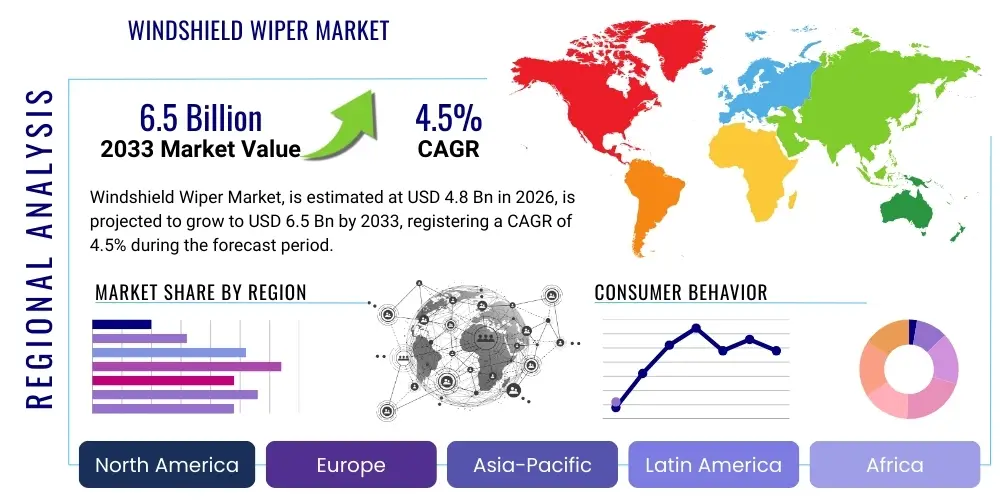

Windshield Wiper Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437107 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Windshield Wiper Market Size

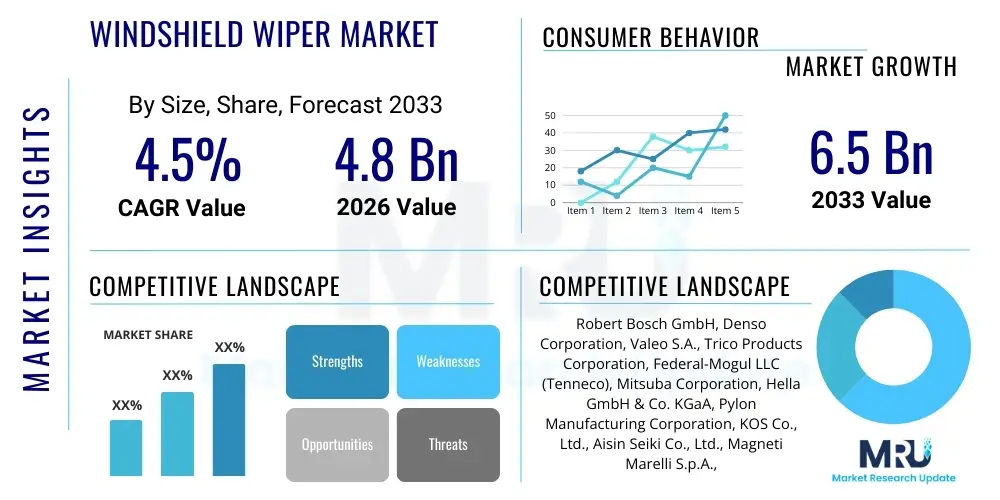

The Windshield Wiper Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.5% between 2026 and 2033. The market is estimated at USD 4.8 Billion in 2026 and is projected to reach USD 6.5 Billion by the end of the forecast period in 2033.

The expansion of the global automotive manufacturing sector, particularly the rising production of passenger vehicles and light commercial vehicles in emerging economies such as China, India, and Southeast Asia, serves as the primary catalyst for market growth. Windshield wipers are mandatory safety components, integral to both Original Equipment Manufacturer (OEM) assembly and the expansive aftermarket replacement cycle. The increasing average age of vehicles on the road, coupled with stringent regulatory standards regarding road safety and visibility across North America and Europe, necessitates frequent maintenance and replacement of wiper blades, ensuring a steady revenue stream for manufacturers.

Furthermore, technological advancements are reshaping the product landscape, moving from traditional conventional wipers toward higher-efficiency flat or beam blades and advanced hybrid systems that offer improved aerodynamics, durability, and uniform pressure distribution. Innovations, including specialized coatings (like graphite or PTFE) to reduce friction and noise, are improving the user experience and commanding higher price points. The integration of advanced sensor systems and connectivity in modern vehicles is also driving the demand for smart wiper systems capable of adaptive speed control and predictive maintenance, further supporting the market valuation trajectory through 2033.

Windshield Wiper Market introduction

The Windshield Wiper Market encompasses the manufacturing, distribution, and sale of components and systems designed to clear precipitation, debris, and grime from the windshield (and sometimes rear windows) of motor vehicles, crucial for maintaining driver visibility and overall road safety. Products within this market include the wiper blades, wiper arms, linkage mechanisms, motors, and associated electronic controls. Major applications span the entire automotive spectrum, including passenger cars (sedans, SUVs, hatchbacks), light and heavy commercial vehicles, and specialized vehicles such as buses and agricultural machinery. The primary benefits derived from these systems are enhanced operational safety, compliance with mandatory vehicle safety standards globally, and improved driving comfort under adverse weather conditions. Key driving factors include the continuous expansion of the global vehicle parc, the necessity of regular blade replacement due to wear and tear (the aftermarket cycle), increasing regulatory focus on driver visibility, and ongoing innovation in aerodynamic and smart wiping technologies.

The continuous need for maintenance components is the defining characteristic of the windshield wiper sector. While the OEM segment is reliant on global automotive production volumes and vehicle model changes, the Aftermarket segment benefits from both high-frequency replacement cycles and consumer preference for premium, high-performance blades. Economic indicators, such as consumer disposable income and fuel prices, subtly influence the timing of discretionary aftermarket purchases, but the fundamental safety requirement ensures a resilient demand base. The market structure is characterized by intense competition, with a few global giants dominating the technological development and supply to major automotive OEMs, alongside a fragmented landscape of regional and specialized aftermarket suppliers.

Windshield Wiper Market Executive Summary

The Windshield Wiper Market is poised for stable expansion, primarily fueled by robust automotive production trends in Asia Pacific and the persistent demand generated by the global replacement cycle. Business trends indicate a strong push towards lightweight, aerodynamic flat blade technology, which is increasingly being adopted as standard equipment by OEMs due to superior performance and modern aesthetic appeal. Manufacturers are focusing on supply chain resilience and expanding local production capabilities to mitigate geopolitical risks and optimize logistics, especially in high-growth regions. The competitive landscape is shifting slightly as companies invest heavily in material science for improved rubber formulations and specialized coatings to extend product life and enhance performance in extreme weather conditions.

Regionally, Asia Pacific maintains its dominance, driven by mass vehicle production and the vast vehicle population in countries like China and India, which create an immense opportunity for both OEM supply and aftermarket services. North America and Europe, while slower in new vehicle production growth, represent highly profitable mature markets characterized by higher consumer willingness to pay for premium hybrid and beam wiper solutions, alongside strict regulatory enforcement of vehicle inspection that mandates functional wiper systems. Segment trends show that the Passenger Car category holds the largest market share, though the Commercial Vehicle segment is witnessing accelerated adoption of heavy-duty, durable wiper systems designed for intensive use in freight and logistics operations. The Aftermarket segment is expected to outpace the OEM segment growth rate due to the inevitable and recurring nature of blade replacement.

AI Impact Analysis on Windshield Wiper Market

User queries regarding the impact of Artificial Intelligence (AI) on the windshield wiper market primarily revolve around three interconnected themes: the role of AI in autonomous vehicles, the integration of predictive maintenance systems, and the efficiency improvements afforded by smart sensors. Users frequently question how AI algorithms govern the operation of automatic wipers—specifically, whether AI will replace traditional rain sensors with more nuanced visual processing to better distinguish between rain, mist, and snow, thereby optimizing wipe frequency and pressure. Concerns also exist about data privacy and the complexity of maintaining sophisticated sensor-driven systems in the aftermarket. Furthermore, consumers and industry professionals are keenly interested in how machine learning can predict the end-of-life of a wiper blade, triggering timely replacement notifications directly to the vehicle owner or service center.

The primary influence of AI lies in its ability to process complex environmental data captured by vehicle sensor arrays, including cameras and LiDAR, integrating this input to create highly responsive and optimized wiping strategies. Traditional rain sensors rely on optical reflection changes, but AI allows the system to analyze visual context (e.g., speed of surrounding vehicles, visibility degradation) to adjust wiping intensity proactively, optimizing driver perception. For autonomous vehicles, impeccable and instantaneous forward visibility is non-negotiable; AI ensures that the visual input for the autonomous driving system is consistently clear, potentially coordinating with dynamic cleaning systems (like integrated fluid nozzles) beyond the simple sweeping motion.

Moreover, AI is facilitating the transition toward predictive maintenance within the wiper system components. By continuously monitoring motor torque, operational cycles, and blade friction patterns, AI algorithms can accurately predict mechanical failure or rubber degradation before it compromises safety. This shift from reactive to proactive maintenance benefits both the manufacturer (by enabling targeted warranty coverage) and the consumer (by preventing unexpected visibility failures). This advanced functionality is currently concentrated in premium and luxury vehicle segments but is anticipated to trickle down to mass-market vehicles as sensor costs decrease and standardized vehicle architectures support deeper software integration.

- AI enhances rain sensing by integrating camera and vision processing data for improved environmental distinction (rain vs. dirt).

- Predictive Maintenance (Pdm) algorithms utilize operational data (torque, cycles) to forecast blade degradation and system failure.

- AI is critical for autonomous vehicle safety, ensuring maximum visual clarity for perception systems (cameras, sensors).

- Optimization of wipe frequency and speed based on real-time driving conditions and vehicle speed, improving efficiency.

- Integration of wiper systems with vehicle connectivity for software updates and personalized maintenance scheduling.

DRO & Impact Forces Of Windshield Wiper Market

The dynamics of the Windshield Wiper Market are shaped by a balanced interplay of propelling forces, constraining factors, and strategic opportunities. The primary driver is the sheer necessity of the product for vehicle safety and regulatory compliance across all major automotive markets, guaranteeing non-discretionary demand. Restraints largely focus on the high price sensitivity within the dominant aftermarket segment, particularly in emerging economies where counterfeit or lower-quality products compete heavily based solely on price, impacting reputable manufacturers' market share and margin protection. Opportunities are centered on technological advancements, specifically the shift toward sensor-integrated, high-performance blades and the expansion of vehicle connectivity features that support smart maintenance warnings. These forces collectively dictate manufacturing investments, product innovation cycles, and pricing strategies across the OEM and aftermarket channels.

Impact forces stemming from global economic stability and regulatory changes significantly affect the market. Stricter safety regulations, especially those governing vehicle lighting and visibility requirements in regions like the EU and US, inherently increase the market for high-quality, dependable wiping systems. Conversely, macroeconomic downturns can affect new vehicle sales (the OEM demand) and cause consumers to delay replacing blades until they completely fail, slowing the replacement cycle in the aftermarket. Environmental mandates are also pushing manufacturers toward using sustainable and recyclable materials in both blade components and packaging, adding complexity but creating differentiation opportunities for environmentally conscious brands.

The market also faces internal pressure from raw material price volatility, particularly fluctuations in rubber and specialized plastics used in blade manufacturing. Manufacturers must continuously manage cost pressures while maintaining quality standards essential for optimal performance and brand reputation. The rise of Electric Vehicles (EVs) is an emerging force; while EVs still require wipers, their focus on aerodynamic efficiency and cabin quietness necessitates highly refined, low-noise wiper systems, presenting a specific design challenge and opportunity for system suppliers specializing in noise vibration and harshness (NVH) mitigation.

Segmentation Analysis

The Windshield Wiper Market is extensively segmented based on criteria such as product type, technology, vehicle type, and sales channel, providing a granular view of demand patterns and strategic avenues for growth. Analyzing these segments is crucial for understanding where value is being created and how manufacturers are adapting their product mix. By product type, the segmentation distinguishes between the consumable blade component, the mechanical arm that holds the blade, and the linkage system that translates motor power. By technology, the distinction between traditional framed/conventional wipers, modern flat/beam blades, and hybrid designs (combining elements of both) reflects the technology adoption curve across different vehicle classes.

The most significant differentiation occurs across the sales channel segmentation: OEM (Original Equipment Manufacturer) and Aftermarket. The OEM channel is characterized by high volume, stringent quality standards, and long-term supply agreements, highly dependent on global vehicle production schedules. The Aftermarket channel, conversely, is fragmented, relies on brand loyalty, availability, and competitive pricing, driven by routine maintenance needs. Further analysis of the vehicle type segmentation shows that passenger cars consume the largest volume of wiper systems, but commercial and off-highway vehicles demand highly durable, specialized systems tailored for harsh environments and heavy-duty operation cycles.

- By Product Type:

- Wiper Blades (Conventional, Flat/Beam, Hybrid)

- Wiper Arms

- Wiper Linkage

- Wiper Motors and Pumps

- By Technology:

- Conventional (Framed) Wipers

- Flat (Beam) Wipers

- Hybrid Wipers

- By Vehicle Type:

- Passenger Cars (PC)

- Commercial Vehicles (CV)

- Off-Highway Vehicles

- By Sales Channel:

- OEM (Original Equipment Manufacturer)

- Aftermarket (Independent and Authorized Service Providers)

Value Chain Analysis For Windshield Wiper Market

The value chain for the Windshield Wiper Market initiates with the procurement of critical raw materials, primarily specialized rubber compounds (natural and synthetic), various plastics (polycarbonate, polypropylene), and metals (steel, aluminum) for the frames, arms, and linkage components. Upstream analysis highlights the dependency on petrochemical and metallurgy industries, where volatility in commodity prices directly impacts manufacturing costs. Suppliers often employ hedging strategies to stabilize procurement costs, and large wiper manufacturers frequently integrate specialized rubber processing capabilities internally to ensure quality control over the most crucial component—the blade element. Quality control and material science innovation at this stage are paramount for product performance and longevity.

The midstream involves complex manufacturing processes, including stamping, molding, assembly, and testing. Leading global suppliers, such as Bosch and Valeo, operate highly automated facilities to achieve the precision required for aerodynamic efficiency and consistent pressure distribution. Direct distribution channels are predominantly used for OEM sales, involving Just-in-Time (JIT) delivery to automotive assembly plants globally, necessitating robust logistics infrastructure. Indirect distribution is characteristic of the aftermarket, utilizing a multi-tiered structure involving master distributors, regional wholesalers, and specialized automotive parts retailers or garages. The efficiency of this downstream network, particularly in handling vast SKU catalogs and ensuring immediate availability, defines aftermarket success.

Margin analysis reveals that profitability is generally lower in the high-volume OEM segment due to intense price negotiations, whereas the aftermarket offers higher margins, especially for premium, branded blades. Counterfeit products pose a significant threat within the indirect channel, eroding legitimate supplier margins and posing safety risks to consumers. Consequently, effective intellectual property protection and authorized service network partnerships are crucial strategic priorities for protecting brand equity and ensuring the integrity of the distribution path to the final installer or consumer.

Windshield Wiper Market Potential Customers

Potential customers in the Windshield Wiper Market are distinctly categorized into two primary groups: institutional buyers and individual consumers, segmented by the Original Equipment Manufacturer (OEM) channel and the Aftermarket channel, respectively. Institutional buyers, comprising global automotive manufacturers (e.g., Toyota, Volkswagen, General Motors), represent the largest volume purchasers. They source complete wiper systems (blades, arms, motors) under multi-year contracts, prioritizing reliability, integration compatibility with vehicle electronics, compliance with stringent quality and noise standards, and competitive unit pricing. Their purchasing decisions are heavily influenced by the suppliers’ R&D capabilities, geographical reach, and capacity for scalable global supply chain execution.

The second major group consists of consumers and vehicle fleet operators who purchase replacement parts through the Aftermarket. This segment is highly diversified, including independent automotive repair shops, national chain parts retailers (like AutoZone or Halfords), authorized dealership service centers, and direct-to-consumer e-commerce platforms. Individual consumers are driven by factors such as brand recognition, perceived product life (durability), ease of installation, and increasingly, specific technology features like flat blade aesthetics and specialized coatings. Fleet operators, conversely, prioritize total cost of ownership (TCO) and durability, opting for solutions that minimize downtime and require less frequent replacement, particularly in commercial trucking or public transportation sectors.

The trend towards advanced vehicle systems is creating a specific niche demand within the Aftermarket for high-quality, professional installation, as newer, sensor-integrated wipers often require recalibration or specific diagnostic tools after replacement. This enhances the role of certified service centers as potential customers who demand reliable, well-documented products. Furthermore, the rising adoption of electric vehicles (EVs) is establishing a new customer profile focused on purchasing lightweight, noise-optimized wiper systems that meet the unique aerodynamic and NVH requirements of electric platforms, steering them towards premium product lines.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.8 Billion |

| Market Forecast in 2033 | USD 6.5 Billion |

| Growth Rate | 4.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Robert Bosch GmbH, Denso Corporation, Valeo S.A., Trico Products Corporation, Federal-Mogul LLC (Tenneco), Mitsuba Corporation, Hella GmbH & Co. KGaA, Pylon Manufacturing Corporation, KOS Co., Ltd., Aisin Seiki Co., Ltd., Magneti Marelli S.p.A., Sogefi S.p.A., Capco Co., Ltd., Shanghai Piao'an Wiper System Co., Ltd., Fiamm S.p.A., Pilot Automotive, Xiamen Meto Auto Parts Co., Ltd., Dongyang Industrial Co., Ltd., AM Equipment, and Zhejiang Zhenqi Auto Parts Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Windshield Wiper Market Key Technology Landscape

The technology landscape within the Windshield Wiper Market is characterized by a strong evolutionary shift towards improved aerodynamics, enhanced durability, and intelligent integration with vehicle safety systems. The most significant advancement is the widespread adoption of Flat/Beam Wiper Blade Technology, replacing the traditional framed design. Flat blades utilize tensioned metal springs encapsulated within an aerodynamic spoiler, ensuring more uniform pressure distribution across the entire windshield surface, leading to superior wiping quality, reduced wind lift at high speeds, and a sleeker aesthetic preferred by modern vehicle designers. This technological migration addresses critical consumer requirements for quiet operation and performance stability.

Beyond blade design, significant innovation is occurring in the area of sensing and delivery systems. Modern vehicles increasingly feature rain-sensing wipers (RSW) that utilize optical sensors to detect moisture levels and automatically adjust wipe frequency, often utilizing sophisticated algorithms to minimize unnecessary cycles. Furthermore, the development of Integrated Washer Systems, such as those that deliver fluid directly through micro-nozzles embedded in the wiper arm or blade structure, ensures immediate and targeted cleaning, significantly reducing the amount of washer fluid required and improving momentary visibility during cleaning. This targeted fluid delivery is crucial for maintaining clear camera views in advanced driver-assistance systems (ADAS).

Material science remains a core focus, driving advancements in rubber compounds and specialized coatings. Manufacturers are developing rubber elements infused with graphite, Teflon (PTFE), or nano-coatings to reduce friction, eliminate chatter noise, and enhance resistance to ozone, UV exposure, and extreme temperatures, thereby extending the effective service life of the blade. For the linkage and motor components, the trend is toward lightweight materials and highly efficient, compact motors that consume less energy, aligning with the weight reduction and energy efficiency goals critical for electric and hybrid vehicle platforms. These technological evolutions ensure that the windshield wiper system remains a dynamically developing, high-value component within automotive safety architecture.

Regional Highlights

Regional dynamics are critical to understanding the distribution of market demand, manufacturing hubs, and regulatory influences within the Windshield Wiper Market.

- Asia Pacific (APAC): This region dominates the global market, primarily due to high volume production in China, Japan, South Korea, and India. The region boasts the fastest growth rate, fueled by expanding middle-class vehicle ownership, increasing road infrastructure investment, and the presence of major global and domestic automotive OEMs. Aftermarket demand is rapidly growing, characterized by intense price sensitivity and high product volume.

- Europe: Europe represents a mature, high-value market characterized by stringent quality and performance standards. Regulatory requirements, such as those related to pedestrian safety and mandatory vehicle inspections (TÜV, MoT), ensure steady replacement demand. This region shows high adoption rates for premium flat/beam and hybrid wiper technologies, with manufacturers focusing heavily on integrated sensor technology and aerodynamic designs to meet demanding European homologation requirements.

- North America: This region is a major consumer of aftermarket products, driven by geographical diversity that necessitates wipers capable of handling extreme weather conditions (heavy snow, torrential rain). Market penetration of premium products is high, and consumers often choose branded solutions for perceived reliability and durability. The OEM market is stable, aligned with established US and Mexican vehicle production volumes, with an increasing shift towards original equipment flat blade integration.

- Latin America (LATAM): Growth in this region is moderate, contingent upon economic stability and localized automotive assembly volumes, particularly in Brazil and Mexico. The market is highly price-competitive, with a significant preference for conventional wiper systems due to lower acquisition costs, though urbanization and increasing vehicle safety awareness are slowly driving adoption of better-quality hybrid options.

- Middle East and Africa (MEA): This is an emerging market characterized by diverse conditions, ranging from high dust and sand exposure to heavy seasonal rainfall. Demand is growing steadily, primarily driven by vehicle imports and increasing localization of assembly operations. Aftermarket focuses on robust materials capable of resisting extreme heat and UV degradation, and logistics efficiency is a key competitive differentiator across the diverse sub-regions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Windshield Wiper Market.- Robert Bosch GmbH

- Denso Corporation

- Valeo S.A.

- Trico Products Corporation

- Federal-Mogul LLC (Tenneco)

- Mitsuba Corporation

- Hella GmbH & Co. KGaA

- Pylon Manufacturing Corporation

- KOS Co., Ltd.

- Aisin Seiki Co., Ltd.

- Magneti Marelli S.p.A.

- Sogefi S.p.A.

- Capco Co., Ltd.

- Shanghai Piao'an Wiper System Co., Ltd.

- Fiamm S.p.A.

- Pilot Automotive

- Xiamen Meto Auto Parts Co., Ltd.

- Dongyang Industrial Co., Ltd.

- AM Equipment

- Zhejiang Zhenqi Auto Parts Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Windshield Wiper market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the growth of the Windshield Wiper Market?

The primary factor driving market growth is the recurring demand generated by the replacement cycle, dictated by the mandatory degradation of wiper blades (typically every 6 to 12 months) due to wear, environmental exposure, and the imperative need for maintaining optimal driver visibility and compliance with global automotive safety regulations.

How do Flat/Beam Wipers differ technologically from Conventional Wipers, and why are they gaining market share?

Flat/Beam wipers utilize an internal, tensioned spring mechanism and an aerodynamic spoiler, dispensing with the traditional rigid metal frame. This design provides uniform pressure distribution across the windshield, which significantly reduces streaking and chattering noise, increases high-speed performance by mitigating wind lift, and offers a more streamlined aesthetic favored by modern vehicle OEMs.

What impact does the rise of Electric Vehicles (EVs) have on wiper system design requirements?

The rise of EVs necessitates advancements in wiper design focused on maximizing aerodynamic efficiency to conserve battery range and minimizing noise (NVH characteristics) to maintain the quiet cabin experience typical of electric drivetrains. This drives demand for lightweight, high-performance, and ultra-quiet flat or hybrid wiper systems.

Which sales channel, OEM or Aftermarket, holds the greater revenue potential in the long term?

While the OEM channel is stable and critical for establishing technology standards, the Aftermarket channel holds greater long-term revenue potential due to the sheer volume of recurring replacement transactions. The global vehicle parc size ensures continuous, non-discretionary demand for replacement blades throughout the entire service life of every vehicle.

How is Artificial Intelligence (AI) being integrated into modern windshield wiper systems?

AI is integrated by leveraging complex sensor data (cameras, LiDAR) to create smart wiping systems that precisely optimize wipe frequency and intensity based on environmental context (not just simple moisture detection). Furthermore, AI enables predictive maintenance by monitoring motor torque and friction to warn users before a system failure or significant blade degradation occurs.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Windshield Wiper Market Size Report By Type (Wiper Blade, Wiper Arm), By Application (OEMs Market, Aftermarket), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Windshield Wiper Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Bone Wiper, Boneless Wiper), By Application (OEMs Market, Aftermarket), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

- Windshield Wiper Fluid Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Ready to Use Fluid, Concentrated Fluid), By Application (Personal, Auto Maintenance Shop, Others), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

- Automotive Brush Cards Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (6V, 12V, 24V, Others), By Application (Window lift motors, ABS motors, HVAC / Cooling fans motors, Sunroof motors, Seat motors, Lift gate motors, Sliding door motors, Windshield wiper motors, Headlamp motors, Mirror motors, Power steering motors, Others), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager