Wine And Spirits Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431672 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Wine And Spirits Market Size

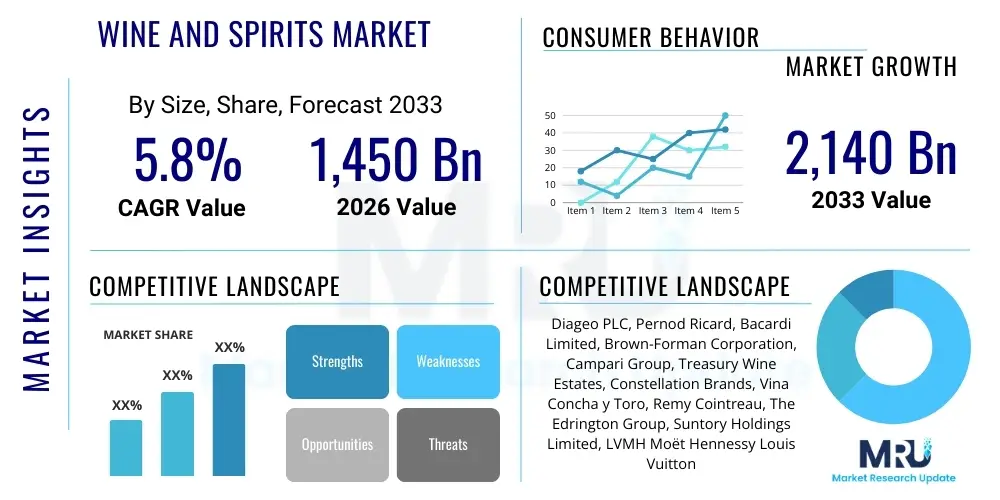

The Wine And Spirits Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at $1,450 billion in 2026 and is projected to reach $2,140 billion by the end of the forecast period in 2033.

Wine And Spirits Market introduction

The Wine and Spirits Market encompasses the production, distribution, and sale of alcoholic beverages derived from fermented grapes or fruits (wine) and distilled alcoholic drinks (spirits). This vast global industry is characterized by significant consumer segmentation, stringent regulatory oversight, and a strong reliance on cultural and celebratory consumption patterns. The market spans numerous categories, including premium and ultra-premium offerings, standard products, and various packaging formats, catering to diverse socio-economic groups and consumption occasions worldwide. Key product categories driving the market include whiskies, vodka, rum, gin, tequila, and an extensive array of still and sparkling wines, each influenced by regional production traditions and evolving global flavor trends.

Major applications of wine and spirits extend beyond simple consumption, heavily influencing the hospitality sector, tourism, and gifting markets. The beverages are central components of fine dining, bar culture (on-trade), and large-scale retail (off-trade), serving purposes ranging from social lubrication and celebratory toasts to sophisticated connoisseurship and investment. A primary benefit of this market is its economic contribution through employment, taxation, and supporting ancillary industries such as agriculture (grape growing, grain cultivation) and specialized packaging. The complexity of the supply chain, from vineyard to consumer, requires advanced logistics and inventory management.

Driving factors for market expansion include the increasing disposable income in emerging economies, particularly across Asia Pacific, which is fueling demand for premium and imported brands. Furthermore, shifting consumer preferences towards high-quality, craft, and artisanal products, coupled with rising interest in cocktail culture and mixology, stimulate innovation within the spirits segment. Despite regulatory challenges concerning alcohol advertising and sales, continuous product diversification, focusing on low-ABV (alcohol by volume) options and health-conscious alternatives, is enabling sustained market growth and attracting a broader consumer base, particularly among younger, health-aware generations who prioritize moderate, high-quality consumption over volume.

Wine And Spirits Market Executive Summary

The Wine and Spirits Market exhibits robust growth driven by premiumization trends, digitalization of sales channels, and geographical expansion into previously underserved markets. Business trends highlight strategic mergers and acquisitions aimed at consolidating market share and achieving portfolio diversification, particularly in high-growth segments like tequila and premium brown spirits. Companies are heavily investing in direct-to-consumer (DTC) models and e-commerce platforms, catalyzed by the rapid acceleration of digital purchasing behaviors observed globally. Sustainability is also a core business mandate, with major producers committing to environmentally friendly practices, including sustainable farming, responsible water usage, and recyclable packaging, driven by increasing consumer awareness and regulatory pressure for corporate social responsibility.

Regional trends indicate that the Asia Pacific (APAC) region, spearheaded by China and India, is emerging as the fastest-growing market due to rapid urbanization, changing lifestyles, and a burgeoning middle class demonstrating increased spending power on luxury consumables. While North America and Europe remain mature markets, they are characterized by an ongoing shift towards premium and super-premium segments, coupled with intense regulatory scrutiny regarding health warnings and responsible consumption messaging. Latin America shows significant potential, primarily driven by strong domestic production and growing export capabilities for spirits like cachaça and regional wines, positioning it as both a consumption and production hub.

Segment trends underscore the dynamism within the spirits category, where the demand for specialized and unique offerings is outpacing general market growth. Specifically, white spirits (like gin and tequila) and high-end whiskies are experiencing significant momentum. In the wine segment, demand is stabilizing, with particular growth noted in sparkling wines (prosecco, champagne) and rosé wines, reflecting evolving consumer tastes toward lighter and more refreshing options for social settings. Distribution channels are undergoing transformation, with the off-trade segment (supermarkets, specialty liquor stores, and especially e-commerce) gaining prominence, necessitating advanced supply chain management and optimized inventory strategies to handle fluctuating demand and complex cross-border logistics effectively.

AI Impact Analysis on Wine And Spirits Market

Common user questions regarding AI's impact on the Wine and Spirits Market frequently revolve around personalization in marketing, optimization of supply chains, and combating counterfeit products. Users are primarily concerned with how AI can enhance the consumer journey, specifically through predictive analytics applied to purchasing patterns, flavor preferences, and personalized recommendations for new product discovery. Another significant area of inquiry centers on operational efficiencies, such as using machine learning algorithms to forecast demand accurately, minimize inventory spoilage, and optimize distribution routes, thereby reducing operational costs and environmental footprint. Furthermore, there is keen interest in AI's role in vineyard management (precision viticulture) and quality control during distillation, ensuring consistency and excellence in production, alongside digital tools for brand protection and verifying product authenticity across global markets.

The integration of Artificial Intelligence (AI) and Machine Learning (ML) algorithms is revolutionizing the Wine and Spirits industry by introducing unprecedented levels of efficiency and consumer engagement. In the manufacturing phase, AI-powered sensors and data analysis systems are used in precision viticulture to monitor soil health, predict optimal harvesting times, and manage environmental risks like pests and diseases, leading to higher yields and superior quality raw materials. For spirits, ML models are applied to analyze fermentation processes and aging conditions, allowing master distillers to maintain batch consistency and experiment with complex flavor profiles based on real-time data analysis, accelerating innovation cycles significantly.

From a consumer interaction perspective, AI is foundational to the future of personalized marketing and sales. E-commerce platforms utilize AI to analyze browsing history, purchase data, and social media trends to offer hyper-personalized wine and spirit recommendations, increasing conversion rates and enhancing customer loyalty. Chatbots and virtual sommeliers powered by natural language processing (NLP) provide instant information on flavor pairings, cocktail recipes, and brand history, significantly improving the digital customer experience. This digital transformation, supported by AI, allows brands to build deeper, data-driven relationships with consumers, moving beyond traditional mass marketing strategies to highly targeted outreach efforts that resonate with individual tastes and preferences.

- AI-driven Precision Viticulture: Optimizing grape yield, monitoring soil conditions, and predicting disease outbreaks for enhanced wine quality.

- Supply Chain Optimization: Using ML for demand forecasting, inventory management, and efficient logistics route planning to reduce waste.

- Personalized Consumer Experience: AI algorithms recommend products, cocktail recipes, and pairing suggestions via e-commerce and mobile applications.

- Counterfeit Detection: Implementing blockchain and AI image recognition tools to authenticate products and safeguard brand integrity.

- Automated Quality Control: Applying sensor data and ML during distillation and aging processes to ensure flavor consistency and adherence to quality standards.

DRO & Impact Forces Of Wine And Spirits Market

The Wine and Spirits Market is shaped by a confluence of driving forces, inherent restraints, and compelling opportunities that collectively dictate market direction and volatility. Driving factors primarily center on the rising global affluence and the associated demand for premiumization, where consumers increasingly opt for higher-priced, higher-quality products over standard offerings. This trend is strongly supported by the growth of organized retail and e-commerce, which provide wider accessibility to diverse international brands. The cultural normalization of cocktail consumption, amplified by social media influence and global travel, further fuels demand for premium spirits like artisanal gin, high-end tequila, and unique whiskies, necessitating continuous product innovation and marketing investment by key industry players.

Conversely, Restraints impose significant challenges on sustained market expansion. Regulatory constraints, including high excise duties, varying trade tariffs, and complex cross-border compliance requirements, notably impact profitability and distribution efficiency. Furthermore, increasing consumer health consciousness and governmental initiatives promoting responsible drinking pose challenges to consumption volume growth, leading to a shift towards low-alcohol, non-alcoholic alternatives, and smaller serving sizes. The reliance on agricultural inputs makes the industry highly vulnerable to climate change, including extreme weather events, which can drastically reduce grape harvests or impact the quality of grains required for distillation, introducing substantial risk into the long-term supply stability and pricing structures.

Opportunities lie in several high-potential areas. The expansion into untapped emerging markets, particularly in Africa and Southeast Asia, offers significant growth avenues as per capita consumption levels rise alongside economic development. Product diversification into non-alcoholic and 'better-for-you' alternatives addresses evolving consumer trends and mitigates risks associated with declining heavy drinking. Technological integration, including the adoption of blockchain for supply chain transparency and AI for marketing personalization, offers avenues for operational excellence and enhanced consumer trust. The strategic development of direct-to-consumer (DTC) channels, facilitated by regulatory relaxations, provides brands with greater control over branding, pricing, and direct consumer data acquisition, maximizing profit margins and loyalty program effectiveness.

Segmentation Analysis

The Wine and Spirits Market is highly fragmented and analyzed primarily based on Product Type (Wine, Spirits), Distribution Channel (On-Trade, Off-Trade), and Packaging format. This comprehensive segmentation allows market participants to tailor their strategies to specific consumer behaviors and regional preferences. The product type segmentation captures the fundamental difference in consumer choice, driven by factors such as occasion, price point, and cultural traditions, where spirits generally command higher pricing and greater mixology potential, while wine remains a staple for dining and general social consumption. Analyzing distribution channels is crucial as the pandemic permanently shifted the balance toward off-trade (retail and e-commerce), demanding optimization of digital sales and last-mile delivery capabilities across all geographical regions.

- Product Type: Wine (Still Wine, Sparkling Wine, Fortified Wine), Spirits (Whiskey, Vodka, Rum, Gin, Tequila, Brandy, Others)

- Distribution Channel: On-Trade (Hotels, Restaurants, Bars), Off-Trade (Supermarkets, Hypermarkets, Retail Stores, E-commerce)

- Packaging Type: Bottles (Glass, Plastic), Cans, Kegs, Cartons

Value Chain Analysis For Wine And Spirits Market

The value chain of the Wine and Spirits Market is intricate, beginning with upstream activities such as agriculture and raw material sourcing, through complex production and distillation processes, culminating in sophisticated distribution and retail channels. Upstream activities involve significant capital investment in agricultural land (vineyards, grain farms) and high dependency on climate conditions and commodity prices. Key upstream processes include grape cultivation, harvesting, and initial fermentation for wine, or the sourcing of grains, potatoes, or molasses for spirit production. Efficiency and sustainability in this stage, including water management and organic farming practices, directly influence the final product quality and cost structure, making sourcing decisions critical for global brands aiming for premium positioning.

The midstream phase involves manufacturing and processing, which are capital and expertise-intensive. For spirits, this includes distillation, aging (often requiring years in specialized wooden barrels), blending, and bottling. Quality control, proprietary blending recipes, and effective inventory management of aging stocks are paramount to maintaining brand consistency and meeting future demand. For wine, production involves fermentation, aging, filtering, and bottling, often adhering to strict geographical indications (GIs) and regulatory standards. Innovation in this stage focuses on energy efficiency in production, optimization of aging techniques, and utilizing technology to enhance product traceability and quality assurance throughout the manufacturing lifecycle.

Downstream activities focus on the distribution, marketing, and sales of the finished product. The distribution channel is bifurcated into direct sales (DTC, particularly via e-commerce), indirect sales through wholesale/distribution networks, and the final retail point (on-trade/off-trade). Direct distribution offers higher margins and direct consumer data, while indirect distribution provides the necessary scale and reach across complex international markets. Marketing and branding expenditures are massive, utilizing sophisticated digital campaigns, celebrity endorsements, and experiential marketing to build brand equity. The efficiency of this downstream segment—managing tariffs, ensuring regulatory compliance across jurisdictions, and optimizing last-mile delivery—is essential for maximizing market penetration and generating profitable returns on the high upfront production investment.

Wine And Spirits Market Potential Customers

The potential customer base for the Wine and Spirits Market is highly diverse, segmented broadly by age, income level, geographic location, and psychographic factors, primarily encompassing recreational consumers, connoisseurs/collectors, and institutional buyers (the hospitality sector). Recreational consumers, typically the largest segment, purchase for social consumption, celebrations, and general enjoyment, prioritizing accessibility, value, and readily recognizable brands. This group is increasingly interested in low-alcohol and non-alcoholic alternatives, driven by wellness trends, making them receptive to product innovation focused on lighter, sessionable drinks and mindful consumption options that align with contemporary healthy lifestyle choices and reduced caloric intake.

Connoisseurs and high-net-worth individuals represent the premium and ultra-premium segments. These buyers prioritize rarity, quality, provenance, and investment potential. They are driven by sophisticated taste, brand heritage, and the pursuit of exclusive, limited-edition releases, such as aged single malts, vintage champagnes, and fine Bordeaux wines. Marketing to this segment requires specialized, relationship-based strategies, often involving private tastings, exclusive club memberships, and partnerships with high-end auction houses and luxury goods providers. Their purchasing behavior is less elastic to price fluctuations and more dependent on reputation and expert reviews, underscoring the critical role of brand storytelling and heritage preservation.

Institutional buyers, comprising the On-Trade sector (hotels, restaurants, bars, and catering companies), are pivotal customers who influence consumption trends and brand visibility. They procure high volumes for immediate service, requiring reliable supply, competitive trade pricing, and robust logistical support. Their choices are heavily influenced by consumer demand (the trending cocktails or fashionable wine lists), menu compatibility, and partnership opportunities with distributors for training and promotional support. E-commerce platforms and online marketplaces also represent a growing customer type—the digital consumer—who values convenience, expansive selection, and detailed product information provided digitally, demanding seamless integration between physical and online purchasing experiences.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1,450 billion |

| Market Forecast in 2033 | $2,140 billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Diageo PLC, Pernod Ricard, Bacardi Limited, Brown-Forman Corporation, Campari Group, Treasury Wine Estates, Constellation Brands, Vina Concha y Toro, Remy Cointreau, The Edrington Group, Suntory Holdings Limited, LVMH Moët Hennessy Louis Vuitton SE, Thai Beverage Public Company Limited, United Spirits Limited, Davide Campari-Milano N.V., Accolade Wines, Heineken N.V. (Spirits/Wine division), Kirin Holdings Company, Limited, Asahi Group Holdings, Ltd., William Grant & Sons Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Wine And Spirits Market Key Technology Landscape

The Wine and Spirits Market is undergoing a rapid technological evolution focused on enhancing efficiency, quality, and consumer engagement. One foundational shift involves the adoption of Internet of Things (IoT) sensors and data analytics throughout the production chain. In vineyards and distilleries, IoT devices monitor critical parameters such as temperature, humidity, pH levels, and alcohol content in real time. This data is fed into sophisticated analytics platforms, enabling predictive maintenance for machinery, optimized resource consumption (especially water and energy), and precise control over the fermentation and aging processes. This technological integration is essential for ensuring product consistency on a global scale and maximizing yields while mitigating environmental risks, particularly within climate-sensitive regions.

Another crucial technological development is the deployment of Blockchain technology for supply chain transparency and brand protection. As premium and luxury alcoholic beverages are highly susceptible to counterfeiting, blockchain provides an immutable, decentralized ledger to track the product's journey from raw material sourcing (e.g., specific vineyard or distillery) to the consumer's hand. This verifiable proof of provenance enhances consumer trust, validates product authenticity, and helps brands comply with increasingly stringent international labeling and traceability requirements. Furthermore, serialization and QR code integration linked to the blockchain allow consumers to easily access detailed information about the product's history using their mobile devices, creating an engaging and trust-building interaction.

Finally, the modernization of the sales and marketing landscape is heavily reliant on Advanced E-commerce Platforms and Augmented Reality (AR). E-commerce necessitates robust inventory management systems capable of handling regulatory complexities across state and international borders, often integrating with third-party logistics (3PL) providers. AR technology is increasingly utilized by brands to enhance the consumer experience, often through interactive bottle labels or virtual tastings. Consumers can use their phones to scan packaging and access immersive content, such as cocktail demonstrations, brand history narratives, or food pairing guides, bridging the gap between the physical product and the digital consumer environment, thereby driving engagement and brand loyalty in a highly competitive retail space.

Regional Highlights

- Asia Pacific (APAC) Dominance and Growth Trajectory: APAC is anticipated to be the fastest-growing region, driven by the expanding middle-class population, rapid urbanization, and increased disposable income in economies like China, India, and Southeast Asian nations. China, despite recent economic fluctuations, maintains strong demand for high-end spirits and premium imported wines, often linked to gifting and business occasions. India's market growth is propelled by its large, youthful demographic adopting Western consumption habits and a growing appreciation for international whiskies and imported wines. This region presents complex regulatory challenges but offers the highest potential for volume and value growth over the forecast period, pushing global companies to localize production and distribution strategies.

- North American Premiumization and Craft Culture: North America, led by the United States, is a mature market characterized by robust demand for premiumization, particularly in the spirits category (Tequila, American Whiskey, and high-end Gin). The region benefits from a thriving craft movement across both beer and spirits, where consumers seek localized, small-batch, and unique flavor profiles, supporting higher average selling prices. Regulatory environments vary significantly between states, impacting distribution models, although the proliferation of e-commerce and DTC sales is changing how consumers purchase alcohol, increasing accessibility and driving innovation in fulfillment logistics.

- European Stability and Tradition: Europe, housing the world's most established wine and spirits producing nations (France, Italy, Spain, UK), remains a cornerstone of the global market. While consumption volumes are stable, the value growth is sustained by strong export performance, particularly for Protected Designation of Origin (PDO) wines and traditional spirits (Scotch Whisky, Cognac). Current regional trends include the rise of organic and biodynamic wines, coupled with increased consumption of low-ABV and non-alcoholic beverages, reflecting the broader European focus on health and sustainability. Regulatory harmonization attempts across the EU continue to influence production and labeling standards significantly.

- Latin American Expansion and Domestic Strength: Latin America is driven by strong domestic consumption of locally produced spirits like Tequila (Mexico) and Cachaça (Brazil), alongside burgeoning demand for premium imported wines and international spirits. Economic recovery and political stability in key markets contribute to increased consumer confidence and spending. Export opportunities, particularly for South American wines (Chile, Argentina), are robust due to favorable climate conditions and strong international marketing efforts, positioning the region as a vital global supplier of quality agricultural products.

- Middle East and Africa (MEA) Complexity and Untapped Potential: The MEA market is highly bifurcated due to diverse religious and regulatory landscapes. In certain areas, growth is restricted by strict alcohol laws, while markets like South Africa and the UAE (through tourism and expatriate communities) show substantial expansion, specifically in luxury and duty-free retail segments. South Africa, a major wine producer, utilizes its strong export network, while the Gulf Cooperation Council (GCC) states attract global brands focused on high-end tourism consumption. Future growth hinges on regulatory liberalization and continued economic diversification in non-oil sectors.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Wine And Spirits Market.- Diageo PLC

- Pernod Ricard

- Bacardi Limited

- Brown-Forman Corporation

- Campari Group

- Treasury Wine Estates

- Constellation Brands

- Vina Concha y Toro

- Remy Cointreau

- The Edrington Group

- Suntory Holdings Limited

- LVMH Moët Hennessy Louis Vuitton SE

- Thai Beverage Public Company Limited

- United Spirits Limited

- Davide Campari-Milano N.V.

- Accolade Wines

- Heineken N.V. (Spirits/Wine division)

- Kirin Holdings Company, Limited

- Asahi Group Holdings, Ltd.

- William Grant & Sons Ltd.

Frequently Asked Questions

Analyze common user questions about the Wine And Spirits market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the premiumization trend in the Wine and Spirits Market?

The premiumization trend is driven by rising global disposable incomes, particularly in emerging markets, coupled with consumer preference shifts toward 'quality over quantity.' Consumers are seeking artisanal, craft, and super-premium brands that offer perceived higher quality, unique flavor profiles, and strong provenance narratives, often influenced by luxury lifestyle marketing.

How has e-commerce affected the distribution of wine and spirits?

E-commerce has significantly expanded market reach and consumer convenience, particularly boosting the Off-Trade segment. Digital platforms allow brands to establish direct-to-consumer (DTC) channels, enabling personalized marketing and optimizing supply chains, although regulatory compliance for cross-border shipping remains a complex challenge for widespread digital distribution.

Which geographical region is expected to experience the highest growth rate?

The Asia Pacific (APAC) region, driven by countries like China and India, is projected to exhibit the highest Compound Annual Growth Rate (CAGR). This acceleration is fueled by favorable demographics, urbanization, and increasing consumer adoption of international alcoholic beverage brands and luxury consumption habits.

What role does sustainability play in the current market dynamics?

Sustainability is a crucial factor, influencing consumer purchasing decisions and corporate strategies. Producers are focusing on sustainable viticulture, water conservation, responsible packaging, and reducing carbon footprints. These initiatives enhance brand reputation and address growing regulatory pressures and consumer demand for environmentally and ethically responsible products.

What are the primary challenges facing wine and spirits manufacturers?

Primary challenges include navigating complex and high-tax regulatory environments globally, mitigating the impact of climate change on raw material supply (grapes, grains), and adapting to evolving consumer trends favoring low-ABV and non-alcoholic alternatives, which necessitate constant product innovation and adaptation.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager