Wire Termination Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433052 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Wire Termination Market Size

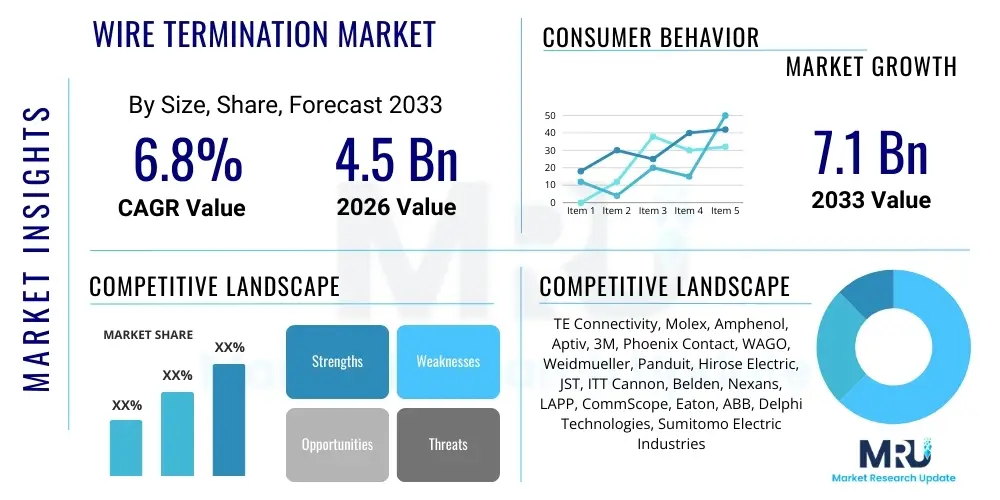

The Wire Termination Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 7.1 Billion by the end of the forecast period in 2033.

Wire Termination Market introduction

Wire termination involves the precise and reliable process of connecting electrical conductors (wires or cables) to devices, circuits, or other conductors, ensuring mechanical robustness and optimal electrical conductivity. These essential components form the backbone of electrical infrastructure across nearly all industries, facilitating power transfer, signal transmission, and data communication. The primary goal of effective wire termination is to prevent short circuits, minimize resistance, reduce electromagnetic interference (EMI), and ensure longevity under operational stress, vibration, and environmental extremes. This market encompasses a vast array of products including terminals, connectors, splices, lugs, ferrules, and associated tooling, which are categorized based on their termination method (e.g., crimping, soldering, insulation displacement, or screw connection) and intended application environment.

The core product portfolio within the wire termination market is characterized by stringent adherence to international standards, such as UL, CSA, and RoHS, particularly concerning material composition, temperature rating, and current capacity. Product descriptions often revolve around the gauge size (AWG or Metric), material science (copper, brass, nickel alloys, often with tin or silver plating), and insulation type (PVC, PTFE, cross-linked polyethylene) used. Major applications span high-reliability sectors like aerospace and defense, high-volume industries like consumer electronics and automotive manufacturing, and critical infrastructure segments such as energy distribution and telecommunications. The functional benefits derived from high-quality wire termination systems include enhanced safety, simplified installation processes, reduced maintenance downtime, and improved overall system performance and efficiency, directly impacting the operational expenditure of end-users.

Driving factors propelling this market growth are fundamentally linked to the global acceleration in electrification and automation initiatives. The explosive demand for electric vehicles (EVs) mandates high-performance, vibration-resistant, and high-current capacity terminations for battery management systems and power distribution units. Similarly, the expansion of 5G infrastructure requires advanced high-frequency connectors and terminations designed for minimal signal loss. Furthermore, the increasing complexity and density of industrial automation systems (Industry 4.0), smart grids, and data centers necessitate reliable, miniaturized, and robust interconnect solutions that can withstand harsh industrial environments, thereby fueling continuous innovation in termination technology and material science to meet these evolving operational demands.

Wire Termination Market Executive Summary

The Wire Termination Market is experiencing robust expansion, primarily driven by transformative business trends centered on digitalization and sustainable infrastructure development. Regionally, Asia Pacific maintains its dominance, spurred by rapid urbanization, massive investment in manufacturing facilities, particularly in the electronics and automotive sectors (including EV battery production), and large-scale public infrastructure projects. North America and Europe demonstrate growth fueled by the retrofit market for industrial automation and stringent regulatory demands requiring higher efficiency and safety in power systems. A significant business trend involves the shift towards tool-less and rapid-connect technologies, which drastically reduce installation time and dependency on highly skilled labor, addressing a key challenge faced by contractors globally. Moreover, key market players are focusing heavily on vertical integration and strategic partnerships with equipment manufacturers to secure long-term supply agreements and tailor solutions specific to evolving industry standards, such especially in renewable energy where high-durability terminations are paramount.

Segmentation trends indicate a strong performance in the crimp termination segment due to its excellent combination of mechanical strength, electrical reliability, and cost-effectiveness across varied applications, although insulation displacement connectors (IDCs) are gaining traction in telecommunications and data applications owing to their speed of assembly. From an application perspective, the automotive segment, particularly EV manufacturing, is the fastest-growing end-use sector, demanding specialized high-voltage and shielded termination solutions capable of managing substantial power flow and thermal stress. The industrial machinery segment also shows continuous growth, correlating with the global push towards automated factories and increased sensor integration, which requires reliable, modular wire-to-board and wire-to-wire connections that facilitate ease of maintenance and system modification in harsh environments. Technology innovation is concentrated on enhancing material resilience to chemical exposure and extreme temperatures, ensuring the reliability demanded by mission-critical systems.

Future market momentum will be heavily influenced by geopolitical factors affecting raw material supply chains (copper, specialty plastics) and the continued global push toward standardization in industrial connectivity protocols. Companies that successfully navigate these supply chain complexities while innovating in areas like enhanced thermal dissipation and miniaturization are expected to capture significant market share. The consolidation of supply chains through merger and acquisition activities remains a critical regional trend, allowing larger entities to leverage economies of scale and comprehensive product portfolios, offering bundled solutions that simplify procurement for large industrial clients. Overall, the executive outlook remains positive, underscored by the foundational role wire termination plays in supporting the global transition toward interconnected, automated, and electrically driven systems across both commercial and public infrastructure.

AI Impact Analysis on Wire Termination Market

User queries regarding the impact of Artificial Intelligence on the Wire Termination Market primarily center on three themes: how AI can enhance manufacturing precision and quality control, the role of predictive maintenance enabled by AI in large-scale connectivity systems, and the potential for AI-driven design optimization of termination components. Users are frequently concerned about the integration of machine vision and deep learning algorithms into automated crimping and soldering machinery to detect micro-defects invisible to human inspectors, thus ensuring higher reliability compliance with rigorous standards like those in aerospace and medical device manufacturing. Furthermore, industrial users are keen on understanding how AI can analyze operational data (temperature, vibration, current load) collected from terminated connections within critical infrastructure (like data centers or wind turbines) to predict connection failure before it occurs, thereby shifting maintenance strategies from reactive to predictive. The synthesis of these concerns highlights a clear user expectation: AI will drive the next generation of quality assurance and operational longevity for wire termination solutions.

The integration of AI into the manufacturing processes of wire termination components promises unprecedented levels of quality assurance and throughput efficiency. AI-driven machine vision systems, coupled with high-resolution imaging, can perform real-time, 100% inspection of crimp height, insulation integrity, and plating thickness. These systems are trained on vast datasets of acceptable and non-conforming parts, allowing them to rapidly identify minute deviations that could compromise the electrical or mechanical integrity of the connection. This eliminates the variability associated with human inspection and significantly reduces the risk of field failures, which is crucial for safety-critical applications. By analyzing manufacturing parameters—such as wire strip force, crimp pressure, and material batch characteristics—AI algorithms can continuously adjust machinery settings, minimizing waste and optimizing material utilization, directly contributing to cost reduction and enhanced process control repeatability.

Operationally, AI is set to transform the post-installation reliability of wire termination systems, especially in large, complex networks. By monitoring data streams from IoT sensors embedded near termination points, AI algorithms can model the thermal profiles, mechanical stresses, and electrical characteristics of thousands of connections simultaneously. Anomalous data patterns, potentially indicative of insulation degradation, loosening connections due to thermal cycling, or early stages of corrosion, can be identified long before catastrophic failure occurs. This predictive capability is highly valued in high-downtime cost environments like petrochemical plants, rail transport, and utility power grids. Moreover, in the design phase, Generative AI tools are being explored to optimize the geometry of terminal lugs and connector housings, reducing material usage while simultaneously enhancing heat dissipation properties and improving the mechanical grip, leading to lighter, more efficient, and structurally superior termination products that better meet modern demands for density and power handling.

- AI-powered machine vision systems enhance quality control, enabling real-time detection of micro-defects in crimp geometry and insulation integrity.

- Predictive maintenance platforms utilize AI algorithms to monitor operational data (heat, vibration) of terminations, forecasting potential failures in critical infrastructure.

- Generative AI is used in the design phase to optimize terminal geometry, improving mechanical robustness and thermal management characteristics.

- AI integration in automated tooling ensures continuous adjustment of crimping parameters, maintaining consistent quality across high-volume production runs.

- Enhanced supply chain visibility and demand forecasting for raw materials (copper, plastics) using AI minimizes inventory risks and responds better to fluctuating market needs.

DRO & Impact Forces Of Wire Termination Market

The dynamics of the Wire Termination Market are shaped by a complex interplay of Drivers, Restraints, and Opportunities, collectively forming the core Impact Forces. A primary driver is the pervasive trend of global electrification and digitalization, specifically the exponential growth in electric vehicles (EVs) and hybrid power systems, which demand specialized, high-reliability, and high-current wire terminations. Complementing this is the robust worldwide investment in expanding data center infrastructure and upgrading telecommunication networks to 5G, necessitating sophisticated, high-density, and low-loss connectivity solutions. These drivers are fundamentally reinforced by mandatory safety and reliability standards imposed by regulatory bodies across aerospace, medical, and industrial sectors, compelling manufacturers to utilize superior termination technology to ensure system safety and compliance. Furthermore, technological shifts toward miniaturization in consumer electronics continue to push innovation in high-precision, small-form-factor terminations.

Conversely, the market faces significant restraints, notably the intense volatility and rising costs of key raw materials, primarily copper and specialized polymer compounds, which squeeze manufacturing margins and complicate long-term pricing strategies. Another critical restraint is the technical challenge associated with ensuring the longevity and reliability of terminations in extremely harsh operating environments, such as high-vibration zones, corrosive marine settings, or high-temperature engine compartments, requiring advanced material science and complex sealing techniques. Moreover, the lack of standardized tooling and processes across smaller or legacy industrial operations can lead to improper installation, resulting in connection failure and subsequent market skepticism regarding quality, presenting a latent risk of poor performance that must be managed through education and advanced tool design.

Opportunities abound, particularly in the untapped potential of smart manufacturing (Industry 4.0), where intelligent wire terminations equipped with integrated sensors could provide valuable real-time diagnostics and performance monitoring, opening up new revenue streams in the service sector. The rapidly expanding renewable energy sector, encompassing solar, wind, and battery storage systems, presents a massive demand for heavy-duty, weather-resistant, and UV-stable termination components capable of handling high DC voltages. Furthermore, the development of specialized, highly automated installation tools that incorporate AI for quality validation offers a path to mitigate labor shortages and enhance installation efficiency globally, positioning companies that invest in tool-and-terminal integrated systems for substantial competitive advantage and market penetration. These forces collectively dictate the strategic trajectory of the market, emphasizing the need for robust innovation against a backdrop of supply chain uncertainty.

Segmentation Analysis

The Wire Termination Market is comprehensively segmented across several crucial dimensions, including the method of termination, the voltage level supported, the type of connector used, and the specific application sector. This granular segmentation allows manufacturers and analysts to precisely target evolving technological demands and regulatory requirements within diverse industries. The primary classification often focuses on the mechanism of connection—whether relying on the high-strength mechanical bonding of crimping, the metallurgical fusion of soldering, the rapid installation of insulation displacement connectors (IDCs), or the simplicity of screw/bolt connections. The performance characteristics, cost profile, and required installation skill set vary significantly across these methods, influencing their adoption in specific end-use environments, such as the preference for crimping in vibration-prone automotive applications versus soldering in high-precision aerospace circuitry.

Furthermore, segmentation by application is critical, reflecting the varied operational stresses and regulatory hurdles specific to each industry. For instance, terminations used in medical devices must adhere to bio-compatibility and sterilization standards, while those in the power utility sector must prioritize high current capacity, robust insulation, and resistance to environmental degradation over decades of service life. The segment concerning voltage level—low, medium, and high voltage—dictates the necessary insulation thickness, creepage distance, and overall component size, fundamentally shaping the material choices and design complexity. Growth trends indicate that segments supporting high-voltage DC applications, driven by renewable energy and battery systems, are expanding at the fastest pace, necessitating innovation in insulation materials and thermal management capabilities to ensure safety and efficiency.

Another significant analytical layer involves the segmentation by material, where the choice of conductor (copper vs. aluminum) and plating (tin, silver, gold) directly impacts electrical resistance, corrosion resistance, and total product cost. The complexity of modern electronic systems also drives segmentation by product form factor, including specialized wire-to-board, wire-to-wire, and wire-to-chassis solutions. Understanding these segments is paramount for strategic market positioning, enabling companies to focus R&D on high-growth niches such as shielded terminations for electromagnetic compatibility (EMC) in industrial control systems or weather-proof splices vital for outdoor telecommunications equipment, ensuring that product offerings align precisely with sophisticated technical specifications and performance benchmarks demanded by advanced end-users globally.

- By Type:

- Crimp Terminations (Insulated and Non-Insulated)

- Solder Terminations (Solder Sleeves and Cups)

- Insulation Displacement Connectors (IDC)

- Screw and Bolt Terminations

- Quick Disconnect Terminals (Spade, Ring, Fork)

- By Application:

- Automotive (Including Electric Vehicles and Commercial Trucks)

- Telecommunications (5G Infrastructure and Fiber Optics)

- Industrial Machinery and Automation (Industry 4.0)

- Consumer Electronics (Data Transmission and Power Supplies)

- Aerospace and Defense

- Energy and Power (Utility Grids, Renewables, Battery Storage)

- Medical Devices

- By Voltage Level:

- Low Voltage (LV - Below 1 kV)

- Medium Voltage (MV - 1 kV to 35 kV)

- High Voltage (HV - Above 35 kV)

Value Chain Analysis For Wire Termination Market

The Wire Termination Market value chain begins with the procurement of critical raw materials, predominantly high-purity copper, brass, and specialty engineering plastics, followed by the manufacturing and processing phase where complex stamping, plating, and molding operations occur. Upstream analysis highlights that the cost structure is highly sensitive to fluctuations in global commodity markets, particularly copper prices. Key upstream players include major metal refineries and chemical companies supplying insulation and housing materials. Manufacturers strategically manage these upstream costs through long-term commodity contracts and exploring material alternatives, such as plated aluminum alloys for high-voltage applications where weight is a constraint, demonstrating the dependency of product innovation on material science advancements and robust supply chain resilience against geopolitical disruption.

The midstream segment involves the core manufacturing and assembly of the termination components, including sophisticated plating techniques (e.g., gold, silver, or tin plating) crucial for optimizing contact resistance and environmental protection, and the subsequent production of application tooling. This phase is characterized by intense capital investment in precision machinery (high-speed stamping presses, automated molding machines) to ensure the tight tolerances required for reliable connections. Distribution channels are varied and complex, involving both direct sales to major OEMs in the automotive and aerospace sectors, and indirect sales through extensive global networks of specialized electrical and industrial distributors. The indirect channel serves smaller industrial consumers and the maintenance, repair, and overhaul (MRO) market, requiring comprehensive inventory management and localized technical support to maintain market penetration and reach.

Downstream analysis focuses on the integration of these terminations into final products by Original Equipment Manufacturers (OEMs) and contract manufacturers across diverse application sectors. For instance, automotive assembly lines utilize highly automated processes for connecting wire harnesses, while industrial field installation often relies on specialized hand tools or semi-automatic equipment. Direct sales are often preferred for highly customized, high-reliability products, ensuring stringent quality control and seamless integration support. Conversely, standard industrial terminals and lugs are largely sold through the indirect channel, prioritizing availability and lead time. The end of the value chain involves after-sales service, including tooling calibration, maintenance, and technical training, which has become an increasing differentiator, especially for complex systems, emphasizing the shift toward solutions-based selling rather than purely component supply, demonstrating the overall maturity and specialization within the market ecosystem.

Wire Termination Market Potential Customers

The potential customers for the Wire Termination Market are exceptionally diverse, spanning every industry that relies on electrical power or signal transfer, categorized primarily as large-scale Original Equipment Manufacturers (OEMs) and specialized field installation contractors or system integrators. OEMs in high-volume sectors such as automotive (including internal combustion engine vehicles, hybrids, and pure EVs) constitute a massive customer base, requiring millions of standardized yet highly reliable terminations annually for applications ranging from engine control units and infotainment systems to high-voltage battery connection points. Similarly, manufacturers of consumer electronics and IT hardware—especially those building servers, data storage arrays, and networking equipment—are critical buyers, focusing on miniaturized, high-density, and high-frequency terminations that maximize component density and data throughput within confined spaces, placing a premium on signal integrity and electromagnetic compatibility performance.

A second major customer category includes industrial and infrastructure development entities. This encompasses manufacturers of heavy industrial machinery, robotics, and factory automation systems who require robust, modular, and vibration-resistant wire terminations suitable for harsh environmental conditions (e.g., dust, moisture, and chemical exposure) prevalent in manufacturing plants. Additionally, energy sector players, including utility companies, renewable energy project developers (solar farms, wind turbines), and battery energy storage system providers, are high-value customers needing heavy-duty lugs, splices, and connectors engineered to manage significant current loads, withstand extreme thermal cycling, and ensure decades of reliable service outdoors. These customers often demand products compliant with highly specific regional safety and performance certifications, driving customization in product design and material selection.

Finally, the Maintenance, Repair, and Overhaul (MRO) sector, alongside specialized defense and aerospace contractors, forms a niche but crucial customer segment. MRO clients, ranging from facility maintenance teams to independent electricians, purchase terminals and associated tooling for repairs, upgrades, and small-scale installations, prioritizing product availability and ease of use. Aerospace and defense contractors, conversely, require ultra-high-reliability components, often specified via military standards, where failure is unacceptable. These buyers demand extensive traceability, specialized material requirements (like high-temperature insulation), and certifications demonstrating resistance to extreme G-forces and temperature fluctuations, underscoring the market's differentiation based on application criticality and regulatory requirements, driving sales through highly specialized distribution channels equipped to handle stringent quality documentation.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 7.1 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | TE Connectivity, Molex, Amphenol, Aptiv, 3M, Phoenix Contact, WAGO, Weidmueller, Panduit, Hirose Electric, JST, ITT Cannon, Belden, Nexans, LAPP, CommScope, Eaton, ABB, Delphi Technologies, Sumitomo Electric Industries |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Wire Termination Market Key Technology Landscape

The technology landscape of the Wire Termination Market is characterized by continuous innovation focused on improving reliability, increasing power density, and accelerating installation speed. A core technological area is the refinement of crimping technology, moving towards highly precise, microprocessor-controlled crimping tools that ensure perfect gas-tight connections irrespective of operator skill. Advanced crimp monitoring systems now use sensors to measure force profiles during the crimp cycle, providing instant feedback and quality logging, critical for maintaining zero-defect production in regulated industries. Furthermore, the development of specialized materials, particularly high-performance insulation compounds (such as high-temperature PTFE and cross-linked polymers), is essential for supporting the escalating power and thermal requirements of modern electronics and electric vehicle battery systems, where standard PVC insulation is insufficient to manage the operating temperatures and electrical stresses.

Another significant technological advancement is the rise of Insulation Displacement Connector (IDC) technology, which offers fast, tool-less termination by piercing the wire insulation to make electrical contact, significantly reducing assembly time in telecommunications, data centers, and industrial control panels. However, IDC robustness for high-vibration environments remains an area of ongoing research, contrasting with the mechanical superiority of traditional crimp connections. In the realm of high-voltage and high-current applications, new cold-shrink and heat-shrink tubing technologies, combined with enhanced sealant materials, are being deployed to provide superior environmental sealing, moisture protection, and UV resistance for outdoor installations in renewable energy and power distribution systems, ensuring the integrity of splices and terminations over prolonged exposure to harsh weather conditions and thermal cycling.

The market is also witnessing a concerted effort toward integration and intelligence. Smart terminations, leveraging embedded micro-sensors and passive RFID technology, are beginning to emerge, allowing for remote monitoring of connection status, temperature, and even current leakage. This technological integration transforms a passive component into an active data point within the Industrial Internet of Things (IIoT) ecosystem, facilitating predictive maintenance and detailed fault analysis. Furthermore, the convergence of wire termination and printed circuit board (PCB) technology has driven innovation in high-density, surface-mount terminals and modular terminal blocks that facilitate easier wiring and repair, optimizing space utilization and streamlining assembly processes for sophisticated electronic control units and compact industrial controllers, pushing the boundaries of miniaturization and maintainability across the industrial automation spectrum.

Regional Highlights

The global Wire Termination Market exhibits distinct regional dynamics driven by localized industrial maturity, regulatory frameworks, and infrastructure investment levels. Asia Pacific (APAC) dominates the market share due to its status as the world’s primary manufacturing hub for automotive components, consumer electronics, and general industrial machinery. Countries like China, South Korea, and Japan drive immense demand, propelled by continuous foreign direct investment in manufacturing capacity and massive government initiatives focused on electrification and infrastructure modernization, particularly in high-speed rail and smart grid development. The rapid expansion of EV production in China and India, coupled with the burgeoning industrial automation sector across Southeast Asia, ensures that APAC remains the key growth engine, focusing heavily on high-volume, cost-effective, yet quality-compliant termination solutions tailored for automated assembly lines.

North America represents a mature yet dynamic market, characterized by stringent quality standards (e.g., FAA, UL requirements) and a high demand for advanced, high-reliability terminations, particularly in the aerospace, defense, and data center segments. The region is investing heavily in upgrading aging power infrastructure and building vast data processing facilities, which mandates sophisticated, error-free connectivity systems. Growth in North America is also being accelerated by government incentives for domestic semiconductor manufacturing and electric vehicle production, driving demand for specialized tooling and highly certified termination products. European markets, similarly mature, emphasize regulatory compliance (e.g., RoHS, REACH) and sustainable manufacturing practices, leading to a strong focus on high-performance, compact, and energy-efficient termination components crucial for highly automated factory floors and precision-engineered European vehicles and rail systems.

The Latin America and Middle East & Africa (MEA) regions, while smaller in scale, offer significant long-term growth potential, largely linked to ongoing urbanization and major investment in oil, gas, and renewable energy infrastructure. MEA, in particular, is witnessing substantial projects in large-scale solar and petrochemical complexes, demanding rugged, corrosion-resistant terminations suitable for extreme heat and desert environments. Latin America’s market growth is tied to automotive manufacturing (especially Brazil and Mexico) and mining operations, where robust, sealed terminations are essential to withstand the highly corrosive and demanding nature of the extraction sector. These regions often prioritize durability and straightforward installation, driving demand for standardized, heavy-duty lugs and splices, thereby offering different product opportunities compared to the high-tech, miniaturization focus seen in APAC and North America.

- Asia Pacific (APAC): Leads in volume demand, driven by EV manufacturing, consumer electronics production, and massive infrastructure projects (5G, smart cities). Key countries include China, Japan, South Korea, and India.

- North America: Focuses on high-reliability solutions for Aerospace, Defense, and rapidly expanding Data Centers. Strong emphasis on domestic manufacturing and adherence to UL and military standards.

- Europe: Characterized by stringent environmental compliance (RoHS, REACH) and high demand from advanced industrial automation (Industry 4.0) and automotive OEMs prioritizing quality and sustainable components.

- Middle East & Africa (MEA): Growth centered on large-scale energy projects (Oil & Gas, Solar) requiring highly durable, high-temperature, and corrosion-resistant termination products.

- Latin America: Demand primarily driven by the automotive assembly sector and the mining industry, necessitating robust and field-installable connections.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Wire Termination Market.- TE Connectivity

- Molex

- Amphenol

- Aptiv

- 3M

- Phoenix Contact

- WAGO

- Weidmueller

- Panduit

- Hirose Electric

- JST

- ITT Cannon

- Belden

- Nexans

- LAPP

- CommScope

- Eaton

- ABB

- Delphi Technologies

- Sumitomo Electric Industries

Frequently Asked Questions

Analyze common user questions about the Wire Termination market and generate a concise list of summarized FAQs reflecting key topics and concerns.What factors determine the most appropriate type of wire termination for a specific application?

The suitability of a wire termination is primarily determined by four factors: the wire gauge and material, the required current/voltage rating, the operational environment (vibration, temperature, moisture), and the need for mechanical strength. Crimp terminations are preferred for vibration resistance, soldering for signal integrity, and screw terminals for high current and easy field maintenance. Compliance with standards such as UL or CSA is also a critical determining factor, dictating material choices and design tolerances to ensure long-term reliability.

How does the shift to electric vehicles (EVs) impact the Wire Termination Market demand?

The EV transition is profoundly increasing demand for specialized, high-performance wire terminations. EVs require robust, high-voltage (HV) connectors and terminals capable of safely managing large DC currents (400V to 800V systems). These components must offer superior thermal management, exceptional sealing against fluids, and resistance to extreme vibration and thermal cycling associated with battery packs and power electronics, driving innovation in copper alloys and advanced insulation materials designed for sustained high power density applications.

What are the primary reliability concerns associated with wire termination failures?

Primary concerns revolve around connection reliability, which includes issues such as high contact resistance, intermittent connections, and eventual mechanical or electrical failure. High resistance leads to excessive heat generation, reduced efficiency, and potential fire hazards. Failure modes often stem from improper installation (e.g., poor crimp depth or insufficient torque), material degradation (corrosion), or thermal expansion/contraction stressing the connection point over time, necessitating precise tooling and proper material selection to mitigate risks effectively across the operational lifespan.

How is Industry 4.0 influencing the design and deployment of industrial wire terminations?

Industry 4.0 necessitates wire terminations that are smaller, higher-density, and integrate features simplifying rapid field installation and modification. This trend drives the adoption of modular terminal blocks, tool-less clamping technologies, and spring cage connections that speed up wiring in complex control cabinets. Future influence includes the potential integration of passive monitoring technologies within terminations to relay diagnostic data to centralized IIoT platforms, supporting automated fault detection and condition-based monitoring programs within smart factories.

What is the role of plating materials (Tin, Silver, Gold) in improving termination performance?

Plating materials are crucial for optimizing electrical contact and protecting the base metal from environmental degradation. Tin plating is cost-effective and suitable for lower temperatures, providing good corrosion resistance. Silver plating is used for high-current applications due to its excellent conductivity and resistance to oxidation, though it can tarnish. Gold plating is reserved for extremely low-current, high-reliability signal applications (e.g., military, aerospace) where supreme conductivity and corrosion resistance over long periods are mandatory, ensuring minimal signal loss and low contact resistance.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager