Wine Closure Solution Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433619 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Wine Closure Solution Market Size

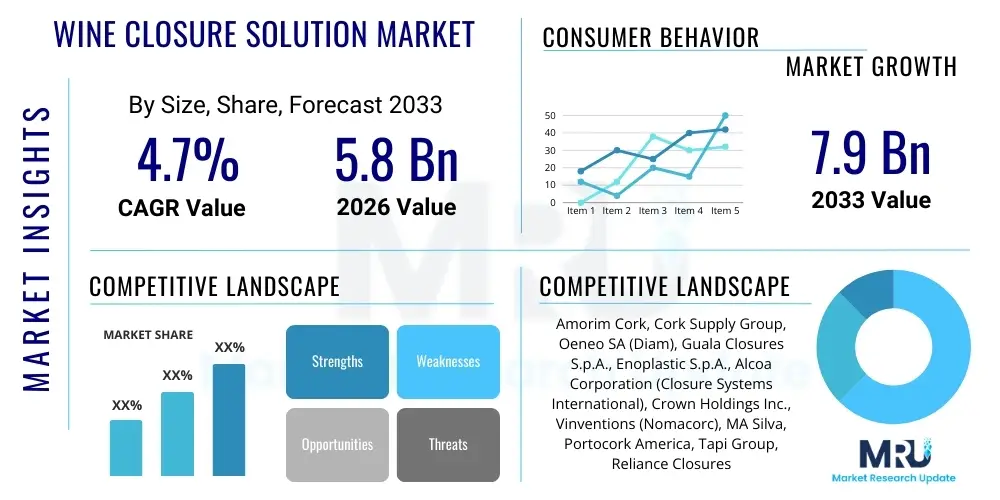

The Wine Closure Solution Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.7% between 2026 and 2033. The market is estimated at USD 5.8 Billion in 2026 and is projected to reach USD 7.9 Billion by the end of the forecast period in 2033.

Wine Closure Solution Market introduction

The Wine Closure Solution Market encompasses all mechanical and non-mechanical devices used to seal wine bottles, primarily focusing on maintaining wine quality, preventing oxidation, and ensuring product integrity from bottling to consumption. Key products include natural corks, technical corks (such as agglomerated or micro-agglomerated), screw caps (or Stelvin closures), synthetic corks, and glass stoppers (Vino-Lok). The necessity of effective closure solutions is paramount in the global wine industry, directly impacting aging potential, flavor profile preservation, and logistical efficiency. Market evolution is driven by the perpetual search for taint-free sealing options, improved oxygen management capabilities, and solutions that cater to both premium, age-worthy wines and high-volume, quick-turnover varietals.

Major applications of these closure solutions span the entire spectrum of wine production, from mass-market table wines and sparkling wines to high-end vintage reds and whites. Natural cork, revered for its traditional appeal and elasticity, remains the closure of choice for many ultra-premium wines intended for long-term cellaring, despite historical challenges related to cork taint (TCA). Conversely, screw caps have dominated the entry-level and mid-range segments, particularly in markets such as Australia and New Zealand, due to their ease of use, consistency, and definitive prevention of taint. Synthetic corks and technical corks occupy a middle ground, offering standardized performance and cost-effectiveness for wines meant for consumption within 1 to 5 years.

Driving factors for this market include escalating global wine consumption, particularly in emerging economies, alongside a heightened focus on sustainability across the supply chain. Consumer preferences are shifting, with increasing acceptance of non-traditional closures like screw caps, driven by convenience and reliability. Furthermore, stringent quality control standards necessitate advanced closure technologies that offer precise, predictable Oxygen Transmission Rates (OTR), allowing winemakers to better manage the maturation process. The continuous innovation in materials science, particularly in developing bioplastic-based synthetic closures and sustainable harvesting practices for natural cork, ensures the market remains dynamic and growth-oriented.

Wine Closure Solution Market Executive Summary

The Wine Closure Solution Market is characterized by intense competition between traditional suppliers of natural cork and modern manufacturers offering alternative closures, predominantly screw caps and synthetic options. A crucial business trend involves vertical integration among major closure providers, aiming to control the entire supply chain from raw material sourcing (cork oak cultivation or aluminum processing) to finished product distribution. Furthermore, mergers and acquisitions are common as companies seek to diversify their closure portfolio and expand geographical reach, particularly into rapidly growing Asian wine markets. Sustainability mandates are also reshaping business models, compelling companies to invest heavily in circular economy practices, lightweight materials, and verifiable low-carbon footprint production processes, which is becoming a significant competitive differentiator for contracts with large global wineries.

Regionally, the market exhibits divergent trends reflecting historical winemaking traditions and consumer acceptance. Europe, particularly France, Spain, and Portugal, remains the epicenter for natural cork demand, driven by entrenched premiumization strategies and cultural heritage. North America, especially the U.S., shows a balanced adoption profile, with strong growth in screw caps for domestic production but continued high demand for premium natural corks for imports and high-end Cabernet Sauvignon. The Asia Pacific region, led by Australia and New Zealand, continues to show robust dominance of screw caps, having pioneered their mass adoption, while burgeoning consumption markets like China are rapidly adopting standardized, reliable closures to ensure product quality across long distribution networks. Latin America focuses predominantly on cost-effective solutions, favoring technical and synthetic corks for local consumption.

Segment-wise, the Screw Cap segment is experiencing the fastest volume growth due to consistent performance, ease of machine integration, and reduced labor costs at the winery level. The Natural Cork segment, however, maintains the highest revenue share, supported by the premium wine sector where brand perception and ritualistic uncorking remain vital elements of the luxury experience. Within the material type, aluminum closures (screw caps) are capitalizing on recyclability credentials, while high-performance plastic closures are gaining traction by mimicking the mechanical properties of natural cork without the threat of TCA taint. The market is also seeing increasing demand for bespoke, customizable closure solutions that integrate security features and enhanced aesthetic design elements for marketing purposes.

AI Impact Analysis on Wine Closure Solution Market

Common user questions regarding AI's impact on the Wine Closure Solution Market typically revolve around operational efficiency, quality control, and predictive supply chain management. Users frequently inquire about how AI can detect and prevent cork taint (TCA) at the source, optimize cork harvesting and processing for maximum yield, and streamline the highly complex logistical networks involved in closure distribution globally. There is also significant curiosity regarding the application of machine learning algorithms in predicting future consumer preferences for closure types and automating quality assurance inspection systems on high-speed bottling lines. These themes highlight a strong expectation that AI will deliver superior reliability, mitigate pervasive quality risks (like TCA), and enhance the responsiveness of the closure supply chain to fluctuating winery demands and environmental variables affecting raw material availability.

The implementation of Artificial Intelligence and advanced machine learning is transforming critical aspects of the wine closure lifecycle, shifting the industry toward a higher standard of predictability and consistency. In the natural cork sector, AI-powered acoustic analysis and hyperspectral imaging systems are being deployed to evaluate the physical and chemical integrity of cork planks immediately after harvest and during the punching process. These systems are significantly more efficient and accurate than traditional human inspection methods in identifying potential flaws, density inconsistencies, and precursors to TCA, thereby reducing the probability of tainted closures entering the supply chain and maintaining brand equity for wineries. This enhanced screening capability is crucial for natural cork to remain competitive against highly standardized alternatives like screw caps.

Furthermore, AI is pivotal in optimizing manufacturing and logistics for alternative closures. For screw cap production, predictive maintenance algorithms analyze data from high-speed presses and lining machines to anticipate equipment failures, minimize downtime, and ensure consistent thread integrity and liner application—factors critical for maintaining low OTR performance. In the broader supply chain, AI-driven demand forecasting models integrate data points such as vintage quality, harvest yield reports, regional wine market trends, and seasonality to provide closure manufacturers with highly accurate predictions of demand for various closure types (e.g., specific OTR screw caps versus premium natural corks). This precision minimizes inventory costs, reduces waste, and ensures timely delivery of closures, which are time-sensitive components of the bottling process.

- AI-driven acoustic and visual inspection systems dramatically reduce TCA risk in natural cork production.

- Machine learning optimizes cork forest management, predicting ideal harvesting cycles based on environmental data.

- Predictive maintenance algorithms enhance efficiency and throughput of high-speed screw cap manufacturing lines.

- Advanced robotics, guided by vision systems, automate quality checks for consistency in synthetic and technical closures.

- AI-powered logistics software optimizes global distribution routes, minimizing lead times and carbon footprint.

- Demand forecasting models integrate global wine consumption trends to anticipate winery closure needs precisely.

DRO & Impact Forces Of Wine Closure Solution Market

The dynamics of the Wine Closure Solution Market are governed by a complex interplay of Drivers, Restraints, and Opportunities (DRO), which collectively constitute the core Impact Forces shaping market expansion and strategic direction. The primary drivers fueling growth include the rising global production and consumption of wine, especially in Asian and North American markets, which necessitates reliable and consistent sealing mechanisms. Simultaneously, the persistent demand for quality assurance, particularly the need to definitively eliminate cork taint (TCA) which affects natural corks, pushes wineries towards alternative, guaranteed taint-free solutions like screw caps and advanced synthetic closures. This pursuit of consistent quality and the growing consumer acceptance of non-traditional closures are powerful forces compelling innovation and market diversification.

However, significant restraints temper the market’s growth trajectory. The inherent volatility in the supply of natural cork, driven by environmental factors and the lengthy 9-12 year harvesting cycle, introduces price fluctuations and supply chain instability. Furthermore, high initial investment costs associated with adopting new bottling line equipment, necessary for switching between different closure types (e.g., moving from cork to screw cap), can deter smaller or mid-sized wineries. Another notable restraint is the cultural and traditional resistance to alternative closures, particularly in established European premium wine regions, where natural cork is intrinsically linked to brand heritage and perceived quality, limiting the penetration of modern alternatives in the highest value segments. The complex debate surrounding the precise impact of different OTRs (Oxygen Transmission Rates) on long-term aging also introduces uncertainty regarding optimal closure choice.

Opportunities within the market largely center on sustainability and technological advancement. There is a vast opportunity for manufacturers to develop and market biodegradable, compostable, or high-recycled content closure materials that align with global environmental mandates and consumer ethical purchasing behavior. The technological front offers opportunities in developing smart closures, potentially incorporating NFC or RFID tags for anti-counterfeiting and enhanced traceability, appealing directly to the premium and luxury wine segments. Furthermore, the expansion of sparkling wine and wine-in-a-can segments creates niche demand for specialized closures, such as crown caps with oxygen scavenging liners or specific synthetic stoppers, allowing companies to tap into novel, high-growth format markets. The continuous refinement of technical corks (using supercritical CO2 extraction or individual component screening) to offer high-performance, taint-free products with the aesthetic appeal of natural cork represents a critical balancing opportunity.

- Drivers:

- Growing global wine production and consumption, driving demand for consistent sealing.

- Increased demand for taint-free closures (TCA elimination), favoring screw caps and synthetics.

- Consumer preference for convenience and easy opening (screw caps).

- Focus on precise oxygen management (OTR control) for specific wine styles and aging requirements.

- Restraints:

- Supply volatility and high cost associated with premium natural cork.

- Cultural and traditional resistance to non-cork closures in high-end European markets.

- High capital expenditure required for wineries to retrofit or install multi-closure bottling lines.

- Ongoing controversy and lack of definitive consensus on the long-term aging impact of specific closure OTRs.

- Opportunities:

- Development and commercialization of sustainable, biodegradable, and low-carbon footprint closures.

- Technological integration of smart closure features (e.g., traceability, anti-counterfeiting).

- Expansion into niche markets such as sparkling wine closures (Crown Caps, specialized corks).

- Refinement of technical cork manufacturing processes to deliver taint-free natural aesthetic.

- Impact Forces:

- Supplier Power: High, due to limited specialized technology and access to premium natural cork resources.

- Buyer Power (Wineries): Moderate, driven by high volume purchasing but constrained by specific equipment compatibility.

- Threat of Substitutes: High, as multiple proven closure types (cork, screw cap, synthetic) directly compete based on performance and price.

- Competitive Rivalry: Extremely High, involving major global players aggressively investing in R&D and sustainability claims.

Segmentation Analysis

The Wine Closure Solution Market is fundamentally segmented based on the material used, the type of closure mechanism, the application (still vs. sparkling wine), and the end-user bottle size. Material segmentation is critical, delineating between natural materials (cork), metals (aluminum for screw caps), and polymers (plastics for synthetics). The performance characteristics, cost profile, and environmental footprint vary drastically across these material types, influencing their adoption rates in different market price points. Screw caps dominate the volume segment where consistency and speed are paramount, while natural cork commands the revenue segment due to its association with premium, age-worthy wines and consequently higher unit costs.

Closure type segmentation further breaks down the market into Screw Caps, Natural Corks, Synthetic Corks, Technical Corks, and Glass Stoppers. Technical corks, which include agglomerated and micro-agglomerated options, are gaining significant traction as they blend the traditional appearance of cork with reduced cost and improved consistency compared to virgin natural cork. These closures are specifically designed for wines intended for medium-term consumption (2-5 years). The evolution within the closure types focuses heavily on enhancing the functional performance, particularly the precise control of OTR. For instance, synthetic closures are now being engineered with specific internal structures to mimic the minute, controlled oxygen ingress characteristic of natural cork, moving beyond their earlier reputation as purely cost-saving, short-term solutions.

Application segmentation reveals a distinct separation, with still wine dominating the overall market share, consuming the majority of screw caps, synthetic, and natural cork volumes. Sparkling wine closures, however, represent a high-value niche characterized by stringent requirements for pressure resistance and specific sealing technology, primarily utilizing specialized natural corks (disk corks) secured by wire cages (muselets). Understanding these segmental dynamics is essential for market players, as investment in production capabilities must align with the specific technical demands of each closure type and the target shelf life and positioning of the final wine product.

- By Product Type:

- Natural Corks (Whole Piece, Colmated)

- Technical Corks (Agglomerated, Micro-agglomerated, 1+1, Twin-Top)

- Screw Caps (Stelvin, ROPP)

- Synthetic Corks (Extruded, Molded, Bioplastic)

- Glass Stoppers (Vino-Lok)

- Others (Crown Caps, specialized muselets)

- By Material:

- Natural Cork

- Aluminum

- Plastic/Polymer

- Glass

- By Application:

- Still Wine

- Sparkling Wine

- By End-User Wine Type:

- Premium Wine

- Mid-Range Wine

- Economy Wine

Value Chain Analysis For Wine Closure Solution Market

The value chain for the Wine Closure Solution Market begins with raw material sourcing, which is highly specialized depending on the closure type. For natural cork, this involves the cultivation, harvesting, and processing of cork oak (Quercus suber) bark, predominantly in the Iberian Peninsula (Portugal and Spain). This upstream activity is highly regulated and time-intensive, characterized by long lead times and high environmental sensitivity. For screw caps, the upstream segment involves aluminum sheet manufacturing and specialized liner material production (often Saran or PVDC substitutes). In both cases, resource management and sustainability certifications play a critical role in determining the quality and market viability of the final product, directly influencing downstream manufacturing costs and speeds.

The middle segment of the value chain involves complex manufacturing processes. Cork processors sort, boil, cut, and treat cork planks before punching individual stoppers, increasingly incorporating advanced technologies like supercritical fluid extraction or individual closure screening to mitigate TCA. Manufacturers of alternative closures utilize high-speed machinery for precision molding (synthetics) or rolling/threading (screw caps). Efficiency at this stage is crucial, as closures are high-volume, low-margin consumables. Downstream processing involves customization, such as printing company logos, applying specific coatings, or installing oxygen-scavenging liners, tailoring the standard product to the specific requirements of the winery's brand and wine style.

Distribution is the final critical link, connecting closure manufacturers to global wineries, which often span multiple continents. Distribution channels are typically a mix of direct sales (especially for large, multinational wineries requiring continuous bulk supply) and indirect sales through specialized distributors and bottling equipment suppliers. These distributors often manage warehousing and inventory, providing Just-in-Time (JIT) delivery services. The choice of channel is influenced by the closure type; high-volume, standardized screw caps often move through highly automated logistics, while premium natural corks may require specialized handling to maintain humidity and quality. Effective logistics management, focusing on speed and minimizing product damage, is essential for maintaining freshness and avoiding production bottlenecks at the winery.

Wine Closure Solution Market Potential Customers

The primary customers and end-users of the Wine Closure Solution Market are wineries, categorized by size, production volume, and the target market segment of their wines. Large, multinational wine corporations (such as Constellation Brands, Treasury Wine Estates, and E. & J. Gallo Winery) represent the highest volume buyers. These customers demand sophisticated supply chain management, standardized product consistency across millions of units, and often require multi-year contracts for various closure types (natural, synthetic, and screw caps) to cover their diverse product portfolio ranging from economy to ultra-premium lines. Their purchasing decisions are heavily influenced by cost-efficiency, guaranteed taint-free assurance, and alignment with their corporate sustainability goals, often favoring suppliers with extensive R&D capabilities.

Mid-sized regional wineries constitute a highly fragmented but substantial customer base. These entities are often highly sensitive to price fluctuations but are also deeply concerned with brand image and perceived quality. They frequently utilize technical or high-end synthetic corks for their mid-market offerings, seeking a balance between the aesthetic of traditional cork and the reliability of modern technology. For their highest-end wines, they usually remain loyal to premium natural corks. Their purchasing behavior is often mediated through local distributors who offer inventory management and smaller volume flexibility. They place a high value on personalized service and technical support regarding optimal closure selection based on wine chemistry and desired aging characteristics.

Specialized bottlers and custom crush facilities represent another significant customer segment. These operations do not produce their own wine but offer bottling services to smaller, independent wineries that lack their own expensive machinery. As these facilities need to accommodate diverse client demands, they require suppliers capable of providing multi-closure solutions and specialized equipment parts. Finally, craft and boutique wineries, while low in volume, represent the ultra-premium segment. These customers prioritize brand heritage and the traditional experience, often exclusively demanding high-grade, individually screened natural corks, viewing the closure as a critical part of their marketing narrative, regardless of the higher cost. These small players influence quality perception across the entire market.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 5.8 Billion |

| Market Forecast in 2033 | USD 7.9 Billion |

| Growth Rate | 4.7% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Amorim Cork, Cork Supply Group, Oeneo SA (Diam), Guala Closures S.p.A., Enoplastic S.p.A., Alcoa Corporation (Closure Systems International), Crown Holdings Inc., Vinventions (Nomacorc), MA Silva, Portocork America, Tapi Group, Reliance Closures, Australian Cork Company, Lafitte Cork & Capsule, Jelinek Cork Group, M.A. Silva Corticas, Trefinos, Supercap, Technicaps, Global Cap. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Wine Closure Solution Market Key Technology Landscape

The technological landscape in the Wine Closure Solution Market is highly dynamic, driven primarily by the need for superior quality control, precision oxygen management, and enhanced manufacturing efficiency. A major technological focus in the natural cork sector is the development of non-additive TCA remediation and screening technologies. Techniques like supercritical fluid extraction, particularly utilized by companies like Oeneo (with their DIAM closure), use pressurized CO2 to effectively remove volatile organic compounds, including TCA, from cork granules without altering the critical mechanical properties of the cork material. Additionally, advanced visual and olfactory screening systems, incorporating gas chromatography and spectroscopy, are used for 100% individual closure testing, moving beyond traditional batch testing to ensure zero-tolerance for taint in premium products, thus restoring confidence in natural cork.

For alternative closures, technological advancements focus on material science and manufacturing precision. Screw caps are benefiting from improvements in liner technology, specifically the development of multi-layered liners designed to offer extremely precise and customizable Oxygen Transmission Rates (OTR). These high-barrier liners can be engineered to allow minute, controlled ingress of oxygen over the aging period, mimicking the slow maturation achieved by traditional closures, an ability previously exclusive to cork. Furthermore, in the synthetic closure segment, co-extrusion and injection molding techniques are being refined to create closures with varying densities and structured internal porosity, providing a consistent seal and superior mechanical stability while often utilizing sustainable biopolymers or recycled plastics to meet environmental standards.

Automation and traceability technologies are also becoming essential components of the closure manufacturing ecosystem. High-speed bottling lines require closures with extremely tight dimensional tolerances; therefore, manufacturing relies on highly precise computer-aided quality inspection systems to ensure uniformity. Beyond manufacturing, smart closure technology represents a growing area of investment. Integrating micro-printed QR codes or embedded Near Field Communication (NFC) chips directly onto or into the closure allows for advanced anti-counterfeiting measures and provides end-to-end traceability for the consumer. This not only protects the brand integrity of the wine but also generates valuable data regarding consumer engagement and point-of-sale verification, providing a technological edge in the competitive premium segment.

Regional Highlights

- Europe (France, Spain, Portugal, Italy, Germany)

- North America (U.S., Canada)

- Asia Pacific (Australia, New Zealand, China, Japan)

- Latin America (Chile, Argentina)

- Middle East and Africa (MEA)

Europe remains the historical and cultural center of the wine closure market, dominating in terms of natural cork supply and premium wine production. Countries like Portugal and Spain are the undisputed leaders in cork harvesting and processing, controlling the vast majority of the global raw material supply. The demand profile in Western Europe is highly bifurcated: the premium segment strongly maintains loyalty to high-grade natural and technical corks, driven by tradition and aging requirements, while the mid-range and volume segments show increasing but slower adoption of screw caps compared to the New World. Regulations focusing on sustainability, particularly in the packaging sector, are also pushing European manufacturers to innovate faster in producing recyclable and renewable closure solutions.

North America, led by the U.S., represents one of the most dynamic and competitive markets, demonstrating a high degree of acceptance for all closure types. Wineries in California and the Pacific Northwest often utilize screw caps for white and younger red wines due to quality consistency and consumer convenience, while premium Cabernet Sauvignon and reserve wines almost exclusively retain the use of high-quality natural corks. The competitive landscape here forces suppliers to offer robust warranties against defects and extensive technical support. The U.S. market is highly receptive to technological advancements, driving the adoption of premium technical corks and innovative synthetic closures that promise consistency without compromising the uncorking ritual.

The Asia Pacific (APAC) region is characterized by explosive growth in wine consumption, particularly in China, and high maturity in winemaking regions like Australia and New Zealand. Australia and New Zealand are global pioneers in the mass adoption of screw caps, primarily for their consistent quality, ease of use, and suitability for high-volume domestic and export markets. This regional preference has created a strong supply chain for aluminum closures. Conversely, the rapidly growing markets of China and Japan are highly focused on imported wines, often preferring the perceived premium quality associated with natural cork for luxury European imports, though local bottling operations increasingly favor reliability and standardization provided by screw caps and technical closures for domestic production.

Latin America (LATAM) is a major wine producer, notably Chile and Argentina, where cost-efficiency is a paramount consideration for the large volume of wines exported globally. This region heavily utilizes synthetic and technical corks as a cost-effective, consistent alternative to high-priced natural cork, especially for wines intended for early consumption. Finally, the Middle East and Africa (MEA) market, though smaller, exhibits specific demands tied primarily to imported wine consumption and localized bottling where supply chain consistency dictates closure choice, often favoring standardized and readily available solutions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Wine Closure Solution Market.- Amorim Cork (Corticeira Amorim SGPS, S.A.)

- Oeneo SA (DIAM Closures)

- Guala Closures S.p.A.

- Vinventions (Nomacorc)

- Cork Supply Group

- Alcoa Corporation (Closure Systems International)

- Crown Holdings Inc.

- MA Silva (M.A. Silva Corticas)

- Portocork America

- Tapi Group

- Enoplastic S.p.A.

- Reliance Closures

- Australian Cork Company

- Lafitte Cork & Capsule

- Jelinek Cork Group

- Supercap

- Trefinos

- Herti AD

- Technicaps

- Global Cap

Frequently Asked Questions

Analyze common user questions about the Wine Closure Solution market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary factors driving the shift away from traditional natural cork closures?

The main drivers include the risk of 2,4,6-trichloroanisole (TCA) contamination, commonly known as cork taint, which affects up to 5% of bottled wines and causes significant economic losses. Other factors are the need for consistent, predictable oxygen management (OTR) offered by technical closures and screw caps, and increasing consumer preference for ease of opening and reliability, particularly in New World markets.

How does the Oxygen Transmission Rate (OTR) impact the choice of wine closure?

OTR is critical as it controls the rate at which oxygen enters the wine, directly influencing maturation and aging potential. Closures like high-barrier screw caps offer near-zero OTR, ideal for retaining freshness and primary fruit flavors in wines meant for early consumption. Conversely, high-grade natural corks offer minute, variable OTRs, suitable for complex wines intended for long-term cellaring and tertiary development. Wineries select closures based precisely on the wine style and intended shelf life.

Which closure segment is experiencing the fastest growth in the global market?

The Screw Cap segment (Aluminum closures) is currently experiencing the fastest volume growth globally, primarily due to its proven consistency, zero risk of TCA taint, superior quality control, and significant penetration in high-volume, cost-sensitive markets. Furthermore, improvements in screw cap liner technology now allow for customized OTR, broadening their applicability across various wine styles.

What role does sustainability play in the Wine Closure Solution Market?

Sustainability is a core competitive differentiator. Natural cork is inherently sustainable (a renewable resource harvested without felling trees), leveraging its environmental credentials heavily. However, manufacturers of alternative closures are aggressively pursuing circular economy models, utilizing high recycled content aluminum for screw caps and developing synthetic corks from plant-based biopolymers (e.g., sugarcane) to reduce fossil fuel dependency and carbon footprint, aligning with consumer ethical demands.

How are technical corks different from standard natural corks, and where are they primarily used?

Technical corks, such as micro-agglomerated and 1+1 closures, are manufactured using cork granules often treated with processes like supercritical CO2 extraction to eliminate TCA. They offer the aesthetic of natural cork but with significantly improved consistency and guaranteed taint-free performance. They are primarily used in the high-volume, mid-range wine category intended for consumption within 2 to 5 years, providing a reliable, cost-effective, and aesthetically pleasing seal.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager