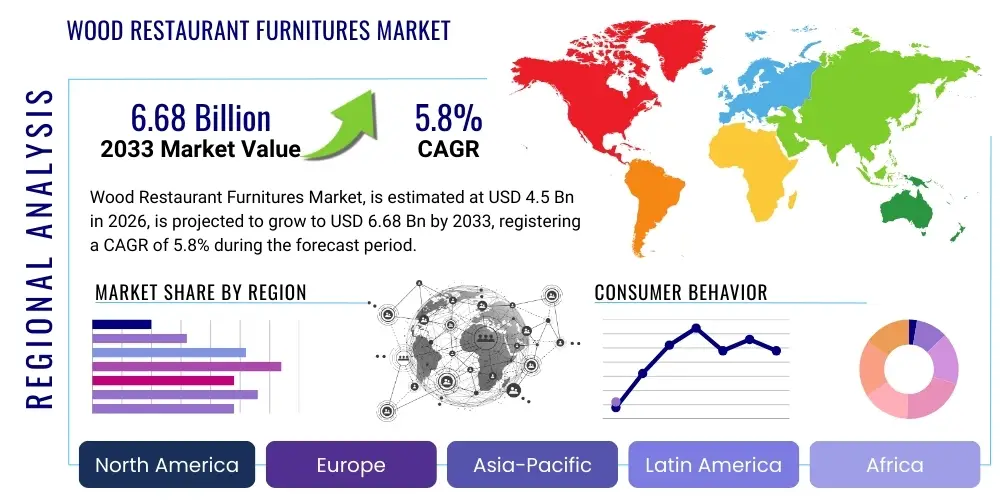

Wood Restaurant Furnitures Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438339 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Wood Restaurant Furnitures Market Size

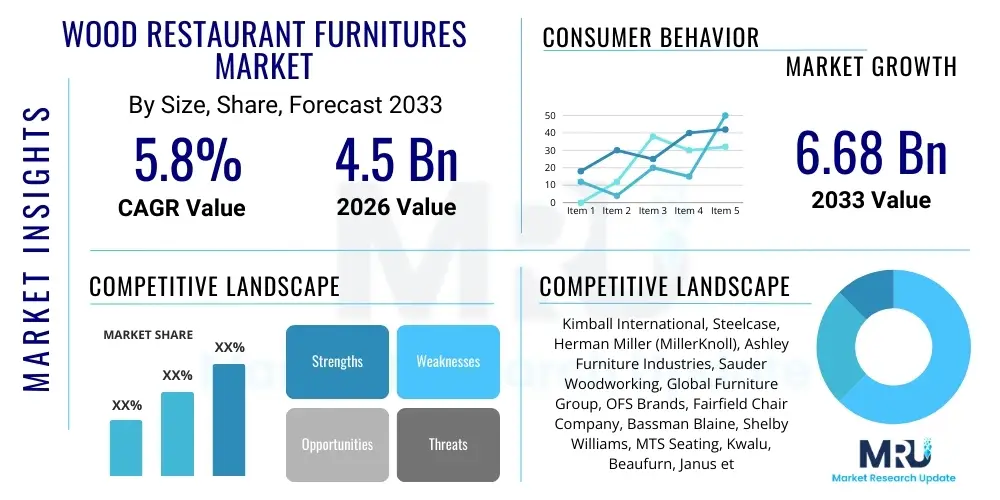

The Wood Restaurant Furnitures Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at $4.5 Billion in 2026 and is projected to reach $6.68 Billion by the end of the forecast period in 2033.

Wood Restaurant Furnitures Market introduction

The Wood Restaurant Furnitures Market encompasses the design, manufacturing, and distribution of tables, chairs, bar stools, booths, and ancillary seating solutions primarily fabricated from various types of wood (including hardwoods, softwoods, and engineered wood products) intended for commercial food service establishments. This market is intrinsically linked to the global hospitality sector's investment cycles, driven by new restaurant openings, renovations, and the continuous need for durable, aesthetically pleasing, and comfortable dining environments. The inherent warmth, texture, and customizability of wood make it a premium choice for high-end dining, casual bistros, and themed eateries seeking to convey a sense of permanence and quality. Key product attributes driving demand include ergonomic design, resistance to heavy commercial use, and adherence to increasingly stringent fire safety and sustainability standards.

Major applications for wood restaurant furniture span the entirety of the food service ecosystem, including fine dining restaurants, fast-casual dining chains, institutional cafeterias, hotel dining areas, and independent cafes. The rising global consumer preference for experiential dining, coupled with design trends that favor natural and sustainable materials (like reclaimed wood or FSC-certified timber), significantly propels market growth. Furthermore, the longevity and repairability of wood furniture offer a superior return on investment compared to many synthetic alternatives, solidifying its position as a staple commercial furnishing material. Manufacturers are increasingly focused on material engineering to enhance durability, such as using moisture-resistant finishes and advanced joinery techniques to withstand the rigors of daily commercial cleaning and high foot traffic.

The primary driving factors sustaining this market include the rapid expansion of the global restaurant and café industry, particularly in emerging economies of the Asia Pacific region, coupled with the frequent refurbishment cycles (typically every 5-7 years) mandated by competitive market aesthetics in North America and Europe. Benefits derived from utilizing wood furniture extend beyond aesthetics; wood offers excellent sound absorption qualities, contributing to a more pleasant dining ambiance, and allows for extensive customization in stain, finish, and upholstery to match specific branding requirements. The shift towards "resimercial" design—blending residential comfort with commercial durability—further champions wood, which inherently delivers a warm, home-like feel essential for modern hospitality concepts.

Wood Restaurant Furnitures Market Executive Summary

The Wood Restaurant Furnitures Market is experiencing robust growth fueled by post-pandemic recovery and substantial investment in the modernization of hospitality infrastructure globally. Business trends indicate a strong move toward sustainable sourcing, with high demand for furniture made from certified, recycled, or rapidly renewable woods, influencing supply chain partnerships and manufacturing processes. Customization remains a critical differentiating factor, leading manufacturers to adopt advanced CNC machining and 3D modeling technologies to meet bespoke design specifications efficiently. Furthermore, consolidation among major contract furniture suppliers is shaping the competitive landscape, creating global entities capable of servicing large chain accounts and international hotel groups, while smaller artisan workshops capture niche high-end markets focused on unique craftsmanship.

Regionally, North America and Europe dominate the market in terms of value, driven by high disposable incomes and a mature, highly competitive restaurant sector that necessitates frequent aesthetic updates. However, the Asia Pacific region (APAC), particularly China, India, and Southeast Asian nations, is poised for the fastest growth. This acceleration is attributed to rapid urbanization, increasing middle-class spending on dining out, and the widespread establishment of international food service brands. Regulatory trends across regions, particularly concerning fire safety (e.g., California Technical Bulletin 117 standards) and timber logging practices (e.g., EU Timber Regulation), significantly influence product specifications and material sourcing strategies, creating barriers to entry for non-compliant global players.

Segment trends highlight the strong performance of the dining chairs and seating category, which accounts for the largest market share due to volume requirements and shorter replacement cycles compared to dining tables or fixed booths. Hardwood furniture, specifically utilizing species like oak, maple, and teak for their durability, continues to lead in material type segmentation, though engineered woods (plywood and MDF) are gaining traction in budget-conscious and fast-casual sectors due to cost-effectiveness and consistency. The rise of outdoor dining spaces, catalyzed by recent public health needs, has also boosted the demand for weather-resistant wood treatments and composite wood furniture suitable for exterior commercial environments, expanding the traditional market scope.

AI Impact Analysis on Wood Restaurant Furnitures Market

User inquiries regarding AI's influence in the wood restaurant furniture domain primarily focus on how automation can enhance customization, optimize manufacturing efficiency, and predict design trends. Key themes revolve around AI-driven generative design for unique, structurally optimized furniture pieces; predictive analytics for inventory management and demand forecasting across complex supply chains; and the integration of machine learning in CNC machinery for defect detection and minimal material waste (yield optimization). Users are concerned about the balance between preserving artisanal craftsmanship, traditionally a hallmark of high-end wood furniture, and leveraging automation to reduce lead times and labor costs. Expectations center on AI streamlining the entire contract negotiation-to-delivery pipeline, offering enhanced transparency and responsiveness to hospitality procurement teams seeking faster project turnarounds.

- AI-driven Predictive Maintenance: Utilizing sensors and machine learning algorithms in woodworking machinery (e.g., saws, routers, finishing lines) to anticipate equipment failure, minimizing unplanned downtime and ensuring consistent production schedules.

- Generative Design Optimization: AI algorithms create novel furniture designs that maximize material efficiency, structural integrity, and ergonomic factors based on specified constraints (wood type, budget, desired aesthetic), accelerating the product development lifecycle.

- Supply Chain and Logistics Forecasting: AI models analyze macroeconomic factors, seasonal hospitality data, and raw material availability (timber) to predict future demand accurately, enabling just-in-time inventory management and reducing storage costs.

- Quality Control Automation: Integration of computer vision systems powered by AI to automatically scan finished wood pieces for surface defects, inconsistencies in staining, or faulty joinery, ensuring compliance with stringent commercial grade quality standards before shipment.

- Personalized Customer Experience (AEC Integration): AI tools assist design firms and procurement specialists by rapidly generating 3D models and visualizations of wood furniture integrated into specific restaurant floor plans, accelerating client approval and project execution.

- Optimized Cutting and Yield Management: Machine learning algorithms analyze complex cutting patterns for lumber, minimizing wood waste and maximizing the usable yield from each board, which is critical for profitability and sustainability targets.

DRO & Impact Forces Of Wood Restaurant Furnitures Market

The Wood Restaurant Furnitures Market is shaped by a confluence of driving factors, restrictive barriers, and substantial opportunities. The primary Drivers include the continuous growth and modernization of the global hospitality sector, sustained by high consumer spending on experiential dining, and the aesthetic demand for durable, natural materials that complement upscale interior design trends. Restraints often center on the volatility of raw timber prices, regulatory hurdles related to sustainable sourcing (certification and import restrictions), and the inherent labor intensity of high-quality wood fabrication, which increases manufacturing costs compared to metal or plastic alternatives. Opportunities lie significantly in expanding product lines focused on outdoor furniture solutions and penetrating rapidly developing urban markets in APAC and LAMEA regions, alongside adopting advanced automation (like robotic sanding and finishing) to mitigate labor shortages and enhance production speed while maintaining quality.

Impact forces within this market are exerted primarily by substitution threats, notably from high-grade metals (aluminum, steel) and durable polymer composites, which offer superior weather resistance and sometimes lower maintenance requirements, particularly in highly dynamic settings. Buyer bargaining power is moderate to high, as large restaurant chains and contract procurement groups typically purchase in bulk and demand competitive pricing, extended warranties, and compliance with stringent material specifications. Supplier power is also significant, especially for specific, ethically sourced hardwoods, where a limited number of certified suppliers control premium raw material access. Technological advancements, particularly in wood lamination, engineered wood performance, and protective coatings, are positive forces that mitigate environmental challenges (moisture, wear) and extend the service life of products, thereby strengthening the competitive position of wood furniture against substitutes.

Segmentation Analysis

The Wood Restaurant Furnitures Market is comprehensively segmented based on product type, material, end-user application, and distribution channel, providing granular insights into demand patterns and competitive positioning. Product type segmentation identifies the highest volume and value categories essential for equipping commercial dining spaces. Material segmentation differentiates between various wood species and engineered products based on durability, cost, and aesthetic appeal. The end-user classification reflects varying procurement requirements and usage intensity across different hospitality formats, while the distribution analysis clarifies the dominant routes to market, ranging from direct contract sales to e-commerce platforms.

- Product Type:

- Seating (Chairs, Bar Stools, Benches, Booths)

- Tables (Dining Tables, Cocktail Tables, Side Tables)

- Storage Units (Buffets, Servers, Display Shelves)

- Other Fixtures (Host Stands, Partitions)

- Material:

- Hardwoods (Oak, Maple, Walnut, Ash)

- Softwoods (Pine, Cedar)

- Engineered Wood (Plywood, MDF, Veneers)

- Reclaimed and Recycled Wood

- End-User Application:

- Fine Dining Restaurants

- Casual Dining and Fast-Casual Establishments

- Cafes and Bistros

- Bars and Pubs

- Institutional/Hotel Dining

- Distribution Channel:

- Direct Sales (Contract Furnishers)

- Dealer/Distributor Networks

- E-commerce Platforms

- Retail Sales (Limited Commercial Usage)

Value Chain Analysis For Wood Restaurant Furnitures Market

The value chain for the Wood Restaurant Furnitures Market begins with upstream activities centered on raw material procurement, encompassing sustainable forestry operations, timber harvesting, and primary processing (sawmilling and lumber drying). Due to increasing regulatory scrutiny and customer demand for eco-friendly products, certification bodies like the Forest Stewardship Council (FSC) and Programme for the Endorsement of Forest Certification (PEFC) play a crucial role, influencing supplier selection and material cost. This upstream segment is characterized by logistical complexities, including fluctuating global timber prices, long lead times for specific species, and strict quality grading necessary for commercial-grade furniture production. Efficient material sourcing and optimized inventory management are critical for maintaining competitive manufacturing costs.

The midstream phase involves the core manufacturing process, where design, engineering, and fabrication take place. This includes cutting, machining (often utilizing specialized CNC equipment), joinery, assembly, sanding, and commercial-grade finishing (stain and protective lacquer application). High-quality wood furniture requires skilled craftsmanship, particularly for complex joinery necessary to withstand heavy commercial use. Manufacturers invest heavily in durable coating technologies that resist spills, abrasions, and UV degradation. Research and development activities in this segment focus on utilizing high-performance engineered wood components and adopting automation technologies (robotics) to enhance consistency, speed production, and reduce labor costs associated with repetitive tasks.

Downstream activities focus on distribution, sales, and post-sale services. Distribution channels are predominantly direct (contract sales) or indirect via specialized dealers and distributors who possess deep knowledge of hospitality design and procurement cycles. Large restaurant chains and hotel groups typically engage directly with manufacturers or major contract furniture suppliers to manage large, custom orders. Direct engagement allows for stringent quality control and streamlined customization processes. Post-sale services, including extended commercial warranties, maintenance guides, and replacement part availability, are crucial competitive factors, as commercial buyers prioritize long-term durability and ease of repair over initial low cost. The trend toward digital showrooms and B2B e-commerce is transforming how buyers discover and specify products, making digital optimization of the sales channel increasingly vital.

Wood Restaurant Furnitures Market Potential Customers

The potential customers for the Wood Restaurant Furnitures Market are diverse institutions within the commercial food service and hospitality sectors, ranging from single independent operators to multinational chains requiring standardized, high-volume furnishings. End-users fundamentally seek durable products that align with their brand identity, offer ergonomic comfort for patrons, and adhere to local commercial safety standards, particularly concerning fire resistance and structural integrity. Key buyers include procurement managers, interior designers specializing in hospitality projects, franchise development teams, and general contractors overseeing restaurant construction or major renovation projects. The purchasing criteria often prioritize longevity, ease of maintenance (cleaning and sanitizing), customization capabilities, and compliance with sustainability certifications.

Fine dining establishments represent a high-value segment, focusing intensely on bespoke design and premium, exotic hardwoods. These customers typically prioritize aesthetic exclusivity and superior craftsmanship, often commissioning smaller runs of highly personalized pieces, leading to higher average unit prices. Conversely, large fast-casual and chain restaurants prioritize cost-efficiency, scalability, and robust construction methods that withstand extreme usage rates. These buyers often demand large volume orders of standardized products and prefer working with manufacturers who can guarantee consistent supply across multiple geographic locations, often leveraging master supply agreements to secure favorable pricing and guaranteed lead times.

Beyond traditional restaurants, institutional buyers such as large corporate cafeterias, university dining halls, and hospitality groups (hotels, resorts) constitute significant potential customer bases. Hotels, in particular, frequently require wood furniture not only for their main dining rooms but also for banquet facilities, outdoor patios, and in-room dining setups, demanding specialized products that integrate seamlessly with broader interior design schemes. The purchasing decision for institutional customers often involves complex bidding processes and multiple stakeholders, emphasizing certifications, compliance history, and the supplier's capacity for complex project management, reinforcing the importance of a professional, structured sales approach focusing on reliability and long-term partnership value.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $4.5 Billion |

| Market Forecast in 2033 | $6.68 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Kimball International, Steelcase, Herman Miller (MillerKnoll), Ashley Furniture Industries, Sauder Woodworking, Global Furniture Group, OFS Brands, Fairfield Chair Company, Bassman Blaine, Shelby Williams, MTS Seating, Kwalu, Beaufurn, Janus et Cie, Krost Business Furniture, Source International, HBF Furniture, Versteel, Trendway, Dorel Industries |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Wood Restaurant Furnitures Market Key Technology Landscape

The manufacturing landscape for wood restaurant furniture is increasingly integrating advanced digital and automation technologies to enhance precision, efficiency, and customization capabilities, transitioning from traditional craftsmanship reliance. Computer Numerical Control (CNC) machining remains foundational, allowing for complex, repeatable cuts and precise joinery necessary for durable commercial pieces. The latest generation of 5-axis CNC routers enables manufacturers to produce intricate, ergonomically contoured components with minimal setup time and negligible material waste. Furthermore, the adoption of robotic finishing and sanding systems is becoming common practice. These systems provide a superior, consistent surface finish and reduce human exposure to volatile organic compounds (VOCs) from lacquers and stains, addressing both quality control and occupational health concerns, which are critical in high-volume production facilities.

Beyond physical production, the design phase is heavily influenced by 3D modeling and visualization technologies. Building Information Modeling (BIM) platforms allow furniture manufacturers to create digital twins of their products, which can be seamlessly integrated into a restaurant designer's overall architectural plans. This facilitates error detection before production, streamlines project coordination, and significantly accelerates the client approval process, a major value proposition for contract suppliers. Additionally, augmented reality (AR) tools are emerging, allowing restaurant owners and designers to virtually place and visualize furniture within their physical spaces, offering real-time dimensional assessment and aesthetic integration before any physical commitment, reducing the risk of costly post-installation changes.

Material science innovation also plays a vital technological role. This includes the development of high-performance engineered woods, such as laminated veneer lumber (LVL) or specialized moisture-resistant plywoods, offering superior stability and strength compared to solid wood while utilizing wood resources more efficiently. Furthermore, advanced coating technologies, including UV-cured finishes and specialized anti-microbial treatments, are increasingly employed to ensure the furniture meets stringent hygiene standards required in commercial food service environments. These protective finishes dramatically enhance the durability and longevity of the furniture, directly impacting the total cost of ownership (TCO) for the end-user and reinforcing the commercial appeal of wood over less durable alternatives.

Regional Highlights

The global wood restaurant furniture market exhibits distinct dynamics influenced by local economic health, hospitality spending, design preferences, and regulatory environments. North America, driven primarily by the expansive U.S. and Canadian markets, maintains a leading market share due to high levels of commercial renovation activity, a vast installed base of restaurants, and a consumer base willing to pay a premium for high-quality, durable furniture. The region favors standardized designs for large chains but also sustains a vibrant niche market for bespoke, domestically sourced hardwood pieces, particularly in metropolitan culinary hubs. Regulatory compliance, specifically concerning fire retardancy (e.g., CAL TB 117), is a non-negotiable requirement for market participation.

Europe represents a mature market characterized by slower but highly stable growth. Demand is concentrated in Western European countries (Germany, UK, France), where sustainability mandates and traceability are paramount. European manufacturers often emphasize timeless design, superior craftsmanship, and adherence to strict EU timber regulations (EUTR) ensuring ethical sourcing. There is a noticeable trend towards incorporating recycled or upcycled wood in designs, aligning with circular economy principles championed by the European Union. Southern Europe continues to show strong demand for resilient outdoor wood furniture designed for extensive patio and café culture.

The Asia Pacific (APAC) region is the engine of future market expansion, exhibiting the highest projected CAGR. This growth is a direct result of rapid urbanization, explosive expansion of both local and international restaurant chains, and increasing disposable income leading to higher frequency of dining out. While cost-sensitivity remains a factor, particularly in developing economies, growing affluence in countries like China and India is fueling demand for mid-to-high-end wood furniture. Manufacturers in this region benefit from robust raw material supply chains and lower manufacturing costs, positioning APAC as both a crucial consumer market and a major global production hub.

Latin America (LATAM) and the Middle East & Africa (MEA) are emerging regions offering significant growth potential, albeit from a smaller base. In the Middle East, high-profile hospitality construction projects, particularly in the UAE and Saudi Arabia, drive demand for luxurious, custom-designed wood furnishings for premium hotels and restaurants, often imported from European or North American suppliers. LATAM markets show resilience, with local manufacturers catering to casual dining and independent establishments, focusing on regionally available hardwoods. Challenges in these regions include economic volatility and less developed regulatory frameworks compared to established markets, although compliance is improving with globalization.

- North America: Dominance in customization and high-end contract sales; strict fire safety compliance (CAL TB 117); reliance on fast renovation cycles for competitive advantage.

- Europe: Focus on certified sustainable sourcing (FSC/PEFC); emphasis on design longevity and minimal environmental impact; strong market for antique and heritage-style wood furniture.

- Asia Pacific (APAC): Highest growth rate driven by rapid chain expansion and new hospitality infrastructure investment; key manufacturing hub; growing demand for ergonomic and space-saving designs due to urbanization.

- Latin America (LATAM): Increasing adoption of international design standards; market driven by local hardwoods and value-based purchasing for mid-range restaurants.

- Middle East & Africa (MEA): High demand for luxury, bespoke pieces in Gulf Cooperation Council (GCC) countries; significant procurement linked to major hotel and resort development projects.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Wood Restaurant Furnitures Market.- Kimball International

- Steelcase

- Herman Miller (MillerKnoll)

- Ashley Furniture Industries

- Sauder Woodworking

- Global Furniture Group

- OFS Brands

- Fairfield Chair Company

- Bassman Blaine

- Shelby Williams

- MTS Seating

- Kwalu

- Beaufurn

- Janus et Cie

- Krost Business Furniture

- Source International

- HBF Furniture

- Versteel

- Trendway

- Dorel Industries

- Gervasoni SpA

- Bernhardt Furniture Company

- Tablebases.com

- B&B Italia

Frequently Asked Questions

What is the primary driver of growth in the Wood Restaurant Furnitures Market?

The primary driver is the sustained global expansion of the hospitality and food service sector, particularly the proliferation of casual dining chains and independent restaurants requiring durable, aesthetically versatile, and commercially compliant seating and table solutions that wood naturally provides.

How do sustainability standards impact the procurement of wood restaurant furniture?

Sustainability mandates critically influence procurement by requiring manufacturers to source materials certified by organizations like FSC or PEFC. This ensures the wood is ethically harvested and traceable, meeting the environmental criteria increasingly demanded by institutional buyers and high-end hospitality brands.

Which product segment holds the largest market share in the wood restaurant furniture industry?

The Seating category, which includes dining chairs, bar stools, and booths, holds the largest market share. This is attributed to the high volume required per establishment and the more frequent need for replacement or reupholstering compared to static components like dining tables.

What technological advancements are optimizing wood furniture manufacturing?

Key technological advancements include the widespread adoption of 5-axis CNC machining for high-precision components, robotic finishing systems for consistent quality control, and the integration of 3D modeling and BIM for streamlined design and client visualization during the procurement process.

What challenges do manufacturers face regarding raw material volatility?

Manufacturers face significant challenges due to price volatility and constrained supply of certified hardwoods. Global events, regulatory changes (e.g., import tariffs), and increasing demand from other construction sectors create cost pressure, requiring sophisticated hedging strategies and diversification of wood sources.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager