Wireless Image Transmission System Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438375 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Wireless Image Transmission System Market Size

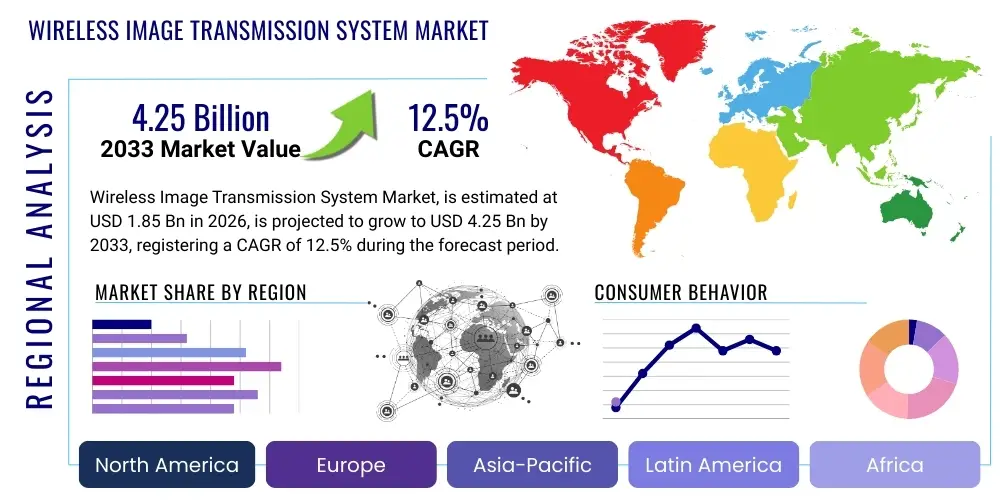

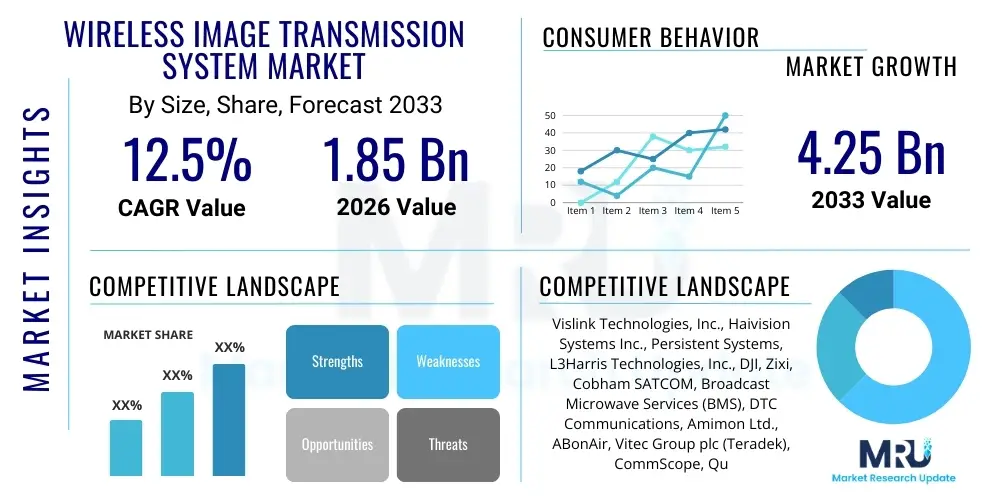

The Wireless Image Transmission System Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.5% between 2026 and 2033. The market is estimated at $1.85 Billion in 2026 and is projected to reach $4.25 Billion by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by the escalating demand for real-time, high-definition (HD) and ultra-high-definition (UHD) video feeds across crucial sectors such as healthcare, defense, and industrial automation. The continuous deployment of advanced wireless infrastructure, particularly 5G networks, is critical in overcoming traditional bandwidth limitations, enabling robust and low-latency image transfer necessary for mission-critical applications.

Market valuation reflects a paradigm shift from traditional wired infrastructure towards flexible, mobile, and highly interconnected systems. Key technological developments, including enhanced compression algorithms and sophisticated error correction techniques, are boosting the reliability of wireless links, making them viable substitutes for wired connections in demanding environments. Furthermore, the proliferation of Internet of Things (IoT) devices and unmanned aerial vehicles (UAVs) equipped with high-resolution cameras necessitates robust wireless transmission capabilities, thereby fueling the market’s financial growth trajectory significantly across all major geographies, especially in regions investing heavily in smart infrastructure development and remote monitoring solutions.

Wireless Image Transmission System Market introduction

Wireless Image Transmission Systems (WITS) enable the seamless, real-time transfer of digital image and video data from a capturing device to a receiving station without physical cable connections. These systems utilize various radio frequency technologies, including Wi-Fi, Bluetooth, 5G, and proprietary microwave links, ensuring flexibility and mobility across diverse operational environments. Products encompass transmitters, receivers, antennas, and specialized processing units designed to handle large data volumes while maintaining image fidelity and minimizing latency. Major applications span surveillance and security, professional broadcasting, medical imaging (telemedicine), industrial inspection (Non-Destructive Testing - NDT), and military reconnaissance.

The core benefits of adopting WITS include enhanced mobility, ease of deployment in complex or hazardous locations, reduced infrastructure costs compared to extensive cabling, and improved operational efficiency. The primary driving factors for market growth include the global rollout of 5G technology, which provides ultra-low latency and massive bandwidth essential for high-quality video streaming; the increasing adoption of UAVs for commercial and governmental purposes; and the growing demand for remote monitoring and inspection solutions in manufacturing and energy sectors. These drivers collectively necessitate advanced, reliable wireless image pipelines that can function effectively over long distances and through challenging atmospheric or physical obstructions, ensuring data integrity remains paramount.

Wireless Image Transmission System Market Executive Summary

The Wireless Image Transmission System market is characterized by rapid technological innovation, focusing heavily on reducing latency and increasing data throughput to support 4K and 8K resolution video. Business trends indicate a strong move towards integration with cloud-based processing and storage solutions, allowing for scalable deployment and sophisticated data analysis powered by machine learning algorithms. Strategic partnerships between hardware manufacturers and telecommunication providers are becoming commonplace to leverage nascent 5G infrastructure for enterprise-grade solutions. Furthermore, security protocols are intensifying as intellectual property and sensitive governmental data transmission become critical functions of these systems, pushing developers to incorporate advanced encryption and anti-jamming capabilities, thereby shaping the competitive landscape toward solution providers offering comprehensive end-to-end security frameworks.

Regionally, North America and Europe currently dominate the market due to robust defense spending, mature broadcasting industries, and early adoption of telemedicine technologies. However, the Asia Pacific (APAC) region is projected to exhibit the highest growth rate, fueled by rapid urbanization, massive investment in smart city projects, and the expanding manufacturing and industrial automation sectors in countries like China, India, and South Korea, which are aggressively deploying IoT and machine vision systems. These regional dynamics highlight a shift in manufacturing and consumption patterns, with APAC becoming a critical hub for both component sourcing and end-user adoption of advanced transmission technologies, driven by large-scale public and private infrastructure projects.

Segment trends reveal that the component segment dominated by transmitters and receivers holds the largest market share, though software and services related to image processing and network management are growing at the fastest pace. Application-wise, the Surveillance and Security segment remains foundational, but the Industrial and Automotive segments are accelerating substantially, driven by the requirement for autonomous vehicles and automated quality control systems demanding instantaneous visual feedback. Technology segmentation indicates a steady transition from traditional point-to-point links toward sophisticated mesh and massive MIMO configurations, capitalizing on 5G New Radio (NR) standards to handle multi-point communication effectively and reliably, catering to complex operational needs across various vertical industries.

AI Impact Analysis on Wireless Image Transmission System Market

User inquiries regarding AI's influence on Wireless Image Transmission Systems frequently center on optimization, autonomy, and predictive maintenance. Common questions revolve around how AI can minimize latency and optimize bandwidth usage under highly congested network conditions, whether AI-driven compression techniques can maintain image quality better than traditional codecs, and the feasibility of autonomous visual systems (like AI-equipped drones) that prioritize transmission based on detected anomalies or pre-defined mission parameters. There is also significant user interest in using AI for predictive failure analysis within the transmission hardware itself and ensuring the security of the transmitted data through intelligent threat detection. The overall user expectation is that AI will transform WITS from passive data pipes into intelligent, self-optimizing visual intelligence platforms capable of making real-time decisions at the edge.

The key themes emerging from this analysis confirm that AI is indispensable for the future scalability and efficiency of wireless image transmission. AI algorithms are crucial for intelligent resource allocation, dynamically adjusting transmission parameters (power, frequency, modulation) based on channel quality and image content complexity. Furthermore, AI enables edge processing, where captured images are analyzed and filtered locally before transmission, substantially reducing the required bandwidth by transmitting only relevant data or metadata, which is vital for applications like autonomous driving and remote medical diagnostics where every millisecond and byte counts. This shift toward intelligent, content-aware transmission systems is the core anticipated impact of AI in this market.

Concerns often raised relate to the computational power required for AI inference on compact, portable transmitting units and the standardization necessary to ensure interoperability between various AI-optimized transmission protocols. However, the benefits, such as vastly improved video quality through deep learning-based super-resolution techniques or enhanced anomaly detection in industrial monitoring, far outweigh these implementation challenges. AI fundamentally empowers WITS to be more adaptive, efficient, and reliable, moving beyond mere data transfer toward becoming a central element of complex, real-time decision-making ecosystems across high-stakes industries.

- AI-driven compression algorithms (Deep Learning Video Coding - DLVC) enhance fidelity while reducing required bandwidth significantly.

- Real-time image quality assessment and autonomous system optimization based on detected environmental factors.

- Intelligent resource allocation and beamforming optimization in massive MIMO systems using machine learning.

- Edge AI implementation for immediate anomaly detection and filtering of irrelevant data prior to transmission.

- Predictive maintenance for transmission hardware components, improving system uptime and reliability.

- Enhanced security through AI-based detection of adversarial attacks and sophisticated jamming attempts.

DRO & Impact Forces Of Wireless Image Transmission System Market

The Wireless Image Transmission System market is primarily driven by the exponential growth of high-resolution image generation devices, particularly within the IoT, automotive, and professional media sectors, demanding immediate and reliable data transfer. Key restraints include persistent issues related to network latency and electromagnetic interference in densely populated areas, alongside the necessity for robust security protocols to protect sensitive visual data. Opportunities abound in the development of ultra-low latency solutions leveraging 5G and future 6G standards for mission-critical applications such as remote robotic surgery and augmented reality industrial maintenance. These forces collectively shape the market's direction, pushing innovation towards greater throughput, reliability, and fortified data protection against evolving cyber threats and physical interference.

Drivers include the widespread deployment of UAVs (drones) for commercial delivery, infrastructure inspection, and defense applications, all requiring stable, high-definition video downlink capabilities over varying distances. The increasing reliance on real-time surveillance systems by governments and private entities for safety and monitoring purposes further accelerates adoption. Technological advancements in wireless chipsets, specifically those supporting high-frequency bands (millimeter wave) and advanced spatial multiplexing techniques (MIMO), are continually expanding the effective operational range and capacity of these systems. Furthermore, the push towards industry 4.0 and automated manufacturing relies heavily on real-time machine vision, necessitating resilient and fast wireless data links.

Restraints include the high cost associated with deploying sophisticated wireless infrastructure, particularly in remote or geographically challenging areas, and the regulatory complexities surrounding spectrum allocation and licensing across different global regions. The challenge of maintaining consistent data rates and low latency in dynamic, congested radio environments remains a significant technical hurdle. Opportunities are concentrated in emerging fields like telesurgery, where latency must be near-zero, and in the integration of WITS into smart city ecosystems for traffic management and emergency response. The development of mesh networking topologies specifically optimized for large-scale video transport presents a lucrative pathway for market expansion, offering redundancy and resilience currently lacking in traditional point-to-point setups.

Segmentation Analysis

The Wireless Image Transmission System market is comprehensively segmented based on technology, component, application, and geography, providing granular insights into market dynamics. The component segmentation, which includes transmitters, receivers, antennas, and accessories, helps in understanding the hardware focus of investments. Technology segmentation is vital as it differentiates between systems utilizing Wi-Fi (standard, low-cost applications), 5G/LTE (long-range, mobility), and proprietary links (high-security, niche applications). Application analysis highlights the end-user adoption patterns, showcasing dominance in sectors like military & defense and broadcast media, while growth is maximized in industrial inspection and healthcare. Geographic segmentation provides critical regional insights into market maturity and regulatory environments, influencing deployment strategies.

- By Component:

- Transmitters (Analog and Digital)

- Receivers (Stationary and Mobile)

- Antennas (Directional and Omnidirectional)

- Accessories (Cables, Signal Boosters, Software)

- By Technology:

- Wi-Fi/WLAN

- 5G/LTE

- Proprietary Radio Links (e.g., Microwave, COFDM)

- Satellite Communication

- By Application:

- Broadcast Media & Entertainment

- Military & Defense

- Industrial Monitoring & Inspection

- Healthcare (Telemedicine & Diagnostics)

- Surveillance & Security

- Automotive & Transportation (Autonomous Vehicles)

- By End User:

- Government and Public Safety Agencies

- Enterprises (Manufacturing, Energy, Construction)

- Commercial Users (Media, Film Production)

- Individual Consumers (Prosumer Drones)

Value Chain Analysis For Wireless Image Transmission System Market

The value chain for the Wireless Image Transmission System market begins with upstream analysis involving critical component suppliers, notably semiconductor manufacturers providing specialized chipsets for modulation, demodulation, and high-speed signal processing. These suppliers, along with optical component providers (cameras, sensors), form the foundation. Midstream activities involve the system integrators and original equipment manufacturers (OEMs) who design, assemble, and rigorously test the complete transmission units, focusing heavily on miniaturization, power efficiency, and robust enclosure design required for field deployment. Quality control and regulatory compliance, particularly regarding spectrum usage and emission standards, are vital steps within this manufacturing stage, ensuring product readiness for diverse global markets.

Downstream analysis focuses on distribution and end-user adoption. The distribution channel is bifurcated into direct and indirect routes. Direct sales are common for high-value, bespoke defense or industrial systems, where detailed technical consultation and integration services are paramount, often involving long-term maintenance contracts. Indirect channels utilize specialized value-added resellers (VARs) and system integrators who customize off-the-shelf solutions for specific industry verticals like broadcasting or surveillance. The final stage involves deployment, maintenance, and ongoing software updates, often provided through specialized service contracts, which represent a significant recurring revenue stream for key market players.

The efficiency of the value chain is increasingly reliant on seamless coordination between proprietary hardware development and specialized software development for compression and network management. Strong intellectual property surrounding low-latency codecs and frequency hopping technologies offers competitive advantages upstream. Downstream success is dictated by effective technical support and the ability to integrate WITS seamlessly into existing operational infrastructures, whether they are corporate networks or governmental command and control centers. The focus remains on maximizing throughput and minimizing the total cost of ownership (TCO) for the end-user over the system’s lifecycle, pushing competitive emphasis toward reliability and service quality.

Wireless Image Transmission System Market Potential Customers

The primary end-users and potential buyers of Wireless Image Transmission Systems are concentrated in sectors that require high-fidelity, real-time visual information for critical operational decisions, where mobility and speed are non-negotiable. Defense and Military organizations represent a major customer base, utilizing these systems for surveillance, reconnaissance, border patrol, and remotely operated vehicles (ROVs) where secure, long-range transmission is essential. The Broadcast and Media industry, including major film studios and live sports coverage providers, demands instantaneous, uncompressed or minimally compressed video transmission from mobile cameras, driving demand for high-bandwidth, proprietary systems.

The Industrial sector, particularly within manufacturing, energy (oil, gas, and renewables), and construction, constitutes a rapidly expanding customer segment. These customers deploy WITS for remote inspection of infrastructure, quality control via machine vision systems, and monitoring hazardous environments using robotic platforms. The immediate feedback provided by wireless transmission systems allows for rapid problem identification and intervention, significantly enhancing safety and operational uptime. This customer base prioritizes ruggedization, reliability in extreme conditions, and integration capabilities with existing industrial control systems (ICS).

Healthcare and Public Safety agencies form the third critical customer group. In healthcare, telemedicine applications, remote diagnostics, and robotic-assisted surgery necessitate ultra-low latency WITS to transmit high-resolution medical imagery and live procedure feeds over secure networks. Public Safety entities (police, fire, EMS) utilize these systems for real-time situational awareness during emergencies, disaster management, and large-scale public event monitoring, requiring dependable communication links even during network congestion or infrastructure failures, thereby creating sustained demand for highly resilient transmission solutions.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1.85 Billion |

| Market Forecast in 2033 | $4.25 Billion |

| Growth Rate | 12.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Vislink Technologies, Inc., Haivision Systems Inc., Persistent Systems, L3Harris Technologies, Inc., DJI, Zixi, Cobham SATCOM, Broadcast Microwave Services (BMS), DTC Communications, Amimon Ltd., ABonAir, Vitec Group plc (Teradek), CommScope, Qualcomm Incorporated, Huawei Technologies Co., Ltd., SAF Tehnika, Silicon Image (Lattice Semiconductor), MikroTik, Intracom Telecom, and Tieline Technology. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Wireless Image Transmission System Market Key Technology Landscape

The technological foundation of the Wireless Image Transmission System market is constantly evolving, driven by the need for higher bandwidth and superior resilience against interference. Orthogonal Frequency-Division Multiplexing (OFDM) remains a dominant modulation technique, particularly in professional broadcasting systems (like COFDM variants) due to its robustness in non-line-of-sight and highly dynamic environments. However, the paradigm is shifting significantly with the widespread adoption of Multiple-Input Multiple-Output (MIMO) and Massive MIMO technologies, which utilize multiple antennas at both the transmitter and receiver to maximize spectral efficiency and spatial diversity. These technologies are crucial for handling the massive data loads associated with 4K and 8K video transmission, especially in dense urban settings, by leveraging spatial multiplexing gains effectively.

The integration of 5G New Radio (NR) standards is perhaps the most significant technological driver currently. 5G NR promises ultra-low latency (down to 1ms) and massive throughput capacity, which is transformative for mission-critical applications such as remote telesurgery and autonomous vehicle sensor data transfer. This capability allows for complex machine vision and control loops to operate seamlessly over wireless links, previously only possible with dedicated fiber optics. Furthermore, millimeter-wave (mmWave) technology, utilizing spectrum above 24 GHz, is increasingly used in short-range, high-capacity scenarios like stadium broadcasting or fixed industrial sensor arrays, although its deployment requires careful consideration of line-of-sight limitations and sensitivity to atmospheric conditions.

Specialized proprietary technologies also hold significant market share in niche applications. For instance, Wireless HD (WiHD) and WiGig (based on 60 GHz band) are utilized for uncompressed, extremely high-speed, short-range transmission in controlled environments like medical operating rooms or high-end consumer electronics. Error correction and coding schemes, such as Low-Density Parity-Check (LDPC) codes, are integral to maintaining image quality and reliability across noisy channels. The future landscape will heavily feature Software-Defined Radio (SDR) and Network Function Virtualization (NFV), allowing transmission systems to rapidly adapt to changing spectrum regulations and performance requirements through software updates rather than requiring hardware replacement, ensuring longevity and adaptability of deployed units.

Regional Highlights

Geographic analysis reveals distinct patterns of adoption and growth drivers across major global regions, influenced primarily by infrastructure maturity, regulatory policies, and the concentration of high-demand industries such as defense and media production. North America, encompassing the United States and Canada, stands as a market leader, characterized by early adoption of cutting-edge wireless standards (including extensive 5G rollout) and high expenditure in defense, aerospace, and advanced medical diagnostics. The presence of major technology developers and strong private investment in high-throughput data solutions solidify this region’s dominant position, focusing on commercializing low-latency systems for autonomous applications and professional broadcasting.

Europe represents a mature market with significant emphasis on industrial automation, surveillance, and smart city initiatives. Countries such as Germany, France, and the UK are heavy users of WITS in manufacturing (Industry 4.0) for automated quality control and predictive maintenance via remote video monitoring. European regulations often dictate stringent standards for spectrum harmonization and data privacy, pushing manufacturers to develop highly secure and efficient frequency management solutions. The European Space Agency’s activities and the robust public safety infrastructure also drive demand for reliable, resilient transmission links for governmental applications, particularly those utilizing COFDM technology.

The Asia Pacific (APAC) region is poised for the most rapid growth, fueled by immense governmental investments in digital infrastructure, urbanization, and the aggressive expansion of the manufacturing and energy sectors, notably in China, Japan, South Korea, and India. South Korea and China are spearheading the commercial deployment of 5G and are massive markets for consumer and commercial drones, requiring pervasive wireless imaging solutions. The focus in APAC is often dual: high-volume, cost-effective solutions for mass surveillance and consumer drones, alongside specialized high-end systems for large-scale infrastructure projects and emerging smart city video analytics programs.

Latin America (LATAM), the Middle East, and Africa (MEA) currently hold smaller market shares but offer significant growth potential. In the Middle East, substantial defense spending, combined with large-scale smart city development projects (like NEOM in Saudi Arabia), drives specialized demand for secure, high-range WITS. African nations are seeing incremental growth driven by necessities in remote monitoring, particularly in the energy and mining sectors, and increasing deployment of public safety surveillance systems. Growth in these regions is heavily dependent on the pace of network infrastructure development, particularly the deployment of reliable mid-band and low-band wireless networks capable of supporting continuous video feeds over vast distances, often relying on satellite and microwave backhaul solutions for connectivity.

- North America: Dominant market, driven by defense, media (Hollywood), and early 5G adoption; strong focus on autonomous vehicle integration and high-frequency communication.

- Europe: Mature market concentrating on industrial automation (Industry 4.0) and public safety applications; strict regulatory environment mandates high security and efficiency.

- Asia Pacific (APAC): Highest projected CAGR, propelled by rapid urbanization, massive infrastructure projects (smart cities), and large-scale drone adoption in China and South Korea.

- Middle East & Africa (MEA): Growth centered on defense modernization, oil & gas remote inspection, and large-scale governmental infrastructure projects demanding specialized, rugged systems.

- Latin America: Emerging market with increasing demand in mining, agriculture, and urban surveillance sectors, reliant on improving regional telecom infrastructure.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Wireless Image Transmission System Market.- Vislink Technologies, Inc.

- Haivision Systems Inc.

- Persistent Systems, LLC

- L3Harris Technologies, Inc.

- DJI (Dà-Jiāng Innovations)

- Zixi

- Cobham SATCOM

- Broadcast Microwave Services (BMS)

- DTC Communications (Domo Tactical Communications)

- Amimon Ltd.

- ABonAir

- Vitec Group plc (Teradek)

- CommScope Holding Company, Inc.

- Qualcomm Incorporated

- Huawei Technologies Co., Ltd.

- SAF Tehnika AS

- Silicon Image (A Lattice Semiconductor Company)

- MikroTik

- Intracom Telecom

- Tieline Technology

Frequently Asked Questions

Analyze common user questions about the Wireless Image Transmission System market and generate a concise list of summarized FAQs reflecting key topics and concerns.What primary technologies are driving the enhanced performance of Wireless Image Transmission Systems?

The primary performance drivers are 5G New Radio (NR) for ultra-low latency and high mobility, coupled with Multiple-Input Multiple-Output (MIMO) antenna systems and advanced COFDM modulation for increased spectral efficiency and signal robustness in complex environments.

How does the integration of AI affect the bandwidth requirements for wireless video transmission?

AI significantly reduces bandwidth requirements by enabling intelligent, content-aware compression and edge processing, allowing systems to prioritize and transmit only critical data or metadata, rather than continuous raw video streams, minimizing network load while maintaining essential visual intelligence.

Which application segment currently holds the largest market share, and which segment is growing fastest?

The Military and Defense segment traditionally holds the largest market share due to critical requirements for secure, long-range reconnaissance. However, the Industrial Monitoring and Inspection segment, fueled by Industry 4.0 and UAV deployment, is projected to exhibit the highest Compound Annual Growth Rate (CAGR).

What are the main security challenges faced by Wireless Image Transmission Systems?

The primary security challenges involve safeguarding against unauthorized interception (eavesdropping), signal jamming or spoofing, and ensuring data integrity through robust end-to-end encryption protocols, particularly important for systems handling sensitive governmental or medical imagery.

What is the market outlook for ultra-low latency WITS in professional healthcare?

The market outlook is highly positive. Ultra-low latency WITS, especially those leveraging dedicated 5G slicing, are crucial for advancing telesurgery and real-time remote diagnostics, enabling tactile feedback and immediate control responses necessary for complex medical procedures conducted remotely.

The detailed analysis provided here confirms the robust expansion trajectory of the Wireless Image Transmission System market, underpinned by technological convergences and critical application demands across diverse industrial and governmental sectors. The future market success hinges on continuous innovation in minimizing latency and maximizing security, particularly as AI integrates more deeply into signal processing and network optimization.

In conclusion, the strategic focus for market participants must center on developing highly reliable, secure, and adaptable systems capable of utilizing the full potential of emerging 5G and future 6G networks. Addressing the stringent performance requirements of autonomous systems and remote critical operations will be key to capturing sustained growth and maintaining competitive advantage throughout the forecast period ending in 2033, ensuring continuous visual data transmission integrity regardless of operational complexity or geographical constraints.

The increasing complexity of modern operational environments—ranging from deep-sea inspection using remotely operated vehicles (ROVs) to high-altitude surveillance via drones—necessitates a new generation of transmission technology. These systems must not only handle high bandwidth but also integrate sophisticated features like automated channel switching, dynamic power management, and seamless handover capabilities. This technological evolution transforms WITS from simple communication tools into essential components of comprehensive visual intelligence networks, further driving market valuation and application scope globally, particularly within infrastructure management and global logistics.

Furthermore, the regulatory landscape regarding spectrum management remains a significant variable. Companies that successfully navigate global frequency allocation complexities and invest in cognitive radio technologies—which can dynamically sense and utilize available spectrum—will gain a decisive market advantage. The standardization of interoperable WITS components, particularly within emerging cross-industry collaborations (e.g., between automotive manufacturers and telecom operators), will also accelerate mass adoption and streamline global deployment efforts, thereby making high-fidelity wireless video connectivity a pervasive utility rather than a specialized technology.

The impact of cloud computing integration is also transformative, enabling WITS to offload heavy processing tasks, such as complex video analytics and long-term archival, to centralized or decentralized cloud platforms. This hybrid approach—combining powerful edge transmission capability with scalable cloud-based backend services—offers end-users unparalleled flexibility and cost efficiency. As data volumes continue to surge, the ability to manage, process, and secure petabytes of visual data wirelessly and efficiently will define the competitive edge, emphasizing the shift toward integrated hardware-software solution offerings rather than standalone transmission units.

Specifically addressing the defense and public safety sectors, the demand for resilient and encrypted transmission systems is non-negotiable. Modern military operations rely heavily on secure real-time intelligence gathered from various airborne and ground assets. This necessity drives the development of advanced proprietary links and sophisticated anti-jamming techniques, ensuring mission continuity even in electronic warfare environments. Consequently, manufacturers focusing on hardened, military-grade WITS components and systems certified for high-level security clearances will continue to see strong demand and premium pricing within these critical governmental markets.

The expansion into telemedicine represents a substantial long-term opportunity. Remote diagnostic tools, patient monitoring, and training simulations often require high-definition video with minimal delay. The successful deployment of WITS in hospitals and remote clinics not only improves access to specialized care but also enhances medical training through live streaming of complex surgical procedures to globally dispersed educational institutions. Overcoming regulatory hurdles related to patient data privacy (such as HIPAA and GDPR compliance) remains paramount for unlocking the full potential of WITS in the medical domain.

Looking ahead, the development and commercialization of 6G technology, while nascent, are already beginning to influence research and development cycles in the WITS market. 6G promises even higher data rates and unprecedented levels of synchronization, potentially enabling entirely new applications like volumetric video transmission (holographic communication) and highly precise remote manipulation, further blurring the line between physical and virtual presence. Companies positioning themselves early in 6G research and patent development will be crucial in defining the next decade of wireless image transmission capabilities, securing significant future revenue streams.

In the consumer electronics sphere, while professional applications dominate market value, the pervasive adoption of high-resolution cameras in consumer drones and virtual reality (VR) headsets necessitates simplified, cost-effective, and high-performance wireless links. This market segment drives volume and innovation in miniaturization and power efficiency. Standards like Wi-Fi 6 (802.11ax) and future Wi-Fi 7 (802.11be) are becoming central to these consumer-grade systems, offering increased throughput and reduced congestion in densely used home and commercial spaces, ensuring high-quality media streaming across personal networks.

The importance of robust customer service and technical support cannot be overstated in this technology-intensive market. Given the critical nature of applications—from live broadcast coverage that costs millions of dollars per minute to remote life-saving surgery—system reliability is paramount. Providers offering comprehensive service level agreements (SLAs), rapid deployment teams, and 24/7 technical assistance will build stronger, more resilient customer relationships, moving beyond mere product sales to becoming essential operational partners for their clients, particularly in the media and enterprise sectors.

The sustainability aspect is also gaining prominence. Manufacturers are increasingly focusing on developing energy-efficient transmission solutions to reduce the environmental footprint, especially for battery-powered mobile units like drones and wearable cameras. Optimization of power consumption through intelligent standby modes and energy-harvesting technologies is becoming a key competitive differentiator, appealing to both environmentally conscious enterprises and governmental agencies with mandates for sustainable operations, influencing procurement decisions significantly across Europe and North America.

Finally, market fragmentation presents both challenges and opportunities. While specialized vendors dominate proprietary, high-end segments (defense, broadcast), major telecommunication equipment providers and semiconductor firms are rapidly converging to offer standardized, scalable 5G-based solutions for mass enterprise and IoT applications. This dynamic creates a highly competitive environment, driving down the cost of entry-level WITS while simultaneously pushing the boundaries of performance and feature integration in the premium segment, ensuring a continuous cycle of innovation and technological refresh across all strata of the market structure.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager