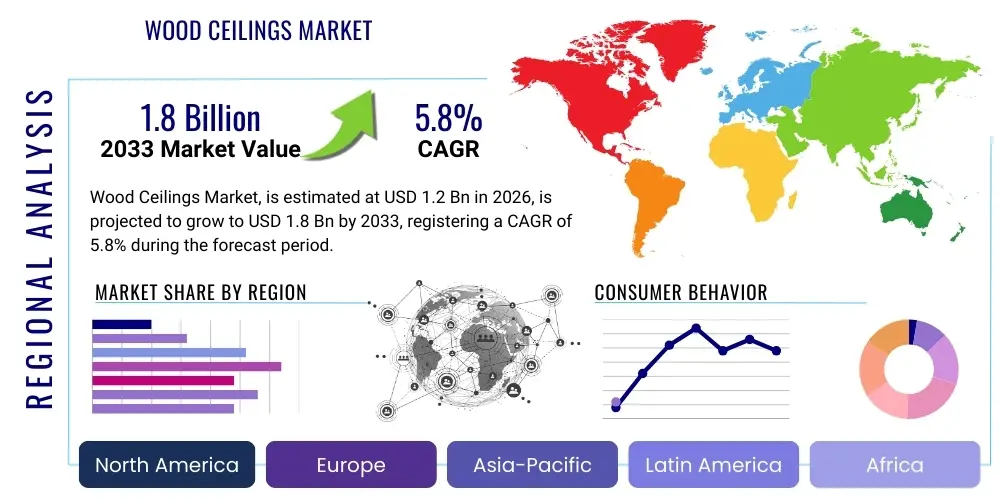

Wood Ceilings Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436991 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Wood Ceilings Market Size

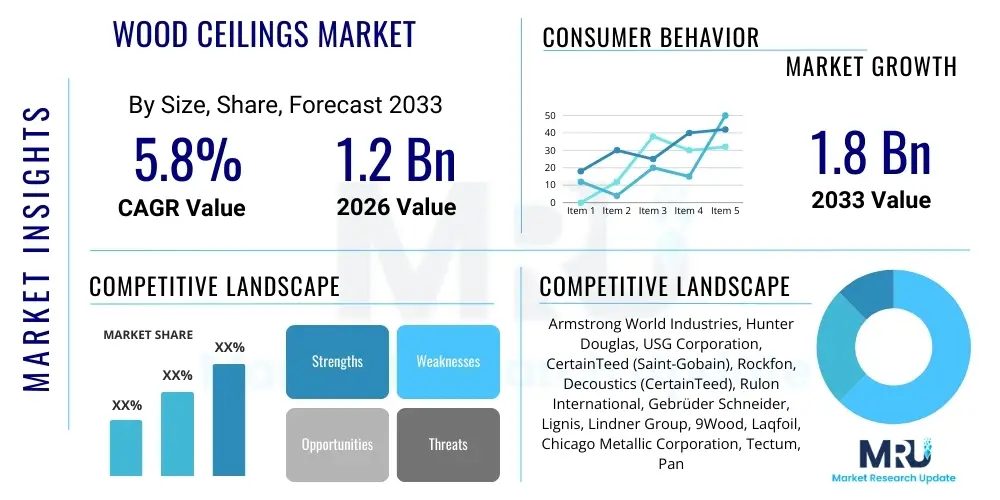

The Wood Ceilings Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at $1.2 Billion in 2026 and is projected to reach $1.8 Billion by the end of the forecast period in 2033.

Wood Ceilings Market introduction

The Wood Ceilings Market encompasses the manufacturing, distribution, and installation of ceiling systems utilizing various wood materials, ranging from solid timber and engineered wood products to decorative veneers and composite panels. These systems are highly valued in architectural design for their aesthetic appeal, acoustic performance, and inherent sustainability characteristics, contributing significantly to biophilic design principles within modern construction. The increasing preference for premium interior finishes in commercial, residential, and hospitality sectors globally is a primary catalyst driving market expansion, especially as building codes increasingly favor materials that offer both visual warmth and structural integrity.

Wood ceiling products are extensively applied across major construction segments. In commercial spaces, such as corporate offices, educational institutions, and healthcare facilities, wood ceilings are used to enhance sound absorption and create visually striking environments that improve occupant well-being and productivity. For the hospitality sector, including luxury hotels and restaurants, they serve as a focal point of interior design, lending an air of sophistication and natural elegance. Residential applications, particularly in high-end custom homes, leverage wood ceilings to introduce warmth, texture, and complex design features, often incorporating integrated lighting and HVAC elements seamlessly into the installation.

Key benefits driving the adoption of wood ceilings include exceptional acoustic regulation capabilities, which are crucial in large-format spaces; design flexibility, allowing for customization in panel size, species, finish, and perforation patterns; and environmental responsibility, particularly when sourcing materials from sustainably managed forests and utilizing low-VOC finishes. Furthermore, technological advancements in fire retardant treatments and modular installation systems have mitigated historical concerns regarding fire safety and complexity of construction, positioning wood ceilings as a preferred high-performance interior finish solution across diverse architectural projects worldwide.

Wood Ceilings Market Executive Summary

The global Wood Ceilings Market is characterized by robust growth driven by accelerating renovation and new construction activities in developed and emerging economies, coupled with an architectural shift towards sustainable and aesthetically superior materials. Current business trends indicate a strong focus on manufacturing efficiency, utilizing advanced CNC machining and automation to produce highly customized and precise wood panels, thereby reducing installation time and waste on site. The market is also seeing increasing adoption of prefabricated wood ceiling modules that integrate ancillary services like lighting fixtures and ventilation systems, streamlining construction processes for large commercial projects and enhancing profitability for specialty contractors.

Regionally, North America and Europe maintain dominance, characterized by stringent building codes favoring high-quality, durable materials and a sophisticated consumer base willing to invest in premium interior finishes. However, the Asia Pacific region is demonstrating the highest growth velocity, fueled by rapid urbanization, significant infrastructure development, and a burgeoning luxury residential market in countries like China and India. This regional expansion is largely supported by the local availability of diverse timber species and increasing government mandates promoting sustainable building practices, creating fertile ground for both international and local manufacturers to scale operations and expand distribution networks across key metropolitan hubs.

Segment trends emphasize the growing preference for engineered wood and wood veneer products over solid wood, primarily due to better cost management, enhanced dimensional stability, and efficient utilization of rare timber resources. Acoustical wood panels, incorporating innovative backing materials and micro-perforations, are experiencing particularly strong demand, driven by stringent standards for noise reduction in educational and corporate environments. Furthermore, the commercial sector, specifically the hospitality and corporate office segments, remains the largest application area, consistently demanding bespoke, high-performance wood ceiling solutions that align with modern interior design philosophies emphasizing natural elements and superior indoor air quality standards.

AI Impact Analysis on Wood Ceilings Market

User inquiries regarding AI's influence on the Wood Ceilings Market frequently revolve around design optimization, supply chain efficiency, and manufacturing automation. Key themes emerging from these questions include how AI algorithms can generate complex, non-repeating wood patterns while ensuring structural viability, and the potential for machine learning to predict optimal inventory levels for diverse wood species, mitigating risks associated with supply volatility and varying lead times. Users also express concerns and expectations about AI-driven quality control systems that can detect minute imperfections in wood grains or finishes during high-speed manufacturing, thereby drastically reducing material waste and improving final product consistency, which is critical for premium architectural finishes where flawless aesthetics are mandatory.

AI is set to revolutionize the design phase through generative design tools that allow architects to quickly iterate complex, parametric wood ceiling geometries, optimizing them for both aesthetic criteria and acoustic performance simultaneously, leading to unprecedented design complexity and efficiency. In the operational sphere, machine learning algorithms are optimizing the cutting and milling processes of wood panels, minimizing waste by calculating the most efficient nested layouts based on raw lumber dimensions and defect locations, an advancement critical for cost management given the high price of architectural-grade timber. This integration of AI not only enhances material yield but also accelerates the customization process, allowing manufacturers to handle high-mix, low-volume orders more profitably.

Furthermore, the integration of AI extends into the sales and installation segments. Predictive maintenance models driven by AI can analyze environmental data (humidity, temperature) within buildings to forecast potential dimensional instability or warping issues in installed wood ceilings, enabling timely intervention and extending product lifespan. On the demand side, AI-powered sales platforms utilize spatial analysis and material databases to recommend optimal wood species and finish combinations based on a project’s intended use, budget, and desired acoustic properties, significantly improving the specification process for architects and interior designers and creating a more transparent and responsive customer experience.

- AI-driven Generative Design: Facilitates the creation of complex, acoustically optimized, and unique wood ceiling geometries, enabling rapid prototyping of intricate patterns and forms tailored to specific project requirements.

- Manufacturing Optimization: Machine learning algorithms enhance yield management by optimizing panel cutting patterns to minimize waste, especially with costly veneers and rare wood species, significantly lowering production costs.

- Predictive Inventory Management: AI systems forecast demand for different wood types, finishes, and panel sizes, improving supply chain resilience and ensuring just-in-time delivery of specialized components.

- Automated Quality Control: High-speed computer vision systems powered by AI detect surface defects, grain inconsistencies, and finishing flaws with higher accuracy and speed than manual inspection, ensuring premium product quality.

- Acoustic Performance Modeling: AI simulations accurately predict the noise reduction coefficient (NRC) of proposed wood ceiling designs before manufacturing, allowing for precise functional customization.

DRO & Impact Forces Of Wood Ceilings Market

The dynamics of the Wood Ceilings Market are governed by a complex interplay of Drivers, Restraints, and Opportunities (DRO), which collectively shape the competitive landscape and future trajectory. Key drivers include the global mandate for sustainable construction and the growing popularity of biophilic design, which elevates the demand for natural, eco-friendly interior materials like wood. Restraints often center around the initial high cost associated with premium, architectural-grade wood ceilings compared to standard gypsum or metal panels, alongside regulatory complexities related to fire safety standards and VOC emissions in specific jurisdictions. Opportunities are abundant in technological innovation, particularly in developing non-combustible wood composites and integrating smart ceiling features, providing substantial growth avenues for manufacturers focusing on high-performance solutions.

Driving forces primarily revolve around aesthetic preference and functional superiority. Architects consistently favor wood for its unmatched visual warmth, high-end appeal, and inherent ability to enhance the acoustic environment of a space, making it a staple in corporate headquarters and luxury retail environments. Furthermore, regulatory support, such as LEED and WELL Building certifications, incentivizes the use of sustainably sourced wood products, pushing the construction industry towards environmentally conscious choices and favoring certified wood ceiling providers. The robust recovery in the commercial real estate sector post-pandemic, focusing on creating appealing and healthy indoor spaces, continues to accelerate adoption rates across major global markets.

The market faces significant limitations due to the volatility in raw timber prices and extended supply chain lead times for exotic or specialized wood species, which can challenge project timelines and profitability. Furthermore, the requirement for highly skilled labor for complex installation procedures, especially for curved or bespoke designs, poses a restraint in regions facing labor shortages. However, the market can capitalize on opportunities through the development of highly durable and moisture-resistant wood treatments, broadening the application scope of wood ceilings to previously inaccessible areas like aquatic centers and humid tropical environments. The expanding retrofit and renovation segment also presents a long-term opportunity, as older commercial buildings seek aesthetic upgrades and acoustic remediation.

Segmentation Analysis

The Wood Ceilings Market is comprehensively segmented based on material type, application, installation method, and regional geography, allowing for precise market evaluation and targeted strategic planning. Segmentation by type differentiates between highly versatile engineered wood products, solid wood planks offering traditional aesthetic value, and cost-effective wood veneer systems that maximize resource efficiency while delivering a premium look. Application segmentation highlights the dominance of the commercial sector, driven by stringent acoustical requirements in offices and institutions, contrasting with the high-margin, customization-focused residential segment.

The segmentation structure is crucial for understanding market dynamics and consumer preferences. For instance, the demand for engineered wood panels, often used in suspended installation systems, dominates the commercial segment due to superior dimensional stability and ease of access to the plenum space for maintenance. Conversely, solid wood tends to be favored in residential and specialized hospitality projects where authenticity and natural characteristics are prioritized, often utilizing a direct-fix installation method for a seamless aesthetic. Geographical segmentation reflects variations in architectural style, material availability, and economic growth rates, with Asia Pacific exhibiting rapid growth in the application segment due to extensive new construction pipelines across various infrastructure categories.

- By Product Type:

- Solid Wood Ceilings

- Wood Veneer Ceilings

- Engineered Wood Ceilings (e.g., MDF or Plywood Core)

- Wood Composite/Laminate Ceilings

- By Application:

- Commercial (Corporate Offices, Retail, Hospitality)

- Residential (High-End Custom Homes, Multi-Family)

- Institutional (Educational Facilities, Healthcare, Government Buildings)

- Industrial

- By Installation Method:

- Suspended Ceiling Systems (Grids, Torsion Spring, Clips)

- Direct Fix/Direct Mount Systems

- By Acoustic Performance:

- Standard Acoustic Panels

- High-Performance Acoustical Systems (Perforated/Slatted)

- Non-Acoustic Decorative Panels

Value Chain Analysis For Wood Ceilings Market

The value chain for the Wood Ceilings Market initiates with the upstream activities involving sustainable forestry management and timber harvesting, followed by the rigorous processing and treatment of raw lumber to ensure dimensional stability and fire resistance—critical steps that directly influence final product quality and regulatory compliance. Midstream activities encompass the specialized manufacturing processes, including CNC milling, veneering, finishing (e.g., staining, clear coating, fire-retardant application), and the fabrication of specialized mounting hardware and suspension grids. Efficiency in this stage, often leveraging automated machinery, determines the manufacturer's ability to produce complex, customized ceiling systems economically and with minimal material waste.

The downstream segment is dominated by distribution channels, which are typically bifurcated into direct sales to large architecture and engineering (A&E) firms for major commercial projects, and indirect sales through specialized distributors and building material retailers catering to smaller contractors and residential builders. Direct channels allow for closer communication regarding project specifications and customization, while indirect channels provide broader market reach and inventory accessibility. Installation, often performed by specialty subcontractors, represents the final critical link, where precision and adherence to acoustic specifications significantly impact the final performance and aesthetic success of the product.

The choice between direct and indirect distribution heavily influences pricing and market penetration. Large multinational manufacturers often employ a dual strategy: direct engagement with architectural specifiers early in the design phase (pull strategy) to ensure their products are included, supported by a network of trusted regional distributors who handle warehousing, logistics, and supply to the installation contractors (push strategy). Effective management of this complex channel system, ensuring consistent product knowledge transfer and timely delivery of bespoke components, is vital for maintaining competitive advantage and navigating the technical requirements inherent in high-performance ceiling systems.

Wood Ceilings Market Potential Customers

Potential customers for the Wood Ceilings Market are predominantly concentrated in sectors prioritizing high aesthetic value, superior acoustic control, and sustainable interior design, placing architects, interior designers, and general contractors at the forefront of the purchasing influence matrix. Specifically, large commercial developers specializing in Class A office spaces, headquarters, and mixed-use complexes constitute a core customer base, as they require large volumes of acoustically rated, durable, and visually appealing ceiling materials that contribute positively to LEED and WELL certifications, enhancing property value and tenant attraction.

The hospitality sector, encompassing luxury hotel chains, boutique hotels, high-end restaurants, and conference centers, represents another critical end-user segment. These buyers prioritize custom finishes, unique design patterns, and material exclusivity to create distinct, immersive guest experiences, making them consistent purchasers of specialized, often bespoke, solid wood and premium veneer ceiling systems. The demand here is less price-sensitive and more focused on design execution and material provenance, demanding close collaboration between manufacturers and hospitality design consultants throughout the specification process.

Furthermore, the public and institutional sectors, including universities, advanced research laboratories, and high-profile government buildings, increasingly specify wood ceilings to balance robust performance requirements (such as fire rating and durability) with the desire to create comfortable, biophilic learning or working environments. Although these customers often operate under strict public procurement guidelines, the long-term lifecycle cost benefits and the ability of wood ceilings to meet stringent acoustic standards in lecture halls and libraries make them a favored, high-quality, long-term interior solution.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1.2 Billion |

| Market Forecast in 2033 | $1.8 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Armstrong World Industries, Hunter Douglas, USG Corporation, CertainTeed (Saint-Gobain), Rockfon, Decoustics (CertainTeed), Rulon International, Gebrüder Schneider, Lignis, Lindner Group, 9Wood, Laqfoil, Chicago Metallic Corporation, Tectum, Panifrance, SAS International, Tate Access Floors, Ceilings Plus, Meranti, Kirei |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Wood Ceilings Market Key Technology Landscape

The technological landscape of the Wood Ceilings Market is rapidly evolving, driven primarily by the need for enhanced acoustic performance, superior fire safety, and increased customization capabilities in large-scale architectural projects. A foundational technology involves advanced Computer Numerical Control (CNC) machining and laser cutting, which allows manufacturers to create highly complex, precision-fit geometric patterns, curvature, and micro-perforations in panels with minimal tolerance errors. This precision is essential for achieving optimal acoustic diffusion and absorption while meeting demanding aesthetic specifications set by leading architectural firms worldwide. The adoption of five-axis CNC routers further enables the production of three-dimensional, sculptural wood ceiling elements that were previously prohibitively expensive or structurally challenging to manufacture.

Material science innovation constitutes another significant technological pillar. This includes the development and application of non-halogenated, intumescent fire-retardant treatments that penetrate deep into the wood structure without altering its natural appearance or texture, allowing wood ceilings to comply with stringent Class A fire ratings required for high-occupancy commercial and institutional buildings. Furthermore, manufacturers are increasingly using high-pressure laminates (HPL) and engineered wood cores with improved moisture resistance and dimensional stability, drastically reducing issues like warping and cracking, thereby extending the lifespan and application versatility of the final product in environments with fluctuating humidity levels.

The integration of smart building technologies represents a forward-looking technological trend. This involves the incorporation of ceiling-integrated components such as low-voltage LED lighting systems, sensors for environmental monitoring (e.g., CO2, light, occupancy), and distributed audio systems seamlessly concealed within wood slatted or perforated panels. This sophisticated integration is crucial for creating aesthetically clean, high-tech environments without visual clutter, appealing strongly to modern corporate and retail clients who prioritize both design elegance and advanced building intelligence. Standardization of modular suspension systems, utilizing lightweight aluminum or steel grids, also accelerates installation time and reduces labor complexity on site.

Regional Highlights

Regional dynamics play a crucial role in shaping the Wood Ceilings Market, dictated by varying construction expenditure, architectural preferences, and regulatory environments across the globe. North America and Europe, as mature markets, continue to represent significant revenue generators, driven by large-scale commercial retrofitting projects and a high concentration of sophisticated architectural practices that routinely specify premium, bespoke wood ceiling solutions. Asia Pacific is emerging as the fastest-growing region, propelled by unprecedented levels of infrastructure investment and rapid urbanization, particularly in China, India, and Southeast Asian nations, leading to massive demand for modern interior materials in both public and private construction sectors.

The regulatory emphasis on environmental performance and sustainability is particularly pronounced in Europe, where the widespread adoption of certifications like FSC and PEFC has made certified sustainable wood a mandatory requirement for many public and corporate projects, thereby influencing sourcing and manufacturing strategies across the entire continent. In contrast, the Middle East and Africa (MEA) market, though smaller, exhibits niche demand centered around large, high-profile projects in the hospitality and luxury retail segments within major urban centers like Dubai, Riyadh, and Doha, where opulence and unique design are prioritized over cost efficiency, often favoring exotic wood species and highly customized installations.

- North America (USA and Canada): This region holds a leading market share due to high construction spending, stringent fire and acoustic standards requiring specialized wood treatments, and strong consumer preference for biophilic and warm interior design in corporate and institutional buildings. The market benefits from established supply chains and major players who innovate in modular and prefabricated wood ceiling systems, targeting rapid installation cycles in large commercial campuses.

- Europe (Germany, UK, France): Characterized by a strong focus on sustainable sourcing and sophisticated design integration, the European market is heavily regulated regarding environmental certifications (FSC/PEFC) and VOC emissions. Germany and the UK are key markets, driven by the renovation of historic buildings and the construction of energy-efficient, modern offices that utilize complex engineered wood systems for enhanced thermal and acoustic insulation.

- Asia Pacific (China, India, Japan, South Korea): The highest growth rate globally is projected for APAC, fueled by massive population growth, urbanization, and the rise of a discerning middle class demanding higher quality commercial and residential interiors. China and India's construction boom, coupled with Japan's advanced prefabricated construction techniques, drives demand for cost-effective wood veneer and engineered wood panels suitable for large-scale, high-rise developments.

- Latin America (Brazil, Mexico): This region represents a developing market segment with growth concentrated in commercial centers and high-end residential areas. Market adoption is currently sensitive to economic fluctuations, but the increasing availability of sustainably harvested local tropical hardwoods and improving trade routes are fostering greater specification of native wood species in architectural projects, focusing on durability and aesthetic value.

- Middle East and Africa (MEA): Growth in MEA is project-driven, centered on major infrastructure development and luxury hospitality projects. Extreme climate conditions necessitate the use of highly treated, stable wood products resistant to high temperatures and humidity. Demand is predominantly for premium, custom-designed solid wood and elaborate veneer installations in landmark buildings, often procured through international sourcing networks to ensure supply of specialized materials.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Wood Ceilings Market.- Armstrong World Industries

- Hunter Douglas

- USG Corporation

- CertainTeed (Saint-Gobain)

- Rockfon

- Decoustics (CertainTeed)

- Rulon International

- Gebrüder Schneider

- Lignis

- Lindner Group

- 9Wood

- Laqfoil

- Chicago Metallic Corporation

- Tectum

- Panifrance

- SAS International

- Tate Access Floors

- Ceilings Plus

- Meranti

- Kirei

Frequently Asked Questions

Analyze common user questions about the Wood Ceilings market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary advantages of wood ceilings over standard gypsum or metal panel systems?

Wood ceilings offer distinct advantages in aesthetic warmth, superior acoustic performance (especially sound absorption), and adherence to biophilic design principles. They provide excellent customization options in terms of species, finish, and perforation, significantly enhancing the perceived value and indoor environment quality of a space.

How do manufacturers address fire safety regulations for wood ceiling installations in commercial environments?

Manufacturers utilize advanced chemical treatments, primarily non-toxic intumescent coatings, that are pressure-impregnated into the wood, ensuring the panels achieve Class A or Class 1 fire ratings required by most commercial building codes, enabling safe use in high-occupancy areas.

Which product type—solid wood, veneer, or engineered wood—is dominant in the commercial Wood Ceilings Market?

Engineered wood and wood veneer ceilings are increasingly dominant in the commercial sector. Engineered products offer superior dimensional stability, better cost efficiency, and higher yield utilization of timber, making them ideal for large-scale projects requiring consistent quality and specific acoustic properties.

How does the sustainability of wood ceilings influence purchasing decisions in modern construction?

Sustainability is a major driver, particularly in North America and Europe. Architects prioritize wood ceilings sourced from certified sustainable forests (FSC/PEFC) to secure green building certifications like LEED or WELL, valuing the renewable nature of wood and low embodied carbon footprint compared to many alternative materials.

What is the typical lifespan and required maintenance for high-quality wood ceiling systems?

High-quality, properly installed wood ceiling systems can last for the life of the building, often 25 to 50 years, provided they are in a climate-controlled environment. Maintenance is minimal, usually involving periodic dusting and checking the integrity of the suspension hardware, eliminating the need for frequent replacement or extensive upkeep.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager