Wood Grinder Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433402 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Wood Grinder Market Size

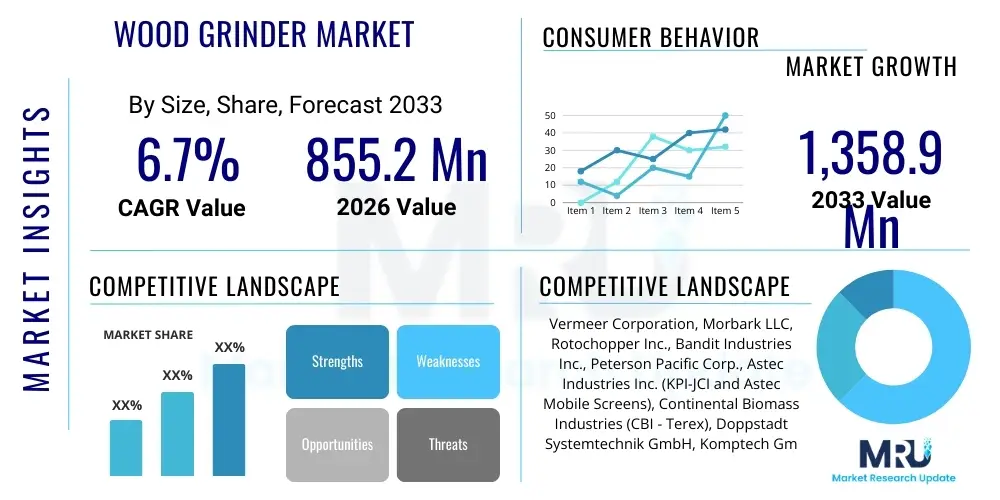

The Wood Grinder Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.7% between 2026 and 2033. The market is estimated at USD 855.2 Million in 2026 and is projected to reach USD 1,358.9 Million by the end of the forecast period in 2033. This consistent growth trajectory is fundamentally supported by the escalating global demand for biomass energy feedstock and the stringent regulatory environment promoting efficient waste management and wood waste recycling across industrialized nations. Furthermore, advancements in grinder technology, including improved efficiency, reduced maintenance downtime, and enhanced safety features, are making these machines more attractive investments for municipalities, forestry operations, and specialized waste processing contractors.

Wood Grinder Market introduction

The Wood Grinder Market encompasses the manufacturing, sale, and servicing of heavy-duty machinery designed to reduce large volumes of wood materials—such as forestry residue, construction and demolition (C&D) waste, storm debris, and recycled wood pallets—into smaller, manageable particles. These sophisticated machines utilize powerful engines, rotating drums, and specialized cutting or hammering mechanisms to achieve significant volume reduction, preparing the processed wood for various industrial applications. Key product categories include tub grinders, horizontal grinders, and specialty crushers, differentiated primarily by their feed mechanism, mobility, and ultimate output capacity.

The primary applications of processed wood fiber derived from grinding operations are diverse and crucial for sustainable resource management. Major end-users rely on wood grinders to produce biomass fuel for co-generation power plants, mulch and soil amendment products for landscaping and agriculture, animal bedding, and raw materials for composite wood manufacturing like particleboard. The integration of advanced diagnostics and telematics into modern wood grinders ensures optimal performance and predictive maintenance, thereby reducing operational costs and maximizing throughput efficiency. This technological evolution enhances the value proposition of modern grinding equipment in complex material handling environments.

Driving factors for market expansion include robust governmental mandates supporting renewable energy sources, particularly bioenergy derived from wood waste, which offers a carbon-neutral alternative to fossil fuels. The rising costs associated with landfill disposal and the subsequent necessity for volume reduction in C&D debris further stimulate demand. Additionally, the rapid pace of infrastructure development and urbanization, particularly in emerging economies, generates substantial wood waste volumes, necessitating efficient, high-capacity grinding solutions. The benefits of utilizing these grinders extend to environmental protection through reduced landfill burdens and economic advantages via the creation of marketable commodities from previously discarded waste streams.

Wood Grinder Market Executive Summary

The Wood Grinder Market is characterized by intense technological competition focused on enhancing material throughput, fuel efficiency, and reducing environmental emissions, particularly noise and dust pollution. Key business trends involve the increasing adoption of electric and hybrid-powered grinding solutions, driven by tightening emission standards in developed markets, which promises lower operating expenses and reduced environmental footprints in urban processing centers. Furthermore, the market is experiencing consolidation among specialized equipment providers, leading to broader product portfolios and integrated solutions spanning chipping, grinding, and screening processes, providing end-users with single-source procurement advantages and streamlined service contracts. The trend toward subscription-based or leased equipment models is also gaining traction, particularly for smaller contractors seeking to manage capital expenditures more effectively.

Regionally, North America maintains market dominance due to its mature forestry sector, extensive construction activities, and established biomass energy infrastructure, alongside rigorous governmental support for recycling initiatives. However, the Asia Pacific region is poised for the fastest growth, primarily fueled by massive infrastructure projects, industrialization, and rapidly developing waste-to-energy markets, particularly in China and India, where regulatory frameworks are progressively prioritizing waste valorization. Europe exhibits strong and stable demand, driven by well-established bioenergy targets and stringent regulations governing forestry residue management and the circular economy mandate, emphasizing high-quality output specifications for biomass fuels.

Segment trends highlight the growing preference for horizontal grinders over traditional tub grinders, especially in urban or confined spaces, owing to their enhanced safety features, superior control over material feeding, and ability to handle long, bulky materials efficiently. The application segment focused on biomass fuel production continues to represent the largest revenue share, reflecting global energy transition efforts. Within technology, the integration of intelligent sensors and predictive maintenance systems is becoming standard, ensuring maximum uptime and optimized operational parameters, thereby increasing the effective life cycle and return on investment for high-capital machinery assets.

AI Impact Analysis on Wood Grinder Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Wood Grinder Market frequently revolve around optimizing machinery performance, automating sorting processes, and enhancing safety protocols. Common concerns include how AI can manage material variability (e.g., differentiating clean wood from contaminated wood/metal), whether AI-driven maintenance can truly prevent catastrophic failures, and the cost implications of integrating such advanced technologies into existing fleets. Users seek quantifiable evidence of efficiency gains, focusing specifically on improved fuel consumption rates, enhanced particle size consistency, and reduced wear part expenditure through proactive, data-driven operational adjustments. There is significant interest in AI’s potential to standardize output quality, which is critical for meeting stringent feedstock specifications required by high-efficiency biomass boilers and composite material manufacturers.

The integration of AI, machine learning (ML), and sophisticated sensor fusion technologies is fundamentally transforming the operational efficiency and predictive capabilities of modern wood grinding equipment. AI algorithms process real-time telemetry data—including engine load, hydraulic pressure, cutter head speed, and material flow visualization—to instantaneously adjust grinding parameters. This capability allows the grinder to optimize its energy consumption based on the density and type of material being processed, resulting in significant reductions in fuel usage and minimizing stress on critical components. For example, ML models can predict the optimal time for replacing screens or hammers based on analyzed wear patterns and historical operational load factors, shifting maintenance from reactive to truly predictive, thereby minimizing unexpected downtime.

Furthermore, AI-powered vision systems are being deployed at the in-feed stage to automatically detect and reject contaminants such as large stones, metal fragments, or ungrindable plastics before they enter the grinding chamber. This automated contamination detection vastly improves equipment safety, reduces the risk of damage to expensive internals, and enhances the purity of the final product, which commands a premium in specific downstream markets. The long-term impact of AI is expected to extend to fully autonomous grinding operations, potentially managed remotely, increasing productivity and addressing the skilled labor shortage challenge facing heavy equipment industries.

- AI-driven Predictive Maintenance: Minimizes unexpected downtime by analyzing operational telemetry and wear indicators to forecast component failure accurately.

- Optimized Throughput and Fuel Efficiency: ML algorithms adjust rotor speed and feed rates in real-time based on material composition and load factors, ensuring maximum fuel economy.

- Automated Contaminant Detection: Vision systems and sensors powered by AI identify and divert non-wood materials (metal, rock) to prevent internal machine damage and maintain product purity.

- Enhanced Particle Size Consistency: Algorithms monitor and adjust screen settings and hammer profiles to meet strict end-user specifications for biomass or mulch products.

- Remote Monitoring and Control: Allows operators to manage and fine-tune grinding operations from a distance, increasing labor efficiency and safety compliance.

DRO & Impact Forces Of Wood Grinder Market

The dynamics of the Wood Grinder Market are shaped by a complex interplay of positive momentum derived from regulatory mandates and technological evolution, counterbalanced by significant operational and economic constraints. The overarching Impact Forces are heavily weighted towards environmental mandates and the global energy transition. Strong drivers include the accelerating demand for sustainable energy sources (biomass), supportive government policies promoting the utilization of waste wood for fuel and value-added products, and stringent C&D waste diversion regulations compelling businesses to process debris rather than landfilling it. These forces collectively create a sustained, high-volume requirement for efficient size reduction equipment.

However, the market faces notable restraints that temper growth rates. The high initial capital investment required for purchasing heavy-duty, high-capacity wood grinders remains a major barrier to entry for smaller enterprises and contractors. Furthermore, the operational challenges associated with dust, noise, and vibration emissions often lead to complex permitting processes and operational limitations, especially near residential areas. The dependence of the market on fluctuating prices for processed wood commodities (biomass pellets, mulch) and the availability and cost of raw wood waste feedstocks also introduce economic volatility, impacting the return on investment calculations for end-users.

Opportunities for significant expansion lie primarily in the development and proliferation of mobile and electric grinding solutions, which address environmental restraints and offer operational flexibility, allowing contractors to serve diverse, geographically dispersed projects more efficiently. The growing sophistication of waste segregation and preprocessing facilities also presents an opportunity, as high-purity feedstock reduces wear and tear on grinders, enhancing their lifespan and efficiency. Furthermore, geographic expansion into rapidly urbanizing regions of Asia and Latin America, coupled with the development of smaller, more affordable grinders suitable for localized community recycling initiatives, represent viable pathways for sustained future growth and market penetration.

Segmentation Analysis

The Wood Grinder Market is fundamentally segmented based on factors crucial to machinery performance, end-user operational requirements, and the characteristics of the input material. Key segmentation variables include Product Type (Horizontal Grinders, Tub Grinders, and Specialty/Other Grinders), Mobility (Mobile and Stationary), Power Source (Diesel and Electric/Hybrid), and End-Use Application (Biomass Production, Mulch and Landscaping, and Recycling/Waste Management). This structure allows for granular analysis of demand patterns, enabling manufacturers to tailor machine specifications and marketing strategies to specific industry needs, addressing issues like space constraints, mobility requirements, and emission standards specific to different operational environments globally.

Horizontal grinders are currently dominating the market share, primarily due to their enhanced safety features—as the material is fed horizontally away from the operator—and their versatility in processing long, bulky materials like whole trees and construction timbers. In contrast, tub grinders, known for their high throughput capacity, remain popular in large-scale, dedicated operations such as dedicated biomass yards or large municipal composting facilities where space is less restrictive. The shift towards electric and hybrid-powered systems is a critical trend driven by stricter emission regulations, particularly in urban and European markets, influencing the power source segmentation significantly. Mobile grinders, essential for forestry and site clearing contractors, continue to account for the larger share within the Mobility segment due to the necessity of processing material close to the source, thereby minimizing transportation costs.

The biomass production segment holds the highest revenue percentage, reflective of the global commitment to renewable energy targets and the established infrastructure for converting wood waste into thermal or electrical energy. However, the mulch and landscaping segment demonstrates steady, resilient growth, supported by constant demand for high-quality soil conditioners and decorative groundcover in both residential and commercial sectors. The recycling and waste management application segment is projected to exhibit robust future expansion, largely due to policy pressure on C&D waste diversion and the economic incentive to recover valuable materials from mixed waste streams, driving demand for heavy-duty, contamination-tolerant grinding systems.

- Product Type:

- Horizontal Grinders

- Tub Grinders

- Specialty & Other Grinders (e.g., Shredders, Low-Speed Grinders)

- Mobility:

- Mobile Grinders (Tracked, Wheeled)

- Stationary Grinders

- Power Source:

- Diesel Powered

- Electric/Hybrid Powered

- Application:

- Biomass Energy Feedstock Production

- Mulch and Landscaping Products

- Recycling and Waste Management (C&D Debris)

- Pulp & Paper Industry Residue Processing

Value Chain Analysis For Wood Grinder Market

The value chain of the Wood Grinder Market initiates with the upstream procurement and processing of specialized components and raw materials, primarily high-grade steel alloys for structural frames, rotors, and wear parts like hammers, tips, and screens. Manufacturers rely heavily on precision engineering companies for advanced hydraulic systems, robust diesel engines (meeting Tier 4/Stage V standards), electronic controls, and sophisticated gearing mechanisms. The complexity of the manufacturing phase involves rigorous processes such as CNC machining, heavy welding, specialized heat treatment of wear parts to maximize durability, and final assembly, ensuring the machinery can withstand the high-impact stress of wood reduction operations. Manufacturers must maintain high quality control standards to guarantee the longevity and safety performance of these expensive capital goods.

Mid-stream activities are dominated by the Original Equipment Manufacturers (OEMs) who design and produce the grinders, utilizing global supply chains for components to manage costs and ensure availability. Distribution channels are highly structured, relying on a network of authorized dealers and specialized equipment distributors. Direct sales models are often employed for large fleet purchases or governmental contracts, but indirect distribution through local dealerships remains the primary route, offering local sales support, technical expertise, and critical financing options to end-users. These dealerships play a crucial role in managing inventory and providing immediate after-sales service and spare parts supply, which are paramount to minimizing operator downtime.

Downstream activities center on the end-user operations, including forestry contractors, recycling plants, municipal waste facilities, and biomass fuel producers. The value chain concludes with comprehensive aftermarket support, which represents a significant and stable revenue stream for OEMs and dealers. This includes the sale of proprietary wear parts (which require frequent replacement due to abrasion), scheduled maintenance contracts, repair services, and technology upgrades (e.g., software or sensor additions). The efficiency and reliability of this downstream support are major competitive differentiators, as downtime directly impacts the profitability of the end-user’s material processing operations.

Wood Grinder Market Potential Customers

The potential customer base for wood grinding equipment is broad, spanning multiple sectors that generate large volumes of wood waste or require processed wood fibers for their operations. The largest and most frequent buyers are professional forestry and logging contractors who require mobile, high-capacity grinders to clear logging debris (slash) and produce chips or fuel feedstock directly in the forest, thereby reducing transportation costs and meeting sustainable forestry standards. Secondly, dedicated waste management companies and municipal solid waste (MSW) facilities are critical buyers, utilizing grinders to process yard waste, construction and demolition (C&D) debris, and bulky wood items, significantly reducing volume before final disposal or valorization into recycling streams.

A third significant customer group comprises biomass energy producers and co-generation power plants that require vast, consistent supplies of wood fuel (hog fuel or specialized pellets). These entities often purchase or lease large, stationary, high-horsepower grinders to process raw wood materials to meet stringent particle size and moisture content specifications necessary for efficient combustion and boiler operations. Furthermore, landscaping and horticulture firms, particularly large commercial mulch producers, rely on medium-to-large grinders to turn wood waste into marketable mulch products, ensuring consistent quality and volume necessary to serve retail and wholesale demand.

In addition to these major segments, secondary buyers include specialized material handling firms, independent timber recycling yards, and governmental agencies responsible for disaster cleanup (e.g., following hurricanes or major storms). These diverse end-users prioritize different grinder attributes—forestry contractors value mobility and ruggedness; energy producers prioritize throughput and consistency; and recycling centers focus on contaminant tolerance and durability—necessitating that manufacturers offer a differentiated and customized product portfolio to capture all segments effectively.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 855.2 Million |

| Market Forecast in 2033 | USD 1,358.9 Million |

| Growth Rate | 6.7% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Vermeer Corporation, Morbark LLC, Rotochopper Inc., Bandit Industries Inc., Peterson Pacific Corp., Astec Industries Inc. (KPI-JCI and Astec Mobile Screens), Continental Biomass Industries (CBI - Terex), Doppstadt Systemtechnik GmbH, Komptech GmbH, Hammel Recyclingtechnik GmbH, FAE Group S.p.A., Heinola Sawmill Machinery Inc., Jenz GmbH, Trelan Manufacturing Inc., Shred-Tech Corp., McCloskey International Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Wood Grinder Market Key Technology Landscape

The technological landscape of the Wood Grinder Market is rapidly advancing, moving beyond simple mechanical size reduction towards intelligent, high-precision processing systems. A primary area of innovation is in power unit efficiency, specifically the increasing shift towards hybrid and fully electric drivetrain systems. These advanced systems offer superior torque delivery, reduced fuel consumption (up to 30% in hybrid models), and zero localized emissions, satisfying stringent environmental regulations like those in the EU and California. Furthermore, manufacturers are focusing heavily on hammer and cutting mechanism design, utilizing proprietary, abrasion-resistant alloys and quick-change systems to maximize uptime and extend the lifespan of wear components, which traditionally represent a major operational expense.

Telematics and the Internet of Things (IoT) integration represent another pivotal technological trend. Modern wood grinders are equipped with sophisticated sensor suites that continuously monitor operational metrics—engine diagnostics, oil temperature, hydraulic flow, rotor RPM, and fuel levels—transmitting this data via cloud platforms. This allows fleet managers to remotely track performance, schedule preemptive maintenance based on real-time usage, and identify bottlenecks in the processing workflow. This data-driven approach is essential for optimizing the efficiency of dispersed fleets and ensuring compliance with warranties and service schedules. The capability for remote software updates also allows manufacturers to continuously improve machine performance post-sale.

Safety and automation technologies are crucial differentiators. Advanced grinders now incorporate sophisticated control systems that automatically manage the material in-feed rate to prevent engine lugging or material surging, thereby ensuring consistent output and protecting the machinery. Furthermore, enhanced safety features, such as remote-control operation, integrated metal detection systems that automatically reverse the feed mechanism upon contaminant sensing, and improved noise reduction enclosures, are becoming standard requirements. These innovations address key end-user concerns related to operator safety, operational efficiency, and environmental compliance, reinforcing the need for continuous technological investment by leading OEMs to maintain market competitiveness.

Regional Highlights

The global demand structure for wood grinders is highly asymmetrical, reflecting diverse regional economic maturity, regulatory environments, and the prevalence of specific end-use applications, such as large-scale biomass energy production in Europe versus general C&D recycling in North America.

- North America: Dominates the market owing to its vast forestry resources, highly industrialized construction sector, and mature recycling infrastructure. The region, particularly the United States and Canada, features large-scale operators (logging companies, municipal waste authorities) that require high-capacity, heavy-duty mobile grinders. Regulatory drives focused on biomass production and C&D waste diversion in states like California and provinces like British Columbia ensure steady demand for technologically advanced, often diesel-powered, high-throughput equipment.

- Europe: Characterized by stable, technology-driven growth, largely fueled by aggressive renewable energy directives and mandates for decentralized heat and power generation using wood biomass. European markets, led by Germany, the UK, and Scandinavia, prioritize environmental performance, driving the demand for electric, hybrid, and low-emission diesel grinders. The focus here is on producing highly specified wood chips and pellets that meet strict quality standards for energy efficiency.

- Asia Pacific (APAC): Identified as the fastest-growing region, driven by rapid urbanization, massive infrastructure projects, and increasing industrialization across countries like China, India, and Southeast Asia. The escalating volume of construction waste and the developing regulatory framework for waste management are key catalysts. While cost sensitivity remains a factor, there is increasing demand for robust, entry-level, and mid-range mobile grinders to handle localized waste processing and basic recycling needs.

- Latin America: Exhibits steady growth, primarily concentrated in Brazil and Mexico, linked to agricultural residue management, expanding commercial forestry operations, and initial investments in waste-to-energy projects. The demand is often focused on durable, easily maintainable equipment suitable for challenging operational environments and variable fuel quality.

- Middle East and Africa (MEA): Represents a niche, emerging market, with demand stemming mainly from large-scale governmental infrastructure development, landscaping projects, and managing specialized wood waste generated by the timber import/processing sectors. Growth is sporadic and highly dependent on specific national investment cycles in waste management and renewable energy infrastructure.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Wood Grinder Market.- Vermeer Corporation

- Morbark LLC (A subsidiary of Astec Industries Inc.)

- Rotochopper Inc.

- Bandit Industries Inc.

- Peterson Pacific Corp. (A subsidiary of Astec Industries Inc.)

- Continental Biomass Industries (CBI - A Terex Brand)

- Doppstadt Systemtechnik GmbH

- Komptech GmbH

- Hammel Recyclingtechnik GmbH

- FAE Group S.p.A.

- Jenz GmbH

- Heinola Sawmill Machinery Inc.

- Trelan Manufacturing Inc.

- Shred-Tech Corp.

- McCloskey International Ltd. (A subsidiary of Metso Outotec)

- Terex Corporation (Finlay and Cedarapids brands often handle related crushing/screening equipment)

- Willibald GmbH

- Continental Biomass Engineering (CBE)

- SatrindTech S.p.A.

- ECO Green Equipment

Frequently Asked Questions

Analyze common user questions about the Wood Grinder market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary differences between horizontal grinders and tub grinders?

Horizontal grinders feed material into the rotor horizontally, offering superior safety and better control over long, bulky items like construction debris. Tub grinders feed material from the top into a grinding tub, providing higher throughput capacity for forestry residue and smaller, loose materials, but require more operational space and have greater ejection risk.

How is the demand for biomass energy impacting the Wood Grinder Market?

The demand for biomass energy is a primary market driver, necessitating high-capacity grinders that can consistently produce specialized feedstock (wood chips/hog fuel) meeting strict particle size and moisture content specifications for co-generation plants globally. This drives technological development in consistency and volume output.

What role do electric and hybrid wood grinders play in the market?

Electric and hybrid grinders are increasingly important for meeting stringent emission regulations, especially in urban or indoor recycling operations and European markets. They offer lower operational noise, reduced reliance on fluctuating diesel prices, and potentially lower maintenance costs compared to conventional diesel systems.

What are the major challenges related to operating wood grinding equipment?

Key operational challenges include managing high wear and tear on components (hammers, tips, screens) due to abrasion, mitigating severe dust and noise pollution, high initial capital investment costs, and the need for rigorous maintenance schedules to ensure maximum operational uptime.

Which regions are expected to show the fastest growth in the Wood Grinder Market?

The Asia Pacific (APAC) region, specifically emerging economies like China and India, is projected to exhibit the fastest growth. This acceleration is driven by rapid industrialization, increasing volumes of construction and demolition waste, and governmental initiatives focusing on developing organized waste management and recycling infrastructure.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager