Wire Netting Machines Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431726 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Wire Netting Machines Market Size

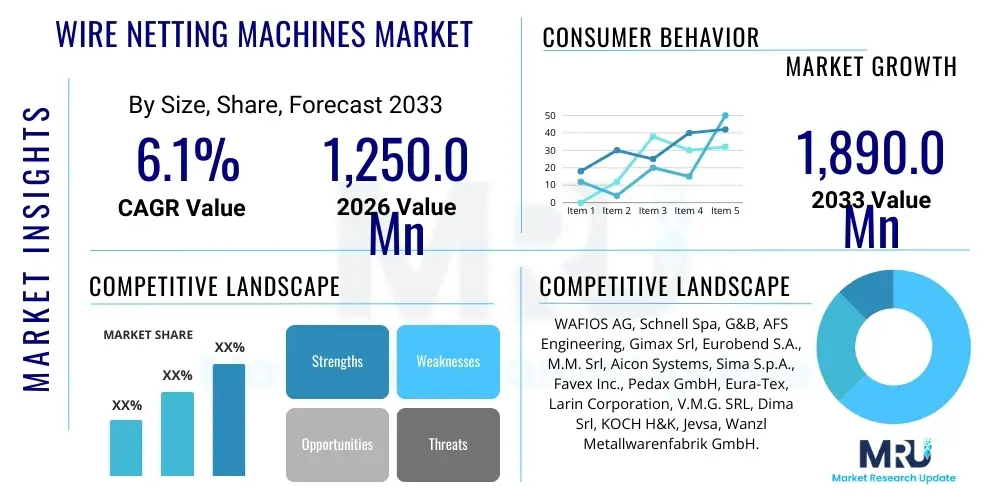

The Wire Netting Machines Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.1% between 2026 and 2033. The market is estimated at USD 1,250.0 Million in 2026 and is projected to reach USD 1,890.0 Million by the end of the forecast period in 2033.

Wire Netting Machines Market introduction

The Wire Netting Machines Market encompasses specialized industrial equipment designed for the automated or semi-automated production of various types of wire mesh, including chain-link fencing, welded mesh, hexagonal wire netting, and razor wire. These machines utilize processes like weaving, welding, or twisting to transform raw wire coils—typically galvanized, stainless steel, or PVC coated—into standardized or customized net products. The core product functions include precise wire cutting, bending, interlinking, and rolling finished products for efficient handling and transportation. The sophistication of these machines ranges from simple manual operation to highly advanced Computer Numerical Control (CNC) driven systems capable of high-speed, continuous production with minimal human intervention, catering specifically to mass manufacturing requirements in modern construction and infrastructure projects.

Major applications of the wire netting output are highly diversified, spanning essential industries such as construction, where welded mesh is crucial for concrete reinforcement; agriculture, utilized for livestock enclosures and crop protection; infrastructure development, including highway barriers and railway fencing; and industrial safety applications, such as machine guards and storage partitioning. The primary benefits driving the adoption of advanced netting machines include significantly increased production efficiency, superior mesh quality uniformity, reduced labor costs, and the flexibility to rapidly switch between different mesh specifications (e.g., aperture size and wire gauge). This capability allows manufacturers to respond dynamically to fluctuating demand across diverse sectors, making the machinery a vital asset in scaling production capacity.

The market growth is primarily driven by persistent global urbanization trends, leading to sustained demand for residential and commercial construction, coupled with massive government investments in infrastructure projects, particularly in developing economies across Asia Pacific and Latin America. Additionally, increasing global focus on security and perimeter protection measures fuels the demand for high-strength, durable fencing solutions, directly correlating with the need for high-performance netting machinery. Technological advancements, such as the integration of servo-motors and automation features that enhance speed and reduce material waste, further propel market expansion by lowering the total cost of ownership (TCO) for manufacturers and ensuring compliance with stringent quality standards required for certified construction materials.

Wire Netting Machines Market Executive Summary

The Wire Netting Machines Market is poised for stable expansion, underpinned by robust business trends emphasizing automation, precision engineering, and energy efficiency. Manufacturers are increasingly prioritizing the development of fully automatic CNC machines that minimize downtime and maximize material utilization, responding to the global scarcity of skilled labor and the need for high-volume output. Key business strategies observed include strategic mergers and acquisitions among leading technology providers to consolidate market share and expand product portfolios, alongside heavy investment in research and development aimed at producing machines capable of handling high-tensile wire and producing complex three-dimensional mesh structures. These investments ensure that equipment suppliers remain competitive by offering solutions that directly address the operational efficiency challenges faced by wire mesh producers globally.

Regionally, the Asia Pacific (APAC) market dominates in terms of volume consumption, driven by colossal infrastructure spending, rapid industrialization in countries like China and India, and the associated boom in residential construction. North America and Europe, while mature, exhibit strong trends toward replacing older machinery with technologically advanced, energy-efficient models compliant with rigorous safety and environmental standards. Furthermore, the rising adoption of customized and decorative wire mesh for architectural purposes in developed regions represents a niche but highly profitable segment, stimulating demand for flexible machinery. Latin America and the Middle East & Africa (MEA) are emerging as high-growth regions, benefiting from government initiatives focused on modernizing transportation networks and expanding agricultural capacity, thereby increasing the necessity for security and protective fencing materials.

Segmentation trends highlight the dominance of the fully automatic machine type due to its superior productivity and lower operating expenditures over the long term, making it the preferred choice for large-scale manufacturers. Within applications, the construction sector remains the largest consumer, primarily for welded mesh used in concrete slab reinforcement, though the agricultural segment demonstrates robust growth, particularly for chain-link and hexagonal netting used in protected cultivation and farming boundaries. The market also sees increasing differentiation based on wire type and coating compatibility, with high-performance machines specifically designed to handle galvanized, stainless steel, and aluminum wires becoming standard requirements for high-end applications demanding superior corrosion resistance and longevity.

AI Impact Analysis on Wire Netting Machines Market

Common user questions regarding AI's impact on the Wire Netting Machines Market center on how artificial intelligence can move beyond simple automation to truly optimize complex manufacturing processes. Users frequently inquire about the feasibility of AI-driven defect detection systems for real-time quality control, predictive maintenance algorithms to minimize costly downtime, and machine learning models used for optimizing wire feeding rates and welding parameters based on material variations. There is a strong expectation that AI will standardize mesh quality across different production runs, reduce material wastage through intelligent pattern nesting, and allow machines to self-diagnose and correct minor operational faults. The synthesis of user concerns suggests a high anticipation for AI to transform these capital-intensive machines into smart, self-regulating production units, thereby significantly boosting overall equipment effectiveness (OEE) and lowering operational risk associated with human error and mechanical failure.

- Implementation of predictive maintenance using machine learning algorithms to forecast component failure, reducing unplanned downtime by up to 30%.

- AI-powered vision systems for real-time, non-contact defect detection (e.g., miswelds, uneven twists) ensuring zero-defect output and superior quality assurance.

- Optimization of production schedules and machine settings (wire tension, speed, cutting cycles) based on material batch variability and desired output specifications using deep learning models.

- Autonomous process adjustment capabilities, allowing machines to self-calibrate welding current or weaving patterns instantly to maintain mesh uniformity.

- Enhanced operator safety through AI monitoring of operational envelopes and immediate shutdown protocols upon anomaly detection.

- Streamlining supply chain integration by forecasting raw material (wire coil) consumption based on current order books and production efficiency metrics.

- Development of digital twins of the machinery for simulation, remote diagnostics, and virtual testing of new product specifications before physical production commences.

DRO & Impact Forces Of Wire Netting Machines Market

The market for Wire Netting Machines is significantly influenced by a dynamic interplay of Drivers, Restraints, and Opportunities (DRO), which collectively shape the competitive landscape and investment decisions. Primary drivers include rapid global infrastructure development, especially in developing economies requiring vast quantities of fencing and reinforcing mesh, coupled with stringent safety standards mandating robust perimeter solutions in industrial and public spaces. However, the market faces significant restraints, such as the high initial capital investment required for purchasing advanced automatic machinery and the volatility in raw material prices, specifically steel and zinc (for galvanization), which impacts the profitability of wire mesh manufacturers. The key opportunities lie in embracing Industry 4.0 technologies, including IoT connectivity and AI integration, to enhance machine efficiency, alongside expanding into niche applications like architectural mesh and specialized high-security fencing, offering high-margin potential.

The core Drivers fueling demand are threefold: Firstly, the sheer scale of global urban migration necessitates continuous construction activity, demanding concrete reinforcement mesh (welded wire mesh). Secondly, agricultural modernization requires durable, long-lasting netting for secure farming environments and controlled animal husbandry. Thirdly, the push for automated, high-speed production facilities globally drives manufacturers to invest in newer, faster equipment capable of meeting large-scale tenders efficiently. These factors create consistent, underlying demand for replacement and expansion machinery, particularly fully automatic models that promise quick returns on investment through minimized labor input and increased output rates, making them indispensable tools for ambitious manufacturers aiming for global competitiveness.

Restraints primarily revolve around economic factors and technical expertise. The complex maintenance and operation of advanced CNC netting machines require specialized, highly trained personnel, which can be a significant bottleneck in regions with lower technical skill pools. Furthermore, the lifecycle of these durable machines is long, potentially slowing down the replacement cycle unless newer models offer revolutionary productivity gains or regulatory non-compliance issues force upgrades. The impact forces are predominantly high, driven by technological leaps (new welding techniques, multi-axis control) and market competition, which push machine providers to innovate constantly. The increasing requirement for machines that can handle multiple wire types and gauges without extensive reconfiguration acts as a critical factor influencing purchasing decisions, forcing suppliers to focus on flexibility and modular design to retain market relevance and overcome price sensitivity restraints.

Segmentation Analysis

The Wire Netting Machines Market is segmented based on the specific type of machine and the end application of the manufactured net, providing a granular view of market dynamics and targeted demand pockets. Key segmentation is defined by the level of automation (Fully Automatic, Semi-Automatic, Manual), the type of net produced (Welded Mesh, Chain Link, Hexagonal Netting, Barbed/Razor Wire), and the application vertical (Construction, Agriculture, Industrial, Security Fencing). Analyzing these segments helps stakeholders understand which technology types are experiencing the fastest adoption rates and which end-user sectors are driving the largest volume demands, thereby guiding R&D investments and marketing strategies tailored to regional industrial needs. For instance, high-volume construction activity necessitates high-speed, fully automatic welded mesh machines, while specialized security fencing requires highly precise, customizable machinery for razor wire production.

- By Type:

- Fully Automatic Wire Netting Machines

- Semi-Automatic Wire Netting Machines

- Manual/Customized Wire Netting Machines

- By Net Type:

- Welded Wire Mesh Machines (for concrete reinforcement and general fencing)

- Chain Link Fence Machines (for perimeter security and residential use)

- Hexagonal Wire Netting (Gabion) Machines (for retaining walls and erosion control)

- Barbed Wire and Razor Wire Machines (for high-security applications)

- By Application:

- Construction & Infrastructure (Largest Segment)

- Agriculture & Farming

- Industrial Safety & Guards

- Residential & Commercial Security Fencing

- By Wire Gauge Handling Capacity:

- Light Gauge (up to 3.0 mm)

- Medium Gauge (3.0 mm to 6.0 mm)

- Heavy Gauge (above 6.0 mm)

Value Chain Analysis For Wire Netting Machines Market

The value chain for the Wire Netting Machines Market begins with the upstream suppliers providing essential high-precision components, including specialized servo-motors, electrical control systems (PLCs, CNC units), cutting tools, and structural steel used for the machine chassis. Success at the upstream level relies heavily on maintaining rigorous quality standards and reliable supply chains for advanced electronics, which are critical for the machine's speed and precision. Key upstream activities involve sourcing specialized materials like hardened alloys for weaving heads and welding electrodes to ensure longevity and minimal maintenance requirements for the final machinery. Integration with upstream component manufacturers is crucial for machine builders to manage costs and ensure technological compatibility, particularly with the latest Industry 4.0 compliant sensors and controllers necessary for smart manufacturing integration.

The midstream stage is dominated by the original equipment manufacturers (OEMs) who design, assemble, test, and install the wire netting machinery. This stage involves complex engineering, including mechanical design, software development for operational control, and rigorous factory acceptance testing (FAT). The distribution channel varies, encompassing direct sales teams for large, customized, or regional manufacturers and partnerships with specialized industrial distributors or agents, particularly in international markets. Direct channels offer better control over installation and post-sales service, which is crucial given the complexity and cost of the equipment. Indirect channels, through specialized distributors, provide better market penetration and localized support, particularly for standard, high-volume machine models in diverse geographic territories.

The downstream segment involves the end-users—primarily wire mesh manufacturers, large construction firms, and specialized fencing companies—who operate the machinery to produce commercial wire net products. Service and maintenance (MRO) form a critical part of the downstream value delivery, generating significant revenue for OEMs through spare parts, training, and technical support. The long-term profitability of the machinery manufacturer is closely tied to the reliability of their equipment and the effectiveness of their aftermarket support. Therefore, OEMs often invest in remote diagnostic capabilities and localized service centers to minimize operational disruptions for their global customer base, ensuring high customer retention rates and sustained revenue streams from consumables and maintenance contracts.

Wire Netting Machines Market Potential Customers

The primary potential customers and end-users of Wire Netting Machines are large-scale wire mesh manufacturers who require high-volume production capabilities to supply materials to the construction, infrastructure, and agricultural sectors. These specialized manufacturing facilities purchase equipment based on criteria such as maximum production speed, reliability, mesh versatility, and the total cost of ownership (TCO), aiming to maximize their output while adhering to specific national and international quality certifications (e.g., ASTM, ISO standards). Investment decisions are often driven by major infrastructure project awards, which necessitate capacity expansion or replacement of obsolete, slower machinery, ensuring compliance with strict project timelines and material specifications required for public works.

Beyond specialized manufacturers, large vertical construction and contracting companies that manage massive residential or commercial projects often invest in their own netting machinery to ensure guaranteed material supply and customize mesh according to site-specific needs, thus gaining greater control over their supply chain and project costs. Furthermore, governmental agencies responsible for border security, transportation infrastructure maintenance (highways, railways), and agricultural development projects represent substantial indirect customers, driving demand through large-scale tenders for fencing materials that the machine operators ultimately supply. The security industry also forms a growing segment, including companies specializing in high-security perimeter solutions, which requires machines capable of producing specialized products like razor wire and high-tensile anti-climb fencing.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1,250.0 Million |

| Market Forecast in 2033 | USD 1,890.0 Million |

| Growth Rate | CAGR 6.1% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | WAFIOS AG, Schnell Spa, G&B, AFS Engineering, Gimax Srl, Eurobend S.A., M.M. Srl, Aicon Systems, Sima S.p.A., Favex Inc., Pedax GmbH, Eura-Tex, Larin Corporation, V.M.G. SRL, Dima Srl, KOCH H&K, Jevsa, Wanzl Metallwarenfabrik GmbH. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Wire Netting Machines Market Key Technology Landscape

The technological landscape of the Wire Netting Machines Market is rapidly evolving, driven by the need for higher production speeds, superior quality control, and increased operational flexibility. Central to this evolution is the widespread adoption of high-precision Computer Numerical Control (CNC) systems coupled with sophisticated servo-motor technology. CNC systems allow for instantaneous adjustments to mesh size, wire spacing, and cutting length through digital input, eliminating the lengthy mechanical changeover processes characteristic of older machinery. Servo-motors provide unparalleled accuracy in wire feeding and welding stroke timing, minimizing material waste and ensuring homogenous mesh aperture size, a critical requirement for certified construction materials. This shift towards digitally controlled processes enhances productivity and enables manufacturers to handle complex customized orders efficiently.

Another significant technological advancement is the integration of high-frequency resistance welding techniques, especially prevalent in welded mesh machines. Modern welding systems offer greater energy efficiency and superior weld strength compared to older technologies, allowing the machinery to handle high-tensile steel wire without compromising structural integrity. Furthermore, the incorporation of advanced sensing and monitoring systems, based on Industrial Internet of Things (IIoT) principles, is becoming standard. These sensors monitor machine health (vibration, temperature), wire tension, and welding energy in real-time. Data collected is transmitted to cloud-based platforms, enabling manufacturers to engage in remote diagnostics, performance benchmarking, and proactive maintenance scheduling, thereby optimizing the Overall Equipment Effectiveness (OEE) of their assets and minimizing expensive unplanned stoppages.

Looking forward, the focus is increasingly shifting towards modular machine design and automation add-ons. Modular construction allows end-users to upgrade specific parts of the machine (e.g., adding automated stackers, roll packaging units, or advanced quality inspection systems) without replacing the entire unit, thereby extending asset lifecycle and reducing replacement capital expenditure. Furthermore, integrated robotic handling systems are being adopted at the end of the production line for automated mesh stacking, bundling, and palletizing, fully realizing the potential of lights-out manufacturing and significantly reducing the physical labor burden associated with handling large, heavy mesh panels, setting a new benchmark for operational efficiency and labor optimization within the industry.

Regional Highlights

- Asia Pacific (APAC): APAC is the dominant market and the fastest-growing region, primarily fueled by massive infrastructural investments in China, India, and Southeast Asian nations. The region’s rapid urbanization and the subsequent boom in commercial, residential, and industrial construction necessitates enormous volumes of reinforcing mesh and fencing. Governments are heavily investing in smart city projects, high-speed rail networks, and port expansions, creating sustained, high-volume demand for robust, high-speed welded mesh machines. The competitive landscape is characterized by both large international players and strong regional manufacturers offering cost-effective, high-output solutions.

- North America: The North American market is highly mature, characterized by a strong emphasis on automation, quality, and specialized product demand (e.g., high-security fencing and architectural mesh). Market growth here is driven less by capacity expansion and more by replacement cycles, where older, less efficient machinery is traded for new, Industry 4.0-compliant models featuring advanced software, remote diagnostics, and energy-saving features. Regulatory compliance, particularly related to worker safety and material standards, is a significant driver for equipment upgrades in the US and Canada, favoring suppliers offering fully integrated, safety-certified solutions.

- Europe: Europe represents a sophisticated market with strong demand for precision and environmental sustainability. Western European countries exhibit stable demand for high-quality, durable fencing and specialized gabion mesh for civil engineering applications (e.g., slope stabilization). The focus is on R&D leading to machines that reduce scrap rate and energy consumption. Eastern Europe is experiencing stronger growth due to ongoing EU infrastructure funding and construction recovery, driving demand for new and modernized machinery, particularly chain-link and welded mesh production lines compliant with stringent European Union technical specifications.

- Latin America (LATAM): LATAM is an emerging growth market characterized by high investment volatility but significant long-term potential. Key markets like Brazil and Mexico are witnessing increased government and private sector investment in logistics and energy infrastructure, stimulating demand for fencing machinery. The market primarily targets cost-effective, semi-automatic, and reliable fully automatic machines that offer a balance between investment cost and productivity. Agricultural modernization, particularly in South America, also drives demand for specialized netting used in large-scale commercial farming and livestock protection.

- Middle East & Africa (MEA): The MEA region shows promising growth, driven by mega-projects (such as NEOM in Saudi Arabia and various urbanization projects in the UAE) that require extensive security fencing and construction reinforcement mesh. The demand is often project-specific and large-scale, requiring machinery capable of handling heavy-gauge wires for maximum security applications. Africa presents a long-term opportunity, with increasing urbanization and industrial development requiring basic and advanced netting solutions, although market penetration is often constrained by logistical challenges and access to high-quality technical service and spare parts.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Wire Netting Machines Market.- WAFIOS AG

- Schnell Spa

- G&B Fencing Systems

- AFS Engineering

- Gimax Srl

- Eurobend S.A.

- M.M. Srl

- Aicon Systems

- Sima S.p.A.

- Favex Inc.

- Pedax GmbH

- Eura-Tex GmbH

- Larin Corporation

- V.M.G. SRL

- Dima Srl

- KOCH H&K

- Jevsa Fencing Machines

- Wanzl Metallwarenfabrik GmbH

- Mechel Group (Machinery Division)

- TJK Machinery

Frequently Asked Questions

Analyze common user questions about the Wire Netting Machines market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving demand for fully automatic Wire Netting Machines?

The primary driver is the need for enhanced production efficiency and reduced labor dependency. Fully automatic machines offer superior speed, accuracy, and consistent output quality essential for large-scale infrastructure and construction projects globally, minimizing operational costs and maximizing throughput.

How does Industry 4.0 technology impact the Total Cost of Ownership (TCO) of netting machinery?

Industry 4.0 integration, including IoT sensors and AI-driven predictive maintenance, lowers the TCO by drastically reducing unplanned downtime, optimizing material usage, and extending the operational lifespan of the equipment through timely, condition-based servicing rather than reactive repairs.

Which geographical region holds the largest market share for Wire Netting Machines?

The Asia Pacific (APAC) region currently holds the largest market share, driven by rapid urbanization, massive government investment in infrastructure development, and high volumes of residential and commercial construction across major economies like China and India.

What are the key technical specifications potential buyers look for when purchasing new welded mesh machines?

Buyers prioritize high operational speed (welds per minute), wire gauge handling capacity (ability to handle heavy-gauge steel), weld strength consistency, energy efficiency of the resistance welding system, and flexibility to quickly change mesh aperture configurations.

What is the significance of hexagonal wire netting machines in infrastructure projects?

Hexagonal netting machines primarily produce gabion mesh, which is critical for civil engineering applications such as constructing retaining walls, slope stabilization, erosion control, and riverbank protection. Demand is directly correlated with governmental spending on environmental and transportation infrastructure.

What is the expected average lifecycle of a high-quality fully automatic wire netting machine?

A high-quality, well-maintained fully automatic wire netting machine typically boasts an operational lifecycle ranging from 15 to 25 years. This longevity is supported by robust mechanical design, scheduled maintenance, and timely software and component upgrades, particularly for high-wear parts like welding electrodes and cutting tools.

How does the volatility of steel prices affect the Wire Netting Machines Market?

Steel price volatility significantly affects the market as steel wire is the primary raw material for mesh production. High and unstable steel prices increase the operating costs for mesh manufacturers, potentially slowing down their expansion plans and delaying investment in new netting machinery until raw material costs stabilize or decrease.

In the Value Chain, what role does specialized component manufacturing play?

Specialized component manufacturers provide critical high-precision parts such as servo-motors, advanced CNC control units (PLCs), and proprietary welding transformers. These components are foundational to the machine’s performance, determining its speed, accuracy, and overall durability, making component sourcing a critical upstream bottleneck.

What emerging technology is most likely to disrupt traditional wire netting manufacturing?

The integration of advanced robotic handling systems combined with AI-powered quality control (vision systems) is highly disruptive. This allows for fully autonomous production from wire input to packaged mesh output, maximizing lights-out manufacturing potential and achieving unprecedented quality consistency without human intervention.

Which machine type is preferred by manufacturers focusing on concrete reinforcement mesh?

Manufacturers focused on concrete reinforcement overwhelmingly prefer Fully Automatic Welded Wire Mesh Machines. These machines are designed for maximum output of large-panel, heavy-gauge mesh, meeting the stringent quality and dimensional stability required by the construction industry for structural integrity.

What considerations are critical for Wire Netting Machine OEMs targeting the European market?

OEMs targeting Europe must prioritize machines that adhere to strict EU safety regulations (CE marking), deliver superior energy efficiency, and ensure output material compliance with European building codes. Additionally, offering robust, localized technical support and spare parts availability is crucial due to high labor costs and the emphasis on continuous operation.

How do machine manufacturers address the need for versatility across different net types?

Manufacturers increasingly utilize modular machine design and quick-change tooling systems. Modular units allow specific sections (e.g., weaving heads or welding jigs) to be rapidly swapped, enabling a single machine platform to efficiently produce different products, such as switching from light chain-link fencing to heavy-duty welded mesh with minimal reconfiguration time.

What constitutes the downstream analysis in the Wire Netting Machines value chain?

Downstream analysis focuses on the end-users (wire mesh producers, construction firms) and crucial after-sales activities, including machine installation, operator training, ongoing maintenance, and the supply of consumable spare parts. Effective downstream support is vital for customer retention and service revenue generation for the OEM.

Why is the agricultural sector increasingly demanding advanced netting machines?

The agricultural sector requires durable, specialized netting for high-density livestock farming, secure crop enclosures, and protection against wildlife. Modern machinery provides PVC-coated or galvanized mesh that offers superior corrosion resistance and longevity, reducing replacement frequency and long-term operating costs for farmers and agricultural suppliers.

How do leading companies use digitalization to maintain a competitive edge?

Leading companies leverage digitalization by integrating sophisticated software for remote diagnostics, offering performance analytics dashboards to customers (OEE tracking), and utilizing digital twin technology for rapid prototyping and virtual commissioning, thereby drastically accelerating product innovation and improving service response times globally.

What is the main restraint preventing small-to-medium enterprises (SMEs) from purchasing fully automatic machines?

The primary restraint for SMEs is the high initial capital investment required for fully automatic CNC equipment. While these machines offer long-term savings, the upfront cost often necessitates complex financing, pushing smaller players towards more affordable semi-automatic or refurbished alternatives to manage immediate cash flow demands.

Explain the role of sensors in optimizing wire netting production.

Sensors monitor key operational parameters such as wire tension, temperature, welding current, and component vibration. This real-time data allows the machine's control system to instantly adjust settings to maintain material consistency, detect potential machine faults early, and prevent costly material defects or catastrophic equipment failures.

What niche application segment presents high-margin opportunities for machine manufacturers?

The architectural and decorative mesh segment presents high-margin opportunities. This niche requires machines capable of producing complex patterns, handling specialty metals (e.g., stainless steel, copper), and maintaining extremely high aesthetic standards for use in building facades, interior design, and specialized screening solutions.

How is the market addressing the demand for environmentally sustainable production?

The market is responding by developing machines that are highly energy-efficient (especially resistance welding systems), minimizing material waste through advanced cutting and nesting algorithms, and designing equipment compatible with wires made from recycled materials or low-impact coating processes like water-based PVC alternatives.

What is the significance of heavy gauge handling capacity in current market trends?

Heavy gauge capacity (above 6.0 mm) is increasingly significant because of the rising demand for high-security fencing and structural reinforcement mesh in major infrastructure projects. Machines capable of handling thicker, high-tensile wire offer greater durability and security, which is critical for government and large industrial contracts.

How does the availability of skilled labor influence purchasing decisions for new machinery?

The scarcity of skilled labor drives manufacturers toward fully automated, self-diagnosing machinery. These machines require less intensive human intervention for operation and troubleshooting, allowing companies to rely on a smaller team of highly trained technicians rather than a large pool of semi-skilled workers for basic machine operation.

What types of wire netting machines are essential for erosion control applications?

Hexagonal Wire Netting (Gabion) Machines are essential for erosion control. They produce large, strong, flexible meshes used to form gabion cages, which are filled with stone and deployed to stabilize embankments, prevent landslides, and control water flow along rivers and coastlines, making them crucial for civil engineering infrastructure.

Why is customization ability important for Barbed and Razor Wire Machine buyers?

Customization is vital because security requirements vary significantly across locations (borders, prisons, military bases). Buyers need machines that can easily switch between various blade types, wire gauges, and coiling patterns (e.g., concertina vs. straight line) to meet specific high-security project specifications and compliance needs.

Describe the role of specialized industrial distributors in the market.

Specialized distributors act as vital intermediaries, especially in emerging markets, providing localized sales expertise, financing advice, immediate spare parts inventory, and first-level technical support. They help OEMs overcome logistical hurdles and achieve deeper market penetration than direct sales efforts alone could manage.

What is the impact of global supply chain disruptions on machine delivery timelines?

Global supply chain disruptions, particularly those affecting electronic components (PLCs, sensors) and high-quality structural steel, significantly extend the lead times for machine delivery. This volatility forces OEMs to maintain higher component inventories and diversify their supplier base to mitigate risks and ensure timely fulfillment of customer orders.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager