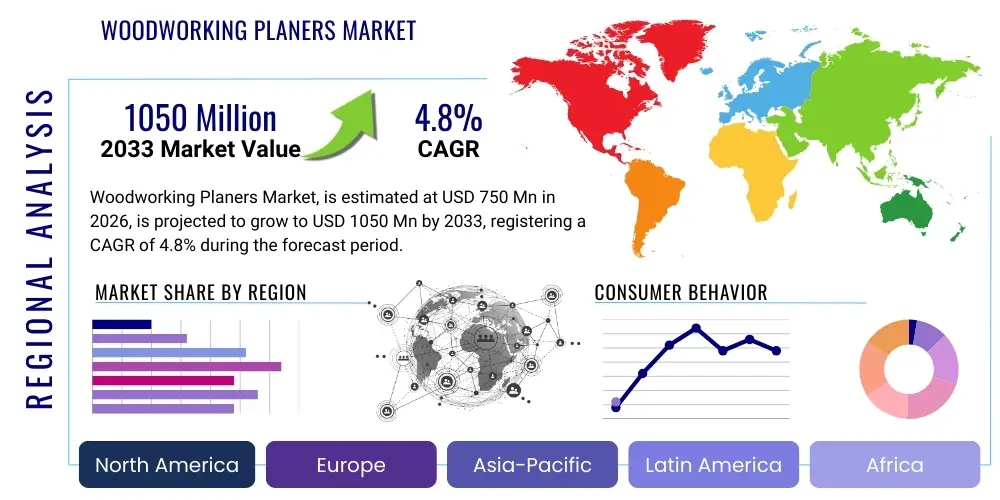

Woodworking Planers Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438980 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Woodworking Planers Market Size

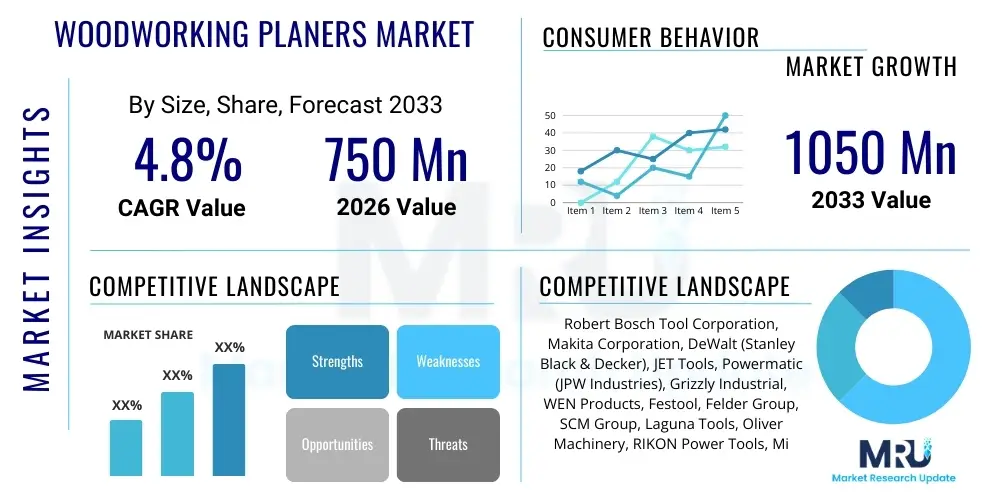

The Woodworking Planers Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at $750 Million in 2026 and is projected to reach $1050 Million by the end of the forecast period in 2033.

Woodworking Planers Market introduction

The Woodworking Planers Market encompasses the global trade of machinery designed to flatten, smooth, and reduce the thickness of wood stock, preparing it for fine woodworking or construction applications. These tools are crucial for achieving parallel and co-planar surfaces, which is fundamental for high-quality joinery and assembly. The market includes various types such as thickness planers (also known as dimensioners), jointer-planers, and handheld electric or manual planers, serving a diverse user base from large industrial lumber mills to professional custom furniture makers and DIY enthusiasts. Key performance indicators for these products include precision, cutting capacity (width and depth), feed rate, and the type of cutter head utilized (straight knife or helical/spiral).

Product demand is fundamentally driven by the robust growth in the construction and renovation sectors globally, coupled with a renewed interest in custom and handcrafted furniture production. Technological advancements, particularly in motor efficiency, dust collection integration, and the adoption of helical cutter heads which offer superior finish and noise reduction, are continually enhancing product appeal and functionality. Major applications span residential and commercial building infrastructure, cabinet making, flooring preparation, and intricate architectural millwork. The primary benefits of utilizing woodworking planers include significant time savings compared to manual planing, superior dimensional accuracy, and the ability to reclaim and repurpose rough or salvaged lumber efficiently.

Driving factors propelling market expansion include the increasing automation of workshops, particularly among small to medium-sized enterprises (SMEs) seeking to improve output quality and throughput. Furthermore, the accessibility of affordable, yet high-performance, benchtop models has lowered the barrier to entry for hobbyists and home workshops, contributing substantially to market volume growth. The global focus on sustainable construction and the utilization of natural materials also indirectly boosts demand for efficient wood preparation tools. However, market growth is often contingent on economic stability influencing residential construction spending.

Woodworking Planers Market Executive Summary

The Woodworking Planers Market is poised for stable expansion, propelled primarily by macro-level trends in residential refurbishment and specialized manufacturing. Business trends indicate a strong shift towards cordless and battery-powered planers in the handheld segment, enhancing portability and site flexibility, while the stationary segment sees continued innovation in helical cutter head technology, optimizing finish quality and reducing operational noise and maintenance costs. The competitive landscape is characterized by established power tool giants focusing on integrating smart features, such as digital depth readouts and connectivity options, particularly for professional-grade stationary units, aiming at maximizing efficiency and reducing setup time in commercial workshops.

Regional trends highlight that North America and Europe remain mature but strong markets, characterized by high adoption rates of premium, large-capacity stationary planers due to established woodworking traditions and stringent quality standards in the construction and furniture industries. Conversely, the Asia Pacific (APAC) region is expected to demonstrate the highest growth rate, fueled by rapid urbanization, significant government investment in infrastructure, and the expansion of the regional manufacturing base. Countries like China and India are seeing booming domestic demand for affordable benchtop models catering to emerging SME workshops and vocational training centers.

Segment trends confirm the dominance of stationary planers in terms of value, owing to their higher price point and industrial application. However, the benchtop segment is exhibiting rapid volume growth, driven by the increasing popularity of DIY woodworking and the necessity for compact, high-performance tools in smaller professional settings. From an application perspective, professional woodworkers and construction contractors constitute the largest revenue generating segment, demanding high precision and durability, while the hobbyist segment, valuing affordability and ease of use, is crucial for stimulating sales through online retail channels and big-box home improvement stores. The market is increasingly focused on developing highly efficient dust and chip extraction systems, addressing critical user concerns regarding workshop cleanliness and air quality.

AI Impact Analysis on Woodworking Planers Market

Users frequently inquire about how Artificial Intelligence will translate into tangible improvements in traditional woodworking machinery, particularly regarding precision, maintenance, and material optimization. Common questions revolve around the feasibility of AI-driven material thickness detection, automated feed rate adjustments based on wood density or grain direction, and predictive maintenance schedules for cutter heads and motors. Based on this analysis, the key user theme is the desire for automation that minimizes material waste, enhances user safety, and reduces the need for constant manual monitoring and adjustment, thereby maximizing shop productivity. Users expect AI to move planers beyond simple mechanical functions toward smart, self-optimizing machines capable of handling variable wood stock with minimal operator intervention.

- AI-Powered Defect Detection: Real-time scanning of lumber for knots, internal stresses, or grain reversal to automatically adjust planing depth or speed, preventing tear-out and damage.

- Predictive Maintenance: Algorithms monitoring motor vibration, bearing temperature, and cutter head wear patterns to schedule tool replacement, reducing unplanned downtime significantly.

- Automated Feed Optimization: AI adjusting the feed rate instantaneously based on torque load and wood type identification (e.g., hardwood vs. softwood) to maintain optimal cutting efficiency and surface finish.

- Digital Integration and Diagnostics: Planers connected to cloud platforms allowing remote monitoring of operational metrics and performance diagnostics for large industrial setups.

- Enhanced Safety Features: Vision systems utilizing AI to instantly recognize foreign objects (like nails or staples) in wood and halt the feed mechanism before impacting the cutter head.

DRO & Impact Forces Of Woodworking Planers Market

The Woodworking Planers Market dynamics are significantly influenced by robust construction activities worldwide and a growing consumer preference for custom wood products (Driver). However, the market faces headwinds from the high initial capital investment required for industrial-grade stationary planers and the volatile pricing of raw wood materials, which affects downstream demand (Restraint). The increasing adoption of advanced cutter head technologies, such as helical systems that improve finish quality and durability, presents a substantial market opportunity, particularly in mature markets seeking upgrades (Opportunity). These forces collectively shape the market landscape, pushing manufacturers toward developing more cost-efficient, high-precision, and durable equipment that addresses both industrial throughput requirements and the accessibility needs of smaller workshops, making technological innovation the primary impact force.

Drivers: Global expansion of residential and commercial construction; rising demand for high-quality, precision-machined wood components; increasing interest and participation in DIY and small-scale professional woodworking; technological improvements leading to reduced noise and better dust management. The trend toward using reclaimed and recycled lumber requires efficient planing technology to dimension and prepare irregular stock, providing a significant boost to market demand.

Restraints: High initial investment cost for advanced stationary models, particularly those featuring complex automation and large capacity; concerns regarding operator safety during high-speed operation; and the long replacement cycle typical for durable capital equipment in professional settings. Economic fluctuations impacting the construction sector and housing starts can directly dampen demand for woodworking machinery.

Opportunities: Development of affordable, high-precision cordless planers for mobile applications; market penetration in emerging economies through locally tailored, cost-effective models; integration of Industry 4.0 principles, including sensor technology and IoT, for improved machine performance monitoring and maintenance; expansion into specialized markets such as engineered wood product processing.

Impact Forces: The most prominent impact force is technological innovation, specifically the shift toward helical cutter heads and efficient dust extraction systems, which directly addresses consumer demands for superior finish, quieter operation, and cleaner workshops. Secondary forces include regulatory mandates concerning dust control and operator safety, which compel manufacturers to constantly upgrade product design and compliance features, ensuring market standards are consistently elevated.

Segmentation Analysis

The Woodworking Planers Market is extensively segmented based on machine type, power source, application, and distribution channel, allowing for a nuanced understanding of varying consumer needs across the global landscape. The analysis provides crucial insights into which product categories are experiencing rapid technological adoption (e.g., cordless tools) and which application segments offer the most lucrative long-term value (e.g., professional commercial use). The diversity of machine types, ranging from small handheld electric planers used for quick adjustments to massive stationary planers used in lumber mills, underscores the complexity and breadth of the market, necessitating tailored marketing and product development strategies for each segment.

Understanding the segmentation reveals that while corded benchtop planers dominate volume sales due to their excellent price-to-performance ratio for small shops, stationary, large-capacity planers capture the majority of the market value, driven by high industrial expenditure. The power source segmentation is crucial, differentiating between traditional corded reliability favored in fixed workshops and the increasing utility of powerful cordless planers for on-site construction work where mobility is paramount. Application segmentation clarifies the divergent needs between professional users, who prioritize robustness, precision, and longevity, and hobbyists, who focus primarily on safety, compactness, and entry-level affordability.

- By Type:

- Benchtop Planers (Compact, high-volume segment)

- Stationary Planers (Industrial, high-value segment)

- Handheld Electric Planers (Mobile, high-utility segment)

- Manual Planers (Niche, traditional segment)

- By Power Source:

- Corded (Wired, continuous power)

- Cordless/Battery-Powered (Mobile, increasing adoption)

- By Application/End-User:

- Professional Woodworkers and Cabinet Makers

- Construction and Remodeling Contractors

- Industrial Lumber and Millwork Operations

- Hobbyists and DIY Enthusiasts

- Educational and Vocational Institutions

- By Distribution Channel:

- Offline Retail (Specialty Stores, Big-Box Stores)

- Online Retail (E-commerce Platforms, Manufacturer Websites)

Value Chain Analysis For Woodworking Planers Market

The value chain for the Woodworking Planers Market commences with the upstream segment involving raw material procurement, primarily steel, aluminum, high-grade plastics, and specialized motor components. Key activities in the upstream phase focus on securing consistent, high-quality components, particularly for the precision-machined parts like cutter heads and feed mechanisms, which directly influence the final product's performance and longevity. Manufacturers often maintain stringent quality control over bearing suppliers and motor housing providers to ensure durability and reliability, essential characteristics sought by end-users in professional settings. Efficiency in sourcing these high-cost materials is vital for maintaining competitive pricing strategies in a market where price sensitivity, especially in the benchtop segment, is high.

The core manufacturing and assembly stage involves high-precision machining, motor integration, safety feature installation, and final quality assurance. Innovation at this stage includes incorporating robotics for consistent assembly and investing in advanced casting technologies for machine frames to minimize vibration during operation. Downstream activities focus heavily on effective distribution. The market utilizes a mixed channel approach: direct sales for large, customized industrial stationary planers (often requiring complex installation and after-sales support) and indirect channels for the high-volume, standardized benchtop and handheld models. Major distribution channels include specialized woodworking machinery dealers, large international hardware chains, and increasingly, robust e-commerce platforms which offer convenience and comparison capabilities to hobbyists and small shop owners.

The service and support phase forms the final critical link in the value chain, particularly for high-end professional equipment. Manufacturers differentiate themselves through comprehensive warranty programs, readily available spare parts (especially knives/blades and belts), and extensive technical support. The prevalence of indirect distribution via retailers means that robust training and support must also be extended to channel partners to ensure accurate product representation and satisfactory customer service. Successful value chain management hinges on optimizing logistics to deliver bulky, heavy machinery efficiently and ensuring a continuous supply of maintenance consumables to maintain high customer satisfaction and repeat business.

Woodworking Planers Market Potential Customers

Potential customers for woodworking planers are broadly categorized by their operational scale, frequency of use, and required level of precision. The primary large-scale customers include industrial lumber processors, specialized architectural millwork companies, and large-volume furniture manufacturers who require heavy-duty, stationary planers capable of continuous operation and handling wide, deep cuts. These customers prioritize machine throughput, automated features, and minimal deviation tolerances, viewing the planer as a critical capital investment in their production line. Their purchasing decisions are often influenced by total cost of ownership (TCO) including energy efficiency, maintenance downtime, and cutter head longevity.

The mid-tier customer segment comprises professional cabinet makers, residential renovation contractors, and custom furniture artisans. This group demands high-quality benchtop or medium-capacity stationary planers that offer a blend of precision, portability (for contractors), and affordability. For this segment, ease of setup, reliable dust extraction integration, and the ability to achieve a finish requiring minimal secondary sanding are key buying criteria. They frequently rely on specialty woodworking retailers for advice and are highly brand-loyal, favoring brands known for durability and robust customer support.

The rapidly growing tertiary customer base includes DIY enthusiasts, hobbyists, and vocational schools. These customers typically purchase entry-level benchtop models or handheld planers, valuing simplicity, safety features, and price competitiveness. Their purchasing pathway is often digital, influenced by online reviews and instructional videos. For manufacturers, this segment represents significant volume potential, driving innovation in compact, accessible machine designs, and strong demand through large-scale general retailers and e-commerce platforms.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $750 Million |

| Market Forecast in 2033 | $1050 Million |

| Growth Rate | 4.8% ( Include CAGR Word with % Value ) |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Robert Bosch Tool Corporation, Makita Corporation, DeWalt (Stanley Black & Decker), JET Tools, Powermatic (JPW Industries), Grizzly Industrial, WEN Products, Festool, Felder Group, SCM Group, Laguna Tools, Oliver Machinery, RIKON Power Tools, Milwaukee Tool, Metabo, Koki Holdings (Hitachi Power Tools), General International. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Woodworking Planers Market Key Technology Landscape

The technological landscape of the Woodworking Planers Market is characterized by continuous refinement aimed at improving efficiency, precision, noise reduction, and longevity. The most significant advancement impacting performance is the widespread adoption of helical or spiral cutter heads, replacing traditional straight-knife systems. Helical heads feature numerous small, indexable carbide inserts arranged in a spiral pattern. This design results in a sheer, rather than a chopping, cut, dramatically reducing tear-out, especially on highly figured or knotty woods. Furthermore, these inserts can be rotated when dull, providing four fresh cutting edges before replacement is necessary, leading to lower operating costs and significantly less downtime. The resulting surface finish from a helical head often minimizes or eliminates the need for subsequent sanding operations, boosting overall shop productivity.

Beyond the cutter head, modern planers are integrating sophisticated motor technology and digital controls. Variable speed controls are becoming standard on higher-end stationary models, allowing operators to adjust the feed rate and cutter head RPM to suit different wood species and desired surface finishes. Digital readouts for thickness measurement offer unparalleled accuracy, replacing manual scales and minimizing user error. In the motor segment, brushless motor technology is driving the cordless planer market, offering longer run times, higher power output, and reduced maintenance compared to traditional brushed motors, making cordless options increasingly viable for professional job sites. These power advancements facilitate larger cutting capacities even in portable formats.

A crucial area of technological focus, driven heavily by regulatory requirements and operator health concerns, is dust and chip management. Manufacturers are incorporating advanced shrouded hood designs and highly efficient dust ports engineered for optimal airflow, ensuring maximum debris extraction when connected to vacuum systems. Additionally, for large industrial planers, the integration of advanced sensor technology, often linked to IoT platforms, allows for real-time monitoring of machine vitals, predictive failure analysis, and automated diagnostics, contributing to the development of 'smart workshops.' The fusion of mechanical precision with digital control and monitoring defines the cutting edge of the modern woodworking planer market.

Regional Highlights

The global distribution of demand for woodworking planers exhibits clear regional variances driven by economic development, construction activity, and woodworking traditions. North America, encompassing the U.S. and Canada, represents a high-value market dominated by demand for premium, large-capacity stationary planers and high-performance benchtop models. This region benefits from robust residential renovation cycles, a strong professional woodworking community, and high disposable income that supports investment in high-end machinery featuring the latest helical cutter head technology and digital controls. Manufacturers here must emphasize durability, precision, and adherence to stringent safety certifications (e.g., UL, CSA).

Europe, particularly Western Europe (Germany, UK, France), is characterized by long-standing woodworking craftsmanship and a focus on specialized, energy-efficient machinery. Demand is strong for high-precision combination machines (jointer-planers) and industrial equipment conforming to strict European safety standards (CE marking). Eastern Europe is emerging rapidly, driven by industrial modernization and infrastructure projects. The market here is sensitive to environmental factors and demands tools with superior dust extraction capabilities and sustainable manufacturing processes.

Asia Pacific (APAC) is the fastest-growing region, driven by massive urbanization projects and the relocation of global manufacturing centers. While the industrial segment (China, South Korea) demands high-throughput machinery, the benchtop segment is exploding in developing nations (India, Southeast Asia) where a large number of small, independent furniture and construction workshops are emerging. Price competitiveness and robust after-sales service are critical success factors in this diverse and dynamic market. Infrastructure development and a shift towards mechanized carpentry are the primary growth catalysts.

Latin America (LATAM) and the Middle East & Africa (MEA) represent emerging markets with sporadic, localized demand spikes tied primarily to infrastructure spending and resource processing industries. LATAM shows promise due to internal housing demands, focusing on mid-range, versatile equipment. MEA, particularly the GCC countries, sees demand driven by large-scale construction and luxury real estate projects, requiring specialized machinery for high-end millwork, although logistical challenges and regional political stability remain influential factors.

- North America: Market maturity, focus on premium, helical cutter planers; strong DIY and professional segments; high adoption of large, stationary industrial machines.

- Europe: Emphasis on precision, safety compliance (CE), and combination machines; high replacement demand for energy-efficient models in established markets.

- Asia Pacific (APAC): Highest projected CAGR; fueled by urbanization, infrastructure development, and growing volume demand for affordable benchtop planers in SME sectors.

- Latin America (LATAM): Growth tied to housing and local construction demand; preference for mid-tier, robust, and easily maintainable equipment.

- Middle East & Africa (MEA): Demand primarily linked to large governmental construction projects and specialized architectural millwork requirements.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Woodworking Planers Market.- Robert Bosch Tool Corporation

- Makita Corporation

- DeWalt (Stanley Black & Decker)

- JET Tools

- Powermatic (JPW Industries)

- Grizzly Industrial

- WEN Products

- Festool

- Felder Group

- SCM Group

- Laguna Tools

- Oliver Machinery

- RIKON Power Tools

- Milwaukee Tool

- Metabo

- Koki Holdings (Hitachi Power Tools)

- General International

Frequently Asked Questions

Analyze common user questions about the Woodworking Planers market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the growth of the stationary planer segment?

The primary factor is the increasing global requirement for highly precise, dimensionally stable wood components used in complex joinery, cabinetry, and flooring. Stationary planers offer superior capacity, rigidity, and the latest helical cutter technology, fulfilling the quality and throughput needs of professional millwork shops and industrial applications.

How do helical cutter heads differ from traditional straight-knife systems in woodworking planers?

Helical cutter heads use multiple small, carbide inserts arranged in a shear-cutting spiral pattern, resulting in a cleaner finish, significantly reduced noise, and extended cutter life due to the indexable inserts. Straight-knife systems use large, continuous blades, which are louder and more prone to tear-out on difficult grain.

Which geographical region is expected to show the highest growth rate in the forecast period?

The Asia Pacific (APAC) region is projected to exhibit the highest Compound Annual Growth Rate (CAGR). This acceleration is attributed to rapid infrastructural development, burgeoning domestic housing demand, increasing industrial automation, and the expansion of small and medium-sized woodworking enterprises across countries like China and India.

What role does digitalization play in modern woodworking planers?

Digitalization involves the integration of features such as digital depth readouts for enhanced precision, variable speed controls, and increasingly, IoT connectivity for remote diagnostics and predictive maintenance scheduling. This shift aims to maximize operational efficiency and reduce manual calibration errors for professional users.

Are cordless planers gaining market share, and for which application?

Yes, cordless planers are rapidly gaining market share, driven by advancements in brushless motor and battery technology. They are predominantly favored by construction and remodeling contractors who require maximum mobility, portability, and convenience for quick adjustments and trimming tasks on job sites where fixed power sources may be limited.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager