Wireless Bluetooth Printers Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433599 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Wireless Bluetooth Printers Market Size

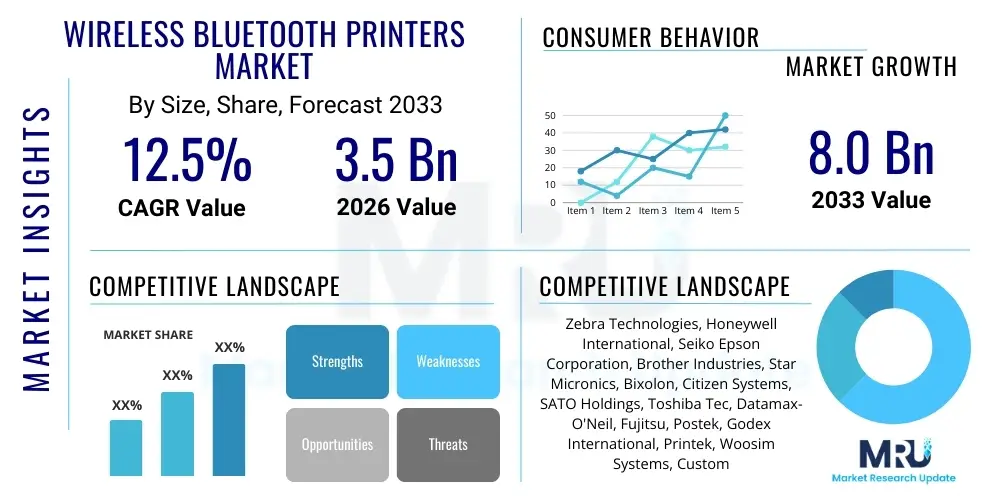

The Wireless Bluetooth Printers Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.5% between 2026 and 2033. The market is estimated at USD 3.5 Billion in 2026 and is projected to reach USD 8.0 Billion by the end of the forecast period in 2033. This robust expansion is primarily driven by the escalating demand for mobile point-of-sale (mPOS) systems across the retail and hospitality sectors, alongside significant adoption in logistics and field service operations requiring instantaneous documentation and receipt generation. The shift from traditional wired systems to highly portable, battery-operated devices is a defining characteristic accelerating this market's valuation.

Wireless Bluetooth Printers Market introduction

The Wireless Bluetooth Printers Market encompasses portable and semi-portable printing devices that utilize Bluetooth technology for seamless, short-range communication with host devices such as smartphones, tablets, and mobile computing terminals. These devices eliminate the necessity for cumbersome physical cabling, offering unparalleled mobility crucial for dynamic work environments. Primarily, these printers function as thermal transfer or direct thermal printers, specializing in generating receipts, labels, tickets, and small-format documents instantly at the point of need. The core product category includes rugged mobile printers designed for demanding industrial environments and sleek, compact printers optimized for retail environments.

Major applications of wireless Bluetooth printers span across vertical industries including retail for queue busting and mPOS transactions, logistics and warehousing for inventory labeling and proof-of-delivery receipts, and healthcare for bedside patient documentation and wristband printing. The intrinsic benefits of these devices, such as enhanced operational efficiency, reduced transaction times, and improved customer experience through instant service, have cemented their necessity in the modern operational landscape. Furthermore, their relatively low maintenance requirements compared to traditional inkjet or laser printers contribute positively to their total cost of ownership (TCO).

Key driving factors underpinning the market growth include the global proliferation of e-commerce, which necessitates efficient label printing for shipping and tracking; the increasing digitization of payments requiring instantaneous, verifiable receipts; and the broader trend of mobile workforce empowerment. Integration capabilities with various operating systems (iOS, Android, Windows Mobile) via standardized Bluetooth protocols (specifically BLE 5.0 for low energy consumption) have made deployment easier and faster for enterprises of all sizes, pushing the market toward higher penetration rates globally, especially in emerging economies undergoing rapid digitalization.

Wireless Bluetooth Printers Market Executive Summary

The Wireless Bluetooth Printers Market is experiencing an accelerated transition driven by miniaturization and enhanced battery technology, allowing devices to maintain high throughput with extended operational cycles. Current business trends emphasize the integration of these printers into sophisticated mPOS ecosystems and enterprise resource planning (ERP) systems, moving beyond simple receipt generation to complex label and barcode printing for asset tracking and compliance. Manufacturers are focusing on developing ruggedized models that offer IP ratings for dust and water resistance, catering specifically to harsh outdoor or industrial environments, thereby broadening the addressable market beyond traditional retail settings. Security remains a paramount concern, prompting the adoption of advanced encryption standards within Bluetooth protocols to protect sensitive transaction data.

Regionally, the Asia Pacific (APAC) stands out as the primary growth engine, fueled by massive investment in logistics infrastructure, the explosive growth of m-commerce platforms, and the rapid adoption of digital payment solutions in countries like China and India. North America and Europe, while representing mature markets, exhibit strong demand for technology replacement cycles and high-performance industrial-grade printers integrated with IoT frameworks. Latin America and the Middle East & Africa (MEA) are emerging regions showing high potential, driven by infrastructure development and the formalization of small and medium-sized enterprises (SMEs) that increasingly rely on portable, affordable transaction systems.

Segment trends indicate a strong inclination towards direct thermal printing technology due to its simplicity, speed, and cost-effectiveness, dominating the receipt and short-term label segment. However, the thermal transfer segment, offering higher durability and resistance to environmental factors, maintains dominance in specialized industrial and inventory labeling applications. Application-wise, the retail and hospitality segment retains the largest market share, but the logistics and transportation segment is projected to exhibit the fastest Compound Annual Growth Rate, driven by the intense need for real-time tracking and delivery confirmation documentation.

AI Impact Analysis on Wireless Bluetooth Printers Market

User queries regarding AI's influence on wireless Bluetooth printers frequently center on how AI can enhance predictive maintenance, optimize printing workflows within smart warehouses, and improve security measures. Users are keenly interested in minimizing downtime by predicting component failure (e.g., printhead lifespan, battery degradation) and ensuring optimal inventory management of consumables like paper and labels. Furthermore, the integration of AI-driven voice commands or hands-free operation in rugged environments is a major theme, particularly for field service technicians or warehouse workers who need simultaneous operation capabilities. Expectations are high for AI to move printing from a reactive task to a proactive, integrated component of the IoT ecosystem, managing device health, resource allocation, and workflow prioritization autonomously.

AI’s primary role in this market is not about changing the fundamental printing mechanism but rather optimizing the entire lifecycle and operational efficiency of the devices. By leveraging machine learning models trained on vast datasets of usage patterns, battery charge cycles, print volumes, and error logs, manufacturers can deliver intelligent firmware updates and cloud-based management platforms. This allows for unparalleled device fleet management, where print jobs are dynamically routed to the nearest available or least utilized printer, ensuring load balancing and preventing bottlenecks in high-volume settings. Such intelligent management significantly enhances overall system reliability and reduces the operational expenditure associated with premature hardware replacement or unexpected failures.

Furthermore, AI algorithms are being employed to analyze print data for business intelligence purposes, particularly in retail and logistics. By analyzing the frequency and content of printed receipts or labels, businesses can gain insights into transaction peak times, popular products, and logistical inefficiencies. This data-driven approach transforms the printer from a passive peripheral into an active data collection point. The implementation of AI-enhanced anomaly detection also bolsters security, instantly flagging unusual printing activity that might indicate a data breach or unauthorized access, thereby safeguarding sensitive transactional information transmitted over the Bluetooth connection.

- AI-enabled Predictive Maintenance: Algorithms forecast printhead wear and battery failure, minimizing equipment downtime.

- Optimized Workflow Management: AI dynamically routes print jobs based on printer location, load, and battery status.

- Enhanced Consumables Inventory: Machine learning models predict paper and label replenishment needs automatically.

- Data-driven Business Insights: Analysis of print logs provides actionable intelligence on transaction patterns and supply chain efficiency.

- Advanced Security Monitoring: Anomaly detection identifies and flags suspicious or unauthorized printing activity instantly.

DRO & Impact Forces Of Wireless Bluetooth Printers Market

The Wireless Bluetooth Printers Market dynamics are shaped by a complex interplay of rapid technological advancements (Drivers), inherent limitations (Restraints), and vast untapped potential (Opportunities), which collectively define the Impact Forces influencing market trajectories. The primary driver is the accelerating shift towards mobility and digitalization across essential sectors like e-commerce and field services, demanding instant, verifiable documentation. Conversely, persistent challenges related to maintaining reliable, extended battery life and addressing the perceived security vulnerabilities of wireless connections act as significant restraints. The long-term opportunity lies in deep integration with Industrial IoT (IIoT) applications and expanding reach into highly fragmented emerging markets, particularly within decentralized logistics networks.

Key drivers include the global expansion of the Internet of Things (IoT) ecosystem, making seamless peripheral connectivity essential, and the robust growth of mobile commerce (m-commerce), which necessitates portable and reliable receipt solutions at the point of interaction. The legislative push for instant documentation in regulated industries, such as healthcare and transportation, further mandates the adoption of mobile printing solutions. These factors create strong positive feedback loops, propelling enterprise investment in upgraded mobile infrastructure and accelerating the replacement cycle of older, wired POS systems with modern, flexible Bluetooth-enabled alternatives.

However, the market faces several inherent restraints. The limited operating range and occasional connection stability issues inherent to standard Bluetooth technology can impede performance in large warehouse environments, often necessitating supplementary solutions like Wi-Fi or RFID. Furthermore, while the cost of the units is decreasing, high-performance, ruggedized industrial models still carry a significant initial investment compared to desktop counterparts. Lastly, managing power consumption to ensure all-day operation remains a design challenge, and end-user concerns regarding Bluetooth security protocols for transmitting sensitive financial data require continuous reassurance through advanced encryption techniques and certifications.

Segmentation Analysis

The Wireless Bluetooth Printers Market is comprehensively segmented based on technology employed, the type of output generated, the end-user application, and the geographic region. This segmentation provides a granular view of market dynamics, revealing varying growth rates and adoption patterns across different subsets. Technology segmentation primarily differentiates between direct thermal and thermal transfer methods, each catering to specific durability and application needs. Type segmentation often distinguishes between mobile, portable, and desktop (with Bluetooth connectivity) models, reflecting differences in size, battery capacity, and ruggedness. The functional application segment is crucial, dividing the market into receipt printing, label and barcode printing, and specialized ticket printing, providing insight into volume versus value segments.

- By Technology:

- Direct Thermal

- Thermal Transfer

- By Type:

- Mobile/Handheld Printers

- Portable Printers (Shoulder/Belt-mounted)

- Desktop Printers with Bluetooth Interface

- By Application:

- Retail and Hospitality (mPOS, Receipt Generation)

- Logistics and Transportation (Proof-of-Delivery, Labeling)

- Healthcare (Patient Wristbands, Documentation)

- Field Service and Utilities (Invoices, Work Orders)

- Government and Public Sector (Ticketing, Enforcement)

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East & Africa (MEA)

Value Chain Analysis For Wireless Bluetooth Printers Market

The value chain for wireless Bluetooth printers begins with upstream activities involving the sourcing of critical electronic components, specialized printing mechanisms, and advanced polymer materials for rugged casing. Key components include printheads (often Japanese or German-sourced), Bluetooth modules (chipsets), and specialized lithium-ion batteries that significantly impact device performance and market competitiveness. Manufacturers must establish robust relationships with component suppliers to manage cost fluctuations and secure access to next-generation Bluetooth Low Energy (BLE) modules essential for maximizing energy efficiency and connectivity reliability. This upstream phase dictates the final quality, durability, and technological capability of the finished product, emphasizing supply chain resilience and component quality control.

Midstream activities involve the design, assembly, and quality assurance processes. Advanced manufacturing techniques, including precision assembly of thermal components and integration of highly compact motherboards, are crucial. Given the global nature of this market, localized assembly and testing centers are often utilized to comply with regional regulatory standards, such as FCC, CE, or specialized safety certifications required for industrial use. Furthermore, product differentiation is achieved through proprietary firmware development and software development kits (SDKs) that facilitate easy integration with third-party mPOS software and enterprise mobile applications. Efficient manufacturing scaling is essential to meet the rapidly expanding demand from volume-driven segments like retail and logistics.

Downstream activities focus heavily on distribution channels, which are bifurcated into direct and indirect methods. Direct channels involve sales to large enterprise clients (e.g., major retailers or global logistics firms) through dedicated sales teams, offering customized integration services and long-term service contracts. Indirect channels utilize a dense network of specialized technology distributors, Value-Added Resellers (VARs) who bundle printers with mPOS software, and e-commerce platforms targeting SMEs and individual users. Effective channel management, coupled with strong post-sales support and technical training, is critical for market penetration and customer retention, especially as printers move into complex, integrated mobile environments where seamless operation is expected.

Wireless Bluetooth Printers Market Potential Customers

The primary end-users and buyers of wireless Bluetooth printers are businesses across various sectors requiring transactional or logistical documentation at decentralized locations, mobility being the central purchasing criterion. Retail and hospitality remain the dominant customer groups, driving significant volume for compact receipt printers used in queue management, tableside ordering, and pop-up store operations. These customers prioritize speed, reliability, and integration ease with mobile POS software, viewing the printer as a critical component in enhancing customer flow and transactional efficiency, especially during peak business hours or seasonal rushes.

The second major cohort comprises the logistics, transportation, and warehousing industries. These end-users demand ruggedized, high-durability label and barcode printers suitable for harsh environments, resistant to dust, temperature variations, and accidental drops. Key applications include printing shipping labels, asset tags, inventory manifests, and proof-of-delivery receipts in real-time. For these buyers, the printer's ability to seamlessly interface with complex warehouse management systems (WMS) and ERP platforms, coupled with long battery life to cover entire shifts, is paramount, making device reliability a non-negotiable purchasing factor.

Emerging, high-value customer segments include healthcare providers and field service organizations (utilities, telecom maintenance). Healthcare facilities utilize these printers for essential applications like printing precise patient identification wristbands at the bedside, ensuring medical safety and compliance, demanding specialized media handling and sanitation compliance. Field service teams rely on mobile printers for generating instant work orders, invoices, and compliance documentation on-site, enhancing service delivery professionalism and accelerating billing cycles. These specialized applications often require specific certifications and robust security features to protect patient data (HIPAA compliance) or proprietary business information.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.5 Billion |

| Market Forecast in 2033 | USD 8.0 Billion |

| Growth Rate | 12.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Zebra Technologies, Honeywell International, Seiko Epson Corporation, Brother Industries, Star Micronics, Bixolon, Citizen Systems, SATO Holdings, Toshiba Tec, Datamax-O'Neil, Fujitsu, Postek, Godex International, Printek, Woosim Systems, Custom America, HPRT, Dascom, HP Inc., Canon Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Wireless Bluetooth Printers Market Key Technology Landscape

The technological landscape of the Wireless Bluetooth Printers Market is predominantly characterized by advancements in thermal printing methods, secure wireless connectivity, and improved energy management systems. Direct Thermal (DT) printing remains the most common technology for receipt generation due to its cost-effectiveness, speed, and minimal need for consumables other than specialized paper. However, for applications requiring archival quality or resistance to heat, abrasion, or chemicals—such as specialized logistics labels or asset tracking tags—Thermal Transfer (TT) technology, which utilizes a ribbon, is the preferred standard. Innovations are focused on optimizing printhead density (DPI) to handle increasingly complex 2D barcodes and small QR codes accurately, essential for digital verification and tracking systems.

Crucially, the market’s performance is intrinsically tied to the evolution of Bluetooth standards. The widespread adoption of Bluetooth Low Energy (BLE), particularly the Bluetooth 5.0 and newer specifications, has been a game-changer. BLE significantly reduces the power consumption required for maintaining continuous connection while increasing range and data throughput capacity. This allows portable devices to achieve extended operational battery life, a critical performance metric for all-day field service use. Security enhancements, including mandatory robust encryption and pairing authentication protocols, address enterprise concerns regarding data integrity during wireless transmission, thereby accelerating adoption in compliance-heavy sectors like finance and healthcare.

Furthermore, the integration of printers with cloud-based management platforms via embedded Wi-Fi or cellular gateways, coupled with Bluetooth connectivity to local devices, represents a significant technological leap. This hybrid connectivity model supports fleet management, remote diagnostics, automatic firmware updates, and centralized configuration across geographically dispersed devices. Manufacturers are increasingly providing comprehensive Software Development Kits (SDKs) and Application Programming Interfaces (APIs) compatible with diverse mobile operating systems, ensuring seamless integration and future-proofing the devices within evolving enterprise mobile ecosystems. The ongoing trend is towards making the printer a smarter, network-aware IoT endpoint rather than just a simple peripheral.

Regional Highlights

Regional dynamics in the Wireless Bluetooth Printers Market are highly diversified, reflecting varying levels of infrastructural maturity, digital payment penetration, and logistics sector growth. North America, characterized by high disposable income and early adoption of technology, represents a mature market focused on integrating high-performance, rugged mobile printers into large-scale retail and logistics operations. Demand here is driven by technology replacement cycles, strict regulatory compliance requiring precise documentation, and the widespread use of mPOS systems in the highly competitive retail environment. Market players focus heavily on offering advanced security features and robust integration capabilities with complex enterprise software suites common in the region.

Asia Pacific (APAC) stands out as the global leader in terms of market expansion and growth potential. Countries such as China, India, and Southeast Asian nations are undergoing massive transformations in their logistics and e-commerce sectors, fueling unprecedented demand for affordable, high-volume receipt and label printers. The rapid proliferation of smartphones and mobile wallets in this region directly translates into increased need for mobile printers to finalize transactions efficiently. Government initiatives promoting digitalization and the growth of millions of small and medium-sized enterprises (SMEs) contribute significantly to the sheer volume uptake of these devices, often prioritizing cost-effectiveness and localized language support.

Europe maintains a strong market presence, driven by strict requirements in the healthcare and public sectors, alongside robust demand from the structured retail environment. The European market emphasizes quality, sustainability, and adherence to regional data protection regulations (like GDPR), necessitating advanced encryption and secure device management features. Latin America and the Middle East & Africa (MEA) are characterized by lower market maturity but exhibit high growth rates. Investment in infrastructure and the formalization of economies in these regions are steadily increasing the need for formalized receipting and labeling solutions, particularly in rapidly urbanizing areas and developing international trade hubs.

- Asia Pacific (APAC): Highest projected CAGR, driven by explosive e-commerce growth, logistics infrastructure investment, and high mobile payment penetration in China and India.

- North America: Mature market focusing on technology replacement, rugged industrial-grade printers, and deep integration with large enterprise logistics and retail chains.

- Europe: Strong regulatory environment (GDPR, documentation standards) drives demand for secure printers in retail, healthcare, and public services; emphasis on quality and compliance.

- Latin America (LATAM): Emerging market showing rapid growth due to increasing formalization of small businesses and investment in local distribution networks and mobile technology.

- Middle East & Africa (MEA): High potential fueled by developing trade routes, urbanization, and government initiatives promoting digitization of services and infrastructure projects.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Wireless Bluetooth Printers Market.- Zebra Technologies

- Honeywell International

- Seiko Epson Corporation

- Brother Industries, Ltd.

- Star Micronics Co., Ltd.

- Bixolon Co., Ltd.

- Citizen Systems Japan Co., Ltd.

- SATO Holdings Corporation

- Toshiba Tec Corporation

- Datamax-O'Neil (now part of Honeywell)

- Fujitsu Limited

- Postek Electronics Co., Ltd.

- Godex International Co., Ltd.

- Printek LLC

- Woosim Systems Inc.

- Custom America Inc.

- HPRT (Xiamen Hanin Electronic Technology Co., Ltd.)

- Dascom (Beijing Dingsheng Dascom Data Processing Co., Ltd.)

- HP Inc.

- Canon Inc.

Frequently Asked Questions

Analyze common user questions about the Wireless Bluetooth Printers market and generate a concise list of summarized FAQs reflecting key topics and concerns.What specific Bluetooth standard is most important for modern mobile printers?

Bluetooth Low Energy (BLE), particularly specifications 5.0 and higher, is critical. BLE maximizes battery life, ensures faster pairing, and provides the secure, sustained connection required for all-day operation in retail and field service environments.

How do wireless Bluetooth printers enhance operational efficiency in logistics and warehousing?

They enable real-time printing of shipping labels, inventory tags, and receipts directly at the point of action, eliminating travel time to stationary printers. This mobility accelerates processes like cross-docking, inventory audits, and proof-of-delivery confirmation, significantly reducing fulfillment cycles.

What is the primary difference between Direct Thermal and Thermal Transfer Bluetooth printers?

Direct Thermal (DT) printers use heat-sensitive paper and do not require ink or ribbons, making them ideal for temporary outputs like receipts. Thermal Transfer (TT) printers use a ribbon, providing highly durable, long-lasting print quality resistant to heat, light, and chemicals, necessary for asset tracking labels.

Are Bluetooth printers secure for handling sensitive transaction data like credit card information?

Modern enterprise-grade Bluetooth printers use advanced encryption methods and secure pairing protocols to safeguard transmitted data. Integration with PCI-compliant mobile POS systems further ensures that sensitive card data is encrypted end-to-end, meeting industry security standards.

Which application segment offers the highest growth potential for wireless Bluetooth printers in the forecast period?

The Logistics and Transportation segment is projected to show the highest CAGR. Driven by the massive global increase in e-commerce volumes and the necessity for instant, verifiable tracking information and delivery receipts, demand for ruggedized mobile label printers is soaring.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager