Wood Interior Doors Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431659 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Wood Interior Doors Market Size

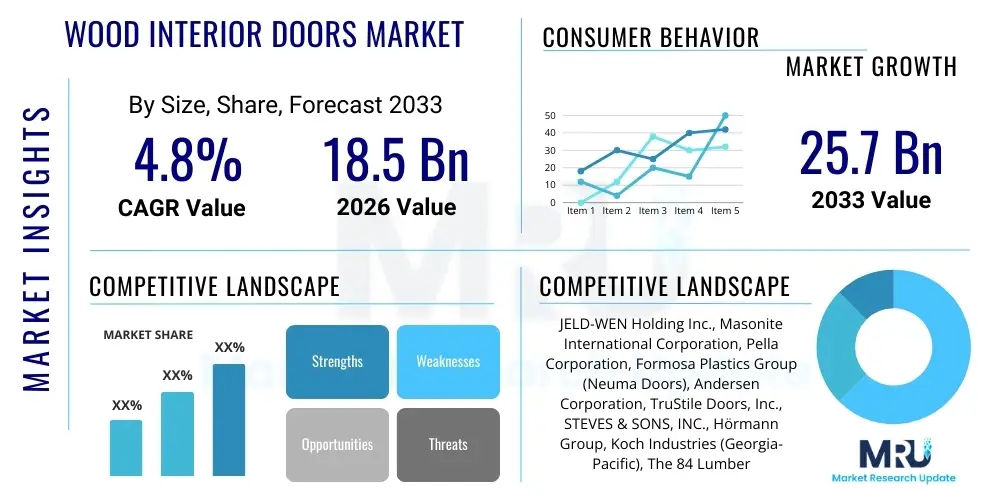

The Wood Interior Doors Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at $18.5 Billion in 2026 and is projected to reach $25.7 Billion by the end of the forecast period in 2033. This consistent growth trajectory is primarily driven by robust residential construction activity globally, particularly in emerging economies, coupled with increasing renovation and remodeling trends in mature markets. Consumer preferences are shifting towards natural, sustainable, and aesthetically pleasing interior fittings, positioning wood doors as a premium and desirable choice over alternative materials.

The valuation reflects a sustained demand stemming from both new construction projects and the replacement market. High-density urban development, necessitating high-quality and acoustically effective interior solutions, further supports market expansion. Factors such as customization capabilities, durability, and the thermal insulation properties inherent to wood contribute significantly to its sustained adoption rate across various building typologies, ranging from luxury housing to commercial office spaces undergoing aesthetic upgrades. Manufacturers are continuously investing in advanced finishing technologies and innovative door designs, ensuring a competitive edge and meeting stringent building codes regarding fire safety and structural integrity.

Geographically, Asia Pacific is anticipated to be the fastest-growing region, fueled by rapid urbanization and massive investments in infrastructure development, particularly residential complexes in countries like China and India. Conversely, North America and Europe maintain substantial market shares due to established housing markets and a consistent cycle of interior modernization projects. The move toward sustainable forestry and certified wood products (such as FSC certified materials) also enhances the market’s appeal among environmentally conscious developers and consumers, bolstering the overall market size projections throughout the forecast period.

Wood Interior Doors Market introduction

The Wood Interior Doors Market encompasses the manufacturing, distribution, and sales of doors designed for internal use within residential, commercial, and industrial structures, utilizing wood or wood composites as the primary construction material. These products serve essential functions, including providing privacy, managing temperature flow, controlling acoustics, and enhancing the aesthetic appeal of interiors. The primary products include panel doors, flush doors, bifold doors, and French doors, categorized further by the core material—solid wood, solid core, or hollow core—each catering to specific performance and budgetary requirements across diverse applications.

Major applications of wood interior doors are concentrated in the residential sector, driven by new housing starts and extensive home renovation projects. Commercial applications, including hotels, offices, hospitals, and educational institutions, also represent a significant demand base, often requiring specific features like fire-rated or sound-dampening capabilities. Key benefits of utilizing wood doors include superior aesthetic versatility, excellent thermal and acoustic insulation, high durability when maintained, and the inherent warmth and luxury they impart to an interior space. Furthermore, the ability to customize wood species, stains, finishes, and panel configurations allows architects and designers extensive creative freedom.

Driving factors propelling this market include the global rebound in the construction industry post-economic uncertainties, increasing disposable incomes leading to higher investment in premium home decor, and technological advancements in wood processing that improve moisture resistance and structural stability. The rising trend of sustainable building practices also favors wood products derived from responsibly managed forests. The market is highly competitive, characterized by continuous innovation in design and manufacturing efficiencies to address evolving consumer tastes and stringent regulatory standards related to building safety and energy efficiency.

Wood Interior Doors Market Executive Summary

The Wood Interior Doors Market is characterized by steady expansion, driven fundamentally by robust global residential development and a strong consumer focus on interior aesthetics and functional quality. Business trends indicate a noticeable shift toward premium products, specifically solid wood and solid core doors, reflecting increased investment in long-term property value. Manufacturers are focusing heavily on integrating advanced design technologies, such as customized CNC routing and specialized veneers, to offer differentiated products. Supply chain resilience, particularly concerning the sourcing and certification of sustainable timber, remains a critical operational focus, influencing pricing and availability across regional markets. Strategic mergers and acquisitions are common as large players seek to consolidate regional market presence and expand specialized product portfolios, particularly those appealing to the high-end renovation segment.

Segment trends reveal that the flush door segment, primarily due to its cost-effectiveness and broad utility in the mass market, continues to hold a significant volume share. However, the panel door segment, particularly five-panel and six-panel designs, is experiencing accelerated value growth, driven by their traditional aesthetic appeal in luxury and custom homes. In terms of material, composite wood doors (like MDF and HDF) are witnessing high adoption, balancing the natural look of wood with enhanced stability and resistance to warping, a critical concern for builders. Furthermore, the distribution channel is increasingly optimized through e-commerce platforms, though traditional dealer networks remain essential for customized, high-value installations requiring professional measurement and fitting services.

Regionally, Asia Pacific is projected to lead in market growth rate due to rapid urbanization and large-scale government-backed housing projects in developing nations. North America and Europe, while growing at a more mature pace, command significant market value, driven by high average selling prices (ASPs) and continuous demand from the renovation and refurbishment sector, especially relating to energy efficiency upgrades. Regulatory compliance, particularly concerning fire ratings (e.g., UL standards in North America and CE standards in Europe), dictates product development and market entry strategies in these developed economies. The Middle East and Africa (MEA) are emerging markets, capitalizing on significant infrastructure investments in commercial real estate and hospitality sectors, demanding high-quality, customized wood door solutions for luxurious projects.

AI Impact Analysis on Wood Interior Doors Market

User inquiries regarding the integration of Artificial Intelligence in the Wood Interior Doors Market frequently revolve around three core themes: optimizing manufacturing processes for efficiency, enhancing personalization and design capabilities, and improving supply chain visibility and forecasting accuracy. Users are keen to understand how AI can reduce material waste during cutting and assembly, automate quality control for complex finishing processes, and predict raw material price fluctuations (especially timber). A major expectation is the use of AI-driven tools for consumers and designers, allowing instantaneous visualization of custom door specifications within digital building models (BIM). Concerns often center on the capital investment required for adopting AI robotics and software, and the subsequent retraining needs for the workforce, particularly in traditional manufacturing settings. Overall, the market expects AI to transition wood door manufacturing from a craft-based industry to a highly efficient, demand-responsive sector capable of high-volume customization.

The application of AI algorithms is fundamentally transforming operational capabilities within the sector, moving beyond simple automation to sophisticated optimization. AI-powered software can analyze complex sensor data from manufacturing lines to preemptively identify maintenance needs for machinery like CNC routers and presses, drastically reducing unplanned downtime. Furthermore, machine learning models are deployed to scrutinize the grading of raw timber, ensuring optimal material usage and minimal waste based on grain pattern, defect identification, and required product dimensions. This precision minimizes costs and maximizes the yield from expensive specialty woods, significantly improving profitability margins. The integration of generative design principles, aided by AI, also allows for rapid prototyping of aesthetically novel and structurally sound door designs, accelerating time-to-market for new collections.

In the realm of sales and logistics, AI provides powerful tools for demand forecasting, particularly useful for managing long lead times associated with custom wood products. By analyzing historical sales data, seasonal variations, housing market indicators, and geopolitical factors affecting timber supply, AI can generate highly accurate production schedules. This leads to improved inventory management, reducing the costs associated with overstocking or the revenue loss from understocking popular items. For consumers, AI integration facilitates personalized experiences through augmented reality (AR) apps that allow virtual placement of doors in their homes, enabling better decision- making and reducing the return rate associated with aesthetic mismatch. This technological shift is pivotal for maintaining competitiveness in a segment where customization is becoming the norm.

- AI optimizes timber cutting patterns, minimizing material waste and maximizing raw material utilization.

- Predictive maintenance schedules for manufacturing equipment are enhanced using machine learning, reducing costly operational downtime.

- Automated visual inspection systems (computer vision) improve quality control for finishes, veneer matching, and structural defects.

- AI algorithms enhance demand forecasting, aiding supply chain resilience and optimal inventory management for custom products.

- Generative design tools assist architects and manufacturers in rapidly creating new, structurally optimized door styles.

- AI-driven chatbots and recommendation engines improve the customer experience during the specification and purchasing process.

DRO & Impact Forces Of Wood Interior Doors Market

The market dynamics are governed by a complex interplay of Drivers, Restraints, and Opportunities (DRO), which collectively constitute the Impact Forces influencing market trajectory. Key drivers include the global expansion of the residential and commercial construction sectors, particularly in Asia Pacific, coupled with the increasing trend of home remodeling and renovation activities in developed economies. The aesthetic superiority and natural appeal of wood compared to composite or metal alternatives sustain high consumer demand. Restraints primarily involve the volatile pricing and supply chain unpredictability of quality timber, heightened environmental concerns leading to stringent sourcing regulations, and the competitive threat posed by alternative door materials offering superior moisture resistance or lower cost structures. Furthermore, the specialized labor required for high-quality installation can sometimes restrict market scalability, particularly in regions facing labor shortages.

Opportunities in the market are abundant, centered around technological advancements and sustainability efforts. The development of advanced wood composites (e.g., engineered wood products) that offer enhanced stability, fire resistance, and durability presents a significant avenue for growth. Penetration of smart home technology also opens new doors (pun intended) for integration, such as concealed sensors and automated locking systems within the door frame, enhancing functionality and security. Furthermore, market players can capitalize on the growing demand for sustainable and green building materials by securing and promoting Forest Stewardship Council (FSC) or equivalent certifications, appealing to the environmentally conscious consumer and achieving compliance in green building projects. Expanding market share in fire-rated door segments, driven by stricter global safety regulations, also presents a lucrative opportunity for specialized manufacturers.

The major Impact Forces shaping the market include government regulations related to building safety (especially fire and acoustic ratings), which force manufacturers to continuously innovate and certify their products. Economic fluctuations, particularly changes in interest rates and housing affordability, directly influence new construction volume, acting as a powerful external force. Technological advancements in coatings and finishes, enhancing the lifespan and appearance of wood doors, also exert a positive force, boosting consumer confidence in wood durability. Lastly, the powerful force of consumer preference for customization and unique aesthetic elements dictates design trends and manufacturing flexibility, favoring producers who can offer extensive bespoke options efficiently and cost-effectively.

Segmentation Analysis

The Wood Interior Doors Market is comprehensively segmented based on material type, design type, application, and core structure. This granular segmentation allows manufacturers and stakeholders to precisely target specific end-user needs, addressing variances in budget, aesthetic requirements, and functional performance across residential and commercial sectors. The core structural composition (solid core vs. hollow core) is perhaps the most critical determinant of price and performance, influencing attributes like soundproofing, thermal insulation, and weight. The increasing preference for bespoke or semi-customized designs is driving the growth in high-value segments like panel doors and French doors, particularly in renovation projects where aesthetic integration is paramount.

- By Material Type:

- Solid Wood (e.g., Oak, Maple, Cherry, Pine)

- Engineered Wood/Wood Composites (e.g., MDF, HDF, Particleboard)

- By Design Type:

- Flush Doors

- Panel Doors (e.g., 2-panel, 4-panel, 6-panel)

- Bifold/Sliding Doors

- French Doors/Glass Insert Doors

- Louver Doors

- By Core Structure:

- Solid Core Doors

- Hollow Core Doors

- By Application:

- Residential (Single-family, Multi-family)

- Commercial (Hotels, Offices, Healthcare, Education)

- By Distribution Channel:

- Direct Sales (B2B)

- Retail Stores/Showrooms (B2C)

- Online Sales/E-commerce

- Dealer Networks

The segmentation by Material Type highlights the fundamental divergence between premium and value products. Solid Wood doors, valued for their natural beauty, acoustic properties, and longevity, dominate the high-end, luxury residential, and hospitality segments. Species such as Oak and Maple are often favored for their durability and attractive grain patterns. Conversely, Engineered Wood/Wood Composites, including MDF (Medium-Density Fiberboard) and HDF (High-Density Fiberboard), offer superior dimensional stability, resistance to warping, and a significantly lower cost point. These materials are heavily used in the mass residential and budget commercial sectors, providing a cost-effective solution that can be finished to mimic natural wood aesthetics. The advancement in composite technology, particularly high-performance laminates, is blurring the visual distinction between solid and engineered products, impacting purchasing decisions based on environmental stability.

Analyzing segmentation by Design Type reveals specific consumer trends. Flush Doors, characterized by their simplicity and smooth surfaces, are the mainstay of contemporary and minimalist designs, offering ease of cleaning and installation. They are prevalent in both budget housing and institutional settings. Panel Doors, particularly those with raised or recessed panels, reflect traditional and classical architecture and hold substantial market share in established residential markets like North America and Europe, where historical aesthetics are prized. The growing popularity of open-plan living drives demand for Bifold/Sliding Doors, which maximize space utilization and flexibility. French Doors, featuring large glass inserts, are increasingly favored for maximizing natural light flow between internal rooms, particularly in dining areas and home offices, contributing to the premium segment's growth.

The Core Structure segmentation is crucial for performance assessment. Solid Core Doors (using solid wood components or particleboard/MDF core) provide excellent noise reduction, superior structural integrity, and are often required for fire-rated applications, making them essential in healthcare, hotels, and high-rise residential buildings. While heavier and more expensive, their performance benefits justify the cost in demanding environments. Hollow Core Doors, lighter and significantly cheaper, are constructed with a honeycomb cardboard or minimal wood framework inside, suitable for areas where acoustic performance and security are less critical, such as internal closets or secondary rooms in budget housing. The application segmentation clearly delineates demand: Residential use focuses on aesthetics and customization, while Commercial applications prioritize regulatory compliance (fire ratings, ADA requirements) and long-term durability under heavy traffic conditions.

Value Chain Analysis For Wood Interior Doors Market

The value chain for the Wood Interior Doors Market starts with rigorous Upstream Analysis, primarily focusing on raw material sourcing. This stage involves timber harvesting, sawmilling, and the production of specialized wood derivatives, such as veneer, plywood, and MDF panels. Key upstream activities include securing certified wood supplies (e.g., FSC certified), optimizing log breakdown for maximum yield, and treating raw materials for stability and resistance to pests and moisture. Fluctuations in global timber prices, driven by environmental regulations, trade tariffs, and logging restrictions, significantly impact the manufacturing cost at the subsequent stages. Strong supplier relationships and long-term contracts are essential for mitigating supply volatility, especially for exotic and high-grade solid woods utilized in premium door production.

Midstream activities involve the core manufacturing processes: door construction, including framework assembly, core insertion, pressing, and finishing. This stage incorporates specialized operations like routing for design features, application of veneers or laminates, and sophisticated painting or staining processes. Technology integration, such as computer-numerical-control (CNC) machinery for precision cutting and assembly line automation, is crucial for maintaining competitive efficiency and achieving high levels of product consistency. Quality control checks, including dimensional stability tests and finish durability assessments, are mandatory here. Manufacturers often specialize based on their core capabilities—some focus on high-volume, standardized hollow core doors, while others concentrate on custom, handcrafted solid wood doors.

Downstream analysis addresses distribution and sales channels. Direct Sales (B2B) channels are vital for large commercial projects (hotels, multi-family housing), where manufacturers deal directly with developers, contractors, and architects, providing bulk orders and customized specifications. Dealer Networks and Retail Stores/Showrooms form the primary channel for the residential renovation and single-family construction markets, providing personalized consultation, installation services, and a physical display of products. The shift towards e-commerce and Online Sales is gaining traction, particularly for standard, easily shippable models, offering convenience and transparent pricing to smaller contractors and DIY homeowners. Effective logistics, including packaging tailored to prevent damage and timely delivery, are paramount for maintaining customer satisfaction across all these diverse distribution channels.

Wood Interior Doors Market Potential Customers

The primary end-users and buyers in the Wood Interior Doors Market are broadly categorized into three major segments: the Residential Sector, the Commercial and Institutional Sector, and Specialized Contractors/Distributors. Within the Residential Sector, demand originates from new home builders, particularly those focusing on mid-range and luxury single-family homes, who often require customized or semi-customized solid or panel doors to align with architectural themes. Additionally, individual homeowners engaged in renovation, remodeling, or property flipping projects constitute a high-frequency buying segment, typically sourcing products through retail outlets or specialized dealers, prioritizing aesthetics, durability, and warranty protection.

The Commercial and Institutional Sector includes large-scale developers and facility managers for properties such as hotels, corporate offices, hospitals, educational institutions, and government buildings. These customers represent high-volume contracts and prioritize compliance with stringent safety and performance specifications, such as fire ratings (e.g., NFPA, EN standards), acoustic dampening properties, and adherence to ADA accessibility guidelines. For example, the hospitality industry demands high-end, custom-finished doors that offer superior sound insulation, while healthcare facilities require durable, sanitary surfaces and often specialized swing mechanisms. These transactions usually involve direct B2B engagement with manufacturers or specialized commercial suppliers.

Specialized Contractors and Distributors act as crucial intermediaries, purchasing products in bulk from manufacturers to supply smaller construction firms or specific project requirements. Architectural firms and interior designers also play a pivotal role, influencing material specifications and product selection, making them indirect but highly significant potential customers. These professionals often require technical data, sustainable sourcing certifications, and customized sizing options. Successful market penetration necessitates manufacturers building strong relationships across this diverse buyer ecosystem, offering tailored product lines that meet both high-volume standardized needs and low-volume, high-value custom requirements.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $18.5 Billion |

| Market Forecast in 2033 | $25.7 Billion |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | JELD-WEN Holding Inc., Masonite International Corporation, Pella Corporation, Formosa Plastics Group (Neuma Doors), Andersen Corporation, TruStile Doors, Inc., STEVES & SONS, INC., Hörmann Group, Koch Industries (Georgia-Pacific), The 84 Lumber Company, Woodgrain Millwork, Simpson Door Company, VT Industries, Allegion plc, Dierre S.p.A., Premdor Inc., Madero Doors and Hardware, LIXIL Group Corporation, Buya Door, Guangzhou TATA Wood Doors |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Wood Interior Doors Market Key Technology Landscape

The technological landscape of the Wood Interior Doors Market is evolving rapidly, driven by the need for increased precision, customization, material efficiency, and enhanced performance characteristics. Computer Numerical Control (CNC) machinery represents a foundational technology, essential for high-precision cutting, routing, and drilling operations, allowing manufacturers to produce complex designs (such as intricate panel profiles and custom sizes) with minimal human error and high repeatability. This technology directly supports the market trend towards increased customization and shorter lead times. Advanced gluing and laminating technologies are crucial for engineered wood products, ensuring long-term structural integrity and resistance to common issues like delamination and warping under varying humidity conditions, significantly expanding the applicability of wood doors in diverse climates.

In terms of materials science, the development of high-performance surface finishes and coatings constitutes a vital technology segment. These coatings, including UV-cured lacquers, water-based polyurethane finishes, and specialized stain systems, offer superior scratch resistance, color consistency, and protection against moisture and UV degradation, extending the lifespan and aesthetic appeal of the doors. Furthermore, intumescent technology, integrated into the core or edges of the door, is mandatory for fire-rated wood doors. This technology utilizes materials that swell dramatically when exposed to heat, sealing gaps and preventing the passage of fire and smoke, thereby complying with increasingly rigorous international building safety codes for commercial and multi-family residential structures.

Digital technologies are also transforming the front end of the value chain. Building Information Modeling (BIM) integration allows architects and builders to incorporate specific door models directly into their project designs, streamlining the specification process and reducing conflicts during installation. Additionally, Augmented Reality (AR) applications are increasingly used by manufacturers to provide immersive purchasing experiences, allowing end-users to visualize how different door styles, wood species, and finishes will look in their actual spaces before purchase. This blend of precise manufacturing technology and consumer-facing digital tools is enhancing efficiency, accuracy, and overall customer satisfaction within the wood interior doors industry.

Regional Highlights

The global Wood Interior Doors market exhibits substantial regional disparities driven by construction cycles, regulatory environments, and prevailing architectural styles. North America, encompassing the US and Canada, represents a mature market characterized by a strong demand for high-quality, pre-hung panel doors, particularly in the renovation and remodeling sector. Housing affordability challenges coupled with high raw material costs (especially tariffs on imported wood) can periodically influence market growth, yet the overall market value remains high due to consumers’ willingness to invest in premium materials like solid core and authentic wood species. Strict energy efficiency and fire safety codes in both residential and commercial construction necessitate continuous innovation in product certification and material composition, maintaining a focus on performance alongside aesthetic appeal.

Europe stands as another high-value, mature market, defined by diverse regional preferences and stringent environmental and performance regulations (such as CE marking). Western European countries demonstrate high demand for custom and solid wood products reflecting traditional craftsmanship, while Central and Eastern European markets show faster volume growth, driven by modernization and new residential complex construction. A notable trend across Europe is the strong emphasis on sustainability, favoring manufacturers who utilize certified, sustainably harvested timber (FSC/PEFC). The market is highly fragmented, with strong local manufacturers catering to specific national styles, although consolidation among major players is increasing to achieve economies of scale and better manage complex cross-border logistics and compliance requirements.

Asia Pacific (APAC) is unequivocally the fastest-growing region, powered by unprecedented rates of urbanization, monumental infrastructure spending, and the exponential growth of middle-class populations in China, India, and Southeast Asian nations. The demand here is dual-natured: high-volume, cost-effective hollow core and engineered wood doors dominate the mass housing sector, while a rapidly growing luxury market demands imported, high-end solid wood and customized designer doors for premium residential and hospitality projects. Rapid development necessitates speed and efficiency, favoring manufacturers capable of delivering large quantities swiftly. Furthermore, the region is becoming a crucial manufacturing hub, leveraging lower labor costs and extensive regional timber resources, although environmental compliance remains a critical challenge in several manufacturing clusters.

Latin America (LATAM) and the Middle East and Africa (MEA) represent emerging markets with high growth potential, albeit subject to greater economic and political volatility. In LATAM, urbanization and a growing middle class drive demand, particularly in large economies like Brazil and Mexico. The market often balances traditional wood preferences with the need for cost-effective, weather-resistant materials due to diverse climatic conditions. The MEA region, specifically the GCC nations, is marked by ambitious, high-profile construction projects in the commercial and hospitality sectors (e.g., luxury hotels, mega-developments). This segment drives demand for highly luxurious, large, customized solid wood and decorative veneer doors, often sourced internationally. African markets are primarily served by locally manufactured or imported standardized products, with future growth tied closely to stability and foreign investment in residential and commercial infrastructure.

- North America: Dominance in renovation sector; high adoption of pre-hung, engineered wood panel doors; strict fire and acoustic rating standards (UL certified).

- Europe: High focus on certified sustainable timber (FSC/PEFC); strong demand for traditional solid wood craftsmanship; fragmented market structure dictated by national design preferences and rigorous CE standards.

- Asia Pacific (APAC): Leading growth region driven by rapid urbanization and large-scale residential projects (especially China and India); balanced demand between low-cost hollow core and high-end customized doors.

- Latin America: Growing market potential linked to urbanization; challenges posed by economic volatility and the need for climate-appropriate materials.

- Middle East and Africa (MEA): High demand from luxury commercial and hospitality developments in GCC countries; focus on aesthetically elaborate and large custom door solutions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Wood Interior Doors Market.- JELD-WEN Holding Inc.

- Masonite International Corporation

- Pella Corporation

- Formosa Plastics Group (Neuma Doors)

- Andersen Corporation

- TruStile Doors, Inc.

- STEVES & SONS, INC.

- Hörmann Group

- Koch Industries (Georgia-Pacific)

- The 84 Lumber Company

- Woodgrain Millwork

- Simpson Door Company

- VT Industries

- Allegion plc

- Dierre S.p.A.

- Premdor Inc.

- Madero Doors and Hardware

- LIXIL Group Corporation

- Buya Door

- Guangzhou TATA Wood Doors

Frequently Asked Questions

Analyze common user questions about the Wood Interior Doors market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between Solid Core and Hollow Core wood interior doors?

Solid Core doors feature a dense interior composition (usually particleboard or composite wood) offering superior sound insulation, better fire resistance, higher durability, and a heavier feel, making them ideal for bedrooms and offices. Hollow Core doors have a minimal framework and an internal honeycomb cardboard structure, making them lighter, significantly cheaper, and suitable for closets or areas where acoustic performance is not critical.

How does the sustainability trend impact the selection of wood interior doors?

The sustainability trend drives demand for doors manufactured using certified wood, such as those verified by the Forest Stewardship Council (FSC) or PEFC. Consumers and commercial developers increasingly prefer products traceable to sustainably managed forests, often favoring engineered wood products (MDF/HDF) which utilize wood fiber waste efficiently, aligning environmental responsibility with product specification.

Which geographical region exhibits the highest growth potential for wood interior doors?

The Asia Pacific (APAC) region is projected to demonstrate the highest growth potential, primarily fueled by rapid urbanization, significant government investment in housing, and booming commercial construction activities in large economies like China, India, and various Southeast Asian nations. This growth is supported by both high-volume mass market construction and increasing luxury development.

What key technological advancements are influencing wood door manufacturing?

Key technological advancements include the widespread adoption of Computer Numerical Control (CNC) machinery for precision cutting and customization, the use of advanced durable and moisture-resistant surface coatings, and the integration of digital tools like Building Information Modeling (BIM) and Augmented Reality (AR) for improved design and consumer visualization.

Are wood interior doors subject to fire safety regulations, and how is compliance achieved?

Yes, especially in commercial, multi-family, and institutional buildings, wood doors must comply with specific fire safety regulations (e.g., UL 10C, BS 476). Compliance is typically achieved by constructing the doors with specialized fire-rated materials, often incorporating solid cores and intumescent strips along the edges that expand when heated, effectively sealing the door in the event of a fire.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager