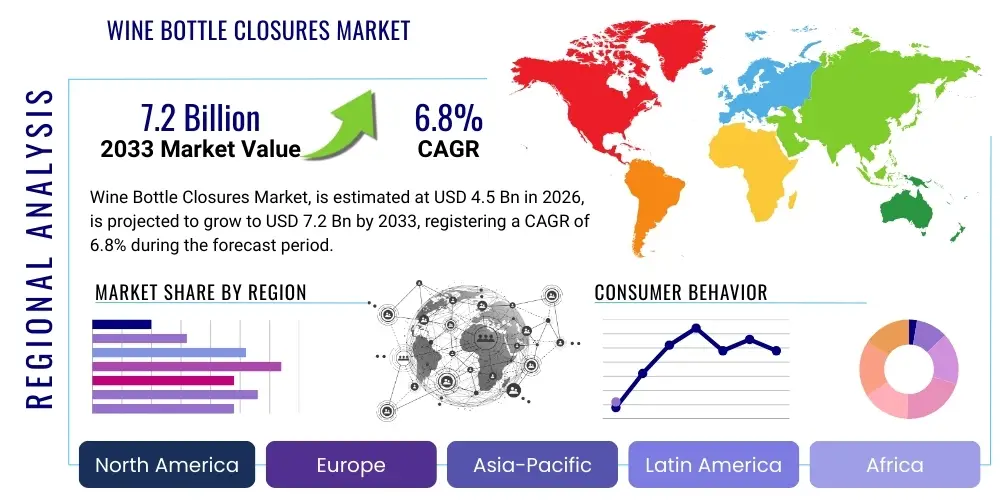

Wine Bottle Closures Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436446 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Wine Bottle Closures Market Size

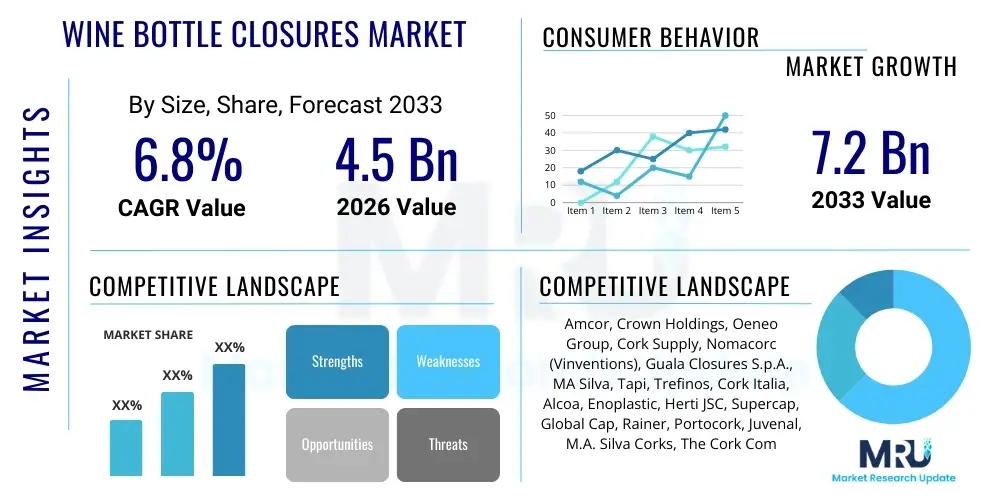

The Wine Bottle Closures Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 7.2 Billion by the end of the forecast period in 2033.

Wine Bottle Closures Market introduction

The Wine Bottle Closures Market encompasses a diverse range of products designed to seal wine bottles, ensuring preservation, preventing spoilage, and maintaining the wine's intended quality profile until consumption. Historically dominated by natural cork, the market has rapidly diversified with the introduction of alternative closures such as screw caps, synthetic corks, and technical corks, driven by performance demands, sustainability concerns, and shifts in consumer preferences regarding convenience and ease of opening. These closures are integral components in the global wine industry supply chain, directly impacting factors like shelf life, aging characteristics, and the overall marketing appeal of the wine product.

The primary applications of these closures span across Still Wine, Sparkling Wine, and Fortified Wine categories, each demanding specialized closure properties. For instance, sparkling wines often necessitate closures capable of withstanding high internal pressures (e.g., muselets and specialized corks), while premium still wines often rely on natural cork for perceived heritage and controlled oxygen ingress critical for maturation. The market's growth is fundamentally driven by the escalating global consumption of wine, particularly in emerging economies, alongside a strong industry focus on minimizing cork taint (TCA), ensuring consistent quality, and offering user-friendly packaging solutions tailored to different wine varietals and price points. The ongoing debate between tradition (natural cork) and modernity (screw caps) continues to shape investment and innovation within this essential packaging segment.

Key benefits provided by modern wine bottle closures include improved quality consistency, reduced incidence of wine spoilage attributable to closure failure, enhanced brand differentiation through custom printing and design options, and significant convenience for the end consumer, especially with twist-off aluminum closures. Furthermore, the push for eco-friendly packaging mandates that closure manufacturers prioritize sustainable sourcing, material recyclability, and reduced carbon footprints. The driving factors behind current market expansion are multifaceted, including rising disposable incomes in APAC leading to increased per capita wine consumption, technological advancements in closure materials enabling precise Oxygen Transmission Rate (OTR) management for specific aging needs, and strategic marketing campaigns by closure providers emphasizing the technical superiority and reliability of non-cork alternatives.

Wine Bottle Closures Market Executive Summary

The Wine Bottle Closures Market is characterized by intense material competition and significant investment in sustainable packaging solutions, positioning innovation in technical cork and highly recyclable aluminum as core business trends. The shift towards convenience and consistency is bolstering the adoption of screw caps, particularly in high-volume, quick-turnaround wine categories, though natural cork maintains dominance in the ultra-premium and fine wine sectors due to its perceived authenticity and established link with long-term aging tradition. Strategic collaborations between closure manufacturers and large-scale wineries aimed at optimizing bottling line efficiency and ensuring global supply chain resilience are defining the current competitive landscape, particularly in response to historic shortages and price volatility in natural cork supplies.

Regionally, Europe remains the largest consumer and producer of traditional cork closures, driven by deeply entrenched winemaking heritage in France, Spain, and Italy. However, North America and the Asia Pacific (APAC) regions are experiencing the fastest growth rates, primarily fueled by the strong preference for screw caps in North America due to consumer acceptance and quality consistency, and rapidly expanding domestic wine production and import activities across APAC, notably in China and Australia. This regional dynamic requires manufacturers to maintain dual production strategies, catering to both the traditional, high-end European demand and the convenience-focused, rapidly scaling markets elsewhere, necessitating decentralized manufacturing bases and optimized logistics networks.

Analyzing segment trends reveals that the Screw Cap segment, under the Material category, is anticipated to record the highest volume growth due to its superior sealing properties, cost-effectiveness in large runs, and elimination of TCA concerns. Concurrently, within the Technical Cork segment, products utilizing advanced binding agents and individual cork inspection technologies are capturing market share from traditional natural cork, offering a premium aesthetic with enhanced quality assurance. The application segment remains largely skewed toward Still Wine, though sparkling wine closures, driven by robust consumption trends globally, are experiencing significant technological upgrades, including lighter materials and improved pressure resistance for transportation safety and product integrity.

AI Impact Analysis on Wine Bottle Closures Market

Common user questions regarding AI's impact on the Wine Bottle Closures Market frequently center on how machine learning can be leveraged to predict material defects, optimize production yields, and personalize closure choice based on desired wine aging profiles and geographic distribution requirements. Users are concerned with the accuracy of AI systems in identifying microscopic TCA contamination in cork and the ability of AI to model the precise Oxygen Transmission Rate (OTR) performance of synthetic closures over several years. Key expectations revolve around using predictive analytics for dynamic inventory management, forecasting shifts in global raw material prices (especially cork bark), and employing computer vision for instantaneous quality control checks during high-speed bottling processes, thereby minimizing waste and enhancing product reliability for the end consumer.

- AI-driven Quality Control: Implementation of computer vision systems combined with deep learning algorithms to instantaneously scan corks and other closures for structural defects, visual imperfections, and potential TCA contamination indicators, drastically improving inspection speed and accuracy beyond human capacity.

- Predictive Maintenance: Using machine learning models to analyze sensor data from high-speed bottling and closure application machinery, predicting equipment failures, and scheduling proactive maintenance, thereby minimizing costly downtime and improving overall production line efficiency.

- OTR Optimization and Modeling: AI tools are employed to model the long-term impact of varying closure materials and designs on the wine’s chemical composition, optimizing the specific closure type (e.g., different density synthetic corks or screw cap liners) required for a wine intended for specific aging periods or markets.

- Supply Chain and Inventory Forecasting: Utilization of AI algorithms to analyze global climate data, cork harvesting cycles, transportation costs, and consumer demand trends to provide highly accurate forecasts for raw material procurement (cork, aluminum), ensuring just-in-time inventory and mitigating price volatility risks.

- Consumer Preference Analytics: AI analyzing retail data, online reviews, and market surveys to identify regional or demographic shifts in closure preference (e.g., preference for glass closures in luxury segments or screw caps in accessible segments), guiding product development and marketing strategies for closure manufacturers and wineries.

DRO & Impact Forces Of Wine Bottle Closures Market

The dynamics of the Wine Bottle Closures Market are heavily influenced by a convergence of accelerating demand for consistent quality and the imperative for environmental stewardship, which together act as powerful driving forces. The primary driver is the global consumer preference for wines free from cork taint (TCA), leading to massive investment in alternative closure technologies that guarantee consistency and predictability, pushing wineries toward reliable, non-cork options like screw caps and high-tech technical corks. Conversely, the market faces significant restraints, notably the volatile and often inelastic supply chain of high-quality natural cork, coupled with the increasing cost of raw materials (aluminum and specialized polymers) used in alternative closures, which introduces margin pressure across the value chain. Opportunities are abundant in developing and scaling truly sustainable closure solutions, such as bio-based polymers for synthetic corks or highly aesthetic, 100% recycled aluminum screw caps, appealing to the rapidly growing segment of environmentally conscious consumers and achieving better compliance with international waste reduction mandates. These interwoven factors create a complex environment where tradition battles innovation and cost efficiency is balanced against sustainability requirements.

The key market drivers include the expansion of the premium wine segment globally, where closure choice becomes a critical differentiating factor impacting perceived quality and market positioning, alongside regulatory pressures, particularly in export markets, that demand rigorous food contact safety standards for packaging materials. Furthermore, the convenience factor associated with screw caps continues to drive widespread adoption, particularly in markets outside of Western Europe, where wine consumption is often less centered on ritual and more focused on immediate enjoyment. However, the market is restrained by deeply rooted consumer perceptions, especially in heritage markets, linking natural cork to quality and aging potential, which hinders the full-scale adoption of alternatives even when technical evidence supports their superior performance. Another major restraint is the significant capital expenditure required by bottling facilities to convert or upgrade machinery to handle different closure types, particularly transitioning from cork insertion to high-speed screw capping lines, slowing down rapid market shifts.

The overarching impact forces shaping the market involve intense technological competition focused on the precise control of Oxygen Transmission Rate (OTR), which determines how a wine ages in the bottle. Manufacturers are racing to develop closures offering tailored OTR profiles suitable for specific wine styles, from young, fresh whites (requiring near-zero OTR) to aged reds (requiring minimal, controlled OTR). This technological push is coupled with strong environmental pressure from regulators and retail chains demanding full material traceability and documented lifecycle assessments for all packaging components. The opportunity to dominate the sustainable closure segment, utilizing materials like recycled glass or plant-based plastics, represents a significant growth vector. Failure to adapt to these technological and environmental mandates will result in rapid market share erosion, making innovation in material science and production efficiency the central force determining success in the forecast period.

Segmentation Analysis

The Wine Bottle Closures Market is comprehensively segmented based on Type, Material, and Application, providing a granular view of specific market dynamics and consumer preferences across different product categories and price points. The Type segmentation details the competitive landscape between traditional cork products (Natural Cork and Technical Cork) and modern alternatives (Screw Caps, Synthetic Corks, and Glass Closures), reflecting the industry's ongoing evolution from focusing purely on tradition to prioritizing consistency and ease of use. This segmentation is crucial as performance characteristics, such as OTR and shelf-life guarantee, vary significantly across these closure types, dictating their suitability for different wine styles and desired aging durations. Market players often specialize in one or two closure types, leading to distinct supply chains and R&D pipelines.

The Material segmentation—Cork, Aluminum, Plastic, and Glass—analyzes the reliance on various raw material sourcing and processing capabilities, which directly impacts production costs, sustainability metrics, and the final aesthetic appeal of the packaged wine. For instance, the Aluminum segment (used predominantly in screw caps) is sensitive to global metal prices and recycling infrastructure, while the Cork segment is linked intrinsically to agricultural outputs and geopolitical factors affecting Mediterranean cork forests. Understanding these material splits is essential for assessing supply chain vulnerabilities and forecasting long-term pricing stability. Furthermore, the Application segmentation differentiates demand across Still Wine, Sparkling Wine, and Fortified Wine, recognizing that sparkling wines require highly specialized closures for pressure retention, creating a unique, high-barrier sub-market.

- By Type:

- Natural Cork

- Technical Cork (Agglomerated, 1+1, Colmated)

- Screw Caps (Aluminum Closures)

- Synthetic Corks (Polymer-based)

- Glass Closures (Vino-Lok/Vinolok)

- Others (Crown Caps, Zork)

- By Material:

- Cork (Natural and Agglomerated)

- Aluminum

- Plastic/Polymer

- Glass

- By Application:

- Still Wine

- Sparkling Wine

- Fortified Wine

- By Region:

- North America (U.S., Canada, Mexico)

- Europe (UK, Germany, France, Italy, Spain, Rest of Europe)

- Asia Pacific (China, India, Japan, Australia, Rest of APAC)

- Latin America (Brazil, Argentina, Rest of Latin America)

- Middle East and Africa (South Africa, GCC Countries, Rest of MEA)

Value Chain Analysis For Wine Bottle Closures Market

The value chain for the Wine Bottle Closures Market is complex, beginning with the upstream procurement of specialized raw materials, followed by advanced manufacturing processes, and concluding with a highly specialized downstream distribution network leading directly to the wineries. Upstream analysis focuses heavily on raw material sourcing. For cork closures, this involves the sustainable harvesting of cork oak bark, often regulated by environmental and forestry standards, followed by extensive quality grading and processing (boiling, punching, and washing) to minimize TCA. For aluminum screw caps, the upstream segment involves securing high-grade aluminum sheets and specialized polymer liners, necessitating strong relationships with large metal and chemical suppliers who must meet stringent food-grade safety criteria. Ensuring traceability and material consistency at this stage is paramount for the final closure performance.

The midstream involves the manufacturing and conversion process, which is highly technology-intensive, encompassing processes like high-speed injection molding for synthetic corks, precision cutting and treatment for natural corks, and complex lithography and rolling for screw caps. This stage adds significant value through proprietary technologies such as OTR-controlling liners, anti-counterfeiting features, and custom printing for branding. Downstream activities focus on direct and indirect distribution channels. Due to the critical, time-sensitive nature of bottling, closure distribution often relies on specialized, just-in-time logistics providers who can deliver high volumes of closures directly to large wineries, or through regional distributors who service smaller, boutique producers. Direct sales channels are common for large, multinational closure suppliers engaging with Tier 1 global wine producers, providing bespoke solutions and technical support, whereas indirect channels (agents, packaging suppliers) facilitate market penetration for smaller closure players or reach geographically dispersed wineries.

The efficiency of the distribution channel is vital, as closures are heavy, bulky components that require careful handling to maintain hygiene and integrity. Distribution must be agile enough to respond to seasonal peak bottling demands. The indirect channel often involves packaging brokers who consolidate various components (bottles, labels, capsules, closures) for smaller wineries, offering convenience and simplified purchasing. The dominance of direct sales in the premium segment underscores the need for close collaboration between wineries and closure manufacturers to customize OTR specifications and ensure seamless integration with high-speed bottling lines. This tight coupling between supplier and end-user emphasizes service, technical support, and guaranteed quality consistency as major value drivers in the entire chain, reducing the risk of costly bottling line stoppages or post-bottling wine faults.

Wine Bottle Closures Market Potential Customers

The potential customers for the Wine Bottle Closures Market are concentrated primarily within the global wine production sector, segmented across wineries of varying scales and specializations, alongside auxiliary packaging and bottling service providers. The core buyer group consists of large-scale, mass-market wineries (e.g., those producing 500,000+ cases annually) who prioritize cost-efficiency, scalability, and performance consistency, making them major purchasers of screw caps, synthetic corks, and technical corks, where bulk purchasing power dictates favorable pricing and optimized logistical supply. This group requires robust closures that minimize spoilage rates across massive production runs and vast international distribution networks, often favoring suppliers capable of providing technical support and rapid troubleshooting during high-volume bottling periods. Their decision-making is heavily influenced by quality assurance metrics and long-term supply agreements.

A second crucial customer segment involves boutique and premium wineries, particularly those focused on aging high-value, collectible wines (e.g., vintage Bordeaux, premium Napa Cabernets). These customers often maintain a strong traditional preference for natural cork, viewing it as integral to the wine's heritage and perceived quality, despite the inherent risk of TCA. Their procurement decisions are less cost-sensitive and more focused on the pedigree, sourcing transparency, and TCA-free guarantee offered by the closure supplier, leading them to purchase highly graded, premium natural corks or advanced technical corks that mimic natural cork performance while providing quality consistency. Furthermore, contract bottling companies, which handle packaging services for multiple small and medium-sized wineries, represent a consolidation point for demand, requiring a diverse inventory of closures to cater to their varied client needs.

Finally, indirect potential customers include major alcoholic beverage distributors and large supermarket chains (retailers) that, while not directly purchasing the closures, exert significant influence over closure choice. Retailers often pressure wineries to adopt convenient closures (like screw caps) to enhance consumer satisfaction and reduce in-store breakage or product returns. For wines sold internationally, export mandates and customs requirements regarding closure type also play a role. Ultimately, the buying decision rests with the winery’s production management and marketing teams, who balance technical performance (OTR, sealing integrity) against market perception, tradition, and overall packaging costs, seeking the optimal closure solution tailored to the specific wine and its intended sales market and aging trajectory.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 7.2 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Amcor, Crown Holdings, Oeneo Group, Cork Supply, Nomacorc (Vinventions), Guala Closures S.p.A., MA Silva, Tapi, Trefinos, Cork Italia, Alcoa, Enoplastic, Herti JSC, Supercap, Global Cap, Rainer, Portocork, Juvenal, M.A. Silva Corks, The Cork Company |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Wine Bottle Closures Market Key Technology Landscape

The technology landscape within the Wine Bottle Closures Market is primarily centered on controlling the Oxygen Transmission Rate (OTR), ensuring hermetic seals, and implementing advanced quality assurance mechanisms to eliminate faults like cork taint (TCA). The most significant technological advancement is the precision engineering of synthetic and technical closures to achieve specific, predictable OTR values. This involves the development of proprietary polymer blends and multi-layer screw cap liners, allowing wineries to select a closure that meters oxygen ingress exactly as required for their specific wine style—ranging from ultra-low OTR for fresh whites to controlled micro-oxygenation for aged reds. This move toward OTR precision marks a major shift from the variable performance historically associated with natural cork, providing winemakers with an unprecedented level of control over the aging process and consistency across vintages.

In the natural cork sector, technology focuses intensively on TCA remediation and prevention. Key innovations include advanced screening processes such as individual cork analysis using technologies like supercritical CO2 extraction or patented steam-based processes (e.g., DIAM's process) to neutralize TCA compounds within the cork granules used in technical closures. For high-end natural corks, spectroscopic analysis and sensor technology are being deployed to inspect individual cork stoppers before bottling, guaranteeing TCA absence and mitigating the commercial risk associated with tainted wine. Furthermore, the push for anti-counterfeiting measures has integrated technologies like laser etching, invisible inks, and serialized QR codes directly onto the closures, allowing both producers and consumers to verify the authenticity and traceability of the wine and its packaging components through blockchain-enabled systems.

Another area of intense technological development is the mechanization and efficiency of the bottling line, specifically regarding closure application. Modern screw capping machinery utilizes sophisticated torque sensors and vision systems to ensure precise and consistent application, which is crucial for maintaining the closure's seal integrity and OTR performance. For sparkling wine, specialized closures are benefiting from advanced lightweight materials that maintain high pressure resistance while reducing packaging weight and carbon footprint, often incorporating innovative ergonomic designs for easier removal. The overall technological direction points towards smart closures that could potentially integrate passive sensors to monitor temperature or environmental stress during shipping, offering real-time data on the wine's journey from cellar to consumer, although these are still emerging concepts primarily focused on high-value shipments.

Regional Highlights

- Europe: Europe holds the largest market share, driven by its deep winemaking heritage, particularly in countries like France, Italy, and Spain. This region exhibits the highest demand for high-quality natural cork closures, particularly for premium and aged wines, where tradition dictates packaging choice. However, Northern European markets (like the UK and Germany) are significant consumers of imported wines often sealed with screw caps, leading to a dual-closure market structure. Innovation here focuses on sustainable cork harvesting and advanced technical cork products like high-performing micro-agglomerated corks, balancing tradition with guaranteed quality consistency.

- North America (NA): North America is characterized by the rapid and widespread adoption of screw caps, especially in the US and Canada, across diverse wine categories, including high-volume domestic brands and premium imports. Consumers in this region prioritize convenience, consistency, and the elimination of cork taint. The US market is also a major driver for innovation in sustainable and aesthetic closures, with growing interest in glass closures (Vinolok) for select high-end products to enhance shelf appeal. Regulatory compliance regarding recycling standards strongly influences closure material selection.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing market due to the rapid expansion of wine consumption and localized production, notably in China, Australia, and New Zealand. Australia and New Zealand are global pioneers in adopting screw caps across virtually all wine price points, setting a regional trend for reliability and freshness. The increasing demand from the emerging Chinese middle class for imported and domestic wines is driving huge volume growth, prompting manufacturers to establish local production facilities to optimize logistics and meet the high demand for both traditional (status-driven) and modern (convenience-driven) closures.

- Latin America (LATAM): LATAM, centered around major producers like Chile and Argentina, shows a blend of traditional closure use for export-oriented premium wines (natural cork) and increased domestic use of technical and synthetic corks for value-based products. Chilean wineries have been particularly proactive in testing and adopting alternative closures to maintain quality consistency in their expansive export programs, especially to North America and Europe, positioning the region as a significant consumer of large volumes of technical closure solutions.

- Middle East and Africa (MEA): The MEA region's wine closure demand is largely driven by South Africa, a major global wine exporter. South African wineries exhibit a high rate of adoption for alternative closures, often prioritizing screw caps for white and entry-level wines destined for international markets to ensure consistency and competitive pricing. The remaining MEA market is heavily dependent on imported wines, making closure preferences secondary to import regulations and duty structures.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Wine Bottle Closures Market.- Amcor

- Crown Holdings

- Oeneo Group

- Cork Supply

- Nomacorc (Vinventions)

- Guala Closures S.p.A.

- MA Silva

- Tapi

- Trefinos

- Cork Italia

- Alcoa (Howmet Aerospace)

- Enoplastic

- Herti JSC

- Supercap

- Global Cap

- Rainer

- Portocork

- Juvenal

- M.A. Silva Corks

- The Cork Company

Frequently Asked Questions

Analyze common user questions about the Wine Bottle Closures market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the adoption of alternative wine closures, such as screw caps, over traditional cork?

The primary driver is the necessity for quality consistency and the virtual elimination of Trichloroanisole (TCA), commonly known as cork taint, which can spoil up to 5% of wines sealed with natural cork. Screw caps and technical corks offer predictable, guaranteed performance regarding TCA freedom and controlled Oxygen Transmission Rate (OTR).

How do technological advancements in OTR control impact the wine aging process and closure selection?

Advanced closure technology allows winemakers to select closures with precise, tailored OTRs. This control ensures that wines designed for short-term consumption receive minimal oxygen (preserving freshness), while wines requiring long-term aging receive the optimal micro-oxygenation necessary for complex flavor development, improving vintage consistency.

Is the use of natural cork expected to decline significantly across all wine segments?

While the volume share of alternative closures is rising significantly in entry-level and mid-market segments, natural cork maintains robust demand and dominance in the ultra-premium and collectible fine wine sectors globally. Its perceived link to tradition and long-term maturation ensures its sustained relevance in high-value categories, albeit with increased quality guarantees.

Which geographical region exhibits the fastest growth rate for wine bottle closures?

The Asia Pacific (APAC) region, particularly driven by increased consumption and production in countries like China and the sustained high adoption rates in Australia and New Zealand, is forecast to exhibit the fastest Compound Annual Growth Rate (CAGR) due to expanding middle-class consumer bases and growing preference for consistent, imported wine packaging.

What are the key sustainability challenges faced by closure manufacturers?

Manufacturers face challenges in sustainably sourcing natural cork without ecological harm, and developing highly recyclable or bio-degradable polymer materials for synthetic and screw cap liners. Key industry focus areas include reducing closure weight, enhancing the recyclability of aluminum screw caps, and minimizing the overall carbon footprint of production and distribution.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager