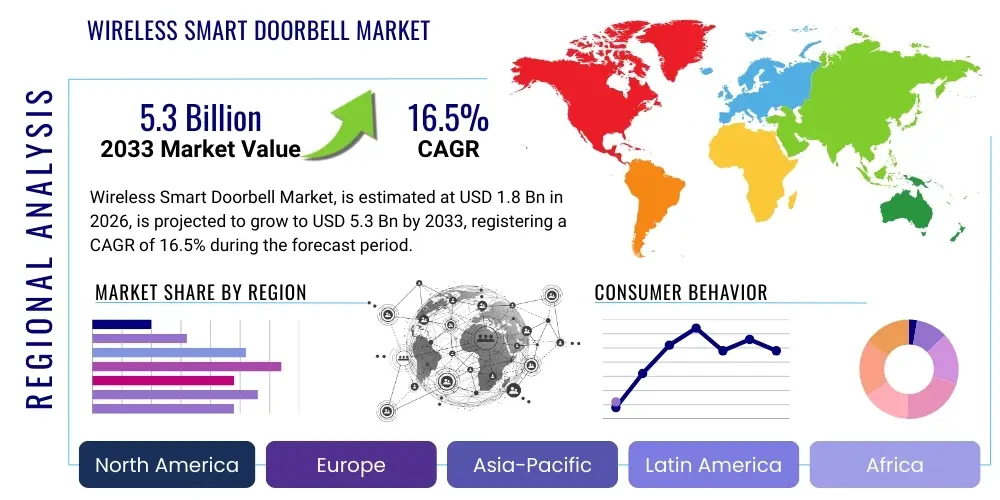

Wireless Smart Doorbell Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437272 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Wireless Smart Doorbell Market Size

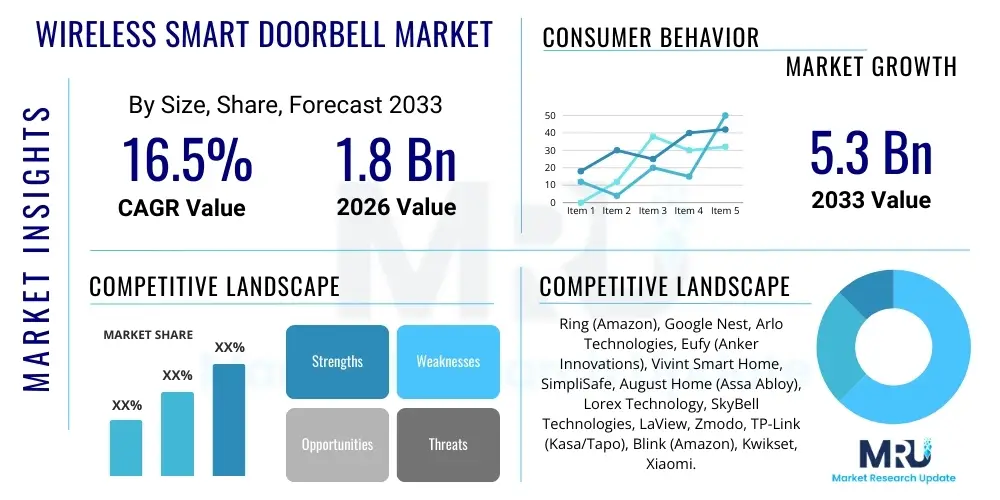

The Wireless Smart Doorbell Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 16.5% between 2026 and 2033. The market is estimated at USD 1.8 Billion in 2026 and is projected to reach USD 5.3 Billion by the end of the forecast period in 2033.

Wireless Smart Doorbell Market introduction

The Wireless Smart Doorbell Market encompasses advanced security and communication devices designed to replace traditional doorbells, utilizing wireless connectivity protocols like Wi-Fi or Bluetooth to transmit audio and video streams to connected mobile devices or smart home hubs. These devices offer substantial enhancements over conventional systems, providing features such as two-way talk, motion detection, night vision capabilities, and cloud storage options for recorded footage. The integration into the broader smart home ecosystem is a primary driver, positioning smart doorbells as an essential component of residential and small commercial security infrastructure, offering convenience and remote accessibility that resonate strongly with modern consumer needs for safety and monitoring.

Product descriptions typically highlight the ease of installation, eliminating the need for complex wiring, which significantly expands the potential consumer base, particularly in retrofit scenarios or rental properties. Major applications span residential security, where they monitor package deliveries and deter potential intruders, and smaller commercial settings, where they manage entry and monitor visitor flow outside operating hours. The increasing sophistication of embedded sensors, combined with higher resolution cameras and improved battery life, has made these devices highly reliable and effective tools for continuous front-door surveillance, ensuring homeowners can monitor their property regardless of their physical location.

The core benefits driving market adoption include enhanced property security, the convenience of remote monitoring, and proactive alerts regarding suspicious activities or unauthorized access attempts. Key driving factors include the escalating consumer interest in smart home automation, decreasing average selling prices of hardware components, and crucial developments in connectivity technologies, such as the rollout of faster, more stable Wi-Fi standards. Furthermore, growing concerns regarding residential crime rates and the desire for seamless integration across multiple smart devices (e.g., smart locks and security cameras) strongly propel the market trajectory toward significant sustained growth throughout the forecast period.

Wireless Smart Doorbell Market Executive Summary

The Wireless Smart Doorbell Market is characterized by intense competition driven by technology innovation and strategic pricing models, reflecting robust business trends focused on subscription services for cloud storage and advanced AI features, generating significant recurring revenue streams alongside hardware sales. Key business trends include partnerships between device manufacturers and smart home platform providers (e.g., Amazon, Google) to ensure seamless interoperability, alongside a strong focus on enhancing user data privacy and cybersecurity measures to build consumer trust. This competitive environment necessitates continuous improvements in camera resolution, battery efficiency, and detection accuracy, prompting rapid product iteration cycles to maintain market relevance against emergent low-cost players from Asia Pacific offering comparable basic functionality.

Regional trends indicate that North America currently dominates the market, largely due to high rates of smart home adoption, significant disposable income allocated toward home security, and the entrenched presence of major market players. However, the Asia Pacific region is forecast to exhibit the highest Compound Annual Growth Rate (CAGR), fueled by expanding urbanization, increasing internet penetration, and a burgeoning middle class in countries like China and India who are prioritizing smart security solutions for new housing developments. Europe maintains steady growth, driven by stringent data protection regulations which necessitate sophisticated security measures in product design, focusing on local data processing and compliance with GDPR standards, particularly in Western European nations.

Segmentation trends highlight the increasing consumer preference for Battery-powered devices due to their installation flexibility, although Wired models remain strong in markets prioritizing reliability and continuous power supply. The Residential segment continues to be the dominant application area, but the Commercial segment, particularly small businesses and multi-family residences, is rapidly expanding due to the need for scalable and centralized access control systems. Technological differentiation is increasingly crucial, with the market shifting toward advanced features such as ultra-wide-angle lenses, pre-roll recording capabilities, and improved integration with specialized third-party monitoring services, moving smart doorbells beyond simple video feeds into sophisticated security hubs.

AI Impact Analysis on Wireless Smart Doorbell Market

User queries regarding the impact of Artificial Intelligence (AI) on the Wireless Smart Doorbell Market primarily revolve around four central themes: the reliability of advanced detection capabilities, concerns over facial recognition accuracy and privacy implications, the practical effectiveness of automated responses, and the potential for device security vulnerabilities introduced by complex algorithms. Users frequently ask how AI can differentiate between packages, pets, and people, seeking highly reliable systems that minimize false alerts, which are a major source of user frustration. Furthermore, there is significant interest in understanding the ethical boundaries and regulatory frameworks governing the use of continuous video monitoring and biometric identification features, highlighting a critical tension between security functionality and privacy rights that manufacturers must navigate carefully.

The prevailing expectation is that AI should transform the user experience from reactive notification to proactive security management. Consumers anticipate features such as predictive analytics to identify suspicious patterns before an event occurs, personalized activity zones that learn regular movements, and sophisticated sound detection (e.g., breaking glass, alarm sounds) that triggers immediate, targeted alerts. The adoption of on-device (edge) AI processing is highly anticipated, promising faster response times and reduced reliance on cloud processing, which addresses bandwidth limitations and enhances data security. The market success of new product generations is now intrinsically linked to the efficacy and transparency of their embedded AI algorithms, making AI integration a non-negotiable factor for premium smart doorbell offerings.

Manufacturers are heavily investing in deep learning models to enhance product performance, moving beyond basic motion detection to intelligent identification and classification. This not only improves operational efficiency by filtering out irrelevant alerts (e.g., passing cars) but also unlocks new service potentials, such as visitor access logs based on recognized faces or delivery confirmation protocols. Addressing user concerns about data handling and bias in algorithms remains paramount, requiring robust auditing and clear communication about how data is used and protected. The increasing implementation of AI-driven battery management systems also ensures prolonged operational life, mitigating a key constraint previously associated with purely battery-powered devices, thus further cementing AI’s transformative role across hardware and software performance.

- AI-powered Facial Recognition: Enables personalized alerts, automated entry for known individuals, and swift identification of strangers.

- Advanced Object Detection: Distinguishes reliably between humans, animals, vehicles, and package deliveries, minimizing false notifications.

- Predictive Motion Analysis: Uses machine learning to analyze movement patterns and anticipate suspicious activity before an incident occurs.

- Automated Response Systems: Allows the doorbell to deliver pre-recorded messages or trigger integrated smart lights based on visitor identity or action.

- Edge Computing Implementation: Processes complex video data locally on the device, significantly reducing latency and enhancing user privacy.

- Noise and Sound Identification: Recognizes specific ambient sounds such as glass breaking, car alarms, or dog barking, triggering tailored security responses.

DRO & Impact Forces Of Wireless Smart Doorbell Market

The Wireless Smart Doorbell Market is primarily driven by the expanding ecosystem of smart homes, coupled with heightened global concerns regarding residential security, which compels consumers to invest in proactive monitoring solutions that offer remote accessibility and immediate alerts. Technological advances, particularly in high-resolution imaging, robust battery technologies, and seamless network integration, have significantly enhanced product utility and reliability, addressing previous consumer skepticism about system performance. Furthermore, the aggressive market entry of tech giants and highly competitive pricing strategies have made these devices more affordable and accessible to a broader consumer demographic, accelerating adoption across various socioeconomic segments. These factors collectively create a powerful growth momentum, pushing innovation toward more integrated and intelligent security offerings.

Despite strong driving forces, the market faces significant restraints, including ongoing consumer apprehension regarding data privacy and the potential for unauthorized access to video feeds, which necessitates substantial investment in cybersecurity protocols and transparent data governance policies. Furthermore, technical hurdles, such as inconsistent Wi-Fi connectivity quality in older homes or geographically challenging areas, can negatively impact device performance and user satisfaction, leading to negative reviews and slowing adoption rates in certain regions. The necessity for users to manage subscription fees for cloud storage and advanced AI features also presents a financial hurdle for some price-sensitive consumers, restraining the mass market penetration of premium models offering recurring revenue streams.

Opportunities for market expansion are abundant, particularly through strategic geographical expansion into untapped markets in Latin America and emerging economies in Asia Pacific, where disposable incomes are rising and smart infrastructure is rapidly developing. Product innovation focusing on energy harvesting technologies and ultra-low power consumption can overcome battery life constraints, while enhanced interoperability standards (like Matter) will simplify the integration of smart doorbells with diverse smart home ecosystems, increasing consumer convenience. Moreover, establishing partnerships with home insurance providers and incorporating these devices into broader municipal safety initiatives present significant commercial opportunities for long-term sustainable growth, moving the smart doorbell from a consumer gadget to a subsidized, essential household appliance.

The impact forces within this market are substantial, defined by high bargaining power of suppliers for critical components like image sensors and chipsets, counterbalanced by intense rivalry among a large number of established and emerging players who constantly undercut prices and introduce new features. Consumer demand, highly influenced by technology reviews and perceived reliability, exerts a strong pull factor, forcing manufacturers to prioritize user experience and ease of installation. The threat of substitutes, though currently low (due to the unique combination of features offered), could rise if traditional security systems integrate similar remote video capabilities at competitive price points. Overall, strong technological drivers and market rivalry are the dominant forces shaping the competitive landscape and driving innovation.

Segmentation Analysis

The Wireless Smart Doorbell Market is meticulously segmented primarily based on Power Source, Application, and Technology, reflecting the diverse needs and installation environments of global consumers. The power source segmentation, dividing the market into battery-powered and wired options, is crucial as it dictates ease of installation and operational reliability, heavily influencing consumer choice between flexibility and continuous performance. Application segmentation differentiates between Residential and Commercial end-users, recognizing that security requirements, operational scale, and integration complexity vary significantly between these two primary sectors, demanding tailored product features and service packages.

The segmentation by technology, mainly focusing on Wi-Fi and Bluetooth connectivity, addresses the core mechanism of data transfer and integration within the smart home network. While Wi-Fi is the predominant standard due to its high bandwidth and range suitable for video streaming, Bluetooth is increasingly utilized for low-power setup processes and localized short-range interactions. Furthermore, geographic segmentation remains vital, as regional preferences for specific types of security features, adherence to local privacy regulations, and varying infrastructure readiness (e.g., broadband speeds) necessitate region-specific product adjustments and marketing strategies to ensure optimal market penetration and adoption rates.

Analyzing these segments provides strategic insights for market players, allowing them to allocate resources effectively, develop targeted marketing campaigns, and tailor product development efforts toward the fastest-growing or most lucrative niches. For instance, understanding the surge in demand for battery-powered solutions in rental markets (a key residential sub-segment) enables companies to prioritize battery efficiency R&D. Similarly, recognizing the commercial sector's need for enhanced tamper resistance and professional monitoring capabilities helps suppliers develop robust, high-security enterprise-grade models, thereby maximizing overall market reach and revenue generation.

- Power Source:

- Battery-powered

- Wired (Hardwired)

- Application:

- Residential

- Commercial (including small offices, retail outlets, and multi-tenant buildings)

- Technology:

- Wi-Fi Enabled

- Bluetooth Enabled

- Dual Connectivity (Wi-Fi + Bluetooth)

- Distribution Channel:

- Online Retail

- Offline Retail (e.g., Home Improvement Stores)

- Professional Installation and Security Dealers

Value Chain Analysis For Wireless Smart Doorbell Market

The value chain for the Wireless Smart Doorbell Market begins with Upstream Analysis, focusing on the procurement of critical components such as high-resolution image sensors (CMOS), System-on-Chip (SoC) processors that handle video encoding and AI algorithms, long-lasting lithium-ion battery packs, and complex wireless modules (Wi-Fi/Bluetooth). Supplier bargaining power in this stage is high, especially for proprietary chipsets and specialized sensors, necessitating strong procurement relationships and robust inventory management by manufacturers. Research and Development (R&D) activities constitute a core value-adding activity here, focused on miniaturization, enhanced processing efficiency (Edge AI), and improving device durability and weatherproof capabilities to meet stringent consumer expectations.

Manufacturing and Assembly form the intermediate stage, where components are integrated, firmware is loaded, and rigorous quality control and testing protocols are implemented to ensure product reliability and compliance with regional safety standards. Major Original Design Manufacturers (ODMs) located primarily in East Asia dominate this stage, offering cost advantages and scaling capabilities. Following production, the logistics and distribution segment is paramount, utilizing efficient global shipping networks to move products from assembly lines to regional warehouses and ultimately to the consumer interface. This phase requires optimized inventory flow to handle seasonal demands and rapid product updates typical of the consumer electronics sector, often leveraging centralized distribution hubs to manage costs.

Downstream analysis centers on reaching the end consumer through diverse Distribution Channels, which are critical for market success. These channels include Direct-to-Consumer (D2C) models via company websites, leveraging the control over branding and customer data; Indirect channels through major Online Retailers (e.g., Amazon, Best Buy online), which offer massive market reach and robust logistics; and traditional Offline Retail channels like large home improvement stores (e.g., Home Depot, Lowes), which facilitate in-person product demonstration and immediate purchase. Professional Installation and Security Dealer networks represent a specialized indirect channel, crucial for high-end, professionally monitored smart doorbell systems, adding value through expert setup and integration with broader security ecosystems. Effective post-sale service and firmware updates via the cloud are final, critical value-adding activities that sustain long-term customer satisfaction and loyalty.

Wireless Smart Doorbell Market Potential Customers

The primary End-Users/Buyers of wireless smart doorbells are broadly categorized into Residential Consumers and Commercial Entities, each possessing distinct purchase motivations and system requirements. Within the Residential segment, the core demographic consists of tech-savvy homeowners and young families (ages 25-55) who prioritize convenience, family safety, and remote monitoring capabilities, particularly those frequently receiving package deliveries or seeking deterrence against porch piracy. These buyers are typically sensitive to ease of installation (favoring battery-powered DIY models) and are often receptive to subscription models that offer enhanced cloud storage and AI-based features like facial recognition.

A rapidly growing sub-segment within residential customers includes renters and individuals residing in multi-family units (apartments or condos) who require easily removable, non-invasive security solutions. Their purchase decision is strongly influenced by device portability and compatibility with existing limited smart home setups. Another critical residential segment involves elderly individuals or those with mobility limitations who rely on the device for screening visitors and communicating remotely without having to open the door, valuing the two-way audio and video functionality as a fundamental safety and convenience tool.

The Commercial segment includes Small to Medium Enterprises (SMEs), particularly small retail stores, boutique offices, and property management companies overseeing multiple residential or commercial rental units. For these professional buyers, the smart doorbell serves multiple functions: access control, monitoring staff entry/exit, inventory security, and detailed visitor logging. Commercial requirements emphasize system scalability, robust tamper resistance, and integration with existing networked access control systems. These users often opt for Wired models for uninterrupted operation and are more likely to procure products through professional security integrators rather than standard retail channels, prioritizing service level agreements and centralized management software capabilities over simple cost factors.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.8 Billion |

| Market Forecast in 2033 | USD 5.3 Billion |

| Growth Rate | 16.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Ring (Amazon), Google Nest, Arlo Technologies, Eufy (Anker Innovations), Vivint Smart Home, SimpliSafe, August Home (Assa Abloy), Lorex Technology, SkyBell Technologies, LaView, Zmodo, TP-Link (Kasa/Tapo), Blink (Amazon), Kwikset, Xiaomi. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Wireless Smart Doorbell Market Key Technology Landscape

The technology landscape of the Wireless Smart Doorbell Market is defined by a rapid evolution in sensor technology, wireless communication protocols, and processing power, driven by the consumer demand for instantaneous response and high-definition video clarity. Core technologies include high dynamic range (HDR) camera sensors and ultra-wide-angle lenses, which ensure clear imaging even in challenging lighting conditions (e.g., direct sunlight or deep shadow), coupled with infrared or thermal night vision capabilities to maintain surveillance integrity 24/7. The transition toward 2K and 4K resolution video feeds demands robust encoding standards and efficient compression algorithms to manage bandwidth and storage requirements without compromising video quality, ensuring smooth streaming to mobile devices across diverse network environments.

Connectivity relies heavily on advanced Wi-Fi chipsets, particularly those supporting Wi-Fi 6 (802.11ax), which offers improved spectral efficiency, reduced latency, and enhanced power efficiency compared to older standards, crucial for optimizing battery life in wireless models while maintaining a stable connection for continuous streaming. Furthermore, the integration of low-power Bluetooth Low Energy (BLE) facilitates quick pairing and simplified device setup, contributing significantly to a better initial user experience. Crucially, the move towards Edge Computing is a defining technology trend, wherein sophisticated AI processing—such as facial detection and object classification—is executed directly on the device's integrated processor (SoC), minimizing reliance on external cloud servers, reducing data transmission bottlenecks, and substantially improving response times for critical alerts.

Battery technology remains a key area of differentiation and innovation, with manufacturers exploring high-capacity, rechargeable lithium-polymer batteries optimized for cyclical deep discharge and long stand-by times, often coupled with power management chipsets designed to minimize parasitic drain. Additionally, the proliferation of secure cloud architecture is essential, providing encrypted storage solutions for video footage and facilitating reliable over-the-air (OTA) firmware updates to patch security vulnerabilities and introduce new features post-purchase. Future technological integration is expected to focus on interoperability standards like Matter and Thread, ensuring seamless communication with other smart home devices (e.g., smart locks automatically unlocking for recognized visitors), thereby solidifying the doorbell's role as a central security nexus.

Regional Highlights

- North America: This region holds the largest market share, characterized by high consumer awareness, widespread adoption of smart home ecosystems (driven by major players like Amazon and Google), and substantial discretionary spending on home security. The market here is highly mature, focusing on premium features like professional monitoring subscription services and highly advanced AI functionalities, with strong demand across both suburban and urban residential sectors.

- Europe: Europe represents a significant market, although growth is moderated by stringent regional data privacy regulations (GDPR). This regulatory environment necessitates that manufacturers focus heavily on localized data storage options and robust encryption methodologies. Western European countries, particularly the UK and Germany, demonstrate high adoption rates, driven by quality perception and seamless integration capabilities with established security systems.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region, fueled by rapid urbanization, increasing middle-class income levels, and expansive investments in high-speed internet infrastructure in key markets like China, South Korea, Japan, and India. The market is highly price-sensitive, leading to strong growth in value-for-money, feature-rich products from regional players, with a growing emphasis on mobile-first user interfaces.

- Latin America (LATAM): This emerging market is experiencing robust growth driven primarily by acute concerns over residential security, which often outweighs privacy considerations in high-risk urban areas. Demand is focused on reliable, durable, and affordable products, with distribution heavily reliant on local electronics retailers and specialized security installers.

- Middle East and Africa (MEA): Growth in the MEA region is concentrated in the Gulf Cooperation Council (GCC) countries, supported by large-scale smart city initiatives and high-end residential developments that mandate integrated security solutions. Extreme weather conditions in this region drive demand for highly durable, temperature-resistant devices.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Wireless Smart Doorbell Market.- Ring (Amazon)

- Google Nest

- Arlo Technologies

- Eufy (Anker Innovations)

- Vivint Smart Home

- SimpliSafe

- August Home (Assa Abloy)

- Lorex Technology

- SkyBell Technologies

- LaView

- Zmodo

- TP-Link (Kasa/Tapo)

- Blink (Amazon)

- Kwikset

- Xiaomi

- Honeywell International Inc.

- Panasonic Corporation

- Dahua Technology Co., Ltd.

- Hikvision Digital Technology Co., Ltd.

- Netatmo (Legrand)

Frequently Asked Questions

Analyze common user questions about the Wireless Smart Doorbell market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary advantages of a wireless smart doorbell over a traditional doorbell?

The primary advantage is remote monitoring, allowing users to see and communicate with visitors from anywhere via a smartphone application. Wireless smart doorbells also feature motion detection, night vision, and secure video recording, offering comprehensive 24/7 front-door surveillance that standard doorbells cannot provide.

How significant is data privacy risk associated with using smart doorbells?

Data privacy is a moderate risk factor, primarily concerning the security of cloud-stored video data and potential hacking attempts. Leading manufacturers mitigate this risk through end-to-end encryption, strong user authentication protocols, and increasingly, by processing sensitive biometric data locally using on-device AI (edge computing).

Are battery-powered smart doorbells as reliable as wired models?

Battery-powered models offer excellent reliability and installation flexibility but require periodic recharging or battery replacement. Wired models provide continuous power and typically more stable connectivity, making them preferable for heavy usage or environments requiring uninterrupted high-resolution video streaming. Reliability largely depends on the specific product's battery optimization and Wi-Fi signal strength.

What role does AI play in improving the functionality of modern smart doorbells?

AI significantly enhances functionality through intelligent object recognition, enabling the doorbell to accurately identify people, packages, or vehicles, thereby drastically reducing false alerts caused by irrelevant motion. AI also powers facial recognition for personalized alerts and enhances battery management by optimizing sensor usage.

What are the typical recurring costs associated with owning a wireless smart doorbell?

Recurring costs are usually associated with optional subscription services. These subscriptions are required for cloud video storage (to save recorded clips for a longer duration), accessing advanced AI features like facial recognition, and enabling professional monitoring services. Basic live viewing and motion alerts often remain free.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager