Wood Fillers Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435944 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Wood Fillers Market Size

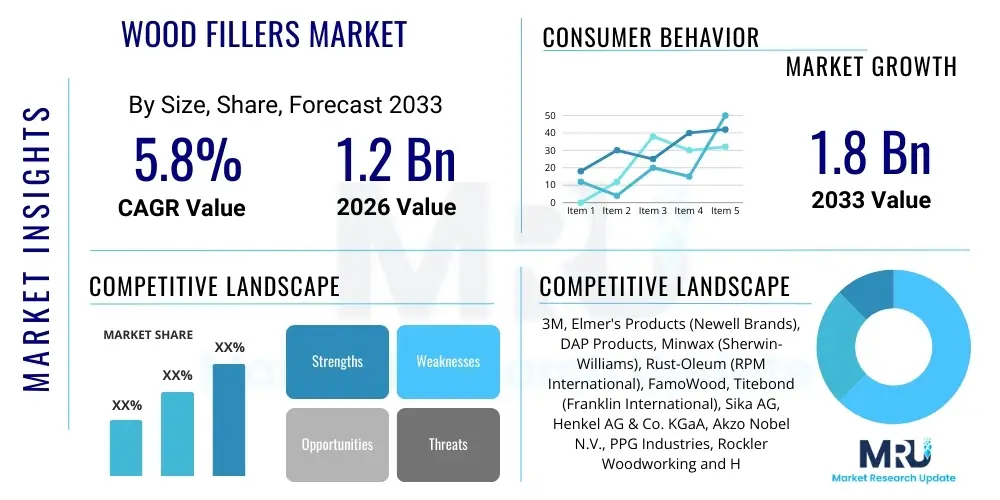

The Wood Fillers Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 1.2 Billion in 2026 and is projected to reach USD 1.8 Billion by the end of the forecast period in 2033.

Wood Fillers Market introduction

The Wood Fillers Market encompasses materials designed to repair imperfections, cracks, holes, and damaged sections in wooden surfaces, enhancing aesthetic appeal and structural integrity before finishing processes like staining or painting. These fillers are formulated from various bases, including solvent-based, water-based, and epoxy resins, each offering distinct performance characteristics regarding drying time, shrinkage, durability, and compatibility with different wood types and subsequent coatings. The primary function of wood fillers is to create a seamless, smooth surface, crucial for high-quality woodworking, restoration, and construction projects, thereby extending the lifespan and visual quality of wooden assets.

The market is characterized by continuous innovation focused on improving product characteristics such as zero volatile organic compounds (VOCs) formulations, enhanced flexibility, and faster curing times to meet stringent environmental regulations and demanding project timelines. Major applications span residential remodeling, commercial construction, furniture manufacturing, and automotive interiors, where wood is utilized extensively. The increasing global emphasis on interior design, coupled with a booming residential housing sector in developing economies, significantly boosts the demand for reliable and effective wood repair solutions.

Key driving factors include the rising trend of do-it-yourself (DIY) home improvement activities, particularly in North America and Europe, post-pandemic. Furthermore, the necessity for efficient maintenance and restoration of antique furniture and historical wooden structures fuels demand for specialized, high-performance epoxy and solvent-based fillers. Benefits derived from using quality wood fillers include improved structural stability, effective moisture resistance at the point of repair, and the ability to perfectly match the wood grain or color, providing an invisible repair that enhances the final product value.

Wood Fillers Market Executive Summary

The Wood Fillers Market exhibits robust growth driven by high activity in the residential renovation and commercial construction sectors globally. Business trends show a significant shift toward sustainable and low-VOC water-based fillers, aligning with global environmental policies and consumer preferences for safer indoor air quality. Manufacturers are heavily investing in R&D to develop bio-based and non-toxic formulations, leading to rapid market adoption of eco-friendly products. Consolidation among smaller, regional players and larger multinational corporations is observed, aiming to achieve economies of scale and expand distribution networks, particularly into high-growth regions like Asia Pacific.

Regionally, Asia Pacific is anticipated to demonstrate the highest growth rate, fueled by massive infrastructure projects, burgeoning furniture manufacturing hubs in China and Vietnam, and increasing urbanization. North America and Europe remain mature but dominant markets, characterized by high adoption rates of premium, specialty fillers used in sophisticated woodworking and historical restoration. European regulations regarding chemical safety and waste management profoundly influence product development, pushing the frontier for solvent-free alternatives. Latin America and the Middle East and Africa are emerging markets, driven by growing construction activities and rising disposable incomes leading to higher investment in interior furnishings.

Segment trends highlight the dominance of the Water-based segment due to its user-friendly nature, low odor, and environmental compliance, making it preferred for DIY and indoor commercial projects. However, Epoxy-based fillers maintain strong traction in high-performance applications, such as marine and exterior repairs, where superior moisture resistance and structural strength are mandatory. The Furniture Manufacturing and Flooring applications segments collectively represent the largest share, reflecting the continuous need for aesthetic surface perfection in finished wood products and installed flooring solutions.

AI Impact Analysis on Wood Fillers Market

User questions related to AI's impact on the Wood Fillers Market primarily revolve around optimizing manufacturing processes, improving quality control, and streamlining supply chain logistics rather than fundamentally changing the chemical composition of the fillers themselves. Users are keen to understand how AI-driven predictive maintenance can reduce downtime in production lines and how advanced machine vision systems can ensure flawless color matching and defect detection in pre-filled wood products. Furthermore, there is interest in using AI algorithms for demand forecasting to manage the volatile raw material costs (resins and solvents) and optimize inventory levels across diverse product lines, addressing concerns about supply chain resilience and cost efficiency in specialized filler production.

The integration of AI and machine learning (ML) is less about replacing the product and more about revolutionizing the operational framework. AI algorithms can analyze vast datasets concerning climate conditions, wood species shrinkage rates, and filler performance metrics to guide the development of new, highly specialized formulations that automatically adjust to different environmental parameters. For example, ML can optimize the curing kinetics of epoxy fillers based on ambient temperature and humidity data provided by smart sensors in the application environment, ensuring optimal performance and consistency. This shift enhances product reliability and reduces application failure rates, providing a significant competitive advantage to early adopters.

Moreover, AI is poised to transform customer service and technical support within the market. Advanced AI-powered diagnostic tools can guide professional contractors and DIY users through complex repair scenarios, recommending the precise filler type, application technique, and curing time based on uploaded images of the damage and wood type identification. This personalized guidance improves user satisfaction and reduces product misuse, effectively democratizing access to expert repair knowledge. The future application of AI in this sector lies in creating intelligent, responsive manufacturing systems and highly precise, automated quality assurance mechanisms.

- AI optimizes supply chain management by predicting resin and solvent price fluctuations.

- Machine vision systems utilize AI for real-time quality control, ensuring perfect color and texture matching.

- Predictive maintenance schedules for mixing and packaging equipment reduce operational downtime and costs.

- AI-driven formulation science assists in creating specialized fillers with optimized curing times based on environmental variables.

- Chatbots and diagnostic AI tools enhance technical support, providing precise product application recommendations to users.

- Automation enhanced by AI minimizes human error in measuring and blending specialized chemical components during manufacturing.

DRO & Impact Forces Of Wood Fillers Market

The Wood Fillers Market is fundamentally shaped by robust demand from the global construction and furniture sectors (Drivers), balanced against stringent environmental regulations and fluctuating raw material costs (Restraints). Opportunities lie primarily in the rapid commercialization of sustainable, bio-based filler technologies and the penetration of emerging markets characterized by significant infrastructure development. The core Impact Forces influencing market growth include intense competition focused on product performance specialization (e.g., fast-drying, non-shrinking formulas) and the necessity to comply with increasing global pressure for low-VOC products, pushing technological boundaries.

Drivers: Significant global growth in construction, particularly in residential renovation and commercial interior fit-outs, drives the fundamental need for wood repair and finishing products. The increasing popularity of high-end, custom woodworking, requiring flawless finishes, necessitates the use of premium wood fillers. Furthermore, the convenience and ease of application of modern water-based fillers have lowered the entry barrier for DIY consumers, expanding the overall user base and frequency of purchase. Restoration projects involving heritage architecture also provide a constant, albeit niche, source of demand for high-durability epoxy fillers.

Restraints: The market faces considerable challenges from the volatile pricing and supply chain instability of key raw materials, including petroleum-derived resins and specialized solvents. Furthermore, regulatory hurdles, particularly in Europe and North America, imposing strict limits on VOC content, necessitate costly reformulation efforts, which can slow down product introduction and increase manufacturing complexity. Substitute materials, such as synthetic wood composites or alternative repair techniques using adhesives and sawdust mixes, pose a minor competitive restraint, particularly in cost-sensitive segments.

Opportunities: The primary opportunity lies in the development and scaling of truly sustainable wood fillers derived from natural or recycled materials, meeting the demand of green building initiatives. Geographic expansion into untapped markets in Africa and specific parts of Asia where formal finishing materials are gaining adoption represents a major growth avenue. Additionally, developing multi-functional products that combine filling and sealing capabilities in a single application streamline professional processes, offering efficiency gains for contractors and attracting premium pricing.

Segmentation Analysis

The Wood Fillers Market segmentation provides a clear view of consumption patterns, technological preferences, and application diversity across various end-use industries. The market is primarily categorized based on the type of formulation (Water-based, Solvent-based, Epoxy), which dictates performance metrics such as curing speed, strength, and environmental impact. Further segmentation by application (Furniture, Flooring, Construction, Automotive) and end-use sectors (Residential, Commercial, Industrial) reveals critical demand dynamics, showing a decisive shift towards environmentally conscious and consumer-friendly water-based products, while high-stakes industrial applications retain demand for robust chemical formulations.

- By Type:

- Water-based Wood Fillers

- Solvent-based Wood Fillers

- Epoxy-based Wood Fillers

- Others (e.g., Polymer-based, Cementitious)

- By Application:

- Furniture Manufacturing

- Wood Flooring & Decking

- Construction & Interior Design

- Automotive Interiors

- Marine Applications

- By End-Use Sector:

- Residential

- Commercial

- Industrial

- DIY (Do-It-Yourself)

- By Distribution Channel:

- Online Retail

- Offline Retail (Hardware Stores, Home Centers)

- Direct Sales (Business-to-Business)

Value Chain Analysis For Wood Fillers Market

The value chain for the Wood Fillers Market begins with the Upstream Analysis, focusing on the procurement of essential raw materials. Key components include synthetic resins (acrylics, polyurethanes, epoxies), specialized solvents, cellulosic materials (wood flour, pigments), and various chemical additives such as thickeners and stabilizers. The cost and quality of these raw materials significantly impact the final product pricing and performance characteristics. Suppliers of specialized chemicals and bulk polymers hold moderate bargaining power, influencing manufacturing costs, necessitating sophisticated procurement strategies to mitigate price volatility.

Midstream activities involve core manufacturing, formulation, packaging, and quality assurance. This stage is crucial for differentiating products based on technical performance, such as consistency, drying speed, and compatibility with different stains. Manufacturers invest heavily in R&D to optimize formulations for low-VOC compliance and enhanced durability, creating barriers to entry. Packaging and branding are also pivotal, particularly for the DIY segment, where ease of use and shelf appeal drive consumer choices. Efficient production scaling and adherence to safety standards are key competitive advantages at this stage.

Downstream Analysis encompasses distribution and sales channels. Products reach end-users through a mix of channels: direct sales (B2B) to large furniture manufacturers and construction firms, and indirect distribution through hardware stores, specialized woodworking retailers, and increasingly, e-commerce platforms. The dominance of large home improvement centers provides significant leverage in pricing and placement for mass-market products. Online retail platforms are gaining momentum, offering greater product variety and reach to remote locations. Effective logistics and inventory management are critical to ensuring product freshness and timely delivery across the fragmented customer base.

Wood Fillers Market Potential Customers

The potential customer base for the Wood Fillers Market is highly diversified, spanning professional tradespeople, large-scale industrial manufacturers, and individual consumers engaged in home improvement. Professional contractors, including carpenters, cabinet makers, and refinishing specialists, represent a crucial segment, demanding high-volume, reliable products with fast curing times and superior sanding properties. These professional buyers prioritize performance and consistency, often relying on direct relationships with manufacturers or specialized industrial distributors for bulk purchases of high-grade solvent or epoxy fillers for demanding applications.

Industrial manufacturers, particularly those in the furniture, door, and window manufacturing sectors, are major end-users. These customers incorporate wood fillers into their assembly lines to repair minor defects in raw wood before finishing, seeking fillers that are machine-applied and compatible with automated sanding and staining processes. Their demand is driven by cost efficiency, production speed, and seamless integration into large-scale factory operations. The adoption of pre-finished components in housing construction also increases the demand for OEM (Original Equipment Manufacturer) grade wood fillers tailored for rapid industrial use.

The residential and DIY segment constitutes another significant customer group, predominantly favoring water-based and easy-to-use fillers available through retail channels. These consumers seek products for small-scale repairs, hobby projects, and general home maintenance. Key purchasing drivers for the DIY market include ease of cleanup, minimal odor, and specific attributes like color-matching capabilities or suitability for exterior use. Retailers and e-commerce platforms must cater to this segment by offering variety, clear instructions, and readily available products that meet high safety and environmental standards.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.2 Billion |

| Market Forecast in 2033 | USD 1.8 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | 3M, Elmer's Products (Newell Brands), DAP Products, Minwax (Sherwin-Williams), Rust-Oleum (RPM International), FamoWood, Titebond (Franklin International), Sika AG, Henkel AG & Co. KGaA, Akzo Nobel N.V., PPG Industries, Rockler Woodworking and Hardware, Gorilla Glue Company, Woodtek, Chem-Pruf International, Sashco Inc., LePage (Henkel), Custom Building Products. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Wood Fillers Market Key Technology Landscape

The Wood Fillers Market technology landscape is undergoing a transformation primarily driven by regulatory compliance and performance enhancement requirements. A core technological trend involves the shift from traditional solvent-based chemistries, which often contain high levels of VOCs and are slower to cure, toward advanced Water-based technologies. Modern water-based formulations utilize sophisticated polymer chemistry to achieve rapid drying, minimal shrinkage, and superior sanding characteristics previously exclusive to solvent products. Encapsulation techniques and advanced colloidal suspensions are employed to stabilize pigments and binding agents, ensuring consistency and long-term durability, even in fluctuating environmental conditions.

Another crucial area of innovation is in two-part Epoxy and specialized structural fillers. These high-performance products are leveraging nanotechnology and fiber reinforcement to achieve extreme structural strength, making them suitable for load-bearing repairs or demanding marine and exterior applications. The use of low-viscosity epoxy resins allows for deep penetration into wood fibers, providing a permanent bond. Furthermore, manufacturers are developing smart fillers with color-changing indicators that signal when the product is fully cured or ready for sanding, addressing a major bottleneck in professional woodworking projects.

The third major technological focus is the integration of bio-based and sustainable components. Research is concentrated on replacing petroleum-derived polymers with renewable materials, such as bio-resins sourced from plant oils or waste biomass. This not only aids environmental compliance but also offers new performance features, such as increased breathability and better interaction with natural wood treatments. Furthermore, digital technologies are playing a role; specialized color-matching systems use spectral analysis to precisely formulate fillers that blend invisibly with various wood species and existing stains, greatly improving aesthetic outcomes for high-end restoration projects.

Regional Highlights

- North America (USA, Canada, Mexico)

- Europe (Germany, France, UK, Italy, Spain, Rest of Europe)

- Asia Pacific (China, Japan, South Korea, India, Southeast Asia)

- Latin America (Brazil, Argentina, Rest of Latin America)

- Middle East and Africa (MEA)

North America is a mature market characterized by high consumer awareness regarding product quality and environmental impact. The region exhibits strong demand driven by robust residential remodeling activities and a large DIY culture. The implementation of stringent environmental regulations, particularly California's VOC standards, compels manufacturers to prioritize the development and commercialization of low-VOC and water-based fillers. US consumers and professional contractors often favor established brands and specialized epoxy fillers for historical preservation and high-value architectural woodworking projects. Market growth is stable, focusing on premium, performance-driven products and streamlined retail availability.

The prominence of large home improvement retailers and the widespread use of wood in housing construction underpin the consistent demand for wood fillers. Canada and Mexico are also witnessing growth, tied to expanding housing starts and investments in commercial infrastructure. Innovation in the region centers on faster setting times and fillers specifically optimized for high-humidity environments and exterior deck repairs, addressing climatic variations across the continent.

Europe is a highly regulated market, where directives such as REACH significantly influence raw material sourcing and product formulation. This regulatory environment has made Europe a global leader in adopting sustainable and water-based filler technologies. Demand is strong across two primary sectors: high-quality furniture manufacturing in countries like Italy and Germany, and the extensive renovation of historical buildings, which requires specialized, durable, and reversible repair materials. The UK and France show consistent demand fueled by residential maintenance and interior design trends that favor natural wood aesthetics.

The market trend here is towards specialized, small-batch fillers tailored for specific wood species or applications, emphasizing quality over volume. Eastern European nations are experiencing faster growth rates as their construction standards align with Western Europe, leading to increased adoption of professional-grade wood finishing products. European consumers show a strong preference for certified eco-labels, further accelerating the transition away from traditional solvent-based chemistries.

Asia Pacific is the fastest-growing market globally, primarily fueled by rapid urbanization, massive infrastructure investment, and the region's emergence as the world's leading furniture manufacturing hub (especially China and Vietnam). The initial focus in many parts of APAC was on cost-effective, bulk-supply fillers, often utilizing solvent-based systems due to less restrictive environmental oversight compared to the West.

However, environmental consciousness is rising, particularly in developed economies like Japan and South Korea, driving a dual market dynamic: high volume, cost-sensitive production, and a rapidly expanding segment for premium, eco-friendly fillers used in high-end commercial projects and exported goods. India and Southeast Asia's burgeoning middle class and residential construction booms are expected to maintain the high CAGR throughout the forecast period, transitioning demand from simple putties to advanced polymer and water-based compounds.

The Latin American market is characterized by fluctuating economic conditions but possesses significant long-term potential driven by substantial housing deficits and improving construction spending. Brazil dominates the regional market due to its large domestic furniture industry and extensive forest resources. The demand profile is mixed, with a strong focus on cost-effectiveness in general construction, but a growing willingness to adopt imported, high-performance fillers for specialty projects.

Infrastructure projects and the need for durable repairs in regions subject to high heat and humidity favor epoxy and robust polymer fillers that offer enhanced resistance to tropical climates. Distribution challenges remain a factor, necessitating local manufacturing partnerships and optimized logistics to efficiently reach fragmented construction sites and retailers across the continent.

The MEA market is largely driven by massive construction and tourism infrastructure projects in the Gulf Cooperation Council (GCC) countries (e.g., UAE, Saudi Arabia) and increasing residential development in key African economies (e.g., South Africa, Nigeria). Wood filler demand in the GCC is highly specialized, focusing on products that perform exceptionally well under extreme desert conditions, including high temperatures and intense solar radiation, requiring formulations with superior UV stability and heat resistance.

In Africa, growth is primarily linked to imported goods and basic construction materials, though local manufacturing bases are slowly emerging. The region's diverse climate necessitates a wide range of product formulations, from moisture-resistant fillers for coastal areas to heat-stable products for interior applications. Market penetration is increasing as global finishing standards are adopted for luxury commercial and residential builds.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Wood Fillers Market.- 3M

- Elmer's Products (Newell Brands)

- DAP Products

- Minwax (Sherwin-Williams)

- Rust-Oleum (RPM International)

- FamoWood

- Titebond (Franklin International)

- Sika AG

- Henkel AG & Co. KGaA

- Akzo Nobel N.V.

- PPG Industries

- Rockler Woodworking and Hardware

- Gorilla Glue Company

- Woodtek

- Chem-Pruf International

- Sashco Inc.

- LePage (Henkel)

- Custom Building Products

- ITW Polymers & Fluids

- Red Devil Inc.

Frequently Asked Questions

Analyze common user questions about the Wood Fillers market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the demand for sustainable wood fillers?

The primary driver is stringent government regulation, particularly concerning Volatile Organic Compound (VOC) emissions in construction materials across North America and Europe, coupled with increasing consumer preference for low-odor, environmentally friendly building products that ensure better indoor air quality.

Which type of wood filler is recommended for structural exterior repairs requiring high moisture resistance?

Epoxy-based wood fillers are highly recommended for structural and exterior repairs. They provide exceptional adhesion, superior mechanical strength, and outstanding resistance to moisture, humidity, and temperature fluctuations, minimizing shrinkage and ensuring long-term durability.

How does the segmentation of the wood fillers market by application influence product innovation?

Application segmentation dictates innovation by demanding specialized properties; for example, furniture manufacturing requires fillers that accept stain and blend seamlessly, while flooring applications necessitate fillers with high compressive strength and rapid cure times for efficient installation and traffic tolerance.

What role does the DIY segment play in the growth of the Wood Fillers Market?

The DIY segment significantly boosts market growth, particularly for water-based fillers, due to their ease of use, lower toxicity, and simple cleanup. The accessibility of online tutorials and renovation content encourages more homeowners to undertake minor wood repair and finishing projects.

Which geographic region is expected to exhibit the fastest growth rate in the Wood Fillers Market?

Asia Pacific (APAC) is projected to experience the fastest growth rate, driven by accelerated urbanization, massive government investment in housing and infrastructure, and the continuous expansion of the region's dominant furniture manufacturing and export industry.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager