Wireless Flash Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432066 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Wireless Flash Market Size

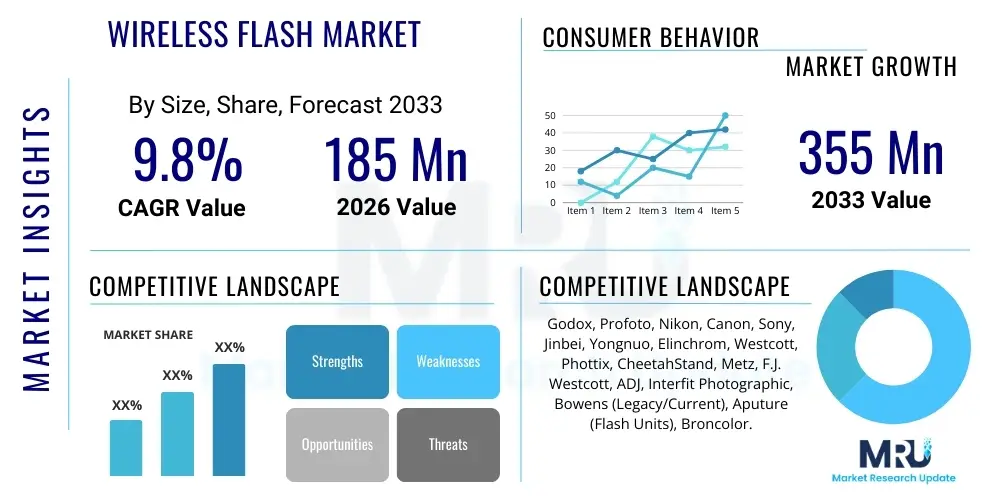

The Wireless Flash Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.8% between 2026 and 2033. The market is estimated at $185 Million USD in 2026 and is projected to reach $355 Million USD by the end of the forecast period in 2033. This robust growth trajectory is primarily driven by the increasing adoption of mirrorless camera systems, which necessitate advanced, high-power external lighting solutions capable of complex off-camera flash coordination. Furthermore, the expansion of the digital content creation industry, spanning professional studios, freelance photographers, and sophisticated hobbyists, fuels the demand for flexible and portable lighting setups that wireless flash technology inherently provides.

Market expansion is also supported by continuous technological advancements, particularly in High-Speed Sync (HSS) capabilities and improved battery technology, such as lithium-ion integration, which offers longer operational times and faster recycling speeds. These innovations reduce workflow friction, making professional lighting techniques more accessible and efficient for on-location shoots. The transition from legacy optical triggering systems to highly reliable radio frequency (RF) systems ensures consistent performance across varied environments, positioning wireless flash as an indispensable tool in modern professional photography toolkits globally.

Wireless Flash Market introduction

The Wireless Flash Market encompasses photographic external lighting units (speedlights and strobes) designed to operate remotely without direct physical connection to the camera body, utilizing radio frequency (RF) or optical communication protocols for triggering and control. These systems are crucial for manipulating light quality, direction, and intensity off-camera, enabling creative control over exposure, shadow, and mood. Products range from compact, battery-powered speedlights primarily used by wedding and event photographers to high-powered, AC/DC-powered studio strobes favored by commercial and fashion photographers. The core functionality revolves around reliable, synchronized firing and precise power management facilitated through dedicated remote transmitters mounted on the camera's hot shoe.

Major applications of wireless flash technology span several lucrative sectors, including commercial advertising, portrait photography, event coverage (weddings, sports), cinematic production requiring selective light reinforcement, and the rapidly expanding field of e-commerce product photography. The inherent benefit of wireless operation lies in the unparalleled flexibility it offers: photographers can place lights far from the camera, behind subjects, or in locations where cables would be impractical or hazardous. This freedom enhances artistic expression and dramatically improves the quality of captured imagery by allowing for dynamic, multi-point lighting configurations that cannot be achieved with on-camera flash units alone.

Key driving factors accelerating market adoption include the proliferation of high-resolution digital cameras demanding sophisticated lighting for optimal image quality, the consumer shift towards professional-grade content production facilitated by accessible pricing models, and the ongoing miniaturization of high-output flash units. The development of robust, interference-resistant RF triggering systems, often with proprietary software integration for specific camera brands (e.g., Canon, Nikon, Sony), further secures reliable performance, cementing the wireless flash system as a fundamental component of contemporary digital imaging workflows worldwide.

Wireless Flash Market Executive Summary

The Wireless Flash Market is experiencing significant momentum driven by robust business trends focusing on integration, portability, and smart control systems. Key manufacturers are prioritizing the development of proprietary 2.4 GHz RF systems that offer extended range and advanced features like Through-The-Lens (TTL) metering and High-Speed Sync (HSS) compatibility across diverse camera platforms, reducing reliance on outdated optical slaves. The competitive landscape is characterized by established camera brands (Canon, Nikon) defending market share against specialized third-party lighting experts (Godox, Profoto) who offer more versatile, often cross-brand compatible, and aggressively priced systems. The trend towards modular design and interchangeable accessories (reflectors, softboxes) supports a thriving ecosystem for professional users seeking customizable lighting solutions.

Regionally, Asia Pacific (APAC) stands out as the fastest-growing market, propelled by its substantial manufacturing base, rapid urbanization, and a burgeoning middle class investing in high-quality digital imaging equipment for both leisure and professional pursuits. North America and Europe maintain dominance in terms of overall market value due to a high concentration of established professional studios, advertising agencies, and demanding freelance creative professionals who regularly upgrade to high-end, premium wireless strobe systems. Latin America and MEA are exhibiting high growth potential, albeit from a smaller base, driven by increasing internet penetration and the localized rise of social media influencers requiring sophisticated self-produced content.

Segmentation trends highlight a critical shift from dedicated TTL-only systems to hybrid manual/TTL units that offer the precision of automated metering alongside the fine control of manual power adjustments, catering to both speed and creative control demands. By application, the professional portrait and wedding photography segments remain core revenue drivers, but the e-commerce and commercial content creation segment is rapidly gaining ground, particularly favoring portable, battery-powered systems that facilitate on-location and quick-setup product shoots. This convergence of professional functionality and consumer accessibility dictates future product development and pricing strategies across the market.

AI Impact Analysis on Wireless Flash Market

User queries regarding AI's influence in the Wireless Flash Market primarily center on automated exposure control, smart metering capabilities in complex lighting scenarios, and the integration of AI-powered subject recognition for optimized light placement and intensity. Users are keenly interested in whether AI can simplify the often-complex setup process involving multiple off-camera flashes, particularly concerning calculating guide numbers, flash duration, and light fall-off dynamically. The underlying expectation is that AI technology will move wireless flash systems from reactive metering to proactive, predictive lighting control, significantly reducing the manual adjustments required during fast-paced or rapidly changing shooting environments like weddings or sports.

The immediate and tangible impact of AI is visible in enhanced Through-The-Lens (TTL) metering algorithms. Traditional TTL struggles with highly reflective surfaces or complex scenes where the central subject occupies only a small portion of the frame; AI-enhanced systems utilize deep learning models trained on vast datasets of photographic scenarios to accurately identify the primary subject, assess ambient conditions, and calculate the exact flash power needed for balanced exposure, minimizing blown highlights or deep shadows. This computational intelligence translates into a higher hit rate of perfectly exposed images straight out of the camera, saving significant time in post-production and improving user satisfaction, particularly among intermediate users.

Furthermore, AI facilitates predictive modeling for complex multi-flash setups. Future wireless flash triggers, equipped with edge computing capabilities, could potentially analyze real-time video feed or initial pre-flashes, recognize the physical placement and angle of multiple slave units, and suggest or automatically implement power ratio adjustments (e.g., 2:1 ratio for key light to fill light) based on desired creative output (e.g., high-key, dramatic, flat). This automation drastically lowers the entry barrier for intricate lighting schemes and promotes the adoption of multiple flash heads, consequently driving sales of advanced wireless systems and related accessories.

- AI-Enhanced TTL Metering: Improves flash exposure accuracy by utilizing subject recognition and environmental analysis, reducing misfires in complex scenarios.

- Predictive Power Adjustment: Enables triggers to analyze ambient light changes and subject movement, automatically adjusting flash intensity for continuous, optimal illumination.

- Automated Multi-Flash Ratios: AI systems can analyze the relative position of multiple lights and calculate necessary power ratios for balanced lighting schemes without manual user input.

- Simplified Workflow Integration: AI algorithms streamline the interface of wireless triggers, offering smart modes that suggest optimal settings based on the camera lens, focal length, and intended subject distance.

- Real-time Color Consistency: AI calibration ensures that the color temperature and quality across multiple flash units remain consistent, correcting for slight variances in tube age or power level.

DRO & Impact Forces Of Wireless Flash Market

The Wireless Flash Market is subject to various interconnected Drivers, Restraints, and Opportunities (DRO) that shape its competitive dynamics and overall growth trajectory. Key drivers include the exponential growth in demand for high-quality visual content fueled by social media, e-commerce, and digital marketing, pushing professionals and serious enthusiasts to invest in superior lighting equipment. Concurrently, technological miniaturization and efficiency gains in battery technology have dramatically enhanced the portability and power of wireless units, enabling high-quality results on location without the logistical complexity of traditional studio equipment. These forces collectively amplify the market's reach and necessitate continuous product innovation to meet evolving consumer expectations for speed and reliability.

However, the market faces notable restraints. The primary impediment is the high initial cost associated with professional-grade wireless systems, particularly proprietary systems offered by legacy camera manufacturers, which limits adoption among budget-conscious consumers and emerging photographers. Furthermore, the complexity inherent in setting up and managing multi-flash configurations, including navigating compatibility issues between third-party triggers and proprietary camera protocols, acts as a significant barrier to entry. Reliability challenges, especially concerning radio interference in crowded urban environments or inconsistent performance when mixing brands, necessitate specialized technical knowledge, often deterring wider amateur adoption.

Significant opportunities for growth reside in the expansion of High-Speed Sync (HSS) technology, allowing photographers to utilize wide apertures in bright sunlight, a feature highly valued in outdoor portraiture. The development of unified, universal wireless triggering platforms that seamlessly interface with all major camera brands would resolve current compatibility restraints, unlocking substantial market potential. Moreover, integrating smart features, such as app-based control and integration with IoT platforms for seamless setup, offers pathways for manufacturers to differentiate their offerings and appeal to a tech-savvy user base, propelling the market forward through enhanced user experience and functionality. These impact forces necessitate a strategic focus on user-friendliness and universal compatibility to maximize future penetration.

Segmentation Analysis

The Wireless Flash Market is comprehensively segmented across several dimensions, including Triggering Mechanism, Compatibility, Usage, and Power Output, reflecting the diverse needs of photographers ranging from amateur enthusiasts to large commercial studios. Understanding these segments is critical for strategic product development, marketing, and pricing optimization, as the performance requirements and budget allocations vary significantly across user groups. The market sees a clear delineation between portable speedlights (low power, high mobility) and powerful, battery-powered strobes (high power, studio-grade light quality), each serving distinct professional applications such as event photography versus fashion editorials.

The evolution of technology has heavily influenced the segmentation, particularly in the shift from basic optical slave mode (which requires line-of-sight and is sensitive to ambient light) to advanced 2.4 GHz radio frequency (RF) triggering. RF systems now dominate the professional and serious enthusiast segments due to their superior range, reliability, and ability to transmit complex data (like TTL and HSS settings) through walls and obstacles. Consequently, the segment focusing on high-end RF triggers and integrated TTL flash units represents the highest revenue potential, characterized by higher average selling prices and lower price elasticity of demand due to required professional reliability.

Furthermore, segmentation by compatibility remains fiercely proprietary, with systems designed specifically for Canon, Nikon, Sony, or Fuji operating environments often commanding premium pricing. However, universal or cross-compatible third-party brands have carved out a substantial market share by offering multi-system compatibility at a competitive price point, appealing to users who own multiple camera brands or seek flexibility. Future growth will likely be concentrated in segments that offer both high power and portability, catering directly to the rapidly growing mobile content creator segment that prioritizes efficiency and studio-quality results in dynamic locations.

- By Triggering Mechanism:

- Radio Frequency (RF) Triggering

- Optical/Infrared Triggering (Slave Mode)

- Integrated System Triggering (e.g., Camera Brand Proprietary Systems)

- By Compatibility:

- Canon E-TTL

- Nikon i-TTL

- Sony ADI/TTL

- Universal/Manual Compatibility

- By Product Type:

- Speedlights (On-camera flash/Small off-camera)

- Studio Strobes (High power, Battery/AC powered)

- Trigger/Transmitter Units

- By Usage/End-User:

- Professional Photography (Wedding, Portrait, Commercial)

- Serious Enthusiasts/Hobbyists

- E-commerce and Content Creators

Value Chain Analysis For Wireless Flash Market

The value chain for the Wireless Flash Market begins with upstream activities centered on the procurement and manufacturing of sophisticated electronic components, primarily focusing on high-voltage capacitors, IGBTs (Insulated Gate Bipolar Transistors) for controlling flash duration, and advanced 2.4 GHz transceiver chips necessary for reliable wireless communication. Component sourcing is often globally distributed, with core manufacturing activities heavily concentrated in East Asia, benefiting from specialized electronic assembly capabilities and cost efficiencies. Research and Development (R&D) at this stage focuses on enhancing battery life (moving towards lithium-ion), improving flash tube efficiency, and developing proprietary RF communication protocols that offer faster synchronization speeds (HSS) and greater range, demanding substantial investment from market leaders.

The midstream phase involves assembly and brand management, where proprietary technologies are integrated into final products. Key aspects here include stringent quality control, especially regarding color temperature consistency and mechanical durability, which are critical performance metrics for professional end-users. Distribution channels are varied: direct sales often handle premium, high-end studio lighting brands (e.g., Profoto), maintaining brand control and direct customer relationships. In contrast, the majority of volume sales, particularly for mid-range and third-party universal units, flow through indirect channels, including specialized photographic equipment retailers (both physical and e-commerce platforms like B&H Photo and Adorama) and regional distributors who manage inventory and localized service support.

Downstream analysis focuses on reaching the diverse customer base. Direct and indirect channels are critical; while indirect channels ensure wide market coverage and availability, direct manufacturer websites and specialized workshops provide valuable technical support and direct feedback loops, informing future product iterations. Potential customers are heavily influenced by reviews, educational content, and professional endorsements, making content marketing and establishing robust technical service networks crucial elements of the downstream value chain. The final stage involves after-sales service, including warranty support and firmware updates, essential for maintaining the longevity and compatibility of complex electronic devices in an ever-evolving camera technology landscape.

Wireless Flash Market Potential Customers

Potential customers in the Wireless Flash Market are segmented primarily by their level of expertise, frequency of use, and budget allocation for lighting equipment, spanning from high-volume, professional entities to individual creative enthusiasts. The core market segment comprises professional photographers specializing in high-demand fields such as wedding, portrait, and commercial advertising photography. These end-users, requiring absolute reliability, precision, and high power output, are the primary buyers of premium battery-powered strobes and advanced TTL/HSS compatible wireless triggers, viewing the equipment as a critical investment necessary for delivering high-quality, consistent results under tight deadlines and varied environmental conditions.

A rapidly expanding customer base includes serious photographic enthusiasts and advanced hobbyists who are transitioning from basic on-camera flash to off-camera techniques to elevate the quality of their personal projects and portfolios. This segment is highly price-sensitive but seeks strong performance and cross-brand compatibility, making them key consumers for high-value third-party brands that offer professional features at a more accessible price point. The rise of sophisticated mirrorless systems has catalyzed this transition, as these cameras increasingly empower users to explore advanced lighting control.

Furthermore, the booming e-commerce sector and the vast landscape of social media content creation represent a significant, emerging customer segment. Businesses and individual influencers frequently require quick, repeatable, and high-quality product or personal branding photography. These users typically seek portable, user-friendly wireless solutions that are powerful enough to illuminate small studio setups or outdoor scenes effectively, often prioritizing convenience and minimal setup time, leading to high demand for compact, lithium-ion powered speedlights and mini-strobes.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $185 Million USD |

| Market Forecast in 2033 | $355 Million USD |

| Growth Rate | 9.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Godox, Profoto, Nikon, Canon, Sony, Jinbei, Yongnuo, Elinchrom, Westcott, Phottix, CheetahStand, Metz, F.J. Westcott, ADJ, Interfit Photographic, Bowens (Legacy/Current), Aputure (Flash Units), Broncolor. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Wireless Flash Market Key Technology Landscape

The Wireless Flash Market is fundamentally defined by three intersecting technological pillars: high-speed synchronization protocols, reliable radio communication, and advanced power management systems. High-Speed Sync (HSS), also known as Focal Plane Flash Synchronization, is a crucial technology that allows flash units to synchronize with shutter speeds far exceeding the camera’s mechanical sync speed (typically 1/200th to 1/250th of a second). HSS achieves this by emitting a rapid burst of light pulses during the short duration the focal plane shutter is open, enabling photographers to use large apertures (e.g., f/2.8) in bright sunlight to achieve shallow depth of field, a highly sought-after effect in portraiture. The efficient implementation of HSS requires sophisticated control over the Insulated Gate Bipolar Transistor (IGBT) and precise timing coordination between the camera body and the remote trigger unit.

Radio Frequency (RF) communication, particularly utilizing the 2.4 GHz band, has largely replaced older infrared/optical triggering methods due to superior range, immunity to ambient light interference, and the ability to operate non-line-of-sight. Key technology within the RF landscape involves proprietary communication protocols (e.g., Godox X System, Profoto Air) that efficiently transmit complex data streams, including TTL metering results, manual power settings, and group control signals, minimizing latency between the trigger command and flash execution. Manufacturers continually invest in optimizing antenna design and signal encoding to ensure robust performance across challenging urban and environmental settings, which directly impacts professional reliability and market uptake.

Finally, the shift towards advanced battery technology, primarily high-capacity Lithium-Ion (Li-ion) packs, represents a foundational technological advancement. Li-ion batteries offer drastically faster recycling times (the time required for the flash to recharge and be ready for the next shot) and significantly higher shot counts compared to traditional AA NiMH battery setups. This improved power management not only enhances user efficiency but also allows for the miniaturization of high-power strobes, enabling units with 400Ws or 600Ws output to be fully battery-powered and highly portable, catering directly to the needs of on-location professional photographers demanding studio quality light with minimal footprint.

Regional Highlights

The global Wireless Flash Market exhibits distinct regional dynamics driven by local economic conditions, the concentration of professional photographic industries, and technological readiness. North America remains a dominant and highly valuable market segment, characterized by high adoption rates of premium, professional-grade lighting systems. The United States and Canada host a dense ecosystem of advertising agencies, large-scale commercial studios, and affluent freelance professionals who demand the latest innovations in HSS and battery technology, often leading to rapid uptake of high-end brands like Profoto and Broncolor, alongside robust adoption of versatile systems from Godox and Elinchrom. Marketing strategies here focus heavily on professional endorsements and high-performance metrics.

Asia Pacific (APAC) is projected to be the fastest-growing region, driven by several factors: the presence of major manufacturing hubs (China, South Korea), which facilitates lower production costs and faster innovation cycles; a rapidly expanding consumer electronics market; and a massive, young population increasingly engaged in digital content creation and e-commerce. China, in particular, dominates both the supply and demand sides, acting as a global leader in the manufacturing of third-party, universal wireless flash systems (e.g., Godox, Yongnuo). This region is highly price-sensitive but rapidly increasing its demand for mid-to-high-power battery strobes to support its enormous e-commerce photography industry.

Europe represents a mature and technologically discerning market, where countries like Germany, the UK, and France possess deeply established photography cultures and a strong tradition of high-quality studio work. European consumers, particularly in the fine-art and editorial sectors, prioritize durability, precision, and reliable color consistency. While highly receptive to innovation, market growth tends to be steady rather than explosive, focusing on replacement cycles and upgrades to systems offering superior integration with advanced camera bodies. The region's regulatory landscape regarding frequency spectrum usage also influences the design and certification of wireless triggering systems.

- North America (USA, Canada): High market value driven by professional commercial photography, strong demand for premium, high-end battery-powered strobes, and rapid adoption of cutting-edge HSS technology.

- Asia Pacific (China, India, Japan): Fastest growth rate fueled by manufacturing prowess, booming e-commerce, and the rise of local third-party brands offering high-value universal systems.

- Europe (Germany, UK, France): Mature market emphasizing product longevity, precision, and aesthetic quality, with steady demand for systems integrated into established studio workflows.

- Latin America (Brazil, Mexico): Emerging market potential driven by increasing digital content creation and rising disposable income; demand centers on affordable, versatile wireless speedlights.

- Middle East and Africa (MEA): Growth concentrated in urban centers (UAE, Saudi Arabia, South Africa); demand primarily focuses on event photography and media production, seeking reliability in diverse climate conditions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Wireless Flash Market.- Godox

- Profoto

- Nikon Corporation

- Canon Inc.

- Sony Corporation

- Jinbei

- Yongnuo

- Elinchrom

- Westcott

- Phottix

- CheetahStand

- Metz

- F.J. Westcott

- ADJ

- Interfit Photographic

- Broncolor

- Aputure (Focusing on hybrid lighting)

- Cactus

- B&H Photo & Video (Significant Distributor/Retailer Influence)

- Adorama (Flashpoint/Glow Brands)

Frequently Asked Questions

Analyze common user questions about the Wireless Flash market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary advantage of Radio Frequency (RF) wireless flash systems over Optical systems?

RF systems offer significantly greater reliability, range, and operational flexibility compared to Optical systems. RF communication does not require line-of-sight between the camera trigger and the flash unit and is unaffected by bright ambient light interference, enabling consistent firing even when units are placed behind obstacles or far from the camera. This makes RF standard for professional off-camera lighting.

How does High-Speed Sync (HSS) technology affect the use of wireless flash?

HSS allows the flash to synchronize with the camera’s shutter speeds higher than the native mechanical sync speed (e.g., up to 1/8000th of a second). This is crucial for outdoor portraits where a photographer needs to use a wide aperture (low f-number) to achieve a shallow depth of field while overpowering bright ambient daylight, effectively balancing flash power and environmental light.

Are third-party wireless flash brands compatible with proprietary camera systems like Canon E-TTL and Nikon i-TTL?

Yes, many prominent third-party manufacturers (e.g., Godox, Yongnuo) develop wireless flash systems and triggers designed to decode and emulate proprietary TTL (Through-The-Lens) protocols for major camera brands. This cross-compatibility allows users access to advanced automatic metering features, though compatibility robustness can sometimes vary slightly compared to the native brand's equipment.

What factor is driving the increased demand for lithium-ion battery integration in wireless flash units?

The shift to lithium-ion batteries is driven by the professional demand for faster recycling times and greater power consistency. Li-ion packs significantly reduce the wait time between full-power flashes and offer a much higher shot capacity compared to traditional AA battery packs, dramatically improving workflow efficiency during high-volume shoots like weddings or events.

Which geographic region demonstrates the strongest growth potential for the Wireless Flash Market?

Asia Pacific (APAC), particularly driven by the immense manufacturing capabilities and vast e-commerce sectors in countries like China, exhibits the strongest growth potential. This region is witnessing rapid adoption of professional lighting equipment among a burgeoning class of commercial content creators and photographers.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager