Wire Harness Testers Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434252 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Wire Harness Testers Market Size

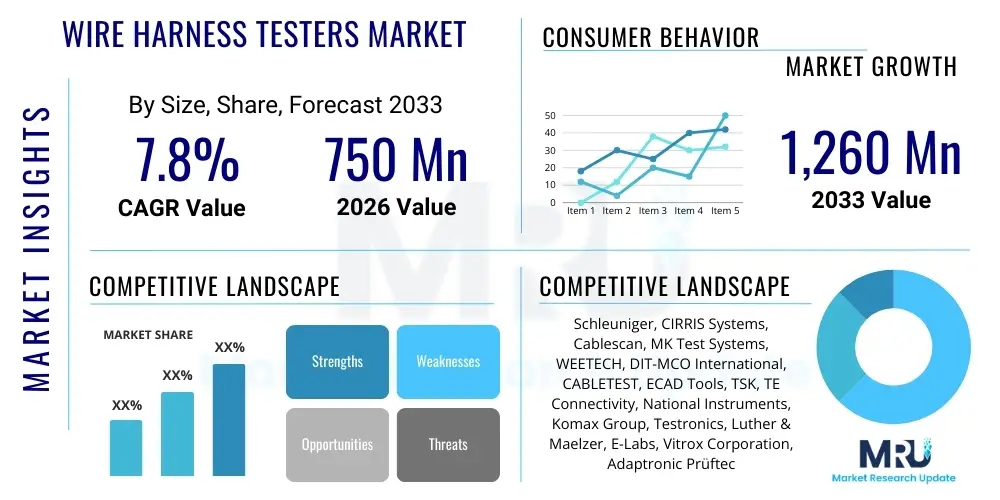

The Wire Harness Testers Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at $750 Million in 2026 and is projected to reach $1,260 Million by the end of the forecast period in 2033.

Wire Harness Testers Market introduction

The Wire Harness Testers Market encompasses specialized electronic instruments designed for verifying the integrity, continuity, insulation resistance, and functional performance of complex wire harnesses and cable assemblies. These harnesses are critical components in almost all electrical systems, ranging from automotive vehicles and aircraft to complex medical devices and industrial machinery. The primary function of these testers is to ensure that assemblies meet stringent quality standards, minimizing the risk of electrical faults, short circuits, or open connections that could lead to system failure, operational downtime, or safety hazards. The testing process typically involves high-speed checks across thousands of connection points, ensuring compliance with industry-specific requirements like IPC/WHMA-A-620.

Product descriptions within this market vary significantly based on capability, ranging from basic continuity testers suitable for simple, low-volume production to sophisticated, high-voltage testers utilizing advanced software for complex aerospace and defense applications. Major applications driving demand include the automotive industry’s shift toward Electric Vehicles (EVs) and Advanced Driver-Assistance Systems (ADAS), which necessitate higher testing reliability due to increased electronic content. Furthermore, the aerospace sector requires highly accurate, comprehensive testing regimes for mission-critical wiring systems, fueling the demand for precision, high-voltage, and partial discharge testing capabilities.

The core benefits of implementing robust wire harness testing solutions include enhanced product quality, significant reduction in manufacturing defects and rework costs, and crucial adherence to mandatory safety and regulatory certifications. Key driving factors include the escalating complexity of modern electronic systems, the proliferation of connected devices (IoT), the unwavering global focus on operational safety across transportation and industrial sectors, and continuous innovation in testing technology, such as the integration of automated optical inspection (AOI) and predictive maintenance analytics into testing platforms.

Wire Harness Testers Market Executive Summary

The Wire Harness Testers Market is poised for robust expansion, fundamentally driven by pervasive digitalization across end-use industries and the critical need for fault detection in high-density electronic assemblies. Key business trends indicate a strong move toward high-voltage testing capabilities, spurred by the rapid global adoption of electrified vehicles (EVs) and high-power industrial equipment. Manufacturers are increasingly prioritizing automated, scalable testing solutions that integrate seamlessly into modern production lines, facilitating faster throughput and minimizing human error. Mergers and acquisitions focusing on integrating software-defined testing methodologies and data analytics capabilities are becoming prominent, enabling competitive differentiation through superior diagnostic insights and traceability. The market is shifting from simple verification to sophisticated predictive quality assurance, using testing data to refine manufacturing processes proactively.

Regionally, Asia Pacific (APAC) stands out as the primary growth engine, fueled by massive investments in automotive manufacturing hubs (especially China, Japan, and South Korea) and the rapid expansion of the consumer electronics and industrial automation sectors. North America and Europe maintain leading positions in terms of technological adoption and demand for high-end, high-reliability testers, particularly within the aerospace and medical device industries where stringent quality control is mandatory. Regional trends also show increasing regulatory pressure in Western markets concerning product reliability and safety, compelling manufacturers to invest in more advanced, high-precision testing equipment.

Segment trends reveal that the high-voltage tester segment is witnessing the highest growth rate due to requirements specific to EV battery management systems and high-power aerospace wiring. By application, the Automotive segment dominates the market share, reflecting the sheer volume and increasing complexity of in-vehicle electronic networks. The focus on functional testing, which verifies the harness under simulated operational conditions beyond simple continuity checks, is expanding significantly. Furthermore, there is a distinct trend towards modular testing systems, offering scalability and customization tailored to varying production volumes and harness complexity, thus providing flexibility for small and large-scale manufacturers alike.

AI Impact Analysis on Wire Harness Testers Market

Common user questions regarding AI’s impact on the Wire Harness Testers Market revolve primarily around predictive diagnostics, automation efficiency, and the ability of AI to handle increasingly complex and variable harness designs. Users frequently ask if AI can reduce false positives, whether machine learning models can anticipate harness degradation or failure points before they occur (predictive quality), and how AI integration affects test cycle times and required operator skill levels. Concerns often center on the computational resources needed for AI implementation and data privacy related to manufacturing test results. The analysis indicates that users expect AI to transition testing from a reactive quality gate to a proactive quality management tool, utilizing historical test data and real-time sensor feedback to optimize testing parameters and identify subtle anomalies undetectable by traditional threshold-based measurements. The key theme is the shift toward smarter, adaptive testing environments.

- AI-Powered Predictive Diagnostics: Machine learning algorithms analyze historical test data to predict potential failure modes or recurring manufacturing defects, enabling immediate process correction.

- Enhanced Test Routine Generation: AI optimizes test sequences based on harness geometry and component specifications, reducing overall test cycle time and improving efficiency.

- Adaptive Fault Isolation: AI systems rapidly identify and categorize complex or intermittent faults that challenge standard testers, decreasing troubleshooting time and increasing first-pass yield.

- Integration with Automated Optical Inspection (AOI): AI enhances the capability of visual inspection systems by accurately identifying minor cosmetic or structural defects in connectors and wire placement.

- Autonomous Calibration and Self-Correction: AI enables testers to monitor their own performance and drift, initiating automatic calibration routines to maintain measurement accuracy without manual intervention.

- Optimization of Test Parameter Thresholds: Machine learning fine-tunes acceptable resistance and insulation limits dynamically based on environmental conditions and material batch variation, minimizing false rejects.

DRO & Impact Forces Of Wire Harness Testers Market

The Wire Harness Testers Market is fundamentally shaped by powerful, reinforcing drivers, moderated by specific technological and economic restraints, while numerous opportunities exist to leverage emerging industrial shifts. The primary drivers include the mandatory reliability requirements in critical sectors like aerospace and medical devices, coupled with the exponential growth in electronic content across the automotive industry, particularly with the transition to high-voltage EV architectures. These drivers create a non-negotiable demand for sophisticated, high-speed, and high-precision testing apparatus. Simultaneously, the restraints, such as the high initial capital investment required for advanced testers (e.g., those capable of 5,000+ points and 1500V testing) and the inherent complexity involved in integrating these systems into diverse manufacturing execution systems (MES), often pose significant barriers, especially for smaller market participants or those in developing economies.

The critical opportunities lie primarily in technological convergence and geographical expansion. The integration of Industry 4.0 principles, including cloud connectivity, IoT sensors, and machine learning for predictive maintenance and data analytics, represents a major avenue for market penetration and value addition. Furthermore, untapped potential exists in expanding market reach into emerging industrial sectors and regions where quality standards are rapidly maturing. The market is also heavily influenced by impact forces such as stringent regulatory mandates (e.g., FAA, ISO standards, and automotive safety requirements), which act as a constant stimulus for quality improvement and mandate the use of certified testing equipment. Economic volatility and global supply chain stability also impact the market, influencing capital expenditure decisions among end-users.

The interplay of these forces ensures a continuous market evolution. While the imperative for safety and reliability provides a consistent demand floor (Driver), the pace of technological obsolescence in related industries (e.g., connector technology) requires constant R&D investment from tester manufacturers (Restraint). The greatest opportunity stems from providing modular, scalable, and data-rich testing solutions that address the specific needs of high-growth segments like electric vehicle battery harnesses, which require specialized high-voltage and thermal testing capabilities not standard in legacy systems. Success hinges on manufacturers’ ability to mitigate high implementation costs while maximizing the diagnostic value derived from the testing process.

Segmentation Analysis

The Wire Harness Testers Market is segmented based on key criteria including the type of tester functionality, the testing method employed, the voltage capacity, and the primary application industry. This granular segmentation allows market participants to tailor their product offerings to specific operational requirements, ranging from high-volume, low-cost continuity checks in consumer electronics to extremely precise, low-volume, high-reliability testing required in space exploration or surgical robotics. Analyzing these segments provides crucial insights into demand dynamics; for instance, the dominance of the automotive sector drives demand for rapid, automated testing solutions, whereas the aerospace sector necessitates equipment focused on diagnostic depth and high-voltage insulation integrity. The differentiation between hardware-centric and software-defined testers is also becoming increasingly vital, impacting pricing structures and the long-term scalability of the installed testing base.

- By Tester Type:

- Low-Voltage Testers (Continuity, Resistance)

- High-Voltage Testers (Dielectric Withstand, Insulation Resistance)

- Universal/Combination Testers

- By Testing Method:

- Continuity Testing

- Insulation Resistance (IR) Testing

- Dielectric Withstand Voltage (DWV) Testing (HiPot)

- Functional Testing

- Capacitance and Inductance Testing

- By Application:

- Automotive and Transportation (EVs, ADAS)

- Aerospace and Defense

- Industrial Machinery and Equipment

- Medical Devices and Healthcare

- Consumer Electronics

- Telecommunications

Value Chain Analysis For Wire Harness Testers Market

The value chain for the Wire Harness Testers Market starts with upstream suppliers providing critical components such as high-precision measuring electronics, specialized switching matrices, power supply units, and advanced software platforms. These inputs are foundational to the quality and performance of the final testing system. Upstream analysis focuses on securing reliable sources for these components, especially proprietary high-speed data acquisition modules and high-voltage power components, where supply chain reliability is paramount. Component quality directly dictates the accuracy and longevity of the testing equipment, impacting manufacturers' ability to meet certified standards. Strategic relationships with key component providers often define competitive advantage in terms of cost and innovation speed.

The middle segment involves the core activities of the tester manufacturers, including R&D, system integration, software development, and assembly. This stage adds the most significant value, translating raw components into sophisticated, integrated testing platforms. Manufacturers focus heavily on developing user-friendly software interfaces, optimizing test algorithms for speed and accuracy, and ensuring compliance with multiple international standards. Distribution channels are varied, involving direct sales teams for complex, customized systems (especially in aerospace) and indirect channels utilizing regional distributors or technical representatives for standard product lines. The choice of channel depends heavily on the complexity of the product and the geographical reach required, with direct channels dominating where system integration expertise is mandatory.

Downstream analysis focuses on the end-users—the manufacturers of wire harnesses and final product integrators across diverse industries. The downstream phase includes installation, commissioning, operator training, calibration services, and long-term maintenance support. This support network is crucial, as uptime and accurate calibration directly impact the end-user’s production throughput and quality assurance commitment. Direct engagement in the downstream segment provides valuable feedback for iterative product improvement, especially concerning the integration of testers with existing manufacturing execution systems (MES). The overall health of the value chain relies on efficient logistics and a highly skilled technical support base to maintain complex testing apparatus over their multi-year lifespan.

Wire Harness Testers Market Potential Customers

The primary potential customers and end-users of wire harness testers are manufacturers and integrators operating in sectors where electrical connectivity is mission-critical and where failure carries severe consequences in terms of safety, financial loss, or reputational damage. These buyers generally seek high throughput, high diagnostic accuracy, and robust data reporting capabilities to satisfy both internal quality metrics and external regulatory audits. The heterogeneity of customer requirements mandates that tester manufacturers offer flexible, scalable solutions; for example, a Tier 1 automotive supplier requires ultra-fast, automated multi-point systems, while a specialized defense contractor may require fewer points but extremely high insulation resistance testing at elevated voltages.

Key buying centers include Quality Assurance Departments, Manufacturing Engineering Teams, and Production Managers. Procurement decisions are influenced heavily by the total cost of ownership (TCO), which factors in initial capital expenditure, calibration costs, software licensing fees, and the productivity gains realized from reduced defect rates. The largest volume buyers are typically high-volume manufacturers in the automotive and consumer electronics sectors. However, the highest value per unit sale often comes from specialized markets like aerospace, where customization and certified performance are non-negotiable requirements. Understanding the specific compliance needs (e.g., UL, CE, military standards) of each customer segment is crucial for successful market penetration.

The evolving customer base, particularly in the e-mobility sector, increasingly demands testers capable of handling complex shielded cables, specialized connectors, and integrated battery monitoring circuitry. This necessitates testers with advanced capabilities beyond standard continuity checks, pushing potential customers toward investments in functional testers that simulate real-world load conditions. Therefore, potential customers are primarily defined by their volume, complexity of assembly, required voltage capacity, and regulatory environment, leading to a target market spanning high-volume OEMs to specialized industrial system builders.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $750 Million |

| Market Forecast in 2033 | $1,260 Million |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Schleuniger, CIRRIS Systems, Cablescan, MK Test Systems, WEETECH, DIT-MCO International, CABLETEST, ECAD Tools, TSK, TE Connectivity, National Instruments, Komax Group, Testronics, Luther & Maelzer, E-Labs, Vitrox Corporation, Adaptronic Prüftechnik, CableTest Engineering, Nexeya Group, Dynalab Test Systems. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Wire Harness Testers Market Key Technology Landscape

The technological landscape of the Wire Harness Testers Market is rapidly evolving, moving beyond traditional resistive measurement systems to incorporate sophisticated digital and software-defined architectures. A foundational technology remains the use of advanced multiplexing and switching matrices, allowing a single high-precision measurement unit to rapidly interface with thousands of test points. Modern systems leverage solid-state relays and high-speed switching to minimize wear and dramatically increase test speed, crucial for high-volume manufacturing lines. Furthermore, the integration of high-voltage testing capabilities (often exceeding 1500V DC or AC) is now standard, driven specifically by the safety requirements associated with electrified vehicle battery packs and aerospace power distribution systems. This requires robust shielding and precise voltage control, utilizing specialized power modules that can handle transient loads.

A significant trend is the increasing reliance on advanced software platforms for test data management, analysis, and visualization. Tester manufacturers are embedding machine learning algorithms to enable predictive diagnostics—not just identifying a failure, but predicting *why* it occurred based on historical trends and parametric data drift. Communication protocols such as Ethernet/IP, PROFINET, and standard API connectivity are essential for seamless integration with broader Industry 4.0 ecosystems, including MES and ERP systems. This shift transforms the tester from a simple pass/fail device into a sophisticated data acquisition hub, providing actionable intelligence back to process engineering teams to achieve zero-defect manufacturing goals.

In addition to electrical testing, many modern systems incorporate complementary technologies. Automated Optical Inspection (AOI) utilizing high-resolution cameras and pattern recognition software is frequently used to verify connector seating, strain relief application, and wire color coding, ensuring mechanical integrity alongside electrical performance. Furthermore, specialized functional testing rigs simulate complex operational environments, incorporating thermal cycling and vibration testing alongside electrical checks to ensure reliability under extreme conditions. The technological focus is consistently on increasing test point density, enhancing measurement accuracy (especially low-level resistance), improving diagnostic speed, and maximizing data output for comprehensive quality traceability throughout the product lifecycle.

Regional Highlights

- North America: This region is characterized by high demand for sophisticated, high-reliability testing equipment, predominantly driven by the robust presence of the aerospace and defense sectors, along with pioneering electric vehicle and medical device manufacturers. The market requires systems compliant with stringent regulatory standards (e.g., military specifications) and typically adopts technological innovations rapidly. Key countries like the United States and Canada are leading in the deployment of AI-integrated testing systems and specialized functional testers for complex, safety-critical harnesses. The region’s focus on high quality, rather than low cost, sustains demand for premium, high-point count equipment.

- Europe: Europe represents a mature market with a strong emphasis on automation and regulatory compliance, particularly within the automotive (Germany, France) and industrial automation (Scandinavia) sectors. Strict European Union directives regarding product safety and quality necessitate thorough testing protocols. There is a marked trend towards sustainable manufacturing, encouraging the use of efficient, modular testers that reduce energy consumption and maximize resource utilization. Eastern Europe is emerging as a significant manufacturing base for automotive Tier 1 suppliers, driving localized demand for mid-to-high complexity testers capable of high throughput on production lines.

- Asia Pacific (APAC): APAC is the fastest-growing market globally, primarily due to massive manufacturing scale across China, Japan, South Korea, and India. This growth is fueled by surging production in consumer electronics, mass-market automotive assembly, and the rapid expansion of EV manufacturing capabilities. The demand here is diverse, spanning from cost-effective, high-volume testers in consumer electronics assembly to high-end, precise testers required by Japanese and South Korean automotive OEMs. Investment in new manufacturing facilities ensures sustained, high growth rates, positioning the region as the largest consumer of new wire harness testing equipment globally.

- Latin America (LATAM): The market in LATAM is driven primarily by the automotive manufacturing industry centered in Mexico and Brazil, serving both domestic and export markets. Demand is often focused on durable, cost-effective testers suitable for medium-complexity harnesses. Market growth is stable but dependent on foreign direct investment into the automotive sector. Opportunities exist as local manufacturers gradually upgrade legacy testing equipment to meet rising international quality expectations from global OEMs.

- Middle East and Africa (MEA): MEA represents a developing but niche market, largely focused on specific high-value sectors such as aerospace (UAE, Turkey), defense, and localized assembly operations for automotive and energy infrastructure projects. The demand is often project-specific, requiring robust, reliable equipment capable of operating in challenging environmental conditions. Growth is typically tied to large governmental infrastructure and defense procurement cycles.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Wire Harness Testers Market.- Schleuniger

- CIRRIS Systems

- Cablescan

- MK Test Systems

- WEETECH

- DIT-MCO International

- CABLETEST

- ECAD Tools

- TSK

- TE Connectivity

- National Instruments

- Komax Group

- Testronics

- Luther & Maelzer

- E-Labs

- Vitrox Corporation

- Adaptronic Prüftechnik

- CableTest Engineering

- Nexeya Group (HENSOLDT)

- Dynalab Test Systems

Frequently Asked Questions

Analyze common user questions about the Wire Harness Testers market and generate a concise list of summarized FAQs reflecting key topics and concerns.What factors are driving the increased demand for high-voltage wire harness testers?

The primary driver is the rapid global transition to Electric Vehicles (EVs) and hybrid vehicles, which utilize high-voltage battery systems requiring specialized testers (1000V DC and above) for critical insulation resistance and dielectric withstand voltage (HiPot) checks to ensure safety and prevent catastrophic failure.

How does Industry 4.0 influence the future development of wire harness testing equipment?

Industry 4.0 mandates the integration of testers with manufacturing execution systems (MES) via standard APIs, facilitating real-time data exchange, remote diagnostics, and the use of machine learning (AI) for predictive fault analysis, moving testing toward smarter, connected quality control processes.

Which application segment holds the largest market share for wire harness testers?

The Automotive and Transportation segment consistently holds the largest market share globally due to the extremely high volume of harnesses produced and the increasing complexity introduced by advanced driver-assistance systems (ADAS) and sophisticated in-vehicle infotainment systems, demanding stringent quality control.

What is the difference between continuity testing and functional testing in wire harness inspection?

Continuity testing verifies basic electrical integrity, ensuring that a circuit path exists and resistance is within specification. Functional testing, conversely, simulates the actual electrical load and operational signals the harness will experience in the final product, verifying performance under real-world conditions beyond simple pass/fail connectivity.

What are the primary restraints affecting market growth for advanced wire harness testers?

Key restraints include the substantial initial capital investment required for high-point, high-voltage, and fully automated testing systems, as well as the complexity and cost associated with integrating and custom developing test interfaces (fixturing) for highly specialized and low-volume harness designs.

The structure of the Wire Harness Testers Market is intrinsically tied to global economic cycles, particularly those affecting the automotive and aerospace industries. Future market penetration strategies will likely involve the provision of subscription-based or leasing models for testing software and hardware, mitigating the high upfront capital expenditure that currently restrains smaller businesses. Furthermore, the push for miniaturization and weight reduction in electrical systems necessitates even higher precision testing, compelling manufacturers to develop testers that can accurately measure extremely low resistance values (milli-ohms) across delicate, high-density connectors without causing damage. The ability to handle complex shielding and twisted-pair configurations common in high-speed data transfer (e.g., Ethernet and CAN bus) is rapidly becoming a core competence. Manufacturers focusing on flexible software solutions that allow rapid reconfiguration for different harness versions will secure a competitive edge, aligning with the agile manufacturing demands prevalent in the modern industrial landscape. The geopolitical stability in key manufacturing regions, especially in Southeast Asia, will directly influence the short-term capital expenditure cycles for new testing equipment.

The aerospace and defense sector, while representing a smaller volume market compared to automotive, remains critical due to its emphasis on absolute reliability and zero defects. Testers designed for this segment often incorporate enhanced data logging, tamper-proof audit trails, and certification standards mandated by bodies like the FAA or EASA. The migration towards modular testing frameworks is particularly beneficial here, allowing companies to scale test point counts incrementally as aircraft or defense platform designs evolve. This modularity not only manages costs but also ensures long-term system relevancy. The continuous evolution of avionics standards, such as those related to high-bandwidth data transmission cables, dictates that testers must be backward compatible while supporting emerging testing methodologies like time-domain reflectometry (TDR) for diagnosing intermittent faults and locating fault positions along long cable runs with high accuracy.

Environmental sustainability and regulatory compliance also exert significant pressure on the market. As global manufacturing shifts toward environmentally conscious practices, tester efficiency and materials used in construction (fixtures and adaptors) are becoming procurement considerations. Furthermore, compliance with international standards such as ISO 9001, AS9100, and IATF 16949 is non-negotiable for large-scale manufacturers. Wire harness tester manufacturers must provide detailed certification reports demonstrating system accuracy and calibration validity, often requiring specialized, accredited service partners. The strategic imperative for market leaders is to blend superior hardware reliability with state-of-the-art software intelligence, offering end-to-end traceability from raw material input through to final assembly sign-off, thereby maximizing the lifetime value proposition for the end-user.

The Latin American region, particularly Mexico, has cemented its position as a critical node in the global automotive supply chain, benefiting from proximity to the North American market. This requires a stable supply of testing equipment to maintain high-volume production output. Brazilian manufacturing, while facing localized economic challenges, maintains significant demand in industrial machinery and aerospace components. The primary market requirement in LATAM often centers on robust, easy-to-maintain systems with localized technical support, emphasizing resilience over cutting-edge features. Investment decisions are highly sensitive to exchange rate fluctuations and trade agreements, meaning suppliers who can offer competitive local servicing and training gain a substantial advantage.

In the Middle East and Africa (MEA), growth potential is concentrated in Gulf Cooperation Council (GCC) countries, driven by ambitious diversification plans away from fossil fuels, focusing on advanced manufacturing and defense technology (e.g., Saudi Vision 2030). These new high-tech sectors create nascent demand for specialized wire harness testing capabilities. For instance, large-scale infrastructure projects require extensive testing of control and power harnesses. The African market remains nascent, with demand largely focused on basic continuity testers for maintenance and repair operations, though countries like South Africa show potential growth in localized automotive and energy sectors. Penetration strategies in MEA must address logistics complexity and the need for comprehensive on-site training due to localized skill gaps.

The competitive landscape is characterized by a mix of specialized, niche players (focusing on ultra-high voltage or specific aerospace standards) and larger, integrated automation providers. Key differentiation strategies include test speed, diagnostic capability, maximum test point count, and voltage range (AC/DC HiPot). Companies like DIT-MCO International and MK Test Systems maintain strong presences in the high-end defense and aerospace segments, while others like CIRRIS Systems and WEETECH focus on broader industrial and automotive applications. The evolution of software user experience (UX) and data visualization tools is increasingly becoming a deciding factor in purchasing, as complex test results must be digestible and actionable for factory floor personnel and quality engineers alike. Furthermore, the rising cost of labor in many industrialized nations is accelerating the adoption of fully automated test cells, where the harness tester is integrated robotically, requiring seamless communication protocols and enhanced reliability to minimize unplanned downtime.

In summary, the Wire Harness Testers Market is undergoing a rapid technological transformation, moving from basic validation to proactive quality intelligence. The core growth hinges on the electrification of transport and the pervasive complexity inherent in modern electronics. Success for market participants requires continuous investment in high-voltage capabilities, robust data analytics, AI integration, and flexible, modular hardware design to meet the divergent demands of highly regulated sectors such as aerospace and high-volume, cost-sensitive sectors like consumer electronics and general industrial automation.

The emphasis on minimizing false failures is critically important for high-volume manufacturers, where unnecessary rework can drastically impact profitability. Modern testers utilize sophisticated filtering and noise cancellation techniques to ensure measurement stability in electrically noisy factory environments. This technological advancement in noise mitigation, often coupled with enhanced grounding and shielding features in the tester design itself, represents a significant area of current R&D focus. The accuracy of low-resistance measurements, vital for assessing connector crimps and splice integrity, defines the reliability of the entire electrical system. Testers capable of four-wire (Kelvin) resistance measurement are preferred in applications where extreme precision is mandatory, such as medical robotics or high-performance computing.

Another emerging trend is the specialization of test fixtures and adapters, which are often the most labor-intensive and costly part of setting up a new harness testing regimen. Manufacturers are developing quick-change fixture systems and standard connector libraries to reduce setup time and costs. Furthermore, utilizing universal connection technologies (e.g., interchangeable module systems) allows for maximum flexibility and reuse across different harness programs, enhancing operational efficiency and making the capital investment more palatable for end-users facing frequent design changes. The interface between the tester and the fixture often includes safety interlocks, particularly important for high-voltage testing, ensuring operator safety under all operating conditions.

The integration of Non-Destructive Testing (NDT) techniques, while still niche, is gaining traction. This includes the aforementioned TDR for cable fault location, but also sophisticated capacitance and inductance checks which can diagnose subtle issues like incomplete shielding or variations in twisted-pair geometry that might affect signal integrity. These advanced diagnostic tools are crucial for harnesses carrying high-speed data (e.g., automotive Ethernet), where timing and impedance matching are as critical as basic electrical connectivity. The development of software tools that can model and simulate the harness performance before production, coupled with the tester data acting as validation, completes the digital thread of quality assurance, minimizing costly physical prototyping and ensuring first-time-right manufacturing.

The market faces ongoing pressure to reduce the footprint of testing equipment while increasing point count capacity. This has driven innovation in compact switching technologies and integrated power supplies. Modular designs, where high-point systems are built by stacking smaller, standardized units, provide scalability and easier maintenance. This approach aligns perfectly with the manufacturing flexibility required by modern automotive platforms, where multiple vehicle models might run down the same assembly line, each requiring a slightly different test configuration. The ability to quickly load specific test programs via network connection or QR code scanning further streamlines the process, reinforcing the core market demand for speed, accuracy, and adaptability in testing infrastructure.

Addressing cybersecurity concerns is a growing necessity, especially as testers become connected network devices integrated into industrial control systems. Protecting proprietary test data, intellectual property embedded in harness designs, and ensuring the integrity of the test process software against unauthorized modification are paramount. Tester manufacturers are therefore implementing advanced authentication protocols, data encryption, and secure network segmentation to meet the rigorous IT standards of their largest industrial and defense customers. This cybersecurity layer adds complexity but is essential for maintaining the trustworthiness of the generated quality records and the overall system reliability.

In conclusion, the Wire Harness Testers Market is sustained by unrelenting requirements for safety and performance in modern electronic systems. The future will be defined by intelligent, adaptive, and highly integrated testing platforms that leverage AI and Big Data to not only detect faults but prevent them, thereby transforming the role of the tester from a quality checkpoint into a central node of a smart factory environment.

The global shift towards renewable energy infrastructure, specifically wind and solar farms, also contributes significantly to specialized demand. These installations utilize heavy-duty, high-current harnesses often exposed to harsh environmental conditions, necessitating rigorous testing for insulation resistance and environmental seal integrity. Testers designed for this sector often require specialized fixtures capable of handling large gauge conductors and robust industrial connectors. Manufacturers are developing portable, robust testing solutions that can be deployed for field installation and maintenance checks, providing flexibility beyond the fixed factory floor environments typical of the automotive industry. This diversification into robust industrial field testing represents a substantial untapped opportunity.

Furthermore, training and certification are becoming increasingly critical competitive factors. As the testing equipment becomes more complex, specialized knowledge is required for operation, troubleshooting, and calibration. Market leaders are investing heavily in comprehensive training programs and augmented reality (AR) tools for maintenance staff, aiming to reduce dependence on costly manufacturer service visits and improve end-user operational independence. The availability of multilingual support and documentation tailored to local industrial standards also plays a pivotal role in market penetration across diverse geographical regions like APAC and LATAM, ensuring effective utilization of high-value equipment.

The influence of supply chain constraints, particularly concerning semiconductor shortages and specialized measurement components, impacts the delivery lead times and cost structure of new testers. Manufacturers must employ proactive supply chain risk management strategies, often involving dual-sourcing critical electronics, to ensure they can meet the increasing global demand curve. Price competition remains fierce, particularly in the high-volume, low-to-mid complexity segment dominated by generic continuity testers. However, in the premium high-voltage and aerospace testing segment, competition is based almost entirely on technical specifications, certification, and service quality rather than price, allowing specialized vendors to maintain healthy margins based on technological superiority.

The concept of "Test Data as a Service" (TDaaS) is slowly gaining traction. This model leverages cloud-based platforms to store, analyze, and benchmark test results across multiple manufacturing sites globally. TDaaS allows multi-national corporations to standardize quality reporting, identify systemic manufacturing weaknesses across regions, and utilize advanced analytics without heavy upfront investment in proprietary local servers or complex IT infrastructure. This service-oriented approach not only drives recurring revenue for tester manufacturers but provides end-users with unparalleled visibility into their global quality performance, ultimately driving greater system harmonization and efficiency across global production networks.

In summary, sustaining market leadership requires a multipronged approach: technological innovation in high-voltage and AI-driven diagnostics; strategic supply chain resilience; investment in customer support and training; and the development of flexible, data-centric business models that address both the high-volume demands of automotive electrification and the bespoke, high-reliability requirements of aerospace and specialized industrial sectors.

The ongoing push for automation in harness assembly lines (utilizing robotics for cutting, stripping, and connecting) inherently demands fully integrated testing solutions. The tester must be able to communicate flawlessly with robotic arms and conveyor systems, initiating tests and receiving feedback signals within milliseconds to maintain production throughput. This requires robust I/O handling and high-speed communication protocols. The transition from human-operated testing to robotic handling minimizes variations introduced by operator fatigue or inconsistencies in harness placement, further improving the reliability of the test results and validating the overall investment in automation.

Moreover, the longevity of testing systems is a critical purchasing consideration. Given the high initial investment, end-users expect support and calibration services to extend beyond a decade. This necessitates that tester manufacturers design systems with easily replaceable modular components and commit to long-term software support and upgrades. Software obsolescence, particularly concerning operating systems and security patches, poses a challenge, requiring manufacturers to provide continuous development to ensure the testers remain compliant and secure throughout their operational lifespan. This long-term commitment often differentiates the top-tier suppliers from those offering only baseline hardware solutions.

Finally, niche testing requirements, such as those related to fiber optic cables increasingly integrated into high-speed data harnesses, are driving demand for combination testers. These testers must integrate electrical checks with optical verification (e.g., loss, return loss, and physical inspection of fiber ends), expanding the functional scope beyond traditional copper wiring. While this is a smaller segment, it represents high value and complexity, pushing the boundaries of what a single integrated testing platform can accomplish, thereby creating significant opportunities for specialized R&D investment.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager