Wool Felt Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435019 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Wool Felt Market Size

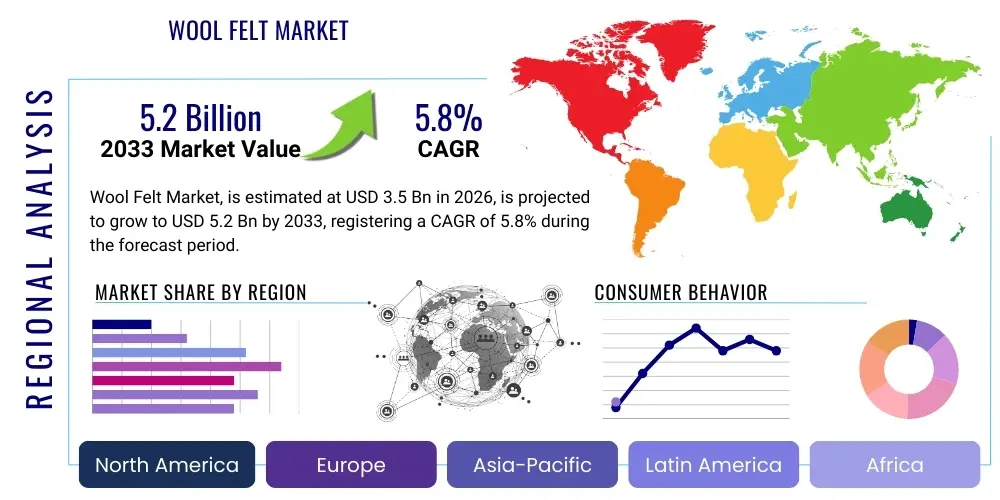

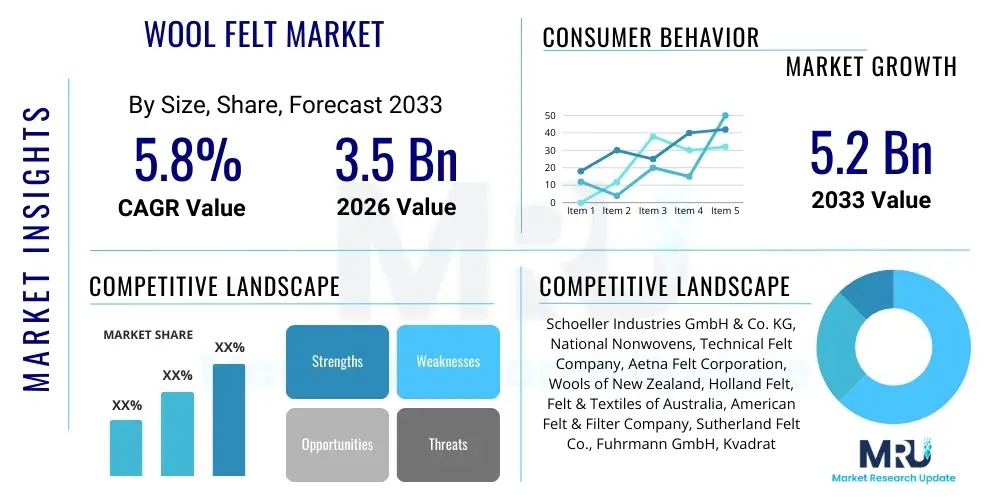

The Wool Felt Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 3.5 Billion in 2026 and is projected to reach USD 5.2 Billion by the end of the forecast period in 2033.

Wool Felt Market introduction

Wool felt represents a cornerstone material within the technical textiles and non-woven fabrics sector, distinguished by its unique manufacturing process involving the interlocking, condensing, and hardening of natural wool fibers, predominantly sheep’s wool, without weaving or knitting. This process, known as felting, capitalizes on the natural scales (barbs) present on the wool fiber surface, which, when subjected to heat, moisture, lubrication, and mechanical agitation, migrate and permanently lock together. The resulting material exhibits superior physical properties, including exceptional compression resistance, excellent thermal insulation (R-value), impressive sound dampening capabilities, and natural flame retardancy, making it invaluable across diverse and demanding applications ranging from precision engineering to architectural design. The market landscape is increasingly defined by the search for sustainable, high-performance alternatives, where wool felt inherently surpasses many synthetic competitors due to its renewability and end-of-life biodegradability, satisfying stringent environmental procurement policies across developed nations.

The primary applications propelling the market's trajectory include the automotive industry, where wool felt is indispensable for Noise, Vibration, and Harshness (NVH) control, utilizing high-density pressed felt for specialized gaskets, seals, and fluid wicking components. In the construction sector, its inherent acoustic properties are leveraged for advanced architectural sound absorption panels and internal insulation systems, meeting rigorous modern building codes designed to enhance occupant comfort and energy efficiency. Beyond these industrial heavyweights, the traditional uses of wool felt in apparel, footwear, and crafting sectors continue to provide a stable demand base, specifically targeting high-end, premium markets that value natural aesthetics and material quality. The core benefits—including natural elasticity, hypoallergenicity, resistance to wear, and consistent performance across a wide temperature range—establish wool felt as a highly versatile component in specialized machinery and filtration systems where consistency and reliability are paramount.

Driving factors fueling market growth include rising consumer awareness regarding the environmental footprint of materials, which favors natural fibers, coupled with governmental incentives supporting sustainable building practices. Furthermore, technological advancements in felting machinery, particularly in needle-punching technology, have broadened the spectrum of products, allowing for cost-effective, customized felt production with varied densities and thicknesses suitable for technical textiles and geotextile applications. The synergy between traditional craftsmanship and modern material science, yielding enhanced performance characteristics such as higher abrasion resistance and antimicrobial treatments, ensures that the Wool Felt Market remains dynamic and poised for stable expansion throughout the forecast period, addressing complex industrial challenges with a natural, reliable solution. The material's innate resilience to temperature fluctuations and its ability to wick and retain oil and solvents make it a preferred choice over many polymers in mechanical applications requiring long-term operational integrity and low maintenance, particularly within heavy machinery and specialized transportation vehicles that operate under extreme conditions.

Wool Felt Market Executive Summary

The Wool Felt Market exhibits strong performance driven by a compelling intersection of technological innovation in processing and shifting global priorities toward natural and sustainable material utilization. Current business trends indicate a robust investment cycle focusing on optimizing the supply chain for raw wool, primarily addressing challenges related to price volatility and traceability, which are crucial for maintaining competitiveness against synthetic substitutes. Manufacturers are increasingly entering strategic partnerships with regional wool growers to secure consistent access to high-micron, specialty wool necessary for high-specification industrial felt. Vertical integration strategies, covering scouring, carbonizing, and finishing processes, are becoming commonplace among leading market players to control quality and reduce lead times, thus enhancing market responsiveness to fluctuating demand from core sectors like transportation and industrial machinery. Innovation is also focused on developing composite felt materials that blend wool with other high-performance fibers to achieve specific thermal or fire resistance ratings necessary for highly regulated industries.

Regionally, Asia Pacific is anticipated to dominate market growth, primarily fueled by rapid industrialization, burgeoning automotive manufacturing capabilities, and significant infrastructure development projects in countries like China and India, focusing largely on high-volume needle-punched felt for cost-sensitive applications. Conversely, North America and Europe maintain high demand for premium, high-density pressed felt, driven by stringent environmental noise regulations and mature application standards in the aerospace and high-end consumer goods markets. These developed regions are also pioneers in adopting sustainable and recycled wool felt options, setting global benchmarks for circular economy practices within the felt industry. The regulatory framework in Europe, particularly regarding material safety and noise abatement, further strengthens the demand for certified, high-performance acoustic wool felt panels in public and commercial architecture.

Segmentation analysis reveals that while the pressed felt segment maintains a strong revenue base owing to its use in critical mechanical applications requiring material integrity, the needle-punched segment is projected to register the fastest CAGR, supported by its cost-effectiveness, versatility in thickness, and suitability for technical textiles, filtration, and geotextile uses. Furthermore, the market is segmenting based on end-user requirements, with specialized acoustic felt and bio-based insulation felt gaining significant traction, reflecting the broader industry trend towards performance-specific and environmentally conscious product offerings. The push for enhanced functionality is leading to increased research into surface treatments, such as water-repellent and antimicrobial finishes, allowing wool felt to penetrate challenging sectors like medical textiles and specialized outdoor gear, further diversifying revenue streams and solidifying the material’s position as a technical staple.

AI Impact Analysis on Wool Felt Market

User inquiries concerning the integration of Artificial Intelligence (AI) into the Wool Felt Market predominantly center on leveraging computational power to transcend traditional limitations associated with raw material variability and process optimization. A central concern is how machine learning can be applied to categorize and grade raw wool batches more efficiently than human inspection, compensating for the inherent natural variations in fiber length, crimp, and micron count, which are fundamental inputs determining the final felt quality. Stakeholders frequently ask about the feasibility of implementing AI-driven closed-loop control systems within the felting machinery (both wet and dry processes) to maintain precise consistency in density and resilience, especially important for felt components used in aerospace or high-precision industrial gaskets where material failure is unacceptable. Furthermore, predicting price swings for wool commodities based on climatic data, sheep population statistics, and geopolitical trade dynamics represents a key area of user interest for strategic procurement and risk mitigation.

The deployment of AI offers transformative potential in optimizing energy consumption and waste reduction across the manufacturing process, aligning with sustainability objectives. By continuously monitoring and analyzing massive datasets generated by sensors measuring parameters like humidity, temperature, and machine vibration, AI models can instantaneously adjust machine settings to achieve maximum energy efficiency while ensuring product quality remains within specified tolerances. For instance, in the fulling stage of wet felting, which is highly energy-intensive, deep reinforcement learning models can determine the exact duration and intensity of agitation required for optimal fiber entanglement based on the input wool type, minimizing over-processing and maximizing throughput. This move towards intelligent manufacturing minimizes operational variability, a longstanding challenge in non-woven textile production, ensuring that felt destined for high-tolerance mechanical applications meets its specification precisely, thereby reducing costly recalls and material waste.

Beyond the factory floor, AI significantly enhances market strategy and customer engagement. Predictive market modeling allows manufacturers to anticipate shifts in demand across geographical regions or product segments (e.g., a surge in acoustic felt needed for public infrastructure projects) well in advance, enabling optimal inventory stocking and production scheduling. Moreover, AI-powered analytics can analyze customer performance feedback and warranty claims associated with felt products, identifying material failure patterns related to specific manufacturing batches or raw material suppliers, thereby driving continuous improvement in fiber sourcing and production protocols. The long-term impact of AI is fostering a highly responsive, data-driven supply chain capable of producing specialized wool felt materials with guaranteed performance specifications, moving the industry toward a higher level of technical sophistication and reliability, ensuring the material remains competitive against increasingly advanced synthetic alternatives.

- Optimization of fiber blending ratios using machine learning to achieve desired density and hardness profiles for specialized industrial felts.

- Predictive maintenance schedules for high-speed needle looms and wet-felting machinery, minimizing operational downtime and extending asset life.

- Real-time quality control and automated defect detection via computer vision and deep learning models during the finishing process, improving conformance to specifications.

- Enhanced supply chain transparency and wool fiber traceability from farm to factory using blockchain and AI tracking systems to support sustainability claims.

- Forecasting global wool commodity prices and securing favorable procurement strategies through advanced statistical modeling incorporating climate and trade variables.

- Automated inventory management based on anticipated demand trends across major sectors like automotive, construction, and specialized technical textiles.

- Simulation of new felt structures and composite material performance under various stress conditions before physical prototyping, accelerating product development cycles.

DRO & Impact Forces Of Wool Felt Market

The Wool Felt Market is primarily driven by the escalating global focus on sustainability and the growing adoption of natural, biodegradable materials in industrial and consumer applications. Wool felt's inherent environmental advantages over petrochemical-based synthetic non-wovens provide a substantial competitive edge, aligning perfectly with corporate sustainability goals and consumer eco-consciousness, particularly in Europe and North America. Significant drivers also include the steady expansion of the automotive sector, where noise reduction and vibration damping are critical design specifications, requiring high-performance wool felt components for NVH control, seals, and gaskets. Furthermore, stringent building insulation and acoustic standards globally mandate the use of high-quality, fire-resistant acoustic materials, boosting demand for dense felt panels in commercial and residential construction, particularly those aiming for LEED or equivalent green building certifications, providing strong regulatory tailwinds.

However, the market faces significant restraints, chiefly concerning the high volatility and fluctuating cost of raw virgin wool, which is heavily reliant on livestock production cycles, climate, and global trade dynamics. This price instability often makes wool felt less competitive compared to cheaper, mass-produced synthetic alternatives derived from petrochemical sources, forcing manufacturers to operate with narrow margins unless they specialize in high-value products. Another restraint is the operational complexity and energy intensity associated with traditional wet felting and fulling processes, which can sometimes limit scalability and standardization, especially in smaller manufacturing setups. Furthermore, the ongoing challenge of securing consistent quality wool fibers that meet highly specific industrial purity and micron requirements poses a continuous hurdle for high-specification end-users, requiring costly and time-consuming pre-treatment processes like carbonizing and advanced scouring.

Opportunities abound in the development of innovative, high-value technical felt products, such as specialized medical felt for padding and supports, advanced functional apparel, and composites combining wool felt with other performance fibers (e.g., carbon fiber, aramid) to enhance mechanical strength or thermal properties for structural applications. The increasing utilization of recycled and reclaimed wool fibers presents a significant opportunity to mitigate raw material cost fluctuations and enhance the sustainability profile of the industry, appealing directly to the principles of the circular economy and opening up large-volume, cost-sensitive markets like packaging and bulk insulation. The market can also capitalize on the rising demand for premium, custom-designed products in the luxury goods and interior design sectors, where the aesthetic and tactile properties of high-quality wool felt command premium pricing, offering higher profit margins for manufacturers focusing on artisanal or niche production techniques and certified material provenance.

Segmentation Analysis

The comprehensive segmentation analysis of the Wool Felt Market dissects the industry into meaningful, actionable categories based on the product’s physical characteristics, method of manufacture, and functional application. The fundamental delineation rests upon the felting technique, differentiating between pressed felt and needle-punched felt. Pressed felt, resulting from the meticulous wet-felting process, is dense, firm, and highly durable, making it the preferred material for precision engineering parts, such as polishing wheels, fluid seals, and heavy-duty vibration dampeners, commanding a premium due to the intensive processing required. Conversely, needle-punched felt, manufactured mechanically using barbed needles to interlock fibers, offers flexibility, greater volume-to-weight ratios, and cost efficiency, dominating large-area applications like acoustical liners, carpet underlays, and specialized industrial filtration media due to its rapid and continuous production capabilities. This structural difference fundamentally dictates the material’s end-use suitability.

Further granularity is achieved through segmenting by application, which clearly illustrates the varied performance requirements of different end-user industries. The Automotive segment demands tight tolerances, specific thermal management properties, and NVH characteristics, requiring specialized, often chemically treated, high-density felt that conforms to OEM safety standards. In contrast, the Construction segment focuses heavily on flammability standards and superior acoustic absorption coefficients (NRC ratings), influencing the selection of low-to-medium density felt panels for passive sound management. The Industrial Filtration application demands felts with high retention efficiency and specific pore sizes, necessitating precise control over fiber web formation and density. Understanding these diverse requirements allows manufacturers to optimize product specifications and focus research and development efforts toward high-growth technical niches, such as felt infused with antimicrobial agents for use in medical environments or specialized geotextiles for civil engineering.

Density segmentation—categorizing products into low, medium, and high density—is vital for matching material properties with functional requirements. High-density felt (e.g., 0.30 g/cm³ and above) offers maximum compressive strength and resilience, essential for structural applications requiring load-bearing or sealing properties. Medium-density felt is balanced for sound absorption and light mechanical use, serving as general padding or liners. Low-density felt is favored for cost-effective thermal insulation and basic cushioning where loft is more important than strength. Strategic market players utilize these density distinctions to inform pricing strategies, as higher density felts typically require higher quality wool and more intensive processing time, commanding a significant price premium. This rigorous segmentation underscores the complexity and performance orientation of the modern wool felt market, which is far removed from its historical commodity status and is firmly established as a highly engineered technical material that adheres to strict industry performance standards.

- By Type (Manufacturing Process): Pressed Felt (Wet Felting - high density, seals, vibration damping), Needle-Punched Felt (Mechanical Felting - insulation, filtration, acoustics).

- By Application: Automotive (Gaskets, Seals, Dampers, Acoustic Insulation, Headliners), Industrial Filtration (Air, Liquid, Oil Separators, Dust Collection), Apparel and Footwear (Insoles, Linings, Outerwear), Consumer Goods and Crafts (Hobby Felt, Designer Furniture Components), Construction and Architectural Acoustics (Wall Panels, Ceiling Baffles, Thermal Insulation), Other Technical Applications (Polishing Pads, Specialized Medical Devices, Aerospace Sealing).

- By Density: Low Density Felt (Insulation and light cushioning), Medium Density Felt (General acoustics and padding), High Density Felt (Precision engineering, fluid retention, structural support).

- By End-User Industry: Transportation (Road, Rail, Aerospace), Manufacturing (Heavy Machinery, Consumer Electronics), Construction (Residential, Commercial, Public Infrastructure), Consumer Arts and Textiles, Medical and Hygiene.

Value Chain Analysis For Wool Felt Market

The upstream segment of the wool felt value chain is predicated upon sustainable agriculture and efficient fiber preparation. This stage involves meticulous processes starting with sheep farming and shearing, followed by raw wool classification based on quality factors like fineness (micron count), color, and staple length—parameters that dictate the suitability for high-performance felt versus commodity applications. Crucial processing steps include scouring, which removes grease (lanolin) and impurities, and carbonizing, which chemically removes residual vegetable matter. Manufacturers must manage complex global sourcing networks, often dealing with brokers in major wool-producing nations like Australia, New Zealand, and South America. Upstream performance directly influences downstream costs and product integrity; thus, securing certified, ethically sourced wool is a growing compliance requirement, especially for suppliers targeting European and North American premium markets, necessitating robust quality checks at the point of origin.

The midstream is the transformation phase, dominated by high-capital manufacturing operations. Carding aligns the scoured and blended fibers into a uniform web, followed by the actual felting process. Pressed felt production requires extensive wet processing (fulling and hardening), demanding significant investment in heavy machinery and precise temperature/chemical control to achieve specified density and hardness. Needle-punched felt production, while faster, involves complex needle loom configurations and specialized fiber blends to control loft and tensile strength, catering primarily to the technical non-wovens market. Distribution efficiency here is critical; many manufacturers adopt make-to-order models for specialized industrial parts, minimizing inventory risk but requiring precise production scheduling and highly skilled technical operators to maintain product specifications across varying batches and fiber inputs. Investment in advanced automation and quality control systems in the midstream significantly impacts the overall cost structure and the ability to compete on precision and speed.

Downstream activities involve secondary processing, marketing, sales, and distribution to diverse end-users. Secondary processing includes lamination, adhesive application, specialized chemical treatments (e.g., fire retardants), and precision die-cutting using CAD systems for complex component shapes (e.g., automotive seals), adding significant value to the base material. Distribution channels are bifurcated: direct sales are vital for securing long-term contracts with major original equipment manufacturers (OEMs) in the automotive and machinery sectors, requiring specialized technical sales teams offering customized solutions and stringent quality certifications. Indirect channels rely on specialized industrial distributors, wholesale textile merchants, and retail supply chains for craft, apparel, and general construction applications. The effectiveness of the downstream segment is measured by the ability to provide value-added services, quick turnaround times for custom parts, and comprehensive technical support related to material performance, ensuring that the highly specific requirements of industrial clients are met efficiently.

Wool Felt Market Potential Customers

The primary customer base for the Wool Felt Market is structurally diverse and highly industrialized, driven by distinct needs for acoustic performance, sealing capabilities, and insulation properties across engineering applications. Automotive original equipment manufacturers (OEMs) and their Tier 1 suppliers represent a massive consumer segment, utilizing wool felt for sound dampening in vehicle interiors, headliners, floor mats, and mechanical components such as oil wicks, gaskets, and seals, where its natural resilience, fluid absorption capacity, and NVH characteristics are highly valued. The rigorous quality control, long-term contractual demands, and zero-tolerance specifications associated with this sector make it a cornerstone for high-density, performance-grade felt producers who can consistently supply certified materials.

Another crucial end-user sector is the construction and architecture industry. Professionals such as acoustical engineers, interior designers, and commercial builders increasingly specify wool felt for soundproofing panels, wall coverings, and ceiling tiles in commercial buildings, recording studios, and high-end residential projects. This segment demands aesthetically pleasing, fire-compliant, and high-performing acoustic absorption materials that contribute positively to building sustainability ratings. Furthermore, heavy machinery manufacturers and industrial maintenance companies are consistent buyers, using wool felt for critical functions such as vibration isolation mounts, specialized polishing pads for metal and glass finishing, heavy-duty filtration, and lubrication retention in complex industrial machinery, relying on the material's durability, chemical resistance, and predictable long-term performance.

Beyond large industrial users, the specialized technical segments, including aerospace and medical device manufacturing, represent high-margin potential customers. Aerospace utilizes highly specific, fire-retardant wool felt for insulation and padding in cockpits and cabins, requiring exceptional traceability and compliance with aviation standards. Medical manufacturers use purified wool felt for orthopedic padding, supports, and specialized filters, emphasizing hypoallergenicity and material purity. Lastly, the retail and craft sectors, including independent designers and manufacturers of premium apparel and luxury goods, continue to provide demand for non-industrial grade wool felt, valuing its natural texture and environmental story, rounding out a comprehensive customer base spanning the spectrum from heavy industry to high-fashion retail.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.5 Billion |

| Market Forecast in 2033 | USD 5.2 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Schoeller Industries GmbH & Co. KG, National Nonwovens, Technical Felt Company, Aetna Felt Corporation, Wools of New Zealand, Holland Felt, Felt & Textiles of Australia, American Felt & Filter Company, Sutherland Felt Co., Fuhrmann GmbH, Kvadrat A/S, Filzfabrik Fulda GmbH & Co KG, Diversified Nonwovens, The Felt Store, US Felt, Lanova Feutres, Central Felt & Fabric Inc., Texel Technical Materials, Hovding Jarn & Metall, Feltcrafts. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Wool Felt Market Key Technology Landscape

The technological landscape of the Wool Felt Market is characterized by continuous refinement of traditional processes coupled with the integration of modern automation and material science techniques, moving the industry toward higher precision and consistency. Key technology focuses on enhancing the efficiency and versatility of the manufacturing stages. Wet felting technology, crucial for producing high-density pressed felt, is evolving through advanced computer-controlled fulling machines that offer precise management of moisture, temperature, and agitation cycles, leading to more uniform material density, particularly critical for engineering-grade felt. Innovations in fiber pretreatment, such as plasma surface modification and advanced chemical scouring, are also being explored to improve the interlocking capacity of wool fibers, thereby enhancing the overall strength, thermal performance, and durability of the finished felt product for demanding industrial applications requiring specific SAE or military standards compliance.

In the segment of needle-punched felt, the technological advancements are centered around increasing production speed, reducing energy consumption, and enhancing efficiency. Modern high-speed needle looms feature complex cam patterns and specialized needle configurations designed to minimize fiber damage while maximizing entanglement efficiency across various fiber blends and thickness profiles. Furthermore, the integration of non-woven layering technologies, often using aerodynamic or mechanical web formation systems, allows manufacturers to create multi-layer felt structures with optimized performance characteristics, such as combining sound absorption layers with abrasion-resistant outer layers for complex automotive components. The adoption of recycled wool necessitates specialized scouring and shredding technologies to ensure consistent fiber length and purity before processing, often relying on spectral analysis for rapid contaminant detection to protect expensive downstream machinery.

Furthermore, the industry is increasingly leveraging digital manufacturing tools to enhance quality assurance and customization. Laser cutting and sophisticated CAD/CAM systems allow for highly precise shaping and finishing of felt components, crucial for zero-tolerance applications like machine seals, acoustic baffles, and industrial gaskets, minimizing material waste and speeding up time-to-market for custom orders. This precision enables just-in-time production of complex geometries, a necessity for serving the dynamic automotive supply chain. Ongoing research into bio-composite materials, where wool felt is combined with sustainable binders or reinforcing fibers, represents a frontier technology aiming to push the performance limits of felt in structural and high-temperature environments, ensuring the material remains competitive against synthetic and composite materials, thereby securing the long-term technical relevance of natural wool felt in demanding sectors.

Regional Highlights

The regional dynamics of the Wool Felt Market are diverse, reflecting varying levels of industrial development, regulatory environments, and consumer preferences for natural materials. Asia Pacific (APAC) stands out as the primary growth engine due to robust expansion in its manufacturing and construction sectors. Countries like China and India are witnessing unprecedented demand for felt, primarily in automotive assembly, large-scale industrial filtration systems necessary for managing increasing pollution levels, and basic infrastructure insulation. The availability of diverse and cost-effective raw wool sources, alongside significant investments in modern textile manufacturing infrastructure, position APAC as both a major producer and a rapidly expanding consumer of standard and technical wool felt products, particularly the high-volume needle-punched varieties used in cost-sensitive applications like geotextiles and construction liners.

Europe represents a mature but highly innovation-driven market, characterized by stringent environmental regulations and a high consumer propensity for sustainable, natural materials. European manufacturers often focus on producing high-value, niche felt products, particularly for architectural acoustics, luxury fashion, and specialized filtration systems compliant with strict EU standards. The emphasis on circular economy principles fuels demand for recycled and certified organic wool felt, often commanding a significant price premium over non-certified alternatives. Germany, Italy, and the UK are key contributors, driven by strong automotive luxury segments and advanced interior design markets that prioritize high-quality, traceable materials, ensuring the region maintains a significant share in value, focusing on performance attributes like fire retardancy and superior NRC ratings.

North America, driven predominantly by the United States, demonstrates steady demand across its industrial, automotive, and construction sectors, often requiring felt that meets specific military or federal material specifications (e.g., density and thickness tolerances). The region is a major consumer of high-density pressed felt used in machinery vibration control and specialty medical applications. The resurgence of domestic manufacturing and increased spending on infrastructure projects requiring advanced insulation and acoustic solutions will underpin market stability. Meanwhile, Latin America and the Middle East & Africa (MEA) are emerging markets, showing gradual increases in wool felt consumption tied to expanding basic construction and textile manufacturing bases. However, these regions often face challenges related to supply chain stability and competition from imported synthetic alternatives, though local governmental pushes towards sustainable sourcing could offer future opportunities for basic and medium-density felt penetration.

- Asia Pacific (APAC): Dominates the market share driven by high volume manufacturing, rapid automotive expansion, and critical demand from industrial filtration sectors, particularly in China and India, focusing on capacity and cost efficiency.

- Europe: Characterized by high-value, premium market segments focused on strict acoustic standards, sustainable sourcing, and luxury consumer applications, supported by strong regulatory frameworks enforcing material quality and environmental ethics.

- North America: Stable and mature demand for high-performance industrial felt, particularly for mechanical components, vibration damping, and stringent commercial building acoustic requirements, often supplied through established, specialized distributors.

- Latin America (LATAM): Emerging market with growing demand tied to residential construction and local textile production, gradually improving its technical application portfolio as local manufacturing capabilities advance.

- Middle East & Africa (MEA): Small but growing market primarily for construction insulation and basic consumer textiles, dependent on global wool price stability and regional infrastructure investment cycles, facing high import dependency for specialized grades.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Wool Felt Market, encompassing integrated producers, specialized component manufacturers, and key innovators focusing on sustainable felt solutions.- Schoeller Industries GmbH & Co. KG

- National Nonwovens

- Technical Felt Company

- Aetna Felt Corporation

- Wools of New Zealand

- Holland Felt

- Felt & Textiles of Australia

- American Felt & Filter Company

- Sutherland Felt Co.

- Fuhrmann GmbH

- Kvadrat A/S

- Filzfabrik Fulda GmbH & Co KG

- Diversified Nonwovens

- The Felt Store

- US Felt

- Lanova Feutres

- Central Felt & Fabric Inc.

- Texel Technical Materials

- Hovding Jarn & Metall

- Feltcrafts

- Filc S.p.A.

- Non-Wovens & Industrial Felt Co.

- Western Nonwovens Inc.

- Shanghai G&T Industrial Felt Co., Ltd.

- J.R. Industrial Felt Co.

Frequently Asked Questions

Analyze common user questions about the Wool Felt market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the key differentiator between pressed wool felt and needle-punched wool felt?

Pressed wool felt (wet-felted) uses moisture, heat, and pressure to create high-density, highly resilient material typically used for seals, gaskets, and polishing, offering superior compression resistance. Needle-punched felt is mechanically interlocked, resulting in lower density, greater versatility, and cost-effectiveness, commonly deployed in insulation, filtration, and large-area acoustic applications where loft and quick production are priorities.

How does the sustainability trend impact the demand for wool felt?

The increasing global focus on sustainability significantly boosts wool felt demand because it is a natural, renewable, biodegradable, and often responsibly sourced fiber. This eco-friendly profile makes it a preferred alternative to synthetic, petroleum-derived non-wovens, particularly in the automotive, apparel, and architectural sectors prioritizing green building certification and circular economy practices, driving premiumization.

Which application segment drives the highest volume consumption in the Wool Felt Market?

The Automotive and Industrial Filtration segments consistently drive the highest volume consumption globally. Automotive manufacturing relies heavily on wool felt for critical Noise, Vibration, and Harshness (NVH) control, along with specialized seals. Industrial filtration applications utilize needle-punched wool felt's structured efficiency for cost-effective liquid and air purification in demanding industrial environments.

What are the main restraints hindering the growth of the Wool Felt Market?

The primary restraints are the high price volatility of raw virgin wool, influenced by global agricultural and climatic conditions, which introduces supply chain instability. Furthermore, intense cost competition from cheaper, mass-produced synthetic non-woven materials acts as a significant barrier to entry in cost-sensitive, high-volume markets.

What role does technology play in modern wool felt manufacturing?

Technology enhances modern wool felt manufacturing through automated, high-precision processes. This includes computer-controlled wet felting for density precision, high-speed needle punching for increased throughput, and the application of AI and laser cutting for real-time quality assurance, defect detection, and precise customization of components for specialized industrial use.

In which region is the demand for technical (industrial) wool felt highest?

North America and Europe currently exhibit the highest demand for specialized, high-performance technical or industrial wool felt, driven by stringent regulatory requirements in mechanical engineering, aerospace, and high-end automotive manufacturing, which require materials with certified density and dimensional stability for critical applications.

How is recycled wool being integrated into the market?

Recycled wool is increasingly integrated to reduce material costs and enhance sustainability credentials. It is primarily used in producing lower to medium-density needle-punched felt for cost-effective products such as insulation bats, carpet padding, and non-critical acoustic panels. This addresses both environmental concerns and the volatility of virgin wool prices.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager