Wool Polishing Pad Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432005 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Wool Polishing Pad Market Size

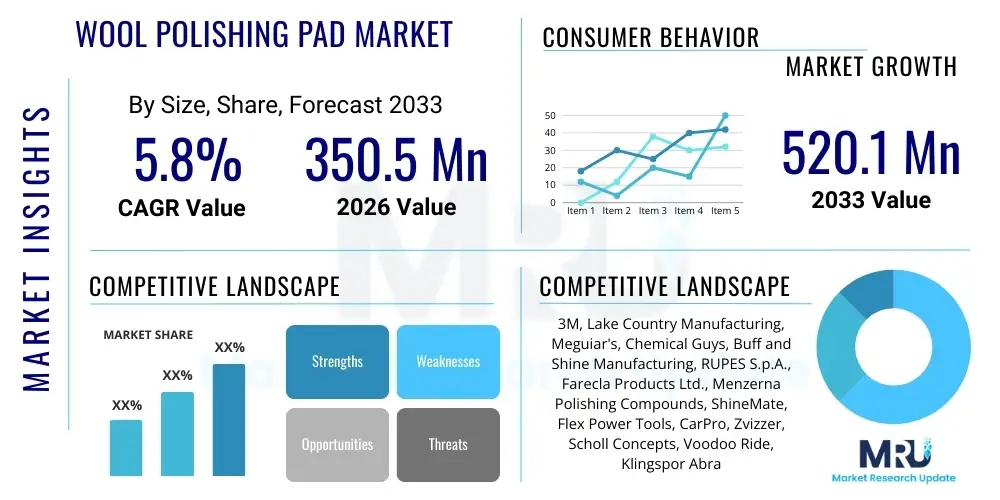

The Wool Polishing Pad Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at $350.5 million in 2026 and is projected to reach $520.1 million by the end of the forecast period in 2033. This growth is primarily driven by the expanding automotive refinishing sector, increased focus on paint correction, and the inherent performance advantages of natural wool fibers in achieving superior finish quality, particularly when dealing with deep scratches and heavy oxidation.

Wool Polishing Pad Market introduction

The Wool Polishing Pad Market encompasses specialized abrasive tools manufactured primarily from natural sheep's wool, used in conjunction with rotary or dual-action polishers to correct paint defects, oxidation, and scratches on surfaces, most notably in the automotive, marine, and aerospace industries. These pads are highly valued for their aggressive cutting action, heat dissipation capabilities, and ability to handle abrasive compounds efficiently, leading to rapid material removal and superior surface clarity compared to foam counterparts in certain applications. Key applications span vehicle paint correction, gel coat restoration on boats, and final finishing stages in industrial manufacturing.

Wool polishing pads are categorized based on their construction, including twisted, blended, or knitted wool, each offering distinct levels of aggression and finishing capability. Twisted wool pads, often utilized for heavy cutting, offer maximum surface contact and are highly effective for removing sanding marks or deep defects. Blended and knitted pads, conversely, are frequently employed for medium-to-light correction and finishing tasks, balancing cutting ability with reduced marring potential. The fundamental benefit of wool lies in its natural fiber structure, which creates microscopic cutting points, allowing for faster defect removal while maintaining a lower operating temperature on the work surface, minimizing the risk of paint burn-through.

The market expansion is significantly bolstered by the increasing consumer and professional demand for meticulous surface maintenance and restoration, especially within the luxury automotive and high-end detailing sectors. Furthermore, advancements in wool processing technology, leading to improved durability and reduced linting, enhance the user experience and extend the product lifecycle. Driving factors include the global rise in vehicle production and aftermarket care services, stringent aesthetic standards in industrial finishing, and the continuous need for restoration of expensive assets like yachts and aircraft, where surface integrity is paramount for both aesthetics and protective functions.

Wool Polishing Pad Market Executive Summary

The Wool Polishing Pad Market exhibits strong resilience driven by robust demand from professional detailing services, collision repair centers, and specialized industrial maintenance providers globally. Key business trends include a notable shift toward specialized, sector-specific pad constructions, such as pads optimized for ceramic coating preparation or UV-cured paint systems. Manufacturers are focusing heavily on developing hybrid pads that integrate synthetic fibers with natural wool to optimize durability, heat resistance, and compounding efficiency, addressing the professional need for tools that bridge aggressive cutting with minimal swirling. Supply chain optimization, particularly the sourcing and processing of high-quality wool fibers, remains a critical competitive differentiator, influencing both product cost and performance consistency in the competitive landscape.

Regionally, Asia Pacific is emerging as the fastest-growing market, propelled by rapid industrialization, burgeoning automotive manufacturing hubs, and the rising middle class investing in vehicle appearance maintenance. North America and Europe maintain dominance in terms of market value, primarily due to the established infrastructure of professional detailing networks and stringent standards for automotive refinishing quality demanded by insurance providers and consumers. Regional trends also reflect increased regulatory scrutiny regarding volatile organic compounds (VOCs) in polishing compounds, indirectly favoring high-performance wool pads that facilitate quicker processes, thereby minimizing exposure time and reducing the overall consumption of chemical agents.

Segment trends highlight the dominance of the Automotive Refinishing application segment, commanding the largest market share owing to the high frequency of paint correction required in accident repairs and cosmetic restoration. Within product types, twisted wool pads maintain leadership for heavy-duty applications, while blended wool pads are seeing accelerating adoption due to their versatility across multiple stages of the polishing process. Furthermore, the Hook and Loop backing type dominates the attachment mechanism segment, preferred by professionals for its speed, ease of use, and compatibility with various machine types. Strategic segmentation focuses on tailoring pad firmness and fiber length to specific paint chemistries, ensuring maximum efficiency and minimal risk of surface damage across the diversified end-user base.

AI Impact Analysis on Wool Polishing Pad Market

Common user questions regarding AI's impact on the Wool Polishing Pad Market center around how AI-driven surface analysis systems might influence pad selection, compound application, and workflow optimization in detailing workshops. Users frequently ask if AI will automate the polishing process entirely, or merely assist human operators by identifying optimal cutting depths, required pad types (wool vs. foam), and necessary machine speeds based on real-time surface metrics. Key concerns revolve around the potential obsolescence of traditional detailing skills versus the opportunity for AI tools to enhance precision, reduce material waste, and guarantee consistent, measurable results across various paint conditions and chemistries. Users anticipate that AI could significantly streamline quality control and training, moving the industry towards predictive maintenance and optimized product utilization.

The core influence of AI is anticipated in the upstream manufacturing processes and downstream quality assurance. In manufacturing, AI can optimize the wool fiber cutting and blending procedures, ensuring tighter tolerances in pad density and consistency, thereby improving product reliability. Downstream, AI-powered systems, often incorporating computer vision and machine learning algorithms, are increasingly being used in high-end collision centers to map paint defects (e.g., swirl marks, orange peel, holograms) with extreme precision. These systems recommend the exact pad aggressiveness and compound combination required to address localized issues, often directing the user to select specific wool pad constructions for optimal defect removal, minimizing unnecessary passes and saving labor time.

Furthermore, AI-driven inventory management and predictive purchasing are impacting distributors and large-scale detailing chains. By analyzing historical usage data, seasonal trends, and repair types, AI systems can accurately forecast demand for different types of wool pads (heavy cut, medium blend, finishing) across various geographies. This reduces holding costs, minimizes stock-outs of high-demand professional products, and allows manufacturers to dynamically adjust production schedules, leading to a more efficient supply chain responsive to professional market needs. The integration of augmented reality (AR) feedback during the polishing process, guided by AI analysis, is also emerging as a revolutionary training tool, standardizing high-quality results.

- AI-driven surface diagnostics dictate precise wool pad selection and required aggression level.

- Manufacturing optimization through AI ensures consistent fiber density and pad performance.

- Predictive maintenance schedules for polishing equipment increase pad utilization efficiency.

- Machine learning algorithms enhance quality control by identifying microscopic finish imperfections invisible to the human eye.

- AI-enabled training modules accelerate skill development for professional detailers using wool pads.

DRO & Impact Forces Of Wool Polishing Pad Market

The dynamics of the Wool Polishing Pad Market are shaped by a complex interplay of Drivers (D), Restraints (R), Opportunities (O), and powerful external Impact Forces. The primary driver is the necessity for high-quality paint finishing, especially in automotive refinishing where wool pads offer unmatched cutting efficiency for deep defect removal compared to foam, satisfying the stringent standards of paint integrity and gloss demanded by both manufacturers and consumers. This is coupled with the growing popularity of expensive protective coatings (like ceramic coatings), which require an immaculate, defect-free surface preparation stage best achieved using specialized wool pads. Opportunities lie predominantly in developing sustainable and eco-friendly wool sources, expanding the adoption of blended wool pads in emerging industrial sectors, and creating application-specific pad designs compatible with next-generation paint formulations, particularly those with higher scratch resistance.

However, the market faces significant restraints, notably the relatively higher cost of natural wool products compared to synthetic alternatives and the perceived learning curve associated with using aggressive wool pads, which requires skilled operation to avoid paint damage (holograms or paint burn). The maintenance requirements of wool pads, which need specialized cleaning processes to ensure longevity and consistent performance, also act as a dampener on mass-market adoption. Furthermore, the volatility in raw material prices, particularly high-grade sheep's wool suitable for professional pad manufacturing, introduces cost instability, challenging manufacturers' profit margins and pricing strategies across global markets.

Impact forces exert powerful directional pressure on market evolution. Technological advancements in pad backing materials, enhancing durability and heat resistance, directly influence product lifecycle and user satisfaction. Regulatory impacts, focusing on environmental sustainability and raw material sourcing ethics (e.g., animal welfare standards), are increasingly forcing manufacturers to ensure transparent and responsible supply chains. Economic impact forces, such as fluctuations in global vehicle sales and disposable income, directly correlate with the demand for detailing services and, consequently, the consumption of high-performance wool pads. The competitive pressure from advanced microfiber and specialized foam pad technologies also forces wool pad manufacturers to continuously innovate in fiber treatment and pad construction to maintain their cutting superiority and finishing capabilities in the professional segment.

Segmentation Analysis

The Wool Polishing Pad Market is comprehensively segmented based on product type, application, and backing type, enabling a granular understanding of consumer preferences and operational needs across diverse end-user industries. This structured segmentation allows manufacturers to tailor product lines specifically for high-aggression cutting versus fine finishing requirements. The market is increasingly influenced by the specific needs of the automotive aftermarket, which demands reliable and long-lasting pads capable of handling tough clear coats and demanding compounding processes. Analyzing these segments is crucial for identifying areas of high growth, such as the blending of materials to create hybrid wool/synthetic pads that overcome the traditional limitations of pure wool, offering a balance of aggressiveness and durability required by modern detailing professionals.

- By Product Type:

- Twisted Wool Pads (Heavy Cut)

- Blended Wool Pads (Medium Cut/Polishing)

- Knitted Wool Pads (Finishing)

- Synthetic Wool Pads (Alternative Fiber Construction)

- By Application:

- Automotive Refinishing and Detailing

- Marine Gel Coat Restoration

- Aerospace Maintenance (Aircraft Surface Finishing)

- Industrial Polishing (Metals, Composites)

- Furniture Finishing and Woodworking

- By Backing Type:

- Hook and Loop (Velcro)

- Screw-on (Threaded)

- Adhesive/Snap-on

- By Distribution Channel:

- Online Retail/E-commerce

- Specialty Retail Stores/Detailing Suppliers

- Direct Sales/OEM

- By Region:

- North America (US, Canada, Mexico)

- Europe (Germany, UK, France, Italy, Spain)

- Asia Pacific (China, Japan, India, South Korea)

- Latin America (Brazil, Argentina)

- Middle East and Africa (UAE, Saudi Arabia, South Africa)

Value Chain Analysis For Wool Polishing Pad Market

The value chain for the Wool Polishing Pad Market begins with the upstream procurement of raw materials, primarily high-quality natural sheep's wool (often imported from specialized regions like Australia or New Zealand) and synthetic fibers for blended constructions. This stage is critical as the quality, staple length, and crimp of the wool directly dictate the final pad's cutting performance and durability. Manufacturers then engage in fiber processing, which involves cleaning, carding, blending, and felting or twisting the wool into the desired pad structure, followed by the attachment of backing materials (such as foam or rigid plastic plates with hook-and-loop fasteners). Efficiency in processing and minimizing waste are key focus areas at this manufacturing level to maintain competitive pricing and product consistency. Ethical sourcing and sustainability practices are becoming increasingly important factors influencing manufacturer decisions at the raw material procurement stage.

The distribution network plays a pivotal role in linking manufacturers to the highly specialized end-users. Distribution channels are bifurcated into direct and indirect routes. Direct sales often target large original equipment manufacturers (OEMs) in the automotive or aerospace sectors that purchase high volumes of standardized pads. Indirect channels rely heavily on established networks of specialized auto care distributors, professional detailing suppliers, and e-commerce platforms. Specialty distributors are vital as they offer technical support and product expertise, which is crucial for professional users selecting specific pads for complex paint systems. E-commerce platforms are growing rapidly, providing global reach and convenience, particularly for smaller detailing shops and independent professionals.

Downstream activities center on end-use application and aftermarket support. The primary downstream consumers are professional detailers, collision repair centers, marine restoration specialists, and industrial finishers. The success of the product depends heavily on performance confirmation under demanding professional conditions, requiring manufacturers to invest in product training, application guides, and technical support. The feedback loop from these end-users is crucial for driving product innovation, particularly concerning pad aggressiveness, heat generation, and compatibility with new generations of polishing compounds and clear coats. The long-term profitability of the value chain is increasingly tied to the ability of manufacturers to produce durable pads that minimize replacement frequency while delivering superior results.

Wool Polishing Pad Market Potential Customers

The primary potential customers and end-users of professional-grade wool polishing pads are segmented across several high-value maintenance and restoration industries that prioritize surface integrity and gloss retention. Automotive refinishing and detailing shops represent the largest consumer base, utilizing wool pads daily for removing severe paint defects, oxidation, and deep swirl marks encountered during collision repair or high-end aesthetic detailing. These customers demand superior cutting ability and heat management capabilities, often opting for high-density twisted wool pads for the compounding stage, ensuring rapid defect removal before transitioning to finishing steps.

A second significant customer group includes marine care specialists and boatyards, who utilize wool pads extensively for restoring and maintaining gel coats on yachts and fiberglass hulls. Gel coats are inherently harder and often suffer from severe chalking and UV degradation, requiring the aggressive cutting power of wool pads to restore depth and gloss. Similarly, the aerospace maintenance sector, focusing on aircraft exterior finishing and composite surface preparation, constitutes a high-value, albeit volume-constrained, customer segment that requires extremely consistent and defect-free finishes, driven by stringent safety and aesthetic regulations.

Furthermore, industrial polishing operations, involving the finishing of metal components, composites, and specialized plastics, represent a growing niche. Customers in this sector include manufacturers of high-end consumer goods, precision machinery components, and architectural materials. These buyers seek pads that offer rapid material removal and consistent surface texture. Indirectly, large-scale automotive manufacturers (OEMs) and paint manufacturers are also influential, as their processes and recommended finishing procedures dictate the type and specification of polishing consumables utilized throughout their certified repair networks, thereby influencing market demand for specific wool pad designs.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $350.5 million |

| Market Forecast in 2033 | $520.1 million |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | 3M, Lake Country Manufacturing, Meguiar's, Chemical Guys, Buff and Shine Manufacturing, RUPES S.p.A., Farecla Products Ltd., Menzerna Polishing Compounds, ShineMate, Flex Power Tools, CarPro, Zvizzer, Scholl Concepts, Voodoo Ride, Klingspor Abrasives, Mirka, Norton Abrasives, Adam's Polishes, SGCB, P&S Detail Products |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Wool Polishing Pad Market Key Technology Landscape

The technology landscape of the Wool Polishing Pad Market is focused primarily on material science innovation and manufacturing precision aimed at enhancing durability, reducing heat generation, and improving compound retention. A critical technological advancement is the treatment of wool fibers to resist matting and improve resilience under high rotational speeds, achieved through specialized chemical or thermal processing. This process helps maintain the pad’s cutting consistency throughout its lifecycle and significantly reduces the need for frequent cleaning and conditioning. Furthermore, manufacturers are increasingly adopting advanced bonding agents and backing structures to prevent premature separation of the wool from the interface layer, a common failure point under heavy professional use. Precision computerized cutting technologies are also utilized to ensure uniform pad thickness and balanced rotation, which is essential for minimizing vibration and maximizing contact efficiency on contoured surfaces.

The integration of specialized foam or synthetic layers beneath the wool fibers represents a major technological trend, leading to the creation of "hybrid" pads. These composite structures are engineered to provide better cushioning and load distribution than traditional pure wool pads. The underlying foam or interface layer acts as a shock absorber, reducing heat buildup transfer to the paint and improving the overall balance between aggressive cutting and fine finishing capabilities. This hybrid design extends the versatility of wool pads, allowing them to be used effectively with dual-action (DA) orbital polishers, whereas pure twisted wool pads historically performed optimally only on rotary machines. This shift broadens the market reach to include a wider range of professional detailing equipment.

Another area of intense technological focus is the backing attachment system. The dominant Hook and Loop (Velcro) technology is constantly being refined using high-temperature, wear-resistant materials to ensure secure attachment even under extreme operational heat and centrifugal forces. Furthermore, research is ongoing into developing biodegradable or more sustainable alternatives for both the wool processing chemicals and the synthetic components of the pads, aligning with global green initiatives. Pad shape geometry, including tapered edges and center holes (for heat dissipation and centering), is also subject to continuous technological refinement, driven by computational fluid dynamics analysis to optimize airflow and minimize friction, ensuring a cooler and safer polishing experience for modern clear coats.

Regional Highlights

The global Wool Polishing Pad Market exhibits distinct regional consumption patterns, driven by varying levels of industrialization, automotive market maturity, and established detailing culture. North America holds a substantial market share, characterized by a highly professionalized detailing industry and stringent consumer expectations regarding vehicle aesthetics and long-term paint protection. The region's high per capita ownership of large vehicles (trucks, SUVs) and specialized vehicles (marine, RVs) requiring extensive surface correction significantly drives demand for high-performance wool pads. The market here is defined by brand loyalty to premium, durable products, often favoring US-based or established European brands that can supply certified and high-specification detailing consumables.

Europe represents another mature and high-value market, particularly driven by Germany, the UK, and France. European demand is characterized by sophisticated consumer awareness regarding paint health and a strong presence of high-end automotive manufacturers (OEMs) who maintain demanding standards for their authorized collision repair networks. This emphasis on perfection mandates the use of specialized wool pads for rapid and precise removal of defects on diverse European clear coat formulations. Furthermore, the robust classic car restoration market across Europe contributes significantly to the demand for specialized, high-quality wool products necessary for sensitive restoration work.

Asia Pacific (APAC) is projected to experience the highest growth rate during the forecast period. This acceleration is fueled by the massive expansion of automotive manufacturing in countries like China, India, and South Korea, coupled with rapidly increasing vehicle parc and subsequent demand for aftermarket maintenance and detailing services. The emerging detailing culture, particularly in urban centers, sees consumers shifting from basic washes to professional paint correction services, demanding high-efficiency tools like wool pads to handle mass-market car volumes efficiently. While price sensitivity remains a factor, the professional segment in APAC is increasingly adopting premium wool pads to meet rising quality standards and compete effectively in the regional market.

Latin America and the Middle East & Africa (MEA) currently hold smaller, but strategically important, market shares. In Latin America, countries like Brazil and Mexico show steady growth, primarily linked to their domestic automotive industries and the need for restoration services due to harsher environmental conditions (e.g., intense UV exposure, leading to faster oxidation). In the MEA region, particularly the Gulf Cooperation Council (GCC) countries, the presence of an extensive luxury car market and the extreme climate conditions necessitate frequent and high-quality paint correction, driving the adoption of premium wool pads known for their ability to manage heat and aggressive compounds effectively.

- North America: Dominant market value driven by large professional detailing networks and high consumer demand for aesthetic quality in the automotive and marine sectors.

- Europe: High demand characterized by stringent OEM repair standards and a robust classic car restoration segment, prioritizing specialized, high-performance pad designs.

- Asia Pacific (APAC): Fastest-growing region due to rapid industrialization, massive automotive production expansion, and rising professional detailing services adoption.

- Latin America: Steady growth influenced by local automotive manufacturing and increased necessity for paint correction due to challenging environmental factors.

- Middle East and Africa (MEA): Growth concentrated in GCC nations, linked to the high volume of luxury vehicles requiring meticulous surface maintenance in harsh desert climates.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Wool Polishing Pad Market.- 3M

- Lake Country Manufacturing

- Meguiar's

- Chemical Guys

- Buff and Shine Manufacturing

- RUPES S.p.A.

- Farecla Products Ltd.

- Menzerna Polishing Compounds

- ShineMate

- Flex Power Tools

- CarPro

- Zvizzer

- Scholl Concepts

- Voodoo Ride

- Klingspor Abrasives

- Mirka

- Norton Abrasives

- Adam's Polishes

- SGCB

- P&S Detail Products

Frequently Asked Questions

Analyze common user questions about the Wool Polishing Pad market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary performance advantages of wool polishing pads over foam pads?

Wool polishing pads offer superior cutting aggression and higher heat dissipation capabilities compared to foam pads, making them highly effective for rapid removal of deep scratches, heavy oxidation, and sanding marks (compounding stage). They cut faster and finish clearer on severe defects, whereas foam pads are typically used for lighter polishing and final finishing.

Which application segment drives the highest demand for wool polishing pads globally?

The Automotive Refinishing and Professional Detailing segment accounts for the highest demand. This segment relies heavily on wool pads for efficient paint correction in collision repair centers and high-end detailing shops, where achieving a flawless finish on clear coats is essential for quality assurance and customer satisfaction.

How does the Hook and Loop backing type dominate the market?

The Hook and Loop backing system dominates due to its exceptional user convenience, allowing for quick and tool-free pad changes, superior alignment, and compatibility across a wide range of modern orbital and rotary polishing machines. Its widespread acceptance is crucial for maintaining efficient workflow in professional environments.

What is the main restraint limiting the mass adoption of wool polishing pads?

The primary restraint is the requirement for advanced user skill and technique. Wool pads are aggressive and can generate significant heat, demanding careful handling to prevent holograms, swirling, or potentially burning through the paint layer, posing a barrier for novice or inexperienced users compared to safer foam alternatives.

Why is the Asia Pacific region expected to exhibit the fastest growth in the wool polishing pad market?

The APAC region’s rapid market growth is driven by accelerated automotive production, increasing vehicle ownership rates, and the subsequent expansion and professionalization of the aftermarket detailing industry across developing economies like China and India, leading to higher consumption of high-efficiency polishing consumables.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager