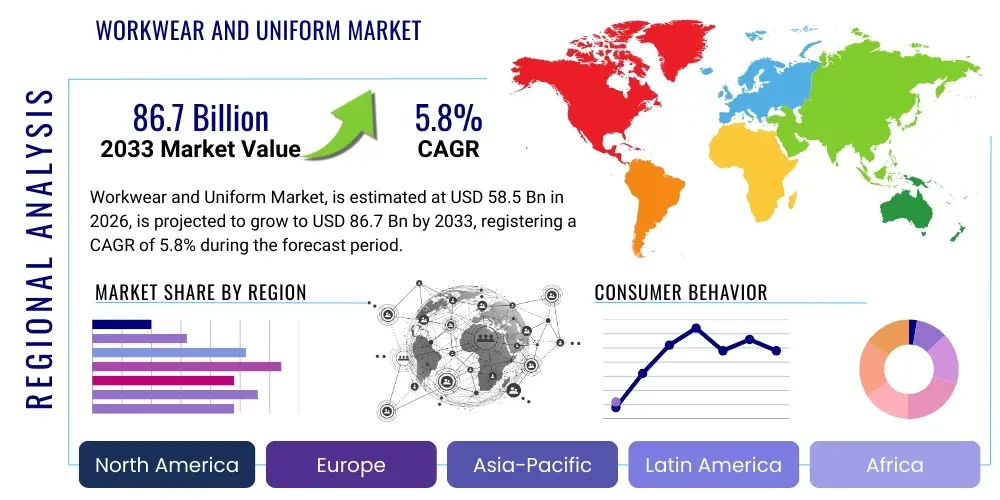

Workwear and Uniform Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437828 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Workwear and Uniform Market Size

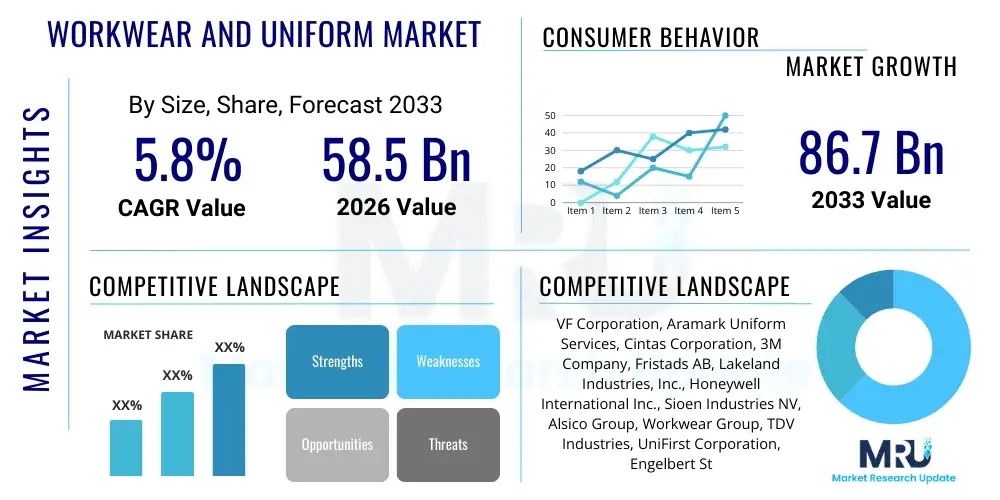

The Workwear and Uniform Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at $58.5 Billion in 2026 and is projected to reach $86.7 Billion by the end of the forecast period in 2033.

Workwear and Uniform Market introduction

The Workwear and Uniform Market is a robust, non-cyclical segment of the global apparel industry dedicated to providing specialized clothing solutions across a multitude of commercial and industrial environments. This market is fundamentally driven by two core needs: the necessity for employee protection against workplace hazards and the strategic requirement for corporate identity and branding consistency. Products encompassed range significantly, from highly specialized Personal Protective Equipment (PPE) such as flame-resistant (FR) coveralls, arc flash suits, and chemical protective ensembles used in petrochemical and heavy manufacturing, to standard corporate attire, medical scrubs, and high-visibility gear used in construction and logistics. The design and material selection process is heavily regulated, often requiring compliance with international standards set by organizations like the International Organization for Standardization (ISO), the National Fire Protection Aassociation (NFPA), and various regional governmental agencies. This regulatory dependency provides a stable baseline demand for replacement and new procurement cycles, mitigating risks associated with general consumer market volatility.

Product complexity is a defining feature of modern workwear. Contemporary uniforms are no longer simple fabric items but are engineered textile solutions. For instance, in healthcare, uniforms must offer antimicrobial properties and withstand harsh industrial laundering processes to prevent cross-contamination, while in construction, clothing must balance rugged abrasion resistance with comfort and breathability for prolonged outdoor use. The introduction of hybrid materials, blending natural fibers like cotton for comfort with high-performance synthetics like polyester and nylon for durability and specific functional properties (such as moisture-wicking and quick-drying), represents a significant evolutionary trend. These specialized materials contribute substantially to the higher average selling price (ASP) of professional workwear compared to conventional clothing, consequently bolstering overall market valuation. Furthermore, customized solutions for fit and logo application demand specialized manufacturing infrastructure, establishing high barriers to entry for new competitors who cannot meet stringent compliance and quality control criteria.

The principal benefits derived from the adoption of standardized workwear include a measurable reduction in occupational injuries due to superior protection, enhanced efficiency through purpose-built garment design (e.g., specific pocket placements, ergonomic cuts), and the establishment of a professional corporate image that builds trust with clients and the public. Key driving factors fueling continuous market expansion include rapid global industrialization, especially in APAC, which increases the workforce exposed to hazards; continuous advancements in fabric technology making high-performance materials more accessible; and governmental efforts worldwide to enforce stricter safety mandates. Moreover, the growth of the outsourced service sector, encompassing facility management, logistics, and retail, necessitates large volumes of branded uniforms, further cementing the market's positive growth outlook over the forecast period, emphasizing both safety attributes and sophisticated appearance management for service professionals.

Workwear and Uniform Market Executive Summary

The Workwear and Uniform Market is currently navigating a pivotal shift characterized by technological integration and a renewed focus on sustainability and worker wellbeing. Major business trends include aggressive vertical integration and strategic mergers and acquisitions among key market players to control supply chains, from raw textile production to specialized laundering and distribution services. The market is increasingly dominated by rental and leasing models, particularly in mature economies, where companies seek to transition from CapEx (capital expenditure) to OpEx (operating expenditure) for uniform procurement. This shift minimizes the administrative burden on end-users and guarantees compliance with hygiene and safety standards, particularly crucial for medical and food handling environments. Another pervasive trend involves the digital transformation of inventory management using technologies like RFID, significantly improving tracking accuracy and replacement planning across vast, multi-site organizations.

Geographically, market dynamics are segmented based on industrial maturity and regulatory rigor. North America and Europe lead in terms of technology adoption, premium pricing, and adherence to sophisticated safety standards, driving demand for innovative, high-cost PPE and smart workwear. Conversely, the Asia Pacific region, led by China and India, represents the largest volume market and the primary growth trajectory due to massive manufacturing bases, rapid infrastructure development, and a gradual tightening of local labor laws. This regional divergence creates opportunities for companies that can offer tailored product lines, ranging from basic, cost-effective utility wear in emerging markets to high-specification, certified protective gear in highly regulated Western jurisdictions. The Middle East remains a key focus for high-temperature and oil and gas sector-specific protective clothing.

Segmentation analysis highlights robust expansion within the protective workwear category, specifically anti-static, chemical-resistant, and high-visibility apparel, directly correlated with global infrastructure and energy investments. Material preference is increasingly moving towards hybrid fabrics that maximize comfort while maintaining mandated protection levels, though fully synthetic materials like Aramid remain essential for extreme protective applications. The healthcare segment, encompassing medical scrubs and lab coats, is experiencing substantial volume growth, driven by aging populations and global pandemic preparedness requiring specialized, easily sanitized textile solutions. Overall, the executive outlook indicates stable volume demand combined with value growth driven by premiumization through safety certifications, advanced material engineering, and comprehensive uniform management service offerings.

AI Impact Analysis on Workwear and Uniform Market

User inquiries surrounding the integration of Artificial Intelligence (AI) in the Workwear and Uniform Market frequently explore its potential to resolve pervasive logistical and compliance challenges inherent in managing large-scale uniform programs. The most common themes revolve around how AI can transition current reactive inventory systems into proactive, predictive models, thereby drastically reducing excess inventory costs and eliminating stockouts, especially for mandatory protective items. Users express high interest in AI's capability to analyze complex datasets—including employee turnover, garment lifecycles, industrial laundering resilience, and regulatory change schedules—to derive highly accurate demand forecasts. Furthermore, a key concern is leveraging AI for quality assurance, ensuring that the protective integrity of high-risk PPE remains compliant throughout its operational life, minimizing organizational liability and maximizing worker safety by predicting material failure points.

AI is strategically being deployed across the entire workwear value chain, moving beyond simple data aggregation to complex decision support. In the design phase, generative AI tools are assisting in optimizing ergonomic cuts and material layups to reduce textile waste during manufacturing, aligning production with sustainability goals. During manufacturing, sophisticated AI-powered computer vision systems are performing continuous, microscopic quality checks on specialized fabrics, such as detecting minute fiber breaks or inconsistencies in FR treatments that human inspectors might miss, ensuring that every garment meets the highest safety certifications before distribution. This automated quality control drastically reduces the risk of non-compliant products entering the supply chain, which is a major regulatory concern for industrial buyers.

In the post-sale service phase, AI models are central to sophisticated uniform rental systems. Machine learning algorithms track individual garment usage through embedded RFID data, analyzing the frequency and severity of laundering cycles to predict the remaining useful life of the item. This predictive maintenance capability allows service providers to automatically pull garments nearing the end of their safe lifespan, replacing them proactively before regulatory compliance is compromised. This level of granular, data-driven management enhances client satisfaction, reduces long-term operational costs for both the supplier and the end-user, and solidifies the value proposition of integrated uniform service contracts, thereby transforming traditional apparel supply into a technology-enabled service offering.

- AI-driven Demand Forecasting: Utilizes machine learning to integrate employee data, seasonal trends, and compliance schedules, predicting precise uniform and size allocation needs, thereby minimizing inventory holding costs and ensuring immediate availability.

- Automated Quality Control and Inspection: AI vision systems quickly analyze fabric integrity, stitching quality, and adherence to required safety standards (e.g., reflecting tape placement, FR treatment consistency) during the high-speed manufacturing process.

- Optimized Supply Chain Logistics: AI algorithms calculate the most efficient routes for delivery and collection in rental services, reducing transportation costs and carbon footprint, particularly for expansive geographical operations.

- Predictive Replacement Scheduling: Analyzing usage history and laundering stress data from embedded sensors, AI determines when specialized protective garments should be retired and replaced to maintain full regulatory compliance and worker protection.

- Customization and Ergonomics: AI-powered modeling assists in creating personalized sizing charts and optimizing garment patterns for improved worker comfort and mobility, essential for high-performance and safety-critical roles.

- Fraud and Counterfeit Detection: Machine learning models analyze supply chain provenance data and digital authentication metrics to rapidly identify and flag potential counterfeit protective workwear, protecting both the brand and worker safety.

DRO & Impact Forces Of Workwear and Uniform Market

The core dynamics of the Workwear and Uniform Market are centrally managed by a confluence of regulatory necessity and operational efficiency. The primary drivers are undoubtedly the mandatory enforcement of occupational safety and health (OSH) standards across developed and rapidly industrializing economies, compelling organizations to invest continuously in compliant protective apparel. This is compounded by the global expansion of the service and healthcare sectors, which mandates specific, often disposable or high-hygiene workwear. Key restraints include the inherent volatility in the pricing of raw materials, particularly technical textiles like Aramid fibers and advanced flame-retardant chemicals, which can compress manufacturer margins and increase end-user costs. Additionally, the complexity of managing global distribution and ensuring certification consistency across different regulatory regions poses a significant logistical and compliance challenge, especially for multinational companies requiring uniform standards globally.

Significant opportunities exist in two parallel tracks: the advanced integration of smart technology and the robust commitment to sustainability. The development of 'smart' uniforms featuring integrated IoT sensors for worker safety monitoring (e.g., location, heat stress, impact detection) represents a high-value niche segment poised for exponential growth, particularly in mining, construction, and utilities. Concurrently, the increasing corporate focus on Environmental, Social, and Governance (ESG) criteria is opening major opportunities for manufacturers who can supply sustainably sourced, long-lasting, and recyclable workwear, often commanding premium pricing. The transition towards circular business models, such as rental and leasing services that manage end-of-life garment recycling, also acts as a potent opportunity, providing recurring revenue streams and addressing client sustainability goals simultaneously.

The impact forces defining the competitive landscape are multifaceted. The relentless pressure from enforcement agencies (like the EU's PPE Regulation or US OSHA) ensures that safety compliance remains non-negotiable, acting as a baseline driver for market demand. Furthermore, consumer and employee expectations for comfort and aesthetic appeal, even in high-risk environments, are influencing design, pushing manufacturers to innovate textiles that are lighter, more breathable, and ergonomically superior—a key differentiator in bidding processes. Economic volatility impacts major capital projects (e.g., large construction), leading to temporary dips in demand for associated PPE, but the resilience of the healthcare and general service sectors stabilizes overall market volume. The increasing prevalence of global e-commerce channels is simultaneously democratizing access to workwear suppliers while intensifying price competition in standardized uniform segments, forcing traditional distributors to add higher-value services like managed logistics to maintain relevance.

Segmentation Analysis

The comprehensive segmentation of the Workwear and Uniform Market provides granular detail on product specialization and end-user requirements, reflecting a market that must cater to a highly diverse set of functional needs. Segmentation by product type highlights the dominant share held by protective industrial workwear, which requires substantial R&D investment and adherence to complex certification standards, offering higher margins. Conversely, the segmentation by end-user reveals that while traditional heavy industries like manufacturing and construction remain the largest volume consumers, the rapidly expanding service and healthcare sectors are influencing design towards higher aesthetic quality, hygiene features (antimicrobial), and enhanced wearer comfort to support employee morale and retention, signifying a crucial area for future investment and market penetration strategies.

Analysis of materials demonstrates a significant shift away from simple cotton or polyester towards highly specialized blends. The need for intrinsic protection drives demand for specialized technical fibers (e.g., high-tenacity polyester, aramid, modacrylic) that offer inherent resistance to hazards without relying solely on chemical post-treatment, ensuring protection lasts throughout the garment's lifetime. Distribution channel segmentation underscores the increasing efficiency and standardization brought about by the rental and leasing model. This service-based approach is appealing to large organizations seeking simplified logistics and guaranteed hygiene compliance, directly contrasting with the fragmented traditional retail and wholesaler model still prevalent for smaller enterprises or specialized, custom PPE purchases.

The detailed segmentation structure is essential for manufacturers and service providers to allocate resources effectively, targeting specific high-growth niches. For example, understanding the difference between the procurement needs of the municipal government sector (which prioritizes durability and visibility) versus the pharmaceutical manufacturing sector (which demands sterile, particulate-free uniforms) allows for tailored marketing and product development efforts. As regulation evolves, particularly around environmental impact and worker health surveillance, these segments will continue to refine, requiring suppliers to maintain flexible production capabilities and a deep understanding of industry-specific compliance matrices to capture market share effectively.

- By Product Type:

- Industrial Workwear (Heavy-duty Trousers, Jackets, Coveralls, High-stress environment gear)

- Corporate Uniforms (Office Wear, Branded Professional Attire, Business Casual uniforms)

- Medical & Healthcare Uniforms (Surgical Scrubs, Patient Gowns, Isolation Gowns, Lab Coats, specialized Barrier Apparel)

- Service Industry Uniforms (Food Service, Hotel Staff, Retail Attendants, Maintenance Crew)

- High-Visibility Clothing (Vests, Jackets, Trousers certified to ANSI/ISEA or EN ISO standards)

- Footwear (Safety Shoes with Composite/Steel Toes, Electrical Hazard boots, Slip-resistant footwear)

- Accessories and PPE (Safety Gloves, Head Protection, Belts, Specific Task Accessories)

- By Material:

- Aramid and Blends (Nomex, Kevlar, inherently FR)

- Polyester (Standard and High-Tenacity for durability)

- Cotton and Blends (Comfort and breathability)

- Nylon (Abrasion resistance)

- Polypropylene (Lightweight chemical resistance)

- High-Performance Fabrics (Anti-static, Anti-microbial, Chemical-resistant laminates, PTFE barriers)

- By End-User:

- Manufacturing Sector (Automotive, General Machinery, Electronics Assembly)

- Construction and Infrastructure (Roads, Bridges, Housing, Utilities)

- Healthcare and Medical (Hospitals, Clinics, Pharmaceutical Production)

- Oil, Gas, and Mining (Offshore/Onshore Drilling, Refining, Extraction)

- Retail and Logistics (Warehousing, Delivery Services, Supermarkets)

- Government and Public Safety (Military, Police Forces, Firefighting and Emergency Services)

- Hospitality and Food Service (Restaurants, Hotels, Catering)

- By Distribution Channel:

- Direct Sales (Large-scale contractual agreements with end-users)

- Retail Stores (Physical retail locations for individual or small business purchase)

- Online Sales/E-commerce (Platform sales, direct-to-consumer models for standardized items)

- Rental and Leasing Services (Full-service uniform management, cleaning, and replacement)

Value Chain Analysis For Workwear and Uniform Market

The upstream segment of the Workwear and Uniform Market value chain is critically defined by specialized R&D and material procurement, primarily focusing on advanced technical textiles. Suppliers must comply with highly specific industry certifications to be accepted by workwear manufacturers, requiring rigorous testing and batch consistency for properties like fire resistance, chemical inertness, and durability. Major activities at this stage include the synthesis of high-performance fibers (e.g., Modacrylic, high-tenacity nylon), specialized yarn spinning, and the application of chemical treatments for functional enhancement (e.g., water repellency, UV protection). Strategic sourcing and long-term contracts with specialized textile mills are paramount for manufacturers to ensure stable supply and quality, especially given the geopolitical instability affecting global cotton and synthetic fiber markets.

The midstream manufacturing stage is characterized by complex, high-volume production with significant quality control requirements. Unlike standard apparel manufacturing, workwear production requires specialized machinery for heavy-duty stitching, reinforced seams, and precise placement of reflective materials and protective layers. Manufacturers are increasingly adopting lean manufacturing principles and automation (such as computer-controlled cutting) to handle the varied runs required for customization across diverse end-users (different logos, color schemes, and certification standards). Customization is a key value-adding activity, encompassing embroidery, heat-seal transfers, and size tailoring. Direct manufacturing capacity grants companies greater control over lead times, crucial for fulfilling large governmental or industrial contracts that often have strict delivery mandates for safety-critical gear.

The downstream distribution and service delivery segment is heavily bifurcated between traditional direct sales/wholesale and the rapidly expanding service model. Direct distribution involves manufacturers supplying large corporate clients or governments, often under multi-year contracts that include provisions for inventory management and replacement. Indirect channels rely on authorized distributors and wholesalers who maintain local inventory and provide logistical support to smaller businesses. The most transformative element is the rental and leasing model. Service providers like Cintas and Aramark handle the entire uniform lifecycle, including customized fitting, professional laundering (meeting industrial hygiene standards), repair, and end-of-life recycling. This service-centric approach provides high recurring revenue and deepens the supplier-client relationship, making the service provider an integral part of the client's operational compliance infrastructure.

Workwear and Uniform Market Potential Customers

Potential customers for the Workwear and Uniform Market are diverse, encompassing virtually every sector that employs a workforce requiring specialized attire for safety, hygiene, or professional representation. The core buyers are large multinational corporations operating within high-risk environments such as construction, oil and gas, and heavy manufacturing, where regulatory compliance dictates standardized purchasing of robust protective wear. These institutional buyers typically engage in long-term contractual agreements, prioritizing product certifications, vendor reliability, and global consistency in supply, often requiring customized solutions integrated with internal inventory tracking systems.

A rapidly expanding customer cohort is found within the healthcare ecosystem, including hospitals, nursing homes, and outpatient facilities, alongside pharmaceutical and cleanroom manufacturing operations. These buyers prioritize uniforms that offer superior hygiene attributes, such as fluid resistance, antimicrobial treatments, and the ability to withstand harsh thermal and chemical sterilization cycles. The sheer volume of staff in this sector, coupled with high turnover and strict sanitation mandates, makes them prime candidates for service-based uniform rental models that guarantee cleanliness and continuous supply, shifting the focus from product ownership to guaranteed service delivery and infection control assurance.

Finally, the vast global service and logistics sectors, including international hotel chains, major retail corporations, fast-food conglomerates, and national postal/delivery services, represent significant volume purchasers of branded uniforms. For these customers, the uniform serves a dual purpose: identification and corporate branding. Key purchasing criteria focus on aesthetic consistency, durability for frequent washing, comfort for long operational hours, and cost-effectiveness. The increasing demand for sustainable and ethically produced service wear is also influencing procurement decisions in this segment, creating opportunities for suppliers who can provide audited, eco-friendly textile options that align with corporate social responsibility (CSR) objectives.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $58.5 Billion |

| Market Forecast in 2033 | $86.7 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | VF Corporation, Aramark Uniform Services, Cintas Corporation, 3M Company, Fristads AB, Lakeland Industries, Inc., Honeywell International Inc., Sioen Industries NV, Alsico Group, Workwear Group, TDV Industries, UniFirst Corporation, Engelbert Strauss GmbH & Co. KG, Adolphe Lafont (Kwintet), Ansell Ltd., Superior Group of Companies, Inc., Ballyclare Limited, Johnson Service Group, Snickers Workwear (Hultafors Group), Dickies (Wren Midco Ltd.), Lion Group, Berendsen (Elis), Lantal Textiles. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Workwear and Uniform Market Key Technology Landscape

The technological evolution within the Workwear and Uniform Market is accelerating, primarily driven by the imperative to enhance safety performance, improve logistical management, and meet evolving sustainability mandates. Key advancements are occurring in the field of high-performance textiles (HPTs). Manufacturers are increasingly utilizing advanced material engineering to develop fabrics that offer inherent protection—such as specialized aramid and modacrylic blends that provide permanent flame resistance rather than chemical post-treatment, which can degrade over time. Furthermore, research is focused on creating lighter, more breathable membranes that offer superior protection against complex hazards like multi-chemical splashes and biological contaminants, crucial for sectors like pharmaceuticals and specialized industrial cleaning. These materials often involve composite structures, including micro-laminates and nanofiber coatings, to achieve maximal barrier protection while minimizing thermal stress on the wearer.

The digitalization of workwear management through Internet of Things (IoT) integration is defining the premium segment of the market. Smart Workwear incorporates miniature, robust electronic components, such as RFID tags or NFC chips, allowing for automated, individual tracking of every garment throughout its lifecycle, from issuance to disposal. This technology is foundational for efficiency in large rental programs, providing real-time data on garment location, laundering frequency, and scheduled maintenance requirements. Beyond logistics, high-end PPE is integrating sophisticated sensors to monitor environmental exposure (e.g., heat, harmful gas levels) and worker physiological data (e.g., body temperature, heart rate), transmitting critical safety alerts back to centralized monitoring systems. This integration transforms workwear from passive protection into an active component of a comprehensive industrial safety network, enabling immediate emergency response and proactive risk mitigation strategies.

Manufacturing and customization technologies are equally advanced. The adoption of 3D printing and advanced visualization tools allows manufacturers to create prototypes and test ergonomic designs rapidly, ensuring optimal fit and function, which is crucial for maximizing the effectiveness of protective garments. Digital printing technology permits high-resolution, durable application of corporate branding and identification marks that withstand industrial laundering processes, ensuring long-term aesthetic quality. Furthermore, the commitment to sustainability is technologically supported through advanced recycling and sorting technologies. These systems allow end-of-life uniforms to be efficiently separated by material type, maximizing the recovery of reusable fibers and reducing the volume of textile waste destined for landfills, thereby closing the loop in the workwear supply chain and reinforcing compliance with corporate circular economy objectives.

Regional Highlights

Regional dynamics play a crucial role in shaping the Workwear and Uniform Market, with market maturity, regulatory environments, and industrial activity levels dictating the primary product mix and service delivery models prevalent in each major geographic area. The disparity in labor costs and safety enforcement creates distinct competitive landscapes and opportunities worldwide.

- North America (U.S., Canada): Highly mature market characterized by stringent federal and state safety regulations (e.g., OSHA, NFPA 2112 for FR clothing). Dominated by specialized, high-cost PPE and integrated uniform rental services (Cintas, Aramark, UniFirst). The market focuses heavily on technological integration, high durability, and sophisticated supply chain management due to high labor costs and compliance risks.

- Europe (Germany, U.K., France, Nordic Countries): Driven by comprehensive EU Directives (e.g., PPE Regulation 2016/425) emphasizing worker safety and environmental responsibility. Strong preference for sustainable textiles, rental models (Berendsen, Elis), and intrinsically protective workwear. Nordic countries lead in functional design and employee comfort standards, influencing broader European trends.

- Asia Pacific (APAC - China, India, Southeast Asia): Fastest-growing region due to explosive growth in manufacturing, construction, and infrastructure projects. Characterized by high-volume demand for cost-effective industrial uniforms, though compliance with Western safety standards is increasing in export-focused industries. China remains the largest manufacturing base globally, while India's rising industrial formalization drives consumption.

- Latin America (LATAM - Brazil, Mexico): Market growth is directly correlated with mining, oil & gas, and agricultural output. Demand is often price-sensitive, balancing essential safety compliance with budget constraints. Regulatory enforcement is improving, leading to increased adoption of standard protective uniforms, especially in large multinational operations within the region.

- Middle East and Africa (MEA - GCC States, South Africa): Demand is concentrated in large energy and infrastructure sectors. High need for specialized protective gear tailored to extreme high-heat environments. GCC countries prioritize international standards (ISO, NFPA) and premium products for highly skilled expatriate workers in the oil and construction industries. South Africa represents a significant market for mining safety gear.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Workwear and Uniform Market.- VF Corporation (Dickies, Timberland PRO)

- Cintas Corporation (Leading uniform rental and facility service provider)

- Aramark Uniform Services

- UniFirst Corporation

- Honeywell International Inc. (Focus on high-end PPE and safety solutions)

- 3M Company (Specialized materials and protective technology)

- Sioen Industries NV (European leader in protective clothing)

- Fristads AB (Scandinavian workwear design and function)

- Alsico Group (Global textile rental and service provider)

- Lakeland Industries, Inc. (Specializing in chemical and heat protection)

- Workwear Group (Australia/NZ leader)

- TDV Industries (Specialized European textile manufacturer)

- Engelbert Strauss GmbH & Co. KG (Direct-to-consumer model, known for ergonomic design)

- Adolphe Lafont (Kwintet Group)

- Ansell Ltd. (Focus on hand and body protection)

- Superior Group of Companies, Inc. (Focus on healthcare and hospitality)

- Ballyclare Limited (Defense and emergency services workwear)

- Johnson Service Group PLC (UK-based workwear rental specialist)

- Snickers Workwear (Hultafors Group)

- Lion Group (Public safety and emergency response uniforms)

- Berendsen (Elis Group)

- Lantal Textiles (Specialized transport/airline textiles)

- Wenaas AS

- Kimberly-Clark Corporation (Disposable protective apparel)

Frequently Asked Questions

Analyze common user questions about the Workwear and Uniform market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the growth of the Workwear and Uniform Market?

The primary driver is the stringent and continuously evolving global regulatory landscape concerning occupational safety and health (OSH). Mandates such as OSHA requirements in the US and EU directives on PPE necessitate the regular procurement of certified, high-quality workwear, ensuring consistent market demand irrespective of minor economic fluctuations. Continuous governmental and corporate emphasis on risk reduction and liability mitigation further reinforces this regulatory demand, making safety apparel a non-discretionary purchase across high-hazard industries.

Which end-user segment demonstrates the highest potential growth?

The Healthcare and Medical sector is expected to exhibit the highest volume and value growth rate. This acceleration is driven by increased global focus on hygiene standards, infection control, the rapid expansion of global medical infrastructure, and the growing demand for specialized, antimicrobial scrubs, surgical gowns, and other clinical attire following heightened public health awareness and pandemic preparedness investments worldwide.

How are technological innovations impacting the functionality of workwear?

Technological innovations are leading to the adoption of Smart Workwear, which incorporates integrated RFID tags for automated inventory tracking and embedded sensors for monitoring worker vital signs, location, and environmental hazards. This digital integration transforms workwear from passive protection into an active component of industrial safety systems, significantly improving both logistical efficiency and proactive safety management.

What role does sustainability play in current uniform procurement?

Sustainability is a critical purchasing criterion for major corporations, especially in Europe and North America. Buyers increasingly prioritize uniforms made from recycled or organic materials, demand supply chain transparency, and often choose full-service rental models that promote garment longevity, repairability, and end-of-life recycling, aligning procurement with corporate Environmental, Social, and Governance (ESG) objectives.

What is the significance of rental and leasing services in this market?

Rental and leasing services are growing rapidly as they offer companies a predictable, cost-effective, and fully managed solution for uniform management. This model transfers the administrative burden of inventory control, laundering (often requiring specialized industrial standards), repair, and replacement from the end-user to the service provider, guaranteeing hygiene compliance and reducing the client’s capital expenditure.

What are the key material challenges facing workwear manufacturers?

Manufacturers face challenges related to the price volatility of specialized raw materials, such as Aramid fibers and performance polyester. Additionally, there is a technical challenge in developing hybrid materials that successfully combine high levels of certified protection (e.g., flame resistance) with the increasing employee demand for comfort, breathability, and aesthetic appeal, requiring continuous innovation in textile engineering.

How does the Workwear Market address protection against environmental hazards?

The market addresses environmental hazards by developing specialized barrier garments, including laminated textiles and non-woven fabrics, that offer protection against dust, particulates, biological agents, and liquid chemicals. Furthermore, specialized FR and arc-rated clothing is mandated for protection against extreme heat and electrical hazards prevalent in the energy and utility sectors, ensuring adherence to standards like NFPA 70E.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager