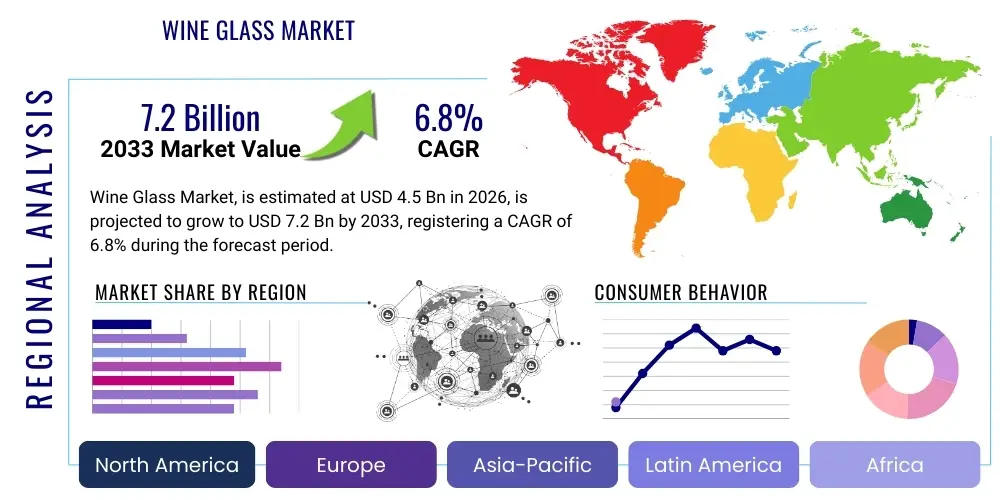

Wine Glass Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436972 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Wine Glass Market Size

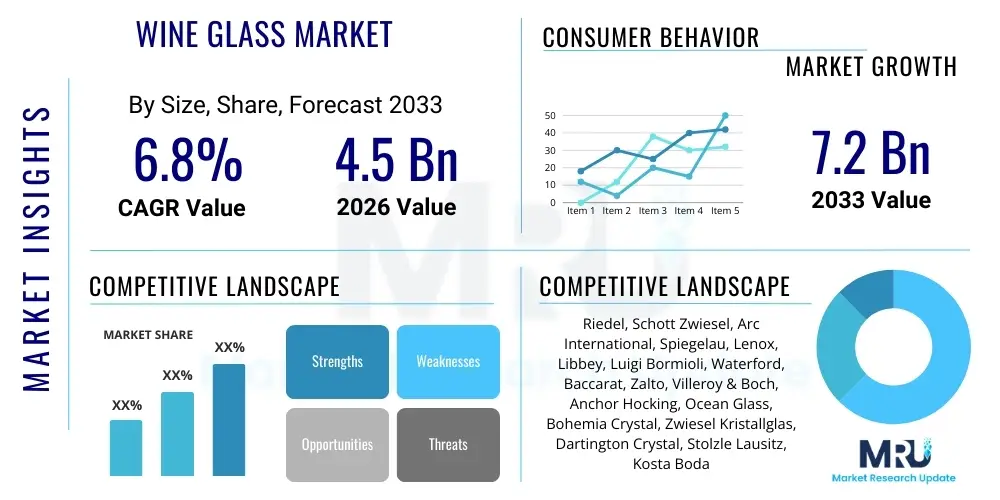

The Wine Glass Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 7.2 Billion by the end of the forecast period in 2033.

Wine Glass Market introduction

The global Wine Glass Market encompasses the sophisticated ecosystem involved in the manufacturing, distribution, and retail of specialized vessels designed specifically for the consumption of wine. These products are engineered based on principles of sensory science, where the specific geometry of the bowl—including its capacity, taper, and rim diameter—is optimized to control the aeration rate, concentrate volatile aromatic compounds, and direct the wine flow to the appropriate sensory zones of the palate. The market is defined by a dichotomy between high-volume, automated production of standard glass stemware and the artisanal creation of premium, hand-blown lead-free crystal, catering to both the functional demands of commercial establishments and the refined tastes of wine connoisseurs globally. Material innovation, particularly the enhancement of clarity and mechanical durability in lead-free crystal, stands as a central competitive theme.

Major applications span the entire food and beverage service industry, dominated by the Hotel, Restaurant, and Café (HoReCa) sector, which requires vast quantities of durable, standardized glassware for daily operation. The second significant application area is the household consumer segment, where purchasing decisions are driven by aesthetic appeal, brand prestige, and the desire to enhance personal entertaining experiences. The primary benefit derived from high-quality wine glasses is the scientifically proven ability to elevate the perceived quality and enjoyment of the wine itself, justifying the investment in specialized glassware over generic drinkware. This emphasis on enhancing the sensory ritual has transformed the wine glass from a simple container into an essential tool for tasting and appraisal.

Market growth is predominantly driven by three key factors: the continuous global expansion of the hospitality and tourism sectors, requiring consistent replenishment of inventory; the widespread consumer trend of wine premiumization, where increased spending on fine wines necessitates complementary high-end accessories; and the burgeoning culture of wine appreciation in emerging economies, particularly across Asia Pacific. Furthermore, the accessibility provided by robust e-commerce channels facilitates consumer discovery and purchase of niche, international glassware brands, significantly broadening market reach beyond traditional retail limitations. Counteracting forces, such as the high cost associated with breakage and raw material price volatility, necessitate constant process innovation focused on improving product resilience without compromising thinness or clarity.

Wine Glass Market Executive Summary

The Wine Glass Market is witnessing accelerated growth, fueled by strong consumer interest in experiential dining and the persistent expansion of the global luxury hotel industry. Current business trends highlight a critical movement toward sustainability, with leading manufacturers adopting energy-efficient electric furnaces and implementing strict traceability protocols for raw materials to appeal to environmentally conscious consumers. Operational excellence is being achieved through the application of advanced robotics and AI-driven quality inspection systems, ensuring uniform product quality at high speeds, which is vital for maintaining competitive pricing in the mass-market segment while preserving the exacting standards required for luxury crystal lines. Strategic consolidation, including acquisitions of specialized crystal workshops by larger industrial groups, is a prevalent strategy aimed at capturing artisanal expertise and expanding portfolio diversity across multiple price points. The premium segment continues to command high margins due to the perceived functional superiority and brand heritage associated with specialized European producers.

Regional market performance displays significant asymmetry. North America and Europe collectively retain the majority value share, sustained by mature consumer bases, high disposable incomes, and the established presence of global luxury brands and HoReCa chains demanding specialized stemware. However, the Asia Pacific (APAC) region stands out as the primary engine for future volume growth, projected to exhibit the highest CAGR. This rapid expansion is a direct result of the Westernization of consumer habits, increased affluence in major urban centers, and widespread infrastructure investment in hospitality and leisure sectors. Successful market penetration in APAC necessitates localized distribution networks, cultural sensitivity in marketing, and competitive pricing strategies. The Middle East and Africa, though smaller, are showing significant growth tied closely to luxury tourism development and the emergence of high-end, international food and beverage outlets.

Segmentation analysis clearly indicates the technological superiority and revenue dominance of the lead-free crystal segment, which has effectively replaced traditional lead crystal while retaining highly desirable optical properties. The Type segmentation reveals a crucial split: Stemware remains indispensable in professional and formal settings due to its functional role in temperature and aeration control, while Stemless glasses are experiencing superior volume growth in the Household segment, driven by practicality, durability, and a modern aesthetic preference for minimalism. The proliferation of online distribution channels represents the most impactful shift in market dynamics, facilitating direct-to-consumer models and significantly expanding global access to niche and high-end specialized glassware, thereby intensifying cross-border competition and requiring manufacturers to invest heavily in secure, robust parcel packaging and specialized logistics.

AI Impact Analysis on Wine Glass Market

User inquiries concerning AI's influence in the Wine Glass Market primarily center on its ability to transcend human limitations in precision manufacturing, its potential to personalize the consumer journey, and its role in stabilizing the historically complex logistics of highly fragile goods. Industry stakeholders are keenly observing how AI-driven predictive maintenance can reduce catastrophic equipment failure in glass furnaces, a critical factor given the immense energy and capital investment involved in glass production. While concepts of truly 'smart' glassware remain largely futuristic, the practical application of AI in optimizing geometry for varietal-specific glasses based on simulation and sensory data analysis is already transforming product development, allowing for faster iterations that scientifically maximize wine characteristics.

Within the manufacturing sphere, Artificial Intelligence is enabling unprecedented levels of quality assurance and process consistency. Automated optical inspection systems utilizing deep learning algorithms are deployed post-production to identify defects such as micro-cracks, bubbles, or minute deviations in rim thickness that are imperceptible to the human eye. This ensures that every unit leaving the factory floor meets the stringent dimensional tolerances necessary for premium, thin-walled crystal. Furthermore, machine learning models analyze real-time operational data—such as furnace temperature, cooling rates, and vibrational patterns—to automatically adjust machinery parameters, thereby optimizing energy consumption and improving the yield of flawless products, directly reducing waste and lowering per-unit production costs for high-volume glassware.

Commercially, AI algorithms are proving invaluable in navigating the highly fragmented distribution landscape. Retailers leverage AI to forecast demand across thousands of SKUs, predicting the precise volume needed for specific glass types based on regional wine consumption trends, seasonality, and promotional activity. This enhanced forecasting minimizes inventory holding costs for fragile stock and mitigates stock-out risks for popular items. On e-commerce platforms, recommendation engines powered by AI analyze consumer purchase histories and viewing patterns to suggest optimal glassware pairings (e.g., suggesting Pinot Noir glasses after a user purchases corresponding wine), significantly boosting cross-selling revenue and enhancing the overall customer experience by simplifying the selection process.

- AI-driven Quality Control: High-resolution computer vision systems rapidly detect subtle manufacturing defects and measure geometric uniformity crucial for high-end crystal.

- Supply Chain Optimization: Machine learning models improve demand forecasting, inventory placement, and logistics routing to minimize product damage during handling and transportation of fragile goods.

- Predictive Manufacturing: Utilizing AI analytics on sensor data to anticipate and prevent equipment failure in high-cost, high-temperature glass melting and molding machinery, maximizing uptime.

- Personalized Consumer Recommendations: AI engines on retail sites provide tailored suggestions, matching specific wine glass shapes and materials to consumer preferences and usage scenarios, increasing conversion rates.

DRO & Impact Forces Of Wine Glass Market

The market trajectory is significantly shaped by a dynamic combination of strategic Drivers, operational Restraints, and emerging Opportunities. Key market drivers include the sustained global rise in wine consumption, specifically the premiumization trend where consumers invest more in the sensory experience, necessitating specialized, high-performance stemware. The continuous, cyclical expansion and refurbishment cycle of the global HoReCa (Hotel, Restaurant, Catering) sector creates a steady, high-volume replacement demand for durable, commercial-grade glassware. Additionally, the increasing global awareness of wine culture, supported by sommeliers and educational initiatives, drives consumer desire for varietal-specific glasses, moving beyond all-purpose vessels and stimulating innovation in design and material science among manufacturers.

Despite the strong drivers, several restraints pose persistent challenges to market growth and profitability. The primary operational restraint is the inherent fragility and high replacement rate of fine crystal and delicate stemware, leading to substantial recurring costs for commercial buyers. This fragility also mandates specialized, expensive packaging and complex logistics protocols, inflating the total cost of distribution. Economically, the industry is vulnerable to significant volatility in the cost of raw materials (silica, additives) and, crucially, the extremely high energy costs required to operate glass melting furnaces, which puts continuous pressure on manufacturers to seek cost efficiencies without sacrificing product quality. Furthermore, the rising regulatory scrutiny regarding product safety and environmental impact adds complexity to global compliance efforts.

Significant market opportunities are emerging through technological advancements and geographical market penetration. The continuous innovation in material science, particularly the development of ultra-durable, thin, and dishwasher-safe crystalline glass formulations, presents a major opportunity to overcome the fragility restraint, appealing strongly to both the HoReCa and high-end household segments. Geographically, aggressive expansion into the rapidly developing Asia Pacific and parts of Latin America, where wine consumption culture is maturing quickly, offers vast untapped volume potential. Product diversification represents another key opportunity, focusing on specialized glassware for burgeoning categories like high-end non-alcoholic beverages, craft beers, and unique cocktail service, ensuring manufacturers are positioned to capture revenue across the broader luxury beverage accessories market.

Segmentation Analysis

Segmentation analysis of the Wine Glass Market is essential for strategic planning, detailing product differentiation based on material composition, functional design, intended application, and channel of access. The segments reveal the fundamental divergence between high-value luxury goods and high-volume commercial utility. Material segmentation clearly differentiates between the optical and physical performance characteristics of lead-free crystal—preferred for premium clarity and acoustics—versus standard soda-lime glass, which dominates the mass-market based on cost and foundational durability. Understanding these material characteristics allows companies to optimize production lines and target specific price elasticities within consumer purchasing behavior.

The segmentation by Type, distinguishing Stemware from Stemless designs, reflects a growing cultural divide. Traditional Stemware, encompassing varietal-specific designs (e.g., Bordeaux, Burgundy), remains paramount in formal settings and professional tasting environments, fulfilling the technical requirement of minimizing hand heat transfer and maximizing aeration control. Conversely, Stemless glasses are experiencing rapid volume growth, driven by their superior convenience, reduced propensity for breakage, and ease of storage, making them highly popular for casual home use, gifting, and outdoor catering environments. Application segmentation further separates the market into the HoReCa segment—characterized by high-volume, durability-focused procurement—and the Household segment, which emphasizes aesthetic design, brand status, and suitability for entertaining.

Distribution Channel segmentation reveals the dynamic restructuring of consumer access. Offline Retail, including specialized glassware shops and high-end department stores, continues to serve the luxury consumer who requires tactile inspection before purchasing high-value items. However, Online Retail, through major e-commerce platforms and brand-specific direct-to-consumer sites, is increasingly dominant due offering competitive pricing, inventory depth, and global accessibility. This channel shift is mandating manufacturers to invest heavily in secure packaging technology and specialized logistics to ensure product integrity upon delivery. Success across the entire market requires a nuanced strategy that addresses the stringent quality demands of the professional HoReCa segment while leveraging the digital landscape to capture the highly dispersed household consumer base.

- Material: Lead-Free Crystal, Standard Glass (Soda-Lime), Plastic/Polycarbonate (Niche, safety-focused).

- Type: Stemware (Functional, Varietal-Specific, Formal), Stemless (Convenience-driven, Durable, Casual).

- Application: HoReCa (Hotels, Restaurants, Catering), Household/Consumer (Gifting, Home Entertaining).

- Distribution Channel: Offline Retail (Specialty Stores, Department Stores), Online Retail (E-commerce Platforms, Brand Websites).

Value Chain Analysis For Wine Glass Market

The value chain commences with critical upstream activities, focusing on the procurement of high-purity raw materials such as silica sand, soda ash, and specialized reinforcing oxides. Upstream analysis requires managing the complex, capital-intensive process of batch preparation and melting within high-temperature furnaces. Since energy costs represent a significant component of the final product price, strategic partnerships with energy suppliers and investment in sustainable, efficient furnace technologies are crucial for competitive advantage. The purity of these raw inputs directly determines the clarity and lack of flaws (such as seed or cord) in the final product, demanding rigorous material certification and quality control at the earliest stage.

The midstream segment involves the core manufacturing process, which includes design, mold creation, and the formation techniques—ranging from highly skilled, manual hand-blowing (for luxury goods) to high-speed, fully automated machine blowing and drawing (for mass-market and durable crystal). This phase incorporates specialized secondary processes like annealing (stress relief through controlled cooling), laser-cutting for ultra-fine rims, and advanced polishing. Downstream analysis addresses the final market delivery, encompassing specialized packaging (necessary to protect fragile contents), warehousing, and distribution. The logistical challenge presented by fragility necessitates specialized handling and freight services, significantly contributing to the final cost of goods sold, especially for international shipments.

Distribution channels define the final movement of the product to the consumer, utilizing both Direct and Indirect methodologies. Direct channels involve manufacturers selling directly to large HoReCa chains via contracts, or operating proprietary retail stores and e-commerce platforms for higher margin capture and brand control. Indirect channels involve utilizing third-party intermediaries, including wholesalers, specialized distributors, and global e-commerce marketplaces like Amazon, which offer massive market reach but introduce price competition and require sophisticated management of inventory allocation and fulfillment. The efficiency of the downstream network, particularly in managing the unique logistical requirements of delicate glassware, determines market responsiveness and consumer satisfaction.

Wine Glass Market Potential Customers

Potential customers for wine glasses are broadly segmented into high-volume commercial purchasers and high-value individual consumers, representing the End-Users/Buyers of the specialized products. The largest volume buyers are concentrated in the HoReCa segment, comprising international luxury hotel groups, regional restaurant chains, dedicated wine bars, and high-volume catering services. These commercial clients prioritize durability, standardization, industrial dishwasher safety, and large-scale bulk pricing, often engaging in multi-year supply contracts. Their purchasing criteria are centered around operational efficiency and minimizing long-term replacement costs, making advanced, break-resistant crystal formulations highly attractive.

The Household Consumer segment is highly stratified. At the high end are wine connoisseurs and collectors—often high-net-worth individuals—who purchase premium, hand-blown, varietal-specific crystal stemware (e.g., Zalto, Riedel Sommelier series). For this group, the glassware functions as an essential, high-performance tool for sensory analysis and a luxury status symbol, driving demand for exquisite craftsmanship and brand heritage. The mass-market household consumer, conversely, seeks value, versatility, and convenience, driving demand for durable, affordable sets of all-purpose or stemless glasses purchased primarily through large retail or online discount channels. Gifting also represents a critical sub-segment, particularly during holiday seasons, sustaining demand for mid-to-high quality packaged sets.

Niche customer bases include corporate entities purchasing glassware for promotional branding, client appreciation gifts, or internal employee recognition programs, demanding high levels of customization such as engraving or logo placement. Educational institutions, including sommelier schools and hospitality colleges, require specialized tasting glasses for curriculum delivery, emphasizing functional standardization over aesthetic luxury. Manufacturers must strategically align their product lines—from the rugged, stackable HoReCa glass to the delicate, artisanal collector's piece—with the distinct operational and aspirational demands of these diverse end-user segments to maintain comprehensive market coverage and optimize pricing strategies.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 7.2 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Riedel, Schott Zwiesel, Arc International, Spiegelau, Lenox, Libbey, Luigi Bormioli, Waterford, Baccarat, Zalto, Villeroy & Boch, Anchor Hocking, Ocean Glass, Bohemia Crystal, Zwiesel Kristallglas, Dartington Crystal, Stolzle Lausitz, Kosta Boda, Rosendahl, RONA. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Wine Glass Market Key Technology Landscape

The Wine Glass Market operates at the intersection of material science and high-precision automation, with the key technology landscape continuously evolving to address the twin demands of aesthetic delicacy and structural durability. A primary technological focus involves the development of proprietary crystal glass compositions, specifically emphasizing lead-free formulations reinforced with metal oxides such such as titanium, potassium, or barium. These advancements aim to replicate the brilliance and acoustic properties of traditional lead crystal while significantly improving resistance to chipping, etching, and thermal shock experienced during repeated industrial dishwashing cycles. The chemical integrity and consistency of these new crystalline recipes define the product's performance profile and are a crucial competitive differentiator for premium brands.

In manufacturing, the technology centers on maximizing throughput while maintaining micron-level precision. Automated production relies on sophisticated computer-numeric control (CNC) machinery and high-speed drawing techniques to create seamless, stress-free junctions between the bowl and the stem, minimizing structural weak points. Laser-cutting and fire-polishing are essential finishing techniques employed to create ultra-fine, smooth rims that are paramount for sensory evaluation, requiring absolute consistency in rim diameter and thickness across millions of units. Furthermore, manufacturers are increasingly integrating sustainable technology, including electric melting furnaces powered by renewable energy and advanced heat recovery systems, to reduce the substantial carbon footprint associated with the energy-intensive process of silica melting and glass refinement.

Complementary technologies include advanced non-contact metrology and quality assurance systems. High-definition cameras and structured light scanners are used in conjunction with AI to perform automated geometric inspection, ensuring that the critical internal dimensions and volume are precise, which is essential for proper aeration and measurement in professional settings. Additionally, simulation software, such as Computational Fluid Dynamics (CFD), is being leveraged during the design phase to model the behavior of wine (liquid flow, aroma concentration) within new glass shapes. This allows designers to validate the sensory performance of a new glass design before committing to expensive mold tooling, thereby accelerating the innovation cycle and ensuring optimal functional design tailored to specific varietals or beverage types.

Regional Highlights

European nations collectively maintain a leading position in the Wine Glass Market in terms of value, primarily due to their historical association with fine winemaking and established excellence in crystal manufacturing, exemplified by companies in Germany, Austria, and France. This region benefits from a deeply entrenched culture of wine consumption and a high concentration of high-end HoReCa establishments that prioritize investment in high-quality, varietal-specific glassware. European consumers often demonstrate high loyalty to domestic luxury brands, driving demand for premium, often hand-blown, stemware. While volume growth may be slower compared to emerging regions, the premium price points commanded by the luxury segment ensure that Europe remains the core hub for innovation in design and quality benchmarking within the global industry.

North America is characterized by robust commercial activity and significant consumer willingness to adopt new formats, driving strong market size and volume. The market is highly diversified, encompassing high demand for sophisticated imported European crystal alongside a significant domestic market for durable, cost-effective machine-made options. The region has been a major catalyst for the popularity of the stemless wine glass segment, driven by lifestyle preferences emphasizing convenience, versatility, and casual entertaining. North American distribution is heavily reliant on highly efficient e-commerce infrastructure, which allows consumers easy access to a vast global inventory and facilitates frequent purchase cycles. Sustained growth is fueled by strong consumer expenditure on home goods and the continuous expansion of the dynamic restaurant and hospitality sector across the U.S. and Canada.

The Asia Pacific (APAC) region is projected to experience the highest growth rate, making it strategically vital for future market expansion. Countries like China, India, and Australia are driving this trajectory, propelled by increasing disposable income, rapid urbanization, and the adoption of Western culinary and wine consumption habits. High-quality wine glasses, particularly imported European brands, are often purchased as luxury status symbols or high-value gifts, leading to strong growth in the mid-to-high price segments. Key operational challenges for manufacturers targeting APAC include developing robust, localized distribution networks capable of delivering fragile products reliably across vast geographies and navigating complex regional import regulations and quality certifications. Latin America and the Middle East & Africa (MEA) offer niche opportunities, particularly linked to tourism-driven infrastructure investments and the growth of affluent consumer segments in major capital cities, focusing mainly on high-end commercial contracts.

- Europe: Retains value leadership; focus on luxury crystal production and high ASP; strong brand heritage and HoReCa demand for formal stemware.

- North America: Large market size; high adoption of convenience-driven stemless designs; robust e-commerce penetration and strong consumer disposable income.

- Asia Pacific (APAC): Fastest CAGR; growth driven by urbanization, expanding middle class, and investment in hospitality infrastructure (China, India).

- Latin America and MEA: Emerging potential; growth tied to high-end tourism development, infrastructure projects, and localized wine industry growth.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Wine Glass Market.- Riedel (Austria)

- Schott Zwiesel (Germany)

- Arc International (France)

- Spiegelau (Germany)

- Lenox Corporation (USA)

- Libbey Inc. (USA)

- Luigi Bormioli (Italy)

- Waterford Crystal (Ireland)

- Baccarat (France)

- Zalto (Austria)

- Villeroy & Boch (Germany)

- Anchor Hocking (USA)

- Ocean Glass (Thailand)

- Bohemia Crystal (Czech Republic)

- Zwiesel Kristallglas (Germany)

- Dartington Crystal (UK)

- Stolzle Lausitz (Germany)

- Kosta Boda (Sweden)

- Rosendahl Design Group (Denmark)

- RONA a.s. (Slovakia)

Frequently Asked Questions

Analyze common user questions about the Wine Glass market and generate a concise list of summarized FAQs reflecting key topics and concerns.What material dominates the premium wine glass market and why?

The premium segment is overwhelmingly dominated by lead-free crystal, often reinforced with elements like titanium oxide. This material is preferred due to its superior clarity (high light refractive index), lighter weight, acoustically pleasing sound (the 'clink'), and ability to be drawn into extremely thin, laser-cut rims, all of which significantly enhance the sensory experience and meet modern health and durability standards.

How are manufacturers addressing the high breakage rate challenge in commercial settings?

Manufacturers are tackling high breakage rates by using proprietary material science, such as titanium-reinforced crystal compositions, and advanced manufacturing techniques like stress-free seamless stem drawing. These innovations lead to glassware that offers superior mechanical strength, chip resistance, and resilience against thermal shock from industrial dishwashers, optimizing long-term replacement costs for HoReCa clients.

Which distribution channel is experiencing the fastest growth for wine glass sales?

Online Retail (E-commerce Platforms) is experiencing the fastest growth. This channel offers consumers unparalleled product depth, access to niche international brands, competitive pricing, and convenience. Manufacturers are heavily investing in specialized packaging and optimized digital storefronts to capitalize on this exponential digital shift.

Why is the Asia Pacific (APAC) region critical for future market expansion?

APAC is critical because it offers the highest potential for volume growth, driven by rapid economic expansion, soaring urbanization, and the increasing adoption of Western dining and wine culture among the burgeoning middle class. Investment in localized distribution and brand building in countries like China and India is a top strategic priority for global players.

What technological advancement is most impacting wine glass manufacturing precision?

The most impactful technological advancement is the integration of AI-powered computer vision systems into the manufacturing process. These systems perform rapid, hyper-accurate quality control checks, ensuring uniform wall thickness, perfect symmetry, and detecting microscopic flaws in crystal structure, leading to consistently higher product quality unattainable through manual inspection.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager