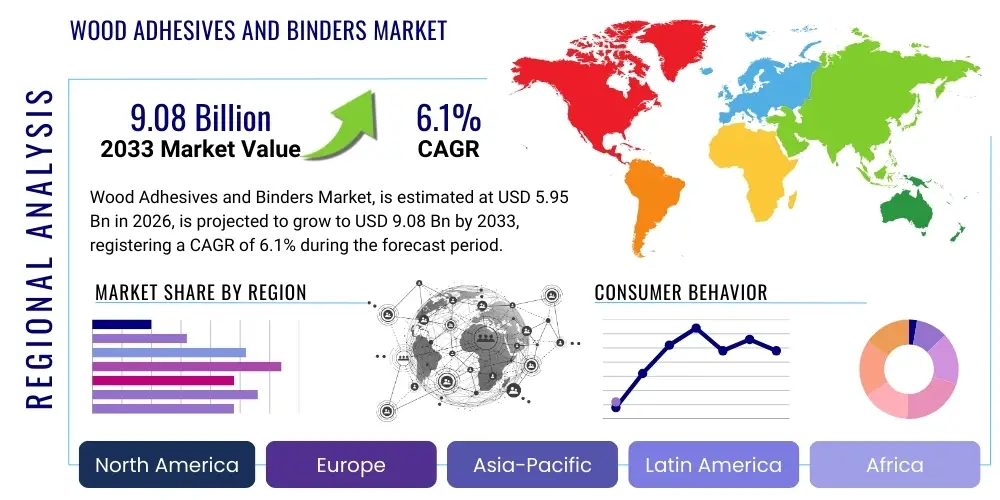

Wood Adhesives and Binders Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435521 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Wood Adhesives and Binders Market Size

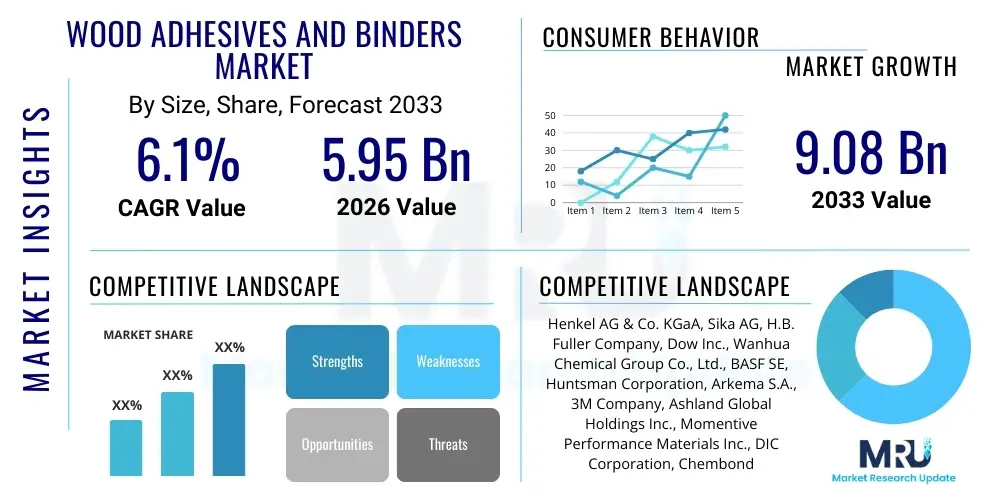

The Wood Adhesives and Binders Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.1% between 2026 and 2033. The market is estimated at USD 5.95 Billion in 2026 and is projected to reach USD 9.08 Billion by the end of the forecast period in 2033.

Wood Adhesives and Binders Market introduction

The Wood Adhesives and Binders Market encompasses a variety of chemical formulations essential for bonding wood and wood-based materials in diverse applications, ranging from furniture manufacturing and construction to flooring and cabinetry. These binding agents are critical for producing engineered wood products (EWPs) such as plywood, particleboard, medium-density fiberboard (MDF), and laminated veneer lumber (LVL), which offer enhanced strength, stability, and sustainability compared to traditional solid wood. Key product types include synthetic adhesives like urea-formaldehyde (UF), phenol-formaldehyde (PF), melamine-urea-formaldehyde (MUF), polymeric diphenylmethane diisocyanate (pMDI), and thermoplastic adhesives like Polyvinyl Acetate (PVA), alongside natural alternatives such as soy-based and starch-based products.

The market growth is fundamentally driven by the resurgence of the global construction sector, particularly in emerging economies like China, India, and Southeast Asian nations, where urbanization projects demand vast quantities of reliable wood products. Furthermore, the increasing preference for engineered wood in prefabricated and modular construction, due to its efficiency and reduced environmental impact, significantly boosts demand for high-performance adhesives. These binders not only provide structural integrity but also often contribute properties such as moisture resistance, fire retardation, and lower volatile organic compound (VOC) emissions, aligning with stringent global environmental and building codes.

Major applications span residential and non-residential construction, automotive interior components, and specialized packaging, but the core demand remains concentrated in the panel production industry. Benefits derived from using advanced wood adhesives include improved product longevity, greater design flexibility in wood utilization, and cost-effectiveness in material processing. Driving factors also include continuous innovation focusing on bio-based and low-formaldehyde content adhesives to meet the escalating regulatory requirements and consumer demands for greener building materials.

Wood Adhesives and Binders Market Executive Summary

The Wood Adhesives and Binders Market is characterized by a strong shift toward sustainable and low-toxicity formulations, notably driven by global regulations such as CARB (California Air Resources Board) and European E1/E0 standards, which mandate reduced formaldehyde emissions in wood panel products. Business trends indicate intensified research and development investments in pMDI and soy-based adhesives, offering superior performance characteristics like moisture resistance while minimizing environmental impact, thereby challenging the dominance of traditional amino-resins (UF/MUF). Strategic mergers and acquisitions are frequent among major chemical manufacturers aiming to consolidate market share, expand geographical presence, and acquire niche technologies, particularly those related to polyurethane and emulsion polymer isocyanate (EPI) systems essential for structural applications.

Regional trends highlight the Asia Pacific (APAC) region as the primary growth engine, fueled by massive infrastructure spending, rapid urbanization, and the flourishing furniture manufacturing hubs in China and Vietnam, resulting in high volume consumption of UF and PF resins. Conversely, North America and Europe demonstrate a maturity in demand, focusing intensely on premium, specialty adhesives (e.g., highly durable EPIs and bio-adhesives) that adhere to stringent green building certifications and prioritize worker safety. The European market, in particular, is witnessing robust adoption of mass timber construction techniques (CLT - Cross-Laminated Timber), which necessitates specialized, high-strength structural binders capable of enduring extreme conditions.

In terms of segment trends, the engineered wood segment, particularly MDF and plywood, dominates consumption due to their versatility and cost structure in construction and furniture making. Technology-wise, water-based adhesives (PVA and acrylics) are experiencing accelerated growth due to their low-VOC profile and ease of application, especially in DIY and interior finishing segments. While thermosetting adhesives remain the volume leaders, the fastest growth trajectory belongs to thermoplastic and reactive adhesives, favored for their enhanced mechanical properties and application flexibility in complex bonding processes, confirming the market's trajectory towards performance-driven and environmentally compliant solutions.

AI Impact Analysis on Wood Adhesives and Binders Market

Users commonly question how Artificial Intelligence will revolutionize the traditional chemical and manufacturing processes within the Wood Adhesives and Binders market, particularly concerning quality control, predictive maintenance, and novel material discovery. Key themes revolve around the potential for AI to optimize resin synthesis, predicting optimal molecular structures for desired bonding performance and stability, thus accelerating the development of next-generation bio-based or zero-formaldehyde adhesives. Concerns frequently touch upon the initial cost of implementing AI-driven monitoring systems and the necessity for upskilling the existing workforce. Expectations are high regarding AI's ability to minimize waste, improve process efficiency in large-scale panel production (e.g., controlling temperature and pressure profiles in press cycles based on real-time sensor data), and tailor adhesive formulations precisely to varying wood species and moisture content, guaranteeing consistent quality and reducing rejects in high-volume manufacturing environments.

- AI-driven Predictive Analytics: Optimizing curing times and process parameters (temperature, pressure) in hot presses for engineered wood production, leading to reduced energy consumption and higher throughput consistency.

- Quality Control Automation: Utilizing machine vision and AI algorithms to detect and classify defects (e.g., delamination, voids) in finished wood panels, far surpassing human capabilities in speed and accuracy.

- Accelerated Material Informatics: Employing machine learning to screen vast chemical libraries and predict the performance and environmental impact (e.g., VOC emissions) of new adhesive raw materials, speeding up R&D cycles for sustainable binders.

- Supply Chain Optimization: Leveraging AI for demand forecasting and managing complex raw material logistics, especially volatile components like petrochemical derivatives and specialty chemicals, minimizing inventory costs and production delays.

- Smart Application Systems: Integrating AI into robotic adhesive application systems in furniture assembly lines for precise dosing and placement, reducing material usage and increasing automation levels.

DRO & Impact Forces Of Wood Adhesives and Binders Market

The market dynamics are governed by a complex interplay of robust demand drivers stemming from global construction expansion and significant regulatory hurdles concerning chemical safety. The primary drivers include the expanding housing and infrastructure sectors, especially the growing adoption of engineered wood products (EWPs) over traditional materials due to their structural advantages and resource efficiency. Conversely, the market faces significant restraints, chiefly the volatile pricing and supply disruptions of critical petrochemical raw materials (e.g., formaldehyde, methanol, and urea), which directly influence manufacturing costs and final product pricing. Opportunities are abundant in the development of disruptive technologies such as fully bio-based, high-performance adhesives that can compete structurally with synthetic resins, addressing both environmental concerns and consumer preferences for natural products.

The core impact forces shaping the industry trajectory are regulatory pressure and material innovation. Regulatory bodies globally are tightening limits on emissions from wood products, compelling manufacturers to rapidly transition away from conventional, high-formaldehyde resins toward alternatives like pMDI, EPI, and increasingly sophisticated soy-based products. This shift requires substantial capital investment in new manufacturing equipment and formulation expertise. Furthermore, the rising awareness of sustainability among architects, builders, and end-consumers acts as a powerful pull factor, favoring companies that demonstrably lead in offering certified green adhesives and binding agents, transforming mandatory compliance into a competitive advantage.

Other significant impact forces include the consolidation of the engineered wood industry, leading to larger buyers demanding greater quality consistency and specialized technical support from adhesive suppliers. Technological advancements in application equipment, such as non-contact dispensing and high-speed pressing, also influence adhesive formulation requirements, favoring products that offer faster curing times and broader substrate compatibility. These forces collectively push the market towards premiumization, efficiency, and compliance, ensuring that innovation remains central to achieving sustainable growth.

Segmentation Analysis

The Wood Adhesives and Binders Market segmentation provides a granular view of consumption patterns based on resin type, application, technology, and end-user. Resin type segmentation is crucial as it dictates performance characteristics, cost structure, and environmental compliance, with amino resins (UF, MUF) dominating the volume due to their low cost and prevalent use in particleboard and MDF, while high-performance synthetic resins like pMDI and EPI capture the value segment focusing on structural applications and exterior use. Application segmentation is predominantly driven by engineered wood manufacturing, including plywood, particleboard, and structural lumber, which represent the largest consumption centers, alongside smaller, yet fast-growing, segments such as flooring and furniture assembly, often relying on PVA and hot-melt systems.

Technology splits the market between water-based, solvent-based, hot-melt, and reactive systems, with water-based systems showing the highest growth due to low VOC content and ease of cleanup, aligning perfectly with modern industrial and consumer requirements. End-user classification is dominated by the construction and furniture industries, reflecting the final destinations of EWP production. Understanding these segments is vital for suppliers to tailor product development, whether focusing on low-cost UF resins for volume panel production or high-durability pMDI for OSB (Oriented Strand Board) destined for demanding construction environments, thereby maximizing market penetration and profit margins.

- By Resin Type:

- Urea-Formaldehyde (UF)

- Phenol-Formaldehyde (PF)

- Melamine Urea Formaldehyde (MUF)

- Polymeric Diphenylmethane Diisocyanate (pMDI)

- Polyvinyl Acetate (PVA)

- Emulsion Polymer Isocyanate (EPI)

- Soy-based Adhesives

- Other (including Polyurethane, Epoxy, Natural Starch)

- By Application:

- Plywood

- Particleboard

- Medium Density Fiberboard (MDF)

- Oriented Strand Board (OSB)

- Laminated Veneer Lumber (LVL)

- Furniture and Assembly

- Flooring and Decking

- Other Construction Components (e.g., Doors, Windows)

- By Technology:

- Water-based

- Solvent-based

- Hot-melt

- Reactive and Pressure Sensitive

- By End-User Industry:

- Construction (Residential and Commercial)

- Furniture

- Packaging

- Automotive and Transportation

Value Chain Analysis For Wood Adhesives and Binders Market

The value chain for wood adhesives and binders begins with upstream petrochemical manufacturers and forestry operations that supply the foundational raw materials. Upstream analysis involves the procurement of chemicals such as methanol, formaldehyde, urea, phenol, and isocyanates (MDI). Price volatility in the global petrochemical market significantly impacts the cost structure for adhesive manufacturers, necessitating robust hedging and supply management strategies. For bio-based adhesives, the upstream focus shifts to agricultural products like soy flour or starch derivatives. Manufacturing involves complex chemical processes to synthesize the resins (polymerization and blending), focusing heavily on quality control, regulatory compliance (especially regarding formaldehyde emissions), and optimizing formulation stability and shelf life.

The core adhesive manufacturers then supply these binding agents primarily to large industrial end-users, specifically engineered wood panel producers (e.g., plywood mills, OSB plants, MDF factories). These downstream manufacturers integrate the adhesives into their high-volume production lines, where the adhesive constitutes a critical factor determining the structural integrity, moisture resistance, and emission classification of the final wood product. Performance requirements are extremely stringent at this stage, demanding technical support and collaborative R&D between the adhesive supplier and the panel manufacturer to fine-tune application parameters and ensure adherence to international standards.

Distribution channels for wood adhesives are typically direct for high-volume, industrial accounts, given the specialized nature and large batch sizes required by panel manufacturers. However, indirect channels, involving specialized chemical distributors or dealers, are utilized for smaller customers, such as custom furniture shops, flooring installers, and retail hardware stores that purchase lower volumes of formulated products (e.g., PVA wood glues, reactive polyurethane). Maintaining a robust and efficient logistics network is crucial, especially for temperature-sensitive products or hazardous materials like isocyanates. The shift towards sustainable products is further influencing the value chain, pushing suppliers to verify the source of raw materials and ensure end-product recyclability.

Wood Adhesives and Binders Market Potential Customers

The primary customer base for high-volume wood adhesives and binders consists of large-scale industrial manufacturers engaged in producing engineered wood products. These include global conglomerates and regional specialists operating facilities for manufacturing particleboard, MDF, plywood, OSB, and advanced structural wood products like Glulam and CLT. These customers demand bulk quantities, precise technical specifications, and consistently low emission profiles, favoring long-term supply agreements with major chemical companies capable of guaranteeing stable quality and supply.

Secondary but rapidly growing customer segments include prefabricated housing manufacturers and modular construction firms, particularly in Europe and North America. These specialized builders rely heavily on high-strength, durable adhesives, often EPI or polyurethane-based, for assembling structural components off-site under controlled conditions, prioritizing adhesives that offer quick curing and reliable performance in demanding structural applications. The shift towards mass timber construction has opened up significant opportunities in this area.

The third major customer group comprises the furniture manufacturing industry and cabinet makers, particularly in high-growth regions like Southeast Asia. While they consume large volumes of standard UF resins for basic panel components, they increasingly utilize advanced hot-melt and PVA adhesives for final assembly, edge banding, and decorative finishing, driven by automation speed and the need for clean, aesthetically pleasing bonds. Retail consumers and professional contractors operating in the renovation and repair sector also form a consistent, albeit lower-volume, market for retail-packaged PVA and polyurethane wood glues.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 5.95 Billion |

| Market Forecast in 2033 | USD 9.08 Billion |

| Growth Rate | 6.1% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Henkel AG & Co. KGaA, Sika AG, H.B. Fuller Company, Dow Inc., Wanhua Chemical Group Co., Ltd., BASF SE, Huntsman Corporation, Arkema S.A., 3M Company, Ashland Global Holdings Inc., Momentive Performance Materials Inc., DIC Corporation, Chembond Chemicals Ltd., Franklin International, Avery Dennison Corporation, Bostik (Arkema subsidiary), Georgia-Pacific Chemicals LLC, Dymax Corporation, Jubilant Industries Ltd., Klenk Adhesives GmbH. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Wood Adhesives and Binders Market Key Technology Landscape

The technology landscape of the Wood Adhesives and Binders Market is undergoing significant evolution, primarily driven by the twin mandates of enhancing performance characteristics and achieving superior environmental compliance. Traditional thermoset resins, such as Urea-Formaldehyde (UF) and Phenol-Formaldehyde (PF), remain the established technology bedrock, valued for their low cost and high binding strength. However, continuous technological improvements focus on reducing the free formaldehyde content in these resins through sophisticated resin modification techniques, including the incorporation of melamine or optimization of the F/U ratio, pushing products towards E1 or E0 standards. The shift is prompting manufacturers to invest in continuous reactor technology and advanced process control systems to ensure batch-to-batch consistency in low-emission formulations.

The fastest growth segment technologically is centered around Polymeric Diphenylmethane Diisocyanate (pMDI) and Emulsion Polymer Isocyanate (EPI) systems. pMDI technology is highly favored in OSB and high-performance panel production due to its exceptional water resistance, low curing temperatures, and non-formaldehyde nature. Innovations here involve developing hybrid pMDI systems that improve handling characteristics and reduce toxicity risks during application. EPI systems, used extensively in structural wood lamination and window/door manufacturing, benefit from enhanced cross-linking technologies that offer structural strength comparable to traditional polyurethane while remaining water-based, thereby simplifying cleanup and reducing VOCs.

Furthermore, significant research and development efforts are concentrated on bio-based adhesives, representing a disruptive technological push. Soy-based adhesives, utilizing agricultural waste products, have successfully penetrated the interior-grade plywood and particleboard market, driven by zero-formaldehyde labeling and renewable source credentials. Technology improvements are focused on modifying natural polymers to enhance durability and moisture resistance, making them viable competitors for exterior-grade applications, often through enzymatic modification or blending with low levels of synthetic cross-linkers. Hot-melt adhesive technology, particularly reactive polyurethanes (PUR), is also seeing increasing adoption in high-speed assembly and edge-banding applications due to rapid set times and high bond strength, optimizing modern automated manufacturing processes.

Regional Highlights

The global consumption and production patterns of wood adhesives and binders vary significantly by region, primarily dictated by prevailing construction methods, regulatory frameworks, and raw material availability. The market structure in each geographic segment reflects unique demands for specific adhesive types, ranging from volume consumption of low-cost resins in emerging markets to high-performance, specialty binders in developed economies.

- Asia Pacific (APAC)

- North America

- Europe

- Latin America

- Middle East and Africa (MEA)

The Asia Pacific region, led by China, India, and Southeast Asia, dominates the global Wood Adhesives and Binders Market in terms of volume and is projected to exhibit the highest CAGR during the forecast period. This dominance is intrinsically linked to the region’s booming construction industry, rapid urbanization, and its standing as the world’s largest manufacturing base for furniture, cabinetry, and wood panels. Countries like China and Vietnam utilize vast quantities of basic amino resins (UF/MUF) due to their affordability and sufficiency for interior-grade panel production. The robust demand for particleboard and MDF, driven by large-scale domestic construction projects and extensive export activities, anchors this high-volume consumption.

Despite the high volume of traditional resins, APAC is also a critical battleground for technological transition. Increasingly stringent environmental mandates in key markets, especially related to air quality and product emissions, are compelling manufacturers to adopt pMDI and low-formaldehyde PF resins for exterior and structural applications. Japanese and South Korean markets, known for their focus on high-quality and environmental standards, lead the regional adoption of specialty and sustainable adhesives, influencing the neighboring markets. Furthermore, the ready availability of skilled labor and efficient supply chains for wood processing feedstock enhances the competitive manufacturing environment in this region.

The region's sustained economic expansion and massive investments in affordable housing and infrastructure development ensure continuous, escalating demand for engineered wood products. Local and international adhesive manufacturers are aggressively expanding production capacities within APAC to capitalize on localized supply advantages and minimize logistics costs. The growth trajectory is also supported by the rising use of engineered wood in earthquake-resistant construction, requiring binders with superior flexibility and long-term durability, pushing manufacturers toward advanced polyurethane and EPI systems.

North America is characterized by a mature market with high regulatory standards, particularly concerning VOC and formaldehyde emissions (e.g., TSCA Title VI). This environment strongly favors premium and high-performance adhesives, notably pMDI for structural panel products like OSB and EPI for structural wood components. The region’s construction industry, which places a heavy emphasis on resilient housing and compliance with green building certifications (e.g., LEED), drives demand for bio-based and zero-formaldehyde binding agents. While overall market volume growth is slower compared to APAC, the value growth remains strong due to the premium pricing associated with specialty resins.

The shift towards modular and prefabricated housing units in the US and Canada further accelerates the need for advanced, fast-curing adhesives that maintain structural integrity across diverse climatic conditions. Key regional trends include the robust consumption of specialized adhesives in the repair and remodeling sector, as existing housing stock ages. Furthermore, North American manufacturers of engineered wood are technologically sophisticated, adopting AI-driven process optimization and demanding adhesives that integrate seamlessly with high-speed, automated production lines, leading to intense competition based on technical support and performance consistency.

The presence of major global chemical companies and ongoing domestic R&D efforts ensures continuous innovation in areas like waterproof and fire-retardant adhesives. The reliance on wood resources in construction and the established infrastructure for wood processing position North America as a leading consumer of high-grade binders. Market players are actively focusing on strategic collaborations with lumber producers and building materials suppliers to capture market share in high-value structural applications.

The European market for wood adhesives is heavily regulated by the REACH framework and specific national standards (e.g., Germany’s DIBt requirements), resulting in one of the most stringent environments globally regarding emission control. This regulatory landscape has virtually eliminated high-formaldehyde resins, leading to widespread adoption of low-emission MUF, pMDI, and EPI systems. Europe is pioneering the utilization of mass timber construction, specifically CLT (Cross-Laminated Timber) and Glulam, which requires extremely durable, structural polyurethane, and specific formaldehyde-free resins capable of bearing high loads over long lifecycles.

The emphasis on sustainable forestry and circular economy principles in Europe further encourages the use of certified wood products and corresponding green adhesives. The furniture industry, particularly in Scandinavia and Central Europe, demands high-quality, aesthetic bonds achieved through advanced hot-melt and reactive systems. Demand for PVA glues also remains strong in the high-end cabinetry and joinery sectors, driven by consumer preference for durable, meticulously crafted wooden furniture.

Innovation in Europe is concentrated on developing fully renewable and biodegradable adhesives that offer high performance without compromising regulatory compliance. Governments and industry consortia actively fund research into lignin-based and other bio-polymer adhesives. Regional fragmentation exists, with Western Europe showing high adoption rates of specialty chemicals, while Eastern European markets still rely somewhat on volume-driven, cost-effective solutions, though they are rapidly converging toward Western European standards due to EU mandates.

The Latin American market is characterized by significant variance in development levels, with Brazil and Mexico representing the largest consumers of wood adhesives, driven by large domestic construction markets and emerging furniture production sectors. UF resins remain dominant due to cost considerations and less restrictive local regulatory environments compared to North America or Europe. However, global standards are gradually influencing local manufacturing practices, particularly for products destined for export, leading to a slow but steady increase in the use of lower-formaldehyde MUF and PF resins.

Infrastructure development, particularly in Brazil and Chile, boosts the demand for structural wood products and, consequently, high-performance binders. The presence of vast forestry resources provides a local advantage for wood processors, but reliance on imported petrochemicals for synthetic resins creates vulnerability to global supply chain volatility. Market expansion is closely tied to economic stability and investment in commercial and residential construction projects across the key economies.

Local adhesive manufacturers often compete primarily on price, although multinational corporations are increasing their presence, bringing advanced technology, especially pMDI, for use in OSB production, which is gaining traction as a reliable building material. Future growth hinges on economic recovery and the adoption of more stringent building codes that mandate higher quality and safer materials.

The MEA region, while a smaller consumer globally, presents targeted growth opportunities, particularly in the Gulf Cooperation Council (GCC) states and South Africa. Demand is largely imported, driven by large-scale commercial and hospitality construction projects that rely heavily on high-specification imported wood panels and furniture. These projects often adhere to international quality and safety standards, generating demand for high-durability, moisture-resistant adhesives, such as pMDI and EPI, necessary to cope with the high heat and humidity prevalent in the Middle East.

In Africa, demand is more fragmented, with local manufacturing primarily focused on basic furniture and commodity panel production utilizing traditional UF resins. South Africa, with a more established industrial base, leads in the adoption of advanced wood processing techniques and higher-quality adhesives. Challenges in the region include political instability, volatile currency exchange rates, and reliance on complex import logistics for both chemical raw materials and finished wood products.

The region’s market trajectory is closely linked to diversification efforts away from oil economies, which include massive investments in new cities and entertainment infrastructure, ensuring a consistent need for high-quality interior and exterior building materials. Adhesive suppliers strategically focus on establishing strong distribution partnerships and offering technical support tailored to the specific climatic challenges of the region.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Wood Adhesives and Binders Market.- Henkel AG & Co. KGaA

- Sika AG

- H.B. Fuller Company

- Dow Inc.

- Wanhua Chemical Group Co., Ltd.

- BASF SE

- Huntsman Corporation

- Arkema S.A.

- 3M Company

- Ashland Global Holdings Inc.

- Momentive Performance Materials Inc.

- DIC Corporation

- Chembond Chemicals Ltd.

- Franklin International

- Avery Dennison Corporation

- Bostik (Arkema subsidiary)

- Georgia-Pacific Chemicals LLC

- Dymax Corporation

- Jubilant Industries Ltd.

- Klenk Adhesives GmbH

Frequently Asked Questions

Analyze common user questions about the Wood Adhesives and Binders market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary drivers of growth in the Wood Adhesives and Binders Market?

The primary growth drivers are the robust global construction industry expansion, particularly in the Asia Pacific region, and the increasing worldwide adoption of engineered wood products (EWPs) like MDF, OSB, and plywood due to their structural performance and sustainable attributes. Regulatory pressure enforcing lower VOC and formaldehyde emissions also compels innovation, driving demand for premium, high-value specialty adhesives.

Which type of wood adhesive is dominating the market in terms of volume consumption?

Urea-Formaldehyde (UF) resins currently dominate the market volume consumption, primarily due to their low production cost and extensive use in the manufacturing of interior-grade wood panels such as particleboard and medium-density fiberboard (MDF), especially in high-volume production centers across Asia.

How do global environmental regulations, such as TSCA Title VI and REACH, impact adhesive formulation?

These stringent regulations critically impact formulation by mandating significantly reduced or zero levels of free formaldehyde, compelling manufacturers to pivot away from traditional UF resins towards low-emission alternatives like Melamine Urea Formaldehyde (MUF), Polymeric Diphenylmethane Diisocyanate (pMDI), and bio-based adhesives, increasing research focus on non-toxic binding systems.

Which regional market is projected to exhibit the fastest growth rate for wood adhesives?

The Asia Pacific (APAC) region is projected to register the fastest Compound Annual Growth Rate (CAGR), driven by rapid urbanization, massive infrastructure development, and the concentration of the world’s largest furniture and wood panel manufacturing facilities within countries such as China, India, and Vietnam.

What role do bio-based adhesives play in the future of the wood binding industry?

Bio-based adhesives, including soy-based and lignin-based formulations, are crucial for the future as they offer sustainable, formaldehyde-free alternatives that align with stringent environmental certifications and consumer demand for green building materials. Technological advancements are focused on improving their durability and moisture resistance to allow them to compete in structural and exterior applications.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager