industries

- Ningbo Keli Auto Parts Co., Ltd.

- Lukasi Auto Parts

Frequently Asked Questions

Analyze common user questions about the Windscreen Wiper Blade market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the growth of the Windscreen Wiper Blade Market globally?

The predominant driver is the mandatory replacement cycle of wiper blades, typically every 6 to 12 months, combined with the continuous expansion of the global vehicle parc (total number of operational vehicles). These factors ensure a constant, high-volume requirement in the aftermarket segment worldwide.

How do flat (beam) blades differ technologically from conventional wiper blades?

Flat or beam blades utilize a single, pre-stressed internal tension spring to distribute pressure uniformly across the entire windshield surface, conforming better to modern curved glass. Conventional blades rely on an articulated metal frame with multiple pressure points, which are less effective at high speeds and can be less aesthetically pleasing.

Which geographical region represents the largest market share and why?

The Asia Pacific (APAC) region currently holds the largest market share due to its significant contribution to global vehicle production (OEM demand) and the massive, rapidly increasing number of passenger vehicles on the road, particularly in populous countries like China and India, fueling immense aftermarket replacement volumes.

What role does the integration of ADAS play in wiper blade innovation?

ADAS integration requires specialized wiper blades and systems designed specifically to avoid obstructing or interfering with the operational field of view of windshield-mounted cameras, Lidar, and other safety sensors. This drives innovation toward low-profile, custom-fit designs and flawless, streak-free wiping performance, which is essential for sensor functionality.

Are silicone wiper blades expected to fully replace traditional rubber blades in the future?

While silicone blades offer superior durability, enhanced resistance to UV damage, and potential for longer lifespan, they are generally positioned in the premium segment and have a higher initial cost. Traditional rubber (natural and synthetic) blades, particularly conventional designs, will continue to dominate the cost-sensitive, high-volume aftermarket segments, preventing a full replacement scenario in the foreseeable future.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager