Wire Stripping Equipment Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439171 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Wire Stripping Equipment Market Size

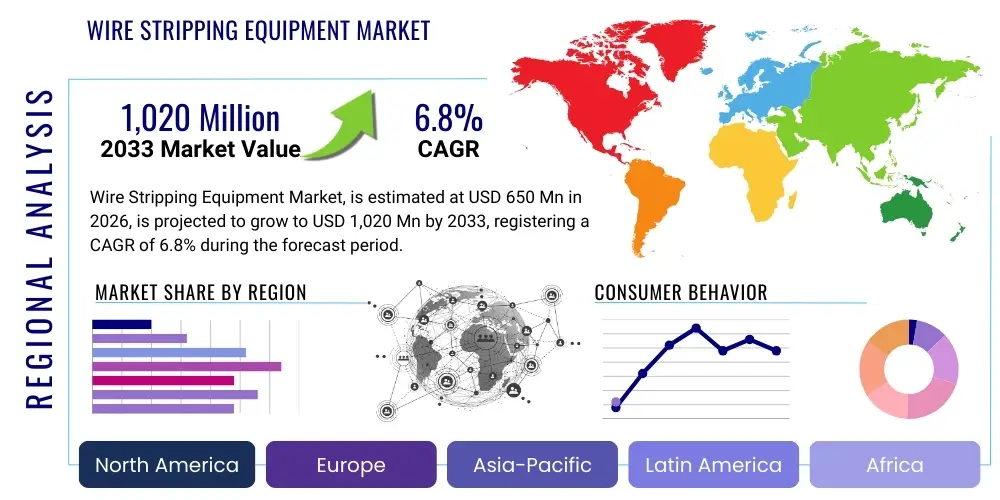

The Wire Stripping Equipment Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 650 Million in 2026 and is projected to reach USD 1,020 Million by the end of the forecast period in 2033.

Wire Stripping Equipment Market introduction

The Wire Stripping Equipment Market encompasses specialized machinery designed to remove the protective insulation or outer jacket from electrical wires and cables, a prerequisite process in virtually all electrical manufacturing and assembly operations. This equipment is pivotal in ensuring proper electrical connectivity, optimizing production efficiency, and maintaining high standards of safety and quality control. Products range from simple manual tools and semi-automatic benchtop strippers to sophisticated, fully automated cutting and stripping machines integrated into complex wiring harness assembly lines. The primary function is precision—stripping without nicking or damaging the conductive material underneath—which is increasingly crucial given the proliferation of miniature and high-precision electronic components.

Major applications of wire stripping equipment span diverse heavy and high-tech industries, including automotive (especially electric vehicle wiring harnesses), aerospace and defense, telecommunications infrastructure, consumer electronics manufacturing, and industrial machinery assembly. The ongoing global trend toward electrification, coupled with the rapid expansion of data centers and renewable energy projects, acts as a foundational demand driver for these precision tools. These systems offer significant benefits, such as enhanced throughput, reduced labor costs, improved accuracy compared to manual methods, and the ability to handle complex materials like PTFE, PVC, and exotic insulation types consistently.

Driving factors propelling market growth include the robust expansion of the automotive sector, characterized by the increasing complexity of vehicle electronics and the transition to electric vehicles (EVs), which require extensive and intricate high-voltage wiring systems. Furthermore, the push towards Industry 4.0 principles necessitates highly automated and intelligent stripping solutions capable of integrating seamlessly into connected manufacturing environments. Technological advancements, particularly in laser stripping technology, offer unparalleled precision for delicate medical and microelectronic applications, further diversifying the market's reach and enhancing the overall value proposition of modern wire processing machinery.

Wire Stripping Equipment Market Executive Summary

The Wire Stripping Equipment Market is undergoing a significant transformation driven primarily by the global demand for automation and high-precision manufacturing across critical industries. Business trends indicate a robust shift towards fully automated, programmable cutting and stripping machines that minimize human error and maximize processing speed, especially for high-volume automotive and consumer electronics production. Key manufacturers are focusing on integrating advanced sensor technology and sophisticated software interfaces to allow for quick changeovers and handling of a wide variety of wire gauges and insulation materials. Furthermore, there is a distinct competitive emphasis on developing environmentally friendly processes, particularly leveraging laser technology which reduces material waste and avoids mechanical stress on conductors.

Regional trends highlight the Asia Pacific (APAC) region as the primary growth engine, fueled by massive investments in electronics manufacturing hubs, expansive automotive production, and substantial infrastructural development in countries like China, India, and South Korea. North America and Europe, while mature markets, maintain strong demand for high-end, specialized equipment driven by stringent quality standards in aerospace, medical device manufacturing, and the burgeoning electric vehicle supply chain. These regions prioritize solutions offering traceability, advanced diagnostics, and compliance with high safety and performance benchmarks, leading to higher average selling prices for equipment.

Segment trends underscore the rising preference for automated equipment over manual and semi-automatic systems, reflecting the necessity for high-volume, repeatable precision. Within the technology segment, laser stripping technology is gaining traction, particularly in applications requiring ultra-fine wire processing or highly resilient insulation materials where mechanical stripping poses a risk. Application-wise, the automotive segment dominates, necessitated by the complexity and sheer volume of wiring required per vehicle, followed closely by the consumer electronics and telecom industries, which demand compact and highly precise stripping solutions for intricate assemblies. The market's future direction is intrinsically tied to advancements in robotics and smart manufacturing integration.

AI Impact Analysis on Wire Stripping Equipment Market

Common user questions regarding AI’s impact on wire stripping equipment primarily revolve around how AI can enhance precision, minimize scrap rate, and enable true predictive maintenance across high-throughput production lines. Users frequently inquire about the integration of machine learning algorithms for automatic fault detection during the stripping process, the ability of AI to adapt equipment parameters dynamically based on material variability, and the creation of self-optimizing cutting profiles. Key concerns center on the return on investment (ROI) for complex AI integration and the necessity for specialized operator training. Overall, users expect AI to transition wire processing from a calibrated, static operation to an intelligent, adaptive manufacturing cell, significantly boosting overall equipment effectiveness (OEE) and ensuring zero-defect output, particularly when handling challenging or sensitive conductors.

The adoption of Artificial Intelligence (AI) and machine learning (ML) is beginning to revolutionize the operational efficiency and quality control aspects of wire stripping equipment. AI algorithms are being integrated to analyze real-time data collected from sensors—including cutting force, insulation thickness variations, and conductor damage levels—to provide instantaneous feedback and automatic micro-adjustments to the machine settings. This capability drastically reduces the time needed for setup and calibration, especially when switching between different wire types or compensating for minor inconsistencies in raw cable quality, thereby achieving unprecedented levels of stripping accuracy and significantly minimizing material waste that results from faulty processes.

Furthermore, AI plays a crucial role in predictive maintenance strategies for complex wire processing machinery. By continuously monitoring the performance metrics of critical components, such as blades, drives, and motors, ML models can predict potential failures or necessary component replacements long before they impact production throughput. This shift from reactive or time-based maintenance to predictive maintenance enhances operational uptime, optimizes inventory management for spare parts, and drastically lowers overall lifecycle costs associated with high-precision capital equipment. The enhanced diagnostic capabilities provided by AI assure manufacturers of consistent, reliable performance in demanding, 24/7 manufacturing environments.

- AI-driven Predictive Maintenance: Forecasts component failure, maximizing uptime and reducing unplanned halts.

- Adaptive Quality Control: Uses machine vision and ML to instantly detect minor conductor damage, ensuring zero-defect production.

- Self-Optimization: Algorithms dynamically adjust stripping parameters (speed, depth, force) based on real-time material feedback.

- Automated Setup & Calibration: Significantly reduces changeover time when processing varied wire types and gauges.

- Process Data Analytics: Provides deep insights into efficiency bottlenecks and energy consumption patterns.

DRO & Impact Forces Of Wire Stripping Equipment Market

The market dynamics are significantly influenced by a confluence of drivers promoting automation and precision, counteracted by restraints related to high capital investment and technical complexities, while vast opportunities arise from emerging technologies and new application sectors. The fundamental driver remains the exponential growth in the global demand for electronics and electrical components, particularly fueled by the massive infrastructure requirements of 5G deployment, industrial automation (Industry 4.0), and, most critically, the global transition towards electric vehicles (EVs). These applications require high-speed, repeatable, and highly precise wire processing, making automation an imperative rather than a luxury. However, a major restraint is the significant initial cost associated with acquiring high-end, fully automated, laser-based stripping equipment, which can be prohibitive for smaller and medium-sized manufacturers (SMEs), coupled with the increasing technical skill requirement needed to operate and maintain these complex systems effectively.

Opportunities for market expansion are predominantly centered on technological innovation, specifically the proliferation of laser stripping technology, which offers superior performance for ultra-fine wires, shielded cables, and high-temperature insulations used in medical and aerospace sectors. Furthermore, the development of integrated wire processing cells that combine stripping, crimping, sealing, and testing functionalities into a single, seamless operation presents a substantial avenue for growth by offering end-users maximized efficiency and minimized handling errors. The impact forces are characterized by moderate technological disruption driven by laser advancements and high buyer power stemming from standardized quality requirements in automotive and aerospace contracts, forcing suppliers to continuously improve precision and durability.

The ongoing miniaturization trend in consumer electronics and medical devices presents a specialized, high-margin opportunity, demanding wire stripping solutions capable of handling wire gauges down to 50 AWG or finer with microscopic precision. Addressing these niche applications requires specialized R&D investment but yields significant competitive advantages. Conversely, the market must navigate supply chain volatilities affecting raw material costs (e.g., steel and specialized blades) and the long lead times often associated with highly customized automated equipment. Successfully leveraging automation drivers while mitigating cost restraints through flexible financing and modular design approaches will determine the market leadership over the forecast period.

Segmentation Analysis

The Wire Stripping Equipment Market is segmented based on the level of automation, the type of stripping technology employed, the specific application area, and the wire type being processed. This segmentation helps manufacturers tailor their product offerings to meet the diverse requirements of sectors ranging from high-volume automotive production to low-volume, high-precision medical manufacturing. The transition from manual and semi-automatic methods towards fully automated systems remains the most significant shift, driven by labor cost optimization and the need for rigorous quality control demanded by safety-critical applications. Furthermore, the distinct performance characteristics and price points of mechanical versus laser stripping technologies create clear segments catering to different material handling needs and budget constraints.

- By Product Type:

- Manual Wire Strippers

- Semi-Automatic Wire Stripping Machines

- Fully Automatic Wire Cutting and Stripping Machines

- Laser Wire Stripping Systems

- By Application:

- Automotive Wiring Harness Manufacturing

- Consumer Electronics and Appliance Manufacturing

- Aerospace and Defense

- Industrial Control and Automation

- Medical Devices

- Telecommunications and Data Centers

- By Wire Type:

- Single-Core Wires

- Multi-Core Cables and Jackets

- Coaxial Cables

- Shielded and High-Voltage Cables

- Fiber Optic Cables (Stripping tools often specialized)

- By Sales Channel:

- Direct Sales (OEMs and large industrial clients)

- Distributors and Resellers (SMEs and repair shops)

Value Chain Analysis For Wire Stripping Equipment Market

The value chain for the Wire Stripping Equipment Market begins with the upstream suppliers of critical components, predominantly encompassing specialized blade materials (e.g., carbide and high-speed steel), precision machining components, electronic controllers, and automation modules like motors and robotics. The quality and availability of these components directly impact the performance, longevity, and manufacturing costs of the final equipment. Strong relationships with reliable suppliers are paramount, especially for custom blades designed for specific insulation materials, as blade quality is a primary determinant of stripping precision and machine uptime. High-end automated machines rely heavily on software and integrated sensor technology, involving partnerships with specialized software developers and sensor manufacturers.

Midstream activities involve the design, manufacturing, and assembly of the wire stripping equipment itself. Market leaders focus heavily on R&D to develop proprietary cutting mechanisms, modular designs that allow for easy customization, and user-friendly human-machine interfaces (HMIs). Manufacturing involves high-precision assembly and rigorous testing to ensure machines meet stringent industry standards, particularly for accuracy and repeatability. Due to the high cost and technical nature of the equipment, manufacturers often provide extensive pre-sale consultation and post-sale technical support, forming a substantial part of the delivered value.

Downstream distribution channels are segmented into direct sales and indirect sales via specialized industrial distributors. Direct sales are typically favored for high-value, customized, fully automated solutions sold to large OEMs in the automotive or aerospace industries, allowing manufacturers to maintain tight control over installation and service. Indirect channels, including local distributors and equipment resellers, primarily handle standardized manual and semi-automatic equipment, providing local access, faster delivery, and regional technical support to SMEs and maintenance shops. Effective distribution relies on channels that possess deep technical knowledge about wire processing applications.

Wire Stripping Equipment Market Potential Customers

Potential customers, or end-users, of wire stripping equipment are organizations involved in the production, assembly, or maintenance of electrical and electronic systems requiring precise wire termination. The primary buyer segment is the wiring harness manufacturing industry, particularly those serving the automotive sector. As vehicles become increasingly reliant on complex electronic architectures—a trend accelerated by EV development—the demand for high-speed, multi-core, and shielded cable processing capabilities dictates the adoption of fully automated equipment. These manufacturers seek solutions that offer high throughput (pieces per hour) and integrated quality verification to comply with strict automotive safety regulations.

Another significant customer base includes manufacturers in the consumer electronics and appliance sectors. These buyers require equipment capable of handling finer gauge wires and compact assemblies with extreme precision to support miniaturization trends in smartphones, laptops, and various smart home devices. For these customers, versatility and the ability to process delicate materials without damage are crucial purchasing criteria. Furthermore, the aerospace and defense industries represent a high-value niche market, demanding ultra-reliable, specialized equipment (often laser strippers) due to the critical nature of their applications and the use of highly specialized, expensive, and difficult-to-strip insulation materials like PTFE and Kapton.

Industrial control panel builders, telecom infrastructure providers (installing communication backbones), and the renewable energy sector (manufacturing solar and wind turbine components) constitute additional major customer segments. For industrial and energy applications, the focus is often on processing heavier gauge wires and cables quickly and reliably. These end-users typically prioritize robustness, durability, and ease of maintenance in environments subject to harsh industrial conditions. The purchasing decision for all these segments is generally influenced by ROI calculations based on speed improvement, labor savings, and reduction in quality-related scrap rates.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 650 Million |

| Market Forecast in 2033 | USD 1,020 Million |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Komax Group, Schleuniger Group, Artos Engineering Company, Eraser Company, Inc., Kingsing Machinery, Kodera, Metzner Maschinenbau GmbH, Schaefer Technologies, Inc., MK Electronics, Wenzhou Jiasida Machinery Co., Ltd., Z&F Corporate, Ramatech Systems AG, Bayard Corporation, Tecalsa, Carpenter Mfg. Co. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Wire Stripping Equipment Market Key Technology Landscape

The technological landscape of the Wire Stripping Equipment Market is rapidly evolving, moving beyond conventional mechanical blade systems towards highly specialized and non-contact methods, driven by the need for superior precision and minimal wire damage. The core technologies currently deployed include standard rotary blade stripping, characterized by high speed and suitability for a wide range of standard insulations like PVC and PTFE. However, the most significant recent advancement lies in the development of sophisticated, microprocessor-controlled cutting modules that allow operators to digitally manage stripping parameters, ensuring consistency across millions of cycles and minimizing variability, which is critical for safety-related wiring in automotive and aerospace applications.

The most disruptive technology entering the market is laser wire stripping, which uses focused thermal energy (typically CO2 or Nd:YAG lasers) to vaporize insulation without physical contact with the conductor. This method is indispensable for ultra-fine wires, high-density coaxial cables, and exotic, heat-resistant insulations (e.g., Kapton or Teflon) where mechanical blades risk nicking or stretching the delicate conductor or shield. While laser systems involve higher capital expenditure, their superior precision, lack of tool wear, and flexibility for intricate stripping patterns justify the investment for high-end medical, aerospace, and high-frequency data transmission applications, positioning them as a premium segment technology.

Furthermore, technology development is heavily focused on machine integration and connectivity, supporting the Industry 4.0 movement. Modern wire stripping equipment often features Ethernet connectivity, allowing for real-time monitoring, remote diagnostics, and integration into Manufacturing Execution Systems (MES) for seamless job management and traceability. Advancements in sensor technology, including machine vision systems and force sensors, are employed to verify the quality of the strip immediately after the process, providing closed-loop quality assurance. This integration capability is essential for large-scale manufacturers aiming for comprehensive process automation and data-driven operational efficiency.

Regional Highlights

The global Wire Stripping Equipment Market demonstrates highly varied regional dynamics, with distinct growth drivers and technological adoption rates across continents. The Asia Pacific (APAC) region stands out as the largest and fastest-growing market, largely due to its dominance in global electronics, consumer appliance, and automotive manufacturing. Countries like China, Japan, South Korea, and increasingly India, are heavily investing in automation to increase production capacity and enhance quality control in their massive export-oriented manufacturing sectors. The rapid expansion of EV and battery production in APAC necessitates the deployment of high-throughput, automated stripping and cutting machines tailored for thick, high-voltage cables, driving significant market revenue.

North America and Europe represent mature markets characterized by a high demand for advanced, high-precision equipment, often incorporating laser technology, driven by stringent quality standards in specialized sectors such as aerospace, medical devices, and defense. These regions prioritize quality, traceability, and the ability to handle highly regulated materials, rather than sheer volume. European manufacturers, particularly in Germany and Switzerland, are known for their innovation in highly customized, fully automatic integrated processing cells that combine stripping, crimping, and sealing, setting the global benchmark for automation complexity and precision engineering. The ongoing re-shoring efforts in North America also drive investment in state-of-the-art domestic manufacturing facilities.

Latin America and the Middle East & Africa (MEA) currently hold smaller market shares but are exhibiting steady growth supported by infrastructural projects and developing industrial bases, particularly in automotive assembly (Mexico, Brazil) and regional electronics assembly. These regions predominantly utilize semi-automatic and mid-range automated equipment to balance cost considerations with the need for improved production quality. Investment patterns in MEA are often linked to specific large-scale energy projects and communication network upgrades, gradually transitioning towards more sophisticated machinery as local technical capabilities and manufacturing volumes increase.

- Asia Pacific (APAC): Dominates the market, driven by massive electronics manufacturing and rapid electric vehicle production scale-up in China and India.

- North America: Focuses on high-value, specialized equipment, especially laser strippers, for aerospace, defense, and advanced medical device manufacturing sectors.

- Europe: Characterized by high technological maturity, strong demand for integrated processing solutions, and adherence to rigorous quality and safety standards (e.g., DIN, ISO).

- Latin America: Stable growth fueled by regional automotive assembly and expanding industrial infrastructure, preferring cost-effective semi-automatic solutions initially.

- Middle East & Africa (MEA): Growth tied to infrastructure development and localized assembly operations, with increasing demand for reliable, robust industrial equipment.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Wire Stripping Equipment Market.- Komax Group

- Schleuniger Group

- Artos Engineering Company

- Eraser Company, Inc.

- Kingsing Machinery

- Kodera

- Metzner Maschinenbau GmbH

- Schaefer Technologies, Inc.

- MK Electronics

- Wenzhou Jiasida Machinery Co., Ltd.

- Z&F Corporate

- Ramatech Systems AG

- Bayard Corporation

- Tecalsa

- Carpenter Mfg. Co.

- Cami-Tech Inc.

- Daeil Systems

- Kutamo Corporation

- Shandong Sinofuda Industrial Co., Ltd.

- Hangzhou Optec Technology Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Wire Stripping Equipment market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the demand for fully automated wire stripping equipment?

The primary driver is the rapid global increase in high-complexity wiring harness requirements, particularly within the automotive sector (Electric Vehicles and ADAS systems) and high-volume consumer electronics. Automation ensures high throughput, minimizes labor costs, and crucially guarantees the precision necessary to meet stringent quality and safety standards (zero-defect manufacturing).

How does laser stripping technology differ from traditional mechanical stripping?

Laser stripping is a non-contact method utilizing focused light energy (e.g., CO2 or Nd:YAG) to vaporize insulation without touching the metal conductor. This is vital for ultra-fine wires, shielded cables, and difficult insulation materials like Kapton or PTFE, eliminating the risk of nicks, scratches, or deformation associated with mechanical blades.

Which region currently dominates the global Wire Stripping Equipment Market in terms of volume?

The Asia Pacific (APAC) region dominates the market volume due to its substantial share in global electronics, appliance, and general manufacturing hubs. High investment in production lines, especially in China and South Korea, requires vast quantities of wire processing equipment to support export demand.

What role does Industry 4.0 play in the evolution of wire stripping machinery?

Industry 4.0 principles necessitate smart, connected machinery. Modern stripping equipment now includes IoT sensors, integrated diagnostic software, and Ethernet connectivity for real-time performance monitoring, remote troubleshooting, and seamless integration into Manufacturing Execution Systems (MES) for data-driven optimization and quality traceability.

What are the key restraints impacting the widespread adoption of advanced wire stripping solutions?

The main restraint is the high initial capital investment required for specialized, fully automated, laser-based systems. This cost factor, coupled with the need for highly skilled technicians to operate and maintain these complex machines, limits their immediate adoption by smaller manufacturers (SMEs).

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager