Wireless Electronic Health Records Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438976 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Wireless Electronic Health Records Market Size

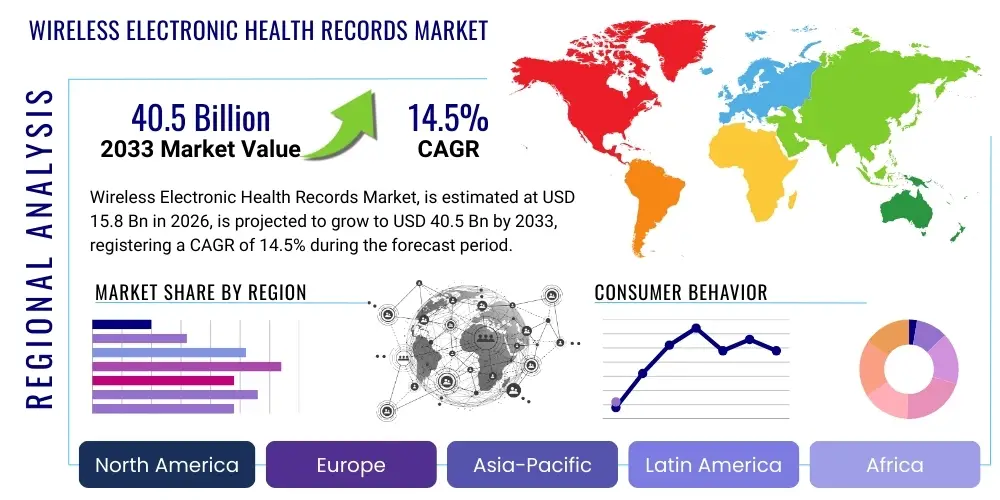

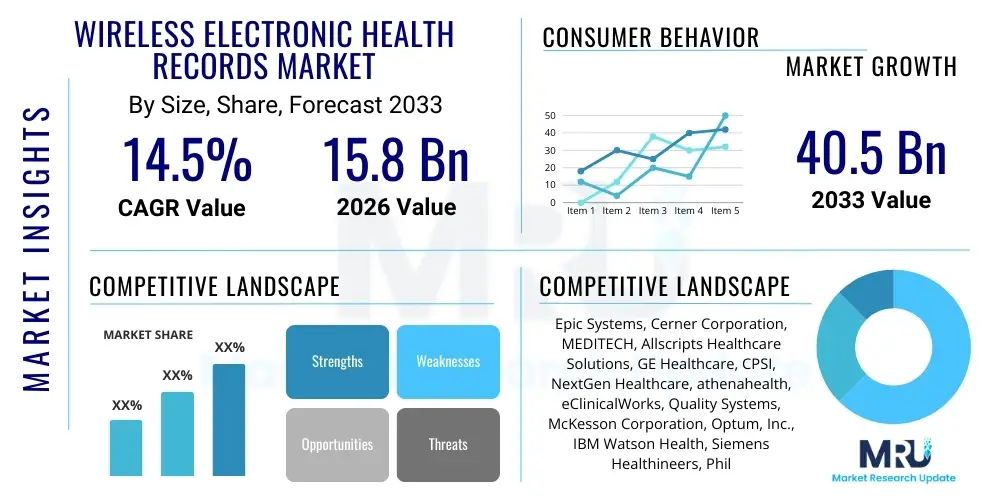

The Wireless Electronic Health Records Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 14.5% between 2026 and 2033. The market is estimated at USD 15.8 Billion in 2026 and is projected to reach USD 40.5 Billion by the end of the forecast period in 2033.

Wireless Electronic Health Records Market introduction

The Wireless Electronic Health Records (EHR) market encompasses solutions that leverage mobile devices, cloud technology, and wireless connectivity (such as Wi-Fi, 4G, 5G, and Bluetooth) to enable healthcare providers to access, update, and manage patient records in real-time, regardless of their physical location within a healthcare facility or while performing telehealth services. These systems move beyond traditional tethered desktop applications, offering unparalleled flexibility, which is critical in fast-paced clinical environments, emergency rooms, and during remote patient monitoring scenarios. The core technology integrates robust security protocols to ensure compliance with global data privacy standards, facilitating seamless data exchange and enhancing clinical decision-making processes at the point of care.

Wireless EHR systems are fundamentally transforming clinical workflows by reducing administrative burden and improving the accuracy of documentation. Major applications span acute care hospitals, specialized clinics, ambulatory surgical centers, and home healthcare settings. The primary product description centers on software suites—often cloud-based—that are optimized for mobile operating systems, accompanied by hardware elements like secure tablets and mobile workstations. These systems provide features such as computerized provider order entry (CPOE), clinical decision support (CDS), and patient portal access, all delivered through secure wireless networks.

The key benefits driving market adoption include significant improvements in operational efficiency, enhanced patient safety through immediate access to comprehensive medical histories, and increased collaboration among multidisciplinary care teams. Furthermore, these systems facilitate better billing accuracy and regulatory compliance necessary for modern healthcare operations. The market is propelled by the global shift towards digital health initiatives, increasing demand for remote patient monitoring tools, and the widespread integration of advanced mobile devices into clinical practice. Government incentives promoting EHR adoption and interoperability standards also act as substantial driving factors for continued market growth.

Wireless Electronic Health Records Market Executive Summary

The Wireless Electronic Health Records market is experiencing robust growth driven primarily by technological convergence, including the mass deployment of 5G networks and the increasing sophistication of cloud computing services tailored for healthcare data. Key business trends indicate a strong move toward subscription-based, Software-as-a-Service (SaaS) models, minimizing upfront capital expenditure for healthcare facilities and allowing for scalability. Furthermore, there is intense competition focused on achieving seamless interoperability, with major vendors actively developing Fast Healthcare Interoperability Resources (FHIR)-compliant solutions to ensure easy data exchange across disparate systems, a crucial factor for integrated care networks and Accountable Care Organizations (ACOs). The strategic focus of market players is shifting towards integrating specialized modules, such as telehealth platforms and advanced predictive analytics, directly into the mobile EHR interface, cementing the utility of wireless access far beyond simple documentation.

Regionally, North America maintains the largest market share, characterized by high digital literacy, established regulatory frameworks (like HIPAA and HITECH Act incentives), and substantial technology investment in large hospital networks. However, the Asia Pacific (APAC) region is projected to register the highest Compound Annual Growth Rate (CAGR) during the forecast period. This accelerated growth in APAC is fueled by massive investments in healthcare infrastructure modernization across countries like India and China, coupled with a surging population demanding accessible and efficient healthcare services, often bypassing legacy fixed infrastructure entirely and adopting mobile-first solutions. European markets are driven by stringent data privacy regulations like GDPR, which mandate high-security standards for wireless EHR implementations, focusing on secure access and controlled data flow among member states' health systems.

In terms of segmentation, the Services component segment, encompassing implementation, training, and maintenance support for complex wireless deployments, holds the dominant revenue share and is expected to continue its growth trajectory due to the ongoing need for customization and optimization of these sophisticated systems. Deployment-wise, the Cloud-based segment is expanding rapidly, overtaking traditional On-premise installations, primarily because cloud solutions offer superior scalability, lower total cost of ownership (TCO), and inherently better support for mobile and remote access requirements vital for wireless functionality. The Hospital end-user segment remains the largest consumer of wireless EHR solutions, but the Ambulatory Surgical Centers and specialized clinics segments are exhibiting faster uptake rates as smaller practices seek cost-effective, easy-to-deploy, and highly mobile record management solutions.

AI Impact Analysis on Wireless Electronic Health Records Market

Users commonly query how Artificial Intelligence (AI) can move beyond passive data storage in wireless EHRs to actively improve clinical workflow and patient outcomes. Key concerns revolve around the accuracy of AI-driven diagnostic suggestions in mobile settings, the impact of AI on clinical autonomy, and critically, the security implications of utilizing vast amounts of aggregated, wirelessly transmitted patient data for machine learning models. Users are keenly interested in predictive analytics capabilities—specifically, how AI integrated into mobile EHR interfaces can flag potential patient deterioration (e.g., sepsis alerts) in real-time or predict appointment no-shows, optimizing resource allocation. The integration must be seamless, fast, and reliable even on variable wireless network connections, leading to questions about edge computing applications within wireless EHR infrastructure.

AI's influence is profound, transforming wireless EHRs from transactional tools into predictive and prescriptive systems. By analyzing unstructured data (like clinical notes and imaging reports) alongside structured data captured wirelessly, AI models provide advanced clinical decision support directly accessible on mobile devices. This immediate insight enhances diagnostic accuracy, personalizes treatment plans, and minimizes human errors associated with data entry or complex calculations. Furthermore, AI automates repetitive administrative tasks, such as medical coding and billing preparation, allowing physicians utilizing mobile devices to dedicate more time to direct patient interaction rather than documentation, thereby significantly boosting the efficiency gains promised by wireless access.

The deployment of AI also heavily impacts the technical backbone of wireless EHRs, particularly in maintaining data integrity and security. AI algorithms are crucial for advanced threat detection, identifying unusual access patterns or data leakage attempts across the distributed wireless network architecture. Optimized AI models running on edge devices (like secure mobile workstations) can perform preliminary data processing and anonymization locally, reducing reliance on constant high-bandwidth connections to the central cloud server while ensuring that real-time clinical alerts are delivered instantly, even in areas with limited connectivity, thereby fulfilling the potential of mobility in healthcare delivery.

- AI enables real-time clinical decision support (CDS) directly on mobile devices, improving diagnosis speed.

- Predictive analytics integrated into wireless EHRs anticipate patient risks (e.g., adverse drug reactions, sepsis).

- Machine learning streamlines administrative processes like automated medical coding and documentation generation.

- Natural Language Processing (NLP) extracts crucial unstructured data from clinical notes for comprehensive analysis.

- AI enhances data security and fraud detection by monitoring access logs and network traffic across wireless environments.

- Workflow optimization using AI minimizes click counts and screen switching in mobile interfaces, improving user experience.

DRO & Impact Forces Of Wireless Electronic Health Records Market

The Wireless Electronic Health Records market is primarily driven by the escalating global need for streamlined, accessible, and high-quality healthcare, coupled with the ubiquity of advanced mobile technology in clinical settings. The significant impact force is the regulatory environment, particularly government mandates and incentives in developed nations (like the U.S. and E.U.) encouraging the digital transformation of patient records to improve interoperability and reduce healthcare costs. Opportunities abound in expanding into emerging markets where mobile health infrastructure is often favored over costly fixed legacy systems. However, market expansion is restrained by persistent high costs associated with initial system implementation and training, and the critical challenge of ensuring robust data security and privacy compliance across distributed, highly mobile access points.

Key drivers include the dramatic rise in telehealth adoption, which fundamentally relies on secure, wireless access to patient data to facilitate remote consultations and monitoring. Furthermore, the drive towards value-based care models globally necessitates real-time data capture and analysis, achievable only through mobile and integrated EHR platforms. Technological advancements such as the deployment of 5G networks are reducing latency, making high-volume, secure data transmission viable in highly mobile environments, significantly overcoming one of the historical technical constraints of truly wireless EHR operation. The increased physician demand for tools that reduce burnout, specifically through efficient mobile documentation, also acts as a powerful demand-side driver.

Restraints center predominantly on cybersecurity vulnerability. Data transmitted wirelessly is inherently susceptible to interception or unauthorized access, demanding continuous investment in advanced encryption and authentication protocols, which adds complexity and cost. Regulatory compliance, specifically maintaining adherence to evolving standards like HIPAA, GDPR, and country-specific data residency laws, adds another layer of complexity, particularly for multinational EHR vendors. The opportunity landscape is vast, primarily through the integration of emerging technologies like Blockchain for immutable record management and enhanced patient data provenance, and the potential to revolutionize chronic disease management through highly personalized, remote monitoring programs powered by integrated wireless EHR data streams.

Segmentation Analysis

The Wireless Electronic Health Records market is comprehensively segmented based on its technical composition (Component), delivery model (Deployment), and the nature of the primary consumers (End-User). This segmentation helps in understanding the varying demands across the healthcare ecosystem, ranging from large-scale hospital networks requiring extensive customization and services to smaller, ambulatory settings favoring standardized, cost-effective cloud solutions. The component segmentation highlights the division of revenue between the core software functionality, the necessary physical hardware (mobile devices, servers), and the critical services required for implementation and continuous support.

Analysis by deployment type reveals a significant market shift. While traditional On-premise solutions still hold market share, particularly in institutions prioritizing absolute control over their sensitive data, the momentum is undeniably with the Cloud-based segment. Cloud deployment facilitates the core benefit of wireless EHRs—mobility and accessibility—by removing dependence on internal IT infrastructure and enabling access from any authorized location using diverse devices. The end-user analysis provides insights into spending patterns, confirming hospitals as the largest segment due to their patient volume and complexity, although ambulatory care centers are the fastest-growing segment, demonstrating rapid digital adoption spurred by the need for operational efficiency in decentralized settings.

- Component

- Software (Clinical Modules, Administrative Modules, Reporting Tools)

- Hardware (Mobile Workstations, Tablets, Dedicated Servers)

- Services (Implementation, Training, Consulting, Support & Maintenance)

- Deployment

- Cloud-based

- On-premise

- End-User

- Hospitals

- Clinics

- Ambulatory Surgical Centers

- Diagnostic Centers

Value Chain Analysis For Wireless Electronic Health Records Market

The value chain for the Wireless Electronic Health Records market begins with the upstream activities centered on extensive Research and Development (R&D) and core software development. This phase involves creating highly sophisticated, secure, and interoperable software architecture, focusing heavily on user interface (UI) and user experience (UX) design optimized for mobile devices and clinical workflows. Crucial upstream inputs include specialized high-performance cloud infrastructure providers, cybersecurity solutions, and developers focused on meeting evolving healthcare standards (e.g., HL7, FHIR). The development stage is capital intensive, requiring deep domain expertise in clinical informatics and regulatory compliance, establishing a high barrier to entry for new market participants and ensuring that established vendors with large R&D budgets dominate the market.

The midstream phase focuses on system integration, manufacturing (for specialized mobile hardware/peripherals), and meticulous quality assurance. System integrators play a vital role, customizing standardized EHR platforms to fit the unique operational requirements of diverse healthcare providers, integrating the EHR with existing legacy systems (such as PACS or LIS), and ensuring secure wireless network performance across the entire facility. Distribution channels are complex, involving both direct sales teams targeting large hospital enterprises and partnerships with Value-Added Resellers (VARs) and IT consultants who cater to smaller clinics and ambulatory centers, offering localized implementation and support expertise, which is crucial for achieving high adoption rates and successful system utilization.

Downstream activities are dominated by implementation, training, and long-term maintenance services, which often represent the largest revenue component (the Services segment). Successful deployment requires comprehensive training for clinicians and administrative staff on using the mobile interfaces effectively while maintaining patient data security protocols. Post-implementation support is mandatory, as systems require constant updates to adhere to regulatory changes, incorporate new clinical guidelines, and integrate emerging technologies like advanced AI modules or new connected IoT health devices. The high reliance on customized implementation and sustained support ensures that the indirect distribution channel, facilitated by specialized service providers, remains a dominant force in the market structure.

Wireless Electronic Health Records Market Potential Customers

The primary purchasers and end-users of Wireless Electronic Health Records solutions are diverse healthcare organizations seeking to modernize their data management systems and enhance mobility within their care delivery models. Hospitals, especially large acute-care, teaching, and integrated delivery networks (IDNs), represent the largest customer base. These institutions require robust, highly scalable, and fully integrated systems capable of managing thousands of patient records, accommodating diverse medical specialties, and supporting complex operational demands, including mobile access within the Emergency Department and operating theaters. Their purchasing decisions are heavily influenced by vendor reputation, proven implementation success, and the system's ability to seamlessly integrate with their existing infrastructure and meet rigorous regulatory compliance standards.

Ambulatory care settings, including specialized physician groups, outpatient clinics, and primary care centers, form the fastest-growing segment of potential customers. These buyers often favor cloud-based wireless EHR solutions due to the need for lower capital investment, rapid deployment, and minimal dedicated IT staff requirements. For these customers, the mobility afforded by wireless access is key to reducing waiting times, enabling documentation during patient encounters, and facilitating immediate access to labs and imaging results without requiring fixed workstations. Furthermore, the growing number of urgent care centers and satellite clinics established by larger hospital systems necessitates agile, wireless EHR access points.

Other significant potential customers include diagnostic laboratories and specialized healthcare facilities such as nursing homes and long-term care facilities. Diagnostic centers require wireless EHR integration to swiftly transmit results to referring physicians and manage high volumes of incoming orders electronically. Long-term care facilities benefit immensely from mobile EHRs to document bedside care, track medication administration, and coordinate care transitions efficiently, improving overall accountability and adherence to mandated care protocols in geographically distributed settings, thus driving demand for highly optimized mobile interfaces.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 15.8 Billion |

| Market Forecast in 2033 | USD 40.5 Billion |

| Growth Rate | CAGR 14.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Epic Systems, Cerner Corporation, MEDITECH, Allscripts Healthcare Solutions, GE Healthcare, CPSI, NextGen Healthcare, athenahealth, eClinicalWorks, Quality Systems, McKesson Corporation, Optum, Inc., IBM Watson Health, Siemens Healthineers, Philips Healthcare, Agfa-Gevaert NV, Greenway Health, Dell Technologies |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Wireless Electronic Health Records Market Key Technology Landscape

The foundation of the Wireless Electronic Health Records market relies heavily on a sophisticated convergence of several interconnected technologies, paramount among which is advanced Cloud Computing architecture. Hyper-scale cloud infrastructure providers (Public, Private, and Hybrid models) offer the necessary scalability, computational power, and disaster recovery capabilities essential for managing massive volumes of sensitive patient data. Crucially, the cloud enables the distributed access model fundamental to wireless EHRs, ensuring that authorized clinicians can securely access data in real-time from any location using their mobile devices. The transition from monolithic on-premise systems to modular, API-driven cloud platforms accelerates feature deployment and regulatory compliance updates, providing a significant competitive advantage in the market.

Mobile Technology Integration (mHealth) is another cornerstone, involving the optimization of EHR software for various operating systems (iOS, Android) and form factors (tablets, smartphones, wearables). This optimization goes beyond simple scaling, requiring specialized user interface design that facilitates quick charting and data retrieval under high-pressure clinical scenarios. Furthermore, the deployment of 5G connectivity is rapidly gaining prominence. 5G’s ultra-low latency and high bandwidth capacity address previous limitations in real-time streaming of large files, such as high-resolution medical imaging, over wireless networks, thus significantly enhancing the utility and speed of mobile EHR access and supporting complex telehealth consultations seamlessly.

Crucially, the market relies on robust Interoperability Standards and Security Technologies. The adoption of FHIR (Fast Healthcare Interoperability Resources) is mandatory, as it standardizes data exchange protocols, enabling seamless communication between different EHR systems, labs, and pharmacies—a prerequisite for integrated wireless care. For security, technologies like End-to-End Encryption, Multi-Factor Authentication (MFA) tailored for mobile access, and increasingly, Blockchain technology, are being implemented. Blockchain offers a decentralized, immutable ledger for tracking access and modification of records, substantially enhancing data provenance and security, especially across fragmented wireless networks and remote access points, addressing the paramount concern of healthcare data integrity.

Regional Highlights

Regional dynamics are critical in shaping the Wireless Electronic Health Records market, driven by varying regulatory climates, healthcare spending habits, and technological readiness across continents.

- North America (U.S. and Canada): This region is the undisputed market leader, primarily due to aggressive governmental initiatives, such as incentives under the HITECH Act, promoting widespread EHR adoption. The presence of major vendors, high rates of advanced technology uptake (especially 5G and cloud services), and significant investments in sophisticated IT infrastructure within large hospital systems ensure continued market dominance. The U.S. market specifically benefits from a strong push toward interoperability and value-based care, necessitating highly mobile and connected EHR solutions.

- Europe (Germany, UK, France): Europe represents the second-largest market, characterized by centralized national health services (e.g., NHS in the UK) and strong adherence to strict data protection regulations, particularly the General Data Protection Regulation (GDPR). Market growth is driven by digitalization efforts aimed at creating seamless cross-border healthcare services and optimizing aging populations' care. Adoption focuses heavily on secure, compliant cloud solutions that facilitate data sharing while maintaining patient privacy.

- Asia Pacific (APAC) (China, India, Japan): APAC is the fastest-growing regional market, driven by rapid urbanization, massive investment in healthcare infrastructure expansion, and a growing middle class demanding higher quality medical services. Countries like India and China are leapfrogging traditional fixed IT infrastructures, directly implementing mobile and cloud-based EHRs, particularly in remote and rural areas, to expand healthcare accessibility. Government support for digital health initiatives (e.g., Ayushman Bharat in India) provides a massive impetus for wireless EHR deployment.

- Latin America (LATAM): This region exhibits moderate but accelerating growth, characterized by increasing private sector investment and government efforts to standardize health record management to improve public health outcomes. Key challenges include fragmented healthcare systems and variable internet connectivity, making highly flexible, often hybrid (on-premise/cloud) wireless solutions preferable.

- Middle East and Africa (MEA): Growth in MEA is concentrated in the Gulf Cooperation Council (GCC) countries (UAE, Saudi Arabia), which are investing heavily in world-class digital hospitals and smart cities, integrating advanced wireless EHRs as foundational elements. Africa's market development is slower but is seeing growth driven by mHealth initiatives leveraging mobile connectivity to provide basic primary care access.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Wireless Electronic Health Records Market.- Epic Systems

- Cerner Corporation (An Oracle Company)

- MEDITECH

- Allscripts Healthcare Solutions (Now Part of Altera Digital Health)

- GE Healthcare

- CPSI (Computer Programs and Systems, Inc.)

- NextGen Healthcare

- athenahealth

- eClinicalWorks

- Quality Systems (NextGen Healthcare)

- McKesson Corporation

- Optum, Inc. (A UnitedHealth Group Company)

- IBM Watson Health

- Siemens Healthineers

- Philips Healthcare

- Agfa-Gevaert NV

- Greenway Health

- Dell Technologies

Frequently Asked Questions

Analyze common user questions about the Wireless Electronic Health Records market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary security risks associated with wireless EHR adoption?

The primary security risks involve data interception during wireless transmission (Man-in-the-Middle attacks), unauthorized access via lost or stolen mobile devices, and vulnerabilities inherent in distributed network access points. Mitigation strategies include robust end-to-end encryption, multi-factor authentication, and strict adherence to data privacy regulations like HIPAA and GDPR.

How does 5G technology specifically benefit the performance of wireless EHR systems?

5G technology significantly benefits wireless EHR performance by offering ultra-low latency and higher bandwidth compared to previous generations. This enables faster real-time data synchronization, quicker loading of large medical images (like MRIs or CT scans) on mobile devices, and more reliable support for complex telehealth video consultations, even in high-density clinical environments.

Which component segment holds the largest share in the Wireless EHR market?

The Services component segment, which includes implementation, system integration, customization, training, and ongoing maintenance support, holds the largest revenue share. This dominance reflects the complexity and customized nature of deploying enterprise-level EHR systems and the continuous need for technical optimization and regulatory compliance updates.

Is the Cloud-based deployment model safer than On-premise for wireless EHRs?

Cloud-based models often offer superior security infrastructure, benefiting from the specialized cybersecurity expertise, continuous monitoring, and substantial resources of major cloud providers, which generally surpass the capabilities of local hospital IT departments. While control is ceded, the resulting security posture is frequently more robust and compliant, especially for mobile access.

What is the most significant driver for the adoption of wireless EHR solutions?

The most significant driver is the increasing global demand for improved operational efficiency and clinical mobility, particularly fueled by the massive growth of telehealth services and the necessity for healthcare providers to access and update patient records instantly at the point of care, thereby reducing documentation time and enhancing patient safety.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager