Working Capital Management Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433185 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Working Capital Management Market Size

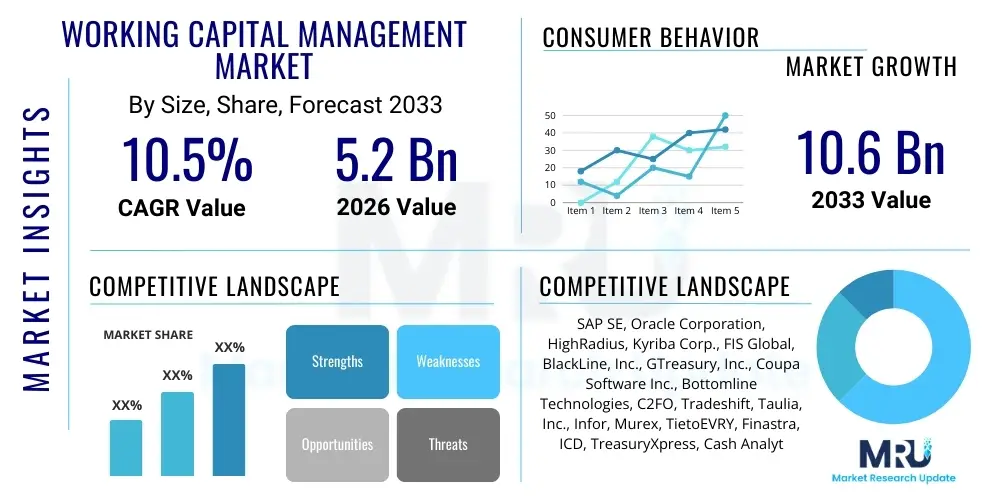

The Working Capital Management Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 10.5% between 2026 and 2033. The market is estimated at $5.2 Billion in 2026 and is projected to reach $10.6 Billion by the end of the forecast period in 2033.

Working Capital Management Market introduction

The Working Capital Management (WCM) Market encompasses a suite of software, services, and strategic consulting aimed at optimizing a company’s liquidity by efficiently managing current assets and liabilities. This discipline focuses specifically on the relationship between cash, receivables, and payables, striving to minimize the cash conversion cycle (CCC) while ensuring sufficient capital is available to cover short-term operating expenses and obligations. Effective WCM solutions provide real-time visibility into global cash positions, automate critical treasury functions, and enhance financial forecasting accuracy. The solutions offered range from advanced cash flow forecasting tools and automated reconciliation systems to sophisticated supply chain finance platforms designed to unlock trapped value within the enterprise ecosystem. The necessity for robust WCM has become paramount in an era characterized by increasing global supply chain volatility and tightening credit markets, forcing businesses to seek technological solutions for maximizing operational cash flow and mitigating inherent liquidity risks.

Products within this market typically include specialized enterprise resource planning (ERP) modules, standalone treasury management systems (TMS), and advanced analytics platforms leveraging machine learning for predictive insights. Major applications span across various critical financial processes, including inventory optimization, dynamic discounting, receivables factoring, and centralized payment management. The primary benefits realized by adopting sophisticated WCM tools include significant reduction in borrowing costs, enhanced profitability through efficient resource deployment, and improved resilience against economic downturns or unforeseen operational disruptions. By transforming manual, reactive processes into automated, proactive strategies, WCM solutions empower financial officers to transition from transactional management to strategic financial governance, directly contributing to sustainable business growth and competitive advantage in fluid market conditions.

The principal driving factors accelerating market adoption revolve around the increasing complexity of cross-border trade, regulatory pressure demanding greater financial transparency, and the widespread digitalization of finance functions across all enterprise sizes. Furthermore, the persistent focus on shareholder value creation mandates stringent control over capital employed, making the efficiency gains provided by WCM technology indispensable. The transition towards cloud-based deployments further democratizes access to sophisticated tools, allowing Small and Medium-sized Enterprises (SMEs) to implement previously cost-prohibitive solutions, thereby broadening the market landscape and driving innovation in modular service delivery models.

Working Capital Management Market Executive Summary

The Working Capital Management market is currently undergoing a transformative period defined by rapid technological integration, shifting geopolitical landscapes, and a heightened emphasis on supply chain resiliency. A major business trend driving growth is the transition from legacy, on-premise treasury systems to integrated, cloud-native platforms, which offer superior scalability, real-time data aggregation, and seamless integration via APIs with banking partners and ERP systems. Furthermore, the increasing adoption of embedded finance and supply chain financing solutions represents a significant opportunity, allowing enterprises to manage vendor and customer financing obligations directly through WCM platforms. The competitive environment is characterized by large financial technology providers (FinTechs) disrupting traditional software vendors, focusing on niche solutions like predictive liquidity forecasting and automated dispute resolution, thereby pushing incumbents toward continuous innovation in their analytics offerings.

Regional trends indicate that North America and Europe remain the largest markets, primarily due to the high maturity of their financial institutions, early adoption of advanced treasury management solutions, and stringent regulatory environments demanding robust cash visibility. However, the Asia Pacific (APAC) region is projected to exhibit the highest Compound Annual Growth Rate (CAGR), fueled by the rapid industrialization, massive growth in cross-border trade, and the imperative for emerging market corporations to formalize and digitize their financial operations. Within APAC, countries like India and China are demonstrating significant investment in digital WCM tools, driven by government initiatives promoting digitalization and the presence of numerous fast-growing SMEs seeking operational efficiency to compete globally. The MEA and Latin America regions are also demonstrating growth, largely concentrated in large enterprises seeking to mitigate currency volatility risks through sophisticated cash pooling and netting strategies.

Segment trends highlight the dominance of the Services component, which includes implementation, consulting, and managed services crucial for successful WCM deployment, particularly for complex multinational corporations requiring tailored integration strategies. However, the Software segment is growing at a faster pace, largely attributable to the proliferation of Software-as-a-Service (SaaS) models and the integration of Artificial Intelligence (AI) and Machine Learning (ML) capabilities into forecasting and risk management modules. The Large Enterprises segment maintains the highest market share, given their inherent complexity in managing global subsidiaries and diverse currency exposures. Yet, the adoption rate among SMEs is accelerating, buoyed by accessible, subscription-based cloud platforms that offer core WCM functionalities specifically designed to address their limited IT budgets and specialized cash flow needs, focusing heavily on accounts receivable automation and short-term liquidity planning.

AI Impact Analysis on Working Capital Management Market

User inquiries regarding AI's influence on Working Capital Management predominantly center on three core areas: the ability of AI to enhance forecasting accuracy, its role in automating repetitive tasks to free up treasury staff, and its potential in identifying and mitigating financial risks (like payment fraud or supply chain disruption) before they materialize. Users are keenly interested in understanding how machine learning algorithms can process vast datasets—including external factors like weather, geopolitical events, and commodity prices—to generate liquidity forecasts far more granular and reliable than traditional statistical models. Furthermore, there is significant curiosity about AI’s capability to automate complex decision-making processes, such as determining the optimal time to pay suppliers (dynamic discounting) or setting credit limits for customers, thereby shifting WCM from a historical reporting function to a predictive strategic asset.

The infusion of Artificial Intelligence and Machine Learning (AI/ML) is fundamentally transforming the WCM landscape, providing unprecedented levels of predictive accuracy and operational efficiency that traditional rule-based systems could not achieve. AI algorithms excel at detecting subtle patterns in transaction data, enabling more sophisticated fraud detection and identifying previously unseen opportunities for cash optimization across the entire order-to-cash and procure-to-pay cycles. For instance, predictive models can forecast invoice payment dates with higher precision, allowing treasurers to manage cash buffers more tightly and efficiently deploy surplus funds. This shift towards predictive intelligence reduces the reliance on subjective human judgment, standardizing and accelerating critical financial decisions.

Moreover, AI-powered automation is drastically lowering the cost and time associated with transaction processing, including automated reconciliation, classifying transactions, and matching invoices across complex global ledgers. This efficiency gain allows WCM teams to allocate their resources towards strategic analysis, focusing on optimizing financial structures rather than routine data entry and validation. The next phase of AI integration is focused on cognitive decision support, where AI systems recommend actions based on real-time market data and internal cash positions, effectively acting as an intelligent co-pilot for the CFO and treasury department, thereby future-proofing the organizations' financial health against increasing global economic instability.

- Enhanced Liquidity Forecasting: AI models analyze historical and external data for highly accurate, granular cash flow predictions.

- Automated Dispute Resolution: Machine learning quickly identifies root causes of invoice discrepancies, accelerating the cash conversion cycle.

- Optimized Payment Strategy: AI determines optimal timing for payments (dynamic discounting) to maximize savings and maintain supplier relationships.

- Advanced Risk Mitigation: Real-time identification of potential payment fraud, credit risk deterioration, or impending supply chain bottlenecks.

- Intelligent Inventory Management: Predicting optimal inventory levels to minimize holding costs while avoiding stockouts that impact sales.

- Robotic Process Automation (RPA): Automating high-volume, repetitive tasks such as bank statement reconciliation and data entry.

DRO & Impact Forces Of Working Capital Management Market

The Working Capital Management market is currently being shaped by a powerful confluence of Drivers (D), Restraints (R), and Opportunities (O), which collectively exert significant Impact Forces on the adoption and evolution of WCM solutions globally. The primary drivers include the exponential increase in global supply chain complexity, forcing multinational corporations to seek centralized cash visibility and control, coupled with the rising necessity for financial resilience against recurring global economic shocks, such as the volatility seen during pandemics and geopolitical conflicts. These factors compel businesses to invest heavily in robust WCM systems capable of providing real-time data and advanced predictive analytics. Simultaneously, opportunities are emerging from the maturation of complementary technologies, notably blockchain for secure cross-border transactions and smart contracts for automated trade finance, presenting avenues for radical efficiency improvements and risk reduction.

Despite these accelerators, the market faces notable restraints that temper growth, primarily the high initial cost and complexity associated with integrating modern WCM software with legacy ERP systems, particularly in older, large enterprises that have multiple disparate financial systems across various geographies. Furthermore, data security and privacy concerns remain a major bottleneck, as WCM solutions handle highly sensitive financial data, necessitating substantial investment in compliance and cybersecurity infrastructure. The shortage of skilled treasury professionals capable of effectively utilizing and managing sophisticated AI-driven WCM platforms also poses an operational challenge, requiring vendors to focus on user-friendly interfaces and robust implementation support services to bridge the skill gap in end-user organizations.

Collectively, these factors generate distinct impact forces. The dominant force is the ‘Efficiency Imperative,’ driven by competition and cost pressures, pushing companies toward cloud-based, automated solutions. A secondary but growing force is the ‘Risk Centralization Mandate,’ where global firms are consolidating treasury functions to gain unified risk visibility and streamline compliance efforts, thereby favoring integrated TMS platforms over point solutions. The balance of power is shifting towards technology providers who can successfully demonstrate rapid return on investment (ROI) through quantifiable reductions in the cash conversion cycle and enhanced financial flexibility. This market dynamic ensures that innovation remains focused on integration capabilities, scalability, and predictive intelligence, further cementing the role of technology as the crucial lever for WCM success.

Segmentation Analysis

The Working Capital Management market is intricately segmented based on solution type, deployment model, enterprise size, and industry vertical, reflecting the diverse needs and operational structures of global businesses. Segmentation analysis is crucial as the requirements of a large multinational manufacturing firm heavily focused on inventory optimization differ significantly from those of a regional bank primarily concerned with streamlined payments and regulatory compliance. The market structure demonstrates a robust demand across all segments, with the fastest growth projected within the cloud deployment model and the SME enterprise size category, driven by increased affordability and ease of access to sophisticated tools. Understanding these segments is key to tailoring product development and sales strategies to capture market share effectively.

- By Solution:

- Software (Treasury Management Systems, Cash Flow Forecasting, Accounts Payable/Receivable Automation, Inventory Management)

- Services (Consulting, Implementation, Maintenance, Managed Services)

- By Deployment:

- On-Premise

- Cloud (SaaS)

- By Enterprise Size:

- Small and Medium-sized Enterprises (SMEs)

- Large Enterprises

- By Industry Vertical:

- Banking, Financial Services, and Insurance (BFSI)

- Manufacturing

- Retail and E-commerce

- Healthcare and Life Sciences

- IT and Telecom

- Energy and Utilities

Value Chain Analysis For Working Capital Management Market

The value chain for the Working Capital Management market begins with upstream activities dominated by core technology providers and specialized data vendors who supply the foundational components necessary for WCM software development. Upstream participants include providers of cloud infrastructure (AWS, Azure), API gateways, AI/ML development frameworks, and specialized financial data feeds (e.g., currency rates, commodity prices, credit ratings). The integration of robust security protocols and compliance modules (e.g., KYC, AML) at this stage is critical, ensuring the foundational software is resilient and legally sound. Innovation at the upstream level, particularly in enhancing real-time data processing capabilities and scalable cloud architecture, directly dictates the performance ceiling of the final WCM solution.

The midstream segment involves the core WCM software developers and solution integrators. Major players focus on designing, building, and continuously updating modular platforms that address various aspects of the cash conversion cycle, from automating invoice processing (P2P) to accelerating collections (O2C). This stage is heavily influenced by intellectual property development, user experience design (UX), and the integration of advanced analytics. Distribution channels are varied, including direct sales teams targeting large enterprise accounts, and indirect channels relying on strategic partnerships with system integrators (SIs), regional value-added resellers (VARs), and major banking institutions who white-label or co-sell WCM functionalities to their corporate clients. The channel strategy is increasingly favoring cloud marketplaces and partner ecosystems to facilitate quicker deployment and wider market penetration, especially among SMEs.

Downstream activities focus on the end-users—the corporations that implement the WCM solutions—and the continuous maintenance and consulting services provided post-implementation. Effective downstream delivery requires specialized training, customization services to fit specific industry workflows (e.g., manufacturing inventory rules vs. retail receivables), and ongoing managed services to ensure optimal performance. The feedback loop generated downstream, covering real-world usage data and specific client challenges, feeds back into the upstream development process, driving agile product improvements. The overall efficiency of the value chain is determined by the speed and seamlessness of data flow between enterprise ERP systems, WCM platforms, and global banking networks, demanding robust API connectivity and adherence to open finance standards.

Working Capital Management Market Potential Customers

The primary potential customers for Working Capital Management solutions are Chief Financial Officers (CFOs), Corporate Treasurers, and finance department controllers across various industries, all unified by the critical mandate to optimize liquidity, reduce financial risk, and enhance shareholder value. These decision-makers require tools that provide holistic, real-time visibility into their global cash positions and actionable insights derived from accurate predictive analytics. The appeal of WCM solutions is highest among businesses facing complex financial challenges, such as those operating across multiple international jurisdictions, dealing with volatile foreign exchange exposures, or managing vast, intricate supply chains that introduce inherent operational uncertainty and liquidity pressure.

In terms of enterprise size, Large Enterprises (those exceeding $500 million in annual revenue) represent the cornerstone of the customer base, possessing the financial complexity and scale necessary to justify substantial investment in sophisticated, customized Treasury Management Systems (TMS) and comprehensive WCM suites. For these giants, the primary need is centralized control over disparate global bank accounts, efficient intra-company netting, and robust risk management for hedge accounting. In contrast, Small and Medium-sized Enterprises (SMEs) represent the fastest-growing customer segment, increasingly seeking accessible, affordable, cloud-based WCM solutions focused on automating basic functions like accounts receivable collection and simple cash flow forecasting, often integrated directly into their existing cloud accounting software.

Industry-wise, the Banking, Financial Services, and Insurance (BFSI) sector, alongside Manufacturing, are consistently major buyers, driven by highly regulated environments and the immense capital tied up in trade payables and receivables, respectively. Manufacturing customers specifically prioritize inventory management and supply chain finance modules to optimize their long production cycles. Retail and E-commerce customers, characterized by high transaction volumes and seasonal variability, seek WCM tools to manage fluctuating demands on cash, accelerate payments, and integrate easily with point-of-sale and digital payment gateways. Essentially, any organization where the efficient management of the cash conversion cycle is critical to operational health and competitive pricing stands as a high-potential customer.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $5.2 Billion |

| Market Forecast in 2033 | $10.6 Billion |

| Growth Rate | 10.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | SAP SE, Oracle Corporation, HighRadius, Kyriba Corp., FIS Global, BlackLine, Inc., GTreasury, Inc., Coupa Software Inc., Bottomline Technologies, C2FO, Tradeshift, Taulia, Inc., Infor, Murex, TietoEVRY, Finastra, ICD, TreasuryXpress, Cash Analytics, ION Group |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Working Capital Management Market Key Technology Landscape

The technological landscape driving the Working Capital Management market is defined by convergence and interoperability, emphasizing cloud architecture, advanced analytics, and distributed ledger technologies. Cloud computing, specifically the Software-as-a-Service (SaaS) model, represents the foundational shift, enabling faster deployment cycles, lower total cost of ownership (TCO), and automated updates crucial for maintaining compliance and security standards. Modern WCM systems leverage microservices architecture within the cloud environment to provide modular functionality, allowing enterprises to select and integrate specific tools—such as advanced cash forecasting or automated reconciliation—without needing a full system overhaul. This cloud-first strategy facilitates the real-time data aggregation necessary for multinational corporations seeking unified global cash positions across diverse geographical locations and multiple banking relationships.

A second critical technology is the heavy utilization of Application Programming Interfaces (APIs). The rise of Open Banking mandates and the need for seamless data exchange between core ERP systems, WCM platforms, and external banking ecosystems have positioned API connectivity as indispensable. High-quality, secure APIs enable instantaneous transaction reporting, automated payment initiation, and integrated risk assessment, moving treasury operations away from cumbersome batch file transfers towards true real-time execution. Furthermore, the integration of advanced analytics, utilizing Machine Learning (ML) and predictive modeling, is transforming data from descriptive reporting into actionable intelligence, significantly improving the accuracy of liquidity forecasts and optimizing complex decisions like setting optimal payment terms or assessing customer creditworthiness.

Finally, emerging technologies such as Blockchain and Robotic Process Automation (RPA) are beginning to carve out specialized roles. Blockchain technology is primarily utilized for supply chain finance and cross-border trade settlements, offering immutable records, enhanced transparency, and accelerated transaction speeds, ultimately reducing counterparty risk and freeing up trapped cash earlier in the cycle. RPA is deployed extensively for automating repetitive, rule-based processes within Accounts Payable and Accounts Receivable, such as matching invoices to purchase orders and handling bank statement reconciliation, thereby maximizing the efficiency of the finance back office. The synergy between these technologies—cloud infrastructure for scalability, APIs for connectivity, AI for intelligence, and DLT for trust—is defining the competitive edge of next-generation WCM solutions.

Regional Highlights

Regional dynamics play a vital role in shaping the demand for Working Capital Management solutions, influenced heavily by economic maturity, regulatory landscapes, and the prevalence of multinational enterprises.

- North America: This region holds the largest market share, characterized by high adoption rates of sophisticated Treasury Management Systems (TMS) and a strong presence of major WCM vendors and financial technology innovators. The demand is primarily driven by large corporations seeking to manage complex currency exposures, implement cash pooling structures, and integrate AI-powered predictive analytics for enhanced risk management and forecasting accuracy. Regulatory frameworks, particularly surrounding corporate governance and transparency, mandate robust WCM practices, ensuring sustained market growth.

- Europe: The European market is mature and highly diverse, driven by cross-border trade within the European Union and the imperative to comply with various regional financial directives (e.g., PSD2, SEPA). European corporations are leading the charge in implementing centralized payment factories and leveraging sophisticated cash netting mechanisms. The adoption of cloud WCM solutions is accelerating rapidly, particularly in Western Europe, while Central and Eastern Europe present high growth potential as companies modernize their legacy financial infrastructure.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region, fueled by rapid economic expansion, increasing foreign direct investment, and a massive surge in cross-border trade volumes, especially within China, India, and Southeast Asian nations. The region’s growth is concentrated in the SME segment adopting accessible cloud-based solutions to navigate the complexities of managing diverse currencies and fragmented banking ecosystems. The emphasis here is on digitalizing core financial processes, moving away from paper-based transactions, and utilizing mobile-first WCM applications.

- Latin America (LATAM): Growth in LATAM is driven by the necessity for companies to mitigate high inflation and extreme currency volatility risks. WCM solutions focused on dynamic hedging, real-time cash visibility, and stringent compliance with local fiscal regulations are highly valued. Market adoption is concentrated among large industrial and resource-based enterprises, seeking tools to protect margins against macroeconomic instability.

- Middle East and Africa (MEA): The MEA market is seeing significant investment, particularly in the Gulf Cooperation Council (GCC) countries, driven by ambitious digitalization agendas and diversification strategies away from oil dependence. Large governmental and quasi-governmental entities are adopting advanced WCM systems to improve public financial management and treasury efficiency. Demand focuses on optimizing liquidity management within complex regulatory structures and supporting regional trade expansion initiatives.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Working Capital Management Market.- SAP SE

- Oracle Corporation

- HighRadius

- Kyriba Corp.

- FIS Global

- BlackLine, Inc.

- GTreasury, Inc.

- Coupa Software Inc.

- Bottomline Technologies

- C2FO

- Tradeshift

- Taulia, Inc.

- Infor

- Murex

- TietoEVRY

- Finastra

- ICD

- TreasuryXpress

- Cash Analytics

- ION Group

Frequently Asked Questions

Analyze common user questions about the Working Capital Management market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary benefit of implementing cloud-based Working Capital Management solutions?

The primary benefit of cloud-based WCM solutions is the delivery of real-time, unified visibility into global cash positions and transactions, enhancing financial decision-making speed and accuracy. Cloud deployment also reduces infrastructure costs, facilitates rapid scalability, and ensures continuous compliance updates, making sophisticated tools accessible even to SMEs.

How does AI impact cash flow forecasting accuracy in Working Capital Management?

AI significantly enhances cash flow forecasting accuracy by utilizing Machine Learning algorithms to analyze complex internal (historical transactions, sales data) and external (economic indices, market volatility) datasets. This predictive modeling identifies patterns and anomalies invisible to traditional statistical methods, resulting in more reliable, granular, and forward-looking liquidity predictions.

What role does the Cash Conversion Cycle (CCC) play in evaluating Working Capital Management efficiency?

The Cash Conversion Cycle (CCC) is the central metric for WCM efficiency, measuring the time (in days) required for a company to convert investments in inventory and resources into cash flows from sales. Effective WCM technology aims to minimize the CCC by accelerating accounts receivable (DSO) collection and optimizing inventory management, thereby freeing up capital for strategic investment.

Which industry vertical demonstrates the strongest demand for advanced Working Capital Management solutions?

The Manufacturing industry demonstrates consistently strong demand, driven by the need to manage vast amounts of capital tied up in long production cycles, raw material inventory, and complex global supply chain payables. Advanced WCM solutions are crucial for optimizing inventory levels, managing supply chain financing risks, and ensuring operational continuity.

What are the main integration challenges faced during the adoption of new WCM software?

The main challenges involve integrating the new WCM platform with disparate, often aging, legacy Enterprise Resource Planning (ERP) systems and numerous regional banking interfaces. Overcoming data silos, ensuring standardized data quality across global subsidiaries, and mitigating data migration risks require specialized consulting and robust API integration frameworks.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager