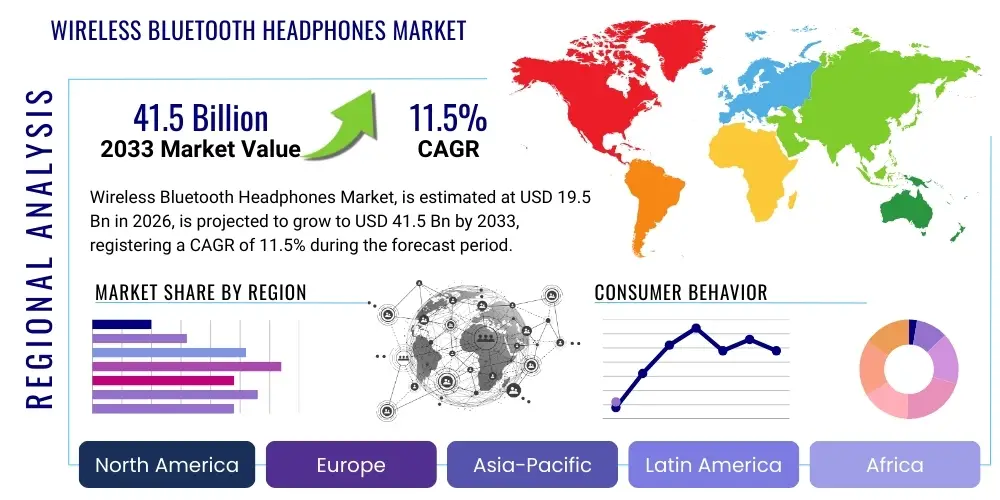

Wireless Bluetooth Headphones Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437402 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Wireless Bluetooth Headphones Market Size

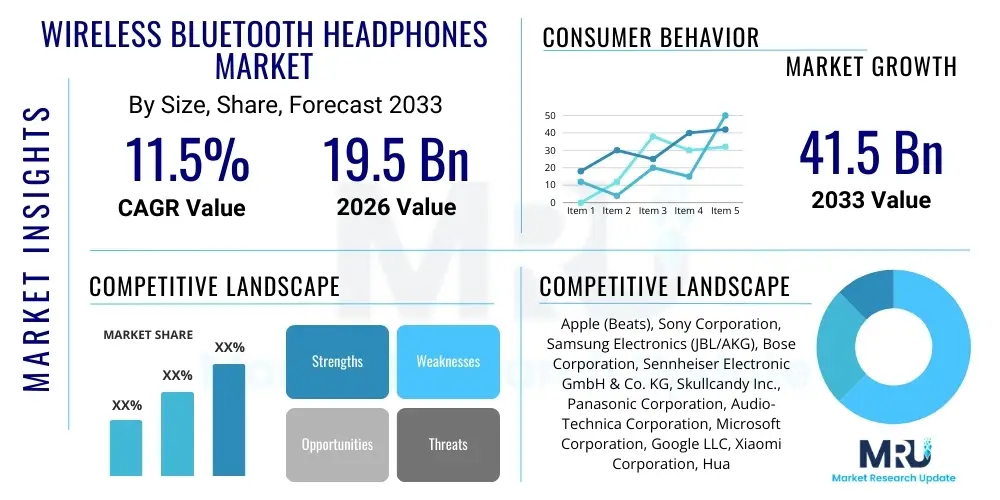

The Wireless Bluetooth Headphones Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 11.5% between 2026 and 2033. The market is estimated at USD 19.5 Billion in 2026 and is projected to reach USD 41.5 Billion by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by the pervasive adoption of smart devices globally and the ongoing technological improvements in battery life, audio fidelity, and connectivity standards, particularly the widespread integration of True Wireless Stereo (TWS) technology across various price points.

Wireless Bluetooth Headphones Market introduction

The Wireless Bluetooth Headphones Market encompasses audio devices utilizing short-range radio frequency technology, specifically Bluetooth, to transmit audio signals from source devices without physical cable connections. Products within this market range from conventional over-ear and on-ear models to highly popular in-ear devices, including neckbands and the ubiquitous True Wireless Stereo (TWS) earbuds. These devices function primarily by converting digital audio streams into analog sound waves that are delivered to the listener, offering enhanced mobility and freedom from tangled wires. The core product description involves sophisticated miniaturized speakers, integrated rechargeable batteries, advanced digital signal processors (DSPs), and specialized Bluetooth chipsets capable of handling high-fidelity audio codecs like aptX HD, LDAC, and AAC.

Major applications of wireless Bluetooth headphones span several key consumer segments. Firstly, Music & Entertainment remains the largest application, benefiting from improved noise cancellation features and high-resolution audio support. Secondly, the Communication segment relies heavily on these devices for professional use, video conferencing, and hands-free calling, driven by features like robust microphone arrays and enhanced voice clarity technologies. Thirdly, the Fitness & Sports category utilizes waterproof and sweat-resistant designs, often incorporating secure-fit mechanisms and lightweight construction to cater to active users. The underlying benefit these products offer is unparalleled convenience, coupled with continuous advancements in features such as personalized audio profiles, seamless multi-device pairing, and integration with voice assistants, significantly elevating the user experience.

The primary driving factors propelling market growth include the global phasing out of the standard 3.5mm audio jack in flagship smartphones, necessitating the adoption of wireless alternatives. Furthermore, continuous reductions in manufacturing costs for TWS components have made high-quality wireless audio accessible to a broader consumer base in emerging economies. The rising consumer demand for premium features such as Active Noise Cancellation (ANC), extended battery longevity, and rapid charging capabilities, coupled with the increasing integration of bio-metric monitoring for health and fitness applications, solidify the market's robust growth trajectory.

Wireless Bluetooth Headphones Market Executive Summary

The Wireless Bluetooth Headphones market is characterized by intense competition driven primarily by technological convergence and rapid product iteration cycles, with major business trends focusing heavily on ecosystem integration. Leading consumer electronics giants, such as Apple, Samsung, and Sony, are leveraging their existing device ecosystems to offer seamless pairing, enhanced controls, and exclusive features, thereby creating significant consumer lock-in. A critical trend observed is the democratization of premium features; once exclusive to high-end models, advanced Active Noise Cancellation (ANC), spatial audio, and robust water resistance are rapidly becoming standard in mid-range offerings, putting immense pressure on legacy audio manufacturers to innovate rapidly or specialize in niche high-fidelity segments. Furthermore, sustainable manufacturing practices and the use of recycled materials are emerging as key differentiators in branding and consumer appeal, particularly in developed markets.

From a regional perspective, Asia Pacific (APAC) stands out as the primary growth engine, fueled by the massive volumes of smartphone users in countries like China and India, coupled with the aggressive entry of regional players offering highly competitive pricing and localized features. North America and Europe, while representing mature markets, continue to drive innovation, particularly in the premium and professional segments, demanding superior audio quality, advanced AI integration for personalization, and sophisticated noise cancellation tailored for open-office or commuting environments. The Middle East and Africa (MEA) and Latin America are experiencing accelerated growth, driven by increasing disposable incomes and improving digital infrastructure, leading to a surge in demand for affordable yet feature-rich wireless options, though infrastructure limitations sometimes pose challenges to high-bandwidth audio streaming.

Segmentation trends indicate a clear dominance of the True Wireless Stereo (TWS) segment, which has redefined portability and convenience, effectively marginalizing neckband and wired headphone formats across the mass market. Within technology segments, the adoption rate of hybrid ANC technology is soaring, as consumers seek versatile devices capable of optimizing sound delivery across dynamic environments. Moreover, the market is segmenting sharply based on application; the Gaming segment is increasingly adopting specialized low-latency wireless headphones featuring optimized microphone quality and spatial sound mapping, while the Health and Fitness segment is prioritizing durable, secure-fit earbuds integrated with environmental awareness modes and basic heart rate monitoring capabilities. The intense focus on battery technology across all segments remains a defining characteristic, with consumers continually demanding longer total playback time and faster charging cycles.

AI Impact Analysis on Wireless Bluetooth Headphones Market

Analysis of common user questions regarding the integration of Artificial Intelligence (AI) in wireless Bluetooth headphones reveals key areas of consumer interest revolving around personalization, noise management, and proactive assistance. Users frequently inquire about how AI can differentiate between various types of background noise (e.g., human speech vs. engine drone) to provide more effective and less fatiguing noise cancellation. A significant number of questions focus on personalized hearing profiles—how AI can analyze the user's auditory responses and the acoustic environment in real-time to adjust equalization (EQ) settings and volume levels automatically, optimizing sound quality specifically for that individual user's ear structure and hearing sensitivity. Furthermore, users express expectations regarding proactive integration with smart assistants, hoping for AI-powered features that predict user needs, manage contextual notifications, and provide immediate language translation, transforming headphones from passive listening devices into intelligent wearable computing interfaces.

The implementation of AI algorithms fundamentally transforms the functionality and perceived quality of wireless audio devices. Advanced AI-driven Digital Signal Processing (DSP) allows for computational audio enhancements that go far beyond traditional equalization, enabling features like adaptive acoustic transparency, which intelligently filters out jarring or critical sounds (like sirens or announcements) while allowing normal conversation to pass through clearly. This real-time, context-aware audio processing enhances safety and utility. Beyond audio quality, AI is crucial for optimizing power consumption; machine learning models analyze usage patterns to intelligently manage power distribution between the connectivity chip, DSP, and battery, thereby extending usable battery life under varying operating conditions without compromising performance.

The growing convergence of headphones with health and wellness platforms is largely dependent on AI. Future generations of wireless headphones are expected to utilize embedded sensors and AI to monitor physiological data (heart rate, movement, body temperature) with high accuracy. AI processes this bio-data, offering personalized coaching, fatigue detection, and stress level monitoring. This evolution shifts the headphone’s role from purely entertainment to a vital component of the personal health monitoring ecosystem, driving innovation in sensor miniaturization and edge computing capabilities within the earpiece itself. The development of low-power, dedicated AI processing cores is essential for realizing these computationally intensive applications without overly draining battery reserves.

- AI-enhanced Adaptive Noise Cancellation (ANC): Real-time identification and cancellation of specific noise frequencies, dynamically adjusting attenuation based on environment.

- Personalized Hearing Profiles: AI algorithms calibrate sound output (EQ and volume) based on individual ear canal resonance and measured hearing thresholds.

- Computational Audio Processing: Optimization of audio staging and spatialization using machine learning models for immersive sound experiences.

- Contextual Awareness and Automation: Intelligent triggering of features (e.g., automatically pausing music or enabling transparency mode upon detecting conversation).

- Voice Assistant Optimization: Improved natural language processing (NLP) and voice recognition, reducing false positives and improving command accuracy in noisy environments.

- Battery Management Optimization: AI analyzing usage patterns to predict and optimize power usage across chipsets for maximized battery longevity.

- Biometric Data Analysis: Processing sensor data (heart rate, motion) for health monitoring and fatigue detection directly within the device (edge AI).

DRO & Impact Forces Of Wireless Bluetooth Headphones Market

The Wireless Bluetooth Headphones Market is shaped by a powerful interplay of Drivers, Restraints, and Opportunities, resulting in dynamic impact forces that dictate market trajectory. Key drivers include the overwhelming consumer demand for mobility and the global trend of smartphone manufacturers eliminating the analog audio jack, effectively forcing mass adoption of wireless alternatives. Additionally, significant advancements in battery technology, which now offer extended listening times exceeding 30 hours with charging cases, alongside rapid charging capabilities, have mitigated previous major restraints related to power limitations. The constant innovation in audio codecs, providing near-lossless transmission quality over Bluetooth, further incentivizes users to upgrade from older wireless models or switch completely from high-fidelity wired setups. These drivers collectively create a strong, consistent pull factor for market expansion, ensuring steady replacement cycles and first-time purchases globally.

Despite robust growth, several restraints impact the market’s full potential. The primary challenge remains latency, particularly critical for competitive gaming and professional video editing, where even minor delays can severely impact performance. While low-latency codecs have improved this, complete elimination of latency remains a technological hurdle inherent in Bluetooth transmission. Furthermore, the high cost associated with implementing premium features like state-of-the-art hybrid ANC and high-resolution proprietary codecs (e.g., LDAC) places these technologies outside the budget of large consumer segments in developing economies, creating market segmentation based on affordability. Another environmental restraint is the disposal of non-replaceable lithium-ion batteries sealed within TWS earbuds, posing growing environmental concerns and regulatory challenges related to e-waste management.

Opportunities for future growth are predominantly centered around the integration of personalized and health-centric features. The rise of the Metaverse and spatial computing demands sophisticated spatial audio technology, positioning premium headphones as critical hardware for immersive virtual experiences. Furthermore, there is a significant opportunity in developing specialized professional-grade wireless headsets tailored for remote work, emphasizing superior environmental noise reduction for microphones and certified compatibility with unified communication platforms (UCC). The convergence of hearing aid technology with consumer earbuds, offering affordable, personalized sound amplification and hearing enhancement features managed via smartphone applications, represents a massive untapped demographic and regulatory opportunity. The overall impact forces are strongly positive, accelerating market penetration, but simultaneously necessitating continuous R&D investment to overcome latency and battery lifecycle constraints, while navigating increasing regulatory scrutiny concerning data privacy related to integrated health sensors.

Segmentation Analysis

The Wireless Bluetooth Headphones Market is highly segmented across several critical dimensions, reflecting diverse consumer preferences, technological maturity, and application-specific needs. The dominant segmentation involves product type, where True Wireless Stereo (TWS) earbuds have captured the majority market share due to their convenience and miniaturization, rapidly displacing traditional neckband and standard wireless headphone styles across consumer and lifestyle applications. Technology segmentation focuses heavily on the adoption of Active Noise Cancellation (ANC), with Hybrid ANC models commanding a premium due to their superior performance in filtering out a broad range of frequencies. Price segmentation remains crucial, dividing the market into low-end (highly competitive, volume-driven), mid-range (balanced features and performance), and premium (focusing on brand legacy, superior fidelity, and advanced smart features) tiers.

Application-based segmentation is becoming increasingly pronounced, driven by specialization. While Music & Entertainment remains the foundation, the Gaming segment is rapidly adopting customized wireless headsets requiring ultra-low latency and dedicated gaming modes. Simultaneously, the Professional/Communication segment demands robust microphone quality and extended comfort for prolonged use in remote work settings. Geographical segmentation confirms Asia Pacific's leadership in volume and growth, while North America dictates premium pricing and technological trends, particularly in AI integration and spatial audio development. This multi-faceted segmentation allows manufacturers to target specific consumer needs with tailored product features and pricing strategies, ensuring market responsiveness across the economic spectrum.

- By Product Type:

- True Wireless Stereo (TWS) Earbuds

- On-Ear Headphones

- Over-Ear Headphones

- Neckband Headphones

- By Technology:

- Active Noise Cancellation (ANC)

- Passive Noise Isolation (Non-ANC)

- By Application:

- Music and Entertainment

- Communication and Office Use

- Fitness and Sports

- Gaming

- By Price Range:

- Low-end (Budget)

- Mid-range

- Premium (High-end)

- By Distribution Channel:

- Online Retail

- Offline Retail (Exclusive Stores, Supermarkets, Electronics Chains)

Value Chain Analysis For Wireless Bluetooth Headphones Market

The value chain for the Wireless Bluetooth Headphones market begins with Upstream Analysis, which involves the sourcing and production of critical raw materials and components. This stage is dominated by specialized suppliers for complex components such as Bluetooth chipsets (e.g., Qualcomm, Realtek, Airoha), micro-electromechanical system (MEMS) microphones, high-capacity lithium-ion batteries, and miniature acoustic drivers (dynamic or balanced armature). Component sourcing is highly centralized, often concentrated in East Asia, necessitating rigorous quality control and robust supply chain management by Original Equipment Manufacturers (OEMs). The innovation at this upstream level, particularly concerning low-power chip design and advanced acoustic materials, fundamentally determines the final product's performance metrics like battery life and audio fidelity.

The core of the value chain is manufacturing and assembly, where OEMs integrate these components, focusing on sophisticated acoustic engineering, industrial design, and mass production efficiency. Following manufacturing, the Downstream Analysis focuses on distribution and sales. The distribution channel is bifurcated into direct and indirect routes. Direct distribution involves companies leveraging their own official e-commerce platforms and brand stores, allowing for maximum control over pricing and consumer experience. Indirect distribution, however, remains paramount, utilizing large global electronics retailers (both physical and online giants like Amazon, Best Buy, and Alibaba) to achieve broad market penetration and accessibility. Efficient logistics, inventory management, and strategic retail partnerships are crucial downstream elements determining time-to-market and regional availability.

The structure of the distribution channel impacts profitability and market reach. Direct channels often yield higher margins but require substantial investment in logistics and customer service infrastructure. Indirect channels provide rapid scale and reach, particularly in fragmented international markets, though they involve sharing margins with retailers and distributors. Marketing and post-sale service complete the chain, where branding, consumer reviews, and accessible warranty support significantly influence customer loyalty and future purchase decisions. The ability to manage reverse logistics for warranty claims and e-waste responsibly is becoming a defining feature, particularly for premium brands aiming to enhance their brand image and sustainability commitment.

Wireless Bluetooth Headphones Market Potential Customers

The potential customers and end-users of wireless Bluetooth headphones are broadly diverse, spanning virtually all demographic and professional groups, reflecting the essential nature of mobile audio consumption in modern life. The largest consumer segment includes general technology enthusiasts and mainstream smartphone users who prioritize convenience, seamless connectivity, and moderate audio quality for daily commuting, media consumption, and casual listening. This segment is highly sensitive to pricing and relies heavily on mid-range TWS options that offer sufficient features like basic noise isolation and reliable battery life. The purchasing decisions for this core group are often driven by brand recognition and compelling value propositions, focusing on mass-market accessibility and ease of use.

A secondary, high-value segment comprises audio aficionados, professional users, and luxury consumers who seek the highest quality components and advanced functionality. These buyers are willing to invest significantly in premium over-ear or high-fidelity TWS models featuring advanced codecs (LDAC, aptX Adaptive), superior acoustic tuning, and best-in-class hybrid Active Noise Cancellation (ANC). For this segment, the buying decision is based on performance metrics, material quality, and ecosystem compatibility (e.g., seamless integration with Apple or Sony ecosystems). This group often includes professionals requiring headsets for Unified Communications (UCC) platforms, demanding exceptional microphone performance and all-day comfort for prolonged use in virtual meetings.

A rapidly growing tertiary segment involves specialized users such as gamers and fitness enthusiasts. Gamers are crucial potential customers for ultra-low latency wireless headsets optimized for real-time responsiveness and spatial audio cues essential for competitive play. Fitness enthusiasts, conversely, prioritize durability, sweat resistance (IP ratings), secure fit mechanisms, and features like ambient awareness modes for safety during outdoor activities. The purchasing behavior in these specialized segments is guided by specific performance indicators—latency for gaming and IP rating/secure fit for sports—rather than generic audio quality alone, prompting manufacturers to develop highly targeted, purpose-built product lines.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 19.5 Billion |

| Market Forecast in 2033 | USD 41.5 Billion |

| Growth Rate | 11.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Apple (Beats), Sony Corporation, Samsung Electronics (JBL/AKG), Bose Corporation, Sennheiser Electronic GmbH & Co. KG, Skullcandy Inc., Panasonic Corporation, Audio-Technica Corporation, Microsoft Corporation, Google LLC, Xiaomi Corporation, Huawei Technologies Co., Ltd., Jabra (GN Audio A/S), LG Electronics, Shure Incorporated, RHA Technologies, Beyerdynamic GmbH & Co. KG, Anker Innovations (Soundcore), Plantronics (Poly), Master & Dynamic. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Wireless Bluetooth Headphones Market Key Technology Landscape

The technological landscape of the Wireless Bluetooth Headphones market is defined by continuous evolution across three core pillars: connectivity, acoustics, and power management. In connectivity, the transition to Bluetooth 5.x standards (5.2, 5.3, and the impending 5.4) is crucial, enabling lower power consumption, increased range, enhanced stability, and robust multi-point connection capabilities. The introduction of Bluetooth LE Audio, utilizing the LC3 codec, represents a fundamental shift by significantly improving power efficiency while maintaining high audio quality, potentially democratizing advanced features across mid-range devices. Furthermore, the development of proprietary low-latency transmission protocols is critical for specific applications like gaming and high-definition video consumption, where standard Bluetooth latency is unacceptable, prompting companies to invest heavily in specialized chipsets and software optimization to reduce audio delay to negligible levels.

Acoustic technologies center on drivers and Digital Signal Processing (DSP). While traditional dynamic drivers remain prevalent, high-end devices are increasingly utilizing balanced armature drivers or hybrid setups (combining dynamic and balanced armature) to achieve superior detail and frequency response across the audio spectrum. Active Noise Cancellation (ANC) technology is moving towards sophisticated hybrid architectures, combining feedforward and feedback microphones controlled by AI-driven DSPs to achieve deeper and more adaptive noise suppression that reacts to environmental changes in real-time. Spatial audio, or 3D audio technology, which uses head-tracking and advanced rendering algorithms to create an immersive, theater-like sound experience, is gaining traction, driven by adoption in gaming, streaming, and premium entertainment platforms.

Power management remains a cornerstone of consumer satisfaction. Innovations focus not only on increasing the volumetric energy density of lithium-ion batteries but also on optimizing the power consumption profiles of the core chipsets. Rapid charging capabilities, often delivering hours of playback after just minutes of charging, have become a standard requirement. Furthermore, wireless charging technology, compatible with Qi standards, is widely integrated into TWS charging cases, enhancing user convenience and ecosystem interoperability. The successful integration of these technologies requires complex system-on-a-chip (SoC) design that balances powerful processing for ANC and AI features with the stringent requirements of miniaturization and extended battery life, highlighting the technical expertise needed to compete effectively in the modern market.

Regional Highlights

- Asia Pacific (APAC): APAC is the largest and fastest-growing regional market for Wireless Bluetooth Headphones, driven primarily by high smartphone penetration, a large youth demographic, and the competitive entry of local brands (e.g., Xiaomi, Oppo, boat) offering feature-rich products at highly affordable price points. Countries like China and India contribute immense sales volume, particularly in the TWS segment. The region exhibits high price sensitivity but also rapid adoption of new technologies, especially in urban centers. APAC manufacturers are quick to incorporate technological advancements like high-capacity batteries and localized voice assistant support, making it a critical manufacturing hub and a volume-driven consumption market.

- North America: North America represents a mature, premium-focused market characterized by strong purchasing power and a high demand for brand quality, sophisticated features (best-in-class ANC, spatial audio), and seamless ecosystem integration (Apple, Bose, Sony). The region sets global trends in audio technology and is a primary driver for the adoption of high-end specialized devices for professional communication and fitness monitoring. Consumers in North America prioritize user experience, reliability, and robust after-sales support, resulting in sustained high average selling prices (ASPs).

- Europe: The European market displays a balanced demand profile, encompassing both premium performance and strong emphasis on sustainability and aesthetic design. Countries like Germany and the UK show high adoption rates for established brands (Sennheiser, Bose), valuing audio fidelity and manufacturing quality. Regulatory factors, such as forthcoming EU regulations on product longevity and repairability, are beginning to influence product design and marketing strategies. The market is highly competitive, catering to both the commuting professional demanding effective ANC and the consumer seeking environmentally conscious and durable audio products.

- Latin America (LATAM): LATAM is an emerging market experiencing accelerated growth, driven by increasing urbanization and expanding digital connectivity. Market demand leans towards value-for-money products, with TWS earbuds gaining rapid acceptance. Import taxes and currency fluctuations often influence final consumer pricing, leading to a strong preference for mid-range and budget-friendly options. Brazil and Mexico are key growth engines, where rising disposable incomes are fueling the switch from basic wired headphones to functional wireless alternatives.

- Middle East & Africa (MEA): The MEA region is characterized by fragmented market development. The GCC countries (UAE, Saudi Arabia) exhibit strong demand for high-end luxury brands and advanced features, mirroring North American preferences, driven by high disposable incomes. Conversely, sub-Saharan Africa focuses on entry-level and budget TWS models, where accessibility and reliability are the primary purchasing criteria. Market growth is closely tied to the expansion of mobile broadband infrastructure and the decreasing cost of basic wireless components.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Wireless Bluetooth Headphones Market.- Sony Corporation

- Apple Inc. (Beats Electronics)

- Samsung Electronics Co., Ltd. (Harman International - JBL, AKG)

- Bose Corporation

- Sennheiser Electronic GmbH & Co. KG

- Skullcandy Inc.

- Panasonic Corporation

- Audio-Technica Corporation

- Microsoft Corporation

- Google LLC

- Xiaomi Corporation

- Huawei Technologies Co., Ltd.

- Jabra (GN Audio A/S)

- LG Electronics

- Shure Incorporated

- RHA Technologies Ltd.

- Beyerdynamic GmbH & Co. KG

- Anker Innovations (Soundcore)

- Plantronics (Poly)

- Master & Dynamic

Frequently Asked Questions

Analyze common user questions about the Wireless Bluetooth Headphones market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary factors driving the explosive growth of the True Wireless Stereo (TWS) segment?

The explosive growth of the TWS segment is primarily driven by three factors: ultimate portability without cables, superior integration with mobile device ecosystems (especially seamless pairing and voice assistant access), and the continuous decrease in the manufacturing cost of advanced components like miniaturized ANC chips and high-density batteries, making premium TWS features accessible across all price points. TWS addresses the critical consumer desire for untethered mobility and discreet audio consumption.

TWS technology has reached a maturity level where it effectively resolves early user complaints regarding connectivity drops and limited battery life. Modern TWS earbuds now feature charging cases that provide multiple recharges, extending total usage time significantly, and utilize Bluetooth 5.0+ protocols for enhanced signal stability. Furthermore, manufacturers are heavily marketing the 'hearable' functionality, positioning TWS not just as audio devices but as intelligent accessories that facilitate health monitoring (via sensors) and provide real-time ambient sound control, accelerating consumer uptake globally, particularly among young, mobile professionals.

How is Active Noise Cancellation (ANC) technology evolving, and what role does AI play in its performance?

ANC technology is evolving from basic noise reduction to sophisticated, adaptive acoustic management through the integration of AI and complex digital signal processing (DSP). Modern ANC uses hybrid methodologies (combining feedforward and feedback microphones) to target a broader spectrum of noise. AI is crucial as it allows the system to analyze ambient sound profiles in real-time, differentiating between transient noises (like horns or voices) and continuous hums (like plane engines). This AI-driven analysis permits dynamic adjustment of the anti-noise waveform, leading to noise cancellation that feels less oppressive and more acoustically optimized for specific user environments, greatly enhancing user comfort and effectiveness compared to legacy static ANC systems.

The progression to computational audio means that high-end wireless headphones now use machine learning models trained on vast datasets of acoustic environments. This enables features such as 'Adaptive Transparency Mode,' where critical sounds are permitted to pass through clearly for safety (e.g., traffic alerts) while distracting background noise is suppressed. This capability, entirely reliant on embedded AI processing, transforms ANC from a simple binary on/off feature into a nuanced environmental audio tool, offering unparalleled acoustic control to the user navigating complex urban or professional settings. The performance differentiator is now intelligence, not just decibel reduction.

What are the key technological hurdles restraining widespread adoption of wireless headphones in high-fidelity (Hi-Fi) and professional audio segments?

The primary technological hurdle restraining full penetration into the Hi-Fi and professional audio segments is the fundamental trade-off between wireless data transmission efficiency and audio bandwidth integrity, specifically related to lossy compression and latency. While advanced codecs like LDAC and aptX Adaptive offer high-resolution transmission, they still rely on compression to manage data flow over Bluetooth, potentially compromising the pristine signal quality demanded by audiophiles. True lossless audio transmission over current consumer-grade Bluetooth remains technically challenging and resource-intensive, often requiring proprietary hardware or specialized transmitting equipment, limiting universal compatibility and consumer accessibility.

Furthermore, latency—the delay between audio source generation and reproduction in the headphone—remains a critical restraint for professional content creation (video editing, music recording) and competitive e-sports gaming. Although dedicated low-latency modes exist, they often rely on non-standardized connections or specific source devices, making them inconsistent across platforms. For high-fidelity enthusiasts, the inherent noise floor and digital artifacts introduced during wireless transmission, coupled with the reliance on internal digital-to-analog converters (DACs) often optimized for power efficiency over pure quality, prevent wireless headphones from fully displacing high-end wired setups that prioritize signal purity and external DAC/Amplifier flexibility.

How is the focus on sustainability and e-waste influencing product design and corporate strategy in the headphone market?

The increasing focus on sustainability and the growing concern over e-waste are significantly impacting product design and corporate strategies by emphasizing longevity, repairability, and the use of eco-friendly materials. Historically, TWS earbuds were designed as sealed units, making battery replacement or repair nearly impossible, contributing directly to large volumes of electronic waste. In response, leading brands are now exploring modular designs and utilizing more easily recyclable plastics and metals, often incorporating Post-Consumer Recycled (PCR) content into headphone casings and charging cases.

From a corporate strategy perspective, companies are implementing programs for product take-back and recycling, often offering incentives for consumers to return old units. Furthermore, the regulatory environment, particularly in Europe, is pushing for greater transparency regarding product lifecycle and repair scores. This pressure is forcing designers to consider the entire product lifecycle, optimizing batteries not just for performance but also for longevity and eventual replacement, shifting the focus from purely disposable technology toward more circular economy models. Brands that effectively communicate their sustainability commitment gain a competitive edge, appealing to environmentally conscious consumers, particularly in developed markets.

Which regional market is anticipated to show the highest growth rate, and what are the specific underlying economic drivers in that region?

The Asia Pacific (APAC) region is anticipated to exhibit the highest Compound Annual Growth Rate (CAGR) throughout the forecast period. This rapid growth is underpinned by several powerful economic and demographic drivers. Foremost among these is the immense and rapidly expanding middle class in populous nations such as India, Indonesia, and Southeast Asian countries. This demographic shift is translating into higher disposable incomes and increasing consumer appetite for personal electronic devices, facilitating the move from basic mobile connectivity to enhanced audio experiences.

Secondly, the infrastructure growth, specifically the massive deployment of 4G and 5G mobile networks across APAC, provides the necessary bandwidth for reliable wireless audio streaming and sophisticated connected services. Crucially, the presence of major global electronics manufacturing hubs within APAC enables local brands to leverage highly efficient supply chains, leading to aggressive pricing strategies and rapid iteration of product features. This combination of rising income, expanding connectivity, and intense local competition ensures a robust, volume-driven market expansion across the region, making APAC the engine of global wireless headphone growth.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager